Global Methyl N-Propyl Ketone Market Size, Share, And Business Benefit By Product Type (Industrial Grade, Pharmaceutical Grade, Others), By Application (Solvents, Chemical Intermediates, Pharmaceuticals, Coatings, Others), By End-User (Paints and Coatings, Pharmaceuticals, Chemicals, Personal Care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 164415

- Number of Pages: 248

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

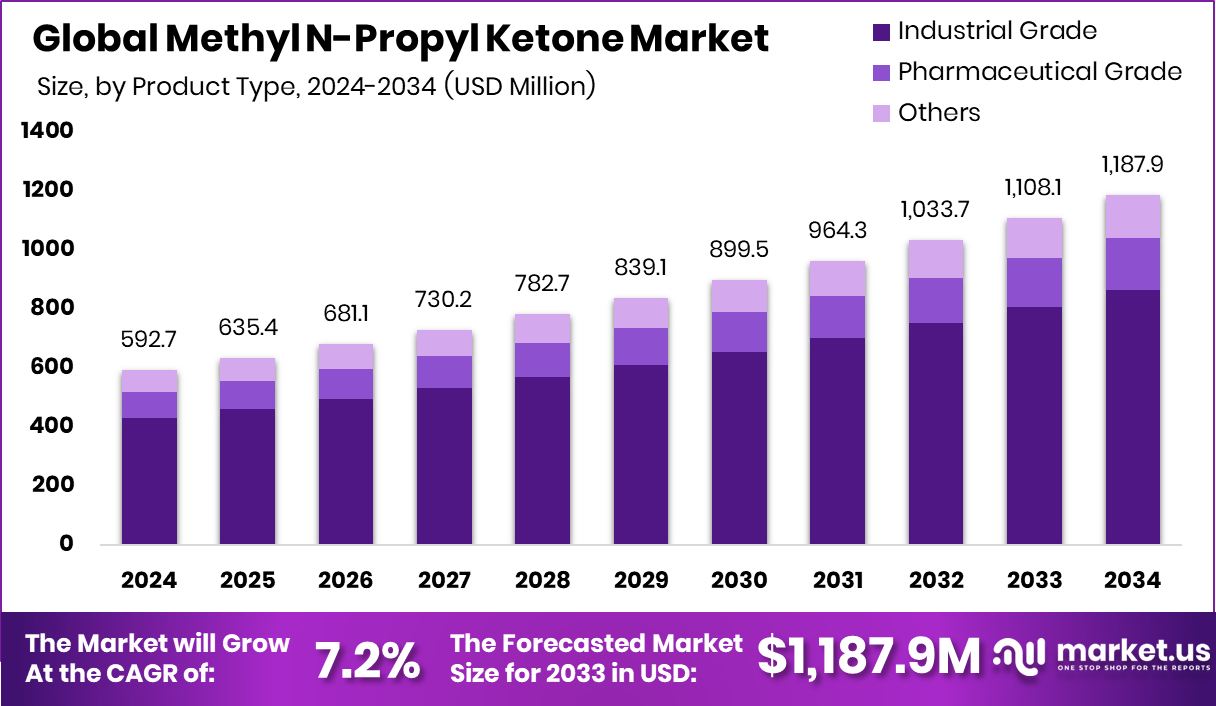

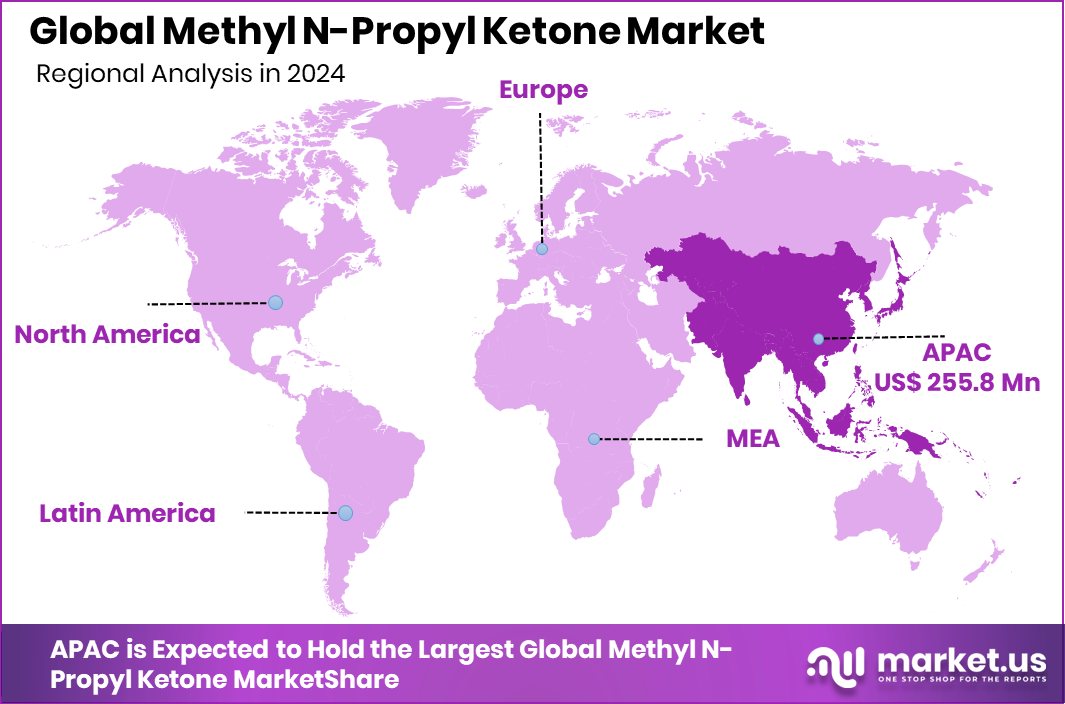

The Global Methyl N-Propyl Ketone Market is expected to be worth around USD 1,187.9 million by 2034, up from USD 592.7 million in 2024, and is projected to grow at a CAGR of 7.2% from 2025 to 2034. Rapid urbanization and expanding coatings industries supported Asia Pacific’s 43.9%, USD 255.8 million leadership.

Methyl n‑Propyl Ketone (MPK) is a colorless liquid solvent commonly used in industries such as coatings, industrial cleaning, and inks. It has excellent solvency properties and a moderate evaporation rate, making it suitable for a wide range of applications, including automotive refinishing, industrial maintenance, and electronics. MPK is often used in combination with other solvents to create formulations that meet specific performance and regulatory requirements.

The MPK market is growing due to the increasing demand for high-performance solvents in coatings and inks, especially in automotive, industrial maintenance, and electronics. The shift towards low-VOC, high-solids coatings that comply with environmental regulations is a key driver for MPK’s market growth. Moreover, the recent investments in sustainable solutions, such as Ecoat securing €21 million to reinvent the future of paint and Distil raising $7.7 million in Series A funding for specialty chemicals, further support the growth of cleaner and greener solvents like MPK.

Demand for MPK is driven by the increasing use of industrial coatings and inks, particularly in sectors like automotive and electronics, where solvent performance is critical. Additionally, MPK’s ability to replace more hazardous solvents due to its favorable environmental and safety profile is fueling its adoption. Innovations and investments, such as Distil’s $7.7 million Series A funding and UP Catalyst raising €18 million to advance critical raw material production, are expanding the market opportunities for MPK.

The MPK market presents significant opportunities as industries transition to sustainable solutions. As environmental regulations tighten and demand for low-emission and non-toxic solvents rises, MPK is well-positioned to capture a larger share. The increase in funding, such as Univar Solutions being acquired for $8.1B, reflects a growing focus on improving chemical production and distribution capabilities, creating more opportunities for MPK in global markets.

Key Takeaways

- The Global Methyl N-Propyl Ketone Market is expected to be worth around USD 1,187.9 million by 2034, up from USD 592.7 million in 2024, and is projected to grow at a CAGR of 7.2% from 2025 to 2034.

- In the Methyl N-Propyl Ketone market, industrial grade accounts for 72.7% of total consumption.

- As a solvent, Methyl N-Propyl Ketone dominates the market with a 45.9% share.

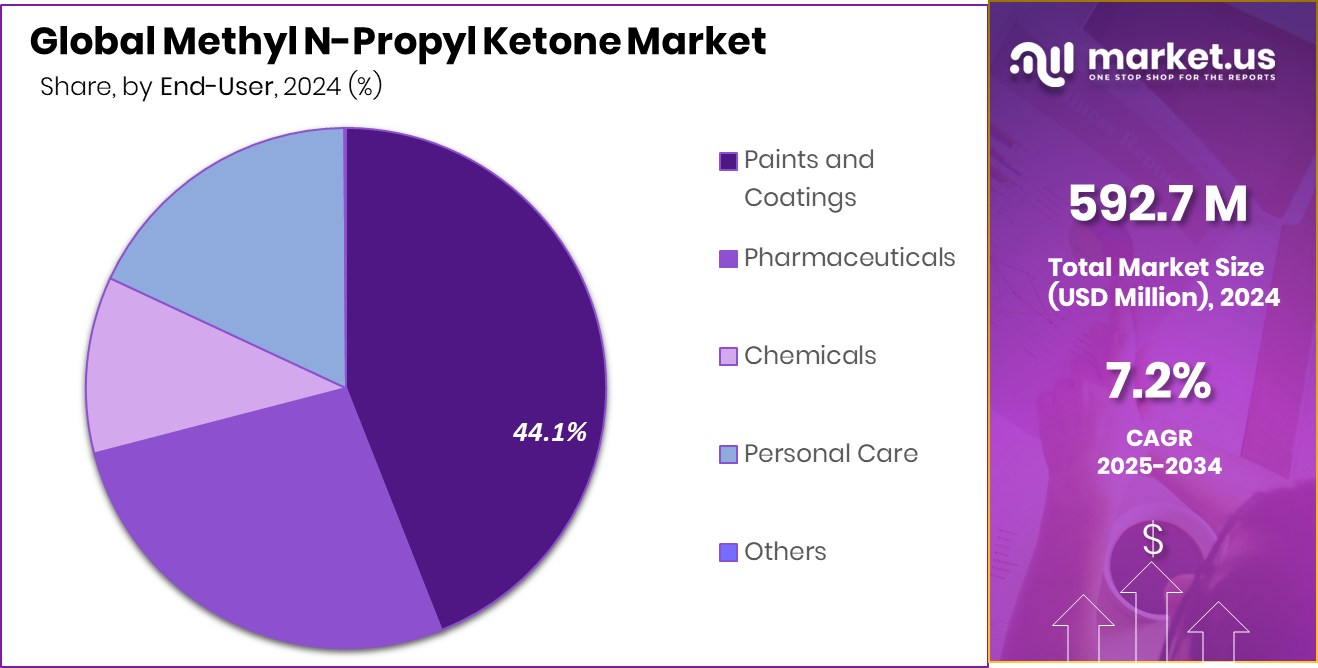

- The paints and coatings sector is the largest end-user of Methyl N-Propyl Ketone, holding 44.1% share.

- The Asia Pacific accounted for a market value of USD 255.8 million, reflecting strong industrial demand.

By Product Type Analysis

Industrial Grade Methyl N-Propyl Ketone dominates the market, capturing 72.7% share.

In 2024, Industrial Grade held a dominant market position in the By Product Type segment of the Methyl N-Propyl Ketone Market, capturing a 72.7% share. This grade is extensively used in coatings, inks, and industrial cleaning formulations due to its excellent solvency power and balanced evaporation rate.

Industrial-grade MPK serves as an efficient solvent for resins such as acrylics, vinyls, and alkyds, supporting its wide acceptance across multiple end-use sectors. Its versatility and compliance with environmental standards make it a preferred choice for manufacturing high-solids and low-VOC coatings.

The growing emphasis on sustainable industrial production and cleaner solvent alternatives has further strengthened the market position of industrial-grade MPK, driving its continued dominance.

By Application Analysis

Solvents hold a significant share in the Methyl N-Propyl Ketone market, 45.9%.

In 2024, Solvents held a dominant market position in the By Application segment of the Methyl N-Propyl Ketone Market, capturing a 45.9% share. This dominance is attributed to the extensive use of Methyl N-Propyl Ketone as an effective solvent in coatings, inks, and industrial cleaning applications. Its excellent solvency power, fast drying capability, and compatibility with various resins make it highly valuable across manufacturing and maintenance industries.

The growing demand for low-VOC and eco-friendly solvents has further strengthened their usage in paints and coatings. Additionally, its role in enhancing product formulation efficiency and reducing hazardous emissions continues to drive the preference for Methyl N-Propyl Ketone in solvent-based industrial processes.

By End-User Analysis

Paints and coatings represent 44.1% of Methyl N-Propyl Ketone’s end-use market.

In 2024, Paints and Coatings held a dominant market position in the By End-User segment of the Methyl N-Propyl Ketone Market, capturing a 44.1% share. This dominance is mainly driven by MPK’s excellent solvent performance, making it ideal for formulating high-quality paints, varnishes, and surface coatings. Its moderate evaporation rate and strong solvency characteristics ensure smooth film formation and enhanced finish quality.

Additionally, the ongoing shift toward low-VOC and high-solids coating formulations has increased MPK’s relevance in sustainable paint production. Its versatility across industrial, automotive, and protective coatings further supports its wide-scale application, cementing paints and coatings as the leading end-user segment within the Methyl N-Propyl Ketone Market.

Key Market Segments

By Product Type

- Industrial Grade

- Pharmaceutical Grade

- Others

By Application

- Solvents

- Chemical Intermediates

- Pharmaceuticals

- Coatings

- Others

By End-User

- Paints and Coatings

- Pharmaceuticals

- Chemicals

- Personal Care

- Others

Driving Factors

Rising Demand for High-Performance Solvent Solutions

A major driving factor for the Methyl N-Propyl Ketone (MPK) market is the rising global demand for high-performance solvents in paints, coatings, and industrial formulations. MPK offers excellent solvency, balanced evaporation, and strong compatibility with resins like acrylics and alkyds, making it essential for producing durable and smooth-finish coatings. The growing construction, automotive, and maintenance sectors are accelerating their adoption, especially as industries shift toward low-VOC and environmentally compliant products.

The market has gained additional momentum from strategic industry investments and acquisitions. For instance, Nippon Paint announced its plan to acquire coatings and resins maker AOC for US $2.3 billion, signaling continued confidence and investment in advanced solvent-based technologies that align with sustainability and innovation goals across the global coatings sector.

Restraining Factors

Stringent Environmental Regulations Limiting Solvent Usage

One key restraining factor for the Methyl N-Propyl Ketone (MPK) market is the increasing stringency of environmental and safety regulations governing solvent usage. Many countries have introduced stricter rules related to volatile organic compounds (VOCs) and hazardous air pollutants (HAPs), which directly impact the production and use of MPK in coatings, adhesives, and cleaning formulations. These regulations are pushing industries to adopt greener alternatives or water-based systems, reducing reliance on traditional solvent-based products.

Compliance with these evolving standards also raises manufacturing costs due to the need for advanced recovery and emission-control systems. As sustainability becomes central to industrial operations, the pressure to minimize solvent emissions continues to limit the broader expansion of MPK applications in several developed markets.

Growth Opportunity

Expanding Use in Advanced Marine Coating Applications

A significant growth opportunity for the Methyl N-Propyl Ketone (MPK) market lies in its expanding use in marine coatings and protective applications. MPK’s excellent solvency, controlled evaporation rate, and compatibility with resin systems make it ideal for high-performance coatings that protect ships and offshore structures from corrosion and harsh marine environments. The increasing global focus on durable and sustainable marine coatings is creating strong demand for MPK-based formulations.

Additionally, new funding activities are reinforcing this opportunity — for example, a Dartmouth startup raised $10 million to take its marine paint global, highlighting innovation and commercialization in marine coatings. Such advancements directly boost MPK consumption in marine-grade formulations, supporting its long-term growth potential in specialized coating markets.

Latest Trends

Growing Focus on Financial Stability and Supply Resilience

A key latest trend in the Methyl N-Propyl Ketone (MPK) market is the growing emphasis on financial stability and supply chain resilience within the chemical sector. As industries face fluctuating raw material costs and evolving environmental regulations, maintaining steady operations and capital access has become crucial. Companies are increasingly investing in solvent optimization technologies and sustainable production processes to ensure consistent availability and compliance.

Recent financial movements also highlight this shift — for example, Molycorp received court approval for $22 million in interim DIP financing, reflecting how capital restructuring and financial support mechanisms are helping sustain production continuity. Such financing initiatives underscore the broader trend of reinforcing economic resilience to secure long-term, solvent supply chains and industry stability.

Regional Analysis

In 2024, the Asia Pacific dominated the Methyl N-Propyl Ketone Market with a 43.9% share.

In 2024, Asia Pacific emerged as the dominant region in the Methyl N-Propyl Ketone Market, capturing a 43.9% share, valued at USD 255.8 million. The region’s leadership is attributed to rapid industrialization, expanding manufacturing bases, and growing demand for coatings, adhesives, and cleaning solvents in China, India, and Southeast Asia. Increasing construction and automotive production further support MPK consumption across industrial and maintenance applications.

North America follows, driven by rising adoption of low-VOC solvents and a mature coatings industry emphasizing sustainable formulations. Europe maintains a steady share with strong environmental compliance and innovation in specialty coatings.

Meanwhile, Latin America and the Middle East & Africa show gradual growth, supported by infrastructural development and industrial expansion, signaling rising solvent demand in emerging markets.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Eastman is positioned as a frontrunner in MPK applications, offering its Eastman™ MPK as a medium-evaporating urethane-grade solvent for synthetic resins, including acrylics, epoxies, vinyls, and alkyds. Their focus on high-solids, low-VOC coating systems gives them a strategic advantage in the MPK market, since MPK’s high solvency and moderate evaporation suit such formulations. Eastman’s marketing of MPK as a non-HAP alternative for aerospace cleaning further highlights its niche capability and regulatory alignment

Celanese operates broadly across industrial chemicals, including solvents and derivatives used in paints, coatings, adhesives, and inks. Although MPK is not explicitly highlighted, Celanese’s established solvent‐systems business and deep coatings industry insight give it indirect potential in the MPK ecosystem. Their ability to supply solvent supports, emulsions, and additives means they could capture downstream value if end-users shift toward MPK-based formulations. As regulations tighten and formulators seek alternatives, Celanese’s integrated portfolio and expertise in coatings materials provide a platform for expansion within the MPK value chain.

ExxonMobil Chemical provides a wide range of hydrocarbon and oxygenated solvents globally, with fully integrated manufacturing sites and global scale in solvents and fluids. While specific references to MPK are limited, their global footprint, supply chain strength, and solvent production capability make them a key supplier or competitor in the broader solvent market, including MPK. Their capacity to deliver differentiated fluids and leverage global manufacturing assets positions them to respond rapidly to shifts toward MPK or alternative solvents as formulators pursue low-VOC or specialty solvent requirements.

Top Key Players in the Market

- Eastman Chemical Company

- Celanese Corporation

- ExxonMobil Chemical

- Dow Chemical Company

- BASF SE

- Sasol Limited

- Arkema Group

- Solvay S.A.

- INEOS Group Holdings S.A.

- Mitsubishi Chemical Corporation

Recent Developments

- In January 2025, Celanese announced a partnership with Cloverdale Paint to offer sustainable paint solutions, marking a shift toward eco-friendly coatings.

- In September 2024, Eastman introduced a new electronic-grade solvent, high-purity isopropyl alcohol (IPA) under its EastaPure™ line, targeting the semiconductor manufacturing market. The product is made in U.S. facilities and intended to support wafer fabrication and advanced packaging processes.

Report Scope

Report Features Description Market Value (2024) USD 592.7 Million Forecast Revenue (2034) USD 1,187.9 Million CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Industrial Grade, Pharmaceutical Grade, Others), By Application (Solvents, Chemical Intermediates, Pharmaceuticals, Coatings, Others), By End-User (Paints and Coatings, Pharmaceuticals, Chemicals, Personal Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Eastman Chemical Company, Celanese Corporation, ExxonMobil Chemical, Dow Chemical Company, BASF SE, Sasol Limited, Arkema Group, Solvay S.A., INEOS Group Holdings S.A., Mitsubishi Chemical Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Methyl N-Propyl Ketone MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Methyl N-Propyl Ketone MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Eastman Chemical Company

- Celanese Corporation

- ExxonMobil Chemical

- Dow Chemical Company

- BASF SE

- Sasol Limited

- Arkema Group

- Solvay S.A.

- INEOS Group Holdings S.A.

- Mitsubishi Chemical Corporation