Global Marine Calcium Market Size, Share, And Enhanced Productivity By Product Type (Brackish Water, Salt Water, Others), By Application (Supplements, Cosmetics, Others), By End-use (Healthcare, Ornament), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177668

- Number of Pages: 239

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

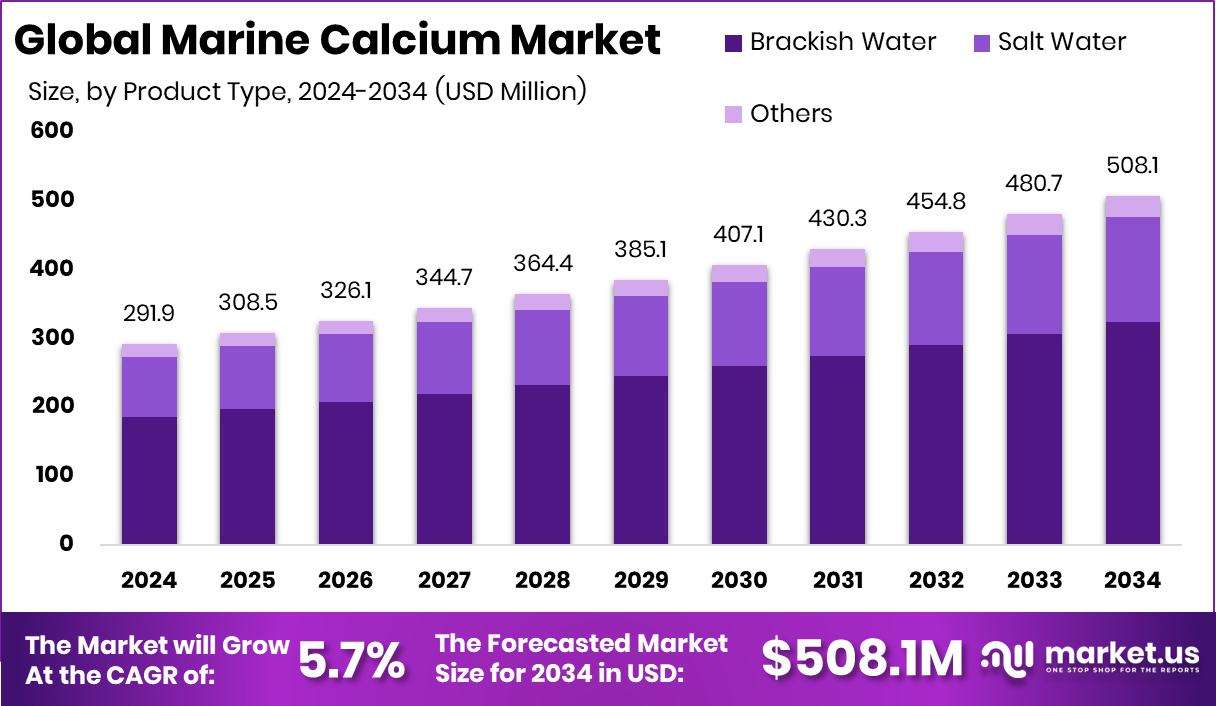

The Global Marine Calcium Market is expected to be worth around USD 508.1 million by 2034, up from USD 291.9 million in 2024, and is projected to grow at a CAGR of 5.7% from 2025 to 2034. Strong supplement demand drives the Asia Pacific 45.1% marine calcium market growth.

Marine calcium is a natural mineral sourced from ocean-based materials such as seaweed, coral fragments, and marine shells. Unlike mined calcium from land, marine calcium contains trace minerals that occur naturally in seawater, which support better absorption in the body. It is widely used in dietary supplements, personal care products, and specialty applications. Its natural origin and balanced mineral profile make it popular among consumers looking for clean and sustainable health ingredients.

The Marine Calcium Market includes products derived from brackish water, salt water, and other marine sources. These materials are processed and supplied for supplements, cosmetics, and other applications, serving end-use sectors such as healthcare and ornamentation. Demand is closely linked to bone health awareness, aging populations, and interest in plant-based or ocean-derived nutrition solutions.

Growth factors are also supported by water infrastructure investments. Recent announcements, such as NM announcing $26M in grants for brackish water projects, NM releasing $40 million for brackish water treatment, and McAllen Public Utility securing nearly $10 million for brackish groundwater desalination, strengthen raw material accessibility. Additional funding, including $12.6 million for desalination research and New Mexico awarding $26 million to seven brackish projects, improves treatment capacity and long-term supply stability.

Rising healthcare demand continues to drive marine calcium consumption, particularly in supplements and therapeutic nutrition. At the same time, opportunities are expanding in cosmetics and specialty formulations as manufacturers explore marine-based mineral enrichment. With ongoing investment in brackish water treatment and desalination infrastructure, the market is positioned for steady and sustainable development.

Key Takeaways

- The Global Marine Calcium Market is expected to be worth around USD 508.1 million by 2034, up from USD 291.9 million in 2024, and is projected to grow at a CAGR of 5.7% from 2025 to 2034.

- Salt water sources dominate the marine calcium market with a 63.8% share globally.

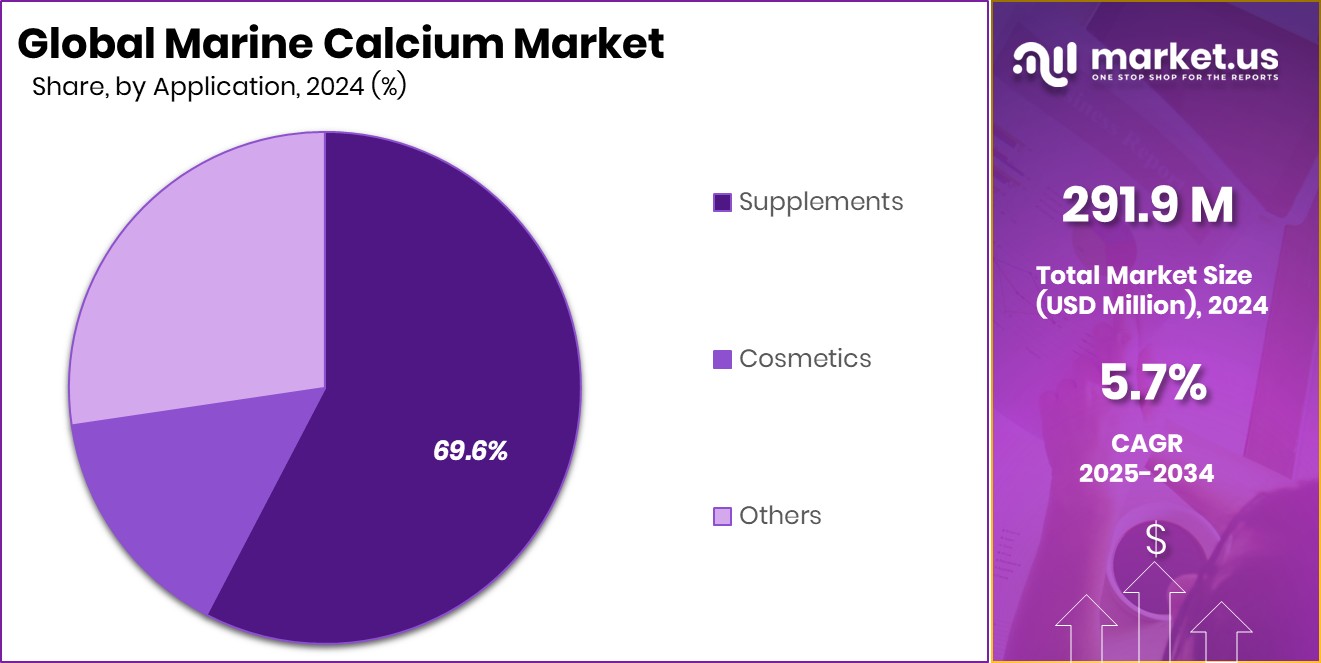

- Supplement applications lead the marine calcium market, accounting for 69.6% of total demand.

- The healthcare end-use segment commands a 78.2% share in the marine calcium market.

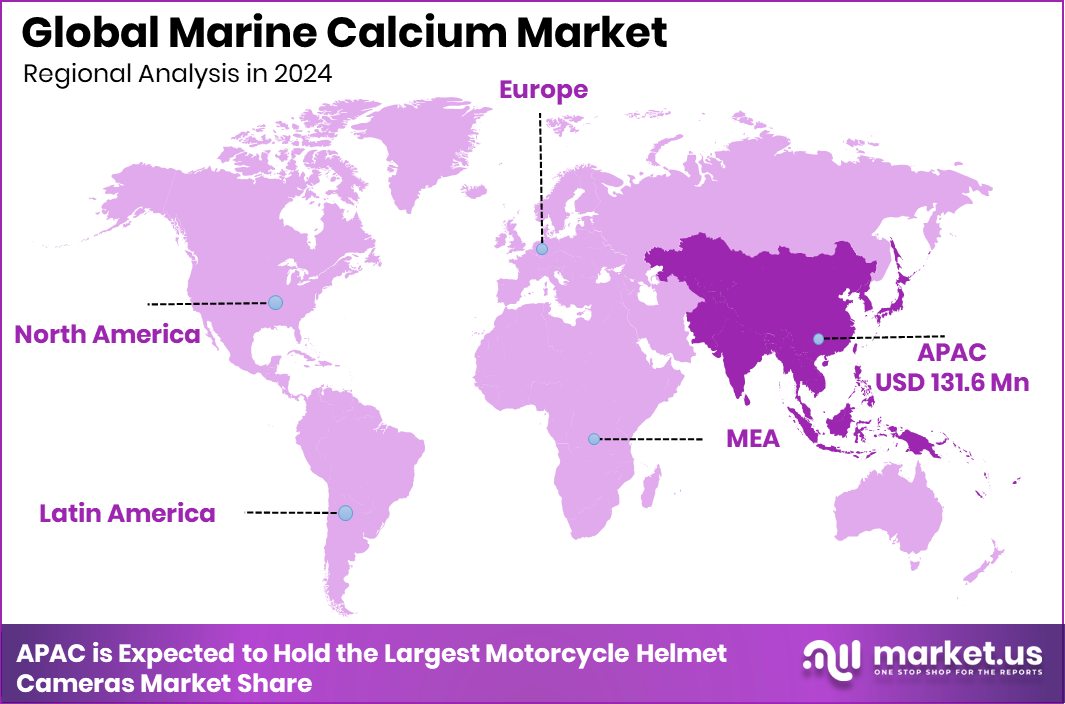

- The Asia Pacific generated USD 131.6 Mn in total revenue.

By Product Type Analysis

Saltwater sources dominate the marine calcium market with a 63.8% share.

In 2024, the Marine Calcium Market showed strong dominance of saltwater–sourced products, accounting for 63.8% of total revenue share. This clear lead reflects the abundance and easy accessibility of marine raw materials such as seaweed, shells, and coral-derived sources found in saltwater environments. Manufacturers prefer saltwater extraction because it offers better mineral concentration and relatively stable supply chains compared to freshwater alternatives.

Coastal processing units in Asia-Pacific and parts of Europe have further strengthened production efficiency, lowering overall processing costs. Additionally, consumers increasingly favor naturally derived calcium from marine ecosystems, believing it to be more bioavailable and closer to its natural mineral matrix. As demand for clean-label and ocean-based nutritional ingredients rises, saltwater-derived marine calcium continues to secure its position as the backbone of the global market.

By Application Analysis

Supplement applications lead the Marine Calcium Market with a 69.6% share.

In 2024, supplements emerged as the leading application segment in the Marine Calcium Market, holding a 69.6% share. The growth is largely driven by increasing awareness around bone density, joint health, and age-related calcium deficiencies. Marine calcium, especially from algae and shell sources, is widely used in capsules, tablets, and powdered formulations due to its superior absorption profile.

Supplement manufacturers are actively marketing marine-based calcium as a cleaner and more sustainable alternative to synthetic or mined calcium sources. The aging global population, particularly in developed economies, has also contributed to the rising consumption of daily calcium supplements. Moreover, fitness-focused consumers and preventive healthcare trends are encouraging younger demographics to adopt mineral supplementation earlier, further strengthening the dominance of the supplements segment across global markets.

By End-use Analysis

Healthcare end-use commands the marine calcium market at 78.2% globally.

In 2024, the healthcare sector accounted for 78.2% of total end-use demand in the Marine Calcium Market, reflecting its critical role in medical nutrition and therapeutic applications. Hospitals, clinics, and pharmaceutical companies increasingly rely on marine-derived calcium in formulations targeting osteoporosis, bone regeneration, and post-surgical recovery. The credibility of marine calcium as a naturally sourced, trace-mineral-rich ingredient enhances its acceptance in professional healthcare settings.

Physicians often recommend calcium supplementation as part of preventive care strategies, especially for elderly patients and women at risk of bone density loss. Furthermore, integration of marine calcium into prescription nutraceuticals and fortified medical foods has strengthened its penetration within institutional healthcare channels, ensuring consistent and large-volume demand throughout the year.

Key Market Segments

By Product Type

- Brackish Water

- Salt Water

- Others

By Application

- Supplements

- Cosmetics

- Others

By End-use

- Healthcare

- Ornament

Driving Factors

Rising demand for bone health supplements

Rising demand for bone health supplements continues to strengthen the Marine Calcium Market as consumers increasingly focus on preventive healthcare and long-term wellness. Aging populations, active lifestyles, and higher awareness of calcium deficiency are pushing supplement sales across retail and online platforms. Marine-sourced calcium is often viewed as more natural and easier to absorb, which supports its growing popularity. Investor confidence in the supplement space also reflects this upward momentum.

For example, supplements brand Feel Goods raised a $4.7 million round in a challenging VC landscape, signaling that nutrition-focused businesses still attract capital even during cautious funding periods. This steady consumer pull, combined with financial backing for supplement innovation, keeps marine calcium positioned as a dependable growth ingredient within health-focused product lines worldwide.

Restraining Factors

High extraction and processing costs

High extraction and processing costs remain a significant challenge for the Marine Calcium Market. Harvesting marine minerals, ensuring purity, and maintaining environmental compliance require advanced filtration, desalination, and mineral separation systems. These processes demand energy, regulatory oversight, and specialized infrastructure, which directly increase production expenses. In addition, innovation in marine resource technologies often depends on public or institutional funding.

The U.S. Department of Energy’s Water Power Technologies Office (WPTO) released a $10 million funding opportunity to advance marine energy innovation, highlighting how marine-based operations require capital-intensive development. While such funding supports broader marine advancements, it also reflects the high investment needed to make marine extraction commercially viable. These structural costs can limit small-scale participation and influence final product pricing.

Growth Opportunity

Expansion into marine-based cosmetic formulations

Expansion into marine-based cosmetic formulations presents a promising opportunity for the Marine Calcium Market. Beauty and personal care brands increasingly incorporate ocean-derived minerals into skincare, anti-aging creams, and wellness-focused cosmetic products. Marine calcium is valued for its mineral richness and natural positioning, aligning with clean-label and sustainability trends in the cosmetics industry. Infrastructure investments aimed at improving brackish water treatment further enhance raw material accessibility.

For instance, NM plans to release $40 million for projects to treat brackish water, strengthening mineral recovery and processing capabilities. Such developments indirectly support stable marine mineral sourcing and long-term supply. As cosmetic manufacturers continue exploring mineral-infused formulations, marine calcium suppliers may benefit from diversified demand beyond traditional supplement applications.

Latest Trends

Shift toward plant-based calcium alternatives

A noticeable shift toward plant-based calcium alternatives is shaping the Marine Calcium Market landscape. Consumers are actively seeking non-synthetic, algae-derived, and ocean plant-based calcium sources that align with vegan and sustainable lifestyles. This trend connects closely with broader environmental concerns surrounding marine ecosystems. Reports indicate that ocean protection requires $15.8 billion in annual funding, yet only $1.2 billion is currently allocated, highlighting a major funding gap.

Growing awareness around ocean conservation is influencing brands to adopt responsible sourcing practices and transparent supply chains. As sustainability becomes central to purchasing decisions, marine calcium producers are under pressure to balance resource extraction with environmental stewardship, making responsible sourcing and eco-certifications increasingly important within the industry.

Regional Analysis

Asia Pacific dominates the marine calcium market with a 45.1% regional share.

In 2024, the Marine Calcium Market demonstrates varied regional performance across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Asia Pacific leads the global landscape, accounting for 45.1% of the total market share, with a market value reaching USD 131.6 Mn. The region’s dominance is supported by strong coastal resource availability and steady demand from healthcare and supplement manufacturers.

North America represents a mature market, driven by established nutraceutical consumption patterns and growing preventive healthcare awareness. Europe follows closely, supported by clean-label product demand and strict quality standards encouraging marine-based mineral adoption.

Meanwhile, the Middle East & Africa region shows gradual expansion due to improving healthcare infrastructure and rising awareness of mineral supplementation. Latin America is witnessing steady development, backed by expanding retail supplement penetration and increasing focus on bone health solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Caltron Clays and Chemicals Pvt. Ltd. continues to position itself as a reliable supplier within the global Marine Calcium Market. From an analyst’s perspective, the company benefits from its focused mineral processing capabilities and established presence in specialty calcium products. Its operational strength lies in maintaining consistent product quality while serving both domestic and export clients. The company’s structured manufacturing approach and attention to mineral purity support its relevance in healthcare and supplement-grade applications. With growing preference for naturally sourced calcium, Caltron Clays and Chemicals Pvt. Ltd. appears strategically aligned to capitalize on steady demand, particularly where regulatory compliance and formulation stability are key purchase considerations.

Carlyle Nutritionals LLC demonstrates a consumer-focused strategy in the marine calcium space, emphasizing finished supplement formulations rather than only raw material supply. Analysts observe that the company’s branding strength and direct engagement with end consumers give it a competitive edge in value-added marine calcium products. Its portfolio positioning around wellness, bone health, and mineral supplementation reflects alignment with preventive healthcare trends. By concentrating on product presentation, labeling transparency, and dosage convenience, Carlyle Nutritionals LLC reinforces its market presence in retail and online channels. This forward-facing approach enhances brand loyalty and supports repeat purchase cycles in the supplement segment.

Coral Calcium remains closely associated with marine-derived calcium solutions, particularly those linked to coral-based mineral sources. From an analytical standpoint, the brand recognition surrounding coral calcium products continues to influence purchasing behavior in specific consumer groups. The company’s emphasis on natural origin and mineral-rich composition strengthens its positioning in bone health and daily supplementation categories. While competition in marine calcium is increasing, Coral Calcium benefits from product familiarity and niche identity. Its continued focus on maintaining mineral integrity and clear health positioning allows it to sustain relevance within the evolving global marine calcium landscape in 2024.

Top Key Players in the Market

- Caltron Clays and Chemicals Pvt. Ltd.

- Carlyle Nutritionals LLC

- Coral Calcium

- Coral Cay Health Pty Ltd.

- Green Nutritionals

- Health Leads UK Ltd.

- Healthwin

- Life Nutrition

- Marine Bio Co. Ltd.

- Nanoshel LLC

- Nature and Praan Naturals

- Natura

- Nature’s Farmacy Wix

- Natures Sunshine Products Inc.

- Nutraceutical Corp.

- Swanson Health Products In

Recent Developments

- In December 2025, the Better Being Co. (parent of Nutraceutical Corp.) announced a strategic transaction to support the next phase of its growth. This move is aimed at strengthening its position in the nutritional supplements and wellness market by expanding manufacturing and distribution capabilities across its branded products portfolio.

- In June 2025, Nature’s Sunshine announced it would support the sale of up to 2,854,607 shares of its common stock through a secondary public offering handled by an underwriter. The shares were sold by a stockholder, with the company potentially able to repurchase up to USD 15 million of its own stock as part of a share repurchase program.

Report Scope

Report Features Description Market Value (2024) USD 291.9 Million Forecast Revenue (2034) USD 508.1 Million CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Brackish Water, Salt Water, Others), By Application (Supplements, Cosmetics, Others), By End-use (Healthcare, Ornament) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Caltron Clays and Chemicals Pvt. Ltd., Carlyle Nutritionals LLC, Coral Calcium, Coral Cay Health Pty Ltd., Green Nutritionals, Health Leads UK Ltd., Healthwin, Life Nutrition, Marine Bio Co. Ltd., Nanoshel LLC, Nature and Praan Naturals, Natura, Nature’s Farmacy Wix, Natures Sunshine Products Inc., Nutraceutical Corp., Swanson Health Products In Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Caltron Clays and Chemicals Pvt. Ltd.

- Carlyle Nutritionals LLC

- Coral Calcium

- Coral Cay Health Pty Ltd.

- Green Nutritionals

- Health Leads UK Ltd.

- Healthwin

- Life Nutrition

- Marine Bio Co. Ltd.

- Nanoshel LLC

- Nature and Praan Naturals

- Natura

- Nature's Farmacy Wix

- Natures Sunshine Products Inc.

- Nutraceutical Corp.

- Swanson Health Products In