Global OEM Coatings Market Size, Share, And Business Benefits By Formulation (Powder Coatings, Water-borne Coatings, Solvent-borne Coatings, Radiation Curable Coatings), By Product Type (Primer, Base Coat, Clear Coat, Electro Coat), By Substrate (Metal, Wood, Plastic, Others), By End-use (Transportation (Automotive, Marine, Others), Consumer Products, Heavy Equipment and Machinery, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153557

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

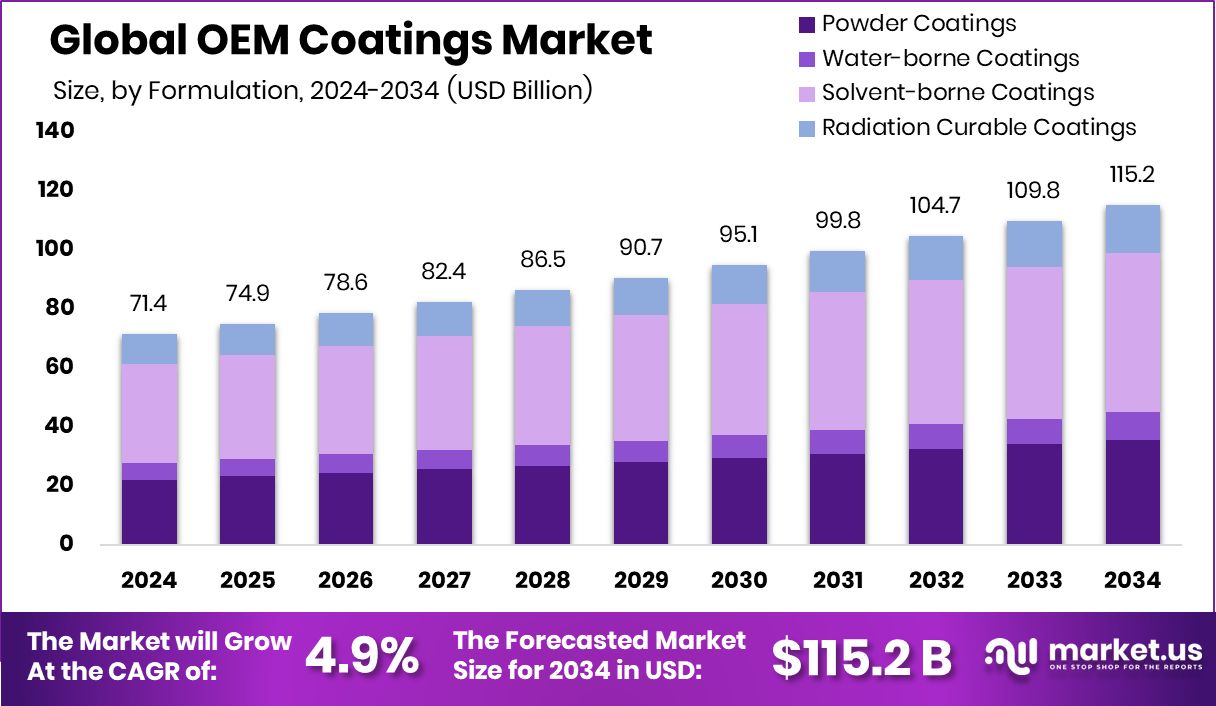

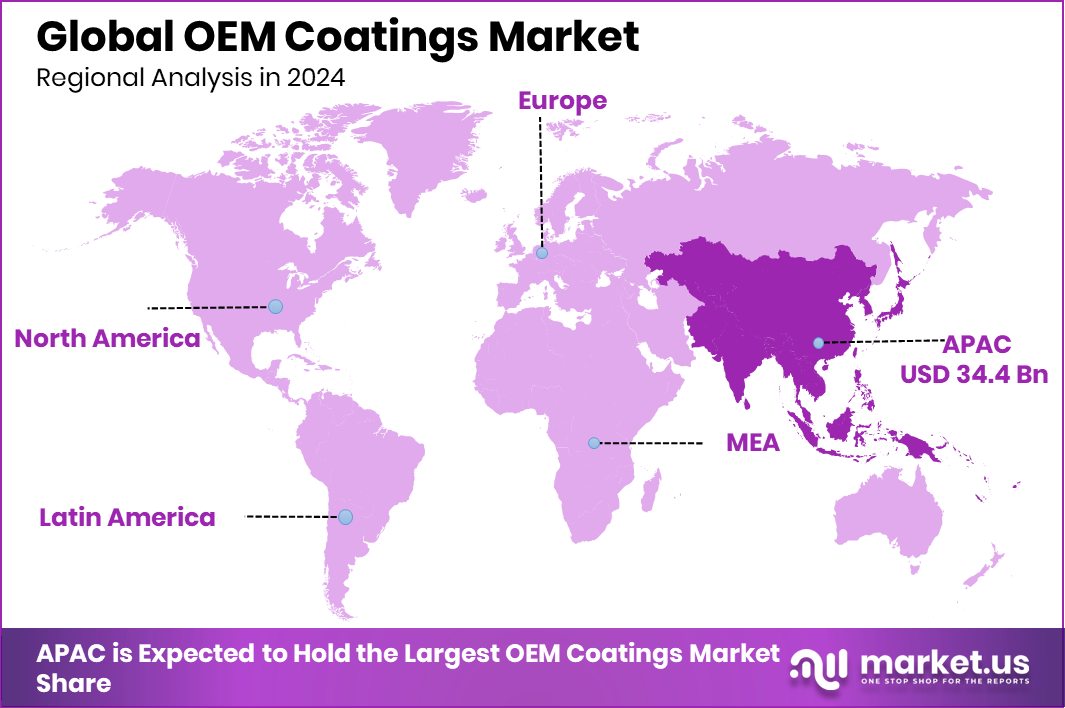

The Global OEM Coatings Market is expected to be worth around USD 115.2 billion by 2034, up from USD 71.4 billion in 2024, and is projected to grow at a CAGR of 4.9% from 2025 to 2034. Strong manufacturing and automotive output drove Asia-Pacific’s 48.3% OEM coatings demand in 2024.

OEM (Original Equipment Manufacturer) coatings refer to protective and decorative layers applied to products during the manufacturing process. These coatings are used on components such as automobiles, appliances, machinery, and electronics before they are delivered to end-users. They are designed to offer corrosion resistance, UV protection, chemical resistance, and aesthetic appeal.

The OEM coatings market represents the global industry that produces and supplies coatings used directly by manufacturers in sectors like automotive, consumer electronics, construction equipment, and industrial machinery. It covers various coating types such as solvent-borne, water-borne, and powder coatings, applied through spray, dip, or electro-deposition methods. The market is closely tied to trends in manufacturing output, product durability requirements, and environmental safety regulations.

The rising demand for durable and long-lasting products across sectors such as transportation and electronics has been a key growth factor. As manufacturers seek to improve product lifespan and appearance, OEM coatings have become critical. Additionally, stricter regulations regarding corrosion protection and emissions are encouraging the adoption of high-performance, eco-friendly coatings.

In this context, BASF is reportedly in the process of selling its coatings division, with the business valued at approximately $6.8 billion, reflecting strategic shifts within the industry and heightened investor interest in high-value coating solutions.

The growing demand in end-use industries such as automotive, appliances, and electronics is fueling the need for OEM coatings. As production levels rebound post-pandemic and infrastructure projects gain momentum globally, the need for protective coatings applied at the manufacturing stage has increased.

Demand is also driven by the push for energy efficiency, where coatings improve thermal insulation and operational efficiency of products. Further supporting innovation, LiquiGlide has secured $16 million in funding to advance the expansion of its coating technology platform, which highlights the growing interest in advanced surface applications across OEM sectors.

Key Takeaways

- The Global OEM Coatings Market is expected to be worth around USD 115.2 billion by 2034, up from USD 71.4 billion in 2024, and is projected to grow at a CAGR of 4.9% from 2025 to 2034.

- In the OEM Coatings Market, solvent-borne coatings dominate, holding a 47.9% share in 2024.

- Base coat emerged as the leading product type, capturing 38.5% share of the OEM Coatings Market.

- Metal substrate accounted for 59.6% share, making it the most preferred surface in OEM Coatings.

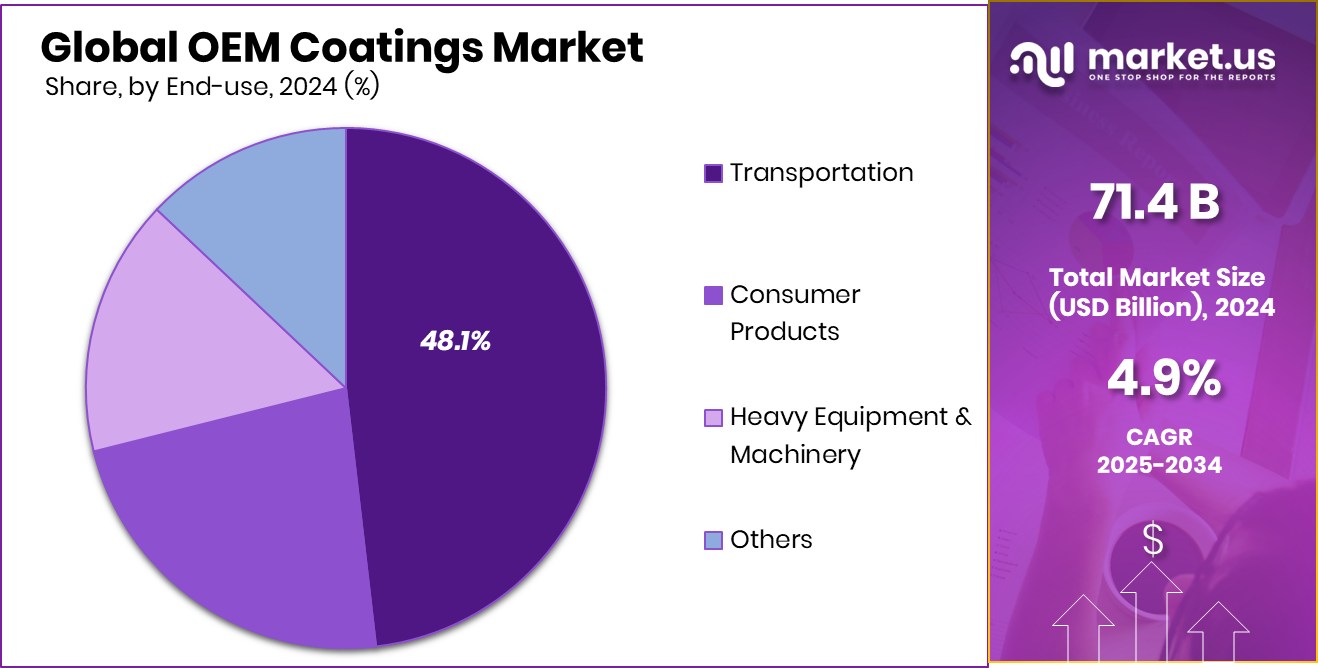

- The transportation sector led the OEM Coatings Market, contributing 48.1% to total end-use applications.

- The Asia-Pacific OEM coatings market reached a valuation of USD 34.4 billion.

By Formulation Analysis

Solvent-borne Coatings lead OEM Coatings Market with 47.9% share.

In 2024, Solvent-borne Coatings held a dominant market position in the By Formulation segment of the OEM Coatings Market, with a 47.9% share. This dominance can be attributed to their superior performance characteristics, including excellent adhesion, high durability, and resistance to harsh environmental conditions. Solvent-borne coatings continue to be widely adopted in industrial manufacturing environments due to their ability to deliver consistent finishes even under challenging application conditions, such as high humidity or fluctuating temperatures.

Their fast-drying properties and long shelf life further enhance production efficiency, making them suitable for high-throughput OEM operations. While regulatory pressures have encouraged shifts toward alternative formulations in some sectors, solvent-borne coatings remain a preferred choice in applications where performance, consistency, and durability are prioritized over environmental concerns. Moreover, manufacturers value their compatibility with a broad range of substrates, from metal to plastic, allowing for greater flexibility in design and production.

Despite ongoing environmental discussions, the formulation’s continued use reflects the balance many OEM manufacturers seek between regulatory compliance and operational efficiency. As a result, solvent-borne coatings are expected to maintain their leading role in the near term, supported by steady demand from sectors such as automotive and industrial equipment manufacturing that prioritize high-performance surface finishes.

By Product Type Analysis

Base Coat dominates OEM Coatings Product Type at 38.5% share.

In 2024, Base Coat held a dominant market position in the By Product Type segment of the OEM Coatings Market, with a 38.5% share. This leading position is primarily driven by its essential role in delivering color uniformity, aesthetics, and durability to finished products. Base coats are widely applied in manufacturing processes where surface finish, gloss, and long-lasting appearance are critical—particularly in sectors such as automotive and appliances.

The base coat acts as the middle layer between the primer and clear coat, playing a vital role in enhancing the visual appeal while also contributing to UV resistance and weather protection. Manufacturers favor base coats for their ability to offer a wide range of color effects, including metallic and pearlescent finishes, which improve the final look of the product without compromising performance.

The 38.5% market share reflects the high consumption of base coats in original equipment manufacturing lines, especially where design and color differentiation are essential for branding and customer preference. Their compatibility with various application technologies such as spray and electrostatic systems also supports efficient production cycles.

By Substrate Analysis

Metal Substrate accounts for 59.6% in OEM Coatings Market share.

In 2024, Metal held a dominant market position in the By Substrate segment of the OEM Coatings Market, with a 59.6% share. This dominance is largely attributed to the extensive use of metal components across key OEM industries such as automotive, industrial machinery, and appliances, where strength, durability, and structural integrity are essential. Metal substrates require high-performance coatings to prevent corrosion, enhance surface durability, and ensure long-term resistance to environmental stressors such as moisture, chemicals, and UV exposure.

The demand for coatings on metal substrates remains strong due to their critical role in enhancing product life and maintaining visual appeal throughout the product’s usage cycle. OEM manufacturers continue to prioritize coating systems that can deliver both functional protection and a uniform finish, particularly on metal surfaces that are prone to oxidation and mechanical wear.

The 59.6% market share underscores the reliance of OEM production on coated metal parts to meet quality and performance standards. Additionally, metal substrates offer compatibility with various coating formulations and application methods, making them suitable for high-volume, automated coating lines.

By End-use Analysis

Transportation Sector holds 48.1% in OEM Coatings Market usage.

In 2024, Transportation held a dominant market position in the By End-use segment of the OEM Coatings Market, with a 48.1% share. This dominance is driven by the extensive use of OEM coatings in the manufacturing of various transportation vehicles such as automobiles, trucks, buses, and commercial transport systems. Coatings in this segment are essential for providing both visual appeal and critical surface protection against corrosion, wear, and environmental factors.

The high 48.1% share reflects the volume and frequency of coating applications required in vehicle production, where surfaces must meet rigorous quality and durability standards. Transportation manufacturers rely on OEM coatings not just for aesthetics, but also to enhance product lifespan and maintain performance under varying operational conditions.

Moreover, the coatings applied in this segment must withstand exposure to UV rays, road salts, chemicals, and temperature fluctuations, making high-performance solutions a necessity. The manufacturing processes within the transportation sector are also highly automated, allowing for efficient application of coatings that meet exact specifications. As the demand for transportation equipment remains steady globally,

Key Market Segments

By Formulation

- Powder Coatings

- Water-borne Coatings

- Solvent-borne Coatings

- Radiation Curable Coatings

By Product Type

- Primer

- Base Coat

- Clear Coat

- Electro Coat

By Substrate

- Metal

- Wood

- Plastic

- Others

By End-use

- Transportation

- Automotive

- Marine

- Others

- Consumer Products

- Heavy Equipment and Machinery

- Others

Driving Factors

High Demand from Vehicle Manufacturing Drives Growth

One of the main driving factors for the OEM Coatings Market is the continuous demand from the global vehicle manufacturing industry. As the production of passenger cars, commercial trucks, and other transport vehicles increases, so does the need for reliable, high-performance coatings. These coatings are essential for protecting metal surfaces from rust, scratches, and weather damage, while also providing a smooth, attractive finish.

Vehicle makers rely on OEM coatings to meet both safety standards and customer expectations for appearance and durability. The coatings are applied during the manufacturing process, which ensures strong bonding and long-lasting protection. As transportation production rises worldwide, especially in growing economies, the OEM coatings market continues to expand in response.

Restraining Factors

Strict Environmental Rules Limit Solvent-Based Usage

A major restraining factor for the OEM Coatings Market is the strict environmental regulations surrounding solvent-based coatings. These coatings often contain high levels of volatile organic compounds (VOCs), which contribute to air pollution and pose health risks. Many governments around the world have introduced tough rules to reduce VOC emissions from industrial processes.

As a result, manufacturers using solvent-based OEM coatings face increased pressure to either upgrade their systems or shift to eco-friendly alternatives like water-based or powder coatings. However, such transitions require new equipment, training, and additional costs, which can be a challenge—especially for small and mid-sized manufacturers. These regulatory hurdles slow down market growth and create uncertainties for companies dependent on traditional solvent-based formulations.

Growth Opportunity

Rising Demand for Eco-Friendly Coatings Offers Opportunity

The OEM Coatings Market has a strong growth opportunity in the shift toward eco-friendly coating solutions. Manufacturers are increasingly seeking water-based and low-VOC (volatile organic compound) coatings that comply with environmental regulations while still delivering high performance. These coatings reduce harmful emissions, align with corporate sustainability policies, and meet growing consumer expectations for green products.

Adopting eco‑friendly coatings also allows OEMs to avoid the high costs and logistical challenges associated with traditional solvent-based systems. As global regulations tighten and sustainability becomes a competitive advantage, water-based coatings offer a path for innovation. This opportunity could lead makers to invest in research and development of advanced formulations, opening new market segments and improving brand reputation through environmentally responsible manufacturing practices.

Latest Trends

Smart Coatings with Self-Healing Properties on Rise

A leading trend in the OEM Coatings Market is the emergence of smart coatings that can self-heal minor damages like scratches and cracks. These advanced coatings are designed with microcapsules or special polymers that repair surface imperfections automatically upon damage. This capability helps extend the lifespan of coated products—such as automotive panels or industrial machinery—by preventing corrosion and reducing maintenance needs.

Self-healing coatings enhance appearance and preserve protective qualities without requiring manual touch-ups or replacements. For OEM manufacturers, this trend presents a chance to offer added value through durability and cost savings over time. As technology advances, more accessible and effective self-repair coatings are expected, supporting demand for innovative, long-lasting solutions in high-end manufacturing applications.

Regional Analysis

Asia-Pacific led the OEM Coatings Market in 2024 with a 48.3% share.

In 2024, the Asia-Pacific region held a dominant position in the global OEM Coatings Market, accounting for 48.3% of the total market share, with a valuation of approximately USD 34.4 billion.

This leadership is primarily driven by the region’s strong industrial base, especially in countries such as China, India, Japan, and South Korea, where large-scale manufacturing of automobiles, electronics, and appliances continues to fuel demand for high-performance OEM coatings. The growing need for durable, corrosion-resistant coatings in transportation and equipment sectors further supports regional growth.

In comparison, North America and Europe represent mature markets with stable demand patterns, supported by established OEM production lines and regulatory shifts encouraging the adoption of eco-friendly coating solutions.

Meanwhile, the Middle East & Africa and Latin America remain emerging regions in this market landscape. These regions are witnessing gradual growth in OEM manufacturing activities, with demand rising in line with expanding industrial and infrastructure investments. However, their overall market shares remain modest relative to Asia-Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AkzoNobel N.V. has continued to leverage its extensive R&D and global production network to advance its coating technologies. The company’s focus on sustainable innovations and low-VOC formulas has strengthened its appeal among OEM clients aiming to meet increasing environmental regulations without sacrificing performance or aesthetics.

Allnex Group has solidified its presence through a broad portfolio of resin-based technologies. With its strategic emphasis on customization and technopolymers, the company addresses specific end-use segments such as automotive and wood products. Allnex’s ability to offer tailor-made solutions has secured its relevance among OEM manufacturers seeking differentiated finishes that meet unique design and performance criteria.

Axalta Coating Systems, Ltd. has reinforced its leadership in performance coatings through continued advancements in high-durability and corrosion-resistant products. Its established global footprint and dedicated automotive OEM channels have allowed Axalta to respond effectively to the growing demand for coatings that combine aesthetic quality with long-lasting protection.

BASF SE has remained a research-driven leader by focusing on multifunctional coating systems. The company’s integrated chemical expertise enables the development of coatings with specialized properties – such as improved adhesion or thermal resistance – that cater to high-value OEM applications in sectors like heavy machinery and electronics.

Top Key Players in the Market

- 3M

- AkzoNobel N.V.

- Allnex Group

- Axalta Coating Systems, Ltd.

- BASF SE

- Covestro AG

- Dow

- HMG Paints Ltd

- Kansai Paint Co., Ltd.

- KAPCI Coatings

- KCC Corporation

- Nippon Paint Holdings Co., Ltd.

- NOROO Paint & Coatings Co., Ltd.

- PPG Industries, Inc.

- SEM Products, Inc.

Recent Developments

- In May 2024, 3M introduced the OEM Match Epoxy Seam Sealer in four colors (black, gray, white, beige), along with a complementary range of 1K and 2K application tips and air supply kits. These products enable technicians to replicate factory-style seam beads more accurately and efficiently, delivering repairs that match OEM specifications and appearance.

- In October 2024, Abu Dhabi National Oil Company (ADNOC) announced its acquisition of Covestro AG by offering €62 per share—valuing the deal at approximately €11.7 billion (~ US$13 billion). ADNOC committed to preserving Covestro’s existing governance structure and technology independence.

Report Scope

Report Features Description Market Value (2024) USD 71.4 Billion Forecast Revenue (2034) USD 115.2 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Formulation (Powder Coatings, Water-borne Coatings, Solvent-borne Coatings, Radiation Curable Coatings), By Product Type (Primer, Base Coat, Clear Coat, Electro Coat), By Substrate (Metal, Wood, Plastic, Others), By End-use (Transportation (Automotive, Marine, Others), Consumer Products, Heavy Equipment and Machinery, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape 3M, AkzoNobel N.V., Allnex Group, Axalta Coating Systems, Ltd., BASF SE, Covestro AG, Dow, HMG Paints Ltd, Kansai Paint Co., Ltd., KAPCI Coatings, KCC Corporation, Nippon Paint Holdings Co., Ltd., NOROO Paint & Coatings Co., Ltd., PPG Industries, Inc., SEM Products, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3M

- AkzoNobel N.V.

- Allnex Group

- Axalta Coating Systems, Ltd.

- BASF SE

- Covestro AG

- Dow

- HMG Paints Ltd

- Kansai Paint Co., Ltd.

- KAPCI Coatings

- KCC Corporation

- Nippon Paint Holdings Co., Ltd.

- NOROO Paint & Coatings Co., Ltd.

- PPG Industries, Inc.

- SEM Products, Inc.