Global Medicated Feed Additives Market Size, Share Analysis Report By Product Type (Antibiotics, Vitamins, Antioxidants, Amino Acids, Prebiotics And Probiotics, and Enzymes), By Formulation (Supplements, Concentrates, Premixes, and Base Mixes), By Animal Type (Ruminants, Swine, Poultry, Aquaculture, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174099

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

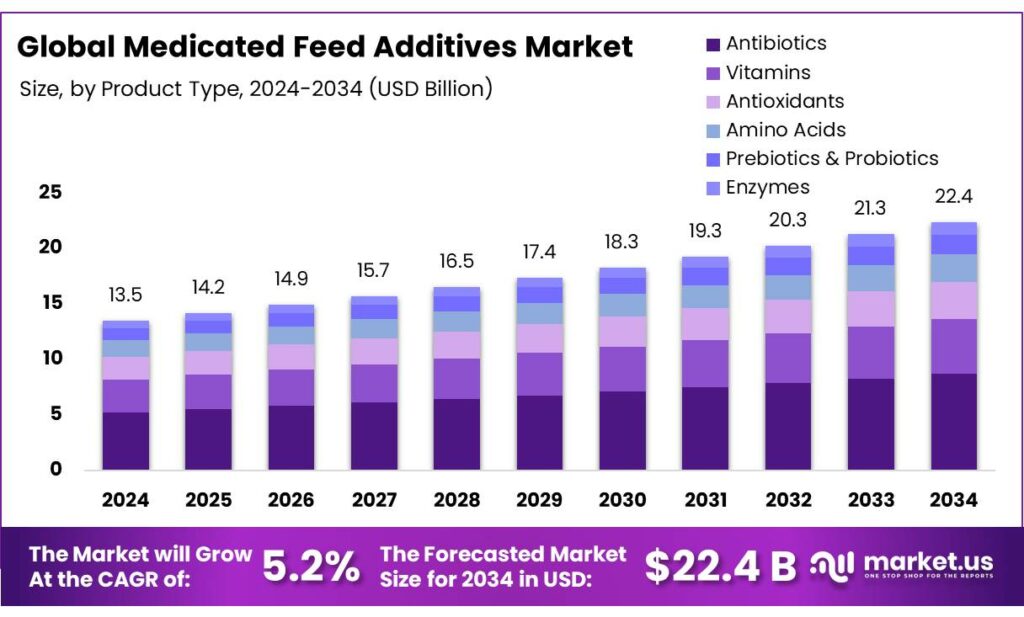

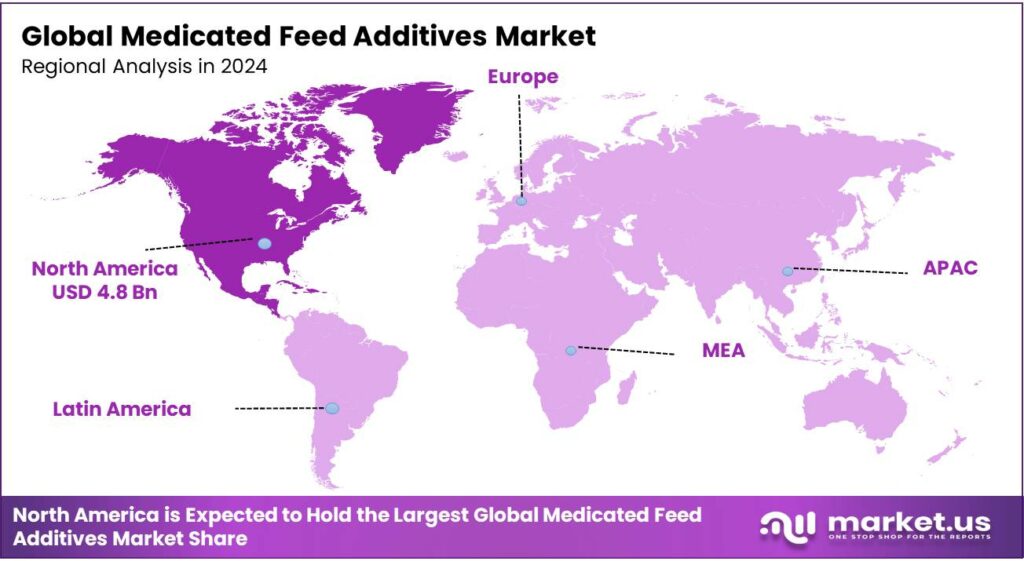

Global Medicated Feed Additives Market size is expected to be worth around USD 22.4 Billion by 2034, from USD 13.5 Billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 39.9% share, holding USD 1.2 Million in revenue.

According to the definition by the US Food & Drug Administration, a medicated feed additive is a veterinary medicinal product produced under controlled conditions and has the purpose of treating or controlling disease in farmed animals, aquaculture species, and pets. It requires a veterinary prescription and is regulated by various organizations around the globe.

- Regulation (EU) 2019/4 establishes rules within the EU governing the manufacture, storage, transport, marketing, import, use, and export of medicated feed and intermediate products, including requirements for labelling, packaging, advertising, and homogeneity assurance. Similarly, Commission Delegated Regulation (EU) 2024/1229 sets maximum permissible cross-contamination levels of antimicrobial substances in non-target feed and defines analytical methods for their detection.

Medicated feed additives play a pivotal role in modern livestock production by supporting animal health, enhancing nutrient utilization, and helping manage disease pressures, particularly in intensive poultry systems where disease susceptibility is high.

- The global per capita intake of animal‑source calories is expected to rise by approximately 6% over the same period, with lower‑middle‑income countries seeing growth as high as 24%, driven by urbanization and higher disposable incomes.

The growing concerns about antimicrobial resistance and residues in meat have intensified the search for alternatives such as probiotics, prebiotics, phytogenic, and organic acids. This shift reflects a broader industry response to regulatory restrictions on antibiotic growth promoters and rising consumer preference for antibiotic‑free products, driving producers to adopt diverse additive strategies to maintain performance. As livestock sectors navigate sustainability pressures, medicated feed additives continue to evolve toward solutions that balance animal health, food safety, and consumer expectations.

Key Takeaways

- The global medicated feed additives market was valued at USD 13.5 billion in 2024.

- The global medicated feed additives market is projected to grow at a CAGR of 5.2% and is estimated to reach USD 22.4 billion by 2034.

- On the basis of product type, medicated feed with antibiotics dominated the market, constituting 38.9% of the total market share.

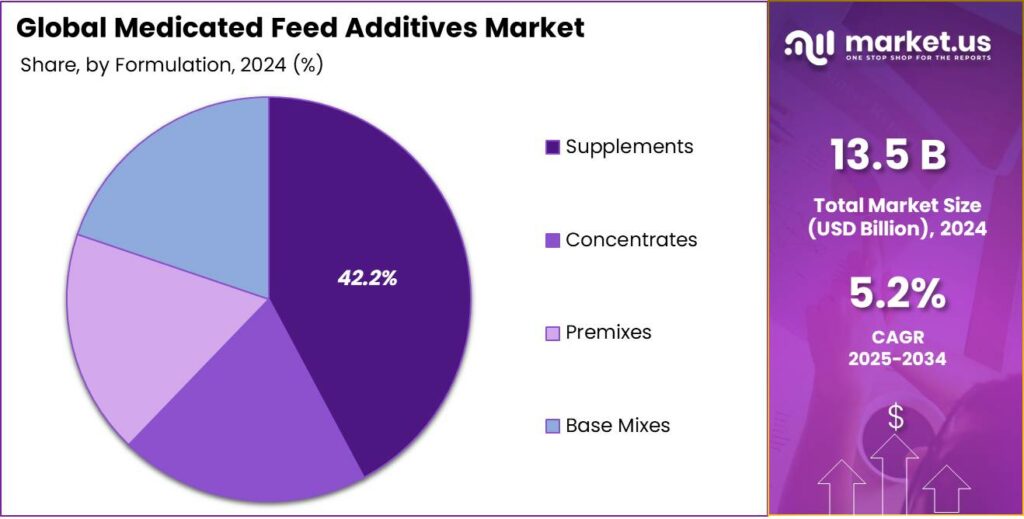

- Based on the formulation, supplements held a major share of the medicated feed additives market, with a substantial market share of around 42.2%.

- Among the animal types, medicated feed additives were most utilized for poultry animals, 36.6% of the total global consumption.

- In 2024, North America was the most dominant region in the medicated feed additives market, accounting for 35.4% of the total global market.

Product Type Analysis

Medicated Feed with Antibiotics is a Prominent Segment in the Market.

The medicated feed additives market is segmented based on product type into antibiotics, vitamins, antioxidants, amino acids, prebiotics & probiotics, and enzymes. The medicated feed with antibiotics led the market, comprising 38.9% of the market share, primarily because antibiotics serve dual functions in livestock production that directly address urgent health and efficiency needs.

The farmers incorporate sub-therapeutic levels of antibiotics into feed, as such inclusion is shown to improve growth performance by 10% to 15% or more, reduce mortality, and prevent bacterial disease outbreaks in high-density production systems, benefits that are not as immediately measurable with other additives. Moreover, antibiotics have been extensively used to control infections and act as growth promoters, a practice that accounts for a substantial portion of global antibiotic use in livestock, with some estimates indicating that up to 80 % of all antibiotics produced globally are used in food production.

By contrast, vitamins and antioxidants primarily bolster general health, amino acids support nutritional balance, and probiotics or enzymes often exert effects that are dependent on feeding duration and microbial ecology, which may not match the immediate, broad-spectrum disease prevention and performance outcomes associated with antibiotics.

Formulation Analysis

Supplements Held a Major Share in the Medicated Feed Additives Market.

On the basis of formulation, the medicated feed additives market is segmented into supplements, concentrates, premixes, and base mixes. The supplements held a major share in the market, comprising 42.2% of the market share, as supplements offer convenience, direct applicability, and flexibility in livestock feeding practices. Medicated feed additives, such as antibiotics or specific functional compounds, are often required in very small quantities and must be distributed uniformly throughout the diet to be effective and safe.

The supplements allow producers to apply these additives directly to complete feeds without complex mixing procedures. In contrast, premixes and concentrates require additional processing steps and specialized equipment to blend micro-ingredients into basal rations, making them more suitable as intermediate products for feed mills rather than on-farm use. Furthermore, supplements reduce the risk of dosing errors associated with handling highly potent additives at scale, ensuring consistent animal intake across diverse production systems.

Animal Type Analysis

Medicated Feed Additives Products Are Mostly Utilized for Poultry Animals.

Based on the animal type, the medicated feed additives market is segmented into ruminants, swine, poultry, aquaculture, and others. Among the applications of the medicated feed additives, 36.6% of the products consumed globally are for poultry animals, due to the unique health challenges and production systems inherent to poultry operations.

Poultry are often raised in intensive, high‑density environments where diseases such as coccidiosis and enteric infections spread rapidly, creating a pronounced demand for consistent, feed‑based medication to maintain flock health and productivity. Additionally, poultry production targets rapid growth and feed conversion efficiency, making medicated feeds an effective tool for preventing performance‑limiting illnesses and maximizing output.

In contrast, ruminants and some swine operations may rely more on individual treatments, pasture management, or water‑administered medicines due to their different digestive physiology and husbandry practices. Similarly, aquaculture species pose formulation challenges, as medicated additives must be stable in water and species‑specific, which complicates broad‑scale feed medication use relative to poultry.

Key Market Segments

By Product Type

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acids

- Prebiotics & Probiotics

- Enzymes

By Formulation

- Supplements

- Concentrates

- Premixes

- Base Mixes

By Animal Type

- Ruminants

- Swine

- Poultry

- Aquaculture

- Others

Drivers

Demand for Animal Protein Drives the Medicated Feed Additives Market.

The growing global population, coupled with rising incomes, has significantly increased the demand for animal protein, particularly in developing countries. As more consumers adopt diets rich in meat, eggs, and dairy products, the pressure on livestock production systems intensifies.

- According to a study by the United Nations (UN), the world population is projected to reach 9.8 billion in 2050. Similarly, according to the Organization for Economic Co-operation and Development, in 2023, the disposable income in the US alone reached US$62,722. This growing population, along with rising disposable incomes, increases the demand for high-quality animal products.

Consequently, farmers are increasingly turning to medicated feed additives to enhance livestock health, improve growth rates, and prevent disease outbreaks. These additives help optimize feed efficiency, contributing to more sustainable production practices. The rising need for efficient livestock production techniques directly correlates with the growing application of these specialized feed products.

- According to a study by the UN-OECD, global output of meat, dairy, and eggs is projected to increase by about 17% by 2034, reflecting larger herds and higher per‑animal productivity as producers strive to meet consumption needs.

Restraints

Human Health Concerns Regarding Residues of the Medicated Feed Additives Might Hamper the Growth of the Market.

Concerns over human health risks related to residues of medicated feed additives in animal products are increasingly influencing consumer behavior and regulatory frameworks. The prolonged use of antibiotics and other additives in animal feed can lead to residue accumulation in meat, eggs, and dairy, which raises the potential for antimicrobial resistance (AMR).

- In a case study by the National Institutes of Health (NIH), 411,530 samples of milk were analyzed, of which 0.21% tested positive for some type of antibiotic.

For instance, the European Union has taken significant steps to curb the use of antibiotics in animal feed, recognizing that traces of these substances in food can contribute to the growing threat of drug-resistant infections. Similarly, the U.S. Food and Drug Administration (FDA) has tightened regulations surrounding the use of medicated feeds, urging farmers to adopt alternatives and limit antibiotics to therapeutic purposes.

As consumers become more health-conscious and demand greater transparency, the livestock industry faces increasing pressure to reduce or eliminate these additives, which could hinder the broader adoption of medicated feed products in the market.

Opportunity

Growing Application in Pharmaceutical Industry Creates Opportunities in the Medicated Feed Additives Market.

The increasing global demand for antibiotic-free meat and consumer preference for naturally raised animal products have created tangible opportunities for prebiotic and probiotic medicated feed additives within livestock production.

- According to a study by the Food and Agriculture Organization of the United Nations, antibiotic use could be reduced by up to 57% if livestock productivity is optimized by incorporating probiotics, which help establish beneficial gut microbiota and improve disease resistance in poultry and swine without reliance on antibiotics.

Moreover, consumer willingness to pay premiums for antibiotic-free products at retail outlets underscores the commercial incentive for producers to adopt these alternatives. For instance, one study found Iranian consumers were willing to pay an 18-20% premium for antibiotic-free chicken meat. In poultry and ruminant sectors, prebiotic compounds such as mannan oligosaccharides (MOS) have demonstrated improvements in feed conversion ratios by 8%-12%, further validating their role as effective replacements for conventional antibiotics.

In addition, major quick-service restaurants are expanding antibiotic-free sourcing, leading contract suppliers to integrate probiotic and prebiotic solutions to meet stringent supply specifications. These shifts reflect a broader industry move toward sustainable, health-oriented livestock nutrition that aligns with evolving consumer expectations.

Trends

Shift Towards Phytogenic Medicated Feed Additives.

The trend towards phytogenic medicated feed additives, which are derived from herbs, spices, essential oils, and other plant bioactives, is gaining substantial traction as livestock producers seek natural alternatives to synthetic chemicals and antibiotic growth promoters. The inclusion of these plant-derived compounds can improve gut health and immune response in poultry by increasing average daily weight gain by 5% to 13%, and in some small ruminants by up to 30%, highlighting measurable performance benefits across species.

Producers in major meat-producing regions, such as parts of Europe, North America, and Asia, are adopting phytogenics to comply with stringent antibiotic regulations and to meet consumer demand for cleaner food products. Common phytogenic ingredients, including turmeric, thyme, and rosemary extracts, are known for their antimicrobial, antioxidant, and digestive-enhancing properties, supporting feed conversion efficiency and overall animal welfare. This shift reflects an ongoing industry movement towards sustainable, residue-free livestock nutrition solutions.

Geopolitical Impact Analysis

Geopolitical Tensions Have Led to Disruption in the Production of Medicated Feed Additives.

The geopolitical tensions, notably the Russia-Ukraine conflict and escalating U.S.-China trade frictions, have had a multifaceted impact on the medicated feed additives market by disrupting supply chains, increasing costs, and shifting sourcing strategies. The Russia-Ukraine conflict exposed vulnerabilities in feed additive supply chains, as Russia imported 95% of its feed additives and veterinary drugs, and the exodus of Western suppliers led to shortages that prompted state initiatives to localize production of enzymes, probiotics, and micronutrients to reduce dependency on imports of the country.

Simultaneously, disruptions to grain and key agricultural inputs from Ukraine and Russia have elevated commodity price volatility, complicating feed formulation costs globally. Furthermore, trade tensions between the United States and China have driven uncertainty in the logistics of raw materials and intermediate products essential to additive manufacturing, with freight rates reported to surge as global shipping routes adjust. Producers have responded by diversifying supply lines and regionalizing feed additive sourcing to mitigate geopolitical risk, reflecting broader shifts in global agricultural input networks.

Regional Analysis

North America Held the Largest Share of the Global Medicated Feed Additives Market.

In 2024, North America dominated the global medicated feed additives market, holding about 35.4% of the total global consumption, underpinned by its extensive livestock production infrastructure and high consumption of animal-derived products.

- In the United States alone, sales of medically important antibiotics used in food-producing livestock increased by approximately 16% in 2024, with particularly notable rises in antibiotics for chicken (79%), cattle (16%), and pigs (13%), reflecting the region’s reliance on such compounds to support dense poultry, swine, and cattle herds.

Furthermore, regulatory structures such as the U.S. Veterinary Feed Directive mandate professional oversight of medicated feeds, demonstrating the region’s structured approach to feed additive deployment. The USDA highlights that animal agriculture, which encompasses substantial livestock feed additive use, constitutes about half of U.S. agricultural activity and supplies high-quality food domestically and internationally.

Moreover, Canada’s stringent approval processes for veterinary products further ensure that additives, including antimicrobials and growth promoters, are carefully regulated to safeguard animal and human health. This robust livestock sector, along with regulatory frameworks and ongoing demand for protein-rich foods, helps explain why North America leads in the application of medicated feed additives globally.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The companies manufacturing medicated feed additives employ a range of strategic activities to secure a competitive advantage and respond to evolving industry challenges. Many players intensify research and development initiatives to create innovative solutions, such as advanced probiotics, enzyme-based formulations, and tailored nutrient delivery systems that enhance animal health and performance.

Additionally, companies pursue strategic acquisitions and joint ventures to integrate complementary portfolios and scale operations efficiently. Similarly, emphasis is placed on digital transformation and traceability platforms, enabling precise feed formulation, regulatory compliance, and improved transparency across supply chains. Furthermore, these players focus on the expansion of global distribution networks and the development of customized additive solutions for specific livestock sectors, further supporting competitive positioning.

The Major Players in The Industry

- Elanco Animal Health Incorporated

- Phibro Animal Health Corporation

- Huvepharma EOOD

- Zoetis Inc.

- Boehringer Ingelheim Animal Health GmbH

- Virbac SA

- Ceva Santé Animale S.A.

- MSD Animal Health

- Zydus Lifesciences Ltd.

- Vetoquinol SA

- Biovet JSC

- Zagro Group

- Calier Laboratorios S.A.

- HIPRA

- Norbrook Laboratories Ltd.

- ADM (Archer Daniels Midland Company)

- Cargill, Incorporated

- Other Key Players

Key Development

- In October 2024, Phibro Animal Health Corporation announced the successful completion of the acquisition of the medicated feed additive product portfolio and certain water-soluble products from Zoetis Inc.

- In July 2024, Huvepharma established a sales and marketing collaboration with ADM to expand its ruminant nutrition portfolio. Under this agreement, three ADM feed additives will be integrated into Huvepharma’s ruminant product line, immediately enhancing its expanding range of livestock solutions.

Report Scope

Report Features Description Market Value (2024) US$13.5 Bn Forecast Revenue (2034) US$22.4 Bn CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Antibiotics, Vitamins, Antioxidants, Amino Acids, Prebiotics & Probiotics, and Enzymes), By Formulation (Supplements, Concentrates, Premixes, and Base Mixes), By Animal Type (Ruminants, Swine, Poultry, Aquaculture, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Elanco Animal Health Incorporated, Phibro Animal Health Corporation, Huvepharma EOOD, Zoetis Inc., Boehringer Ingelheim Animal Health GmbH, Virbac SA, Ceva Santé Animale S.A., MSD Animal Health, Zydus Lifesciences Ltd., Vetoquinol SA, Biovet JSC, Zagro Group, Calier Laboratorios S.A., HIPRA, Norbrook Laboratories Ltd., ADM (Archer Daniels Midland Company), Cargill, Incorporated, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Medicated Feed Additives MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Medicated Feed Additives MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Elanco Animal Health Incorporated

- Phibro Animal Health Corporation

- Huvepharma EOOD

- Zoetis Inc.

- Boehringer Ingelheim Animal Health GmbH

- Virbac SA

- Ceva Santé Animale S.A.

- MSD Animal Health

- Zydus Lifesciences Ltd.

- Vetoquinol SA

- Biovet JSC

- Zagro Group

- Calier Laboratorios S.A.

- HIPRA

- Norbrook Laboratories Ltd.

- ADM (Archer Daniels Midland Company)

- Cargill, Incorporated

- Other Key Players