Global Molded Plastics Market By Type (Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Polystyrene (PS), Polyurethane (PU), Acrylonitrile Butadiene Styrene (ABS), Polyethylene Terephthalate (PET), Polycarbonate (PC)), By Source (Virgin, Recycled), By Molding Technology (Injection Molding, Blow Molding, Compression Molding, Extrusion Molding, Rotational Molding, Thermoforming), By End Use (Packaging, Automotive And Transportation, Building And Construction, Consumer Goods, Electronics And Electrical, Medical And Healthcare, Agriculture, Industrial Machinery), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169731

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

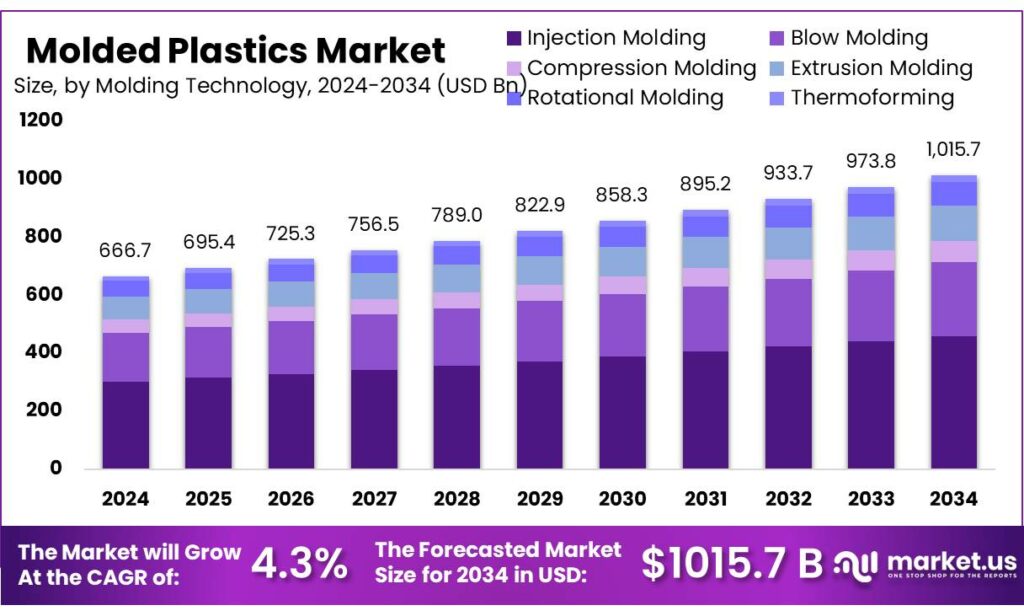

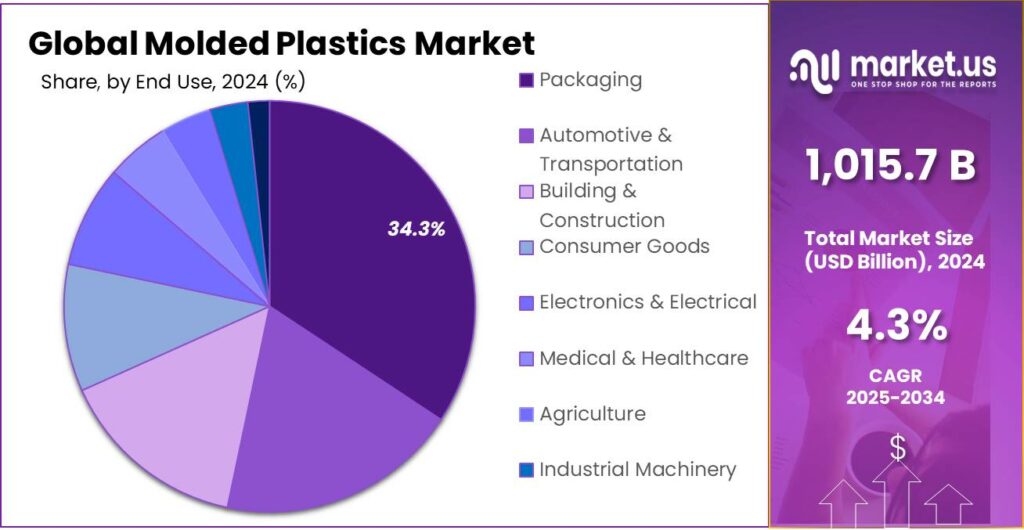

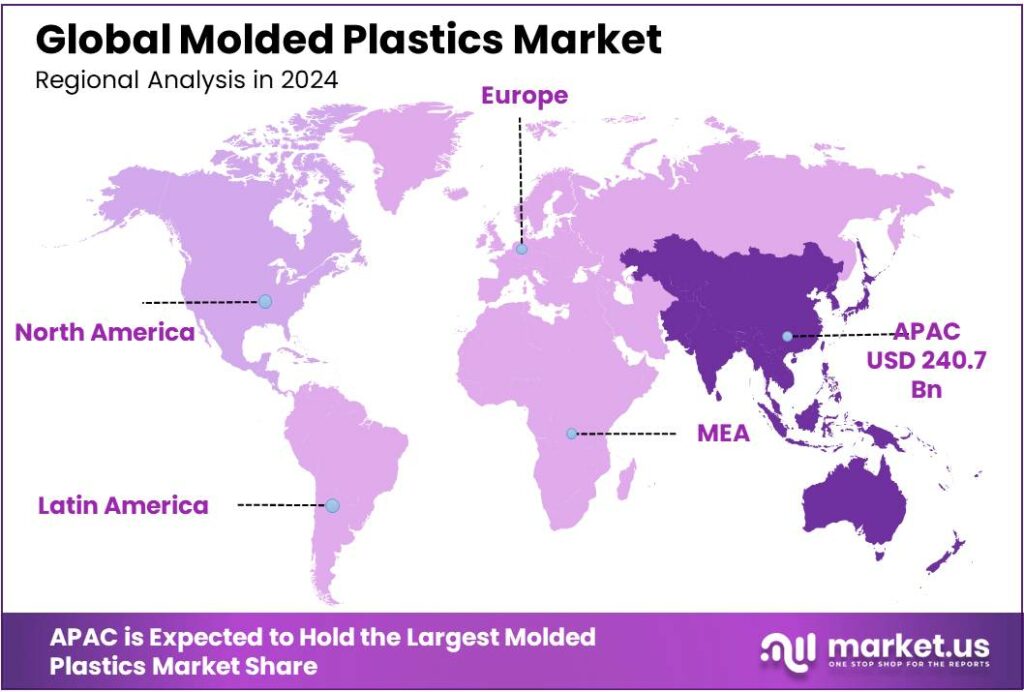

The Global Molded Plastics Market size is expected to be worth around USD 1,015.7 Billion by 2034, from USD 666.7 Billion in 2024, growing at a CAGR of 4.3% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 36.1% share, holding USD 240.7 Billion revenue.

The global molded plastics market is positioned for strong expansion, supported by rising demand across the construction, automotive, packaging, and electronics sectors. Molded plastics continue to play a critical role in the development of lightweight, high-performance components for eco-friendly and low-emission vehicles, a segment experiencing accelerating global adoption.

The packaging industry also remains a major driver, benefiting from rapid modernization, increased consumption of consumer goods, and sustained demand for bottles, containers, cans, and flexible packaging films. In parallel, the electrical and electronics sector relies heavily on molded plastics for the manufacturing of laptops, televisions, computers, mobile phones, and various household devices, contributing significantly to overall market growth.

- Sustainability initiatives are further shaping industry dynamics. Government agencies, regulatory bodies, and market participants are increasingly emphasizing the use of recycled plastics in molded products to reduce environmental impact. In 2024, the European Parliament approved comprehensive rules targeting packaging waste reduction, requiring member states to reduce per-capita packaging waste by 5% by 2030, 10% by 2035, and 15% by 2040 compared to 2018 levels. Such regulations are expected to accelerate investments in recycling technologies and support broader circular-economy objectives within the molded plastics industry.

High-growth regions, particularly Brazil, Russia, India, China, and South Africa (BRICS), as well as emerging markets in the Middle East and Asia Pacific, are contributing substantially to global expansion. These regions have seen significant increases in production capacity, driven by industrialization, infrastructure development, and rising domestic consumption. China, in particular, has experienced rapid growth in plastic molding companies due to competitive manufacturing costs and the availability of skilled labor, strengthening its position as a major hub for molded plastics production.

Key Takeaways

- The global molded plastics market was valued at US$ 666.7 billion in 2024

- In 2024, by type polypropylene (PP) dominated the molded plastics market with significant market share of 32.5%.

- By source, virgin plastics represented a substantial 90.6% of total revenue in 2024.

- Among molding technology, injection molding led the global market, capturing 45.3% of the market share.

- By end use, the packaging sector was the leading segment in 2024, holding a 34.3% market share.

- The Asia Pacific region accounted for 36.1% of the global molded plastics market in 2024, valued at US$ 240.7 billion, and is projected to experience strong growth in the coming years.

Type Analysis

In 2024, polypropylene (PP) accounted for 32.5% of the global molded plastics market, making it the dominant resin type with strong growth anticipated over the forecast period. The material’s versatility is supported by its two primary variants—homopolymer and copolymer polypropylene. Homopolymer PP offers excellent strength, stiffness, and heat deflection, making it suitable for applications requiring structural integrity. Copolymer PP, by contrast, provides enhanced impact resistance and a degree of transparency, expanding its applicability in products that demand durability and aesthetic appeal.

The widespread adoption of polypropylene is attributed to its growing use across the automotive, household goods, electrical, and packaging industries. In automotive applications, PP is favored for components that require a balance of lightweight performance, rigidity, and cost efficiency. Its electrical insulation properties make it well-suited for connector bases, covers, and electrical housings, ensuring both mechanical and electrical protection. In consumer and household products, PP’s durability and chemical resistance support its use in a wide range of everyday items.

Polypropylene also holds a strong position in the food packaging sector. Its durability, heat resistance, and ability to preserve product quality make it a preferred material for containers, caps, films, and other packaging formats. The combination of mechanical strength, recyclability, low density, and cost-effectiveness continues to reinforce polypropylene’s leading role within the molded plastics market, with demand expected to rise as end-use industries expand and prioritize lightweight, high-performance materials.

Source Analysis

In 2024, virgin plastics dominated the global molded plastics market, accounting for 90.6% of total revenue. This strong market position is driven by the material’s consistent quality, superior mechanical performance, and broad applicability across a wide range of industries. Virgin resins offer reliable purity, uniformity, and predictable processing behavior, making them the preferred choice for high-precision applications where material integrity and performance cannot be compromised.

Industries such as automotive, electronics, medical devices, and food packaging rely heavily on virgin plastics due to stringent regulatory and safety requirements. These sectors demand materials with verified chemical composition, high strength, excellent durability, and strong resistance to contamination—criteria that virgin polymers consistently meet. Additionally, the ability of virgin plastics to support advanced molding techniques, maintain tight tolerances, and deliver high-quality surface finishes reinforces their widespread adoption.

Molding Technology Analysis

In 2024, injection molding held a leading position in the global molded plastics market, accounting for a significant 45.3% share of total revenue. Injection molding remains the most widely adopted manufacturing process for plastic components due to its ability to produce large volumes of identical parts with tight tolerances—typically within 50 to 100 microns—and superior surface finishes. Its high accuracy, repeatability, and compatibility with a broad range of polymer materials make it an essential technology for large-scale production across multiple industries.

Demand for injection molding continues to be strengthened by growth in several major end-use sectors. In Europe, the consumer electronics industry is experiencing rising demand for laptops, smartphones, and other personal devices, particularly in the UK, Germany, and France, driving increased production of injection-molded housings and components. Similarly, the automotive industry’s ongoing transition toward lightweighting and metal-to-plastic replacement has expanded the use of injection-molded parts in Germany, Italy, and the UK, where automakers seek improved performance, design flexibility, and manufacturing efficiency.

End Use Analysis

In 2024, the packaging sector maintained its position as the leading end-use segment in the global molded plastics market, accounting for 34.3% of total demand. The sector is expected to experience significant growth in the coming years, driven by the increasing need for durable, lightweight, and versatile packaging solutions across food and beverage, personal care, pharmaceuticals, and consumer goods industries. Molded plastics offer exceptional durability and protection, helping prevent product damage and spoilage during transportation and storage. This enhanced product preservation reduces waste and supports a more sustainable and efficient supply chain from production through final consumption.

Advancements in molding technologies have significantly expanded design capabilities within the packaging industry. Manufacturers can now incorporate intricate features such as snap-fit closures, embossed branding, ergonomic shapes, and multi-material combinations, elevating both functionality and visual appeal. These innovations enable brands to differentiate their products and deliver more engaging consumer experiences while maintaining consistent quality and performance.

Key Market Segments

By Type

- Polyethylene (PE)

- HDPE

- LDPE / LLDPE

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- EPS

- HIPS

- Polyurethane (PU)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyethylene Terephthalate (PET)

- Polycarbonate (PC)

- Others

By Source

- Virgin

- Recycled

By Molding Technology

- Injection Molding

- Blow Molding

- Compression Molding

- Extrusion Molding

- Rotational Molding

- Thermoforming

By End Use

- Packaging

- Automotive & Transportation

- Building & Construction

- Consumer Goods

- Electronics & Electrical

- Medical & Healthcare

- Agriculture

- Industrial Machinery

- Others

Drivers

Growing Demand for Molded Plastics in the Packaging Industry

The expanding use of molded plastics in the packaging sector serves as a major driver for the global molded plastics market. Packaging remains one of the largest end-use industries for molded plastics due to the process’s ability to deliver high-volume, precise, and durable components with consistent quality and strong visual appeal. Molded plastic packaging plays a critical role in safeguarding food, pharmaceuticals, and consumer goods, supporting both product integrity and distribution efficiency.

The rapid pace of global urbanization continues to reinforce the importance of packaged food. As more than half of the world’s population now resides in urban areas where agricultural production space is limited, processed and packaged food has become essential. This shift has significantly increased the reliance on molded plastic packaging, which provides convenience, safety, and extended shelf life for urban consumers.

- Demand indicators underscore the scale of this growth. In Europe, over 20 billion kilograms of plastic are used for packaging each year, with 8.2 billion kilograms dedicated specifically to food products. In the United States, 14.5 million tons of plastic containers and packaging were produced in 2018, a substantial share of which was food-related. Globally, the food sector alone accounts for approximately 36% of all plastic produced for packaging applications.

Plastics also play a pivotal role in reducing food waste by extending shelf life by two to three times, contributing to 30–40% lower food spoilage compared with unpackaged products. Consumer perception further supports market momentum, with 70% of consumers viewing plastic packaging as practical and hygienic.

Restraints

Stringent Environmental Regulations and Compliance Requirements

Stringent environmental regulations are acts as a significant restraint for the global molded plastics market, increasing operational complexity and imposing additional compliance costs on manufacturers. The sector’s environmental footprint—characterized by high energy consumption, waste generation, and emissions—has heightened regulatory scrutiny, compelling companies to invest in cleaner technologies and adopt more sustainable production practices.

In Europe, the EU Green Deal and the Corporate Sustainability Reporting Directive (CSRD) require companies to disclose carbon emissions transparently and integrate eco-design principles into their products, adding substantial reporting and design burdens. The expansion of Extended Producer Responsibility (EPR) frameworks further increases accountability, mandating that packaging and product manufacturers take responsibility for the collection, recycling, and end-of-life management of plastics once they exit production facilities.

In the United States, regulatory oversight is reinforced by the EPA’s 40 CFR Part 463, which sets strict effluent limitations and pollutant discharge standards for both existing and new plastics molding operations. Compliance with these guidelines often necessitates investments in wastewater treatment systems, monitoring technologies, and operational modifications, contributing to higher production costs.

Additionally, Members of the European Parliament have proposed requirements mandating that new vehicle types incorporate a minimum of 20% recycled plastic within six years, increasing to 25% within ten years, subject to availability at reasonable prices. Such mandates place pressure on material supply chains and may limit flexibility in resin selection.

Opportunity

Increasing Focus on Lightweight Materials in the Automotive Sector

The growing emphasis on lightweight materials within the automotive industry presents a significant opportunity for the molded plastics market. Plastics and polymer composites are increasingly utilized in vehicle manufacturing due to their versatility, structural performance, and ability to meet evolving design and engineering requirements. These materials effectively address challenges related to strength, durability, and aesthetics while offering notable weight reduction benefits—an essential factor in achieving improved fuel efficiency and reduced emissions.

The shift toward electrification further amplifies this opportunity. Electric vehicles (EVs) rely heavily on lightweight components to offset the substantial weight of battery systems, thereby enhancing driving range and overall energy efficiency. A mid-size EV is estimated to contain 45% more plastics and polymer composites than an internal combustion engine (ICE) vehicle of comparable size, underscoring the growing importance of molded plastics in next-generation vehicle platforms.

Moreover, plastic and composite parts can significantly outperform traditional metal components in weight reduction. Approximately 100 kg of plastic can replace up to 300 kg of conventional materials, contributing to substantial improvements in vehicle performance. This substitution has been shown to reduce fuel consumption by as much as 750 liters over a vehicle’s lifetime, supporting automakers’ sustainability targets and regulatory compliance.

Major Motor Vehicle Production Regions:

Geography Units Europe 1,72,31,668 Americas 1,91,87,421 Asia Pacific 5,49,07,849 Trends

Automation and Smart Systems (Industry 4.0): Automation and smart manufacturing systems are increasingly reshaping the molded plastics industry as companies adopt Industry 4.0 technologies to enhance operational efficiency and product quality. The integration of advanced IoT-enabled automation allows real-time monitoring of production lines, with sensors capable of detecting early faults and generating detailed performance data that was previously difficult to capture. These insights, combined with sophisticated software platforms, enable manufacturers to optimize workflows, reduce downtime, and improve overall process reliability.

The incorporation of artificial intelligence further elevates quality control by providing predictive analytics, defect detection, and automated adjustments to maintain consistent output standards. Cloud-based systems support remote monitoring and data management, giving manufacturers greater visibility and control across multiple facilities.

Low Pressure Injection Molding: Low-Pressure Injection Molding (LPIM) is gaining increasing attention within the molded plastics industry as manufacturers pursue more efficient and environmentally responsible production methods. This advanced molding process allows for the creation of large, lightweight, and intricately detailed plastic components with high precision, all while operating at substantially lower pressures than traditional injection molding techniques. The reduced pressure lowers material consumption, minimizes waste, and decreases energy requirements, making LPIM an attractive option for companies focused on optimizing sustainability and operational performance.

Geopolitical Impact Analysis

Recent tariff measures targeting imported plastics machinery, molds, and recycled resins are creating both strategic opportunities and operational challenges for the U.S. molded plastics industry. The U.S. administration’s decision to impose 50% tariffs on a wide range of “derivative” steel and aluminum products has direct implications for key manufacturing equipment, including injection molding machines, blow molding systems, compression molds, material handling equipment, and industrial robots. These tariffs encompass products predominantly supplied by long-standing trade partners such as Germany, Japan, and Canada, countries that have historically been major exporters of high-precision molding technologies to the United States.

The elevated tariffs have the potential to bolster domestic mold manufacturing by improving competitive positioning for U.S.-based tooling and equipment producers. However, they also introduce upward pressure on capital expenditures for plastics processors dependent on imported machinery and components. Higher equipment and resin input costs could cascade throughout the industry, influencing production economics, lead times, and investment timelines.

Regional Analysis

Asia Pacific remains one of the most dynamic and rapidly expanding regions in the global molded plastics market with market valued at USD 240.7 billion in 2024. Driven by rising consumption, strong manufacturing growth, and increasing foreign investment. Major international companies continue to expand production capacity in the region to meet accelerating demand for plastic products. Government initiatives in China and India—including tax incentives, eased regulations, and policies promoting foreign direct investment—have further strengthened the plastics manufacturing ecosystem. Within the region, China and India lead market growth, supported by the rapid expansion of the food and beverage, FMCG, and personal care industries.

In India, the surge in end-use sectors is complemented by the booming e-commerce landscape, fueled by a growing digital consumer base and rising online purchasing trends. As these industries expand, the demand for high-performance packaging and molded plastic components continues to rise.

The region’s construction sector also plays a pivotal role in driving demand for molded plastics. Over the past two decades, Asia has witnessed an unprecedented wave of infrastructure development, including airports, rail networks, seaports, road systems, and major urban redevelopment projects. The transformation of skylines across key cities reflects the scale of investment in residential, commercial, and industrial construction. This sustained construction activity has significantly increased the need for durable, lightweight, and cost-effective molded plastic products used in piping systems, insulation, fixtures, panels, and various building components.

Asia Pacific’s growth trajectory is further reinforced by long-term infrastructure commitments made by regional governments. ASEAN countries, in particular, are experiencing robust construction growth fueled by urbanization, infrastructure expansion, and national smart city programs. With a combined population of more than 680 million and a rapidly expanding middle class, ASEAN nations are prioritizing investment in transportation networks, energy systems, and sustainable housing solutions. These initiatives create substantial opportunities for molded plastics, especially in advanced building materials, energy-efficient components, and high-performance packaging solutions.

Emerging ASEAN Countries in Construction Industry

Countries CAGR (2020-2023) Vietnam 7.3% Philippines 9.3% Malaysia 9.4% Indonesia 7.5% Singapore 7.7% Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global molded plastics market is characterized by a highly competitive landscape comprising multinational big giants as well as small domestics players. These players leverage extensive product portfolios, advanced molding technologies, and strong regional footprints to serve diverse end-use industries, including automotive, packaging, healthcare, electronics, and consumer goods. Competition is shaped by innovation in polymer formulation, process optimization, sustainability initiatives, and the ability to deliver high-quality, cost-effective molded components at scale.

The Major Players in The Industry

- DuPont de Nemours, Inc.

- Huntsman International LLC

- Eastman Chemical Company

- Magna International, Inc.

- IAC Group

- Quantum Plastics

- HTI Plastics, Inc.

- Rutland Plastics

- AptarGroup, Inc.

- Lacks Enterprises, Inc.

- The Rodon Group

- Heppner Molds

- Chevron Phillips Chemical Company

- Reliance Industries Limited

- Covestro AG

- Solvay

- Mitsubishi Chemical Corporation

- LG Chem

- Lanxess

- Other Key Players

Recent Development

- In September 2025, Schivo announced its acquisition of Mecaplast SA, a Swiss manufacturer known for its expertise in high-precision injection-molded plastics, metals, and ceramics for the medical device and life sciences industries. This acquisition expands Schivo’s capabilities in advanced materials and reinforces its position as a key partner for complex MedTech and life sciences technologies.

- In September 2025, Resonetics disclosed its acquisition of Eden Holdings (Eden), which includes Eden Manufacturing and Eden Tool. Eden specializes in precision injection molding and micro-machining solutions for critical medical devices, and the acquisition further strengthens Resonetics’ portfolio of advanced manufacturing and engineering capabilities within the medical technology sector.

Report Scope

Report Features Description Market Value (2024) USD 666.7 Bn Forecast Revenue (2034) USD 1,015.7 Bn CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Polystyrene (PS), Polyurethane (PU), Acrylonitrile Butadiene Styrene (ABS), Polyethylene Terephthalate (PET), Polycarbonate (PC), Others), By Source (Virgin, Recycled), By Molding Technology (Injection Molding, Blow Molding, Compression Molding, Extrusion Molding, Rotational Molding, Thermoforming), By End Use (Packaging, Automotive & Transportation, Building & Construction, Consumer Goods, Electronics & Electrical, Medical & Healthcare, Agriculture, Industrial Machinery, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape DuPont de Nemours, Inc., Huntsman International LLC, Eastman Chemical Company, Magna International, Inc., IAC Group, Quantum Plastics, HTI Plastics, Inc., Rutland Plastics, AptarGroup, Inc., Lacks Enterprises, Inc., The Rodon Group, Heppner Molds, Chevron Phillips Chemical Company, Reliance Industries Limited, Covestro AG, Solvay, Mitsubishi Chemical Corporation, LG Chem, Lanxess, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- DuPont de Nemours, Inc.

- Huntsman International LLC

- Eastman Chemical Company

- Magna International, Inc.

- IAC Group

- Quantum Plastics

- HTI Plastics, Inc.

- Rutland Plastics

- AptarGroup, Inc.

- Lacks Enterprises, Inc.

- The Rodon Group

- Heppner Molds

- Chevron Phillips Chemical Company

- Reliance Industries Limited

- Covestro AG

- Solvay

- Mitsubishi Chemical Corporation

- LG Chem

- Lanxess

- Other Key Players