Global N-Methyl Aniline Market Size, Share, And Business Benefit By Product Form (Liquid N-Methylaniline, Solid N-Methylaniline), By Application (Dyes and Pigments, Pharmaceuticals, Aromatic Amines, Agrochemicals, Fuels and Solvents, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 164165

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

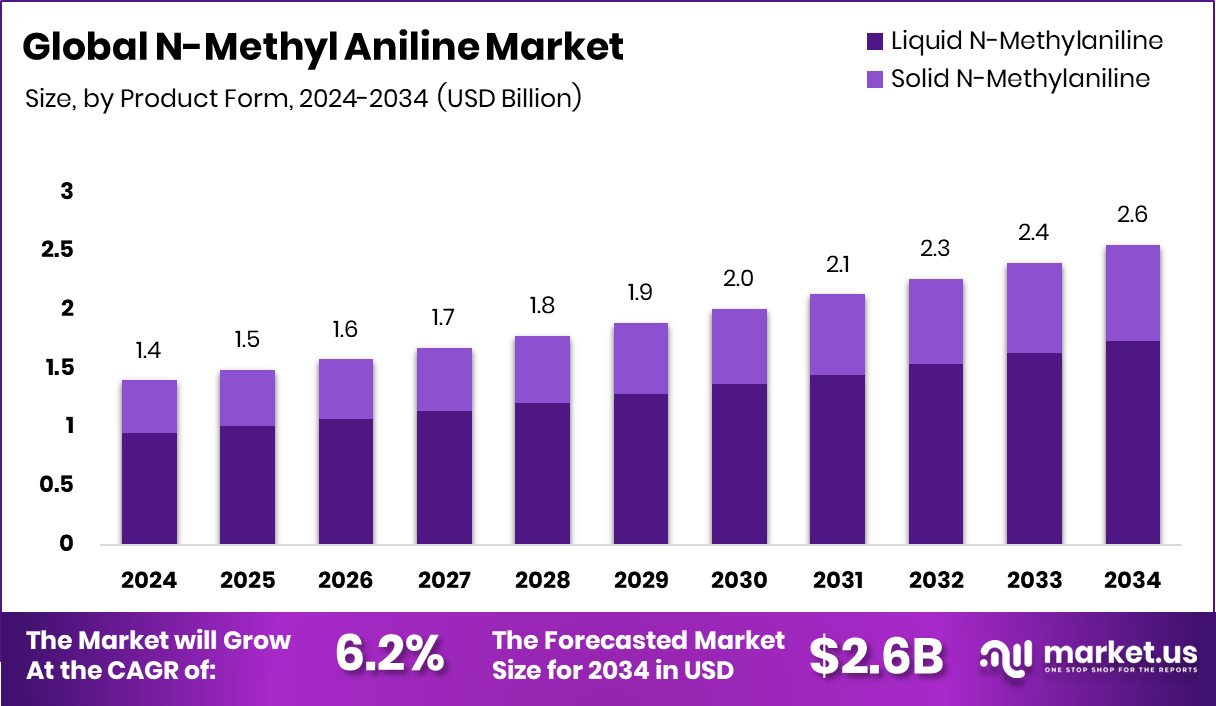

The Global N-Methyl Aniline Market is expected to be worth around USD 2.6 billion by 2034, up from USD 1.4 billion in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034. North America’s 44.90% share reflects growing applications across the chemical and dye industries.

N-Methyl Aniline (NMA) is an organic compound known for its role as an intermediate in producing dyes, pesticides, and fuel additives. It is a colorless to slightly yellow liquid used extensively in agrochemicals, pharmaceuticals, and the chemical industry. Its versatility makes it a vital component in formulating herbicides and other specialty chemicals that support global agricultural productivity.

The growth of the N-Methyl Aniline market is strongly influenced by the expansion of the agrochemical and specialty chemical industries. Recent investments, such as Arbuda Agrochemicals’ NSE Emerge IPO for ₹120 crore to reduce debt and launch a new ALP line, and Kotak arm’s Rs 375 crore infusion into an agrochemical firm, underline the sector’s rising capital flow. These developments fuel higher production of intermediates like NMA, which are essential in advanced formulations.

Increasing agricultural output and the need for efficient crop protection drive continuous demand for NMA. Funding activities such as Bhaskar Agrochemicals redeeming Rs 75 lakh worth of preference shares and IFC investing Rs 300 crore in an agrochemical firm demonstrate market confidence. This rising financial support enhances chemical manufacturing capacities, strengthening the need for intermediates like NMA.

Startups like Scimplify, raising $9.5 million, and VitalFluid, securing €5 million to boost sustainable AgTech, show that innovation and green chemistry are reshaping opportunities in the sector. With agriculture and specialty chemicals evolving toward sustainability, N-methylaniline presents new avenues in eco-efficient synthesis and next-generation agrochemical production.

Key Takeaways

- The Global N-Methyl Aniline Market is expected to be worth around USD 2.6 billion by 2034, up from USD 1.4 billion in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034.

- In 2024, Liquid N-Methyl Aniline dominated the N-Methyl Aniline Market, accounting for 87.4% share.

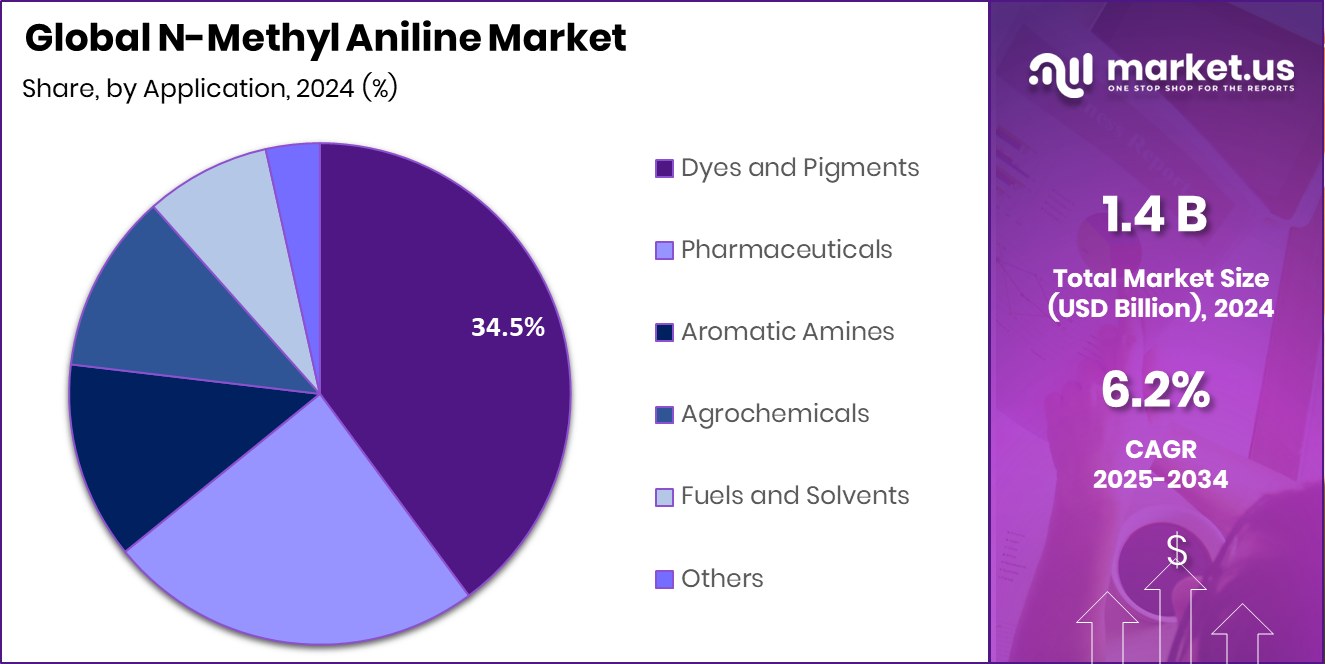

- Dyes and Pigments applications led the N-Methyl Aniline Market, capturing a substantial 34.5% market share

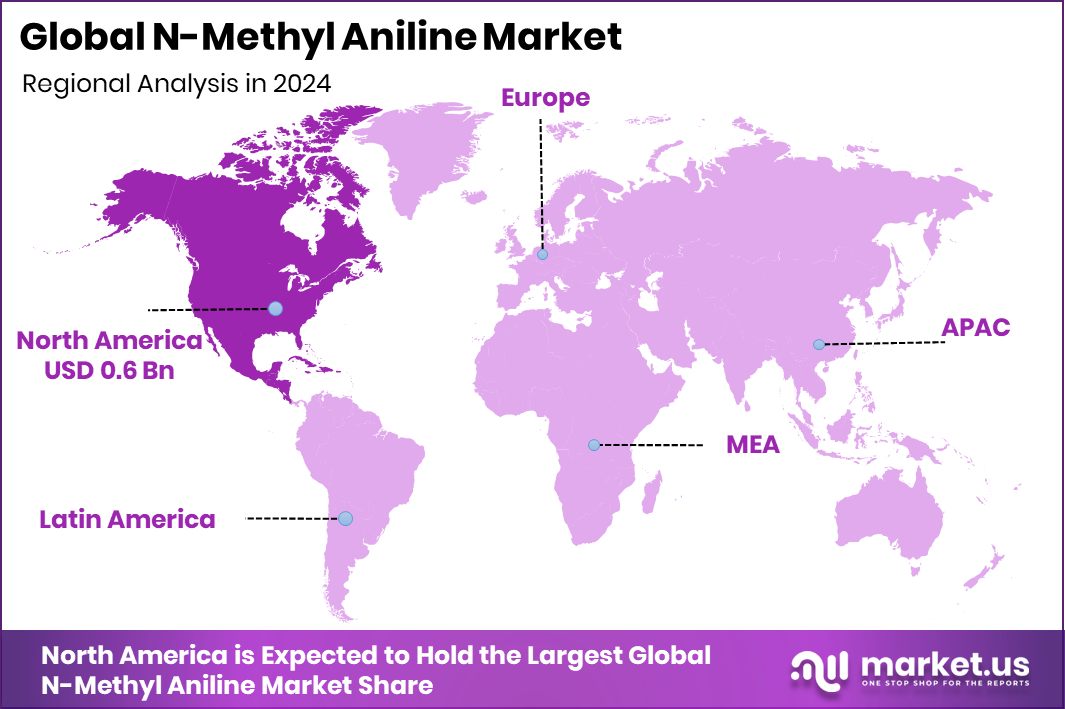

- The North America USD 0.6 Bn strong industrial base supports consistent demand for N-Methyl Aniline production.

By Product Form Analysis

In 2024, Liquid N-Methyl Aniline dominated with 87.4% market share.

In 2024, Liquid N-Methylaniline held a dominant market position in the By Product Form segment of the N-Methyl Aniline Market, capturing an impressive 87.4% share. This dominance is attributed to its widespread use as an intermediate in agrochemical formulations, dye production, and industrial chemical synthesis. The liquid form offers superior solubility, stability, and ease of handling, making it the preferred choice for large-scale chemical manufacturing operations.

Additionally, continuous funding inflows across the agrochemical and specialty chemical industries have further strengthened production capacities relying on liquid N-Methylaniline. The product’s adaptability in diverse end-use industries continues to position it as the most commercially significant and operationally efficient form within the global N-Methyl Aniline market.

By Application Analysis

The Dyes and Pigments segment led the N-Methyl Aniline Market with 34.5% share.

In 2024, Dyes and Pigments held a dominant market position in the By Application segment of the N-Methyl Aniline Market, accounting for a 34.5% share. This strong position is driven by the compound’s extensive use as a key intermediate in manufacturing synthetic dyes and colorants used across textiles, coatings, and printing inks. N-Methyl Aniline’s ability to enhance color stability and performance has made it indispensable for high-quality pigment formulations.

The steady expansion of industrial dye production and increasing demand for durable, vibrant colors across various sectors have further supported its dominance. As manufacturing activities grow globally, the use of N-Methyl Aniline in dye and pigment synthesis continues to reinforce its leadership within this application segment.

Key Market Segments

By Product Form

- Liquid N-Methylaniline

- Solid N-Methylaniline

By Application

- Dyes and Pigments

- Pharmaceuticals

- Aromatic Amines

- Agrochemicals

- Fuels and Solvents

- Others

Driving Factors

Rising Demand for Specialty Chemicals and Bio-Based Pigments

One of the key driving factors for the N-Methyl Aniline market is the increasing demand for specialty chemicals and bio-based pigments across industrial sectors. N-Methyl Aniline serves as an essential intermediate in producing dyes, pigments, and colorants used in textiles, coatings, and agrochemical formulations. The industry is witnessing a notable push toward sustainable pigment solutions, supported by new funding and innovation.

For instance, Living Ink raised $3 million to diversify feedstocks for bio-based pigments, reflecting the growing shift toward eco-friendly and renewable materials. Such developments are expanding opportunities for N-Methyl Aniline in high-performance pigment manufacturing. The move toward greener chemistry and sustainable production continues to boost market growth and strengthen its industrial significance.

Restraining Factors

Strict Environmental Rules Limiting Chemical Manufacturing Growth

A major restraining factor for the N-Methyl Aniline market is the stringent environmental and safety regulations governing the production and handling of aromatic amines. N-Methyl Aniline is classified as hazardous, requiring strict compliance with waste disposal and emission standards, which increases operational costs and limits expansion in some regions. Additionally, industries are gradually shifting toward eco-friendly and bio-based alternatives, which challenge conventional chemical intermediates.

In this context, Cambridge spin-out Sparxell secured a €1.9 million European Innovation Council grant to transform the $48 billion colourants market, emphasizing sustainable pigments that replace harmful chemicals. This global move toward safer, biodegradable colorant solutions may reduce dependency on N-Methyl Aniline, restraining its market growth in traditional dye and pigment applications.

Growth Opportunity

Expanding Use in Sustainable Pigments and Coatings

A major growth opportunity for the N-Methyl Aniline market lies in its expanding application within sustainable pigments and coatings. As industries shift toward eco-friendly colorants and cleaner production processes, the demand for reliable intermediates like N-Methyl Aniline is increasing. The compound’s chemical versatility makes it valuable in developing next-generation pigments that balance performance with environmental responsibility.

Recently, pigment start-up Nature Coatings secured a $2.45 million investment to enhance sustainable pigment production, signaling strong investor interest in green chemistry solutions. Such funding initiatives are opening new pathways for N-Methyl Aniline in renewable pigment formulations and high-performance coatings. This growing integration with sustainable manufacturing trends presents a promising opportunity for long-term market expansion.

Latest Trends

Growing Shift Toward Eco-Friendly and Sustainable Dyes

One of the latest trends in the N-Methyl Aniline market is the strong move toward eco-friendly and sustainable dye production. As global industries seek to minimize chemical waste and reduce carbon emissions, manufacturers are investing in cleaner and more responsible dye technologies. This trend is reflected in recent developments such as Paris-based Ever Dye raising €3.4 million to develop sustainable dyes for the textile industry.

Such funding highlights the industry’s commitment to transforming traditional dye processes using renewable feedstocks and low-impact chemistry. N-Methyl Aniline, being a vital dye intermediate, benefits from this transformation as it becomes part of advanced formulations that align with green chemistry principles, marking a significant step toward a more sustainable colorant future.

Regional Analysis

In 2024, North America held a 44.90% share, valued at USD 0.6 Bn.

In 2024, North America dominated the N-Methyl Aniline market, holding a significant 44.90% share valued at USD 0.6 billion. The region’s leadership is driven by its strong industrial chemical infrastructure, expanding agrochemical production, and steady demand from dye and pigment manufacturers.

The presence of advanced processing technologies and supportive regulatory frameworks further strengthens market performance across the United States and Canada. In Europe, demand remains steady due to the region’s focus on sustainable chemical synthesis and its well-established specialty chemical sector.

The Asia Pacific region continues to emerge as a fast-growing market, supported by expanding manufacturing bases and increasing investment in industrial chemicals. Meanwhile, the Middle East & Africa show gradual adoption of chemical intermediates driven by growing industrial diversification, while Latin America experiences moderate growth led by agricultural sector expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Finetech Industry Limited continued to strengthen its product portfolio through consistent quality improvements and customized chemical synthesis, serving a wide range of industrial users. The company’s focus on precision chemistry and export capabilities enabled it to meet the growing global demand for high-purity intermediates like N-Methyl Aniline.

Hefei TNJ Chemical Industry Co., Ltd. maintained a strong position with its integrated chemical production capabilities and emphasis on safety and environmental standards. Its diversified product line in fine and specialty chemicals allowed it to support applications in dyes, pharmaceuticals, and agrochemicals, expanding its client base across multiple regions.

Changzhou Baolong Chemicals Co., Ltd. continued to be recognized for its manufacturing efficiency and cost-effective production of aromatic amines. Its steady supply network and adherence to global chemical safety protocols positioned it as a reliable partner for downstream industries.

Top Key Players in the Market

- AARTI

- Finetech Industry Limited

- Hefei TNJ Chemical Industry Co.,Ltd.

- Changzhou Baolong Chemicals Co. Ltd

- Hangzhou Dayangchem Co.Limited

Recent Developments

- In October 2024, TNJ Chemical underwent an annual audit by the China Quality Certification Center for its ISO-quality management system.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Billion Forecast Revenue (2034) USD 2.6 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Form (Liquid N-Methylaniline, Solid N-Methylaniline), By Application (Dyes and Pigments, Pharmaceuticals, Aromatic Amines, Agrochemicals, Fuels and Solvents, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AARTI, Finetech Industry Limited, Hefei TNJ Chemical Industry Co.,Ltd., Changzhou Baolong Chemicals Co. Ltd, Hangzhou Dayangchem Co., Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  N-Methyl Aniline MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

N-Methyl Aniline MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AARTI

- Finetech Industry Limited

- Hefei TNJ Chemical Industry Co.,Ltd.

- Changzhou Baolong Chemicals Co. Ltd

- Hangzhou Dayangchem Co.Limited