Global Low-alcohol Beverages Market Size, Share, And Enhanced Productivity By Product (Low Alcohol Beer, Low Alcohol Wine, Low Alcohol RTD, Low Alcohol Cider, Low Alcohol Spirits), By Packaging (Bottles, Cans, Tetra-packs), By Distribution Channel (Off-trade, On-trade), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 172401

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

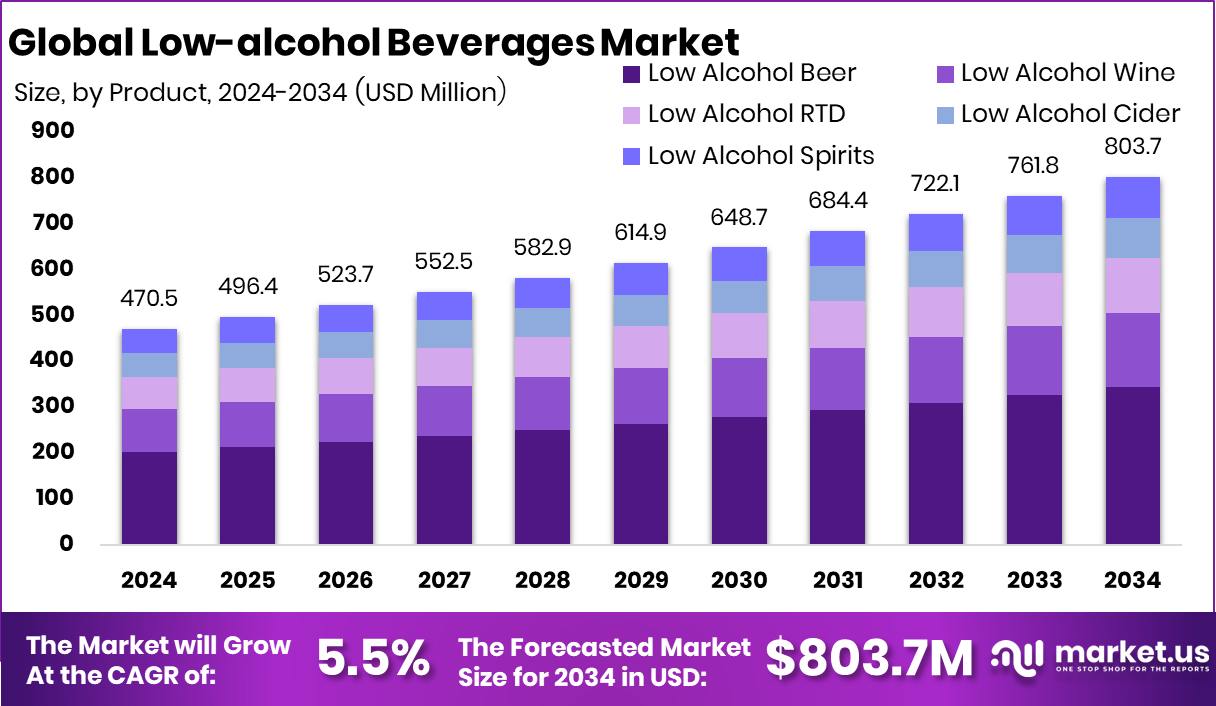

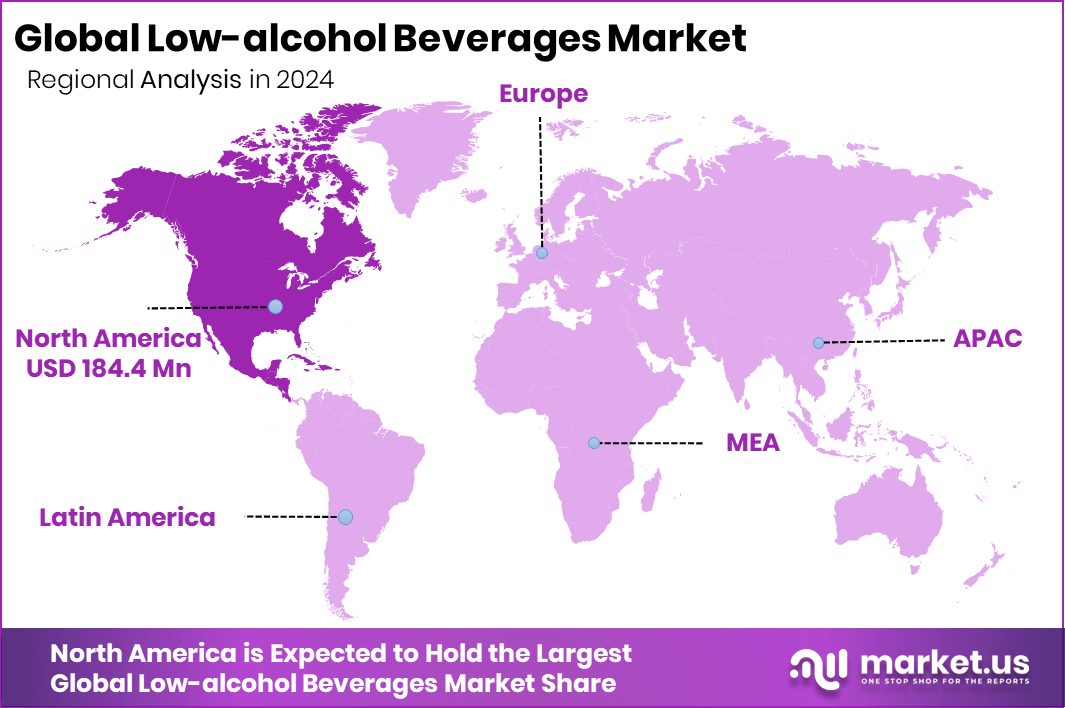

The Global Low-alcohol Beverages Market is expected to be worth around USD 803.7 million by 2034, up from USD 470.5 million in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034. North America dominated the low-alcohol beverages market, holding a 39.20% share and USD 184.4 Mn.

Low-alcohol beverages are drinks made with very small amounts of alcohol, usually much lower than traditional beer, wine, or spirits. They are designed for people who enjoy the taste and social experience of drinking but want fewer alcohol effects. These beverages include low-alcohol beers, wines, and mixed drinks that fit well with modern lifestyles focused on balance, health, and control. Consumers often choose them for weekday use, social gatherings, or wellness-oriented routines.

The Low-alcohol Beverages Market covers the production, sale, and distribution of these reduced-alcohol drinks across retail and hospitality channels. The market is shaped by changing consumer attitudes, where moderation is becoming more socially accepted. Low-alcohol options are no longer niche products; they are increasingly seen as everyday beverages suitable for a wide range of occasions.

One major growth factor is rising innovation, supported by targeted funding. In 2024, non-alcoholic adaptogenic beer brand Collider received £720k in funding, helping it develop functional, alcohol-free recipes. This shows how financial backing is encouraging experimentation with ingredients, taste, and wellness positioning in low-alcohol beverages.

Demand is strongly influenced by consumer spending and confidence in alcohol-free brands. Non-alcoholic beer maker Athletic Brewing secured $50M in investment, while also closing over $17M in an earlier funding round, highlighting sustained interest in scaling low-alcohol production and distribution. These investments reflect steady demand from consumers seeking flavorful alternatives without alcohol.

The opportunity ahead lies in community support and direct consumer engagement. In 2024, Impossibrew’s crowdfunding jumped to £1.2m in under 24 hours, proving strong public backing for low-alcohol innovation. Such momentum indicates long-term opportunities for brands to grow through trust, accessibility, and lifestyle alignment.

Key Takeaways

- The Global Low-alcohol Beverages Market is expected to be worth around USD 803.7 million by 2034, up from USD 470.5 million in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034.

- Low-alcohol beer leads the low-alcohol beverages market, holding 42.8% share due to consumer preferences.

- Bottles dominate low-alcohol beverage packaging with 54.2% share, supported by convenience, familiarity, and retail presence.

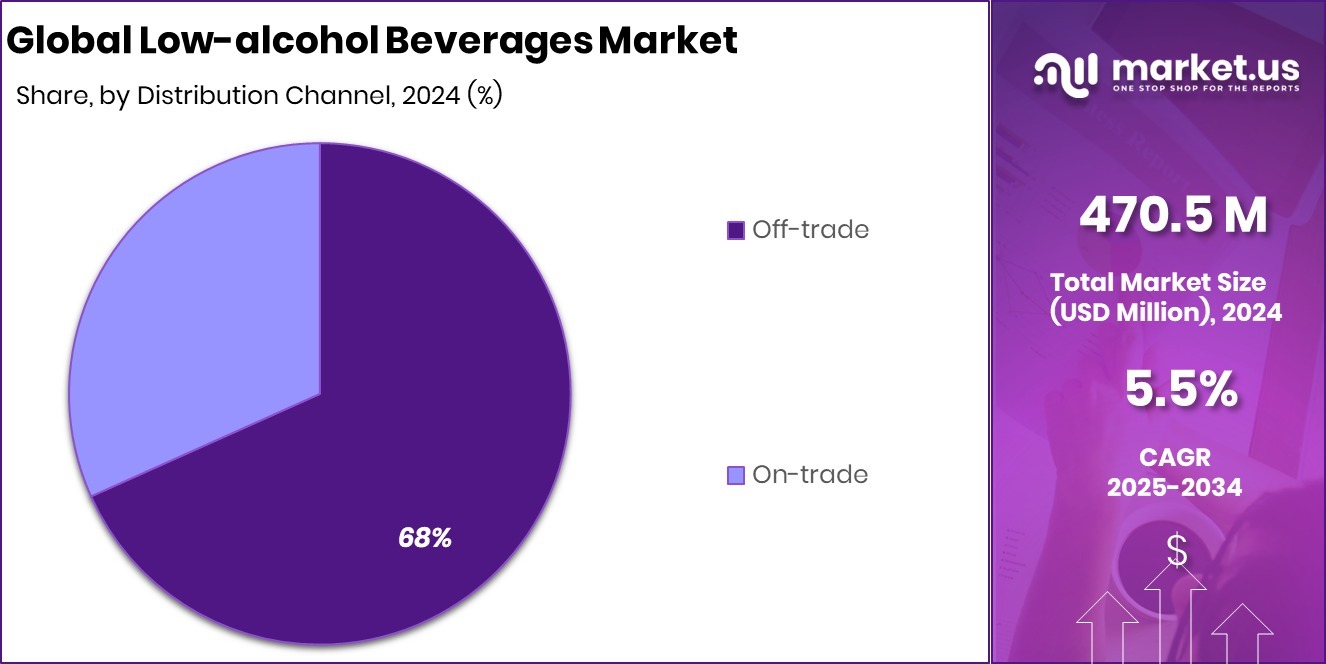

- Off-trade channels account for 68.3% of low-alcohol beverage sales, driven by supermarkets and home consumption.

- In North America, the low-alcohol beverages market reached a 39.20% share, totaling USD 184.4 Mn.

By Product Analysis

Low alcohol beer leads demand as consumers seek moderation without sacrificing taste.

In 2024, the Low-alcohol Beverages Market saw Low Alcohol Beer emerge as the leading product type, accounting for 42.8% of total demand. This dominance is closely linked to changing consumer lifestyles, where moderation, wellness, and social drinking without intoxication are becoming priorities. Low alcohol beer offers familiar taste profiles while allowing consumers to reduce alcohol intake, making it popular among working professionals and health-conscious adults.

Breweries are improving brewing techniques to retain flavor, aroma, and mouthfeel despite lower alcohol levels. In addition, low alcohol beer fits well with social occasions, sports viewing, and casual gatherings, where consumers want extended drinking sessions without heavy alcohol effects. This balance between enjoyment and responsibility continues to strengthen its position within the low-alcohol beverages category.

By Packaging Analysis

Bottles dominate packaging due to familiarity, shelf appeal, and convenience for buyers.

In 2024, Bottles dominated the Low-alcohol Beverages Market by packaging type, holding a 54.2% market share. Bottles remain highly preferred due to their premium appearance, strong shelf presence, and ability to preserve taste and carbonation effectively. For low alcohol products, packaging plays a critical role in communicating quality and authenticity, and bottles align well with these expectations.

Glass bottles also support sustainability goals, as they are widely recyclable and perceived as environmentally friendly by consumers. Many brands use innovative labeling, embossing, and color variations on bottles to differentiate their low-alcohol offerings from traditional alcoholic beverages. Additionally, bottles are widely accepted across retail outlets, restaurants, and specialty beverage stores, reinforcing their continued dominance in the market.

By Distribution Channel Analysis

Off-trade channels grow faster as supermarkets expand low-alcohol beverage assortments worldwide rapidly.

In 2024, the Off-trade segment led the Low-alcohol Beverages Market by distribution channel, capturing a significant 68.3% share. This dominance reflects strong consumer preference for purchasing low alcohol drinks through supermarkets, hypermarkets, convenience stores, and online retail platforms. Off-trade channels offer greater product variety, price transparency, and convenience, allowing consumers to explore different low-alcohol options at their own pace.

Bulk buying, promotional discounts, and private-label offerings further strengthen off-trade sales. E-commerce growth has also played a key role, enabling direct-to-consumer delivery and wider geographic reach. As low alcohol beverages increasingly become part of regular household consumption rather than occasional indulgences, off-trade distribution continues to be the primary sales driver.

Key Market Segments

By Product

- Low Alcohol Beer

- Low Alcohol Wine

- Low Alcohol RTD

- Low Alcohol Cider

- Low Alcohol Spirits

By Packaging

- Bottles

- Cans

- Tetra-packs

By Distribution Channel

- Off-trade

- On-trade

Driving Factors

Growing Consumer Demand for Taste Without Intoxication

One key driving factor of the Low-alcohol Beverages Market is the strong rise in consumer interest for drinks that deliver flavor without heavy alcohol effects. Changing lifestyles, health awareness, and social moderation are pushing producers to rethink traditional alcohol content. This shift is clearly visible in Europe, where over 60% of Italian wineries are actively exploring no- and low-alcohol wine options to meet evolving consumer expectations. At the same time, technology is accelerating this transition.

ALTR, a beverage technology company, raised $5 million in seed funding to commercialize its alcohol-removal solution. Its “Flavor-First” process allows producers to lower alcohol levels while preserving aroma, taste, and mouthfeel. This combination of consumer demand and technology-backed innovation is making low-alcohol beverages more acceptable, enjoyable, and widely available, driving steady market growth globally.

Restraining Factors

Climate Pressures And Economic Strain Limit Expansion

A major restraining factor for the Low-alcohol Beverages Market is the growing pressure on traditional alcohol producers caused by climate stress and economic instability. In Europe, the wine sector is undergoing structural strain, even as it becomes eligible for up to 80% climate-linked funding under a new EU reform deal. While this support targets sustainability, it also highlights how deeply climate risks are affecting raw material availability.

The situation is more difficult in France, where the wine harvest dropped sharply to 36 million hectoliters, creating supply shortages and cost pressure. Amid this downturn, producers are seeking €200 million in emergency aid to survive rising production costs and regulatory uncertainty. Under such conditions, many producers prioritize survival and core operations over investing in low-alcohol product development, slowing market momentum despite rising consumer interest.

Growth Opportunity

Policy Support Unlocks Expansion For Dealcoholized Wines

A strong growth opportunity for the Low-alcohol Beverages Market is emerging from regulatory and policy support across Europe. The Italian wine sector is set to receive a €250 million annual boost as dealcoholized wines move closer to formal approval, allowing producers to legally produce and sell low-alcohol alternatives at scale. This change lowers regulatory risk and encourages wineries to invest confidently in new production lines.

At the regional level, EU lawmakers have also backed a wine sector overhaul that includes a 30% increase in crisis funds, giving producers added financial stability during market transitions. Together, these measures create a safer environment for innovation, helping traditional producers diversify into low-alcohol beverages without threatening their core business. As approvals progress and financial backing strengthens, dealcoholized and low-alcohol drinks are positioned to grow faster across retail and export markets.

Latest Trends

Investment Shifts As Consumers Choose Lower Alcohol

A key latest trend in the Low-alcohol Beverages Market is the clear shift of investment toward lower-alcohol options as global drinking habits change. In 2024, Sazerac unveiled a $1 billion expansion, signaling long-term confidence in adapting portfolios as U.S. alcohol consumption declines. At the same time, alcohol giants worldwide have lost $830 billion in value as global consumption hits historic lows, pushing producers to rethink product strategies. Government support is also reinforcing this shift.

The Australian federal government awarded a grant of almost A$3 million (£1.6 million) to improve quality and innovation in low-alcohol and alcohol-free wines. Together, falling traditional alcohol demand, large-scale corporate investment, and targeted public funding are accelerating innovation and making low-alcohol beverages a central focus rather than a niche category.

Regional Analysis

North America led the low-alcohol beverages market with 39.20% share, at USD 184.4 Mn.

The Low-alcohol Beverages Market shows varied regional dynamics shaped by consumption habits, retail maturity, and lifestyle trends. North America dominates the global landscape, holding a clear 39.20% share and reaching a value of USD 184.4 Mn, supported by strong awareness of moderation, widespread retail availability, and rising acceptance of low-alcohol alternatives across social settings.

Europe represents a mature and culturally rooted market, where low-alcohol beverages benefit from long-standing beer and wine traditions alongside growing interest in mindful drinking. Asia Pacific is steadily expanding, driven by urban lifestyles, younger consumers, and increasing exposure to global beverage trends, although preferences vary widely by country.

In the Middle East & Africa, demand remains selective, influenced by cultural norms and regulatory structures, yet low-alcohol options are gaining visibility in specific urban and tourism-focused markets. Latin America shows gradual adoption, supported by changing consumer attitudes and the growing presence of modern retail channels.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Allagash Brewing Co. represents a craft-led approach to the low-alcohol beverages space in 2024. The company’s strength lies in its deep brewing expertise, quality-first philosophy, and loyal consumer base that values flavor authenticity. Allagash leverages traditional brewing methods and innovation to address demand for moderation without sacrificing taste. Its reputation in craft beer allows it to experiment with lower-alcohol formats while maintaining brand credibility. This positions Allagash well among consumers seeking mindful drinking options rooted in craftsmanship rather than mass production.

Anheuser Busch InBev SA NV plays a strategic and large-scale role in shaping the global low-alcohol beverages market. The company benefits from extensive distribution networks, strong brand portfolios, and advanced brewing capabilities. In 2024, its focus on low-alcohol alternatives reflects a broader shift toward responsible consumption. Anheuser Busch InBev’s ability to scale production, ensure consistent quality, and place products across off-trade and on-trade channels strengthens its leadership. Its global reach allows rapid adaptation of low-alcohol offerings across multiple consumer segments and regions.

Asahi Group Holdings Ltd. brings a premium and disciplined approach to the low-alcohol segment. The company emphasizes refined taste profiles, product balance, and brand trust built over decades. In 2024, Asahi’s focus aligns well with consumers seeking sophisticated low-alcohol choices suited for everyday occasions. Its strong presence in developed markets and emphasis on product quality enable steady expansion of low-alcohol beverages. Asahi’s approach highlights moderation as a lifestyle choice, reinforcing long-term relevance in this evolving category.

Top Key Players in the Market

- Allagash Brewing Co.

- Anheuser Busch InBev SA NV

- Asahi Group Holdings Ltd.

- Bacardi and Co. Ltd.

- Beam Suntory Inc.

- Carlsberg Breweries AS

- CODYs Drinks International GmbH

- Constellation Brands Inc.

- Curious Elixirs

- Diageo PLC

Recent Developments

- In October 2025, Allagash announced it would include new year-round beers in its portfolio for 2025 alongside flagship products in a 12-pack offering. While these are not strictly defined as low-alcohol, this expansion shows the company is diversifying its core offerings.

- In May 2024, Curious Elixirs introduced Curious No. 9, a new non-alcoholic craft cocktail inspired by rosé flavors and botanicals. This latest product expands their lineup of booze-free beverages made with plant extracts and adaptogens, offering a refreshing option for consumers seeking alcohol-free social drinks.

Report Scope

Report Features Description Market Value (2024) USD 470.5 Million Forecast Revenue (2034) USD 803.7 Million CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Low Alcohol Beer, Low Alcohol Wine, Low Alcohol RTD, Low Alcohol Cider, Low Alcohol Spirits), By Packaging (Bottles, Cans, Tetra-packs), By Distribution Channel (Off-trade, On-trade) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Allagash Brewing Co., Anheuser Busch InBev SA NV, Asahi Group Holdings Ltd., Bacardi and Co. Ltd., Beam Suntory Inc., Carlsberg Breweries AS, CODYs Drinks International GmbH, Constellation Brands Inc., Curious Elixirs, Diageo PLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Low-alcohol Beverages MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Low-alcohol Beverages MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Allagash Brewing Co.

- Anheuser Busch InBev SA NV

- Asahi Group Holdings Ltd.

- Bacardi and Co. Ltd.

- Beam Suntory Inc.

- Carlsberg Breweries AS

- CODYs Drinks International GmbH

- Constellation Brands Inc.

- Curious Elixirs

- Diageo PLC