Global Lithium Hexafluorophosphate Market Size, Share Analysis Report By Form (Solid, Liquid), By Product Type (Pitch-based, PAN-based, Rayon-based), By Application (Automotive, Industrial Energy Storage Solutions, Consumer Electronics, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161429

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

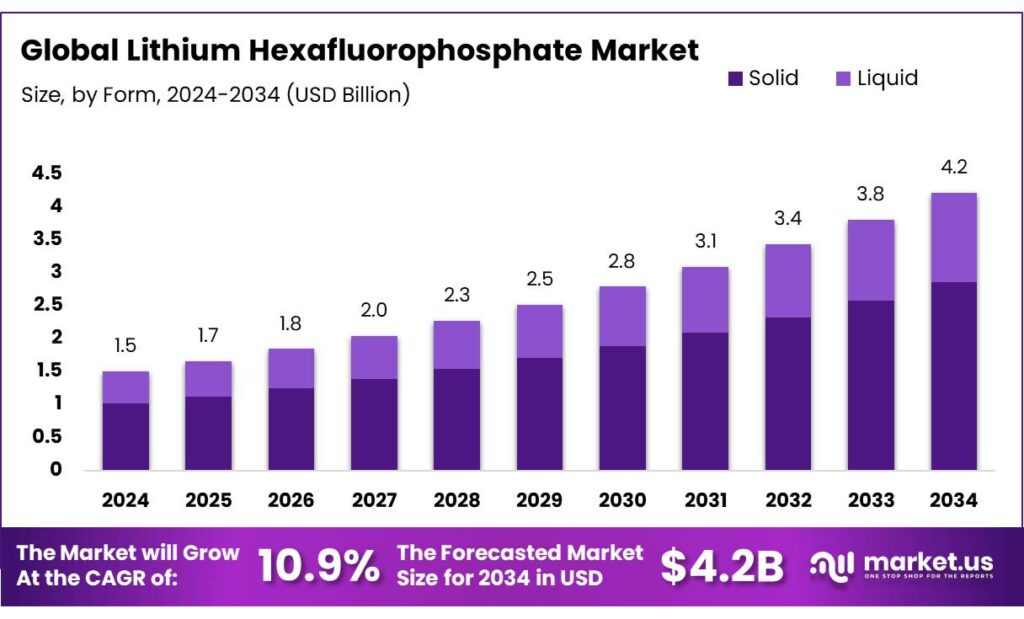

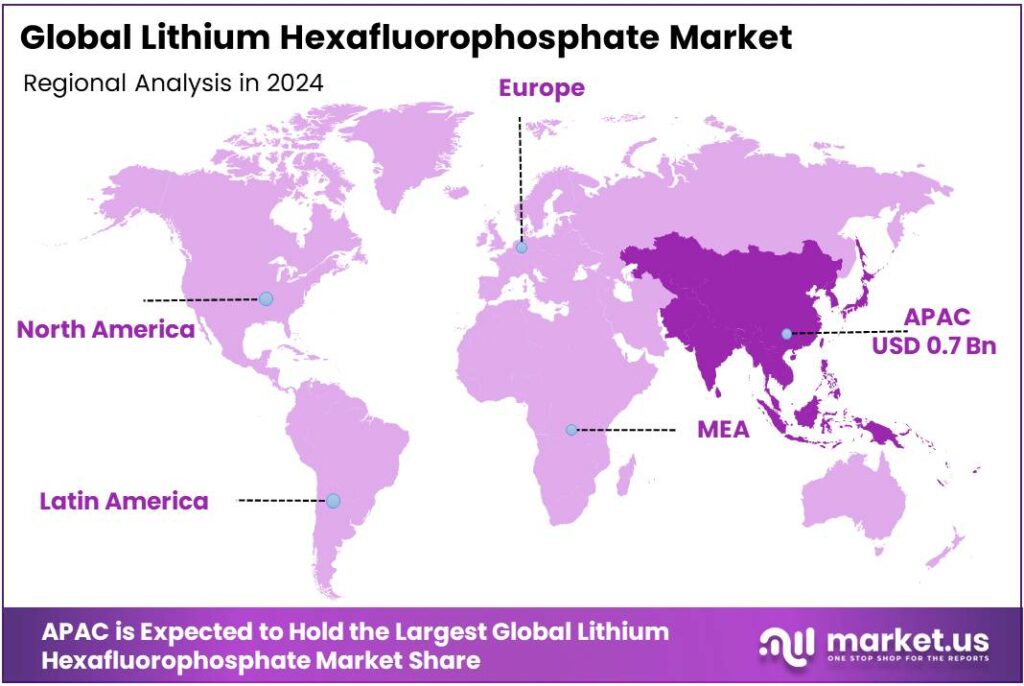

The global Lithium Hexafluorophosphate market size is expected to be worth around USD 4.2 Billion by 2034, from USD 1.5 Billion in 2024, growing at a CAGR of 10.9% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 39.6% share, holding USD 1.4 Billion in revenue.

Lithium hexafluorophosphate (LiPF₆) is a lithium salt widely used as a key electrolyte additive in lithium-ion batteries, serving to provide both ionic conductivity and passivation of electrode surfaces. Its chemical stability and compatibility with common electrolyte solvents make it a preferred choice in commercial lithium-ion cells. As battery technology evolves, high purity grades of LiPF₆ are in demand, and production methods are under continuous optimization to reduce impurities such as HF, PF₅ byproducts, and moisture sensitivity.

The industrial scenario is shaped by demand growth for electric vehicles (EVs), portable electronics and grid storage, supply-chain concentration in Asia, and technology-driven substitution risks. Lithium demand for clean-energy applications was reported to have increased sharply, a trend which has been reflected in downstream electrolyte and salt markets and has materially increased consumption of LiPF₆ for battery manufacture. Production and pricing dynamics have been volatile; industry reporting indicated a substantial increase in LiPF₆ output in 2024 (reported output ≈ 187,000 tonnes, +45% year-on-year, with notable spot-price declines in that year), underscoring sensitivity to upstream lithium availability and to battery demand cycles.

Growth drivers are multi-factorial: first, continued EV and grid-storage roll-out raises baseline electrolyte volumes per year; second, improvements in cell energy density and larger vehicle battery packs have increased electrolyte grams per vehicle in many segments; third, industrial policy and supply-chain reshoring measures have stimulated new domestic electrolytes and precursor projects in several jurisdictions. Battery pack price declines—reported at ~$115/kWh in late-2024—have expanded addressable markets and stimulated volume growth, although price pressure has introduced a competitive dynamic that affects margin profiles across the value chain.

Key Takeaways

- Lithium Hexafluorophosphate market size is expected to be worth around USD 4.2 Billion by 2034, from USD 1.5 Billion in 2024, growing at a CAGR of 10.9%.

- Solid held a dominant market position, capturing more than a 67.8% share in the global lithium hexafluorophosphate (LiPF₆) market.

- Pitch-based held a dominant market position, capturing more than a 57.6% share in the global lithium hexafluorophosphate (LiPF₆) market.

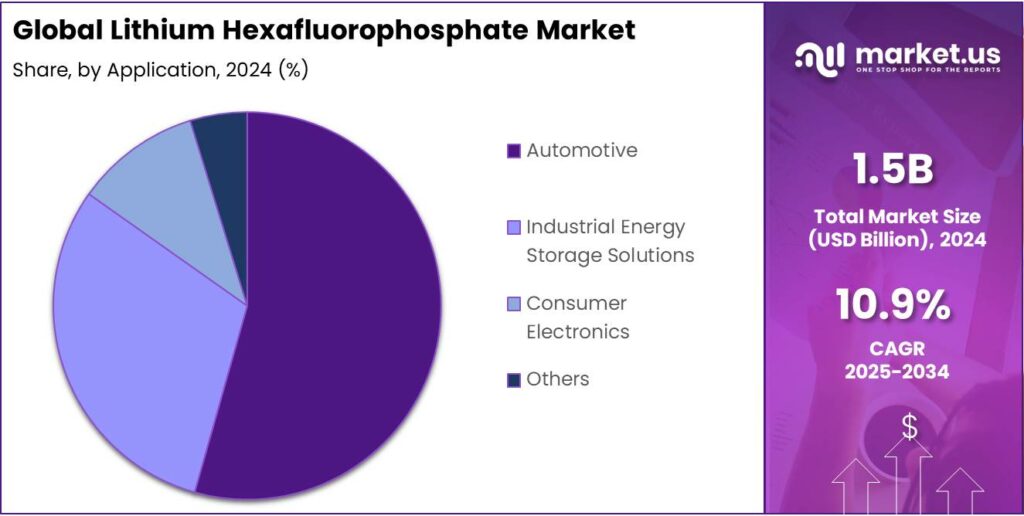

- Automotive held a dominant market position, capturing more than a 57.2% share in the global lithium hexafluorophosphate (LiPF₆) market.

- Asia-Pacific (APAC) region dominated the lithium hexafluorophosphate (LiPF₆) market, securing 47.40% share, equivalent to about USD 0.70 billion.

By Form Analysis

Solid Form Dominates with 67.8% Market Share Owing to Its High Stability and Ease of Handling

In 2024, Solid held a dominant market position, capturing more than a 67.8% share in the global lithium hexafluorophosphate (LiPF₆) market. The solid form has remained the preferred choice among electrolyte manufacturers due to its superior chemical stability, ease of storage, and convenient transportation compared to liquid forms. Its crystalline structure ensures longer shelf life and minimizes the risk of hydrolysis, making it ideal for large-scale applications in lithium-ion battery electrolyte production.

The demand for solid LiPF₆ in 2024 was further strengthened by the rapid growth in electric vehicle (EV) manufacturing and battery energy storage systems, both of which require high-purity and stable electrolyte salts. With global EV battery production surpassing 750 GWh in 2024, consumption of solid LiPF₆ increased proportionally, supported by expansion projects from major cell producers in Asia and Europe. The consistent performance and safer handling of solid LiPF₆ have led most electrolyte producers to standardize its use in mass battery cell manufacturing.

By Product Type Analysis

Pitch-based Leads the Market with 57.6% Share Owing to Its Superior Conductivity and Structural Strength

In 2024, Pitch-based held a dominant market position, capturing more than a 57.6% share in the global lithium hexafluorophosphate (LiPF₆) market. The strong performance of this segment can be attributed to its high electrical conductivity, excellent thermal stability, and uniform carbon structure, which make it highly suitable for use in advanced lithium-ion battery applications. Pitch-based materials are increasingly preferred in the production of high-performance anodes and current collectors, where consistent conductivity and structural integrity are critical for energy efficiency and long battery life.

The widespread expansion of electric vehicle (EV) manufacturing and renewable energy storage systems boosted the demand for pitch-based LiPF₆ products. Manufacturers favored this product type due to its reliable performance in high-voltage batteries and its ability to support fast-charging technologies. The growing focus on energy density and operational safety further reinforced its market position across major battery-producing regions, particularly in Asia-Pacific and Europe.

By Application Analysis

Automotive Segment Dominates with 57.2% Share Driven by Rapid EV Adoption and Battery Demand

In 2024, Automotive held a dominant market position, capturing more than a 57.2% share in the global lithium hexafluorophosphate (LiPF₆) market. This strong market leadership was primarily due to the accelerating production of electric vehicles (EVs) worldwide, which significantly increased the consumption of lithium-ion batteries. LiPF₆ serves as the essential electrolyte salt in EV batteries, ensuring efficient ion transfer, high energy density, and stable performance under varying temperature conditions. The expansion of EV manufacturing facilities in countries such as China, South Korea, and Germany directly boosted the demand for LiPF₆ in automotive applications.

The global EV market experienced substantial growth, with battery-electric and plug-in hybrid vehicles collectively accounting for a record share of new vehicle sales. This surge in adoption created a strong pull for high-purity LiPF₆ to support the mass production of advanced batteries. Automakers increasingly preferred LiPF₆-based electrolytes due to their proven safety and compatibility with high-voltage cathode materials. Additionally, several government programs promoting zero-emission vehicles and providing battery production incentives further supported the automotive sector’s dominance.

Key Market Segments

By Form

- Solid

- Liquid

By Product Type

- Pitch-based

- PAN-based

- Rayon-based

By Application

- Automotive

- Industrial Energy Storage Solutions

- Consumer Electronics

- Others

Emerging Trends

Dramatic Drop in Battery Pack and Mineral Prices

One of the most noticeable trends now affecting lithium hexafluorophosphate (LiPF₆) is how sharply the cost of lithium-ion battery packs and key battery minerals (like lithium itself) have fallen. This matters because LiPF₆ is directly tied to battery economics: when batteries get cheaper, there’s more room for demand growth—and more pressure for purity, performance, and cost control in all battery components including electrolyte salts.

According to the IEA, battery pack prices fell by about 20 % in 2024, marking the sharpest annual decline since 2017. Behind that drop is the fact that lithium prices themselves slumped nearly 20 % in 2024, returning to levels seen in 2015—even though lithium demand was six times higher than in 2015. This price softness matters: LiPF₆ makers must optimize costs further or risk being squeezed as battery makers chase ever lower per-kWh costs.

This trend is reinforced by the broader battery manufacturing build-out. In 2024, global battery cell manufacturing capacity expanded by nearly 30 %, reaching 3.3 TWh, which is more than three times the actual battery demand that year. That oversupply creates fierce competition, pushing down margins and raising demands for suppliers—including LiPF₆ providers—to improve efficiency, reduce impurities, and innovate.

From a regulatory or policy angle, governments are indirectly nudging this trend too. As nations push down the cost of clean energy storage and EVs through subsidies, tax credits, and clean energy standards, they effectively pressure the supply chain to become leaner and cheaper. In sum, the latest trend is all about deflationary cost pressure and technology push—and LiPF₆ must ride that wave or risk being marginalized.

Drivers

Surge in Electric Vehicle Battery Demand

One of the biggest driving forces behind the demand for lithium hexafluorophosphate (LiPF₆) is the rapid growth in electric vehicle (EV) battery production. LiPF₆ is a critical electrolyte salt in lithium-ion batteries, and as more EVs are sold, battery makers need more of it.

In 2023, global battery manufacturing reached 2.5 terawatt-hours (TWh), with 780 gigawatt-hours (GWh) of new capacity added over 2022 — a growth of over 25 % year-on-year. The International Energy Agency (IEA) reports that battery demand in 2024 for EVs alone was more than 950 GWh, up 25% compared to 2023. This sudden leap in battery volume directly translates to increased demand for key battery materials, including LiPF.

Governments play a crucial role too. Many countries are pushing policies, incentives and regulations to accelerate EV adoption. For example, through its Global EV Policy Explorer, the IEA tracks numerous national policies that support EV manufacturing, emissions standards, tax incentives, and infrastructure rollout. Also, under current policy settings, electric cars are projected to exceed 40% of global car sales by 2030. As EVs become a larger share of vehicle sales, battery makers must scale up, in turn pushing up demand for LiPF₆.

This trend is not just limited to passenger cars. Battery demand across all vehicle types (light, medium, heavy) is expected to increase many folds. In the IEA’s Stated Policies Scenario (STEPS), battery demand for EVs is forecast to grow 4.5× by 2030. That means battery makers will be under pressure to secure large volumes of high-purity electrolyte salts like LiPF₆ — pushing its industrial growth.

Restraints

Strict Chemical Safety & Regulatory Barriers

A significant brake on the growth of lithium hexafluorophosphate (LiPF₆) is the heavy burden of chemical safety regulations, especially in jurisdictions like the European Union, which demand rigorous compliance and may restrict or ban substances. LiPF₆ is classified as hazardous — for instance, safety data sheets list risks such as serious eye damage (Eye Dam. 1) and organ toxicity with repeated exposure (STOT RE 1) when handled improperly.

Under the EU’s REACH regulation (Regulation EC 1907/2006), any chemical substance manufactured or imported into the EU above 1 tonne per year must be registered with the European Chemicals Agency (ECHA), including providing data on toxicity, safe handling, and environmental impact. For LiPF₆, companies face high costs, long timelines, and detailed safety testing for registration. This regulatory overhead delays market entry and raises capital risk, especially for smaller firms.

In addition, the EU’s evolving chemical strategy is increasing pressure: tougher restrictions on fluorinated and phosphorus-based chemicals may emerge. According to recent reporting, the EU’s green push is estimated to cost chemical firms more than USD 20 billion annually in compliance and regulatory adjustments globally. For LiPF₆ producers exporting into the EU or working within global supply chains, this adds uncertainty and risk — potentially making alternate materials or local sourcing more attractive.

National governments can also impose export controls or environmental rules on raw materials like fluorine or lithium, thus compounding regulatory risk. For example, to protect environmental health, certain jurisdictions might ban or restrict use of highly corrosive or toxic chemicals in consumer-facing products, which complicates supply chain oversight.

Opportunity

Expansion of Stationary Energy Storage Systems

A compelling growth opportunity for lithium hexafluorophosphate lies in the booming demand for stationary energy storage — the kind used in grids and renewable energy projects. As more wind and solar power come online, electric grids need more ways to store surplus energy. That storage almost always relies on batteries, and batteries require high-quality electrolytes like LiPF₆.

In the IEA’s “Batteries and Secure Energy Transitions” report, global battery storage deployment is expected to rise fourteen-fold by 2030. Even today, battery storage must grow by about 25% per year on average to keep pace. When we think in terms of electricity, by 2030 that could mean around 1,200 GW of battery storage capacity globally.

What makes this opportunity so real is that stationary storage doesn’t compete with EVs for “road use” limits. It’s a parallel demand stream. In IEA’s “Global EV Outlook 2024,” stationary (grid & systems) battery demand in 2030 is projected at 400 GWh under the STEPS scenario. In effect, battery makers and LiPF₆ producers get a second pillar of growth beyond just cars.

Governments are aware of this and many initiatives around the world back it. For example, power grids are being modernized to accept more renewables, and storage incentives or mandates are being introduced. In many nations, energy authorities target 10 %–20% of generation capacity to pair with storage in coming decades.

Regional Insights

APAC region leads with 47.40% share (≈ USD 0.70 billion), driven by battery and EV boom

In 2024, the Asia-Pacific (APAC) region dominated the lithium hexafluorophosphate (LiPF₆) market, securing 47.40% share, equivalent to about USD 0.70 billion in revenue. This commanding position reflects the region’s stronghold in battery manufacturing, aggressive electric vehicle (EV) adoption, and extensive growth of consumer electronics. Key countries such as China, Japan, and South Korea continued to underpin the bulk of demand, both for automotive Li-ion batteries and energy storage systems.

APAC’s valuation in this market was higher (approximately USD 1.14 billion), but due to global market normalization and shifts in demand, 2024 saw a recalibration to USD 0.78 billion for the region. Even so, the relative share in global LiPF₆ usage remained high, roughly corresponding to the given 47.40%. The region’s strengths include cost-efficient production, established supply chains for lithium and precursor fluorine chemicals, and supportive policy frameworks encouraging localization of battery input material manufacturing.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Foosung Co., Ltd. is a South Korean company with approximately 40 years of experience in fluorochemical technologies, including LiPF₆ production. It produces high-purity LiPF₆ and related inorganic fluorine compounds, plus specialty gases and battery materials. The company has expanded operations into China (Nantong, Suzhou) and is constructing LiPF₆ capacity in Europe to serve EV and battery electrolytes markets. Their product specification often includes >99.9% purity, moisture control, and low metal/impurity content.

Anhui Meisenbao Technology is a private Chinese firm based in Huaibei, Anhui Province specialising in high-end fine chemicals and new energy battery materials. Their portfolio includes LiPF₆ among other lithium and sodium battery salts, organic solvents, and additives. They emphasize strong R&D capacity, customise synthesis routes, and maintain export activities across over 20 countries. The company also strives to meet domestic and international quality standards for battery chemicals.

IoLiTec, based in Heilbronn, Germany, focuses on the development, production, and custom synthesis of ionic liquids and intermediates, serving many sectors including battery, electrical, catalyst and sensor industries. While LiPF₆ is not a core specialty (their strength lies more in non-standard ionic liquids), the company contributes via R&D, feasibility studies, and custom material services that can support novel electrolyte chemistries. International customers and smaller scale industrial partners form a large part of their clientele.

Top Key Players Outlook

- Anhui Meisenbao Technology Co., Ltd.

- Foosung Co., Ltd.

- lolitec Ionic Liquids Technologies GmbH

- Kanto Denka Kogyo Co., Ltd.

- Morita New Energy Materials (Zhangjiagang) Co., Ltd.

- Stella Chemifa Corporation

- Zhenjiang Poworks Co., Ltd

- FUJIFILM Wako Pure Chemical Corporation

- E-Lyte Innovations GmbH

- Glentham Life Sciences Limited

Recent Industry Developments

In 2024, Anhui Meisenbao Technology Co., Ltd. exported lithium hexafluorophosphate to GFCL EV Products Ltd. in India, with a shipment value of approximately USD 15,050.

In 2024 Foosung Co., Ltd, LiPF₆ market was valued at approximately USD 1.7 billion, with Foosung Co., Ltd. contributing to this growth through its high-quality products and strong market presence.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Bn Forecast Revenue (2034) USD 4.2 Bn CAGR (2025-2034) 10.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Solid, Liquid), By Product Type (Pitch-based, PAN-based, Rayon-based), By Application (Automotive, Industrial Energy Storage Solutions, Consumer Electronics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Anhui Meisenbao Technology Co., Ltd., Foosung Co., Ltd., lolitec Ionic Liquids Technologies GmbH, Kanto Denka Kogyo Co., Ltd., Morita New Energy Materials (Zhangjiagang) Co., Ltd., Stella Chemifa Corporation, Zhenjiang Poworks Co., Ltd, FUJIFILM Wako Pure Chemical Corporation, E-Lyte Innovations GmbH, Glentham Life Sciences Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Lithium Hexafluorophosphate MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Lithium Hexafluorophosphate MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Anhui Meisenbao Technology Co., Ltd.

- Foosung Co., Ltd.

- lolitec Ionic Liquids Technologies GmbH

- Kanto Denka Kogyo Co., Ltd.

- Morita New Energy Materials (Zhangjiagang) Co., Ltd.

- Stella Chemifa Corporation

- Zhenjiang Poworks Co., Ltd

- FUJIFILM Wako Pure Chemical Corporation

- E-Lyte Innovations GmbH

- Glentham Life Sciences Limited