Global Meta Xylene Market Size, Share, And Business Benefit By Type (Sorbex, UOP, Others), By Application (Isophthalic Acid, 2,4- and 2,6-xylidine, Solvents, Others), By End User (Packaging, Construction, Automotive, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 166718

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

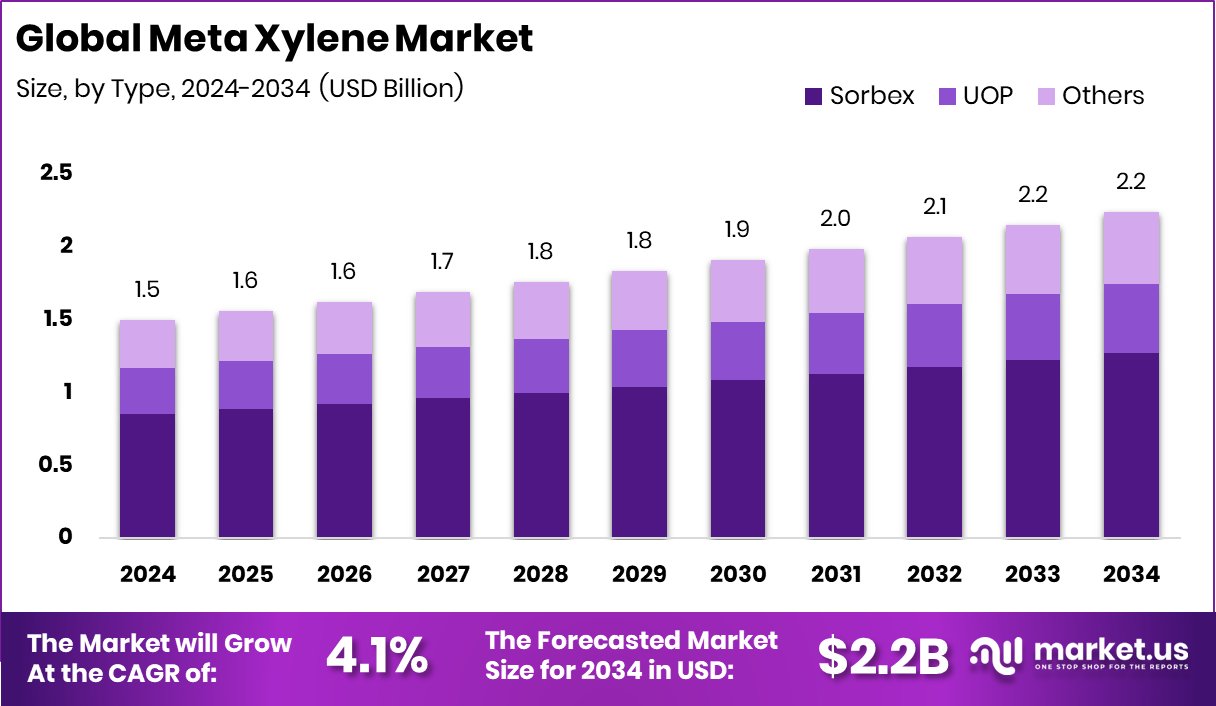

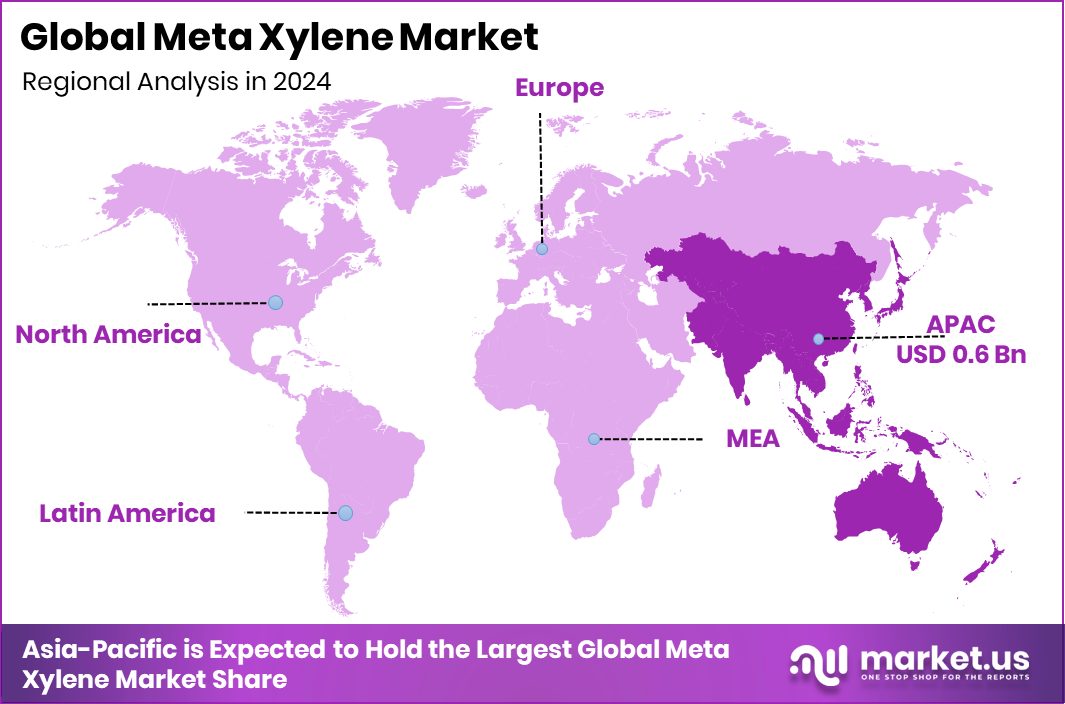

The Global Meta Xylene Market is expected to be worth around USD 2.2 billion by 2034, up from USD 1.5 billion in 2024, and is projected to grow at a CAGR of 4.1% from 2025 to 2034. Asia-Pacific maintained market leadership with a notable 46.20% share reaching USD 0.6 Bn.

Meta-xylene is one of the three isomers of xylene, valued for its role as a chemical building block. It appears as a clear, flammable liquid used mainly to produce isophthalic acid, which later goes into high-performance resins, coatings, and packaging materials. Its stability and solvent strength make it useful in several industrial formulations.

The meta-xylene market represents the global demand, production, and use of this chemical across plastics, adhesives, paints, and specialty materials. The market grows as manufacturers look for strong, temperature-resistant polymers and coatings that improve durability in packaging, construction, and electronics.

Growth is supported by rising demand for isophthalic acid-based resins, especially as industries shift toward higher-performance materials. Many manufacturers prefer these formulations because they offer better strength and heat resistance compared to standard alternatives.

Demand is also expanding as the packaging, automotive, and electronics industries push for durable and lightweight materials. This encourages greater use of specialty polymers derived from meta-xylene, particularly in regions investing in advanced manufacturing.

A key opportunity comes from the rising interest in cleaner, bio-aligned chemicals. Recent activity, such as Bioeutectics securing $2.1M for an eco-friendly solvent launch in the U.S., reflects the growing space for greener formulations. This trend indirectly supports innovation within the wider chemical ecosystem, including opportunities for improved processing routes and sustainable derivatives of meta-xylene.

Key Takeaways

- The Global Meta Xylene Market is expected to be worth around USD 2.2 billion by 2034, up from USD 1.5 billion in 2024, and is projected to grow at a CAGR of 4.1% from 2025 to 2034.

- Sorbex dominates the Meta Xylene Market with 56.8%, driven by its strong separation efficiency.

- Isophthalic acid leads the Meta Xylene Market with 69.2%, supported by rising demand for durable resins.

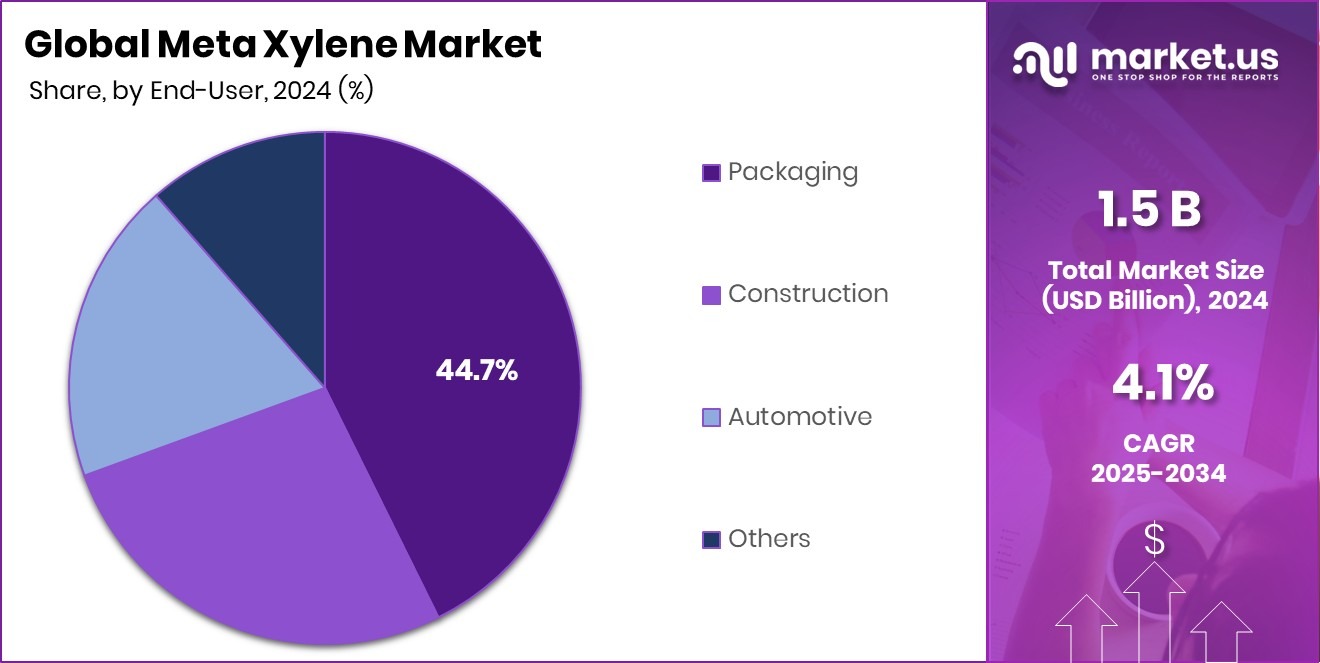

- Packaging holds a 44.7% share in the meta-xylene market due to strong demand for performance materials.

- In the Asia-Pacific, rising manufacturing activity supported the 46.20% share worth USD 0.6 Bn.

By Type Analysis

Meta Xylene Market sees Sorbex dominate with 56.8% due to efficient separation performance.

In 2024, Sorbex held a dominant market position in the By Type segment of the Meta Xylene Market, with a 56.8% share. This separation method remained preferred because it delivers higher purity levels and supports stable production for downstream applications such as resins, coatings, and high-performance materials. Industries relying on consistent feedstock quality continued to choose Sorbex due to its efficiency, reliability, and suitability for large-scale operations.

Its strong share reflects the ongoing shift toward technologies that ensure cleaner output, lower losses, and predictable supply. As demand for advanced polymers and coatings increased, Sorbex maintained its relevance by offering a processing advantage that aligned well with evolving production needs and stricter quality expectations across major end-use sectors.

By Application Analysis

Meta Xylene Market grows as Isophthalic Acid applications hold a strong 69.2% share.

In 2024, Isophthalic Acid held a dominant market position in the By Application segment of the Meta Xylene Market, with a 69.2% share. This strong lead came from its essential role in producing high-performance resins used in packaging, coatings, and reinforced materials. Industries favor isophthalic acid because it improves strength, heat resistance, and durability, making it a preferred ingredient for modern manufacturing needs.

Its wide acceptance across packaging films, protective coatings, and specialty plastics helped sustain its high share through steady industrial consumption. As manufacturers continued shifting toward materials with enhanced performance characteristics, the demand for isophthalic acid remained firmly anchored, reinforcing its dominant presence within the overall application landscape.

By End User Analysis

Meta Xylene Market expands with Packaging leading 44.7%, driven by rising durable-material requirements globally.

In 2024, Packaging held a dominant market position in the By End User segment of the Meta Xylene Market, with a 44.7% share. Its leadership was driven by the rising need for stronger, lightweight, and more durable materials used in food, beverage, and industrial packaging. Meta xylene–based derivatives support the production of high-performance resins that improve barrier strength, shelf stability, and overall product protection.

As consumer goods companies focused on better-quality packaging to reduce damage and extend freshness, demand for these advanced materials continued to rise. This consistent pull from packaging converters and film manufacturers helped the segment maintain its leading share, reflecting its central role in shaping the overall consumption pattern of meta xylene.

Key Market Segments

By Type

- Sorbex

- UOP

- Others

By Application

- Isophthalic Acid

- 2,4- and 2,6-xylidine

- Solvents

- Others

By End User

- Packaging

- Construction

- Automotive

- Others

Driving Factors

Rising Use of High-Performance Resins Drives Growth

One of the strongest driving factors for the Meta Xylene Market is the growing demand for high-performance resins used in packaging, coatings, and industrial materials. Meta xylene is a key ingredient for making isophthalic acid, which helps create resins that are stronger, more heat-resistant, and longer-lasting. As industries look for materials that can handle higher temperatures, provide better protection, and improve product durability, the need for these resins keeps rising.

Packaging companies, in particular, rely on these advanced materials to improve barrier strength and maintain product quality. This steady shift toward better-performing materials continues to boost meta xylene consumption, making it an essential part of modern manufacturing and industrial development.

Restraining Factors

Environmental Concerns Limit Meta Xylene Expansion

A key restraining factor for the Meta Xylene Market is the growing pressure from environmental and safety concerns linked to petrochemical processing. Meta xylene is produced from fossil-based feedstocks, and its manufacturing involves emissions and energy-intensive operations that face increasing regulatory scrutiny. As governments strengthen rules on air quality, waste handling, and industrial emissions, producers often face higher compliance costs and operational restrictions.

These challenges make expansion or new capacity additions slower and more cautious. At the same time, many end-use industries are exploring cleaner and safer alternatives to reduce their environmental footprint. This gradual shift toward eco-aligned materials can limit the long-term pace of meta xylene demand, creating a notable restraint for the market’s growth.

Growth Opportunity

Growing Shift Toward Cleaner Chemical Alternatives

A major growth opportunity for the Meta Xylene Market comes from the rising move toward cleaner and more sustainable chemical solutions. As industries look for safer and more efficient materials, there is increasing interest in upgrading production methods to reduce emissions and improve purity levels. This shift supports innovation around advanced processing routes that can deliver meta xylene with lower environmental impact.

The trend also encourages the development of improved downstream products, especially resins and coatings that offer better performance with fewer ecological concerns. As manufacturers continue modernizing their operations and investing in cleaner technologies, meta xylene stands to benefit from new demand created by sustainability-focused industries looking for reliable and high-quality chemical inputs.

Latest Trends

Rising Preference for High-Purity Meta Xylene Grades

A leading trend in the Meta Xylene Market is the growing preference for high-purity grades that offer better performance in downstream applications. Industries producing resins, coatings, and specialty materials are shifting toward cleaner and more consistent feedstocks to achieve stronger, clearer, and more reliable end products. This trend is driven by the need for better heat resistance, improved durability, and enhanced processing efficiency across packaging, automotive, and electronics.

As manufacturers raise quality standards, they increasingly favor meta xylene with tighter specifications and fewer impurities. This push toward purity encourages producers to modernize equipment, adopt improved separation technologies, and strengthen quality control, making high-purity meta xylene a key trend shaping the future market direction.

Regional Analysis

Asia-Pacific held a strong Meta Xylene Market share of 46.20%, valued at USD 0.6 Bn.

Asia-Pacific dominated the Meta Xylene Market with a 46.20% share, valued at USD 0.6 Bn, supported by strong industrial activity in packaging, resins, and coatings. The region’s manufacturing strength and continuous investment in advanced materials kept demand stable, helping it remain the leading consumer of meta xylene. Its large production base and steady expansion in downstream chemicals further reinforced this dominant position.

North America showed a consistent need for meta-xylene due to its established chemicals and materials sector. The region benefited from steady consumption in high-performance coatings and packaging applications, supported by mature production capabilities and well-defined industrial demand patterns.

Europe maintained stable requirements driven by its focus on high-quality resins and specialty materials. The region’s preference for durable and heat-resistant formulations supported its ongoing use of meta xylene in various industrial applications.

The Middle East & Africa displayed gradual demand, supported by ongoing developments in basic chemicals and growing interest in downstream processing. Its expanding materials sector contributed to a modest but steady pull for meta xylene.

Latin America recorded steady usage, driven by growth in local manufacturing and increased reliance on performance-oriented resins and coatings. The region continued to depend on consistent supply channels to meet its industrial needs.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

GS Caltex Corporation continues to strengthen its position through integrated refining and petrochemical operations, allowing it to maintain a consistent output of aromatics, including meta-xylene. Its strong infrastructure and balanced production systems help support market reliability, especially for downstream users requiring steady-quality feedstock.

Honeywell International Inc. influences the market through its process technologies and engineering capabilities. Its expertise in advanced separation, purification, and aromatics processing systems supports producers aiming to improve efficiency and product purity. By focusing on cleaner and more optimized chemical pathways, the company indirectly enhances the competitiveness of global meta-xylene production.

Lotte Chemical Corporation remains an important contributor through its diversified petrochemical portfolio and strong presence in Asia. Its large-scale operations and investment in modern facilities enable stable availability of meta xylene for resin, coating, and specialty material manufacturers. The company’s integration across the value chain supports dependable supply conditions.

Top Key Players in the Market

- GS Caltex Corporation

- Honeywell International Inc.

- Lotte Chemical Corporation

- Mitsubishi Gas Chemical Company Inc.

- Parchem Fine & Specialty Chemicals

- BASF SE

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- LOTTE Chemical CORPORATION

- Shell Plc

- Chevron Phillips Chemical Company LLC

- BP PLC

Recent Developments

- In July 2024, GS Caltex announced a major planned upgrade of its Yeosu mixed-feed cracker, scheduled for late September to November. The debottlenecking would raise ethylene capacity from 750,000 t/yr to 900,000 t/yr, propylene from 410,000 t/yr to 470,000 t/yr, and increase crude C4s output from 250,000 t/yr to 300,000 t/yr. This enhances downstream chemical feedstocks, supporting aromatics and related products.

- In May 2024, Honeywell launched a new “NEP” (Naphtha to Ethane & Propane) technology that enables converting naphtha feedstocks into ethane and propane, which are then used to make ethylene and propylene. This innovation improves efficiency and lowers CO₂ emissions in petrochemical production.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Billion Forecast Revenue (2034) USD 2.2 Billion CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Sorbex, UOP, Others), By Application (Isophthalic Acid, 2,4- and 2,6-xylidine, Solvents, Others), By End User (Packaging, Construction, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape GS Caltex Corporation, Honeywell International Inc., Lotte Chemical Corporation, Mitsubishi Gas Chemical Company Inc., Parchem Fine & Specialty Chemicals, BASF SE, MITSUBISHI GAS CHEMICAL COMPANY, INC., LOTTE Chemical CORPORATION, Shell Plc, Chevron Phillips Chemical Company LLC, BP PLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- GS Caltex Corporation

- Honeywell International Inc.

- Lotte Chemical Corporation

- Mitsubishi Gas Chemical Company Inc.

- Parchem Fine & Specialty Chemicals

- BASF SE

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- LOTTE Chemical CORPORATION

- Shell Plc

- Chevron Phillips Chemical Company LLC

- BP PLC