Global N,N-Dimethylethanolamine Market Size, Share, And Business Benefit By Formulation (Aqueous Solution, Concentrated Solution), By Application (Water Treatment, Paints and Coating, Pharmaceuticals, Personal Care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 166044

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

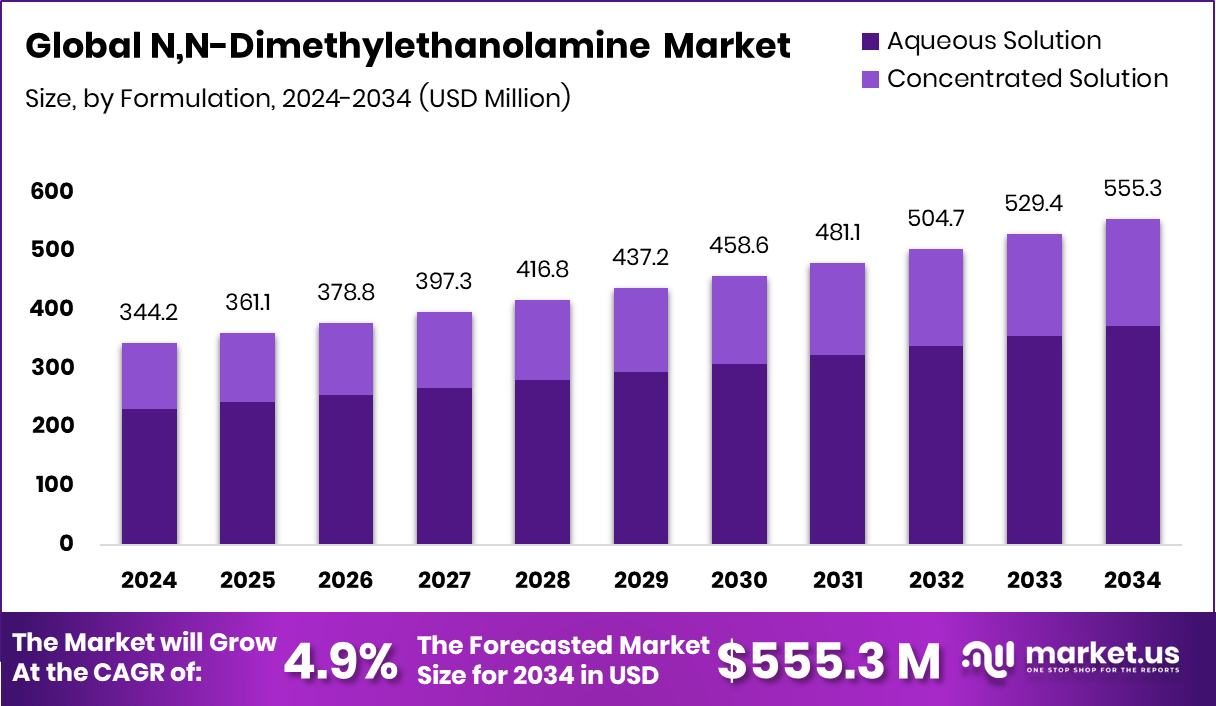

The global N,N-Dimethylethanolamine market is expected to be worth around USD 555.3 million by 2034, up from USD 344.2 million in 2024, and is projected to grow at a CAGR of 4.9% from 2025 to 2034. Asia Pacific commands 36.30% achieving USD 124.9 Mn market influence across regional demand.

N,N-Dimethylethanolamine (DMEA) is an organic amine compound used as an intermediate in chemical synthesis, cosmetics formulations, corrosion inhibitors, gas treatment, ion-exchange resins, and polyurethane foam catalysts. It offers both tertiary amine and alcohol functional behavior, making it reactive, versatile, and suitable for cross-linking, neutralizing, and surface-modifying applications across coatings, personal care, and industrial processing.

The market for N,N-Dimethylethanolamine is shaped by its growing use in high-performance coatings, flexible and rigid foam production, personal care ingredients, and water treatment chemicals. Demand is also linked to rising infrastructure development, cleaner chemical formulations, and performance-driven coatings used in automotive, construction, marine, and electronics. In parallel, sustainability-focused R&D is encouraging the use of cleaner intermediates and low-VOC formulations.

Growth factors include the shift toward high-efficiency, durable coatings and advanced polyurethane applications. Recent capital movements, such as Ecoat securing €21 million to reinvent sustainable paint solutions and discussions around large-scale coatings divestment valued at $6.8 billion, reflect strong strategic realignment and innovation in downstream demand.

Market demand is also supported by rapid investments in water treatment, where amine-based chemicals remain essential. Water management players receiving $50 million and circular-water innovators securing INR 15 crore in funding highlight rising industrial and municipal demand, creating long-term chemical supply opportunities.

Opportunities continue in green-chemistry-driven coatings, next-gen polyurethane systems, and smart-water infrastructure, where DMEA can fit into value chains linked with sustainability, regulatory compliance, and technical performance.

Key Takeaways

- The global N,N-Dimethylethanolamine market is expected to be worth around USD 555.3 million by 2034, up from USD 344.2 million in 2024, and is projected to grow at a CAGR of 4.9% from 2025 to 2034.

- In formulation analysis, aqueous solution holds a 67.2% share, driving safer handling and industrial versatility.

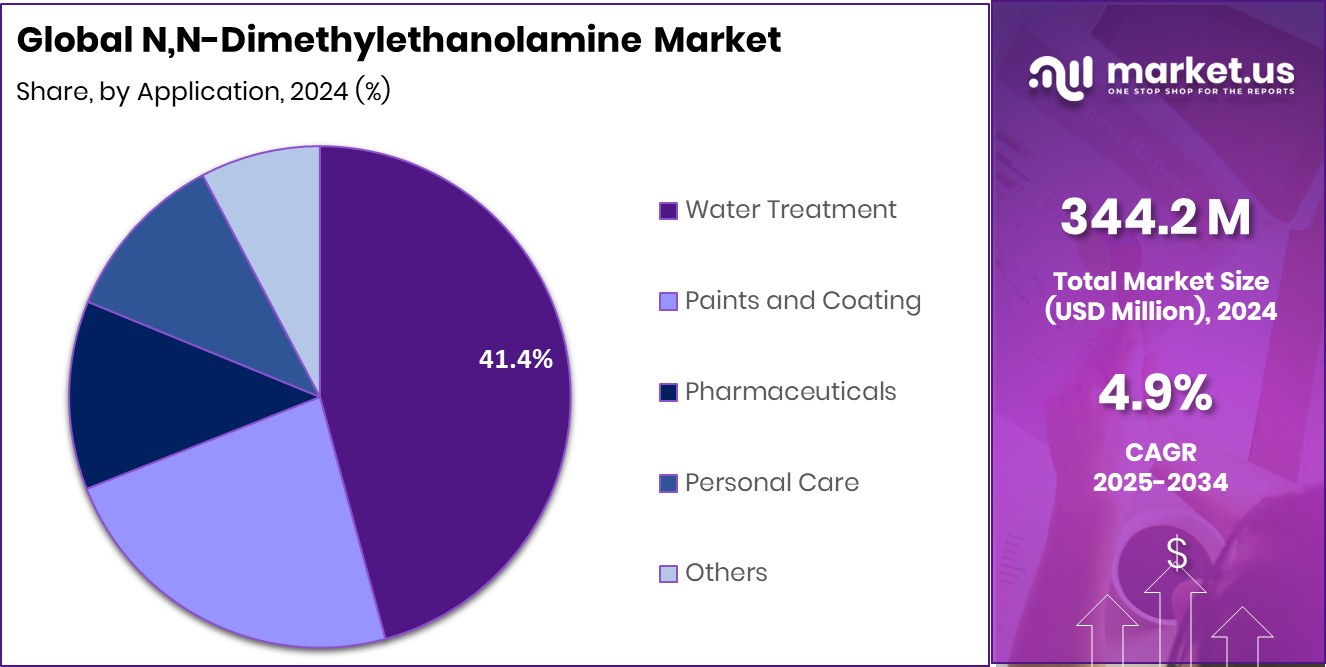

- In the application outlook, water treatment leads with a 41.4% share supported by infrastructure and recycling demand.

- The Asia Pacific region holds 36.30% worth USD 124.9 Mn across major industries.

By Formulation Analysis

The N,N-Dimethylethanolamine Market sees aqueous solution leading with 67.2% strong global acceptance today.

In 2024, Aqueous Solution held a dominant market position in the By Formulation segment of the N,N-Dimethylethanolamine Market, with a 67.2% share. The dominance reflects its suitability for stable handling, efficient dilution, and easier incorporation into industrial processing lines where controlled pH modification, formulation uniformity, and safer application remain key preferences.

Its liquid form allows precise dosing in coatings, personal care bases, and water treatment blends where rapid dispersion and compatibility matter. This share also aligns with industries that prefer ready-to-use intermediates over concentrated or solid formats to minimize processing risks and maintain continuous production flow. The widespread usage of aqueous formulation keeps it relevant for sectors focusing on consistent quality and optimized production efficiency.

By Application Analysis

The N,N-Dimethylethanolamine Market reports water treatment dominance with 41.4% due to rising contamination control.

In 2024, Water Treatment held a dominant market position in the By Application segment of the N,N-Dimethylethanolamine Market, with a 41.4% share. This leadership reflects its strong adoption in chemical treatment cycles where amine-based compounds are used for pH control, corrosion resistance, and operational system stability. Its compatibility with filtration, circulation, and conditioning processes makes it suitable for industrial, municipal, and utility-based applications.

The share also indicates consistent demand from facilities focused on process efficiency and continuous system performance. Its role aligns with treatment streams requiring reliable dosing, fast solubility, and long-term operational benefits, supporting sectors where water system integrity is essential for safety, equipment longevity, and regulatory compliance.

Key Market Segments

By Formulation

- Aqueous Solution

- Concentrated Solution

By Application

- Water Treatment

- Paints and Coatings

- Pharmaceuticals

- Personal Care

- Others

Driving Factors

Rising Demand from Advanced Water Treatment Projects

One key driving factor for the N,N-Dimethylethanolamine market is the growing focus on modern and sustainable water treatment solutions across industries and cities. The compound is widely used in treatment systems where controlled pH, corrosion protection, and long-term process stability are required, making it valuable for both industrial and municipal water management.

Continuous funding support for clean-water projects is strengthening this demand, as seen when water treatment projects became winners of a £42 million funding round from a regulator, reflecting strong institutional and government-backed motivation toward safer and more efficient water systems.

Such financial support encourages new facilities, modern upgrades, chemical supply partnerships, and adoption of reliable treatment inputs, keeping N,N-Dimethylethanolamine aligned with long-term operational growth.

Restraining Factors

Concerns Related to Handling Safety and Regulations

One major restraining factor for the N,N-Dimethylethanolamine market is the concern related to safety handling, workplace exposure, and environmental compliance norms. As it is a chemical intermediate with reactive properties, industries must follow strict guidelines for storage, transport, and operator handling, which increases cost and slows large-scale adoption in smaller facilities with limited safety budgets.

Additionally, regulatory bodies in different regions often revise norms related to emissions, permissible exposure limits, and chemical discharge, making it necessary for manufacturers and end-users to invest in monitoring systems and certifications. These factors can delay commercial decisions, raise operational expenses, and reduce usage flexibility, especially in markets shifting toward biologically safe and low-emission alternatives.

Growth Opportunity

Expansion Linked to Global Sanitation Infrastructure Investments

A strong growth opportunity for the N,N-Dimethylethanolamine market comes from rising investments in sanitation, wastewater improvement, and long-term urban water security programs. As the compound is used in treatment and conditioning systems for corrosion control, pH stabilization, and process efficiency, it can benefit from large infrastructure upgrades in regions working to modernize essential water networks.

The demand outlook becomes more positive when funding programs continue to expand, such as Iraq securing €130 million in French funding for sanitation projects, showing that nations are prioritizing safe, reliable, and high-quality treatment systems. These kinds of financial commitments create new procurement cycles, long-term supply contracts, and modernization of chemical dosing facilities, opening future opportunities for stable market integration.

Latest Trends

Shift Toward Clean-Water and Low-Emission Formulations

A key trend in the N,N-Dimethylethanolamine market is the rising move toward cleaner, low-emission, and long-term environmental performance formulations linked to water and sanitation improvement. Industries and municipalities are adopting chemicals that support stable treatment cycles, controlled dosing, and safer operational behavior, giving more attention to ingredients that balance efficiency with sustainability goals.

This trend becomes stronger as water infrastructure receives new financial support, such as New York unveiling $78 million in funding for water quality improvements, strengthening the direction toward clean-water technology upgrades. Such focused spending encourages new testing programs, updated treatment plants, and more use of pH-control and corrosion-resistant chemistries where performance and sustainability must work together for compliance and operational reliability.

Regional Analysis

Asia Pacific leads with 36.30%, valued at USD 124.9 Mn, today strong growth.

In the Asia Pacific, the N,N-Dimethylethanolamine Market recorded the leading regional position with 36.30%, valued at USD 124.9 million, reflecting strong industrial, manufacturing, and water-treatment driven consumption across multiple economies in the region. Its dominance is supported by expanding chemical production bases and rising deployment of treatment systems across municipal and industrial facilities.

North America remains a significant consumer due to steady usage in advanced industrial processing, specialty formulations, and technology-aligned treatment systems, supported by stable demand in scalable downstream applications. Europe continues to show consistent adoption across regulated chemical and treatment environments, encouraged by structured industrial practices and compliance-focused application standards.

Middle East & Africa demonstrate gradual growth where expanding water management and treatment programs support incremental consumption, especially in urban and industrial expansion corridors. Latin America reflects developing market momentum with increasing awareness and industrial adoption potential in relevant application sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE maintains a position supported by its familiarity with large-scale chemical manufacturing and downstream formulation involvement, especially where ingredients are used in coatings, intermediates, and performance-focused industrial solutions. Its ability to align product offerings with sustainability roadmaps and system-level chemistry integration allows it to stay relevant in evolving application environments.

Eastman Chemical Company holds relevance through its presence in specialty chemicals and intermediate-based product value chains, where material consistency, application compatibility, and safety-aligned development matter. Its strategic focus on engineered formulations and long-term industrial relationships contributes to its alignment with users’ demanding reliable performance and quality-controlled chemical intermediates.

Huntsman Corporation remains notable due to its experience in supplying industrial materials and chemical solutions that support technical sectors requiring stable intermediates, formulation compatibility, and application-driven performance. Its association with industries that value durability, process reliability, and material efficiency places it meaningfully within the N,N-Dimethylethanolamine landscape. Overall, these companies show importance through operational experience, portfolio strength, and continued relevance in industrial chemical usage rather than short-term market cycles.

Top Key Players in the Market

- BASF SE

- Eastman Chemical Company

- Huntsman Corporation

- Mitsubishi Gas Chemical Company, Inc.

- Clariant AG

- Celanese Corporation

- Chevron Phillips Chemical Company LLC

- Others

Recent Developments

- In August 2025, Eastman announced a strategic partnership with Huafon Chemical Co., Ltd. to build a localized cellulose acetate yarn manufacturing facility in China, enhancing its capacity for Naia™ filament yarns and boosting innovation and supply-chain responsiveness in the region.

- In May 2025, BASF agreed to take over the remaining 49% stake of the joint venture Alsachimie (currently 51% BASF-owned) from DOMO Chemicals, aiming for full ownership. The site is a key hub for polyamide 6.6 precursor production in Europe, which strengthens BASF’s raw-material integration.

Report Scope

Report Features Description Market Value (2024) USD 344.2 Million Forecast Revenue (2034) USD 555.3 Million CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Formulation (Aqueous Solution, Concentrated Solution), By Application (Water Treatment, Paints and Coating, Pharmaceuticals, Personal Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Eastman Chemical Company, Huntsman Corporation, Mitsubishi Gas Chemical Company, Inc., Clariant AG, Celanese Corporation, Chevron Phillips Chemical Company LLC, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  N,N-Dimethylethanolamine MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

N,N-Dimethylethanolamine MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Eastman Chemical Company

- Huntsman Corporation

- Mitsubishi Gas Chemical Company, Inc.

- Clariant AG

- Celanese Corporation

- Chevron Phillips Chemical Company LLC

- Others