Global Microbial Fuel Cell Market Size, Share Analysis Report By Type (Mediator Microbial Fuel Cell, Mediator-Free Microbial Fuel Cell), By Application (Power Generation, Wastewater Treatment, Biosensor, Others), By Type of Enterprise (Large, Small and Medium Enterprise), By End User (Agriculture, Food and Beverage, Government And Municipal, Healthcare, Military, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169621

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

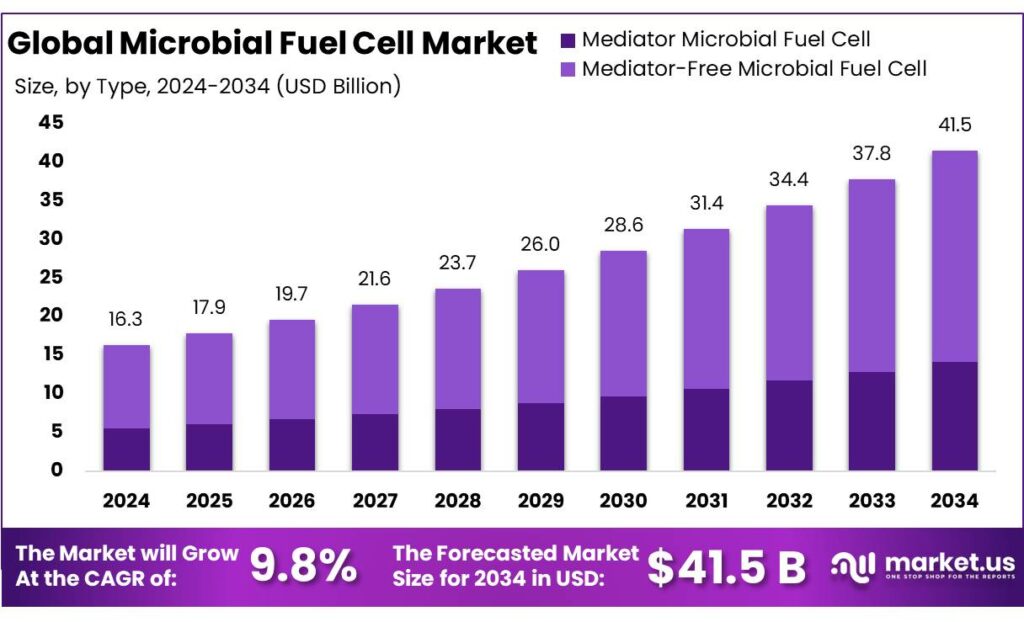

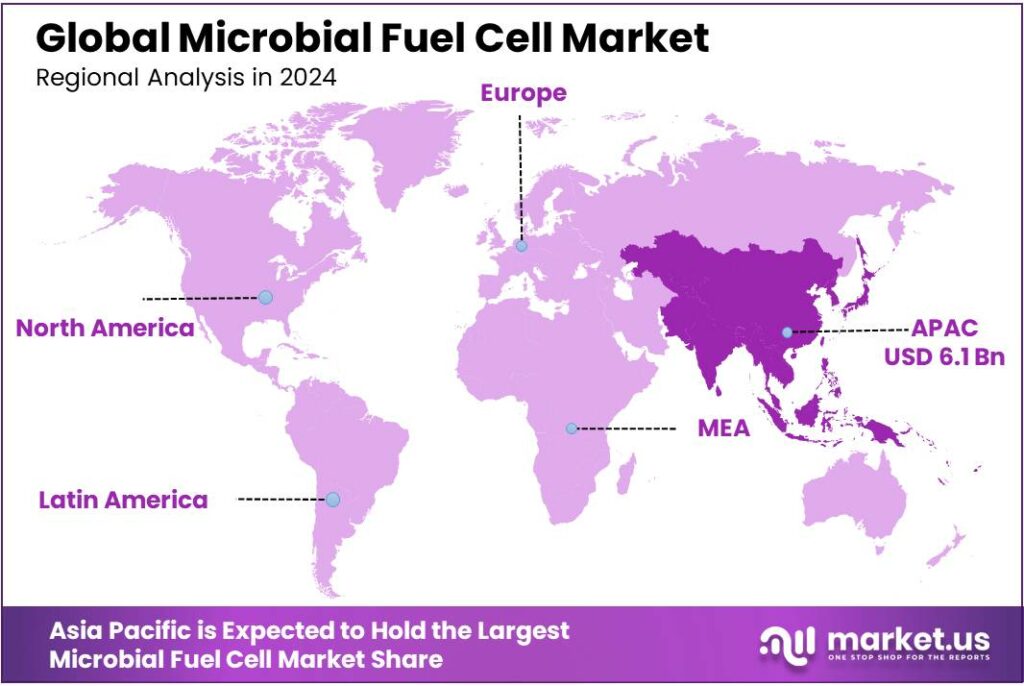

The Global Microbial Fuel Cell Market size is expected to be worth around USD 41.5 Billion by 2034, from USD 16.3 Billion in 2024, growing at a CAGR of 9.8% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 37.8% share, holding USD 6.1 Billion revenue.

Microbial fuel cells (MFCs) are bio-electrochemical systems in which electroactive microbes oxidise organic matter at the anode and transfer electrons to a cathode, generating direct current while treating wastewater. Over the past decade, they have moved from bench scale to pilots, with reactors as large as 1,000 L operated for 6 months on municipal wastewater, demonstrating stable power generation and organic load removal under real conditions.

The industrial context for MFCs is shaped by the sheer scale of untreated wastewater. Recent global assessments estimate around 380 billion m³/year of wastewater production, of which only about 52% is treated, leaving nearly half discharged with limited or no treatment. This treatment gap is particularly acute in rapidly urbanising regions, where utilities face rising operating costs and pressure to recover energy from waste streams. MFCs fit into this gap as a technology that can both remove chemical oxygen demand and recover low-voltage electricity onsite, potentially offsetting part of plant energy demand.

- The International Energy Agency (IEA) reports that bioenergy already generates about 700 TWh of electricity, or 2.4% of global generation in 2023, and is projected to reach around 1,250 TWh (3.2%) by 2030, with modern bioenergy accounting for over 50% of global renewable energy use. In parallel, renewables overall supplied roughly 32% of global electricity in 2024, underlining strong policy momentum for low-carbon technologies that can integrate with existing infrastructure such as wastewater plants and food-processing facilities.

Government and multilateral funding is slowly building an innovation pipeline around MFCs. In Europe, an EU project on “Application of Microbial Fuel Cells for wastewater treatment” received a grant of €50,000, explicitly targeting design improvements for low-cost, decentralised treatment. The European Investment Bank has backed the Hellenic Foundation for Research and Innovation with a €180 million loan, complemented by Greek public funds of €60 million, supporting advanced research programmes including microbial fuel-cell concepts in Greece.

The industrial opportunity for MFCs lies in niche, high-value applications rather than immediate large-scale power generation. Pilot systems such as a 90 L stack treating brewery wastewater with power densities above 1,400 mW/m² show that food and beverage plants, remote mining camps, island communities and decentralised sanitation projects can integrate MFCs where grid access is weak but organic waste is abundant.

Key Takeaways

- Microbial Fuel Cell Market size is expected to be worth around USD 41.5 Billion by 2034, from USD 16.3 Billion in 2024, growing at a CAGR of 9.8%.

- Mediator-Free Microbial Fuel Cell held a dominant market position, capturing more than a 65.9% share.

- Power Generation held a dominant market position, capturing more than a 44.2% share of the microbial fuel cell market.

- Large held a dominant market position, capturing more than a 59.7% share of the microbial fuel cell market.

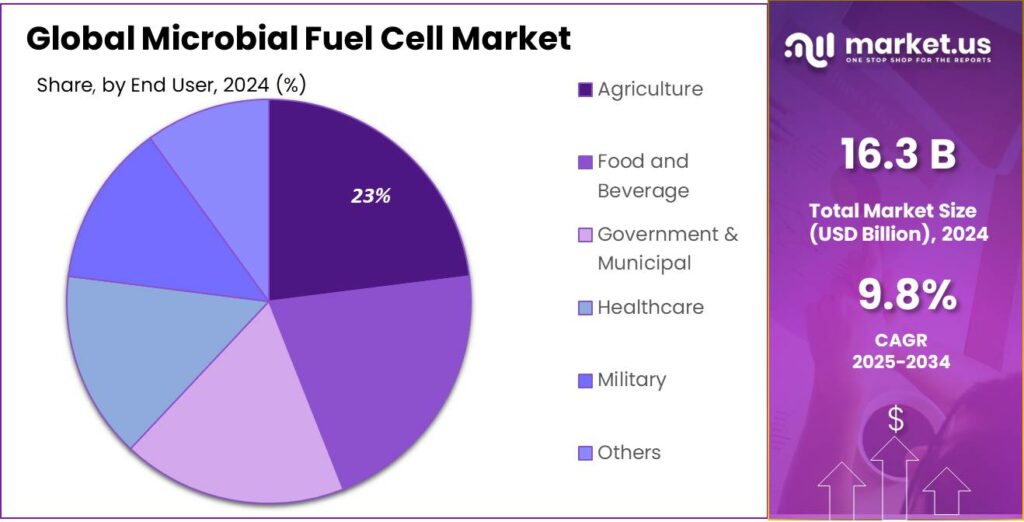

- Agriculture held a dominant market position, capturing more than a 23.3% share of the microbial fuel cell market.

- Asia Pacific region established itself as the dominant revenue centre for microbial fuel cell (MFC) technologies, capturing more than 37.8% of global market share USD 6.1 billion.

By Type Analysis

Mediator-Free Microbial Fuel Cells lead with 65.9% because they simplify operation and lower costs.

In 2024, Mediator-Free Microbial Fuel Cell held a dominant market position, capturing more than a 65.9% share of the microbial fuel cell market by type. This share was driven by the reduced operational complexity of mediator-free designs, which remove the need for added chemical redox mediators and thereby cut both material costs and maintenance demands; as a result, adoption was strongest among wastewater-treatment pilots, decentralized power demonstrations, and research-driven deployments where long-term operational stability and lower lifecycle costs were priorities.

Manufacturing and R&D efforts were concentrated on improving electrode materials, biocatalyst stability and reactor configurations to raise power density while preserving the low-maintenance advantage. Supply chains for key components were adjusted to support modular, scalable units, and service providers aligned testing protocols to validate performance under variable feedstocks. Given the structural benefits and ongoing engineering refinements observed in 2024, the mediator-free segment was positioned to retain leadership into 2025, particularly in applications where cost-efficiency and operational simplicity outweigh the higher peak power potential of mediated alternatives.

By Application Analysis

Power Generation leads with 44.2% as the primary commercial application for microbial fuel cells.

In 2024, Power Generation held a dominant market position, capturing more than a 44.2% share of the microbial fuel cell market by application. This outcome was driven by the technology’s ability to convert organic waste streams into usable electricity, enabling decentralized energy recovery in wastewater treatment plants, remote monitoring stations and industrial effluent sites; such deployments delivered dual benefits of energy offset and reduced disposal costs, which supported commercial uptake.

System-level improvements in electrode materials and reactor design increased net energy yield and reduced levelized costs, encouraging pilot-to-commercial transitions during 2024. Operational focus was placed on integration with existing treatment infrastructure and on performance validation under variable feedstocks to secure buyer confidence. Given the demonstrated value proposition and ongoing engineering advances, the power-generation application was expected to retain its leading role into 2025, with adoption continuing where energy recovery and sustainability targets align.

By Type of Enterprise Analysis

Large enterprises dominate with 59.7% thanks to scale advantages and capital access.

In 2024, Large held a dominant market position, capturing more than a 59.7% share of the microbial fuel cell market by enterprise type. This concentration was driven by larger organisations’ ability to absorb development costs, to invest in pilot-to-commercial scale units, and to integrate MFC systems into existing wastewater and energy-management projects; procurement scale, in-house engineering teams and established O&M capability reduced perceived adoption risk for buyers and supported faster deployment cycles.

Contracting practices and long-term service agreements were favoured by institutional purchasers, which in turn encouraged suppliers to prioritise larger customers when allocating limited production capacity. Given these structural advantages, the large-enterprise segment is expected to retain leadership into 2025, with growth shaped by continued capital projects, regulatory incentives for energy recovery, and supplier moves to offer bundled financing and service models that further lower entry barriers for major adopters.

By End User Analysis

Agriculture leads with 23.3% in 2024 as farms adopt on-site energy recovery and low-maintenance power solutions.

In 2024, Agriculture held a dominant market position, capturing more than a 23.3% share of the microbial fuel cell market by end user. This position was supported by practical on-farm uses — low-power sensors, remote irrigation controllers, and small lighting or monitoring systems that can be run from energy recovered in agricultural wastewater and runoff. The technology was valued where grid access is limited or where operators sought energy-from-waste benefits alongside nutrient reduction; simple, low-maintenance mediator-free designs were commonly preferred to reduce operating demands.

Pilot projects and demonstration systems proved the concept at scale on dairies and crop-processing sites, and supplier focus was placed on modular units that integrate with existing effluent lines to simplify installation. Quality control and predictable maintenance schedules were emphasized to secure buyer confidence. Given these structural drivers, the agriculture segment was expected to remain a key adopter into 2025 as systems moved from demonstration toward routine operational use.

Key Market Segments

By Type

- Mediator Microbial Fuel Cell

- Mediator-Free Microbial Fuel Cell

By Application

- Power Generation

- Wastewater Treatment

- Biosensor

- Others

By Type of Enterprise

- Large

- Small and Medium Enterprise

By End User

- Agriculture

- Food and Beverage

- Government & Municipal

- Healthcare

- Military

- Others

Emerging Trends

Food and Dairy Wastewater Are Turning MFCs into a Practical Tool

One clear trend in microbial fuel cells (MFCs) is their quiet move from “lab gadget” to a practical add-on in circular food and dairy wastewater systems. Policymakers and lenders are now framing wastewater as a resource, not just a liability, and that change is pushing engineers to test bio-electrochemical options alongside familiar tanks and digesters. MFCs fit this new picture because they can sit in the treatment line, trim organic load and produce low-voltage power at the same time.

The tone for this shift is set at the global level. UNEP’s 2023 report “Wastewater – Turning Problem to Solution” estimates that, with the right policies, wastewater could provide alternative energy to 500 million people, supply more than 10 times today’s global desalination output, and offset over 10% of global fertiliser use. When regulators and development banks hear numbers like that, they start to ask industries – including food and beverage – to design treatment projects that recover energy and nutrients, not just meet discharge limits. That naturally opens the door for MFC pilots.

Food and dairy processors are under particular pressure. A recent review on dairy wastewater notes that plants typically generate 1–3 litres of wastewater for every litre of milk processed, and that this water carries high loads of organic matter and nutrients. FAO data referenced in European studies show global milk production at around 852 million tonnes in 2019, up 1.4% from 2018, so these volumes of effluent are not small side streams.

The World Bank’s “Wastewater: From Waste to Resource” initiative adds another layer. Its analysis calculates that around 380 billion m³ of wastewater generated each year could yield roughly 53.2 billion m³ of methane, enough electricity for up to 158 million households if fully recovered. The exact technology mix is left open, but the message is clear: utilities and industries are expected to look beyond “end-of-pipe” solutions and toward smarter, staged treatment trains.

Drivers

Growing Pressure to Turn Food Wastewater into Clean Energy

One of the strongest forces behind interest in microbial fuel cells (MFCs) is the growing pressure on the food and beverage industry to handle its waste streams in a cleaner, smarter way. Food factories, dairies, breweries and slaughterhouses all generate wastewater that is rich in sugars, fats and proteins. This water is difficult and expensive to treat with traditional systems, yet it is also full of chemical energy that MFCs can tap while cleaning the water at the same time.

Global food loss and waste give a sense of the scale. The FAO estimates that about 1.3 billion tonnes of food are lost or wasted every year, roughly one-third of all food produced for human consumption. All of this wasted food eventually becomes a burden on waste and wastewater systems. The World Bank notes that food loss and waste are around 30% of global food production, again close to 1.3 billion tonnes per year, with major implications for water, energy and land use. MFCs directly address this issue by using electroactive microbes to convert dissolved food residues into electricity instead of letting that energy disappear in aeration tanks.

There is also a clear climate angle. The UN climate secretariat reports that food loss and waste are responsible for 8–10% of annual global greenhouse-gas emissions, almost five times aviation emissions. Governments are responding through targets like SDG 12.3, which calls for halving per capita food waste by 2030, and through national climate plans that increasingly mention food systems. As food processors look for credible ways to cut emissions, on-site technologies that both treat wastewater and recover energy, such as MFCs, become more attractive than simply buying more grid power for conventional treatment.

Wastewater itself is now seen as a resource rather than just a liability. A global assessment led by the UN University estimates that about 359–380 billion m³ of wastewater are produced every year, but only around 52% is treated, leaving nearly half discharged without safe treatment. The World Bank calculates that the energy embedded in this wastewater could yield about 53.2 billion m³ of methane, enough electricity for up to 158 million households. The World Bank calculates that the energy embedded in this wastewater could yield about 53.2 billion m³ of methane, enough electricity for up to 158 million households.

Restraints

High Cost and Low Power Output Limit Large-Scale Adoption

One of the biggest restraints holding back microbial fuel cells (MFCs) is the gap between what they promise in theory and what they deliver at scale in real industrial conditions. For food and beverage companies, cost and performance reliability matter more than novelty. Today, MFC systems still produce relatively low electrical power compared to the capital and operating costs required to build and maintain them, making decision-makers cautious.

From a technical point of view, the electricity generated by MFCs is modest. Peer-reviewed studies supported by public research agencies repeatedly show power densities typically in the range of 0.5 to 2.0 watts per square meter of electrode surface when treating real food or municipal wastewater. According to research compiled by the U.S. Department of Energy (DOE) and publicly funded academic programs, this output is far below what is needed for meaningful onsite power supply in energy-intensive food processing plants.

The cost side is even more challenging. Advanced electrode materials such as carbon felt, graphite fibre brushes and, in some designs, platinum-based catalysts, account for a large share of capital expense. Studies funded by the European Commission report electrode material costs alone ranging between USD 150–1,000 per square meter, depending on configuration and durability requirements.

For food and beverage manufacturers, these numbers are difficult to justify when compared with conventional anaerobic digestion (AD). The International Energy Agency notes that anaerobic digesters treating food waste and food wastewater can already generate biogas with methane concentrations of 55–65%, which can be converted to electricity at industrial scale using proven combined heat and power units.

Opportunity

Circular Food Wastewater Systems Open a Big Door for MFCs

A major growth opportunity for microbial fuel cells (MFCs) sits right inside the pipes of the global food system. Food and beverage plants, dairies, breweries and meat processors all produce wastewater rich in sugars, fats and proteins. Instead of seeing this as a disposal problem, MFCs invite companies to treat it as a quiet energy asset, turning everyday effluent into low-voltage power while cleaning the water.

The scale of the underlying resource is huge. The FAO estimates that roughly one-third of all food produced for people is lost or wasted, equal to about 1.3 billion tonnes every year. UNEP’s Food Waste Index adds that people alone waste about 1 billion tonnes of food annually, again close to a third of global production. A large share of this waste ends up in sewers as highly loaded wastewater from washing, cleaning and processing lines – exactly the type of stream where MFCs perform best.

On the policy side, wastewater itself is being reframed as a strategic resource. A recent UN World Water Development assessment reports that more than 80% of the world’s wastewater is still released to the environment without adequate treatment. UNEP now argues that, with the right policies, wastewater could provide alternative energy for 500 million people, supply over 10 times the water currently produced by global desalination, and offset more than 10% of global fertiliser use.

There is also a strong link to agriculture and fertiliser use. A UNEP-supported analysis finds that recovering nitrogen, phosphorus and potassium from wastewater could offset 13.4% of global agricultural nutrient demand. For agro-processors that buy fertiliser and energy, MFCs can be designed as part of integrated systems: MFC stacks recovering electricity upfront, followed by units that capture nutrients for local fields. This “food–wastewater–energy–fertiliser” loop aligns neatly with SDG 6 (clean water) and SDG 12.3 (halving food waste), giving companies a clear story to share with investors and customers.

Regional Insights

Asia Pacific leads with a 37.8% share, representing USD 6.1 billion in 2024

In 2024, the Asia Pacific region established itself as the dominant revenue centre for microbial fuel cell (MFC) technologies, capturing more than 37.8% of global market share and contributing roughly USD 6.1 billion in value. This regional leadership was supported by three structural factors: first, high volumes of municipal and industrial wastewater arising from rapid industrialisation and urban expansion created ready feedstock for MFC deployments, improving project economics and accelerating pilot-to-commercial transitions.

Second, public- and private-sector investment in decentralised energy recovery and wastewater treatment—including demonstration projects integrating constructed-wetland MFCs and on-site energy recovery systems—lowered technology risk and encouraged procurement by utilities and large industrial customers.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Hydrofarm Holdings Group, Inc. advanced its involvement in microbial fuel cell technologies through solutions aligned with controlled-environment agriculture, where power needs for sensors and monitoring equipment are rising. In 2024, the company emphasized integrating low-power MFC modules with irrigation and nutrient-delivery systems to improve resource efficiency. Its distribution strengths and established network in the indoor farming sector supported broader exposure for MFC-based innovations. Hydrofarm’s strategy focused on combining sustainable energy recovery with operational reliability to meet growing clean-tech demand.

Greenlife Cyclopentanone enhanced its presence in microbial and biochemical solution development by contributing to early research and feasibility testing for microbial fuel cell systems. In 2024, the company concentrated on optimizing organic feedstock utilization and improving electrode–microbe interactions to raise power output in small-scale test units. Its efforts supported experimental deployments in agriculture and small industrial sites, where low-maintenance energy recovery offered practical value. By focusing on applied microbial engineering, the company strengthened its role in shaping next-generation MFC performance.

Top Key Players Outlook

- MICRORGANIC TECHNOLOGIES

- SAINERGY TECH INC

- CAMBRIAN INNOVATION

- JSP ENVIRO

- CASCADE Clean Energy, Inc.

- Frontis Energy

- Kurita water industries ltd

- AQUACYCL

Recent Industry Developments

In its 2024 Annual Report, Hydrofarm’s net sales dropped to US$ 190.3 million (from US$ 226.6 million in 2023) and it reported a net loss of US$ 66.7 million for that year.

Report Scope

Report Features Description Market Value (2024) USD 16.3 Bn Forecast Revenue (2034) USD 41.5 Bn CAGR (2025-2034) 9.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Mediator Microbial Fuel Cell, Mediator-Free Microbial Fuel Cell), By Application (Power Generation, Wastewater Treatment, Biosensor, Others), By Type of Enterprise (Large, Small and Medium Enterprise), By End User (Agriculture, Food and Beverage, Government And Municipal, Healthcare, Military, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape MICRORGANIC TECHNOLOGIES, SAINERGY TECH INC, CAMBRIAN INNOVATION, JSP ENVIRO, CASCADE Clean Energy, Inc., Frontis Energy, Kurita water industries ltd, AQUACYCL Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- MICRORGANIC TECHNOLOGIES

- SAINERGY TECH INC

- CAMBRIAN INNOVATION

- JSP ENVIRO

- CASCADE Clean Energy, Inc.

- Frontis Energy

- Kurita water industries ltd

- AQUACYCL