Global Melatonin Market Size, Share Analysis Report By Type (Natural Melatonin, Synthetic Melatonin), By Dosage Form (Tablets, Capsules, Gummies, Liquid Drops, Others), By Application (Dietary Supplement, Medical, Veterinary and Aquaculture, Post-Harvest Agriculture, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162241

- Number of Pages: 225

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

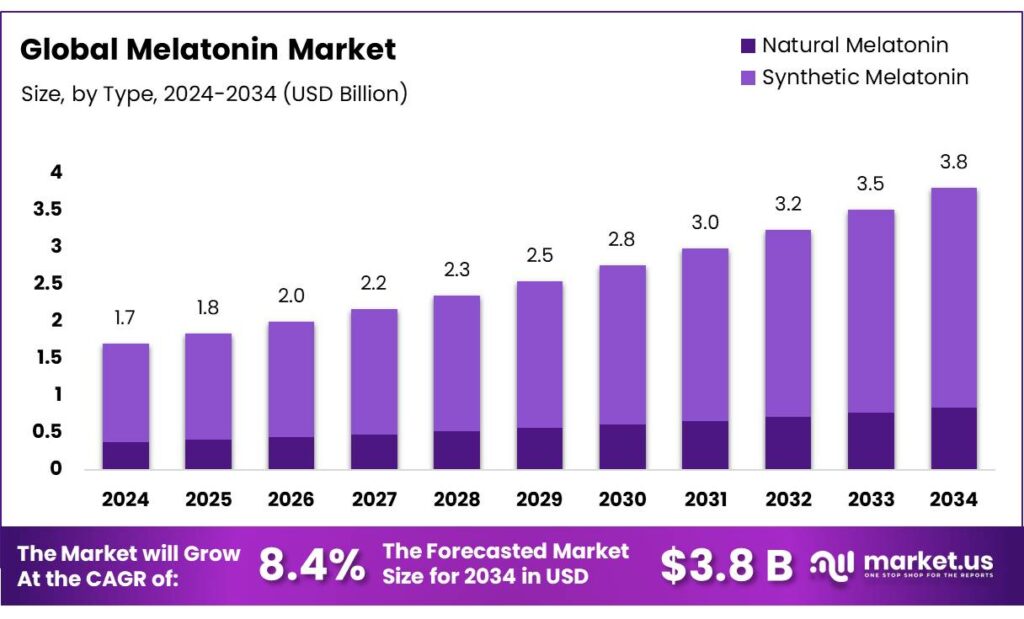

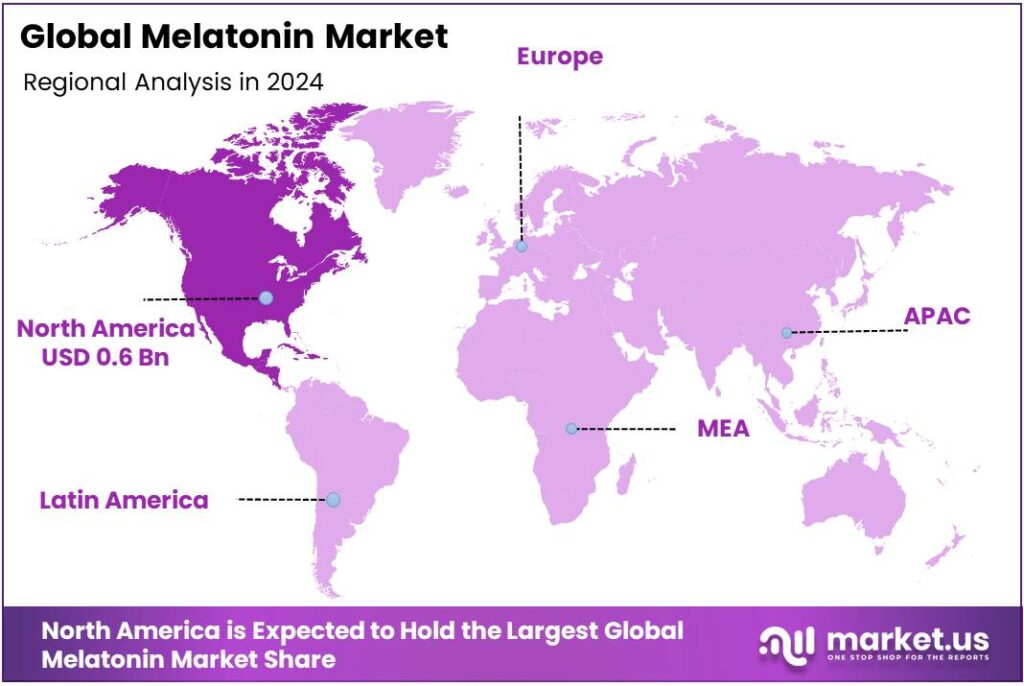

The Global Melatonin Market size is expected to be worth around USD 3.8 Billion by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 8.4% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 38.8% share, holding USD 0.6 Billion in revenue.

Melatonin sits at the intersection of consumer health, nutraceuticals, and regulated medicines. It is widely used to support sleep quality and manage circadian rhythm disruptions such as jet lag. Public-health data confirm the underlying need: in the United States, 35% of adults reported insufficient sleep in 2020, and in 2022 state-level rates of short sleep ranged from 30% (Vermont) to 46% (Hawaii), underscoring a large addressable base for sleep-related products.

Industrial activity spans dietary supplements and prescription-only medicines in many parts of Europe. In the EU, the prolonged-release 2 mg melatonin product Circadin is authorized on prescription, typically one tablet daily for up to 13 weeks, while the EMA also lists additional melatonin medicines with prescription status—evidence of tighter medicinal control versus the U.S. supplements channel.

Demand signals are strong. Among U.S. adults, reported melatonin use rose from 0.4% in 1999–2000 to 2.1% in 2017–2018, indicating multi-year adoption growth that predates the pandemic surge in sleep-aid interest. On the efficacy front, Europe’s risk-assessment and claims system recognizes specific benefits at defined doses: EFSA concluded that 1 mg of melatonin taken close to bedtime reduces sleep-onset latency, and that 0.5 mg taken near bedtime can help alleviate jet lag, shaping claimable benefits and labeling in EU markets.

Policy, safety, and quality are central to the industrial scenario. The CDC reported 260,435 pediatric melatonin ingestions to U.S. poison centers during 2012–2021, with melatonin accounting for 4.9% of all pediatric ingestions in 2021 versus 0.6% in 2012—a powerful signal for packaging standards, dose forms, and retail controls. U.S. health agencies also highlight variability in product content and caution for populations such as older adults, reinforcing the importance of GMP compliance, truthful labeling, and child-resistant formats as the category professionalizes.

Key driving factors include the large prevalence of short sleep and the expansion of evidence-based indications. CDC surveillance shows persistent short sleep across the population, while EU regulators enable targeted, dose-specific claims that support clinician engagement and pharmacy-led recommendations.

- For example, EFSA’s 1 mg claim on sleep-onset latency offers a science-anchored positioning pathway, and EMA-approved products formalize dosing regimens and treatment windows for older adults with insomnia—both strengthening healthcare-channel acceptance.

Key Takeaways

- Melatonin Market size is expected to be worth around USD 3.8 Billion by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 8.4%.

- Synthetic Melatonin held a dominant market position, capturing more than a 78.9% share of the global melatonin market.

- Tablets held a dominant market position, capturing more than a 39.3% share of the global melatonin market.

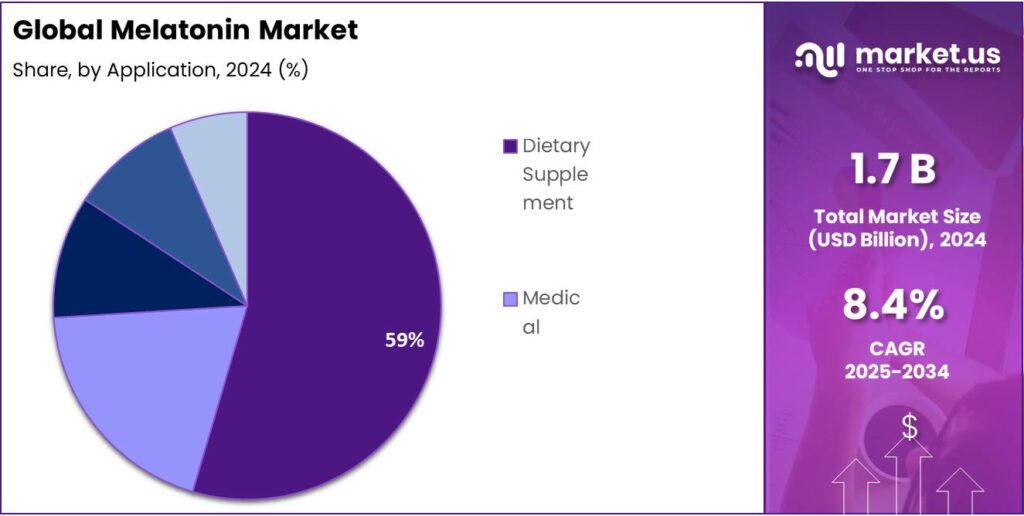

- Dietary Supplement held a dominant market position, capturing more than a 58.8% share of the global melatonin market.

- North America held a dominant market position, capturing more than a 38.8% share of the global melatonin market, valued at approximately USD 0.6 billion.

By Type Analysis

Synthetic Melatonin dominates with 78.9% share due to its high purity and large-scale production efficiency.

In 2024, Synthetic Melatonin held a dominant market position, capturing more than a 78.9% share of the global melatonin market. This strong dominance can be attributed to its cost-effectiveness, consistent purity levels, and wide-scale availability for commercial use. Synthetic variants are widely preferred by manufacturers of dietary supplements, pharmaceuticals, and functional foods due to their stability and standardized formulation, ensuring consistent dosage and safety for end-users.

The demand for synthetic melatonin continued to rise sharply across North America, Europe, and parts of Asia Pacific, supported by growing consumer adoption of sleep-enhancing products and stress management supplements. The production process of synthetic melatonin allows high-volume output at relatively low cost compared to natural extraction, which is complex and resource-intensive. This has enabled manufacturers to meet the expanding global demand for sleep aids and related formulations efficiently.

By Dosage Form Analysis

Tablets dominate with 39.3% share owing to their convenience, stability, and consumer preference.

In 2024, Tablets held a dominant market position, capturing more than a 39.3% share of the global melatonin market. This dominance is mainly due to their ease of administration, longer shelf life, and accurate dosage delivery, making them the most preferred form among consumers and healthcare professionals. Tablets are widely available across pharmacies, supermarkets, and online platforms, providing consumers with a familiar and convenient option for sleep support. Their stability under varying storage conditions also contributes to their popularity among manufacturers, as it ensures product integrity during transportation and long-term use.

Rising consumer awareness regarding regulated dosage and consistent sleep support encouraged the demand for tablet-based melatonin supplements. The segment also benefited from advancements in controlled-release formulations, enabling gradual melatonin release that mimics natural sleep cycles, enhancing user satisfaction and adherence.

By Application Analysis

Dietary Supplements dominate with 58.8% share driven by rising consumer focus on sleep health and wellness.

In 2024, Dietary Supplement held a dominant market position, capturing more than a 58.8% share of the global melatonin market. This strong lead is primarily attributed to the growing awareness of natural sleep aids, stress management, and overall wellness among consumers. Melatonin supplements have become a preferred choice for individuals seeking non-prescription solutions to improve sleep quality and manage jet lag or shift-related sleep disorders. The easy availability of melatonin-based dietary supplements across pharmacies, supermarkets, and online platforms has further accelerated this trend.

The segment witnessed significant expansion as consumers increasingly adopted sleep-supporting products as part of their daily wellness routines. The popularity of innovative formats such as gummies, chewable tablets, and flavored softgels also contributed to a wider consumer base, particularly among younger demographics and first-time supplement users. Regulatory support allowing melatonin as a dietary ingredient in several regions further strengthened its presence in mainstream health and nutrition products.

Key Market Segments

By Type

- Natural Melatonin

- Synthetic Melatonin

By Dosage Form

- Tablets

- Capsules

- Gummies

- Liquid Drops

- Others

By Application

- Dietary Supplement

- Medical

- Veterinary and Aquaculture

- Post-Harvest Agriculture

- Others

Emerging Trends

Safety-First, Evidence-Anchored Melatonin

Across sleep health, the clearest melatonin trend is a pivot toward safer, standardized, and evidence-anchored products. Two forces are reshaping the category. First, large-scale supplement adoption means a broader, less expert user base. In the United States, 57.6% of adults reported using at least one dietary supplement in the past 30 days in 2017–2018, a high baseline that normalizes supplement use and pulls melatonin further into the mainstream. Second, public-health agencies are elevating sleep as a priority. Healthy People 2030 reports only 69.9% of adults got sufficient sleep in 2022, tracking an objective to raise this share, which keeps sleep-support products under a policy spotlight.

Regulatory science is also guiding product design. In the EU, the European Food Safety Authority supports precise claims at low doses: 1 mg of melatonin taken near bedtime may reduce sleep-onset latency, while 0.5 mg can alleviate jet lag—language companies can translate into clear, dose-specific labeling and counseling. This claim architecture is encouraging a shift from “more is better” gummies to targeted, low-dose, timed-use formats. Meanwhile, U.S. surveillance shows melatonin use among adults increased from 0.4% to 2.1%, a long-running adoption curve that further incentivizes brands to align with regulator-recognized dosing.

Safety is now front-and-center in product strategy and retail practice. CDC data document a 530% rise in pediatric melatonin ingestions over 2012–2021, totaling 260,435 reports—findings that have triggered calls for child-resistant closures, clearer front-of-pack warnings, and caregiver education at point of sale. Extending this pattern, CDC investigators estimate about 11,000 emergency-department visits for unsupervised melatonin ingestion among infants and young children during 2019–2022, roughly 7% of all unsupervised medication-exposure ED visits in that age group—evidence accelerating retailer reforms and pharmacy counseling.

Quality standardization is the third pillar of this trend. Independent analyses have shown label–content mismatches are common: in one evaluation, more than 71% of products deviated by over ±10% from labeled melatonin content, with extremes ranging from 83% less to 478% more than stated. These findings are pushing manufacturers toward third-party verification programs and tighter GMP controls, and they’re prompting clinicians and pharmacists to steer consumers to verified SKUs.

Drivers

Widespread Insufficient Sleep Among Adults

One of the most compelling driving forces behind the growing interest in melatonin is the large number of adults who simply aren’t getting enough sleep.

- According to the Centers for Disease Control and Prevention (CDC), roughly 35% of U.S. adults reported in 2020 that they sleep fewer than 7 hours in a 24-hour period. This figure highlights not just a minor issue but a large-scale health and wellness concern impacting millions of people.

In more detail, the CDC’s data show that adequate sleep (defined as 7 or more hours) is still out of reach for a significant swathe of the population. For example, the Healthy People 2030 objective (SH-03) cites that in 2022 only 69.9% of adults were getting sufficient sleep, compared to a baseline of 72.3% in 2020. In other words, even as efforts to promote sleep health have intensified, the share of adults achieving recommended sleep duration is stagnating or possibly slipping.

This chronic short-sleep phenomenon creates a natural environment for sleep-aid options to gain traction, and that’s where melatonin enters the picture. Because melatonin is the hormone the body uses to regulate the sleep-wake cycle, it lies at the heart of a solution many seek when they feel their natural rhythm is off. The fact that such a large proportion of the adult population reports insufficient sleep gives manufacturers, retailers and health advisors a clear impetus: there is a genuine demand for tools—both behavioural and supplemental—that may help people achieve better rest.

Restraints

Variable Quality and Safety Concerns

For example, a peer-reviewed analysis found that more than 71% of over-the-counter melatonin supplements failed to meet a ±10% margin of the amount declared on the label. Some tested products ranged from 83% less to as much as 478% more melatonin than the label claimed. This means that a person might take what they believe is 1 mg, but actually receive nothing measurable or receive 4–5 mg—or more—without knowing.

The human consequences of this variability are especially stark when considering children. According to the Centers for Disease Control and Prevention (CDC), between 2012 and 2021 U.S. poison control centres logged 260,435 pediatric melatonin ingestions, and the annual number of ingestions increased by approximately 530% over that decade. In 2021 alone, these melatonin exposures accounted for 4.9% of all pediatric ingestions reported to U.S. poison control centres.

Moreover, for very young children the risk of unsupervised ingestion is material: from 2019-2022 roughly an estimated 10,930 emergency department visits occurred for unsupervised melatonin ingestion by children aged ≤5 in the U.S., representing 7.1% of all ED visits for unsupervised medication exposures in that age group. A substantial share of cases involved gummy products or chewables that appear candy-like, and many bottles lacked child-resistant closures.

From a consumer perspective, it means healthcare providers must emphasize product selection, proper dosing, secure storage, and realistic expectations. The variability undermines trust: if a supplement one day contains 0.5 mg but another day unbeknownst to the user it contains 3 mg, then outcomes can become unpredictable—leading to excessive drowsiness, disrupted sleep architecture, or unintended interactions.

Opportunity

Rising Public Awareness of Sleep Health

One of the most compelling growth opportunities for the use of Melatonin lies in a genuine, rising interest among people in improving their sleep — not just as a “nice-to-have” but as a core element of health and quality of life. The statistics tell us a story of redistribution of priorities: in the U.S., for example, data show that during 2017–2018, 57.6% of adults aged 20 years and over reported having used at least one dietary supplement in the past 30 days. That large baseline of supplement-savvy consumers opens a channel for melatonin-based products to reach new segments.

Modern lifestyles with screen time, shift work, travel across time zones, and stress mean that more individuals are recognising that getting sleep isn’t just about resting — it’s about functioning, recovery, mood, productivity, and longevity. The natural hormone melatonin and its supplementary form therefore find themselves in a moment when society is ready for sleep-health tools. Crucially, sleep health is often endorsed by public-health messages: for instance the Centers for Disease Control and Prevention (CDC) treats insufficient sleep as a public-health concern and recommends behaviour-linked improvements.

From a consumer perspective, the human story is intuitive: you have a busy life, maybe a tight schedule, perhaps you commute, travel, have irregular sleep hours. You realise you’re not sleeping as well as you used to — you wake up tired, you’re groggy, you wish for something simple to help. Melatonin comes in as a credible option, especially when positioned responsibly, with clear dosing and good product quality. When consumers find that a large proportion of the public already uses supplements — 57.6% in that snapshot — the step of trying a well-packaged, well-explained melatonin product becomes less daunting.

There is also a favourable regulatory and educational backdrop. While oversight varies by region, health authorities increasingly emphasise correct sleep-hygiene practices, timing of melatonin intake (for example, taking 30 minutes before bed) and safe storage. This means companies that align with these messages and invest in consumer education can build trust — and in the health-conscious market, trust often drives adoption. When a supplement is positioned not as a quick fix but as part of a holistic sleep-wellness regimen (good bed-time habits + melatonin if needed), the appeal is stronger and more sustainable.

Regional Insights

North America dominates the global Melatonin market with 38.8% share, valued at USD 0.6 billion in 2024, driven by high supplement consumption and growing sleep health awareness.

In 2024, North America held a dominant market position, capturing more than a 38.8% share of the global melatonin market, valued at approximately USD 0.6 billion. The region’s strong position can be attributed to the widespread use of dietary supplements, an aging population facing higher rates of sleep disorders, and a growing focus on preventive health and wellness. According to the U.S. Centers for Disease Control and Prevention (CDC), nearly one in three adults in the United States reports inadequate sleep, which has significantly boosted demand for melatonin-based sleep aids. The increasing trend of self-medication, along with easy access to over-the-counter formulations, has further contributed to the market’s expansion across the United States and Canada.

Melatonin sales in the U.S. witnessed robust growth, supported by a rise in online retailing and product diversification in forms such as gummies, capsules, and time-release tablets. The United States continues to represent the largest consumer base within the region, accounting for more than 85% of North America’s total melatonin demand. Canada also observed moderate growth, driven by increased acceptance of nutraceuticals and supportive regulatory frameworks for natural health products.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Church & Dwight Co., Inc. expanded its melatonin portfolio in 2024 under its leading consumer health brands, capitalizing on the rising demand for sleep and relaxation aids. The company’s strong retail network and e-commerce presence in the U.S. and Canada have positioned it as a key market contributor. Its focus on affordable yet effective formulations, combined with robust marketing strategies, supports high consumer trust and brand recognition in the over-the-counter sleep supplement segment.

Natrol remains one of the most recognized melatonin supplement brands globally, holding a strong consumer base in 2024 due to its wide range of sleep support products. The company’s product innovations, including fast-dissolve tablets and flavored gummies, have driven strong sales across North America. Natrol’s commitment to clinical quality standards and non-GMO ingredients aligns with rising consumer expectations for natural wellness products. Its robust digital presence and consistent marketing have further reinforced its leadership in the segment.

Nature’s Bounty maintained its leadership position in 2024 as a trusted brand in vitamins and supplements, offering an extensive line of melatonin products. The company benefits from its widespread retail availability, spanning pharmacies, supermarkets, and e-commerce platforms. Its continuous investment in product quality, consumer education, and diverse formats—such as gummies, tablets, and liquid drops—has strengthened its brand loyalty. Nature’s Bounty’s emphasis on natural ingredients and clinically supported formulations keeps it at the forefront of the global melatonin market.

Top Key Players Outlook

- Aspen

- B. Joshi Agrochem Pharma

- Biotics Research

- Church & Dwight Co., Inc.

- Jamieson Vitamins

- Natrol

- Nature’s Bounty

- Pharmavite

- Puritan’s Pride

- Solgar Inc.

Recent Industry Developments

In 2024 Aspen Pharmacare was a visible supplier in the melatonin sector through its prolonged-release product Circadin (2 mg) and related pharmaceutical-grade offerings; the company’s commercial and manufacturing scale supported stable supply to regulated markets. Aspen reported group revenue of R44.7 billion in FY-2024, underpinning its ability to invest in specialty products and quality systems.

In 2024, Jamieson Wellness Inc. reported a revenue of CA$244.8 million, marking an 11.1% increase from the previous year.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Bn Forecast Revenue (2034) USD 3.8 Bn CAGR (2025-2034) 8.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Natural Melatonin, Synthetic Melatonin), By Dosage Form (Tablets, Capsules, Gummies, Liquid Drops, Others), By Application (Dietary Supplement, Medical, Veterinary and Aquaculture, Post-Harvest Agriculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aspen, B. Joshi Agrochem Pharma, Biotics Research, Church & Dwight Co., Inc., Jamieson Vitamins, Natrol, Nature’s Bounty, Pharmavite, Puritan’s Pride, Solgar Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aspen

- B. Joshi Agrochem Pharma

- Biotics Research

- Church & Dwight Co., Inc.

- Jamieson Vitamins

- Natrol

- Nature's Bounty

- Pharmavite

- Puritan's Pride

- Solgar Inc.