Global Nano Silica Market Size, Share, Growth Analysis By Product Type (P-type, S-type, and Type III), By Applications (Concrete, Rubber, Paints and Coatings, Adhesives and Sealants, Electronics, Pharmaceuticals, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157338

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overviews

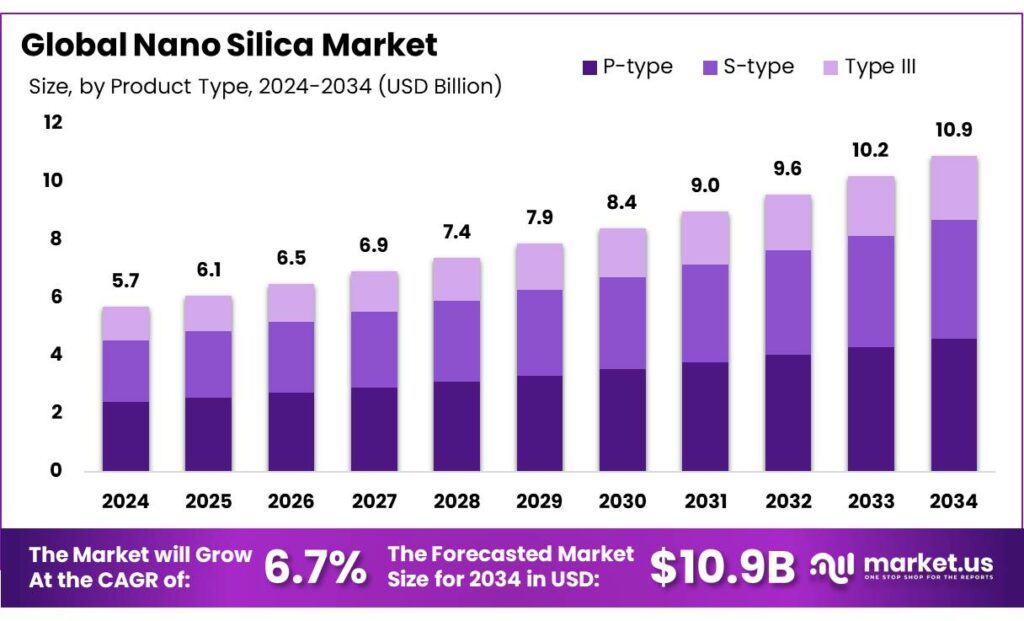

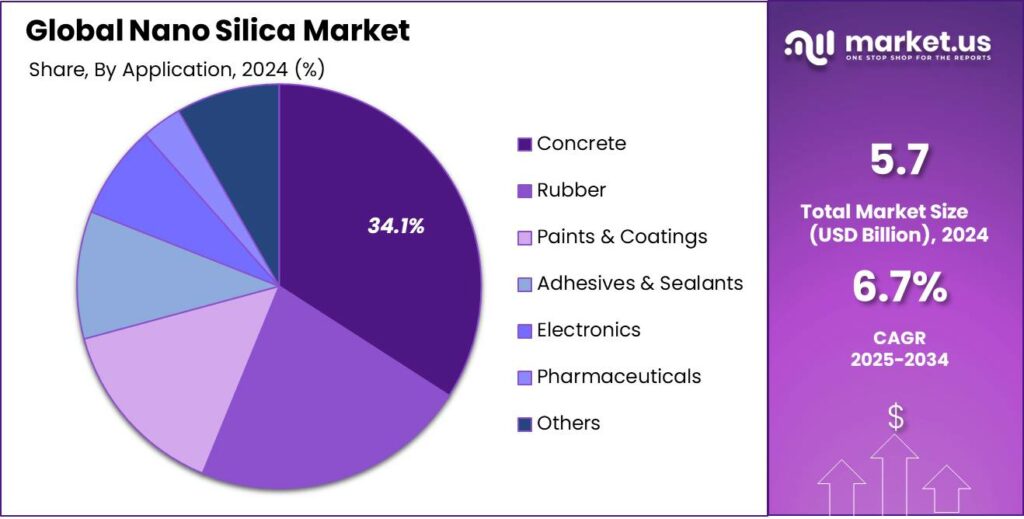

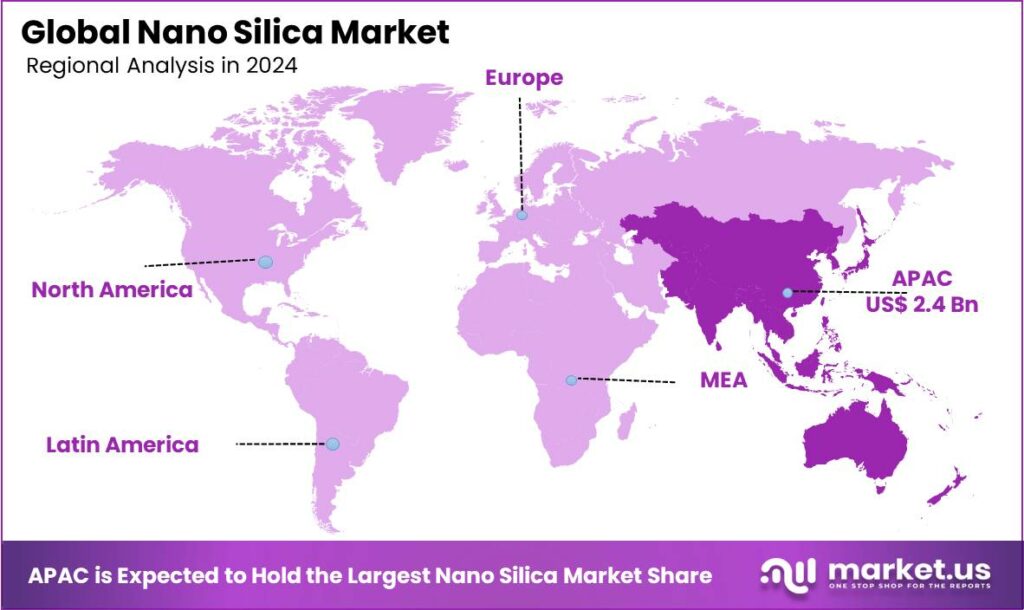

The Global Nano Silica Market size is expected to be worth around USD 10.9 Billion by 2034, from USD 5.7 Billion in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 41.2% share, holding USD 2.4 Billion in revenue.

Nano silica is silicon dioxide (SiO₂) in the form of tiny, amorphous nanoparticles, typically ranging from 5 to 100 nanometers in diameter. Due to its incredibly small size, it exhibits unique properties compared to bulk silica, leading to widespread applications in enhancing materials such as cement and concrete by improving strength and durability. Additionally, it finds use in coatings, composites, and drug delivery systems. The major driver of the market is the expanding construction industry, which uses nano silica in high-performance concrete.

Additionally, nano silica has gained traction in the tire industry and the healthcare industry for drug delivery systems. In recent years, as there has been a global shift towards sustainable manufacturing of products, the production of nano silica from sustainable materials, such as rice husk ash, is gaining momentum. However, health and environmental concerns regarding nanoparticles and silica dust may restrain the growth of the market.

Key Takeaways

- The global nano silica market was valued at US$5.7 billion in 2024.

- The global nano silica market is projected to grow at a CAGR of 6.7% and is estimated to reach US$10.9 billion by 2034.

- Based on product types, nano silica, which belongs to the p-type, dominated the market in 2024, comprising about 1% share of the total global market.

- Among the applications of nano silica in commercial settings, the concrete manufacturing industry dominated the market in 2024, accounting for around 1% of the market share.

- Asia Pacific was the largest market for nano silica in 2024 due to its rapidly expanding construction and infrastructure industry.

Product Type Analysis

Nano Silica that Belongs to P-Type Dominated the Market Due to Its Chemical Properties.

Based on product type, the nano silica market is segmented into p-type, s-type, and type III. P-type of nano silica dominated the market in 2024 with a market share of 42.1%. P-type nano silica is favored over s-type due to its higher pore rate, leading to a larger specific surface area and superior UV reflectivity. P-type nano silica particles are characterized by a large number of nano-pores, which gives them a high pore rate of 0.61 ml/g.

This porous structure makes P-type nano silica a better choice for applications like reinforced filler in concrete and as an additive in rubber and plastics. The presence of numerous pores results in a significantly larger specific surface area compared to S-type particles. It exhibits better reflection of ultraviolet (UV) light, making it more effective in applications requiring UV protection. The high UV reflectivity of p-type nano silica is beneficial in construction and coating applications to protect against UV degradation, thus extending the lifespan of materials.

Application Analysis

The Concrete Industry Dominated the Nano Silica Market in 2024.

In 2024, the concrete industry emerged as the largest end-use sector for nano silica, accounting for nearly 34.1% of the product’s global consumption, outperforming sectors such as rubber, paints & coatings, adhesives & sealants, electronics, and pharmaceuticals. Nano-silica improves concrete by refining the pore structure, acting as a pozzolanic material to produce more calcium silicate hydrate (C-S-H) gel, and acting as nucleation sites for C-S-H growth. These mechanisms enhance mechanical properties such as compressive, flexural, and bond strength, while also increasing durability by reducing permeability and water absorption. While it can increase water demand and alter setting times in fresh concrete, the overall result is improved strength, density, and durability in hardened concrete.

Key Market Segments

By Product Type

- P-type

- S-type

- Type III

By Application

- Concrete

- Rubber

- Paints & Coatings

- Adhesives & Sealants

- Electronics

- Pharmaceuticals

- Others

Drivers

Demand for Nano Silica for the Construction Industry Drives the Market.

The construction industry is a major driver of demand for nano silica, owing to its exceptional properties that enhance the performance of concrete and other building materials. Nano silica, with its ultra-fine particle size and high surface area, significantly improves the compressive strength, durability, and resistance to chemical attacks in concrete.

- For instance, studies have shown that incorporating 3% nano silica by weight of cement can increase the compressive strength of concrete by up to 25%, while also reducing permeability and shrinkage. These characteristics are particularly valuable in infrastructure projects such as bridges, high-rise buildings, and tunnels, where long-term durability is critical.

Additionally, nano silica contributes to sustainability by enabling lower cement usage without compromising strength, thus reducing CO₂ emissions. Countries investing heavily in urbanization and smart city development, such as China and India, are increasingly adopting nano silica-enhanced materials, further fueling their demand across the construction sectors.

Restraints

Potential Toxicity of Nano Silica Might Hamper the Growth of the Market.

Health and environmental concerns present significant challenges to the widespread adoption of nano silica. Due to their extremely small size (1–100 nm), nano silica particles can easily become airborne and inhaled, potentially penetrating deep into lung tissues. A study by the National Health Institute published that prolonged exposure may lead to respiratory inflammation, oxidative stress, or even fibrosis.

For instance, research published in Toxicology Letters found that rats exposed to nano silica developed lung damage and inflammatory responses. Additionally, the environmental impact of nano silica is still not fully understood. Once released into soil or water, these particles can accumulate in ecosystems and potentially affect microorganisms, plants, and aquatic life.

A study in Environmental Science & Technology indicated that nano silica could alter microbial activity in soil, disrupting nutrient cycling. Due to these uncertainties, regulatory agencies in regions such as the EU have implemented strict safety assessments for nanomaterials, which may delay product approvals and increase compliance costs.

Opportunity

Applications of Nano Silica in Drug Delivery Systems and the Tire Industry Create Opportunities in the Nano Silica Market.

Nano silica is gaining traction in both the healthcare and tire industries due to its unique physical and chemical properties. For instance, in drug delivery systems, nano silica’s high surface area, tunable pore size, and biocompatibility make it ideal for controlled and targeted drug release. Mesoporous silica nanoparticles (MSNs) have been shown to enhance the bioavailability of poorly soluble drugs by over 40% in some cases, while also enabling pH-responsive and site-specific delivery. This is particularly valuable in cancer therapy, where precision in targeting tumor cells can minimize side effects and improve treatment efficacy.

Similarly, in the tire industry, nano silica serves as a reinforcing filler that improves fuel efficiency, grip, and wear resistance. Replacing traditional carbon black with nano silica can reduce rolling resistance by up to 20%, contributing to lower CO₂ emissions and better handling, especially in wet conditions. These dual applications showcase the versatility of nano silica and open new avenues for innovation and commercialization in the market.

Trends

Adoption of Sustainable Manufacturing of Nano Silica.

The trend toward sustainable manufacturing of nano silica is gaining momentum as industries increasingly prioritize green and circular production methods. Agricultural byproducts, especially rice husk, are being repurposed as eco‑friendly silica precursors, with extraction methods yielding up to 52-78% silica from varied wastes such as rice husk, bamboo leaves, sugarcane bagasse, and groundnut shells. For instance, thermal-chemical processes have produced high-purity amorphous nano silica from rice husk ash, avoiding CO₂ emissions typically associated with conventional methods.

Similarly, paper mill boiler ash has been transformed to yield approximately 250 kg of nano silica per ton of ash, achieving about 25% synthesis efficiency, and lowering energy input by eliminating high-temperature pre-calcination. Additionally, innovative circular approaches are also being explored, such as silicon waste from end-of-life solar panels being upcycled into nano silica via a Zero C process, producing high-quality powders with zero waste and reduced energy use. These initiatives reflect a growing shift toward sustainable and resource-efficient nano silica production across sectors.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the Nano Silica Market.

Geopolitical tensions are increasingly affecting the nano silica supply chain by aggravating raw material shortages, driving up energy costs, and raising logistical hurdles. For instance, in 2022, China’s energy rationing led to a 20-30% surge in precursor prices, as the country supplies over 6 million tons of silicon metal, crucial for nano silica production. Similarly, the Russia–Ukraine conflict propelled European natural gas prices upward, triggering a 15-25% rise in production costs and squeezing margins in several European countries.

Additionally, Indonesia’s proposed restriction on silica sand exports, a supplier of about 12% of global exports, sparked panic buying across East Asia and lifted prices. These developments underscore that the geopolitical instability, from trade controls to energy volatility, can cascade through upstream supply chains, constraining nano silica availability, inflating costs, and prompting manufacturers to scramble for more resilient sourcing strategies.

Regional Analysis

Asia Pacific Led the Global Nano Silica Market in 2024.

Asia Pacific held the major share of the global nano silica market, led by China and India, valued at around US$2.4 billion. The Asia‑Pacific region emerged as the frontrunner in the global nano silica market, commanding an estimated 41.2% of total revenue share. The dominance of the region is attributed to the rapidly growing construction industry in the developing countries of Asia.

For instance, according to the Construction Industry Development Council of India, the construction industry is the second largest contributor to the GDP of the country after the agricultural sector. Similarly, in the first half of 2024, China’s National Bureau of Statistics reported that the investment in real estate development was 5,252.9 billion yuan. Additionally, growing demand for advanced materials in the region for electronics, automotive, and healthcare sectors creates significant opportunities for nano silica to enhance product functionality and durability.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

There are several global key players in the nano silica market, such as Evonik Industries, Cabot Corporation, DuPont, Wacker Chemie, NanoPore, NanoAmor, Fuso Chemical, nanoComposix, Bee Chems, PPG Industries, and nanoComposix. As the nano silica market is very niche, many players put efforts into strategic activities, such as product development, mergers, partnerships, and investments.

Evonik offers various forms of nano silica with unique properties such as adjustable particle size and increased surface area. The company focuses on responsible nanotechnology development to create sustainable solutions that contribute to environmental protection. Wacker Chemie is a German multinational chemical company producing silicones, polymers, polysilicon, and bio-solutions. Its pyrogenic silica is a light, pure silicon dioxide produced with high purity. The company’s silica is known for its large specific surface area and thermal and electrical insulation.

Fuso Chemical is a Japanese company that manufactures a range of functional chemicals, electronic materials, and life science products, including nano-silica. It is known for its ultra-high purity colloidal silica and high-purity organo silica solution, serving markets such as plastics, paints, and resins with these advanced additives.

The Major Players in The Industry

- Evonik Industries AG

- Cabot Corporation

- DuPont

- Wacker Chemie AG

- NanoPore Incorporated

- NanoAmor (Nanostructured & Amorphous Materials)

- Fuso Chemical Co., Ltd.

- nanoComposix

- Bee Chems

- PPG Industries

- nanoComposix

- Other Key Players

Key Developments

- In January 2025, Evonik launched Smart Effects, which is a strategic merger of its silica and silanes business lines with a total of 3,500 employees worldwide.

- In February 2025, GoNano, North America’s roof protection brand, announced the launch of Bio-Boost, an addition to its asphalt shingle treatment lineup. Bio-Boost has blended high-performance nano silica technology with bio-based ingredients to enhance shingle performance, increase water resistance, and extend roof life.

Report Scope

Report Features Description Market Value (2024) USD 5.7 Bn Forecast Revenue (2034) USD 10.9 Bn CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (P-type, S-type, Type III), By Applications (Concrete, Rubber, Paints & Coatings, Adhesives & Sealants, Electronics, Pharmaceuticals, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Evonik Industries AG, Cabot Corporation, AkzoNobel N.V., DuPont, Wacker Chemie AG, NanoPore Incorporated, NanoAmor (Nanostructured & Amorphous Materials), Fuso Chemical Co., Ltd., nanoComposix, Bee Chems, PPG Industries, nanoComposix, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Evonik Industries AG

- Cabot Corporation

- DuPont

- Wacker Chemie AG

- NanoPore Incorporated

- NanoAmor (Nanostructured & Amorphous Materials)

- Fuso Chemical Co., Ltd.

- nanoComposix

- Bee Chems

- PPG Industries

- nanoComposix

- Other Key Players