Global Naphthalene Market Size, Share, And Business Benefit By Source (Coal Tar, Petroleum), By Form (Flakes, Cake, Powder, Crystals), By Purity (Less than 99%, 99% and Above), By Application (Phthalic Anhydride, Naphthalene Sulfonates, Low-Volatility Solvents, Moth Repellent, Pesticides, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 162791

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

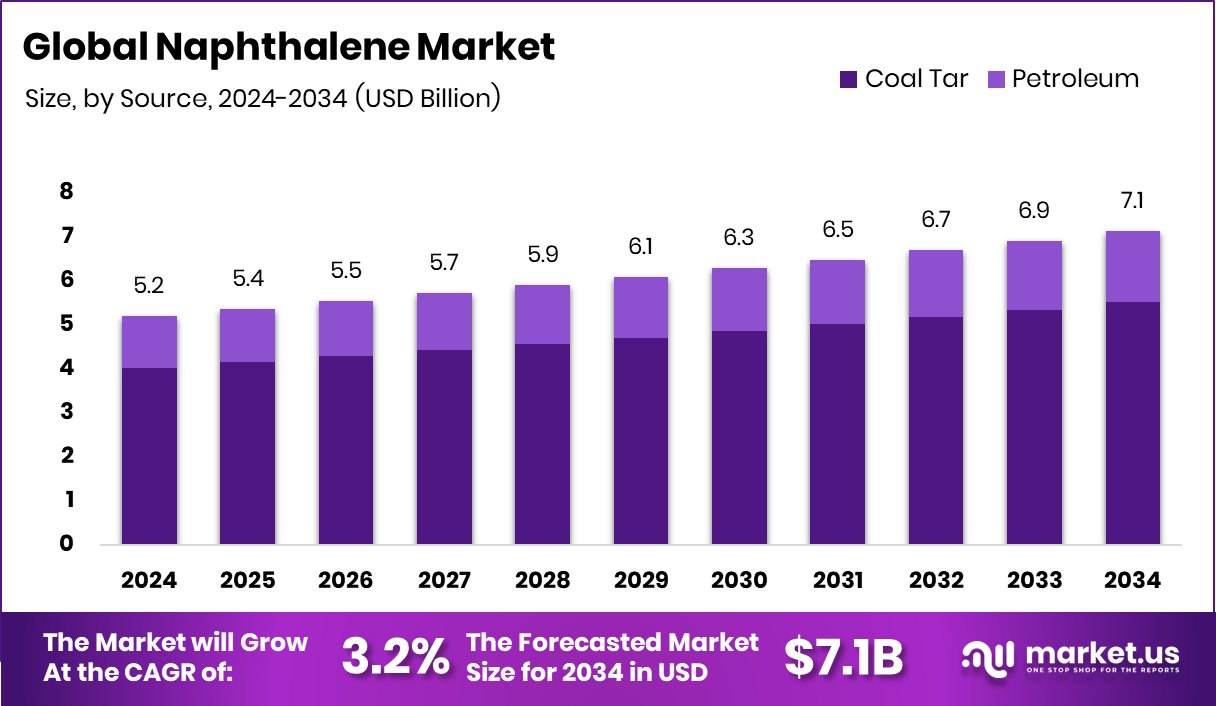

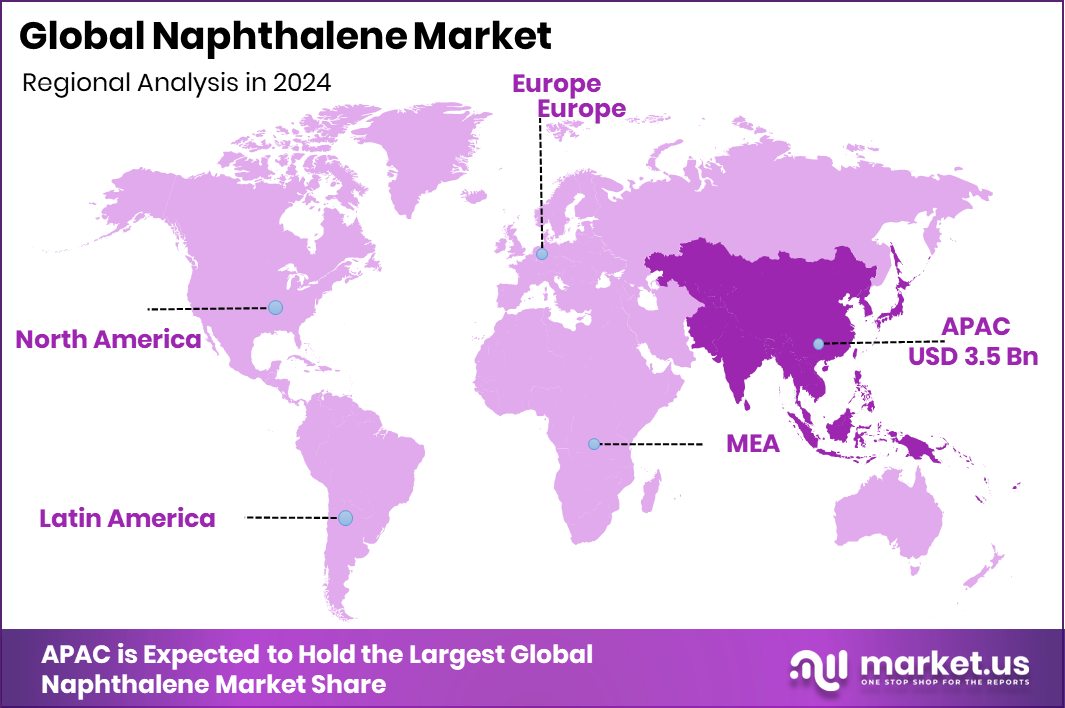

The Global Naphthalene Market is expected to be worth around USD 7.1 billion by 2034, up from USD 5.2 billion in 2024, and is projected to grow at a CAGR of 3.2% from 2025 to 2034. Rapid urbanization and infrastructure growth in the Asia Pacific further boosted its USD 3.5 Bn valuation.

Naphthalene is a white crystalline organic compound composed of two fused benzene rings (chemical formula C₁₀H₈). It is one of the simplest polycyclic aromatic hydrocarbons and has a distinctive mothball-like odor. In industry, it is primarily obtained from coal tar or petroleum distillates and serves as a chemical intermediate in many downstream processes. It finds use in the manufacturing of resins, dyes, plasticizers, and surfactants, among other applications.

The naphthalene market refers to the global trade, production, consumption, and value chain around this compound and its derivatives across multiple application sectors such as construction, textiles, agriculture, chemicals, and plastics. Demand is driven by its role as a feedstock for specialty chemicals (for example, plasticizer precursors) and by its use directly or indirectly in products like concrete superplasticisers and insect-repellent applications.

On the demand side, key end-use sectors such as textiles, agriculture, and chemical processing are significant. Naphthalene derivatives serve as dye intermediates, surfactants, and agrochemical formulations, and as such, the steady growth of these sectors drives demand. Moreover, as global agricultural acreage expands and more crop protection formulations are required, the role of intermediates like naphthalene sulfonates becomes increasingly important.

There is a notable opportunity in developing more sustainable or bio-derived derivative routes for naphthalene applications or substituting naphthalene-based intermediates with greener alternatives. Funding flows and innovation trends are relevant here: for example, Scotland’s SOLASTA Bio Nabs £4 M in Pre-Seed Funding for Nature-Inspired Pesticides.

Given that farmers use $60 billion of pesticides each year and that two MIT scientists have developed a new technology that could cut that number in half, there is a clear chance for next-generation agrochemical intermediates (potentially replacing naphthalene-based ones) to capture value. That creates a parallel pathway of opportunity for the naphthalene market players to evolve or partner in more sustainable solutions.

Key Takeaways

- The Global Naphthalene Market is expected to be worth around USD 7.1 billion by 2034, up from USD 5.2 billion in 2024, and is projected to grow at a CAGR of 3.2% from 2025 to 2034.

- In 2024, the naphthalene market saw coal tar-derived products dominate with a 77.3% share, driven by a stable supply.

- Flake form held 44.2% market share in 2024, favored for easy storage and industrial handling applications.

- Naphthalene with 99% and above purity captured 67.7% share, preferred in dyes, plastics, and specialty chemicals manufacturing.

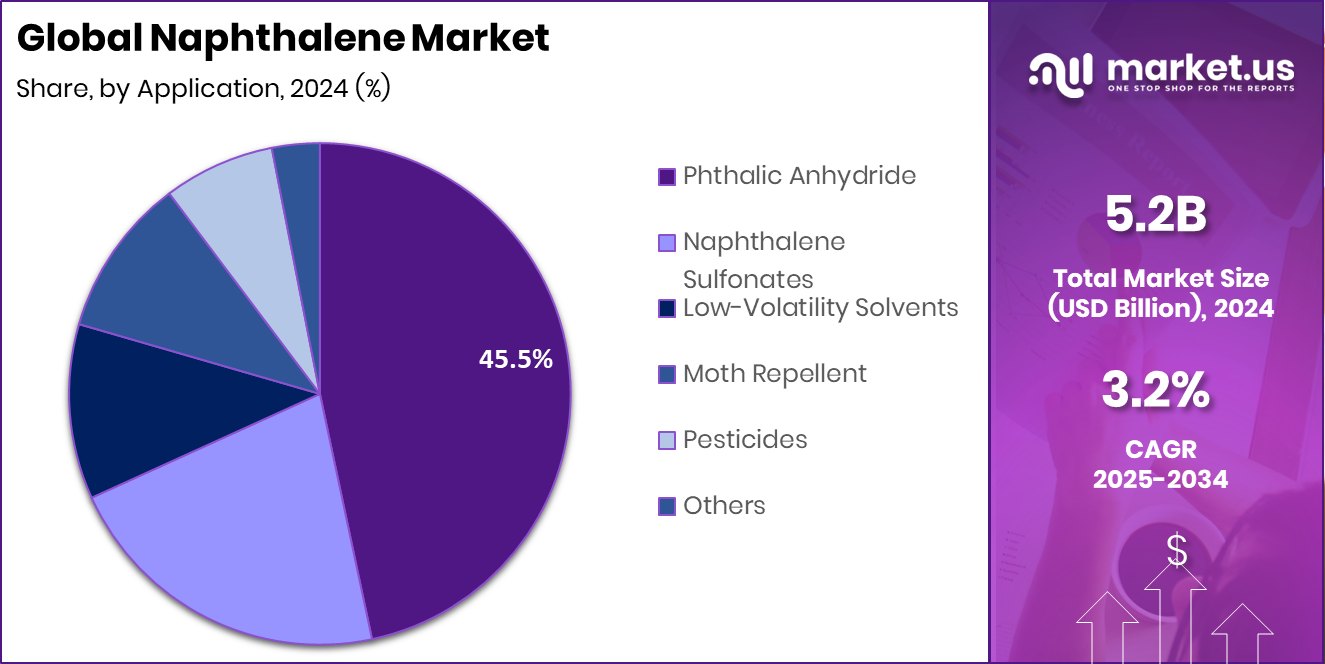

- Phthalic anhydride applications accounted for 45.5% of the market share, supporting plasticizer and resin production across global industries.

- The Asia Pacific USD 3.5 Bn region dominated due to strong industrial demand and chemical production capacity.

By Source Analysis

In 2024, the Naphthalene Market was mainly sourced from coal tar, contributing 77.3%.

In 2024, Coal Tar held a dominant market position in the By Source segment of the Naphthalene Market, with a 77.3% share. This dominance is attributed to its widespread industrial use as a primary raw material for naphthalene extraction, offering a high aromatic hydrocarbon yield compared to alternative sources. Coal tar–derived naphthalene remains essential for producing intermediates used in dyes, resins, and plasticizers.

Its cost-effectiveness and consistent availability from coke oven operations further strengthen its market presence. The purity and performance characteristics obtained from coal tar extraction make it the preferred choice for industrial-scale applications, ensuring stable supply chains and driving strong utilization across multiple downstream sectors in both the chemical and construction industries.

By Form Analysis

Naphthalene Market predominantly featured flakes form, holding a 44.2% market share globally.

In 2024, Flakes held a dominant market position in the By Form segment of the Naphthalene Market, with a 44.2% share. This strong position is due to their widespread use in industrial applications such as dyes, resins, and plasticizers, where ease of handling and uniform melting behavior are critical. Flake naphthalene provides better storage stability and controlled sublimation, making it suitable for large-scale chemical processing and manufacturing operations.

Its consistent composition and compatibility with automated production systems enhance efficiency across end-use industries. The high demand from the construction and textile sectors further supports its dominance, as flakes offer a reliable and pure form of naphthalene preferred for producing high-performance chemical intermediates.

By Purity Analysis

High-purity naphthalene (≥99%) accounted for 67.7% share of global consumption.

In 2024, 99% and Above held a dominant market position in the By Purity segment of the Naphthalene Market, with a 67.7% share. This high-purity grade is widely preferred for applications requiring superior chemical consistency, such as in dye intermediates, surfactants, and resins. Its minimal impurity levels ensure stable reactions and improved performance across industrial processes.

The demand for refined chemical intermediates in construction and coating formulations has further reinforced the adoption of 99% and above purity naphthalene. Additionally, its reliability in meeting stringent quality standards makes it the favored choice among manufacturers seeking optimal product efficiency, thereby solidifying its leadership position within the global naphthalene purity spectrum.

By Application Analysis

Phthalic anhydride production dominated the Naphthalene Market with a 45.5% share worldwide.

In 2024, Phthalic Anhydride held a dominant market position in the By Application segment of the Naphthalene Market, with a 45.5% share. This dominance is primarily due to its extensive use as a key intermediate in the production of plasticizers, resins, and dyes. Naphthalene serves as an essential raw material for manufacturing phthalic anhydride through oxidation processes, supporting large-scale industrial applications.

The growing utilization of phthalic anhydride in coatings, polymers, and construction materials has strengthened its market presence. Its high efficiency, consistent quality, and versatility across end-use industries have made it the leading application segment, driving steady demand for naphthalene as a crucial feedstock in global chemical manufacturing processes.

Key Market Segments

By Source

- Coal Tar

- Petroleum

By Form

- Flakes

- Cake

- Powder

- Crystals

By Purity

- Less than 99%

- 99% and Above

By Application

- Phthalic Anhydride

- Naphthalene Sulfonates

- Low-Volatility Solvents

- Moth Repellent

- Pesticides

- Others

Driving Factors

Rising Infrastructure Investments Drive Market Growth

A major driving factor for the naphthalene market is the surge in global infrastructure investments and industrial expansion. In 2025, India’s Budget allocated Rs 5,597 crore to strengthen the nation’s Strategic Petroleum Reserves, indicating strong public investment in energy and industrial projects. Such initiatives indirectly stimulate the demand for naphthalene-based materials used in construction chemicals, plasticizers, and resins.

The compound’s role in producing high-performance superplasticizers, essential for durable concrete and large-scale infrastructure projects, further reinforces its industrial relevance. As economies focus on modernization and energy security, the increased public funding and industrial spending promote steady growth in demand for naphthalene derivatives, driving both capacity expansion and technological advancements within the global chemical sector.

Restraining Factors

Environmental Regulations Limit Market Expansion Potential

A major restraining factor for the naphthalene market is the increasing stringency of environmental and safety regulations. Naphthalene, being a polycyclic aromatic hydrocarbon, poses potential risks to human health and the environment if not handled properly.

Governments across various regions are tightening control over their production, storage, and disposal to minimize emissions and pollution. These regulations have raised compliance costs for manufacturers, leading to higher operational expenses and reduced profit margins.

Additionally, the shift toward cleaner and eco-friendly chemical alternatives is discouraging industries from using naphthalene-based products. As sustainability becomes a global priority, the limited acceptance of hazardous substances continues to slow down market growth despite rising industrial demand.

Growth Opportunity

Expanding Petrochemical Feedstock Opportunities via Oil Sector Growth

A major growth opportunity for the naphthalene market lies in the upstream oil and petrochemical expansion driven by large-scale investment in raw material production. For example, Kuwait Petroleum Corporation is exploring a US$7 billion pipeline deal to fund its upstream oil expansion plan. This reflects a broader effort to increase crude availability and develop downstream petrochemicals.

As oil-based raw materials become more abundant, the supply chain for aromatic hydrocarbons like naphthalene improves, enabling manufacturers to scale up production of naphthalene-derived intermediates. Such growth in feedstock availability helps reduce cost pressures, strengthen supply security, and support the expansion of high-performance chemicals. The naphthalene market is positioned to benefit as petrochemical producers seek reliable aromatic sources to meet rising demand in coatings, plastics, and construction chemicals.

Latest Trends

Monetisation of Oil Infrastructure Fuels Aromatics Supply Growth

A key latest trend in the naphthalene market is the monetisation of oil infrastructure and expanded petrochemical capacity, which directly impacts the upstream availability of aromatic feedstocks. For instance, Kuwait Petroleum Corporation (KPC) is considering leasing parts of its pipeline network to raise funds for a US$65 billion investment plan, with a potential leasing deal valued at US$5-7 billion.

As major oil and gas players seek new financing models and commit to large-scale expansions, the downstream supply chains that depend on aromatic hydrocarbons like naphthalene gain greater security. This trend adds resilience and scale to the naphthalene value chain, enabling manufacturers to plan capacity increases, reduce feedstock constraints, and respond more rapidly to demand from coatings, plastics, and chemical intermediates industries.

Regional Analysis

In 2024, the Asia Pacific held a 68.90% share, valued at USD 3.5 Bn.

In 2024, Asia Pacific held a dominant position in the global Naphthalene Market, accounting for 68.90% share, valued at USD 3.5 billion. The region’s leadership is driven by rapid industrialization, robust chemical manufacturing bases, and growing construction activities in countries such as China, India, and Japan. Strong demand for naphthalene-derived intermediates used in dyes, resins, and concrete additives has reinforced its dominance.

North America follows with stable growth supported by advancements in specialty chemical production and infrastructure modernization projects. Europe shows consistent consumption due to established manufacturing sectors and strict quality standards promoting refined chemical use.

Meanwhile, the Middle East & Africa demonstrate gradual market expansion with increasing petrochemical investments, and Latin America benefits from developing industrial output and emerging construction demand.

The Asia Pacific region remains the key growth hub, supported by expanding urban infrastructure, rising chemical exports, and the presence of large-scale downstream processing industries, making it the most influential contributor to global naphthalene production and consumption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the global naphthalene market, three players stand out for their differentiated business models and regional footprints.

Alok Industries (India) leverages its domestic manufacturing and chemical-ancillary product lines to supply naphthalene balls and related offerings, strengthening its base in the consumer-hygiene segment.

Meanwhile, Arham Petrochem Private Limited (India) is focused on both crude and refined naphthalene, supplying high-purity grades and tailored aromatic solvents, positioning itself for industrial chemicals and downstream applications.

Finally, Bilbaína de Alquitranes, S.A. (Spain) brings European production of multiple purity grades (technical to pure) and global logistics infrastructure, enhancing its reach in cement-additive, resin, and dye markets.

Collectively, these players reflect different strategic choices—from mass consumer chemical products to high-grade industrial intermediates and global supply chain positioning—thus contributing to a balanced global naphthalene ecosystem.

Top Key Players in the Market

- ALOK INDUSTRIES

- ARHAM PETROCHEM PRIVATE LIMITED

- Bilbaína de Alquitranes, S.A.

- Carl Roth

- China Steel Chemical Corporation (CSCC)

- Deza, a.s.

- Epsilon Carbon Private Limited.

- Himadri Speciality Chemical Ltd

- JFE Chemical Corporation

- Junsei Chemical Co., Ltd.

- Koppers Inc.

Recent Developments

- In December 2024, Koppers announced it would cease production of phthalic anhydride at its Stickney, Illinois, facility, targeting mid-2025 for shutdown. The phthalic anhydride plant used naphthalene as a feedstock in its process

Report Scope

Report Features Description Market Value (2024) USD 5.2 Billion Forecast Revenue (2034) USD 7.1 Billion CAGR (2025-2034) 3.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Coal Tar, Petroleum), By Form (Flakes, Cake, Powder, Crystals), By Purity (Less than 99%, 99% and Above), By Application (Phthalic Anhydride, Naphthalene Sulfonates, Low-Volatility Solvents, Moth Repellent, Pesticides, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ALOK INDUSTRIES, ARHAM PETROCHEM PRIVATE LIMITED, Bilbaína de Alquitranes, S.A., Carl Roth, China Steel Chemical Corporation (CSCC), Deza, a.s., Epsilon Carbon Private Limited., Himadri Speciality Chemical Ltd, JFE Chemical Corporation, Junsei Chemical Co., Ltd., Koppers Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ALOK INDUSTRIES

- ARHAM PETROCHEM PRIVATE LIMITED

- Bilbaína de Alquitranes, S.A.

- Carl Roth

- China Steel Chemical Corporation (CSCC)

- Deza, a.s.

- Epsilon Carbon Private Limited.

- Himadri Speciality Chemical Ltd

- JFE Chemical Corporation

- Junsei Chemical Co., Ltd.

- Koppers Inc.