Global Microalgae Market Size, Share Analysis Report By Species (Spirulina, Chlorella, Nannochloropsis, Haematococcus, Isochrysis, Chlamydomonas, Others), By Source (Marine Water, Fresh Water), By End Use (Food and Beverages Sector, Health and Medical Sector, Animal Feed Sector, Pet Food Sector, Cosmetics and Personal Care Sector, Fertilizers Sector, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169282

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

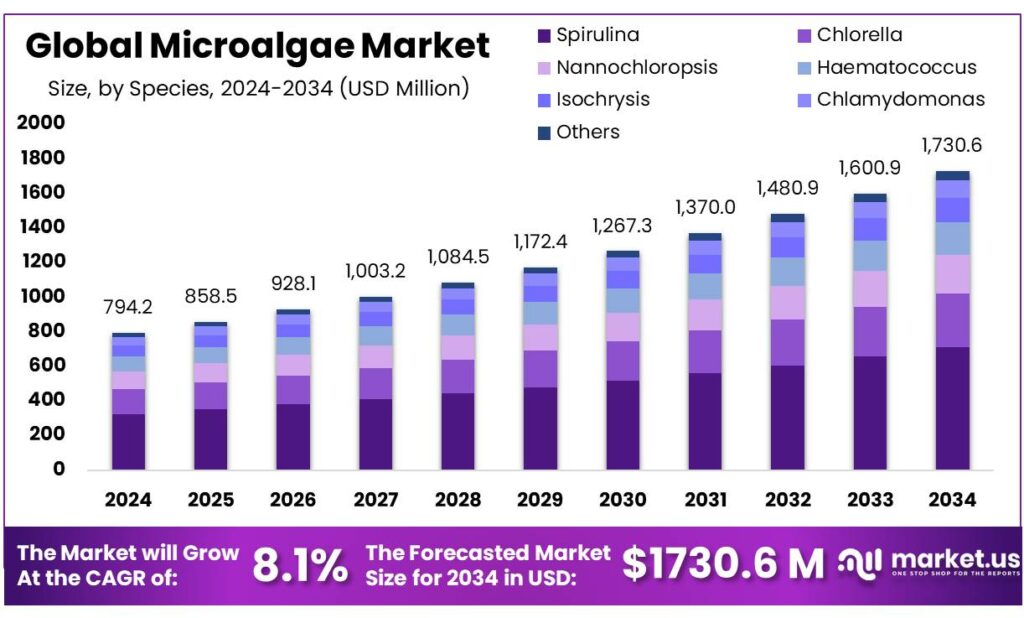

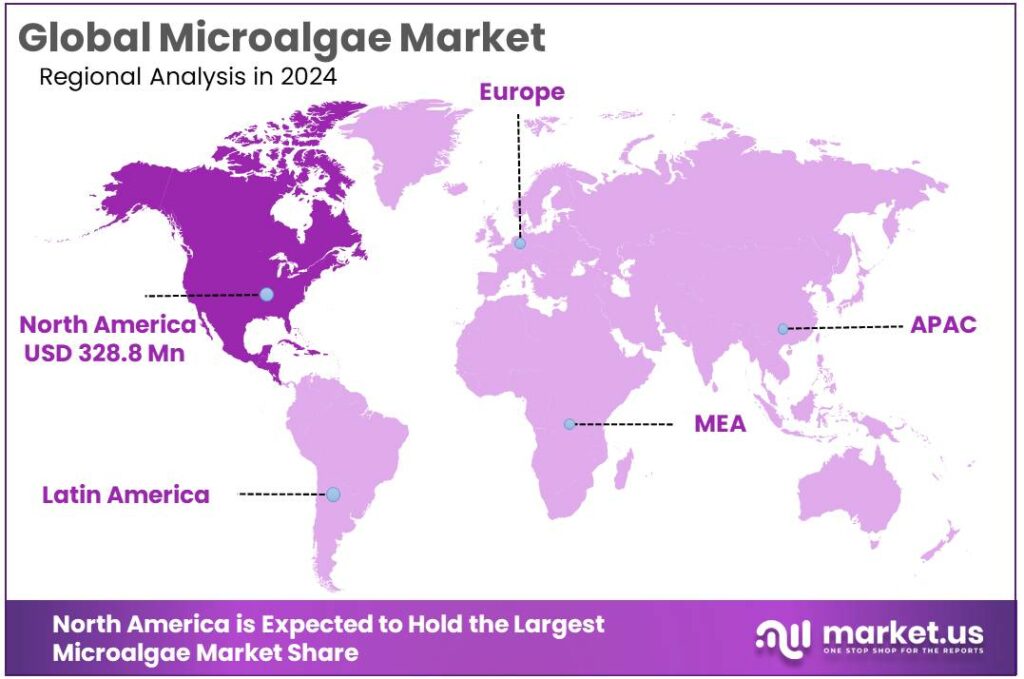

The Global Microalgae Market size is expected to be worth around USD 1730.6 Million by 2034, from USD 794.2 Million in 2024, growing at a CAGR of 8.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 43.90% share, holding USD 328.8 Million revenue.

Microalgae form a fast-growing niche within the wider algae industry, supplying high-value products such as nutraceuticals, aquafeed ingredients, pigments, biofertilizers and, increasingly, low-carbon fuels. FAO estimates that global algae production (seaweeds plus microalgae) reached 37.8 million tonnes in 2022, with 97% coming from aquaculture and almost all of it produced in Asia.

Industrial microalgae volumes are still modest compared with seaweeds, but the sector is scaling. Recent scientific reviews place global microalgae production capacity at roughly 20,000–30,000 tonnes of dry biomass per year, with an estimated market value of around USD 977.3 million for microalgae-based products. A separate assessment reports about 56,465 tonnes of microalgae biomass produced in 2019, heavily concentrated in China, underscoring the dominance of Asian producers in large-scale cultivation. The U.S. Department of Energy also notes that a commercial microalgae industry exists globally with production near 60,000 tons per year, mainly for food and aquaculture markets.

- Demand fundamentals are being reshaped by the global decarbonization agenda. The International Energy Agency (IEA) reports that energy-related CO₂ emissions rose 1.1% in 2023 to a record 37.4 billion tonnes, despite strong growth in clean energy. In parallel, the IEA expects total biofuel demand to increase 23% to 200 billion litres by 2028, with advanced biofuels playing a growing role. In its Net Zero scenario, biofuels from wastes, residues and non-food crops must supply over 40% of total biofuel demand by 2030, positioning microalgae as a strategic feedstock candidate.

Beyond fuels, microalgae also fit into the broader bio-inputs and circular-economy agenda. A 2024 study on microalgae-based agricultural inputs estimates that microalgal plant stimulants alone could reach about EUR 2.5 billion in sales, within a global biostimulants market projected at roughly EUR 5.5 billion.

Government initiatives are increasingly explicit. The European Commission’s communication “Towards a Strong and Sustainable EU Algae Sector” projects European seaweed demand rising from about 270,000 tonnes in 2019 to 8 million tonnes by 2030, with a potential market value of EUR 9 billion for algae-based products and services. A recent EU factsheet indicates that the Union invested roughly EUR 559 million between 2014 and 2023 into 219 algae-related projects, spanning sustainable food, marine restoration, biofuels and bioplastics. These programs create de-risked pathways and shared infrastructure that microalgae players can leverage.

Key Takeaways

- Microalgae Market size is expected to be worth around USD 1730.6 Million by 2034, from USD 794.2 Million in 2024, growing at a CAGR of 8.1%.

- Spirulina held a dominant market position, capturing more than a 41.3% share of the microalgae market.

- Fresh Water held a dominant market position, capturing more than a 72.4% share of the microalgae market.

- Food and Beverages held a dominant market position, capturing more than a 31.8% share of the microalgae market.

- North America held a dominant position in the global microalgae market, capturing more than 43.90% of regional share and accounting for approximately USD 328.8 million.

By Species Analysis

Spirulina dominates with a 41.3% share thanks to strong nutritional demand and established supply chains.

In 2024, Spirulina held a dominant market position, capturing more than a 41.3% share of the microalgae market by species. This leadership was underpinned by widespread use in nutraceuticals, food and beverage formulations, and animal nutrition, where its high protein and pigment content met quality and regulatory requirements; production systems and established supply chains enabled reliable volumes for both powder and extract formats. Demand concentration in health-focused markets and growing consumer preference for natural ingredients supported steady off-take through 2024, and manufacturers prioritized scale and quality controls to retain market access for Spirulina-derived products.

By Source Analysis

Fresh Water leads with a 72.4% share in 2024 due to easier cultivation and lower production costs.

In 2024, Fresh Water held a dominant market position, capturing more than a 72.4% share of the microalgae market by source. This prominence was driven by the relative ease of cultivation, lower infrastructure and operating costs compared with marine systems, and the wide availability of suitable inland sites; such factors allowed producers to scale biomass output for nutraceutical, feed and bioactive ingredient markets. Robust freshwater production platforms and established harvesting practices supported consistent supply and quality control, which in turn encouraged continued buyer preference through 2024.

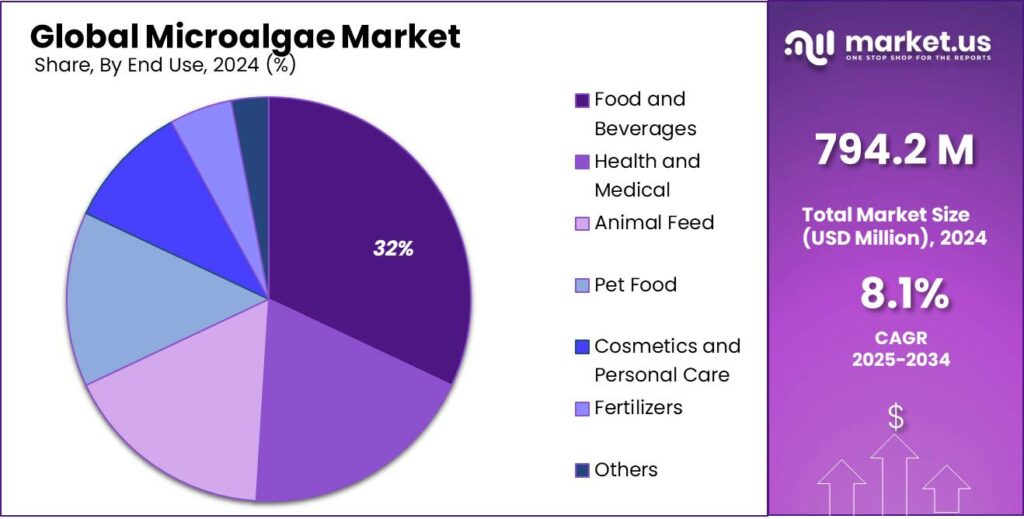

By End Use Analysis

Food and Beverages leads with a 31.8% share driven by growing demand for natural and functional ingredients.

In 2024, Food and Beverages held a dominant market position, capturing more than a 31.8% share of the microalgae market by end use. This leadership can be attributed to the steady uptake of microalgae as natural colorants, protein supplements and functional additives in clean-label formulations; product launches and reformulation efforts were observed to prioritise ingredient naturalness and nutritional enhancement, which supported steady off-take from manufacturers and retailers. Production and quality controls were scaled to meet food-grade requirements, and regulatory approvals for specific microalgae extracts were observed to facilitate wider commercial use.

Key Market Segments

By Species

- Spirulina

- Chlorella

- Nannochloropsis

- Haematococcus

- Isochrysis

- Chlamydomonas

- Others

By Source

- Marine Water

- Fresh Water

By End Use

- Food and Beverages Sector

- Health and Medical Sector

- Animal Feed Sector

- Pet Food Sector

- Cosmetics and Personal Care Sector

- Fertilizers Sector

- Others

Emerging Trends

Microalgae Moving into Mainstream Food, Feed and Blue-Bioeconomy Systems

One clear trend in the microalgae space is that it is no longer seen only as a lab curiosity or a future biofuel. It is being pulled into the real heart of the food system and the broader blue bioeconomy. The latest FAO figures show that global fisheries and aquaculture production hit 223.2 million tonnes in 2022, including 37.8 million tonnes of algae. Algae are not a side story anymore; they sit inside the same statistics as fish and shrimp, and that changes how policymakers and industry think about microalgae too.

What really stands out is how industrial algae cultivation has become normalised in aquaculture. Algae production is now overwhelmingly farmed, not harvested from the wild. An FAO-based analysis notes that about 37.8 million tonnes of algae in 2022 came mainly from aquaculture, while wild collection contributed just around 1.3 million tonnes. Another summary highlights that roughly 97% of global algae production now comes from aquaculture. This huge base of cultivated algae – mostly seaweed today – makes it much easier to imagine microalgae scaling within existing farming, processing and logistics chains.

At the same time, food and nutrition pressures are pushing the world to look hard at new protein and micronutrient sources. UN agencies estimate that about 8.2% of the global population – roughly 673 million people – faced hunger in 2024, and around 2.3 billion people experienced moderate or severe food insecurity. When you put those numbers next to microalgae’s high protein content, omega-3 oils and vitamins, the trend becomes obvious: companies are moving microalgae into functional foods, fortified staples, alternative seafood, and specialty ingredients rather than betting only on fuel.

Government strategies in advanced economies now talk about algae as a strategic resource for food, feed and climate, not just a marine oddity. The European Commission’s communication “Towards a strong and sustainable EU algae sector” draws heavily on work by the Seaweed for Europe coalition, which expects European demand for seaweed to rise from about 270,000 tonnes in 2019 to 8 million tonnes by 2030, unlocking up to EUR 9 billion in annual market value and creating roughly 85,000 jobs.

This policy push also reframes microalgae as part of a broader “services plus products” model. The EU documents highlight algae’s role in wastewater treatment, nutrient removal and carbon management, alongside food and feed markets. That is exactly where many microalgae pilots are heading: co-located with aquaculture farms, food factories or industrial plants, using CO₂ and nutrient-rich effluents to grow biomass that can be sold as ingredients or bio-inputs. It is a practical, low-waste narrative that resonates with regulators, retailers and consumers looking for real climate solutions rather than abstract promises.

Drivers

Rising Demand for Sustainable Food and Feed Drives the Microalgae Industry

A major driving force behind the microalgae industry is the world’s search for sustainable food and feed ingredients. Global fisheries and aquaculture production reached 223.2 million tonnes in 2022, of which aquaculture alone produced 130.9 million tonnes valued at USD 312.8 billion. As aquaculture keeps expanding, producers are under pressure to find new, low-impact sources of protein, lipids and pigments, and microalgae fits this need very well.

Fish and other aquatic foods are becoming more central in people’s diets. FAO reports that global annual per-capita apparent consumption of aquatic animal foods increased from 9.1 kg in 1961 to an estimated 20.7 kg in 2022. This rapid rise means the food system must deliver more high-quality protein and omega-3s without putting unsustainable pressure on wild fish stocks. Microalgae can supply these nutrients directly, or indirectly as feed ingredients in fish farming, while using less land and avoiding competition with traditional crops.

Food security adds another layer of urgency. Latest UN and FAO estimates suggest about 8.2% of the global population – roughly 638–720 million people – faced hunger in 2024. At the same time, healthy and diverse foods remain too expensive for many households. Microalgae-based ingredients, such as protein concentrates, DHA-rich oils, and fortified foods, are seen by policymakers as part of a broader toolkit to improve diet quality without further stressing land and freshwater resources.

Government strategies are starting to convert this need into concrete support. In its communication “Towards a Strong and Sustainable EU Algae Sector,” the European Commission projects that European demand for algae (including microalgae) could grow from about 270,000 tonnes in 2019 to 8 million tonnes by 2030, with a potential market value of EUR 9 billion. An associated analysis suggests that this scaling could create around 85,000 jobs, remove large quantities of nitrogen and phosphorus from European seas, and help mitigate up to 5.4 million tonnes of CO₂ emissions each year.

Restraints

High Production Cost and Technical Complexity Hinder Microalgae Scaling

To begin with, growing microalgae at scale demands a lot of inputs: water, nutrients, controlled light or CO₂ supply, and careful management. According to a recent review, the energy and infrastructure requirements — such as pumping water, providing CO₂, maintaining light and temperature, then drying or dewatering the algae — make it difficult to achieve a positive energy balance under current systems. In fact, estimates suggest that cultivation plus harvesting and dewatering may account for 20–30% of the total production cost.

Another technical challenge is the complexity of cultivation systems. There are many ways to grow microalgae: open ponds (raceway ponds), closed photobioreactors (PBRs), hybrid systems, or even using wastewater. Each has trade-offs. Open ponds are cheaper to build but less productive, more prone to contamination, and sensitive to weather and sunlight. Closed PBRs can deliver higher and more stable yields, but they require much higher capital and operational costs, which again undermines economic viability.

- Harvesting and biomass recovery add further hurdles. Microalgae cultures are typically very dilute (e.g. around 1 gram per liter), which means to get 1 kg of dry biomass, a large volume of water must be processed. Harvesting — via centrifugation, filtration, flocculation, or dewatering — is energy intensive and expensive. Sometimes, even after all that, the yield of desired compounds remains low, or variable depending on species and cultivation conditions.

In short, while microalgae has enormous potential — as food, feed, pharmaceuticals, biofuels, carbon capture — the harsh reality is that producing it at industrial scale remains expensive, resource-intensive, and technically fragile. Until breakthroughs bring down the cost of cultivation, harvesting, drying and processing — or until policy incentives strongly offset those costs — many microalgae ventures will struggle to become commercially viable.

Opportunity

Microalgae as a High-Impact Opportunity for Future Food and Nutrition

A powerful growth opportunity for the microalgae sector lies in supplying sustainable food and protein in a world that is hungry for both nutrition and lower emissions. The FAO’s latest State of World Fisheries and Aquaculture shows that total fisheries and aquaculture output reached 223.2 million tonnes in 2022, including 37.8 million tonnes of algae and 130.9 million tonnes from aquaculture alone, valued at USD 312.8 billion. This huge food system is already used to handling aquatic biomass – microalgae can plug directly into this space with more efficient, climate-friendly products.

At the same time, the world is still struggling with hunger and poor diet quality, which makes nutrient-dense microalgae very attractive in policy discussions. According to the UN, about 8.2–8.3% of the global population – roughly 673 million people – faced hunger in 2024, while around 2.3 billion people experienced moderate or severe food insecurity. The 2025 Global Report on Food Crises adds that more than 295 million people in 53 countries suffered acute hunger in 2024. In this context, microalgae’s ability to deliver complete protein, omega-3 fatty acids, vitamins and pigments from relatively small areas of land and non-arable sites becomes a very real opportunity, not just a technological curiosity.

Governments are starting to treat algae – including microalgae – as a strategic food and protein resource, which further enlarges the growth window. In its communication “Towards a Strong and Sustainable EU Algae Sector”, the European Commission notes that European demand for algae could jump from around 270,000 tonnes in 2019 to 8 million tonnes by 2030, with the value of the European seaweed and algae market potentially rising from about EUR 840 million to EUR 9 billion over the same period. Much of this expected growth is linked to new foods, feeds, nutraceuticals and functional ingredients – exactly the areas where microalgae can shine.

Regional Insights

North America leads with 43.90% share, representing USD 328.8 million in 2024

In 2024, North America held a dominant position in the global microalgae market, capturing more than 43.90% of regional share and accounting for approximately USD 328.8 million in market value. This leadership was supported by well-established nutraceutical and functional-food supply chains, strong private and public R&D investment in algal biotechnology, and a favourable regulatory environment that accelerated commercialisation of food-grade microalgae ingredients.

Large contract manufacturers and vertically integrated producers in the United States and Canada supplied powder and extract formats to food & beverage, nutraceutical, and animal-nutrition customers, which sustained steady off-take through 2024. Market concentration was noted in high-value segments such as spirulina and astaxanthin, where premium pricing and differentiated quality controls increased regional average selling prices relative to other geographies. Investment activity during the year included capacity expansions, demonstration projects for scalable pond and photobioreactor systems, and strategic offtake partnerships that improved supply reliability for downstream brands.

Export flows of higher-value algal ingredients were observed to neighbouring markets, while domestic demand continued to be driven by clean-label and protein-diversification trends. Given existing production scale and regulatory clarity, North America was positioned in 2024 to remain the primary revenue centre for microalgae applications in the near term, with moderate CAGR expectations guided by expanding food-grade approvals and increased use in specialty feeds and cosmetics.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF is positioned as a major supplier of algal ingredients and intermediates, with capabilities spanning R&D, large-scale production, and commercial application support. Investment in bioprocess development and formulation science has been applied to deliver food-grade and industrial algal products. Collaborative agreements with ingredient buyers and contract manufacturers have been used to scale supply and validate applications in food, feed, and personal care. Operational focus has been placed on quality control, regulatory compliance, and sustainability measures to ensure consistent market access and long-term customer partnerships.

Cyanotech is recognised as a specialist producer of high-value microalgae ingredients, notably spirulina and astaxanthin, supplied in powder and extract formats. Production expertise in open-pond systems and process controls has enabled consistent product quality and certification for nutraceutical and food uses. Commercial focus has been placed on traceability, purity, and customer service to support brand formulations and clinical research. Strategic marketing and distribution partnerships have been employed to expand end-market reach, while operational improvements have addressed scale and cost-efficiency challenges.

Corbion is identified for its strengths in biobased ingredients and ingredient formulation, with capabilities extended into algal ingredient applications through joint development and supply arrangements. Technical focus has been applied to improve extraction processes, shelf stability, and ingredient integration for food and specialty markets. Commercial efforts have been directed toward strategic customers in food, beverage, and personal care, leveraging formulation expertise to embed algal actives into finished goods. Sustainability credentials and supply reliability have been emphasised to meet buyer requirements and premium positioning.

Top Key Players Outlook

- BASF SE

- Cyanotech Corporation

- Corbion N.V.

- Koninklijke DSM N.V.

- Solabia Group

- The Archer-Daniels-Midland

- Fuji Chemical Industries Co., Ltd. (AstaReal Co., Ltd.)

- Phycom

- Kuehnle AgroSystems Inc.

Recent Industry Developments

In 2024, BASF supported the microalgae and broader bio-based chemicals landscape by advancing research into algal feedstocks and by leveraging its large-scale production, formulation know-how and commercial channels to trial and scale sustainable ingredient solutions; the company’s strong financial base—sales revenue of €65,260 million and net income of €1,298 million in 2024—enabled continued investment in R&D (€2,061 million) and pilot projects that explored micro-algae as a route to bio-based base chemicals and specialty intermediates, while application teams worked with food, feed and materials customers to validate product performance and regulatory compliance, preserving supply reliability for downstream converters and supporting longer-term decarbonisation targets.

In 2024, Cyanotech continued to operate as a specialist producer of microalgae ingredients, supplying spirulina and astaxanthin to nutraceutical and food customers; stable production capability and targeted quality controls supported consistent shipments despite margin pressure from higher unit costs and inventory adjustments. Financial performance showed net sales of USD 23,071,000 and gross profit of USD 5,945,000 (gross margin 25.8%), while the company reported a net loss of USD 5,267,000 for the fiscal year—outcomes that reflected lower volumes, cost per kilogram increases and inventory write-downs as management aligned output with demand.

Report Scope

Report Features Description Market Value (2024) USD 794.2 Mn Forecast Revenue (2034) USD 1730.6 Mn CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Species (Spirulina, Chlorella, Nannochloropsis, Haematococcus, Isochrysis, Chlamydomonas, Others), By Source (Marine Water, Fresh Water), By End Use (Food and Beverages Sector, Health and Medical Sector, Animal Feed Sector, Pet Food Sector, Cosmetics and Personal Care Sector, Fertilizers Sector, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Cyanotech Corporation, Corbion N.V., Koninklijke DSM N.V., Solabia Group, The Archer-Daniels-Midland, Fuji Chemical Industries Co., Ltd. (AstaReal Co., Ltd.), Phycom, Kuehnle AgroSystems Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Cyanotech Corporation

- Corbion N.V.

- Koninklijke DSM N.V.

- Solabia Group

- The Archer-Daniels-Midland

- Fuji Chemical Industries Co., Ltd. (AstaReal Co., Ltd.)

- Phycom

- Kuehnle AgroSystems Inc.