Global Metal Working Fluid Market Size, Share, And Enhanced Productivity By Product (Mineral, Synthetic, Bio-Based), By Application (Neat Cutting Oil, Water Cutting Oil, Corrosion Preventive Oil, Others), By End-use (Metal Fabrication, Transportation Equipment, Machinery, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170126

- Number of Pages: 230

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

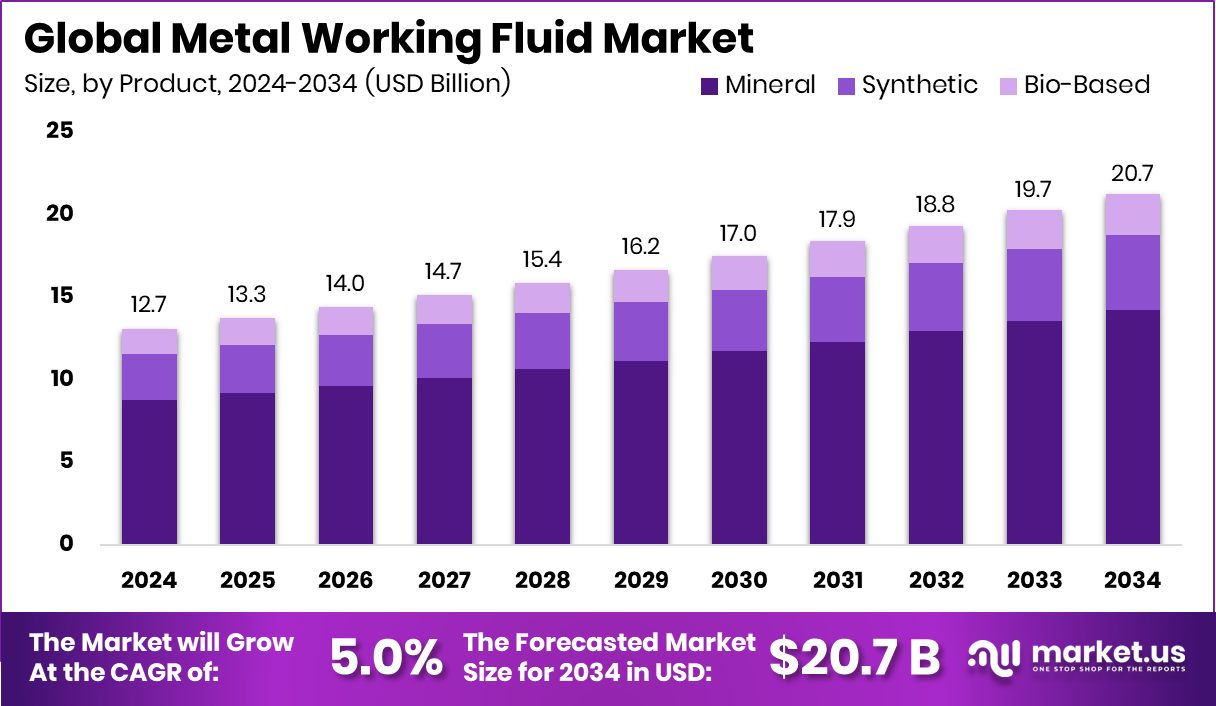

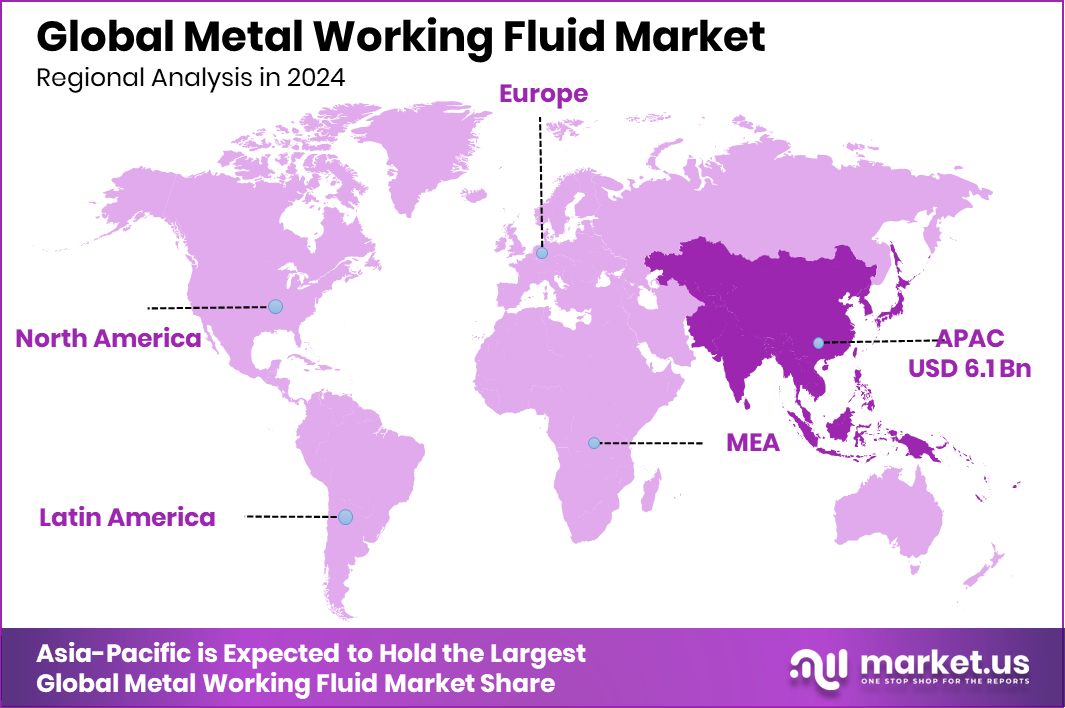

The Global Metal Working Fluid Market is expected to be worth around USD 20.7 billion by 2034, up from USD 12.7 billion in 2024, and is projected to grow at a CAGR of 5.0% from 2025 to 2034. In the Asia-Pacific, the market achieved a 48.30% share, valued at USD 6.1 Bn.

Metal working fluid is a liquid used during cutting, shaping, grinding, or forming metal to reduce heat and friction. It helps tools last longer, keeps surfaces smooth, and improves machining accuracy. These fluids can be water-based or oil-based and are essential in workshops, factories, and manufacturing units that work with metals every day. The metal working fluid market represents the global demand for these fluids, along with the technologies, services, and applications built around machining, fabrication, and production activities.

Growth in this market comes from rising fabrication work, expanding machining centers, and the constant need for precision across industries. Grants supporting training and workshop upgrades also indirectly raise demand. The Marlborough MA, vocational school’s $400,000 Skills Capital grant and Shawsheen Tech’s $1 million welding shop modernization grant strengthen skilled-labor ecosystems, which eventually increases fluid usage in training and production.

Demand continues to build as fabrication businesses modernize. Investments that solve real-world challenges push the industry forward. Fabrication Bazar securing $3 million for improving steel fabrication workflows reflects stronger adoption of machining systems where fluids play a central role.

- Germany’s TVARIT raising €6.5M shows momentum toward AI-driven and energy-efficient metal manufacturing, creating openings for advanced, cleaner fluid technologies.

Additional developments, such as a $740,000 government grant boosting a steel fabricator’s operations and enforcement-driven improvements like the Calgary company’s $200,000 penalty, highlight continuous upgrades in safety, productivity, and facility performance—conditions that support wider use of high-quality metal working fluids.

Key Takeaways

- The Global Metal Working Fluid Market is expected to be worth around USD 20.7 billion by 2034, up from USD 12.7 billion in 2024, and is projected to grow at a CAGR of 5.0% from 2025 to 2034.

- The Metal Working Fluid Market shows strong dominance of mineral products at 68.9%, reflecting widespread industrial acceptance.

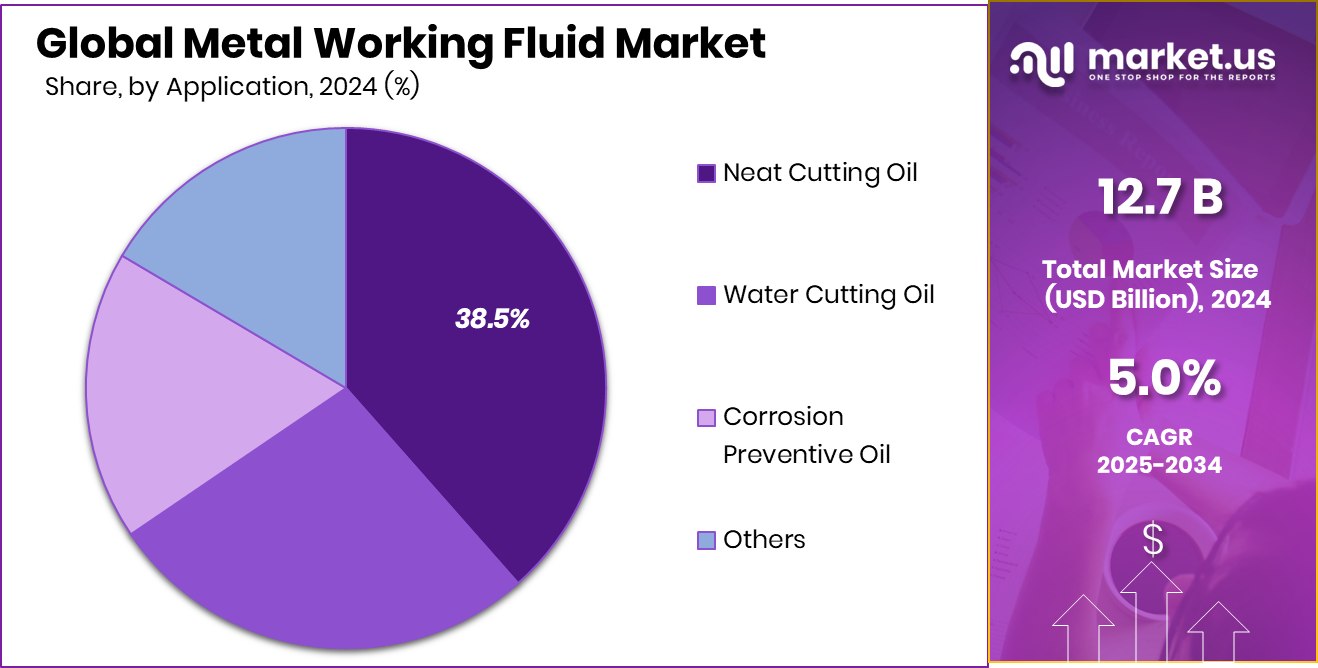

- Application trends highlight neat cutting oils holding 38.5% share, driven by precision machining and efficiency needs.

- End-use demand is led by metal fabrication with a 39.3% share, supported by expanding global manufacturing activities.

- The Asia-Pacific region dominated with 48.30% market share and USD 6.1 Bn.

By Product Analysis

Mineral-based fluids dominate the Metal Working Fluid Market with 68.9% share globally.

Mineral-based fluids remained widely preferred because manufacturers value their stable performance, easy availability, and compatibility with traditional machining systems. The 68.9% share reflects strong reliance on these formulations for cooling, lubrication, and chip removal across routine machining operations. Industries using established metalworking processes continue to choose mineral oils due to their predictable behavior and cost-effectiveness.

Their dominance also stems from the ability of mineral fluids to support high-volume production environments where consistent lubrication is essential. The segment’s scale highlights how entrenched these fluids are in daily industrial workflows, reinforcing their position as the default medium for metal cutting and forming applications.

By Application Analysis

Neat cutting oils lead the Metal Working Fluid Market with 38.5% share.

Neat cutting oils secured a leading role because they provide superior lubrication during precision cutting, reducing tool wear and enabling smoother finishes. The 38.5% share demonstrates their strong preference in operations requiring uninterrupted lubrication without the dilution used in emulsified systems.

Their ability to withstand heavy loads and high temperatures makes them essential for demanding machining tasks across various production setups. This dominance reflects how industries continue to rely on neat oils for enhanced performance in cutting processes where precision, durability, and tool protection remain critical priorities.

By End-use Analysis

Metal fabrication remains the top end-use with 39.3% market share.

Metal fabrication led the market with a 39.3% share, driven by its extensive use of fluids in cutting, shaping, bending, and forming operations. The segment depends heavily on effective cooling and lubrication to maintain equipment efficiency and product accuracy.

The dominance of metal fabrication also reflects the large volume of machining activities performed across construction, machinery, and component manufacturing. Consistent demand for fabricated metal parts ensures ongoing consumption of metalworking fluids, reinforcing the segment’s strong and stable presence within the overall market.

Key Market Segments

By Product

- Mineral

- Synthetic

- Bio-Based

By Application

- Neat Cutting Oil

- Water Cutting Oil

- Corrosion Preventive Oil

- Others

By End-use

- Metal Fabrication

- Transportation Equipment

- Machinery

- Others

Driving Factors

Advanced Fabrication Growth Strengthens Market Demand

The metalworking fluid market grows mainly because fabrication companies are expanding and upgrading their technology. Modern machining systems need reliable fluids for cooling, smooth cutting, and tool protection, which naturally increases demand. A major boost comes from new investments supporting advanced metal fabrication.

- Southland Steel Fabrication Inc. secured a $25 million USDA loan, helping the company adopt state-of-the-art systems and expand its workforce. This upgrade encourages higher metal processing volumes, directly raising the need for high-performance fluids by improving production speed and equipment efficiency.

Another push comes from financing programs helping small manufacturers modernize. The digital loan fund issuing its 100th loan to a cutting-edge metal business shows strong support for innovative operations that depend on improved machining and fluid solutions.

Restraining Factors

High Operational Costs Limit Market Expansion

One major restraining factor for the Metal Working Fluid Market is the rising operational and maintenance costs linked to metal fabrication facilities. Older workshops often struggle to upgrade equipment or adopt new fluid systems because modernization requires steady investment. Even long-standing companies continue operating with legacy machines, which restricts fluid efficiency and increases consumption. The milestone of Ace Metal Kraft Co. Inc. completing 65 years reflects how many firms still rely on traditional setups that limit the adoption of advanced fluids.

- Anderson Steel’s $1.2 million investment to add new jobs shows how upgrades demand sizable capital. For many small and mid-size fabricators, such costs slow modernization, making it harder to shift toward high-performance metalworking fluids despite growing production needs.

Growth Opportunity

Growing Fabrication Expansion Creates Strong Market Opportunity

A major growth opportunity for the Metal Working Fluid Market comes from the rapid expansion of large fabrication facilities. As new mills and fabrication affiliates are added, the demand for cutting, cooling, and machining fluids naturally increases. This is especially true when major steelmakers invest in new production units that require continuous and efficient metal processing.

- Nucor adding a $20M fabrication affiliate to its new $350M Lexington-area mill signals higher machining volumes ahead. This expansion will require more advanced fluids to support shaping, forming, and precision cutting operations.

Another opportunity appears as BMO considers a $1 billion sale of its transportation finance arm, which may redirect capital flows toward industrial and fabrication projects that depend on metalworking fluids for daily operations.

Latest Trends

Shift Toward Cleaner Manufacturing Shapes Market Trend

One of the latest trends in the Metal Working Fluid Market is the steady move toward cleaner and more energy-efficient manufacturing practices. Industries are now looking for fluids that support smoother machining while reducing waste, emissions, and energy use. This shift is becoming stronger as governments and organizations increase funding for cleaner industrial operations, encouraging factories to modernize their equipment and processes.

- TRC Clean Energy Funding passing $2B for clean commercial transportation highlights how large-scale investments are pushing companies toward greener technologies. This momentum influences metal fabrication and machining units as well, motivating them to adopt cleaner fluids that match new sustainability goals.

As cleaner methods grow, demand rises for metalworking fluids designed to support efficient, low-impact production.

Regional Analysis

Asia-Pacific held a strong 48.30% share, reaching a significant USD 6.1 Bn.

Asia-Pacific dominated the Metal Working Fluid Market with a strong 48.30% share, valued at USD 6.1 Bn, reflecting its large manufacturing base and continuous expansion in machining, fabrication, and heavy industrial activities. The region’s scale in automotive components, general engineering, and metal fabrication creates a consistently high demand for cutting, grinding, and forming fluids, strengthening its leadership among all global markets.

North America followed with stable consumption trends supported by its mature industrial systems, where precision machining and high-performance manufacturing processes keep metalworking fluids essential for productivity. Europe showed steady adoption driven by its advanced engineering industries and strong quality standards, maintaining consistent fluid usage across machining and metalforming operations.

Meanwhile, the Middle East & Africa market expanded gradually as industrial diversification and localized manufacturing increased requirements for reliable lubrication and cooling solutions. Latin America also registered steady usage across automotive parts and general fabrication, supported by ongoing industrial modernization.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Houghton International, Inc. continued to strengthen its position in the global Metal Working Fluid Market by focusing on performance-driven formulations tailored for high-precision machining and heavy-duty industrial operations. The company’s long-standing expertise in lubrication chemistry allowed it to support sectors that demand consistent cooling efficiency, tool life enhancement, and process stability. Its wide product adaptability across automotive, general engineering, and metal fabrication contributed to its strategic relevance during the year.

Blaser Swisslube AG maintained its competitive edge through its emphasis on high-quality fluid systems designed to improve machining productivity and energy efficiency. The company’s focus on operator safety, equipment health, and long-term fluid performance helped it remain a preferred partner for manufacturers seeking reliable and clean-running fluids. Blaser’s solutions continued to demonstrate value in complex machining tasks where precision and fluid integrity are essential.

BP plc leveraged its broad industrial footprint to support metalworking segments requiring scalable and consistent lubrication solutions. The company’s diversified portfolio and ability to serve large production networks positioned it well within the global market. Its metalworking fluids remained integral to operations that prioritize durability, high-temperature stability, and smooth cutting performance across various industrial environments.

Top Key Players in the Market

- Houghton International, Inc.

- Blaser Swisslube AG

- BP plc

- Exxon Mobil Corp.

- Total S.A.

- FUCHS

- Chevron Corp.

- China Petroleum & Chemical Corp.

- Kuwait Petroleum Corp.

Recent Developments

- In June 2025, BP launched the sale of its Castrol lubricants unit, which supplies industrial lubricants, engine oils, and specialty fluids used in manufacturing and metalworking applications. The sale could be valued at around US$10 billion, marking a major change in BP’s portfolio and potentially affecting its presence in metalworking and industrial fluids.

- In December 2024, Blaser Swisslube introduced several new metalworking fluid products to enhance machining performance. These include the B-Cool Motec 501, Synergy 915, Grindex S35, and Blasocut 201 under water-miscible coolants, and new neat oils such as Blasogrind GTM 4, Blasomill 15, and Blasomill GT22X. These fluids aim to improve process stability, productivity, and machining quality in manufacturing operations.

- In April 2024, ExxonMobil, which makes Mobil-branded lubricants and industrial fluids used in machinery and metalworking, announced it is building a lubricant manufacturing plant in Maharashtra, India. The plant will make up to 159,000 kiloliters of finished lubricants per year, helping supply advanced oils and fluids for manufacturing sectors once operations start in late 2025.

Report Scope

Report Features Description Market Value (2024) USD 12.7 Billion Forecast Revenue (2034) USD 20.7 Billion CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Mineral, Synthetic, Bio-Based), By Application (Neat Cutting Oil, Water Cutting Oil, Corrosion Preventive Oil, Others), By End-use (Metal Fabrication, Transportation Equipment, Machinery, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Houghton International, Inc., Blaser Swisslube AG, BP plc, Exxon Mobil Corp., Total S.A., FUCHS, Chevron Corp., China Petroleum & Chemical Corp., Kuwait Petroleum Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Metal Working Fluid MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Metal Working Fluid MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Houghton International, Inc.

- Blaser Swisslube AG

- BP plc

- Exxon Mobil Corp.

- Total S.A.

- FUCHS

- Chevron Corp.

- China Petroleum & Chemical Corp.

- Kuwait Petroleum Corp.