Global Oil Condition Monitoring Market Size, Share, Growth Analysis By Offering (Hardware, Software & Services), By Sampling Type (On-site Sampling, Off-site Sampling), By Application (Turbines, Compressor, Engines, Hydraulic Systems, Other), By End-use (Automotive & Transportation, Oil & Gas, Energy & Power, Metal & Mining, Food & Beverages, Pharmaceuticals, Chemicals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170931

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

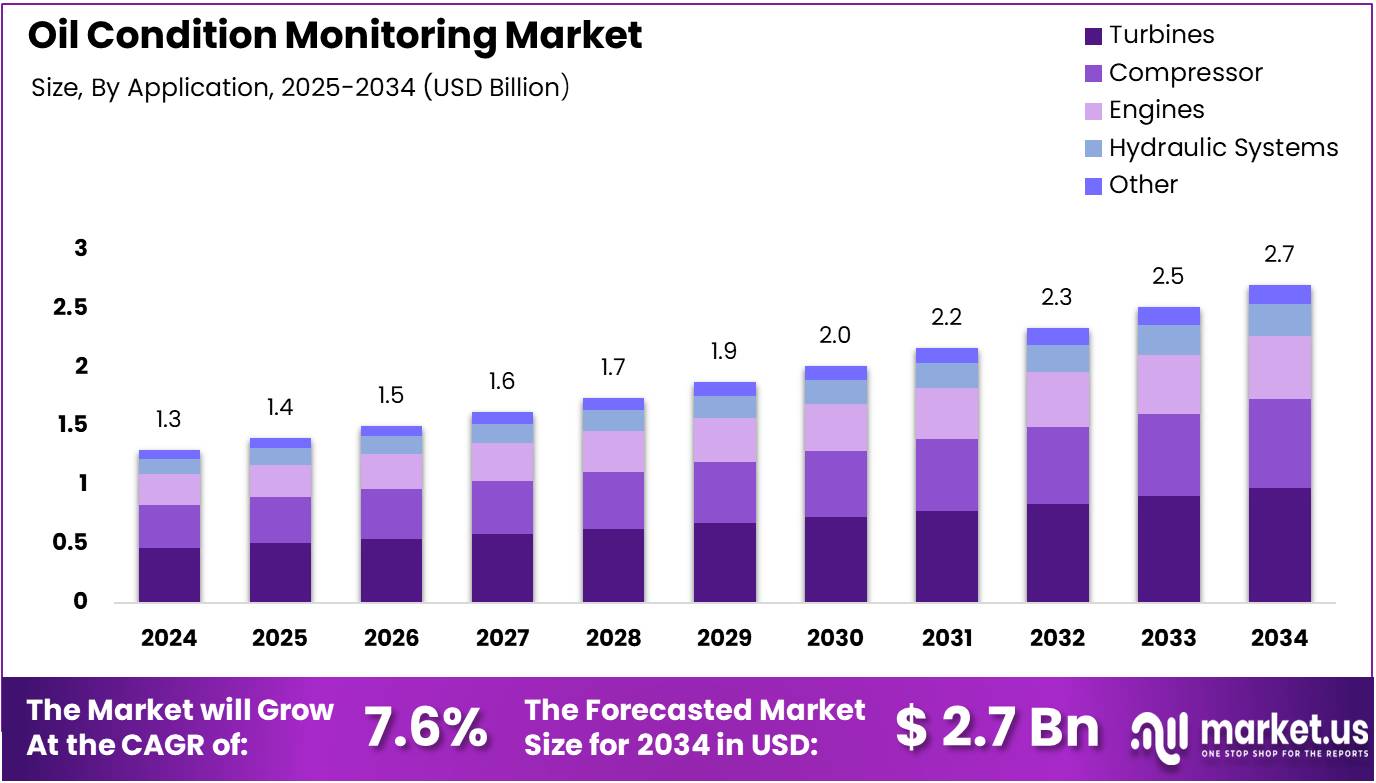

The Global Oil Condition Monitoring Market size is expected to be worth around USD 2.7 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 7.6% during the forecast period from 2025 to 2034.

Oil Condition Monitoring refers to the systematic evaluation of lubricating oil to determine asset health and lubricant performance. It enables early fault detection across mechanical systems. As a result, organizations rely on oil analysis to support predictive maintenance, minimize downtime, and protect high-value industrial equipment efficiently.

From a market perspective, the Oil Condition Monitoring Market is expanding steadily due to rising focus on equipment reliability. Consequently, industries are prioritizing data-driven maintenance over reactive repair practices. Moreover, increasing automation across industrial operations strengthens demand for oil monitoring services, testing programs, and diagnostic technologies.

Growth momentum is supported by the need to control operational costs and avoid unexpected equipment failures. Therefore, asset owners are embedding oil condition monitoring within routine maintenance cycles. Additionally, longer machinery operating hours and higher utilization rates globally further accelerate adoption of oil health assessment solutions.

Opportunities within the Oil Condition Monitoring Market continue to evolve through digitalization and analytics integration. Subsequently, oil condition data is increasingly aligned with maintenance planning systems. This transition enhances maintenance accuracy, improves scheduling efficiency, and creates measurable value for industries managing large equipment fleets.

Government investment and regulatory pressure further reinforce market expansion. For example, stricter safety, emissions, and efficiency regulations encourage proactive equipment monitoring practices. As a result, infrastructure operators and industrial facilities adopt oil condition monitoring to improve compliance, reduce environmental risks, and ensure long-term asset stability.

Operationally, oil condition monitoring delivers measurable performance benefits when applied consistently. Proactive monitoring is correlated with a 20%–30% increase in overall asset lifespan. Therefore, organizations benefit from reduced capital expenditure, extended service intervals, and improved equipment availability across critical operations.

Lubricant health indicators also play a decisive role in maintenance decisions. A viscosity change of ±10% from new oil values typically signals a caution condition. However, viscosity deviation exceeding 20% indicates a critical action threshold, requiring immediate intervention to prevent accelerated component wear.

Contamination control further strengthens the business case for oil condition monitoring programs. Water contamination levels above 0.05% (500 ppm) are generally classified as trace contamination. In contrast, levels exceeding 0.10% (1,000 ppm) are considered critical, posing severe risks to industrial system reliability and performance.

Key Takeaways

- The Global Oil Condition Monitoring Market is expected to grow from USD 1.3 Billion in 2024 to USD 2.7 Billion by 2034 at a CAGR of 7.6%.

- Hardware dominates the By Offering segment with a 59.9% share, supporting preventive maintenance and oil quality measurement.

- On-site Sampling leads the By Sampling Type segment with a 64.8% share for faster diagnostics and immediate action.

- Turbines hold the largest share in the By Application segment at 37.3% due to high operational risk.

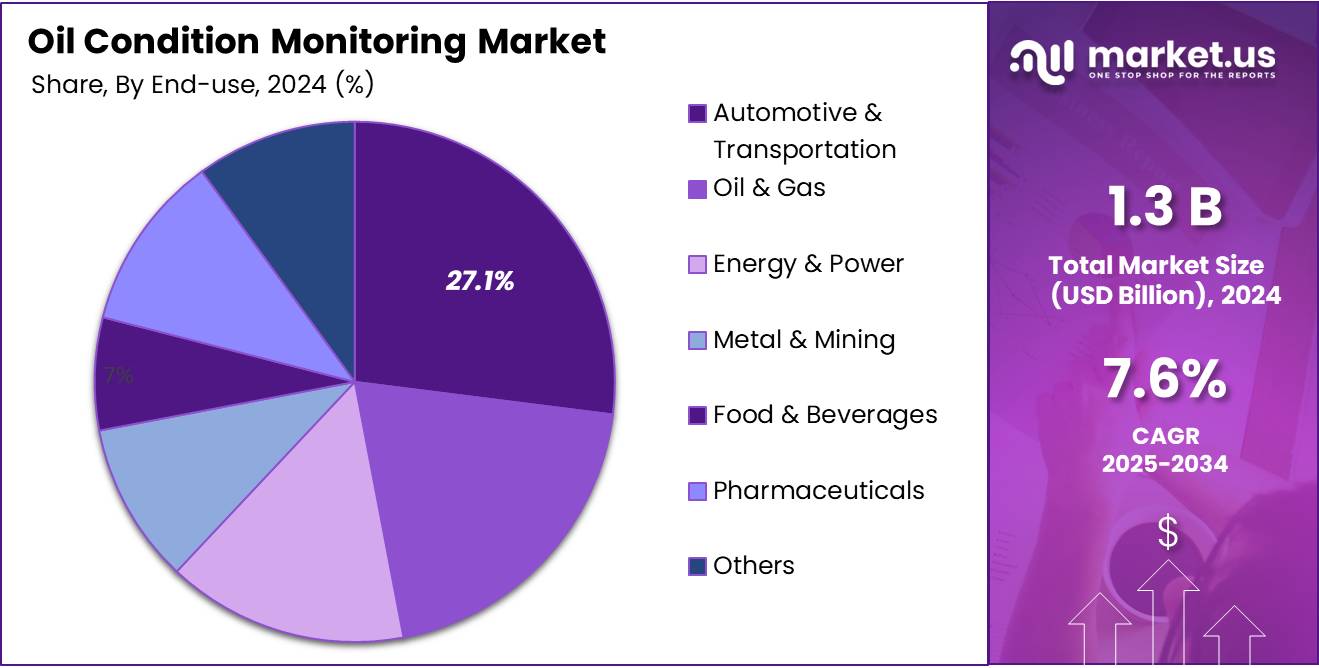

- Automotive & Transportation leads the By End-use segment with a 27.1% share, reflecting high equipment utilization.

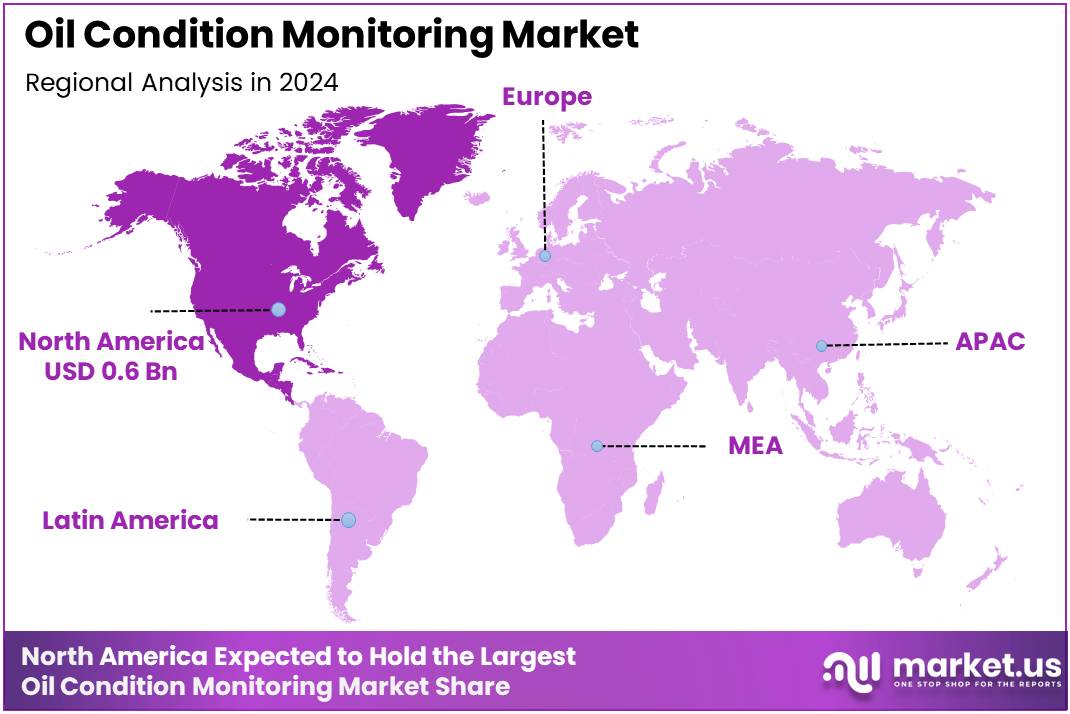

- North America dominates the regional market with 46.9% share, valued at USD 0.6 Billion.

By Offering Analysis

Hardware dominates with 59.9% due to its essential role in direct oil quality measurement and equipment protection.

In 2024, Hardware held a dominant market position in the By Offering Analysis segment of the Oil Condition Monitoring Market, with a 59.9% share. Hardware solutions enable continuous tracking of oil contamination, viscosity, and wear debris. Therefore, industries depend on hardware for early fault detection. Moreover, it supports preventive maintenance planning. As a result, equipment reliability and operational uptime improve consistently.

Software & Services held a supportive position in the By Offering Analysis segment of the Oil Condition Monitoring Market. This sub-segment focuses on interpreting oil data collected from hardware systems. Therefore, it improves maintenance decision accuracy. Moreover, it supports trend visualization and reporting. As a result, maintenance workflows become more structured and efficient.

By Sampling Type Analysis

On-site Sampling dominates with 64.8% due to faster diagnostics and immediate maintenance response.

In 2024, On-site Sampling held a dominant market position in the By Sampling Type Analysis segment of the Oil Condition Monitoring Market, with a 64.8% share. On-site methods allow oil testing directly at equipment locations. Therefore, results are available quickly. Moreover, corrective actions can be taken immediately. As a result, unplanned downtime is significantly reduced.

Off-site Sampling held a secondary position in the By Sampling Type Analysis segment of the Oil Condition Monitoring Market. This approach involves laboratory-based oil testing. Therefore, it delivers deeper chemical analysis. Moreover, it supports long-term oil condition assessment. As a result, it remains relevant for detailed diagnostics despite longer turnaround times.

By Application Analysis

Turbines lead with 37.3% due to their high operational risk and lubrication sensitivity.

In 2024, Turbines held a dominant market position in the By Application Analysis segment of the Oil Condition Monitoring Market, with a 37.3% share. Turbines operate under extreme thermal and mechanical stress. Therefore, oil degradation creates serious failure risks. Moreover, continuous monitoring prevents unexpected shutdowns. As a result, turbines remain the largest application area.

Compressors held a notable position in the By Application Analysis segment of the Oil Condition Monitoring Market. Compressors experience pressure-driven lubrication stress. Therefore, oil monitoring helps detect contamination early. Moreover, it improves performance stability. As a result, operational efficiency is maintained.

Engines held a steady position in the By Application Analysis segment of the Oil Condition Monitoring Market. Engines generate wear particles during regular operation. Therefore, oil condition monitoring supports early wear detection. Moreover, service intervals are optimized. As a result, engine lifespan and reliability improve.

Hydraulic Systems and Other applications held a combined position in the By Application Analysis segment of the Oil Condition Monitoring Market. These systems require clean oil for precision control. Therefore, monitoring reduces failure risks. Moreover, it supports consistent system response. As a result, operational stability is enhanced.

By End-use Analysis

Automotive & Transportation dominates with 27.1% due to high equipment utilization and maintenance intensity.

In 2024, Automotive & Transportation held a dominant market position in the By End-use Analysis segment of the Oil Condition Monitoring Market, with a 27.1% share. Vehicles and fleets operate continuously under varying loads. Therefore, oil degradation occurs frequently. Moreover, monitoring supports predictive maintenance strategies. As a result, fleet reliability and cost control improve.

Oil & Gas held a significant position in the By End-use Analysis segment of the Oil Condition Monitoring Market. Equipment in this sector operates under extreme temperatures, pressure, and continuous load conditions. Therefore, lubrication degradation occurs faster. Moreover, oil condition monitoring enables early detection of contamination and wear. As a result, asset protection improves and unplanned shutdown risks are reduced.

Energy & Power held a stable position in the By End-use Analysis segment of the Oil Condition Monitoring Market. Power generation equipment demands uninterrupted and stable operation. Therefore, oil condition monitoring supports early fault identification. Moreover, it helps optimize maintenance cycles and efficiency levels. As a result, overall system reliability and operational performance remain high.

Metal & Mining held a notable position in the By End-use Analysis segment of the Oil Condition Monitoring Market. Mining equipment operates in abrasive and high-load conditions. Therefore, oil monitoring helps detect wear and contamination early. Moreover, it ensures machinery operates efficiently. As a result, downtime is minimized and productivity is improved.

Food & Beverages held a significant position in the By End-use Analysis segment of the Oil Condition Monitoring Market. Processing equipment requires high cleanliness standards and stable performance. Therefore, oil condition monitoring ensures lubricant quality and prevents contamination. Moreover, it supports consistent production cycles. As a result, operational reliability and product quality are maintained.

Pharmaceuticals held a stable position in the By End-use Analysis segment of the Oil Condition Monitoring Market. Equipment in this sector demands precision and strict regulatory compliance. Therefore, oil monitoring helps maintain equipment reliability and prevents potential process interruptions. Moreover, it supports scheduled maintenance planning. As a result, operational efficiency and compliance standards are strengthened.

Chemicals held a meaningful position in the By End-use Analysis segment of the Oil Condition Monitoring Market. Chemical processing equipment operates under high temperature and corrosive conditions. Therefore, oil condition monitoring detects degradation and contamination early. Moreover, it ensures equipment reliability. As a result, process stability and productivity are maintained.

Others held a notable position in the By End-use Analysis segment of the Oil Condition Monitoring Market. This includes diverse industries requiring reliable equipment performance. Therefore, oil monitoring supports preventive maintenance and operational stability. Moreover, it reduces unplanned downtime risks. As a result, overall maintenance effectiveness and productivity improve across these sectors.

Key Market Segments

By Offering

- Hardware

- Software & Services

By Sampling Type

- On-site Sampling

- Off-site Sampling

By Application

- Turbines

- Compressor

- Engines

- Hydraulic Systems

- Other

By End-use

- Automotive & Transportation

- Oil & Gas

- Energy & Power

- Metal & Mining

- Food & Beverages

- Pharmaceuticals

- Chemicals

- Others

Drivers

Rising Need to Extend Equipment Lifespan Through Proactive Lubrication Management Drives Market Growth

Industrial operators are increasingly focused on extending equipment lifespan through better lubrication control. Oil condition monitoring helps identify early oil degradation, contamination, and wear particles. As a result, maintenance teams can act before damage occurs. This proactive approach reduces long-term repair costs and improves asset reliability.

Unplanned equipment failures remain a major concern across heavy industries. Sudden breakdowns disrupt production schedules and increase operational risks. Oil condition monitoring provides early warning signals related to abnormal wear and lubrication issues. Therefore, organizations can schedule maintenance activities in advance and avoid unexpected downtime.

Process industries are also shifting toward reliability-centered maintenance strategies. These practices rely on real-time equipment health data rather than fixed service intervals. Oil condition monitoring supports this shift by delivering actionable insights. Consequently, maintenance decisions become more accurate, cost-effective, and aligned with actual equipment condition.

In addition, increasing automation and continuous operations raise the importance of equipment stability. Machines often operate under high loads and harsh conditions. Oil condition monitoring ensures lubricant performance remains within safe limits. This supports smoother operations, better planning, and long-term operational efficiency across industrial environments.

Restraints

Limited Technical Expertise for Accurate Interpretation of Oil Condition Monitoring Data Restrains Market Growth

Oil condition monitoring systems generate detailed data related to contamination, viscosity, and wear trends. However, many organizations lack skilled professionals to interpret this information correctly. Without proper expertise, data insights may be underutilized. As a result, the expected maintenance benefits are not fully achieved.

Small and mid-sized industries face greater challenges in building internal technical capabilities. Training maintenance teams requires time and additional investment. Moreover, incorrect data interpretation can lead to unnecessary oil changes or delayed maintenance actions. This reduces confidence in oil condition monitoring solutions and slows adoption.

Sensor reliability remains another key restraint in harsh operating environments. Extreme temperatures, high vibration, and heavy contamination can affect sensor accuracy. When sensors deliver inconsistent readings, maintenance decisions become less reliable. Consequently, operators may revert to traditional maintenance approaches.

Performance consistency is especially critical in continuous-process industries. Frequent sensor recalibration or replacement increases maintenance costs. These technical limitations create hesitation among end users. Therefore, despite clear benefits, market growth is partially constrained by expertise gaps and sensor performance challenges.

Growth Factors

Growing Demand for Condition-Based Maintenance in Aging Industrial Infrastructure Creates Market Opportunities

Aging industrial infrastructure is driving strong demand for condition-based maintenance solutions. Many facilities operate older machinery that requires close performance tracking. Oil condition monitoring helps detect early wear and lubrication issues. Therefore, operators can extend asset life without major capital replacement.

Electric vehicles and advanced powertrain systems also present new growth opportunities. Although EVs use fewer lubricants, critical components still rely on specialized oils. Oil condition monitoring supports efficiency and thermal control. As a result, manufacturers and fleet operators can ensure system reliability and performance optimization.

Mining, marine, and heavy construction equipment fleets are increasingly adopting oil condition monitoring. These machines operate under extreme loads and harsh environments. Monitoring oil health enables early fault detection. Consequently, maintenance planning improves while costly equipment downtime is reduced.

Additionally, fleet operators seek better visibility into asset health across remote locations. Oil condition monitoring provides actionable insights without frequent manual inspections. This supports predictive maintenance strategies. Overall, expanding applications across emerging mobility systems and heavy industries create long-term growth opportunities for the market.

Emerging Trends

Rising Integration of Oil Condition Monitoring with Digital Asset Management Systems Drives Market Trends

The oil condition monitoring market is evolving as industries increasingly connect lubrication data with digital asset management platforms. Integration with digital twin models allows operators to compare real-time oil health with expected equipment behavior. This improves visibility into machine conditions and supports better planning decisions. As a result, maintenance teams gain clearer insights across the full asset lifecycle.

Another important trend is the growing use of multi-parameter sensors. These sensors can measure wear particles, contamination levels, and oil degradation at the same time. This reduces the need for multiple tests and manual sampling. In simple terms, one system now delivers a complete oil health picture. This trend supports faster diagnosis and more reliable maintenance actions.

Automation is also shaping market demand. Industrial operators prefer automated alerts that notify teams before oil-related failures occur. Predictive diagnostics convert oil data into clear maintenance recommendations. This helps reduce human error and unplanned downtime. Automated systems are especially useful in large plants where constant monitoring is difficult.

Regional Analysis

North America Dominates the Oil Condition Monitoring Market with a Market Share of 46.9%, Valued at USD 0.6 Billion

North America leads the Oil Condition Monitoring Market, driven by early adoption of predictive maintenance practices across industrial sectors. The region accounts for a dominant share of 46.9%, with the market valued at USD 0.6 Billion. High asset utilization rates and strict reliability requirements support consistent monitoring demand. Moreover, strong digital integration capabilities further strengthen regional dominance.

Europe Oil Condition Monitoring Market Trends

Europe represents a mature and stable market supported by strong regulatory focus on equipment efficiency and sustainability. Industrial operators increasingly rely on oil analysis to reduce downtime and comply with environmental standards. The region benefits from widespread adoption in manufacturing and energy systems. As a result, steady demand for advanced monitoring solutions continues.

Asia Pacific Oil Condition Monitoring Market Trends

Asia Pacific is emerging as a high-growth region due to rapid industrialization and infrastructure expansion. Increasing investments in power generation, heavy equipment, and transportation assets drive monitoring adoption. Companies focus on extending machinery life and lowering maintenance costs. This creates strong long-term growth potential across developing economies.

Middle East and Africa Oil Condition Monitoring Market Trends

The Middle East and Africa market is supported by extensive use of heavy machinery in energy, mining, and construction activities. Harsh operating environments increase the risk of lubricant degradation. As a result, oil condition monitoring plays a critical role in asset protection. Gradual digital transformation further enhances market uptake.

Latin America Oil Condition Monitoring Market Trends

Latin America shows moderate but consistent adoption of oil condition monitoring solutions. The region focuses on improving equipment reliability in mining, agriculture, and industrial operations. Budget optimization and maintenance efficiency remain key priorities. Consequently, condition-based monitoring is gaining strategic importance across end-use industries.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Oil Condition Monitoring Company Insights

BP plc has combined digital twin initiatives and expanded data partnerships to scale predictive asset monitoring across upstream and midstream operations. Its focus on AI-driven analytics and centralized data lakes helps translate sensor outputs into maintenance actions, supporting reliability and emissions targets. This strengthens BP’s position in integrated oil condition monitoring for large asset bases and complex fleets.

General Electric leverages APM and real-time condition monitoring within power generation and industrial segments to offer turnkey monitoring solutions. GE’s software ties lubricant analytics to asset performance management, enabling early fault detection and automated work recommendations for operators. This software-led model positions GE as a systems integrator rather than a pure laboratory service, driving recurring software and services revenue.

TotalEnergies applies continuous sensing and IoT strategies across refining and offshore facilities, using real-time detection to reduce unplanned downtime and manage fluids more proactively. Its broader energy transition investments complement OCM offerings by emphasising operational efficiency and regulatory compliance across complex sites and supply chains. The company’s scale enables pilot deployments of next-generation sensing architectures.

Intertek Group plc provides specialized oil and lubricant testing through a global laboratory network, delivering standardized UOA and OCM test suites with rapid reporting for fleet operators. Intertek’s emphasis on accredited lab capacity and regional footprints supports scalable, contract-based monitoring for shipping, power, and heavy industry clients while enabling localized technical support and fast turnaround. Growth is tied to global fleet maintenance budgets and regulation.

Top Key Players in the Market

- BP plc

- General Electric

- TotalEnergies

- Intertek Group plc

- Chevron Corporation

- Eaton Corporation

- Bureau Veritas

- SGS SA

- Shell plc

- Parker-Hannifin Corporation

Recent Developments

- In November 2025, Shell Marine launched the Shell Marine Sensor Service (SMSS) — a plug-and-play, 24/7 onboard inline oil-condition monitoring service.

- The service delivers continuous insights into oil and equipment conditions, improving vessel maintenance and operational efficiency.

- In February 2025, SGS announced the acquisition of RTI Laboratories (Michigan), expanding its laboratory and testing capabilities. This acquisition

- strengthens SGS’s position in environmental, materials, and condition-monitoring services across multiple industries.

- In February 2024, Tan Delta Systems launched the SENSE-2 real-time oil condition monitoring kit, a complete display and kit for continuous oil-quality monitoring. It is designed to enhance operational efficiency in manufacturing, power generation, and renewable energy sectors.

- In June 2024, SPECTRO (Spectro Scientific) published product updates and newsletters highlighting new instrument developments. These upgrades improve its oil-analysis and particle-analysis product lines, enabling more accurate and efficient condition monitoring for clients.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 2.7 Billion CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Offering (Hardware, Software & Services), By Sampling Type (On-site Sampling, Off-site Sampling), By Application (Turbines, Compressor, Engines, Hydraulic Systems, Other), By End-use (Automotive & Transportation, Oil & Gas, Energy & Power, Metal & Mining, Food & Beverages, Pharmaceuticals, Chemicals, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BP plc, General Electric, TotalEnergies, Intertek Group plc, Chevron Corporation, Eaton Corporation, Bureau Veritas, SGS SA, Shell plc, Parker-Hannifin Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Oil Condition Monitoring MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Oil Condition Monitoring MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BP plc

- General Electric

- TotalEnergies

- Intertek Group plc

- Chevron Corporation

- Eaton Corporation

- Bureau Veritas

- SGS SA

- Shell plc

- Parker-Hannifin Corporation