Global Lithium Iron Phosphate Market Size, Share Analysis Report By Voltage (Low, Medium, High), By Capacity (0-16,321 MAH, 16,321-40,000 MAH, 40,001-80,000 MAH, Above 80,000 MAH), By Application (Portable, Stationary), By End-use (Automotive, Power, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168656

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

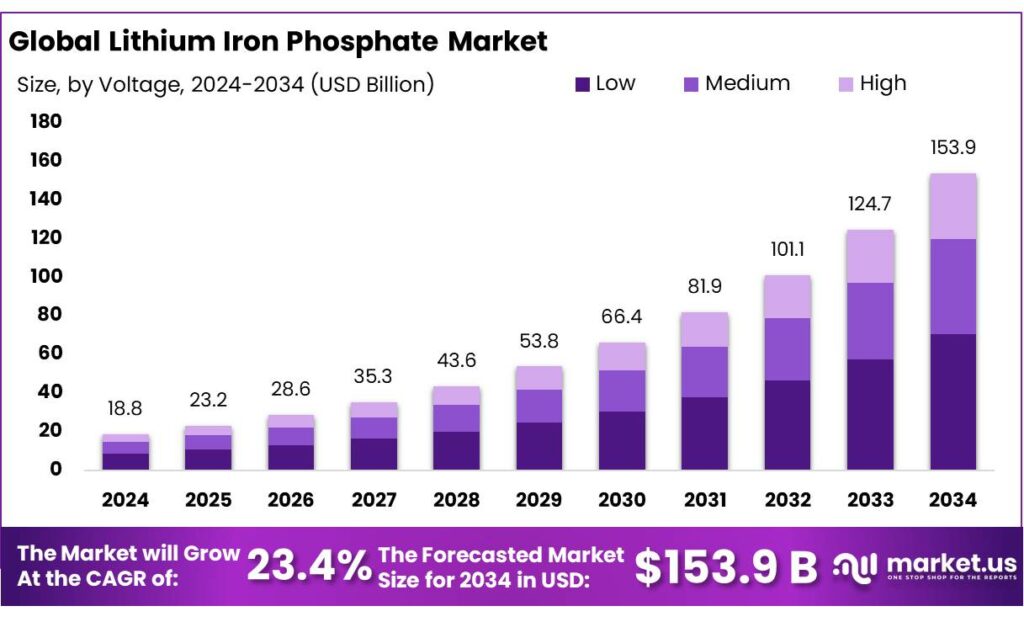

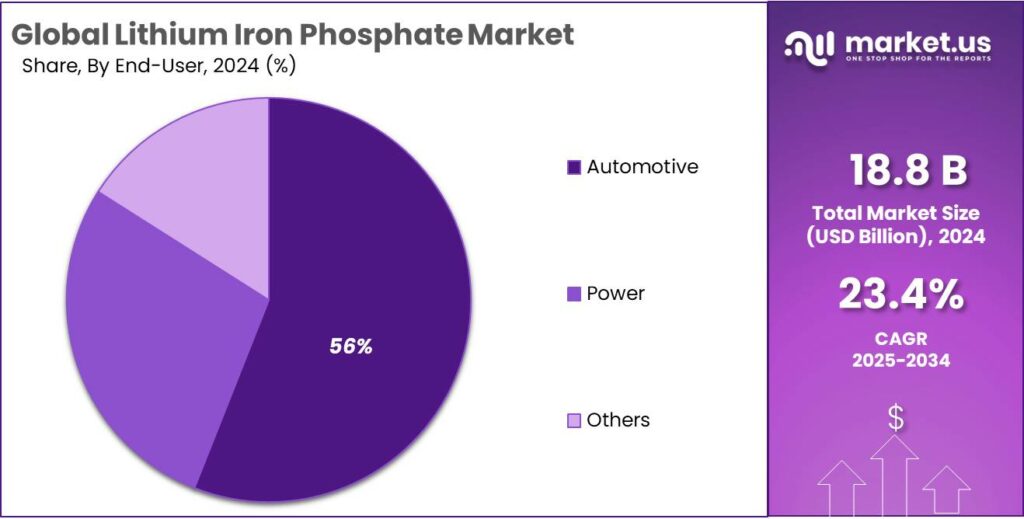

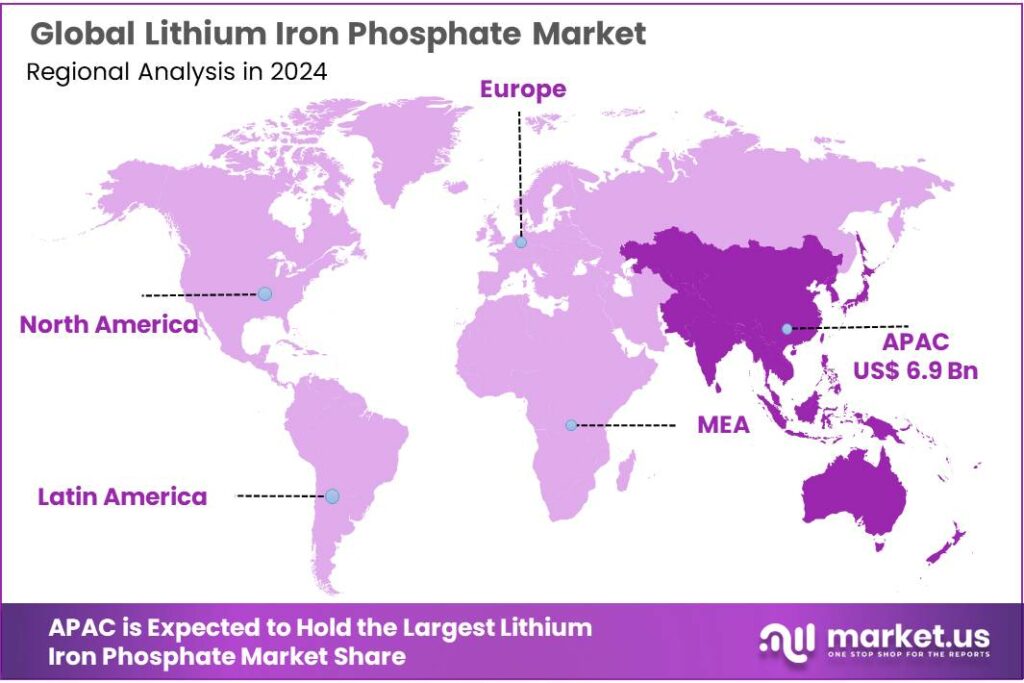

The Global Lithium Iron Phosphate Market size is expected to be worth around USD 153.9 Billion by 2034, from USD 18.8 Billion in 2024, growing at a CAGR of 23.4% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 37.2% share, holding USD 6.9 Billion revenue.

Lithium iron phosphate (LFP) is a lithium-ion cathode material based on iron and phosphate (LiFePO₄). It offers lower energy density than high-nickel chemistries but stands out for thermal stability, long cycle life, and the absence of cobalt and nickel. These features make LFP especially attractive for cost-sensitive and safety-critical applications such as mass-market electric vehicles (EVs), buses, two-wheelers, and stationary storage systems.

On the industrial side, LFP has moved from niche to mainstream in just a few years. The International Energy Agency (IEA) reports that LFP batteries supplied over 40% of global EV battery demand by capacity in 2023, more than double their share in 2020, and made up “nearly half” of the EV battery market in 2024. In China, about two-thirds of EV sales in 2023 and nearly three-quarters of domestic battery demand in 2024 used LFP chemistry, rising to around 80% of batteries sold in late 2024.

Battery demand growth provides a powerful tailwind. IEA projects EV battery demand to exceed 3 TWh in 2030 in its Stated Policies Scenario, up from about 1 TWh in 2024, driven mainly by electric cars but with fast-growing demand from trucks and buses.

- IEA’s earlier work on supply chains also indicated EV battery demand rising from roughly 340 GWh “today” to over 3,500 GWh by 2030 in its Announced Pledges Scenario, highlighting the scale of upstream materials required. As OEMs seek to contain costs under this demand surge, LFP’s cheaper iron- and phosphate-based chemistry is becoming a strategic choice.

Grid decarbonisation is another structural driver. IEA estimates stationary storage will account for about 400 GWh of battery demand in 2030 under its Stated Policies Scenario and 500 GWh under its Announced Pledges Scenario, around 12% of EV battery demand in both cases. IRENA expects global battery storage power capacity to grow about nine-fold from 86 GW in 2023 to roughly 650 GW by 2030, adding 564 GW of new capacity. LFP’s safety, cycle life, and tolerance to deep cycling make it a preferred chemistry for such stationary projects, especially where footprint and weight are less critical than cost and durability.

- Policy frameworks are reinforcing these market forces. The US Inflation Reduction Act’s Section 45X advanced manufacturing production credit provides up to USD 35 per kWh for domestically produced battery cells and USD 10 per kWh for modules, plus a 10% cost credit for electrode active materials, incentivising local LFP cathode and cell manufacturing.

In Europe, Regulation (EU) 2023/1542 on sustainable batteries introduces carbon-footprint and recycled-content requirements and long-term obligations for collection and recycling, favouring chemistries like LFP that use fewer critical raw materials. Meanwhile, China’s industrial policies have been pivotal: a CSIS/ITIF analysis estimates cumulative government support to the domestic EV sector at around USD 230.9 billion between 2009 and 2023, underpinning large-scale LFP innovation and capacity build-out.

Key Takeaways

- Lithium Iron Phosphate Market size is expected to be worth around USD 153.9 Billion by 2034, from USD 18.8 Billion in 2024, growing at a CAGR of 23.4%.

- Low held a dominant market position, capturing more than a 45.9% share of the lithium-iron-phosphate (LFP) market.

- 16,321-40,000 MAH held a dominant market position, capturing more than a 38.40% share.

- Stationary held a dominant market position, capturing more than a 58.3% share of the lithium-iron-phosphate (LFP) market.

- Automotive held a dominant market position, capturing more than a 56.1% share of the lithium-iron-phosphate (LFP) market.

- Asia Pacific region accounted for a leading position in the lithium-iron-phosphate (LFP) market, representing 37.2% of global volume and approximately USD 6.9 billion.

By Voltage Analysis

Low-voltage LFP dominates with 45.9% share thanks to safety and wide applicability

In 2024, Low held a dominant market position, capturing more than a 45.9% share of the lithium-iron-phosphate (LFP) market by voltage category. This preference is driven by the chemistry’s inherent safety, long cycle life and thermal stability, which make low-voltage LFP cells and packs the natural choice for applications where reliability and modest energy density are prioritised over maximum pack voltage.

Adoption is especially strong in applications such as light electric vehicles, small commercial energy-storage systems and backup power modules, where packaging simplicity and proven safety translate into lower system integration cost and reduced operational risk. In 2025, the low-voltage segment is expected to remain a leading category as manufacturers and system integrators continue to favour LFP’s durable performance and predictable end-of-life behavior; this continuing demand supports a stable procurement pipeline for cell makers and pack assemblers focused on low-voltage products.

By Capacity Analysis

16,321–40,000 mAh segment leads with 38.40% as it balances runtime and portability

In 2024, 16,321-40,000 MAH held a dominant market position, capturing more than a 38.40% share. This capacity band is preferred because it offers a practical compromise between long runtime and manageable size, making it suitable for mid-range portable devices, power tools, and small energy-storage modules where sustained discharge and reliability matter.

Manufacturers favour cells in this range for their ability to deliver consistent performance without the packaging and thermal complexities of much larger packs, while system integrators value simpler battery management and lower integration cost. Looking into 2025, demand for this segment is expected to stay strong as product designers continue to prioritise user convenience, safety, and predictable life-cycle performance, keeping the 16,321–40,000 mAh band a central part of LFP supply and procurement strategies.

By Application Analysis

Stationary systems dominate with 58.3% share owing to their critical role in grid and backup applications

In 2024, Stationary held a dominant market position, capturing more than a 58.3% share of the lithium-iron-phosphate (LFP) market by application. This leadership is explained by the chemistry’s suitability for long-duration, stationary use where safety, cycle life and low maintenance matter most — for example in home energy storage, commercial UPS installations and grid-tied storage for peak-shaving and frequency regulation. Buyers prefer LFP for stationary systems because it delivers predictable degradation, simple thermal management and lower total cost of ownership versus some alternatives.

In 2025, demand for stationary LFP is expected to remain strong as utilities and commercial operators expand capacity for renewables integration and resilience projects; procurement is being guided by lifecycle economics, system safety and easy scale-up, which together keep the stationary segment the clear market leader.

By End-use Analysis

Automotive dominates with 56.1% as LFP becomes the preferred choice for electric vehicles

In 2024, Automotive held a dominant market position, capturing more than a 56.1% share of the lithium-iron-phosphate (LFP) market by end-use. This dominance is explained by the chemistry’s combination of safety, long cycle life and stable performance under repeated charge cycles, qualities that align closely with automotive manufacturers’ priorities for passenger EVs, two-wheelers and commercial fleets. Vehicle makers favour LFP for cost-effective energy storage where volumetric energy density is secondary to durability and total cost of ownership; as a result, procurement and pack-design strategies have been adjusted to exploit LFP’s predictable degradation and simpler thermal management.

In 2025 the automotive segment is expected to sustain its leadership as OEMs and tier-one suppliers continue to scale LFP cell and pack integration, supported by wider model adoption and manufacturing localization. The continued focus on safety, lifecycle economics and supply stability will keep automotive demand central to LFP market dynamics.

Key Market Segments

By Voltage

- Low

- Medium

- High

By Capacity

- 0-16,321 MAH

- 16,321-40,000 MAH

- 40,001-80,000 MAH

- Above 80,000 MAH

By Application

- Portable

- Stationary

By End-use

- Automotive

- Power

- Others

Emerging Trends

Global Carmakers Quickly Shifting Towards High-Volume LFP Use

A clear latest trend in lithium iron phosphate (LFP) is how fast it is becoming the “default” chemistry for mass-market electric vehicles and storage systems. The International Energy Agency (IEA) reports that in 2024 LFP batteries made up nearly half of the global EV battery market by capacity, after supplying over 40% of demand in 2023.

The same chemistry is now being localised in North America and Europe instead of only imported. In the United States, Ford plans to invest USD 3.5 billion in its first dedicated LFP EV battery plant in Marshall, Michigan, as part of a wider USD 50 billion EV programme through 2026. This project sits on top of the Inflation Reduction Act’s Section 45X production credit, which offers USD 35 per kWh for domestically produced battery cells and a 10% credit on production costs for electrode active materials.

Another part of the trend is technology catching up with market ambition. CATL’s new Shenxing PLUS LFP system shows how far engineers have pushed this chemistry. The company reports that the system-level energy density surpasses 200 Wh/kg, reaching 205 Wh/kg, and can support driving ranges above 1,000 km for some models.

- There is also a quiet but important materials shift behind this trend. LFP does not use nickel, and that is already reshaping upstream markets. A Reuters analysis notes that Indonesia’s nickel output jumped from 780,000 tonnes in 2020 to about 2.3 million tonnes in 2024, yet China’s growing move towards LFP batteries has reduced its need for nickel, contributing to oversupply and pushing prices down towards production costs.

Drivers

Rising EV And Storage Demand Boosts LFP Battery Use

One big force behind lithium iron phosphate (LFP) growth is the simple fact that electric vehicles are no longer niche. The International Energy Agency (IEA) estimates that almost 14 million electric cars were sold in 2023, lifting the global electric car fleet to about 40 million on the road. By 2024, electric car sales passed 17 million and took more than 20% of global car sales, signalling a structural, not temporary, shift. As carmakers look for safe, affordable chemistries for mass-market models, LFP fits very well.

- Battery demand is scaling just as fast. In its latest Global EV Outlook, the IEA projects that EV battery demand will climb from roughly 1 TWh in 2024 to more than 3 TWh in 2030 in its Stated Policies Scenario. That is more than a three-fold increase in six years. For many high-volume platforms, especially in mid-range cars, buses and two-wheelers, LFP’s lower cost and strong cycle life make it a natural candidate to meet this surge without pushing vehicle prices out of reach.

- According to data from the China Association of Automobile Manufacturers, new energy vehicle sales in China reached 9.49 million units in 2023, up 37.9% year on year, with production at 9.58 million. Much of this volume uses LFP packs, especially in mainstream passenger cars and buses. As other countries try to replicate China’s EV success, demand for similar cost-effective chemistries is likely to follow.

At the same time, the global power system is being rewired around renewables, which directly supports LFP adoption in stationary storage. The International Renewable Energy Agency (IRENA) says renewable power capacity needs to triple by 2030 to more than 11,000 GW under its 1.5°C pathway. A 2024 IRENA analysis for the G7 adds that battery storage power capacity must grow by about 564 GW between now and 2030 to keep that transition on track. LFP’s strong safety profile and tolerance for daily cycling line up perfectly with this need for large-scale, long-life storage.

- Government targets are pulling the same direction. India, for example, has committed to reaching 500 GW of non-fossil electricity capacity by 2030 as part of its COP26 pledge, a goal highlighted by the country’s official communications. Large solar and wind additions under such programmes almost always require battery storage to manage variability. Developers and utilities tend to favour LFP because it is stable at high temperatures, relatively easy to insure, and proven at container-scale.

Restraints

Lower Energy Density Limits Long-Range And Heavy-Duty Adoption

One of the main restraining factors for lithium iron phosphate (LFP) batteries is their lower energy density compared with nickel-rich lithium-ion chemistries. In simple terms, LFP packs store less energy for the same weight and size. This directly affects driving range, payload, and design flexibility, especially in long-range electric vehicles and heavier transport applications.

- Technical data from the U.S. Department of Energy (DOE) shows that commercial LFP battery cells typically deliver around 160–180 Wh/kg, while high-nickel lithium-ion chemistries such as NMC and NCA often reach 240–300 Wh/kg at the cell level. This gap of roughly 30–40% means that an LFP-based battery pack must be larger and heavier to achieve the same driving range as a nickel-based pack. For compact city vehicles, this trade-off is acceptable. However, for premium passenger cars, electric SUVs, and long-haul electric trucks, the weight penalty becomes a real constraint.

Range anxiety continues to influence buyer behaviour and fleet decisions. According to the International Energy Agency (IEA), the global average driving range of new electric cars exceeded 400 km per charge in 2023, largely driven by improvements in battery energy density and pack design. To meet these expectations with LFP alone often requires larger battery capacities, which can increase vehicle weight and reduce overall efficiency. This makes automakers cautious about using LFP in higher-end or long-distance models where range is a key selling point.

The same limitation appears in commercial and heavy-duty transport. The European Commission’s Joint Research Centre (JRC) notes that battery mass is one of the biggest barriers for electric freight trucks above 16 tonnes, where energy demand can exceed 1.5–2.0 kWh per kilometre depending on load and terrain. In such applications, lower energy density translates directly into reduced cargo capacity or shorter operating range, both of which hurt economics for fleet operators. As a result, many manufacturers still prefer nickel-rich chemistries for electric trucks and long-distance buses.

Opportunity

Rapid Expansion of Grid-Scale Energy Storage Opens New Space for LFP

One of the biggest growth opportunities for lithium iron phosphate (LFP) batteries lies in grid-scale energy storage. Power systems around the world are adding record levels of solar and wind, but these sources do not produce electricity all the time. Batteries are becoming essential to balance supply and demand, and this is where LFP has a strong advantage because of its safety, long life, and stable performance.

- The International Renewable Energy Agency (IRENA) states that global renewable electricity capacity must rise to more than 11,000 gigawatts (GW) by 2030 to stay aligned with the 1.5°C climate goal. This is almost three times the installed capacity recorded in 2022. As renewables scale up, storage must grow alongside them. IRENA estimates that global battery storage power capacity needs to increase by about 564 GW by 2030, up from around 86 GW in 2023.

This massive build-out creates a clear opening for LFP chemistry. For stationary storage, energy density is less critical than cost, safety, and cycle life. LFP batteries can often deliver more than 4,000–6,000 charge-discharge cycles, making them suitable for daily grid operations over many years.

Government programmes are reinforcing this direction. The U.S. Department of Energy (DOE) highlights that achieving a carbon-free power sector by 2035 will require large-scale deployment of long-duration and grid-connected battery storage. The DOE reports that installed grid battery capacity in the United States rose from about 1 GW in 2019 to over 16 GW by 2024, showing how fast this segment is already scaling.

In Asia, similar momentum is visible. According to official government statements, China had installed over 30 GW of new energy storage capacity by 2024 and plans further rapid additions to support renewable integration and grid stability. LFP dominates these projects due to its strong safety record and lower fire risk in large installations.

Regional Insights

Asia Pacific leads with 37.2% share, valued at USD 6.9 billion in 2024, driven by manufacturing scale and EV/ESS demand

In 2024, the Asia Pacific region accounted for a leading position in the lithium-iron-phosphate (LFP) market, representing 37.2% of global volume and approximately USD 6.9 billion in regional value. This outcome was supported by concentrated cell and pack manufacturing capacity in China, rising LFP adoption across passenger electric vehicles and commercial fleets, and rapid expansion of stationary energy storage for grid applications. Large OEM and pack-integration activity in key markets reduced supply chain friction and enabled regional price competitiveness, thereby accelerating procurement of LFP cells for both automotive and stationary systems.

The Asia Pacific advantage in 2024 was also reinforced by government and industrial investments that favoured localising battery supply chains, including factory commissioning and raw-material processing that shorten lead times and lower landed costs for integrators. As a result, system designers preferred locally produced LFP for safety-sensitive and cost-sensitive applications, supporting higher regional uptake versus import-dependent markets.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BYD Company Ltd. — BYD has grown from a battery maker into a global mobility and energy group; in 2024 the company reported revenue: CNY 777.1 billion and produced about 4.30 million vehicles while manufacturing roughly 155.7 GWh of EV battery capacity. Its vertical integration—cells, packs, vehicle assembly and downstream energy products—gives BYD strong cost control and fast scale-up for LFP deployment in cars and stationary systems. The company employed nearly 900,000–970,000 people by end-2024, supporting rapid global expansion.

BYD Company Ltd. — BYD has grown from a battery maker into a global mobility and energy group; in 2024 the company reported revenue: CNY 777.1 billion and produced about 4.30 million vehicles while manufacturing roughly 155.7 GWh of EV battery capacity. Its vertical integration—cells, packs, vehicle assembly and downstream energy products—gives BYD strong cost control and fast scale-up for LFP deployment in cars and stationary systems. The company employed nearly 900,000–970,000 people by end-2024, supporting rapid global expansion.

k2battery (K2 / K2 Energy) — K2-branded suppliers provide LFP deep-cycle cells and assembled battery packs targeted at motive-power replacement and solar/backup markets; product pages show cell and pack offerings such as 24V and 25.6V packs with capacities in the tens of Ah and cycle-life claims exceeding 2,000 cycles. The company focuses on lead-acid replacement and portable ESS segments where durability and retrofit simplicity drive adoption.

Top Key Players Outlook

- BYD Company Ltd.

- A123 Systems LLC

- Electric Vehicle Power System Technology Co., Ltd.

- OptimumNano Energy Co., Ltd.

- k2battery

- LiFeBATT, Inc.

- LITHIUMWERKS

- CENS Energy Tech Co., Ltd

- RELiON Batteries

Recent Industry Developments

In 2024 OptimumNano Energy, highlighted product reliability and process refinement through industry recognition and new product announcements, reinforcing its role as a supplier of 32650/32700/32750 cell formats with cycle-life claims of >2,000 cycles on many SKUs — attributes that appeal to integrators seeking durable, low-maintenance LFP cells.

In 2024, BYD installed roughly 153.7 GWh of EV battery capacity, up sharply from 111.8 GWh in 2023 — a growth of about 37.5%.

Report Scope

Report Features Description Market Value (2024) USD 18.8 Bn Forecast Revenue (2034) USD 153.9 Bn CAGR (2025-2034) 23.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Voltage (Low, Medium, High), By Capacity (0-16,321 MAH, 16,321-40,000 MAH, 40,001-80,000 MAH, Above 80,000 MAH), By Application (Portable, Stationary), By End-use (Automotive, Power, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BYD Company Ltd., A123 Systems LLC, Electric Vehicle Power System Technology Co., Ltd., OptimumNano Energy Co., Ltd., k2battery, LiFeBATT, Inc., LITHIUMWERKS, CENS Energy Tech Co., Ltd, RELiON Batteries Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Lithium Iron Phosphate MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Lithium Iron Phosphate MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

BYD Company Ltd. A123 Systems LLC Electric Vehicle Power System Technology Co., Ltd. OptimumNano Energy Co., Ltd. k2battery LiFeBATT, Inc. LITHIUMWERKS CENS Energy Tech Co., Ltd RELiON Batteries