Global N-Heptane Market Size, Share, And Business Benefit By Purity Grade (≥99% (High Purity/HPLC Grade), 95–99% (Laboratory/Analytical Grade), Less Than 95% (Technical/Industrial Grade), Others), By Application (Solvent, Blending Agent, Cleaning Agent, Reference Fuel, Chromatography Reagent, Chemical Intermediate, Others), By End-Use (Pharmaceuticals, Paints and Coatings, Adhesives and Sealants, Rubber and Plastics, Electronics and Semiconductors, Petrochemicals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165024

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

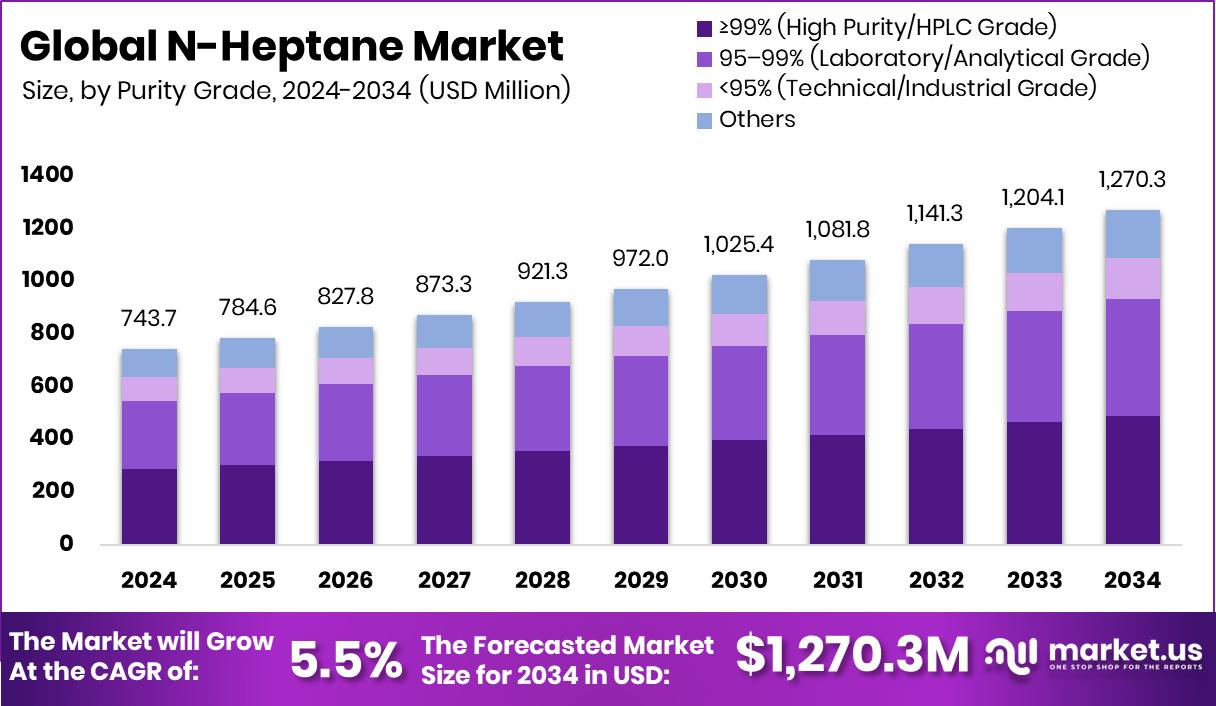

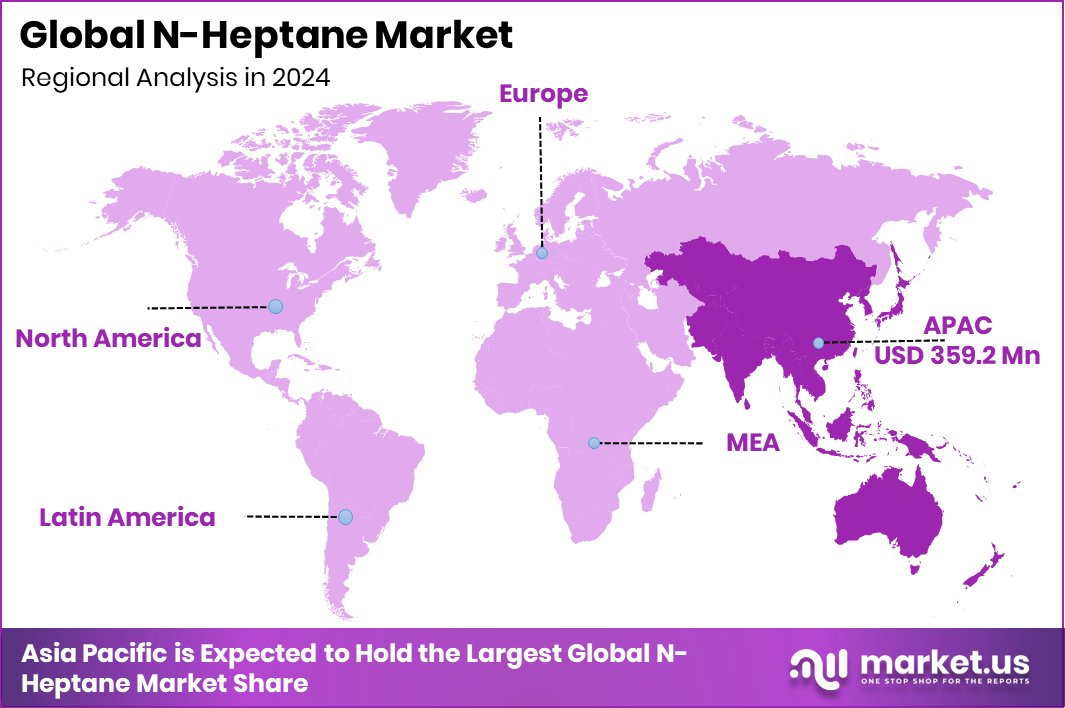

The Global N-Heptane Market is expected to be worth around USD 1,270.3 million by 2034, up from USD 743.7 million in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034. Strong industrial growth in Asia-Pacific supported its 48.30% share, reaching USD 359.2 million.

N-Heptane is a straight-chain hydrocarbon (C₇H₁₆) widely used as a solvent in paints, coatings, adhesives, and laboratories. It is a clear, flammable liquid known for its high purity and consistent performance in blending, cleaning, and extraction applications. Its stable chemical nature and low reactivity make it a preferred choice in multiple industries, including pharmaceuticals, electronics, and specialty chemicals.

The N-Heptane market represents the industrial demand and production dynamics surrounding this solvent. Growth in the manufacturing, automotive, and electronics sectors has significantly boosted its utilization. The market also benefits from rising solvent applications in high-performance coatings and cleaning products, where purity and volatility control are crucial.

One of the major growth factors is the expansion of specialty chemical industries driven by innovation and sustainability. As industries move toward safer and eco-friendly solvents, N-Heptane’s low toxicity and performance make it an appealing choice. Industrial expansion and modernization further push market growth across the Asia-Pacific and Europe.

In terms of demand, N-Heptane continues to gain traction in flexible packaging, adhesive formulations, and ink production. Rapid industrialization and rising exports of formulated chemical products have strengthened its market base globally.

Opportunities are growing through investment flows and consolidation in the chemical and coatings value chain. Recently, Distil raised $7.7 million in Series A funding, JSW promoters pledged a stake to fund a ₹9,000 crore AkzoNobel India deal, and Nippon Paint Holdings secured a $2.3 billion agreement for AOC. Such investments highlight expanding confidence in specialty chemical ecosystems, indirectly uplifting N-Heptane demand.

Key Takeaways

- The Global N-Heptane Market is expected to be worth around USD 1,270.3 million by 2034, up from USD 743.7 million in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034.

- The N-Heptane Market sees a 38.6% share from ≥99% purity grade, ensuring superior solvent performance globally.

- The N-Heptane Market holds a 39.1% share as a solvent, driving coatings and adhesive production.

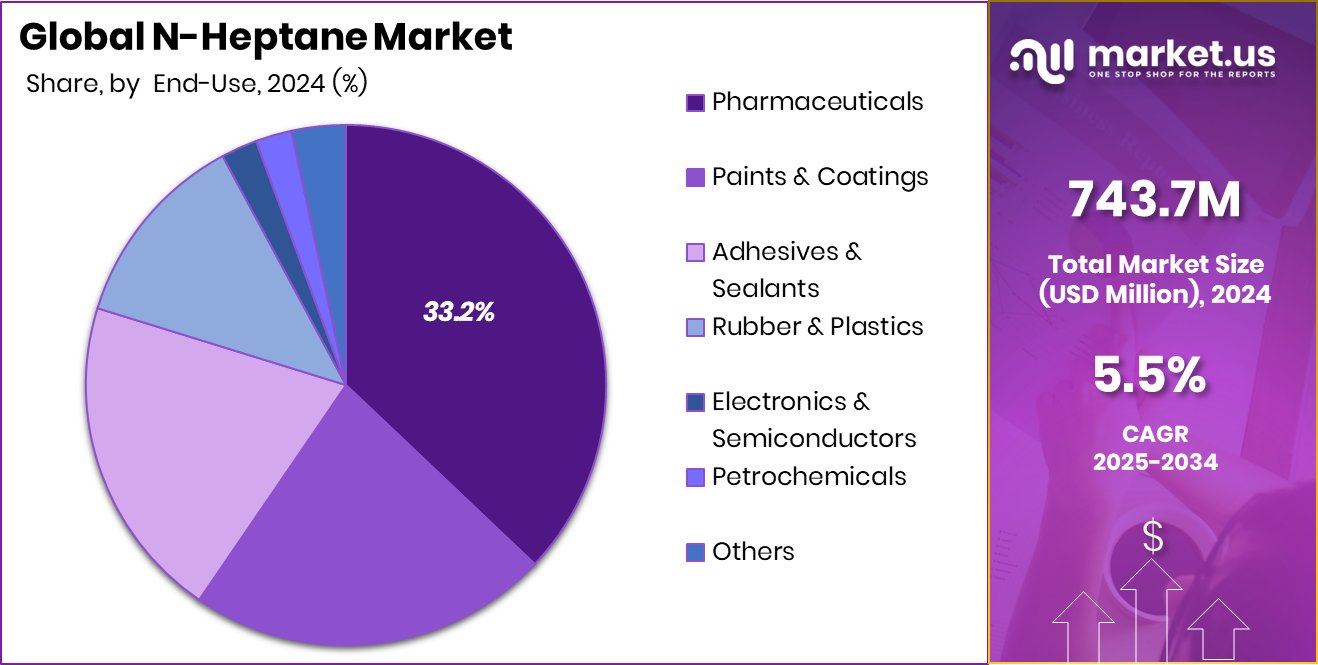

- The N-Heptane Market’s 33.2% share in pharmaceuticals highlights its role in drug formulation processes.

- The Asia-Pacific N-Heptane Market was valued at USD 359.2 million in 2024.

By Purity Grade Analysis

The N-Heptane Market’s ≥99% purity grade holds a 38.6% share.

In 2024, ≥99% (High Purity/HPLC Grade) held a dominant market position in the By Purity Grade segment of the N-Heptane Market, accounting for a 38.6% share. This grade is primarily used where superior solvent quality and high analytical accuracy are required, such as in pharmaceutical synthesis, chromatography, and precision coatings.

Its consistent composition and low impurity levels make it suitable for laboratory and industrial use, ensuring reproducible results and product reliability. The increasing preference for high-purity solvents across research, formulation, and specialty manufacturing sectors continues to strengthen its dominance.

Moreover, industries demanding stringent purity standards, especially in electronics and fine chemicals, rely heavily on ≥99% grade N-Heptane, reinforcing its role as the preferred purity segment in 2024.

By Application Analysis

In the N-Heptane Market, solvent applications dominate with a 39.1% share.

In 2024, Solvent held a dominant market position in the By Application segment of the N-Heptane Market, accounting for a 39.1% share. The segment’s leadership is driven by N-Heptane’s extensive use as a high-performance solvent in paints, coatings, adhesives, and cleaning formulations.

Its non-polar nature, quick evaporation rate, and compatibility with various resins make it essential in industrial and laboratory applications. The growing demand for cleaner, safer, and more efficient solvents across the chemical processing and electronics sectors further reinforces its prominence.

Additionally, industries focused on precision manufacturing and high-purity formulations continue to prefer N-Heptane for its consistent composition and reliability, establishing the solvent application as the cornerstone of market growth in 2024.

By End-Use Analysis

Pharmaceuticals lead the N-Heptane Market with a 33.2% end-use share.

In 2024, pharmaceuticals held a dominant market position in the By End-Use segment of the N-Heptane Market, accounting for a 33.2% share. This dominance is attributed to the compound’s extensive use as a high-purity solvent in drug formulation, extraction, and purification processes.

N-Heptane’s low toxicity, stability, and ability to dissolve non-polar compounds make it ideal for producing active pharmaceutical ingredients and intermediates. The segment benefits from rising pharmaceutical manufacturing and R&D activities that demand reliable solvent performance and regulatory compliance.

Moreover, the shift toward cleaner production processes in pharmaceutical facilities has strengthened the preference for N-Heptane, supporting its continued leadership within the end-use category throughout 2024.

Key Market Segments

By Purity Grade

- ≥99% (High Purity/HPLC Grade)

- 95–99% (Laboratory/Analytical Grade)

- <95% (Technical/Industrial Grade)

- Others

By Application

- Solvent

- Blending Agent

- Cleaning Agent

- Reference Fuel

- Chromatography Reagent

- Chemical Intermediate

- Others

By End-Use

- Pharmaceuticals

- Paints and Coatings

- Adhesives and Sealants

- Rubber and Plastics

- Electronics and Semiconductors

- Petrochemicals

- Others

By Distribution Channel

- Direct Sales

- Distributors/Wholesalers

- E-commerce/Online Chemical Portals

- Others

Driving Factors

Growing Industrial Use in Specialty Chemical Manufacturing

One of the main driving factors for the N-Heptane Market is its growing use in specialty chemical manufacturing and industrial processing. N-Heptane is valued for its high purity, low reactivity, and excellent solvent properties, making it essential in producing coatings, adhesives, and precision chemical formulations. As industries focus on cleaner and more efficient production systems, the demand for reliable solvents like N-Heptane continues to rise.

The expansion of the advanced materials, paints, and adhesives industries further adds momentum to this growth. Additionally, increasing investments in the global chemical ecosystem are reinforcing market confidence. Recently, Glue raised $20 million to strengthen digital collaboration tools and industrial productivity, signaling continued innovation that indirectly supports manufacturing efficiency and demand for solvents such as N-Heptane.

Restraining Factors

Stringent Environmental Regulations and Safety Concerns

One key restraining factor for the N-Heptane Market is the growing impact of strict environmental and safety regulations. Being a volatile and flammable solvent, N-heptane requires careful handling, storage, and disposal to prevent workplace hazards and emissions.

Governments across regions have tightened rules on volatile organic compound (VOC) emissions and solvent waste management, increasing compliance costs for manufacturers. Industries using N-Heptane must invest in proper containment systems and advanced safety equipment, which raises overall operational expenses.

Additionally, regulatory pressure to shift toward eco-friendly or bio-based solvents limits their widespread adoption in certain sectors. These combined challenges make it difficult for producers to maintain profitability while ensuring compliance, slowing the market’s growth momentum despite its industrial benefits.

Growth Opportunity

Rising Demand for High-Purity Solvents in Manufacturing

A major growth opportunity for the N-Heptane Market lies in the rising demand for high-purity solvents across manufacturing and laboratory applications. As industries such as pharmaceuticals, coatings, and specialty chemicals expand, the need for cleaner and more stable solvents is growing rapidly. N-Heptane, known for its excellent solvency and low toxicity, fits perfectly into this demand shift. Its use in precision manufacturing, quality testing, and product formulation is increasing as companies aim for higher production standards.

Furthermore, the trend toward sustainable and efficient chemical processing is encouraging the use of refined solvents like N-heptane. In a related development, Pepperfry secured $40 million in a Series F funding round led by Pidilite, reflecting growing investor interest in material innovation and industrial expansion supporting solvent demand.

Latest Trends

Shift Toward Eco-Friendly and Low-Emission Solvents

A key trend shaping the N-Heptane Market is the growing shift toward eco-friendly and low-emission solvent systems. Manufacturers are increasingly focusing on developing cleaner production processes and sustainable alternatives that meet strict environmental regulations.

N-Heptane, being less toxic and having a lower environmental impact compared to several traditional solvents, is gaining preference across industries. The push for green chemistry and sustainable formulations in paints, adhesives, and coatings is further driving this transition.

Companies are also adopting advanced refining technologies to enhance N-Heptane purity levels, ensuring better efficiency and reduced emissions during use. This trend highlights the industry’s broader movement toward balancing performance with sustainability, aligning solvent applications with global environmental and safety standards.

Regional Analysis

In 2024, the Asia-Pacific region dominated the N-Heptane Market with 48.30%.

In 2024, the Asia-Pacific region dominated the N-Heptane Market, holding a significant 48.30% share valued at USD 359.2 million. The region’s leadership stems from its expanding industrial base, particularly in pharmaceuticals, coatings, and specialty chemicals, where high-purity solvents like N-Heptane are in constant demand. Rapid industrialization, favorable manufacturing policies, and the strong presence of end-use sectors across China, India, and Japan have strengthened its market dominance.

North America follows closely, driven by advancements in chemical formulation and growing consumption in laboratory and research applications. Europe maintains steady growth supported by strict purity standards and widespread use in regulated pharmaceutical production.

Meanwhile, the Middle East & Africa show gradual market development due to emerging industrial infrastructure, while Latin America benefits from increased chemical exports and expanding manufacturing operations.

Collectively, these regions contribute to a stable global market structure, but Asia-Pacific’s manufacturing efficiency, export potential, and rising investment in cleaner solvents continue to position it as the leading region, reflecting its strong influence in global N-Heptane production and consumption trends.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The chemical division of ExxonMobil Chemical remains a significant player in the n-heptane space, offering products like Exxsol™ Heptane and ULT Heptane with ultra-low aromatic and toluene content. This focus on purity gives ExxonMobil a strong position in adhesives, coatings, and industrial cleaning applications where solvent consistency is critical. The firm’s established downstream chemical infrastructure supports reliable supply and regional reach, which is an asset in a competitive market with increasing demands for high-performance solvents.

Shell Chemicals has developed and supplies heptane formulations classified under its “special boiling point” (SBP) aliphatic hydrocarbon solvents, providing narrow boiling range fluids with very low aromatics and olefins. Such precision makes Shell’s product highly suitable for niche applications where drying, residue, and evaporation characteristics matter. Shell’s strong global chemical network and solvent technology expertise reinforce its ability to meet evolving purity and process-control expectations in markets like coatings and electronics.

Chevron Phillips Chemical makes its mark through its “n-Heptane Pure Grade” and related high-purity hydrocarbons. The company emphasises specialty solvent production for sectors including pharmaceuticals, electronics cleaning, and hydrocarbon reference fuels. This allows Chevron Phillips to capture demand in premium segments where purity, regulatory compliance, and batch consistency are key. Their positioning in fine chemicals and solvent applications reinforces their relevance as a top-tier supplier in the n-heptane market.

Top Key Players in the Market

- ExxonMobil Chemical

- Shell Chemicals

- Chevron Phillips Chemical

- Haltermann Carless

- DHC Solvent Chemie GmbH

- SK Geo Centric

- Triveni Chemicals

- Sasol Limited

- Loba Chemie Pvt. Ltd.

- FUJIFILM Wako Pure Chemical Corporation

- Avantor, Inc.

Recent Developments

- In April 2025, Shell announced a major restructuring of its global chemicals business, including its U.S. operations. The company said it would seek strategic partners for its chemicals portfolio, signalling a focus on streamlining and strengthening its operations.

- In November 2024, Exxon Mobil announced an investment of more than US$200 million to expand its chemical recycling operations at its Baytown and Beaumont, Texas, sites. The investment covers advanced recycling projects that feed into its chemical feedstock base.

Report Scope

Report Features Description Market Value (2024) USD 743.7 Million Forecast Revenue (2034) USD 1,270.3 Million CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity Grade (≥99% (High Purity/HPLC Grade), 95–99% (Laboratory/Analytical Grade), <95% (Technical/Industrial Grade), Others), By Application (Solvent, Blending Agent, Cleaning Agent, Reference Fuel, Chromatography Reagent, Chemical Intermediate, Others), By End-Use (Pharmaceuticals, Paints and Coatings, Adhesives and Sealants, Rubber and Plastics, Electronics and Semiconductors, Petrochemicals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ExxonMobil Chemical, Shell Chemicals, Chevron Phillips Chemical, Haltermann Carless, DHC Solvent Chemie GmbH, SK Geo Centric, Triveni Chemicals, Sasol Limited, Loba Chemie Pvt. Ltd., FUJIFILM Wako Pure Chemical Corporation, Avantor, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ExxonMobil Chemical

- Shell Chemicals

- Chevron Phillips Chemical

- Haltermann Carless

- DHC Solvent Chemie GmbH

- SK Geo Centric

- Triveni Chemicals

- Sasol Limited

- Loba Chemie Pvt. Ltd.

- FUJIFILM Wako Pure Chemical Corporation

- Avantor, Inc.