Global Nuclear Power Plant Equipment Market Size, Share, And Enhanced Productivity By Carrier (Island Equipment, Auxiliary Equipment), By Reactor (Pressurized Water Reactor, Pressurized Heavy Water Reactor, Boiling Water Reactor, High-temperature Gas Cooled Reactor, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 176924

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

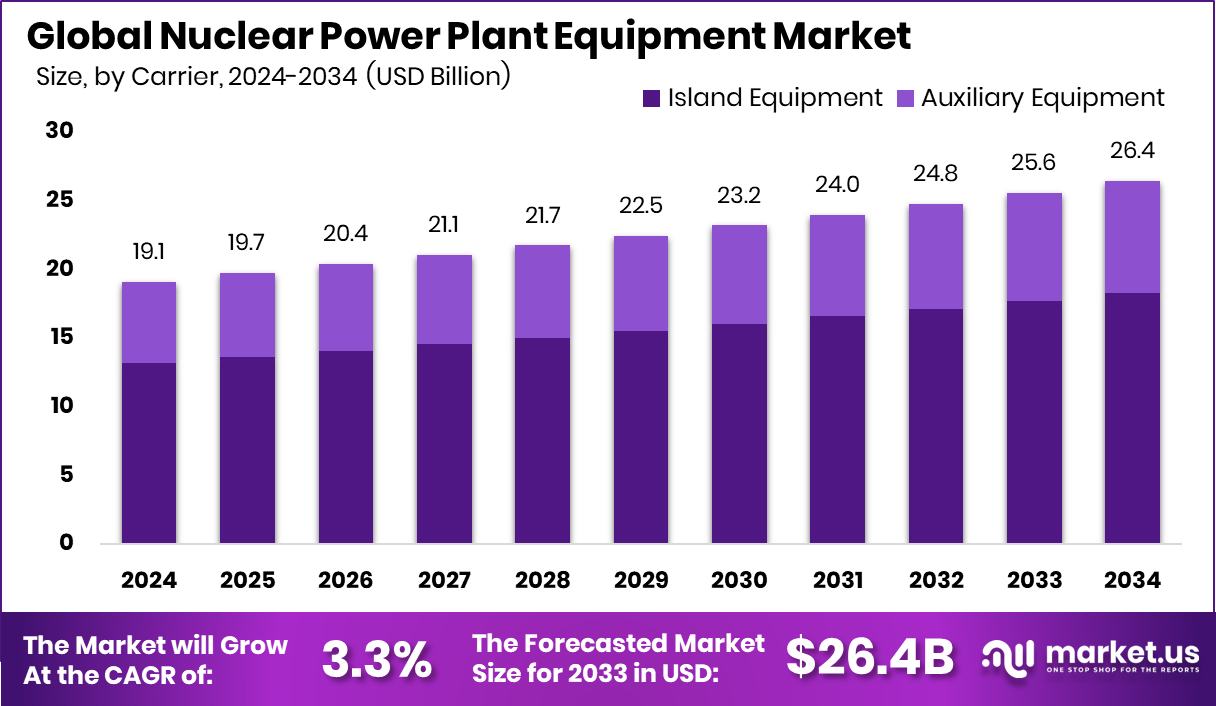

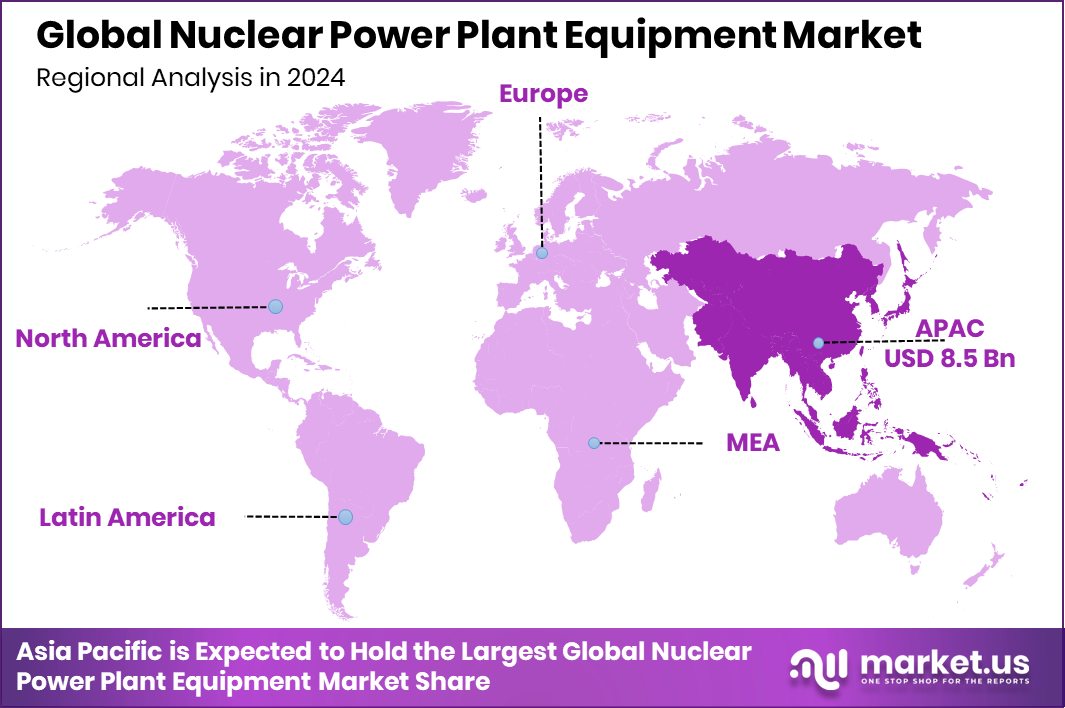

The Global Nuclear Power Plant Equipment Market is expected to be worth around USD 26.4 billion by 2034, up from USD 19.1 billion in 2024, and is projected to grow at a CAGR of 3.3% from 2025 to 2034. Strong investments kept Asia Pacific leading with a 44.6% share and USD 8.5 Bn.

The Nuclear Power Plant Equipment Market covers the systems and machinery used to build, operate, and maintain reactors. It includes island equipment, such as turbines, reactor vessels, heat exchangers, and key safety systems, along with auxiliary equipment that supports operations, including cooling units, monitoring devices, and fuel-handling tools. Nuclear power plant equipment is designed to withstand extreme conditions and ensure safe, stable electricity production over long operating cycles. The broader market reflects the demand for durable, high-precision components that help countries maintain steady baseload energy.

The Nuclear Power Plant Equipment Market represents all commercial activity related to supplying, upgrading, and servicing the equipment inside nuclear facilities. Growth is shaped by rising energy needs, infrastructure renewal, and the increasing appeal of clean electricity. Governments seeking long-term, low-carbon power continue investing in modern reactor technologies and plant upgrades, expanding opportunities for manufacturers and engineering firms.

Growth factors include global attention toward clean energy and improved operational safety. As nations upgrade their power systems, they require newer components that increase efficiency. External funding activity in general industrial sectors—such as $4 million in grants for Vancouver Island manufacturers and up to $25,000 in equipment grants offered by R.I. Commerce—highlights wider support for equipment modernization across industries.

Demand is influenced by aging infrastructure and continuous pressure to improve reliability. Broader funding trends, like NYC Health + Hospitals/Coney Island receiving $250K for advanced medical equipment and USVI businesses gaining up to $100K in equipment grants, show how institutions prioritize upgrading critical systems, a mindset that parallels nuclear modernization needs.

Opportunities grow as countries expand energy capabilities and boost industrial investment. Community and regional programs, such as $758,000 awarded to Newport County fire departments and £39,000 for environmental projects in Jersey, reflect increasing attention to essential infrastructure—reinforcing the long-term potential for advanced equipment solutions, including those supporting nuclear facilities.

Key Takeaways

- The Global Nuclear Power Plant Equipment Market is expected to be worth around USD 26.4 billion by 2034, up from USD 19.1 billion in 2024, and is projected to grow at a CAGR of 3.3% from 2025 to 2034.

- Island equipment holds a 69.2% share, strengthening operational efficiency in the Nuclear Power Plant Equipment Market.

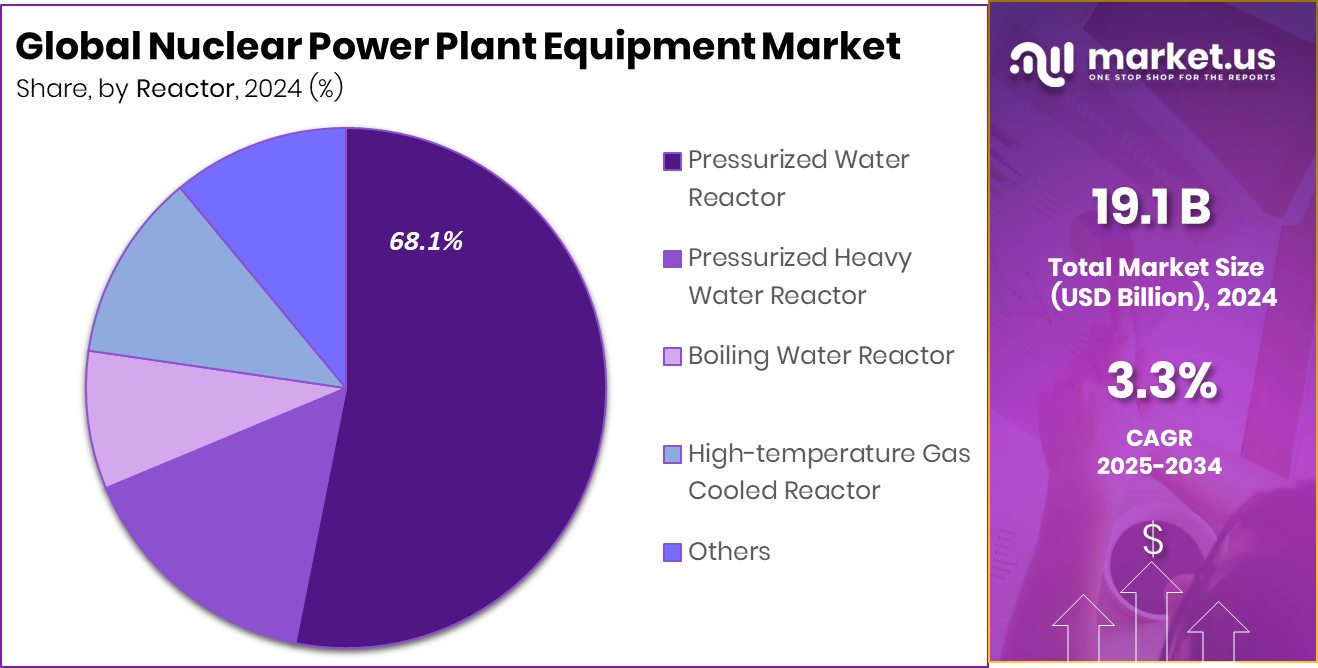

- Pressurized water reactors secure a 68.1% share, reinforcing technology leadership in the nuclear power plant equipment market.

- In this period, Asia Pacific maintained dominance at 44.6% and USD 8.5 Bn.

By Carrier Analysis

The Nuclear Power Plant Equipment Market sees Island Equipment leading with 69.2% dominance.

In 2024, Island Equipment dominated the Nuclear Power Plant Equipment Market with a substantial 69.2% share, reflecting its critical role in ensuring safe and efficient plant operations. This segment includes essential systems such as containment structures, cooling units, pressure vessels, and safety-critical hardware that support stable reactor performance.

Rising global investments in nuclear renovation projects and enhanced safety compliance standards further strengthened the preference for advanced island equipment. As governments modernize aging nuclear fleets and expand clean-energy capacity, demand for durable, high-efficiency island components continues to accelerate. The dominance of this segment underscores its importance as the backbone of reactor operations, contributing significantly to long-term operational reliability and regulatory compliance across nuclear facilities.

By Reactor Analysis

Pressurized Water Reactor dominated the Nuclear Power Plant Equipment Market with 68.1% share.

In 2024, the Pressurized Water Reactor (PWR) segment dominated the Nuclear Power Plant Equipment Market, securing a leading 68.1% share due to its proven safety, operational stability, and widespread global deployment. PWR systems rely on high-pressure water as both coolant and moderator, enabling consistent thermal efficiency and reduced fuel risks.

With more than two-thirds of the world’s commercial reactors operating under PWR technology, equipment manufacturers continue to focus on upgraded pumps, steam generators, and pressure-resistant vessel systems. Nations expanding nuclear energy portfolios increasingly favor PWR units for their reliability and mature regulatory frameworks. As modern reactor projects prioritize lifecycle safety and cost-effective maintenance, the PWR segment maintains strong dominance within the global nuclear equipment landscape.

Key Market Segments

By Carrier

- Island Equipment

- Auxiliary Equipment

By Reactor

- Pressurized Water Reactor

- Pressurized Heavy Water Reactor

- Boiling Water Reactor

- High-temperature Gas Cooled Reactor

- Others

Driving Factors

Rising demand for reliable baseload energy

The Nuclear Power Plant Equipment Market continues to benefit from the rising demand for steady and reliable baseload energy, especially as countries seek long-term, low-carbon power sources. Nuclear plants rely heavily on high-quality island and auxiliary equipment to maintain stable output, creating sustained demand for durable components.

Broader public funding activity also reflects a growing focus on strengthening essential infrastructure, such as when Rep. Malliotakis secured nearly $1M in local public safety funding, reinforcing how governments increasingly prioritize resilient systems. This wider pattern of investment mirrors the continued push for dependable energy technologies, supporting long-term nuclear equipment requirements across multiple regions.

Restraining Factors

High installation and maintenance equipment costs

The Nuclear Power Plant Equipment Market faces challenges due to the high cost of installation, long construction periods, and ongoing maintenance expenses associated with critical reactor systems. Nuclear facilities require specialized components, advanced safety equipment, and strict compliance procedures, all of which elevate overall project spending.

Similar financial burdens are seen in other infrastructure efforts, such as the Acting Governor presenting $10K in new equipment for Island Beautification, illustrating how even smaller-scale equipment upgrades require meaningful budgets. These cost pressures highlight the difficulty many regions face when considering major nuclear investments, creating hesitation among stakeholders evaluating long-term project commitments.

Growth Opportunity

Expansion of advanced small modular reactors

The emergence and global interest in Small Modular Reactors (SMRs) present strong opportunities for the Nuclear Power Plant Equipment Market. SMRs require compact, efficient, and modernized equipment systems, opening new pathways for manufacturers and engineering firms.

The broader environment of development-focused funding aligns with this opportunity, especially as programs like the CHASE Fund, providing $50 million to equip basic schools with PPEs and supplies, demonstrate society’s willingness to support essential infrastructure upgrades. This pattern of targeted investment highlights the potential for future funding channels to also support next-generation nuclear technologies, where SMRs are expected to play an important role.

Latest Trends

Digitalization is improving nuclear equipment monitoring

Digitalization continues to influence the Nuclear Power Plant Equipment Market, as plants adopt smarter monitoring tools, predictive maintenance systems, and advanced diagnostics to enhance safety and efficiency. The move toward digital oversight reflects a global push for modernization across multiple sectors.

Large-scale asset decisions, such as the dramatic sale of $3 billion in defence real estate, show how governments are rethinking long-term infrastructure strategies and reallocating resources toward future-focused development. This shift supports broader acceptance of modern technologies, making digital monitoring solutions increasingly central to nuclear operations and long-term equipment management.

Regional Analysis

Asia Pacific led the market with 44.6%, reaching a USD 8.5 Bn valuation.

Asia Pacific emerged as the leading region in the Nuclear Power Plant Equipment Market, holding a dominant 44.6% share and generating USD 8.5 Bn, supported by expanding nuclear power programs and steady investments in equipment upgrades across major economies.

North America continued to show stable demand as utilities focused on modernizing existing reactors and enhancing operational safety through advanced thermal systems and containment components. Europe maintained a consistent market position, driven by plant life-extension projects and ongoing equipment replacement activities in countries committed to low-carbon power generation.

Meanwhile, the Middle East & Africa region recorded gradual growth as emerging nuclear programs increased procurement of core equipment. Latin America demonstrated modest development, with upgrades in select plants supporting steady but limited equipment adoption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Alstom SA continued to be recognized for its strong engineering capabilities in heavy industrial systems, positioning the company as a valuable participant in nuclear power plant equipment supply chains. Alstom’s expertise in large-scale electromechanical systems, power generation components, and grid-integration technologies aligns well with the critical infrastructure demands of nuclear facilities. The firm’s methodical approach to manufacturing robust turbine and generator systems underscores its ability to meet the strict performance and safety requirements expected within nuclear environments.

AVEVA maintained a strategic focus on advanced industrial software solutions that enable efficient design, simulation, and lifecycle management of complex power plant assets. Its portfolio of digital engineering and operations tools supports critical workflows such as plant modeling, real-time monitoring, and asset optimization—functions that are essential for modern nuclear plant equipment design and maintenance integrity.

BWX Technologies, Inc. sustained its reputation as a trusted supplier of heavy-duty components and specialized nuclear services. With deep experience in nuclear fuel fabrication, reactor components, and precision manufacturing, BWX Technologies plays a central role in supporting reactor operations and equipment modernization. Its disciplined execution and strong compliance culture reinforce confidence among utilities and government partners that rely on high-integrity equipment for safe, long-term plant performance.

Top Key Players in the Market

- ALSTOM SA

- AVEVA

- BWX Technologies, Inc.

- DOOSAN CORPORATION

- EDF

- GE Hitachi Nuclear Energy

- NuScale Power, LLC

- Shanghai Electric

- X Energy

Recent Developments

- In February 2025, BWXT announced that it was awarded approximately USD 2.1 billion in contracts from the U.S. Navy’s Naval Nuclear Propulsion Program. These contracts are for the manufacture of naval nuclear reactor components that will be used in submarines and aircraft carriers. This large award highlights BWXT’s continued strength in supplying critical nuclear hardware.

- In December 2024, Doosan Enerbility signed an agreement to supply a 180 MW steam turbine and generator for a new combined heat and power plant project, with further orders expected from 2025 onward. While not a nuclear plant, this reinforces Doosan’s strong position in large power generation equipment that overlaps nuclear infrastructure capabilities.

Report Scope

Report Features Description Market Value (2024) USD 19.1 Billion Forecast Revenue (2034) USD 26.4 Billion CAGR (2025-2034) 3.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Carrier (Island Equipment, Auxiliary Equipment), By Reactor (Pressurized Water Reactor, Pressurized Heavy Water Reactor, Boiling Water Reactor, High-temperature Gas Cooled Reactor, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ALSTOM SA, AVEVA, BWX Technologies, Inc., DOOSAN CORPORATION, EDF, GE Hitachi Nuclear Energy, NuScale Power, LLC, Shanghai Electric, X Energy Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Nuclear Power Plant Equipment MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Nuclear Power Plant Equipment MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- ALSTOM SA

- AVEVA

- BWX Technologies, Inc.

- DOOSAN CORPORATION

- EDF

- GE Hitachi Nuclear Energy

- NuScale Power, LLC

- Shanghai Electric

- X Energy