Global Monochloroacetic Acid Market Size, Share, And Business Benefits By Form (Crystalline, Liquid, Flakes), By Application (Carboxymethylcellulose (CMC), Agrochemicals, Surfactants, Thioglycolic Acid (TGA), Others), By End-use (Agrochemicals, Personal Care and Pharmaceuticals, Geological Drillings, Dyes and Detergents, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151211

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

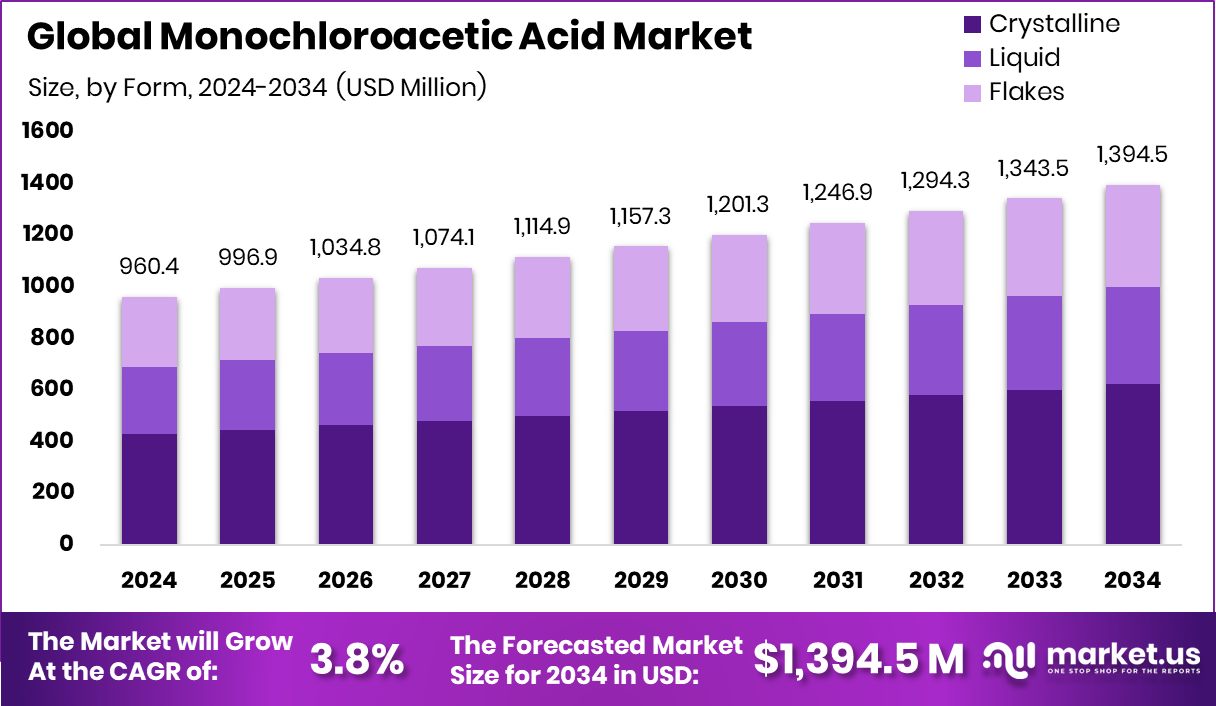

Global Monochloroacetic Acid Market is expected to be worth around USD 1,394.5 Million by 2034, up from USD 960.4 Million in 2024, and grow at a CAGR of 3.8% from 2025 to 2034. Strong industrial demand in Asia-Pacific, 42.5%, supports continued growth and market leadership.

Monochloroacetic acid (MCAA) is a colorless crystalline compound that is highly soluble in water and used primarily as a building block in organic synthesis. It is derived from acetic acid by substituting one hydrogen atom with a chlorine atom. MCAA is highly reactive, making it a versatile intermediate in the production of various chemicals, including carboxymethyl cellulose, agrochemicals, surfactants, and pharmaceuticals.

The monochloroacetic acid market refers to the global trade and commercial landscape surrounding the production, distribution, and utilization of MCAA across various industries. It encompasses the supply chain from raw material sourcing to the end-use applications in sectors such as agriculture, personal care, and textiles.

The steady rise in industrial applications, particularly in agriculture and pharmaceuticals, is a major factor contributing to the growth of the MCAA market. As the demand for herbicides and active pharmaceutical ingredients increases, so does the need for reliable intermediates like MCAA.

Increasing demand for high-performance chemical formulations in agriculture, such as efficient herbicides, is fueling consistent consumption of MCAA. The textile and cosmetic industries also contribute to demand through products like carboxymethyl cellulose, which improves texture and shelf life. These end-user demands ensure a consistent requirement for MCAA in industrial production lines.

Key Takeaways

- Global Monochloroacetic Acid Market is expected to be worth around USD 1,394.5 Million by 2034, up from USD 960.4 Million in 2024, and grow at a CAGR of 3.8% from 2025 to 2034.

- Crystalline form dominates the Monochloroacetic Acid Market, accounting for 44.8% of the total market share.

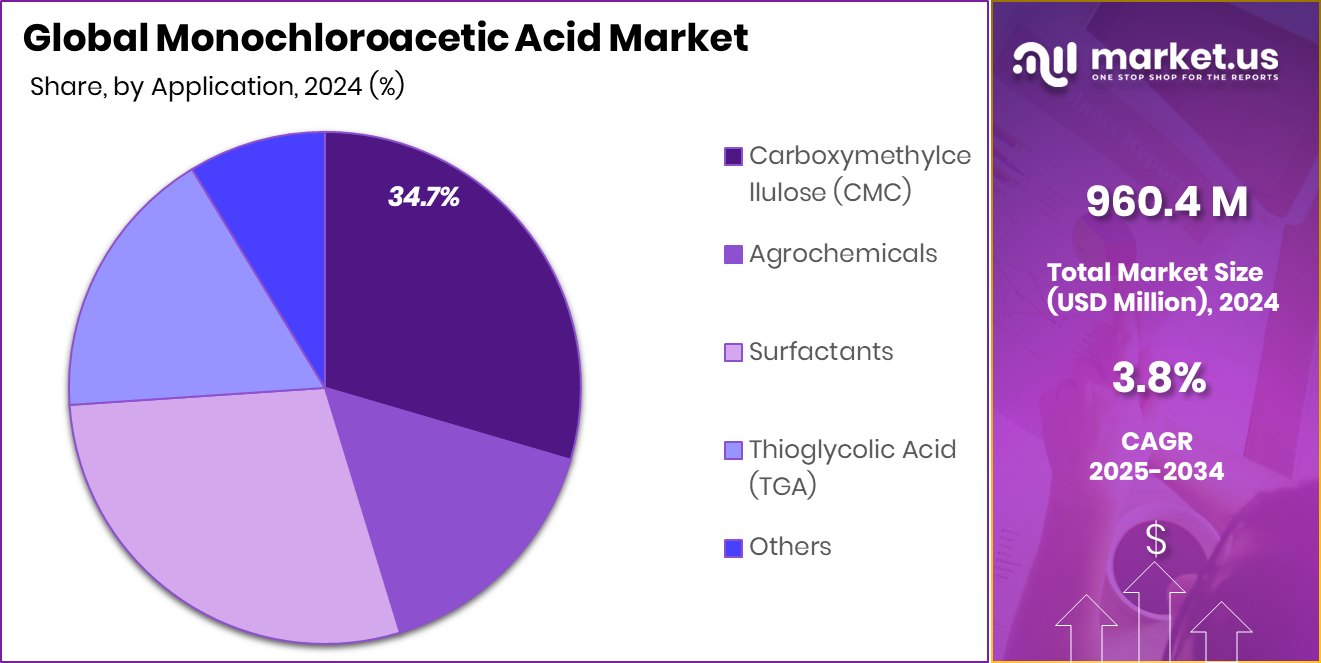

- Carboxymethylcellulose application drives 34.7% of the Monochloroacetic Acid Market, showing strong industrial dependence.

- Agrochemicals lead end-use in the Monochloroacetic Acid Market, capturing a significant 29.4% market value.

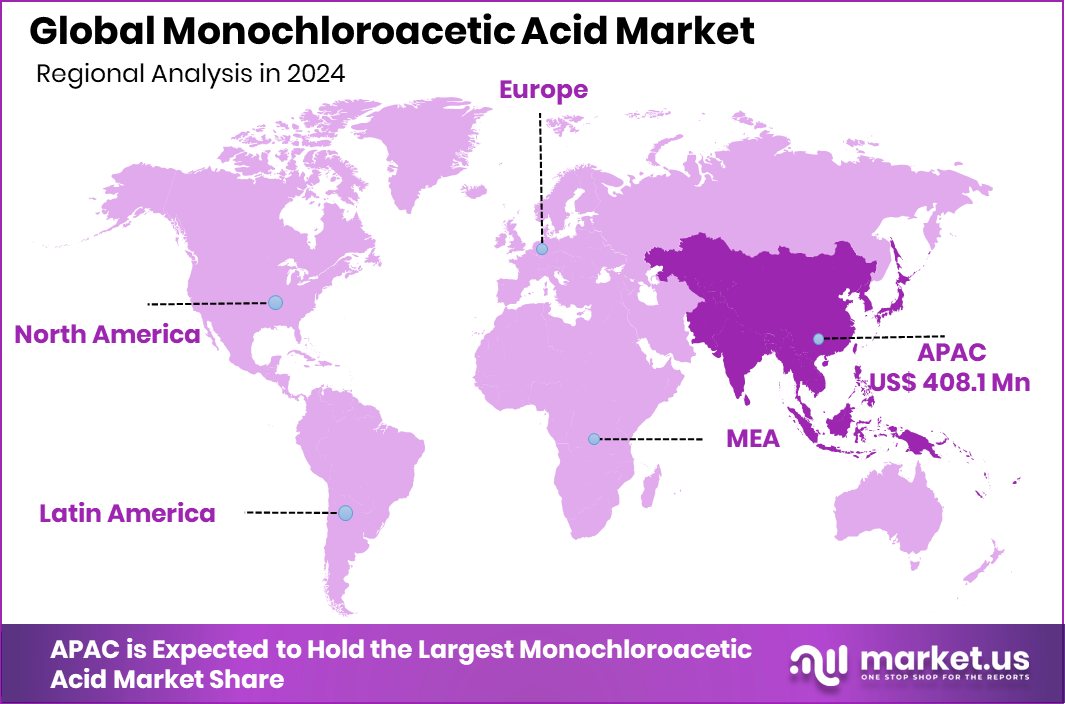

- The Asia-Pacific market value in 2024 reached USD 408.1 million.

By Form Analysis

Crystalline form dominates the Monochloroacetic Acid Market with 44.8% share.

In 2024, Crystalline held a dominant market position in the By Form segment of the Monochloroacetic Acid Market, with a 44.8% share. This significant market share reflects the widespread industrial preference for crystalline MCAA due to its ease of handling, storage stability, and high purity levels.

Crystalline form is particularly favored in applications requiring precise formulation, such as pharmaceuticals and agrochemicals, where consistency and controlled reactivity are essential. The crystalline nature of the compound allows for better packaging, transportation, and extended shelf life, making it an optimal choice for both large-scale manufacturers and specialty chemical producers.

Its solubility in water and organic solvents enhances its application across multiple downstream industries, contributing to its substantial market uptake. The solid form also reduces the risks associated with handling corrosive liquid forms, especially in environments with strict safety protocols. Manufacturers benefit from lower material loss during processing and improved measurement accuracy, further supporting their widespread adoption.

The dominance of the crystalline segment is expected to continue, driven by its functional advantages and growing demand from sectors that prioritize purity and formulation precision. The consistent performance of crystalline MCAA in critical chemical processes reinforces its position as a preferred choice in the global market.

By Application Analysis

Carboxymethylcellulose leads the monochloroacetic acid market applications at 34.7% value.

In 2024, Carboxymethylcellulose (CMC) held a dominant market position in the By Application segment of the Monochloroacetic Acid Market, with a 34.7% share. This leading position highlights the critical role of MCAA as a key raw material in the production of CMC, a widely used cellulose derivative.

CMC is known for its thickening, stabilizing, and water-retention properties, making it a valuable ingredient across various end-use industries such as food, pharmaceuticals, personal care, and paper. The high market share indicates strong and consistent demand for MCAA in the manufacture of CMC products that meet diverse industrial requirements.

The dominance of this application segment can be attributed to the versatility and performance benefits of CMC in both consumer and industrial products. With CMC being a staple in formulations where viscosity control and texture enhancement are crucial, the demand for MCAA remains stable and substantial.

Additionally, the scalable production process of CMC supports large-volume usage of MCAA, further cementing its market share. The 34.7% share underlines how integral the CMC segment is to the overall market structure of monochloroacetic acid, making it a core driver of production and commercial activity within the global chemical landscape.

By End-use Analysis

Agrochemicals hold 29.4% value in the monochloroacetic acid market usage globally.

In 2024, Agrochemicals held a dominant market position in the By End-use segment of the Monochloroacetic Acid Market, with a 29.4% share. This substantial share underscores the crucial role of MCAA in the synthesis of herbicides, pesticides, and plant growth regulators—key components in modern agricultural practices.

The agrochemical industry’s reliance on MCAA stems from its effectiveness as an intermediate in producing active ingredients that enhance crop yield, protect against pests, and improve overall agricultural productivity.

The 29.4% market share reflects the high-volume consumption of MCAA in agrochemical manufacturing, particularly in regions with intensive farming and rising food demand. The consistency, reactivity, and cost-effectiveness of MCAA make it a preferred input for producing a wide range of agrochemical formulations. As agricultural sectors continue to modernize and expand, the need for reliable chemical inputs like MCAA remains strong.

The dominance of the agrochemicals segment in the end-use category illustrates its foundational role in driving MCAA demand, reinforcing its importance in sustaining global food supply chains and supporting efficient farming practices.

Key Market Segments

By Form

- Crystalline

- Liquid

- Flakes

By Application

- Carboxymethylcellulose (CMC)

- Agrochemicals

- Surfactants

- Thioglycolic Acid (TGA)

- Others

By End-use

- Agrochemicals

- Personal Care and Pharmaceuticals

- Geological Drillings

- Dyes and Detergents

- Others

Driving Factors

Rising Demand for Crop Protection Chemicals

One of the top driving factors of the Monochloroacetic Acid (MCAA) market is the increasing use of crop protection chemicals in agriculture. Farmers across the world are focusing on improving crop yield and protecting plants from pests, diseases, and weeds. For this, they need effective herbicides and pesticides—many of which are made using MCAA as a key raw material.

As global food demand continues to grow, especially in developing countries, the need for advanced agricultural chemicals also rises. This trend directly increases the demand for MCAA. Its role as a chemical building block makes it essential in producing reliable and efficient agrochemical products. This growing agricultural need strongly supports the overall growth of the MCAA market.

Restraining Factors

Health and Safety Risks During MCAA Handling

A major restraining factor in the Monochloroacetic Acid (MCAA) market is the health and safety risks linked with its handling and use. MCAA is a highly corrosive and toxic chemical that can cause serious skin burns, eye damage, and respiratory issues if not managed properly. This makes its storage, transportation, and application challenging, especially in facilities without strong safety systems.

Companies must invest in special protective equipment, training, and secure packaging, which increases operational costs. In some cases, small or medium-sized manufacturers may avoid using MCAA altogether due to these risks. Strict safety regulations and concerns over worker health can slow down market growth, making it a significant limiting factor for broader adoption in sensitive industries.

Growth Opportunity

Expansion Into Eco‑Friendly and High‑Purity MCAA Production

An important growth opportunity in the Monochloroacetic Acid (MCAA) market lies in producing eco‑friendly and high‑purity variants. As industries worldwide aim to be greener and safer, the demand for cleaner chemical building blocks is rising. Manufacturers who develop MCAA using lower energy processes, fewer harmful byproducts, and higher purity standards can gain a strong advantage.

High-purity MCAA is especially valued in pharmaceuticals, specialty chemicals, and food-grade applications, where impurities can affect product performance or safety. Investing in cleaner production methods and advanced purification can unlock new customer segments and open doors in regulated markets.

Latest Trends

Adoption of Continuous Processing for MCAA Production

A key recent trend in the Monochloroacetic Acid (MCAA) market is the shift toward continuous processing methods. Traditional batch production is giving way to continuous flow systems, which offer better efficiency, consistency, and safety. In continuous setups, raw materials flow steadily through reactors, reducing downtime between runs and improving energy use. This helps manufacturers produce MCAA more reliably and with fewer impurities or safety incidents.

Continuous processes also allow real-time monitoring and tighter control over reaction conditions, leading to higher-quality output. As more chemical producers adopt this approach, the MCAA market benefits from faster, safer, and cleaner production. Over time, this trend also lowers costs and supports stronger supply reliability, which is good news for industries relying on MCAA.

Regional Analysis

Asia-Pacific dominated the Monochloroacetic Acid market with a 42.5% share.

In the Monochloroacetic Acid market, Asia-Pacific emerged as the dominant regional segment in 2024, capturing a significant 42.5% market share with a value of USD 408.1 million. This dominance is driven by strong industrial growth, high demand from agrochemicals and pharmaceuticals, and expanding chemical manufacturing capacity across countries like China and India. The region’s well-established production infrastructure and rising consumption of specialty chemicals support this leading position.

North America and Europe follow, supported by steady demand in pharmaceuticals, personal care, and regulated agrochemical industries. While these regions contribute consistently, their market share remains comparatively lower due to slower industrial expansion and strict environmental norms. The Middle East & Africa and Latin America represent emerging markets, showing gradual development in industrial applications of MCAA, especially in agriculture.

However, these regions contribute a smaller portion of the global market, with slower adoption and infrastructure limitations. Asia-Pacific continues to lead in volume and revenue due to its competitive production costs and rising domestic demand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Monochloroacetic Acid (MCAA) market saw notable activity from key players including Alfa Aesar, Anugrah In-Org (P) Limited, and CABB Group GmbH. Each company brought unique strengths to the table, contributing to the stability and competitive nature of the market.

Alfa Aesar, known for its specialization in high-purity chemicals, continued to serve niche applications in research, pharmaceuticals, and specialty formulations. Its precise quality control and small-to-medium scale offerings supported customer demand for consistent, lab-grade MCAA, especially in regions with stringent regulatory requirements.

Anugrah In-Org (P) Limited, an India-based player, remained focused on volume production and regional supply. Leveraging India’s strong chemical manufacturing ecosystem, the company provided cost-effective MCAA solutions for large-scale users, particularly in the agrochemical and industrial chemical sectors. Its strength lies in competitive pricing and reliable supply chains, positioning it as a preferred partner in the Asia-Pacific region.

CABB Group GmbH, with its roots in Europe, maintained its reputation for high standards in chemical production and environmental compliance. The company catered to customers seeking dependable MCAA supply for pharmaceutical, personal care, and crop protection applications. Its advanced processing infrastructure and adherence to safety protocols gave it a strategic edge in regulated markets.

Top Key Players in the Market

- Akzo Nobel NV

- Alfa Aesar

- Anugrah In-Org (P) Limited

- CABB Group GmbH

- Denak Co. Ltd

- Henan HDF Chemical Company Ltd

- Merck KGaA

- Meridian Chem Bond Pvt. Ltd

- Niacet Corporation

- Nouryon

- PCC Group

- Puyang Tiancheng Chemical Co. Ltd

- Shandong Minji New Material Technology Co. Ltd

- TerraTech Chemicals (I) Pvt. Ltd

Recent Developments

- In June 2024, Nouryon received ISCC PLUS certification for its green ethylene oxide, ethanolamines, and ethylene amines, and highlighted its green MCA production at Delfzijl in the announcement. This shows their continuing focus on sustainable MCA.

Report Scope

Report Features Description Market Value (2024) USD 960.4 Million Forecast Revenue (2034) USD 1,394.5 Million CAGR (2025-2034) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Crystalline, Liquid, Flakes), By Application (Carboxymethylcellulose (CMC), Agrochemicals, Surfactants, Thioglycolic Acid (TGA), Others), By End-use (Agrochemicals, Personal Care and Pharmaceuticals, Geological Drillings, Dyes and Detergents, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Akzo Nobel NV, Alfa Aesar, Anugrah In-Org (P) Limited, CABB Group GmbH, Denak Co. Ltd, Henan HDF Chemical Company Ltd, Merck KGaA, Meridian Chem Bond Pvt. Ltd, Niacet Corporation, Nouryon, PCC Group, Puyang Tiancheng Chemical Co. Ltd, Shandong Minji New Material Technology Co. Ltd, TerraTech Chemicals (I) Pvt. Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Monochloroacetic Acid MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Monochloroacetic Acid MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Akzo Nobel NV

- Alfa Aesar

- Anugrah In-Org (P) Limited

- CABB Group GmbH

- Denak Co. Ltd

- Henan HDF Chemical Company Ltd

- Merck KGaA

- Meridian Chem Bond Pvt. Ltd

- Niacet Corporation

- Nouryon

- PCC Group

- Puyang Tiancheng Chemical Co. Ltd

- Shandong Minji New Material Technology Co. Ltd

- TerraTech Chemicals (I) Pvt. Ltd