Global Logistics Software Market By Deployment(Cloud-Based,On-Premise), By Application(Warehouse Management System, Transportation Management System, Freight Management & Forwarding Software, Supply Chain Planning (SCP) & Visibility,Fleet Management Software ,Others), By End-User (Retail & E-commerce, Healthcare & Pharmaceuticals, Automotive & Aerospace, Food & Beverage, Oil and Gas, Government and Defense, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jul 2025

- Report ID: 152034

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

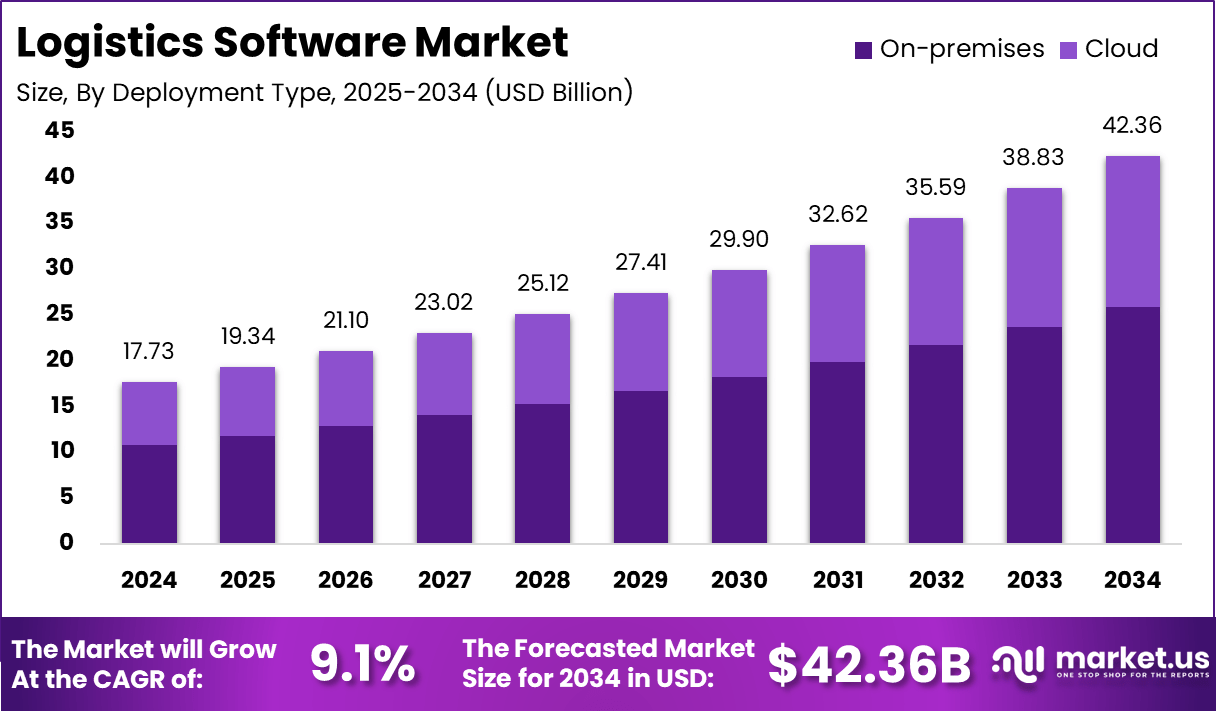

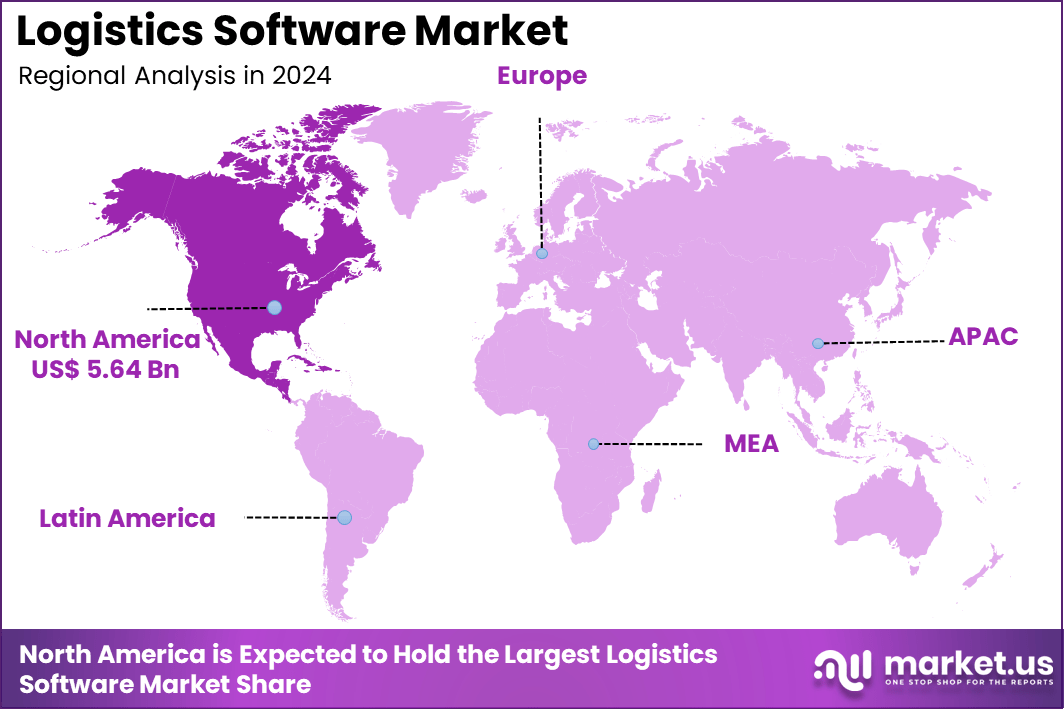

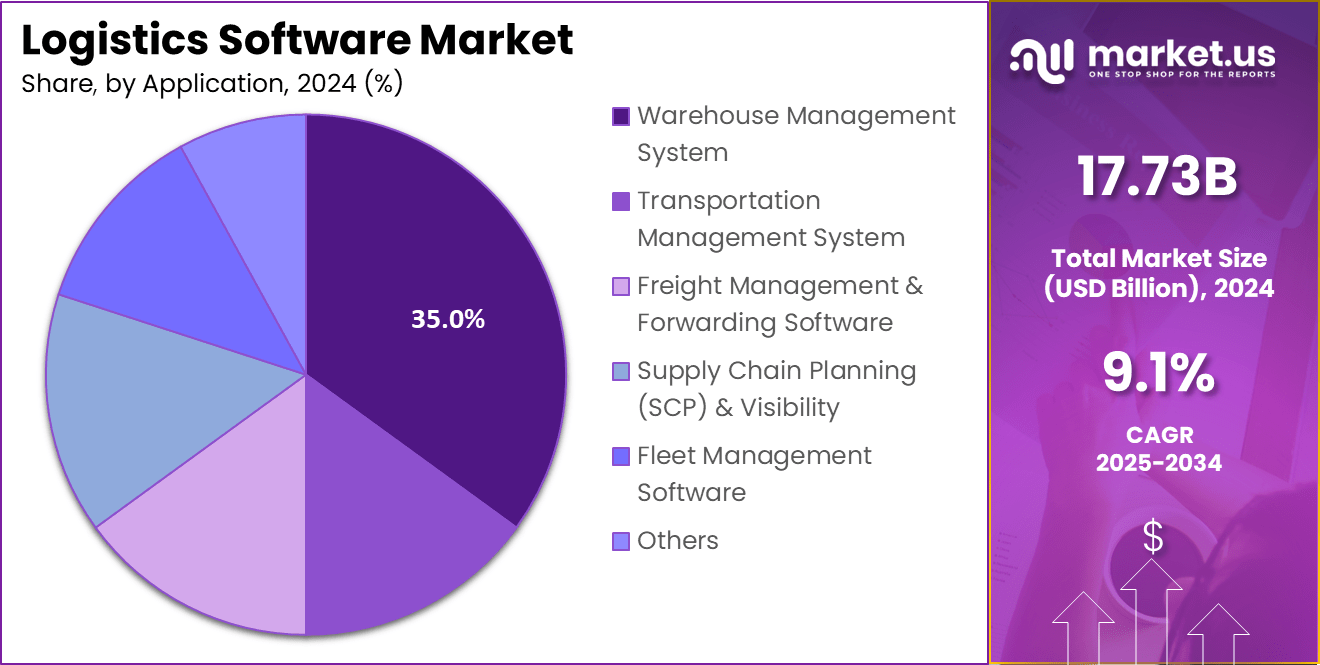

The Global Logistics Software Market size is expected to be worth around USD 42.36 Billion By 2034, from USD 17.73 billion in 2024, growing at a CAGR of 9.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34% share, holding USD 5.64 Billion revenue.

The logistics software market is characterized by the increasing integration of digital tools to manage and optimize complex supply chain activities. This market focuses on software solutions that enable efficient warehouse operations, transportation planning, inventory control, and real-time visibility across the logistics ecosystem. Adoption is being reinforced by the growing need to handle high volumes of goods, minimize errors, and improve delivery accuracy in global trade environments.

The top driving factors of this market include the rapid growth of e-commerce, which has intensified pressure on logistics operations to deliver faster and more accurately. Rising customer expectations for transparency and shorter delivery times have made advanced software essential. Additionally, globalization of supply chains and disruptions from unforeseen events have created a strong imperative for organizations to adopt systems that improve responsiveness and efficiency.

According to the findings from tech.co, The U.S. freight and logistics market is projected to reach approximately $1.63 trillion by 2029, reflecting its vital role in trade and supply chain networks. Logistics costs, which can account for up to 30% of total delivery costs, remain a major concern, with transportation contributing 58%, warehousing 23%, inventory carrying 11%, and administrative activities 8% of these costs.

The increasing adoption of technologies such as artificial intelligence, machine learning, Internet of Things, and blockchain is transforming the market. These technologies are embedded in logistics software to enable predictive analytics, autonomous decision-making, and enhanced transparency. Cloud-based platforms are becoming preferred due to their scalability and ease of deployment.

Key reasons for adopting these technologies include improving operational efficiency, reducing costs through automation, and meeting regulatory compliance. Organizations also seek to enhance customer satisfaction by offering real-time tracking and faster deliveries, which are facilitated by modern software platforms. The ability to make data-driven decisions is another prominent reason.

Key Takeaways

- The global logistics software market is projected to grow steadily, reaching USD 42.36 billion by 2034, up from USD 17.73 billion in 2024, at a CAGR of 9.1% over the forecast period.

- In 2024, North America led the market, capturing over 34% share, with revenues of approximately USD 5.64 billion.

- The United States alone accounted for USD 5.64 billion, growing at a CAGR of 6.9%, driven by early technology adoption.

- Cloud-based deployment dominated with a 61% share, owing to its scalability and cost efficiency for logistics operations.

- By application, warehouse management systems (WMS) held 35% share, reflecting growing warehouse automation needs.

- The retail and e-commerce segment emerged as the top end-user, accounting for 29% share, due to rising online shopping and last-mile delivery demands.

North America Market Size

In 2024, North America held a dominant market position, capturing more than a 34% share, holding USD 5.6 billion revenue, owing to its highly developed logistics infrastructure and strong adoption of advanced digital solutions across industries.

The region benefits from a mature e-commerce sector, well-established transportation networks, and early adoption of cloud and artificial intelligence technologies, which have significantly improved supply chain visibility and efficiency. The presence of a large number of technology providers and logistics service companies further accelerates innovation and deployment of software solutions tailored to diverse business needs.

Enterprises across retail, manufacturing, and third-party logistics have prioritized investments in automation and predictive analytics, reinforcing North America’s leadership. The leadership of North America can also be attributed to strong regulatory support and emphasis on sustainability in logistics operations.

Government initiatives promoting digital transformation and carbon footprint reduction have encouraged organizations to adopt software platforms that optimize routes, minimize emissions, and ensure compliance. Moreover, the competitive landscape within the region drives continuous improvement and integration of cutting-edge features, setting benchmarks for global markets.

By Deployment Analysis

In 2024, the cloud‑based segment held a dominant position within the logistics software market, accounting for over 61% of deployment share. This prominence can be attributed to its ability to deliver robust supply‑chain visibility and real‑time data analytics through a unified platform, enabling stakeholders to make informed decisions rapidly.

The flexibility to scale infrastructure without upfront investment in hardware, combined with subscription‑based pricing, further propelled its adoption by reducing both capital and operational expenditures. Moreover, cloud‑based logistics solutions offer automatic updates and high‑availability architecture, ensuring continuous access and minimal downtime.

These features support seamless integration with evolving technologies such as AI, IoT, and machine‑learning tools, which facilitate enhanced route optimisation, demand forecasting, and predictive maintenance. Such capabilities are particularly valued by enterprises seeking responsive and efficient logistics operations without the burden of managing complex on‑premise infrastructure.

The leading position of the cloud‑based segment can therefore be attributed to its comprehensive value proposition: real‑time visibility, cost‑effective scalability, continuous enhancement through updates, and compatibility with advanced digital tools. This combination aligns closely with evolving industry priorities, driving its sustained dominance in deployment preferences.

Application Analysis

In 2024, the Warehouse Management Systems (WMS) segment achieved a leading position, securing over 35% of global logistics software applications. This dominance reflects the rising importance of efficient inventory control, rapid order processing, and real-time warehouse visibility.

The WMS solution centralises critical functions such as inventory tracking, picking, packing, and order fulfilment – enabling enterprises to streamline operations, reduce errors, and enhance customer satisfaction. Increased adoption has been spurred by e-commerce growth and supply chain complexity, driving firms to deploy WMS software to retain competitive advantage.

Furthermore, the leading stance of WMS can be attributed to its adaptability across diverse industries—ranging from third-party logistics providers to manufacturing distributors. Many systems now offer integration-ready modules with ERP platforms and transportation tools, facilitating end-to-end operational orchestration. This interoperability allows organisations to leverage data insights and automation to optimise layout, labour scheduling, and replenishment cycles.

The sustained preference for WMS is underpinned by its clear value proposition: improved accuracy, faster throughput, enhanced visibility, and scalable performance. Such capabilities align closely with the priorities of enterprises managing high order volumes and complex warehouse networks. As industry stakeholders continue to prioritise operational efficiency and customer-centred service delivery, the WMS segment is expected to maintain its leadership in logistics software applications.

End – user Analysis

In 2024, the Retail & E‑commerce end‑user segment emerged as the leading category, accounting for over 29% of overall logistics software usage. This dominance is reflective of the transformative shift in consumer behaviour, with online sales continuing to rise sharply.

Enhanced digital shopping experiences, including same‑day delivery and omnichannel integration, have placed intensive demands on logistics infrastructure. In response, retailers and e‑commerce firms have significantly invested in software platforms to manage order fulfilment, warehouse operations, and last‑mile delivery, prioritising systems capable of intensive throughput and real‑time responsiveness.

Moreover, the leadership of this segment has been underpinned by the need for scalable, transparent, and agile logistics operations. The Retail & E‑commerce sector demands precise inventory control, predictive analytics for demand forecasting, and robust tracking systems to uphold customer satisfaction.

These requirements have driven the adoption of sophisticated logistics software tools that offer seamless integration across fulfilment centres, transportation networks, and customer‑facing platforms. Thus, the segment’s strong alignment with modern logistics challenges has reinforced its position as the top end‑user category.

Key Market Segments

By Deployment

- Cloud-Based

- On-Premise

By Application

- Warehouse Management System

- Transportation Management System

- Freight Management & Forwarding Software

- Supply Chain Planning (SCP) & Visibility

- Fleet Management Software

- Others

By End-User

- Retail & E-commerce

- Healthcare & Pharmaceuticals

- Automotive & Aerospace

- Food & Beverage

- Oil and Gas

- Government and Defense

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

AI Powered Predictive Intelligence

Logistics software is increasingly integrating artificial intelligence for predictive capabilities. Real time data from IoT sensors and operational systems are used to forecast delivery times, prevent delays, and automate load balancing.

A significant number of companies are digitising end to end workflows, with AI driven forecasting reported to reduce errors by up to 50%. This trend is reshaping software architectures to favour adaptive and data driven platforms that can respond dynamically without manual intervention.

Driver

Digitisation and Automation Norms

The growing imperative to automate routine operations such as routing, inventory management, and order processing is driving demand for advanced logistics software. The deployment of AI, IoT, and process automation is now considered foundational for modern logistics chains. Adoption of these technologies supports cost efficiencies, scalability, and resilience which are increasingly prioritised by logistics providers responding to evolving customer delivery expectations.

Restraint

Legacy Systems Fragmentation

Despite digital momentum, many organisations continue to operate with legacy systems and manual processes. This creates a fragmented technology landscape that impedes full software integration. Such fragmentation poses obstacles to real time visibility and end to end orchestration as older platforms often cannot exchange data seamlessly with newer cloud based modules.

Market Opportunity

Autonomous Supply Chain Execution

The convergence of AI, digital twins, autonomous trucks, and edge intelligence is opening a pathway toward self driving and self optimising logistic networks. These systems aim to adjust routing and capacity in real time with minimal human input. Software providers that innovate in autonomous execution platforms have a clear opportunity to lead in this next evolution of logistics management.

Challenge

Data Sharing and Collaboration

Achieving full supply chain visibility remains difficult. While monitoring of shipments and suppliers is improving, visibility beyond tier one partners continues to lag. Many smaller entities resist sharing logistics data due to competitive concerns or resource limitations. This reluctance hinders the deployment of comprehensive control tower solutions and limits the potential for proactive disruption management.

Key Players Analysis

Leading players in the logistics software market, such as Oracle Corporation and SAP SE, continue to strengthen their positions by offering integrated platforms that enhance supply chain visibility and operational efficiency. These companies focus on expanding cloud-based services and incorporating advanced analytics to meet evolving customer needs.

Manhattan Associates and BluJay Solutions have built a strong reputation in warehouse and transportation management solutions, helping businesses streamline processes and reduce costs. Their emphasis on user-friendly interfaces and scalability makes them preferred partners for large and mid-sized enterprises globally.

Descartes Systems Group, HighJump Software, and IBM Corporation have carved out significant market shares by innovating in real-time tracking, predictive analytics, and automation capabilities. Their solutions enable improved decision-making and agility, especially in complex logistics networks. Similarly, JDA Software Group, Inc. and Kinaxis Inc. focus on demand planning and supply chain optimization, addressing the growing need for resilience and risk mitigation in global trade.

Other notable contributors include 3GTMS, Inc., Aptean, and Epicor Software Corporation, which provide niche solutions tailored to specific industries and operational models. Infor and Ramco Systems have expanded their offerings in emerging markets, emphasizing affordability and cloud adoption to attract small and medium-sized enterprises.

Top Market Leaders

- Oracle Corporation

- SAP SE

- Manhattan Associates

- BluJay Solutions

- Descartes Systems Group

- HighJump Software

- IBM Corporation

- JDA Software Group, Inc.

- Kinaxis Inc.

- The Descartes Systems Group Inc.

- 3GTMS, Inc.

- Aptean

- Epicor Software Corporation

- Infor

- Ramco Systems

- Other Key Players

Recent Developments

- In June 2024, HERE Technologies introduced a comprehensive software package aimed at fleet optimization, designed to enhance scalability and operational efficiency in fleet management. The package integrates advanced components such as HERE Tour Planning, Routing, Geocoding and Search, and Map Rendering, specifically developed to tackle the complexities of commercial fleet routing.

- Earlier, in March 2024, Walmart Commerce Technologies launched an AI-powered logistics solution named Route Optimization, previously used internally, now offered as a SaaS product to external enterprises. This solution is intended to improve supply chain efficiency through intelligent route planning and resource utilization.

- In April 2024, Holman Logistics announced a partnership with Deloitte to implement Fulfilld’s AI-powered warehouse management software, reflecting the rising demand for advanced digital solutions that improve operational efficiency and innovation in warehouse management.

- In February 2024, Oracle expanded its Fusion Cloud SCM platform by adding logistics management capabilities, offering an integrated solution encompassing transportation, warehouse operations, and supply chain visibility, which is expected to drive adoption and enhance overall logistics performance.

Report Scope

Report Features Description Market Value (2024) USD 17.73 Bn Forecast Revenue (2034) USD 42.36 Bn CAGR (2024-2033) 9.1% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2033 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Deployment(Cloud-Based,On-Premise),By Application(Warehouse Management System, Transportation Management System, Freight Management & Forwarding Software, Supply Chain Planning (SCP) & Visibility , Fleet Management Software, Others) , By End-User (Retail & E-commerce, Healthcare & Pharmaceuticals, Automotive & Aerospace, Food & Beverage, Oil and Gas, Government and Defense, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Oracle Corporation, SAP SE, Manhattan Associates, BluJay Solutions, Descartes Systems Group, HighJump Software, IBM Corporation, Kinaxis Inc., JDA Software Group, Inc., The Descartes Systems Group Inc., 3GTMS, Inc., Aptean, Epicor Software Corporation, Infor, Ramco Systems, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Who are the key players in the Logistics Software Market?These are the key players in Logistics Software Market:- Oracle Corporation, SAP SE, Manhattan Associates, BluJay Solutions, Descartes Systems Group, HighJump Software, IBM Corporation, Kinaxis Inc., JDA Software Group, Inc., The Descartes Systems Group Inc., 3GTMS, Inc., Aptean, Epicor Software Corporation, Infor, Ramco Systems, Other Key Players

-

-

- Oracle Corporation

- SAP SE

- Manhattan Associates

- BluJay Solutions

- Descartes Systems Group

- HighJump Software

- IBM Corporation

- Kinaxis Inc.

- JDA Software Group, Inc.

- The Descartes Systems Group Inc.

- 3GTMS, Inc.

- Aptean

- Epicor Software Corporation

- Infor

- Ramco Systems

- Other Key Players