Global Lithium Fluoride Market Size, Share Analysis Report By Type (Upto 98%, Above 98%), By Product Type (Powder, Granule), By Application (Fluorescent Materials, Lithium-ion Batteries, Radiation Measurement, Optical Materials, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161266

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

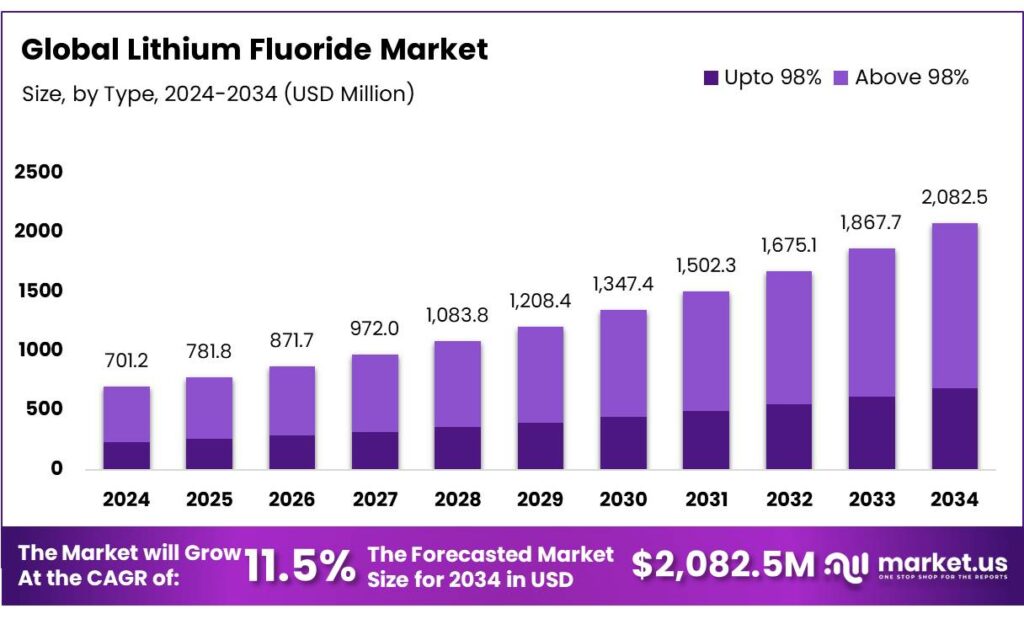

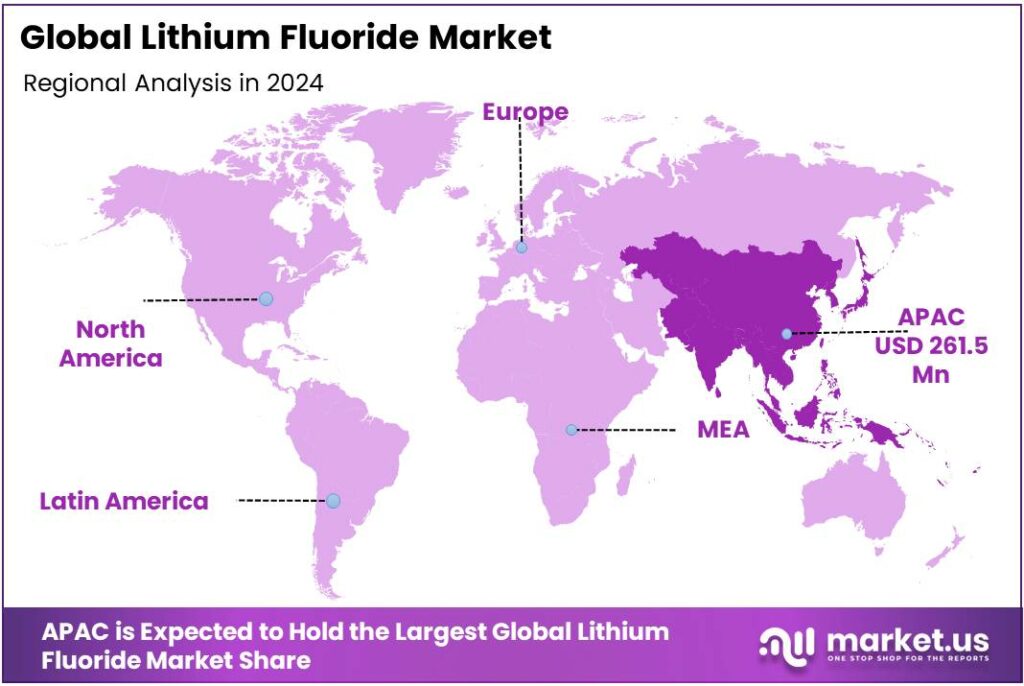

The Global Lithium Fluoride Market size is expected to be worth around USD 2082.5 Million by 2034, from USD 701.2 Million in 2024, growing at a CAGR of 11.5% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 37.3% share, holding USD 261.5 Million in revenue.

Lithium fluoride (LiF) is a versatile inorganic compound with significant applications across various industries, including nuclear energy, optics, metallurgy, and advanced battery technologies. Its unique properties, such as high thermal stability, excellent chemical resistance, and transparency in ultraviolet (UV) and infrared (IR) spectra, make it indispensable in these sectors.

Several factors are driving the demand for lithium fluoride. The rapid expansion of the electric vehicle (EV) market has significantly increased the need for lithium-ion batteries, thereby boosting the demand for battery-grade lithium fluoride. For instance, China’s dominance in the EV market, accounting for over 60% of global EV sales, underscores the growing demand for lithium-based components. Additionally, advancements in nuclear energy and radiation detection technologies have further augmented the utilization of LiF.

According to a report by the U.S. Department of Energy, the demand for lithium batteries in the United States is expected to increase nearly sixfold by 2030, underscoring the importance of developing a robust domestic lithium supply chain

In the nuclear energy sector, lithium fluoride is utilized in molten salt reactors due to its ability to absorb neutrons and operate at high temperatures. The global push towards cleaner energy sources has led to renewed interest in nuclear power, thereby boosting the demand for lithium fluoride. For instance, lithium-7 isotopes are essential in molten-salt reactors, which are anticipated to play a pivotal role in future nuclear energy production.

Key Takeaways

- Lithium Fluoride Market size is expected to be worth around USD 2082.5 Million by 2034, from USD 701.2 Million in 2024, growing at a CAGR of 11.5%.

- Above 98% held a dominant market position, capturing more than a 67.9% share of the global lithium fluoride market.

- Powder held a dominant market position, capturing more than a 68.4% share of the global lithium fluoride market.

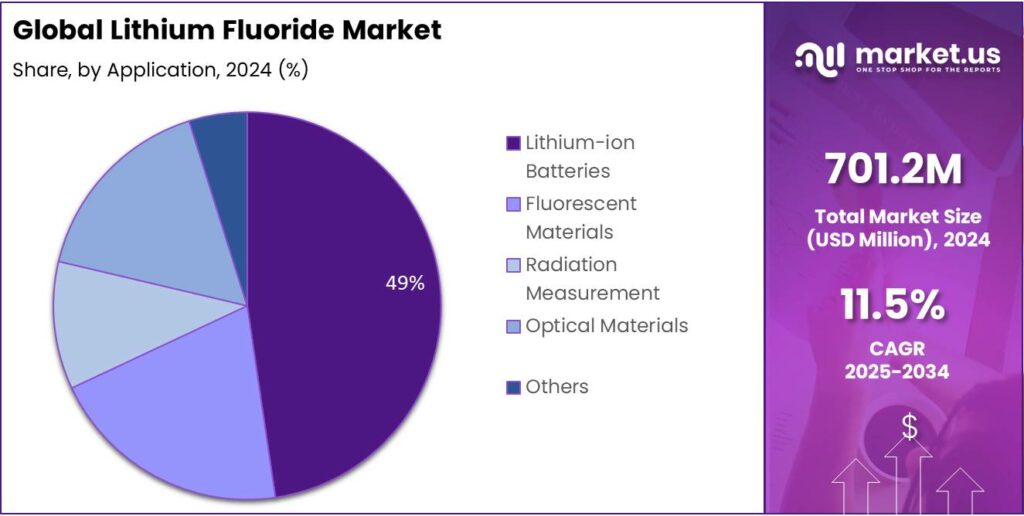

- Lithium-ion Batteries held a dominant market position, capturing more than a 49.2% share of the lithium fluoride market.

- Asia Pacific region held a dominant position in the global lithium fluoride market, accounting for 37.3% of the total market share, valued at approximately USD 261.5 million.

By Type Analysis

Lithium Fluoride Above 98% dominates with 67.9% market share in 2024

In 2024, Above 98% held a dominant market position, capturing more than a 67.9% share of the global lithium fluoride market. This high-purity segment has been preferred across critical applications, particularly in the production of lithium-ion batteries, high-performance optics, and specialized nuclear technology components. The superior purity ensures minimal contamination, making it highly suitable for sensitive industrial processes where performance and safety are paramount. Over the year, demand was especially strong in energy storage solutions, where Above 98% lithium fluoride serves as a reliable precursor for lithium hexafluorophosphate used in batteries.

Additionally, its consistent quality has driven adoption in optical applications, such as UV windows and precision instruments, where low absorption and high transmission are required. The combination of technological relevance and industrial preference has maintained its strong market position, and forecasts for 2025 indicate that Above 98% lithium fluoride will continue to dominate, reflecting sustained growth in sectors dependent on high-purity materials. This dominance highlights the ongoing trend toward precision-grade chemicals in industrial and energy applications, reinforcing the importance of maintaining high standards of production and supply.

By Product Type Analysis

Powder form dominates with 68.4% market share in 2024 due to its versatility and ease of use

In 2024, Powder held a dominant market position, capturing more than a 68.4% share of the global lithium fluoride market. This form has been widely adopted due to its high surface area and ease of handling, which make it suitable for a variety of industrial applications. Powdered lithium fluoride is extensively used in energy storage, particularly in the production of lithium-ion batteries, where precise mixing and reaction rates are essential for efficiency and performance.

Its application in optics and nuclear technology has also contributed to strong demand, as the powdered form allows for uniform distribution in ceramics, glasses, and high-performance optical components. Over the year, the Powder segment benefitted from increased industrial focus on high-purity materials and the growing need for consistent, reliable chemical forms that can be easily incorporated into manufacturing processes. Looking toward 2025, the Powder form is expected to retain its leading position, reflecting the continued preference for versatile, easy-to-use lithium fluoride products in critical industrial and technological applications.

By Application Analysis

Lithium-ion Batteries lead with 49.2% market share in 2024 driven by growing energy storage demand

In 2024, Lithium-ion Batteries held a dominant market position, capturing more than a 49.2% share of the lithium fluoride market. This strong performance is primarily attributed to the rapid expansion of electric vehicles and renewable energy storage systems, which rely on high-quality lithium compounds for efficient battery production. Lithium fluoride plays a critical role as a precursor for lithium hexafluorophosphate, an essential electrolyte component, ensuring optimal battery performance and longevity.

The demand from consumer electronics, including smartphones, laptops, and other portable devices, has further strengthened its position in the market. Over the year, the focus on high-purity and reliable materials has made lithium fluoride indispensable in battery manufacturing processes. Looking ahead to 2025, the Lithium-ion Battery segment is expected to maintain its leading share, reflecting sustained growth in energy storage solutions and the increasing adoption of electric mobility worldwide.

Key Market Segments

By Type

- Upto 98%

- Above 98%

By Product Type

- Powder

- Granule

By Application

- Fluorescent Materials

- Lithium-ion Batteries

- Radiation Measurement

- Optical Materials

- Others

Emerging Trends

Integration of Lithium Fluoride in Advanced Battery Technologies

The lithium fluoride (LiF) market is witnessing a significant shift towards its integration into advanced battery technologies, particularly in the realm of solid-state batteries (SSBs). This trend is driven by the increasing demand for higher energy densities, enhanced safety profiles, and longer battery life, which are critical for applications in electric vehicles (EVs), portable electronics, and large-scale energy storage systems.

Solid-state batteries, which utilize a solid electrolyte instead of the conventional liquid electrolyte, offer several advantages, including improved thermal stability and reduced flammability. Lithium fluoride plays a crucial role in these batteries by enhancing the ionic conductivity of the solid electrolyte and improving the overall performance of the battery. This has led to a growing interest in LiF as a key material in the development of next-generation battery technologies.

China currently dominates the production and consumption of battery-grade lithium fluoride, accounting for about 65% of global production. Companies like Jiangxi Ganfeng Lithium and Shanghai China Lithium Industrial hold substantial market share, reflecting China’s robust EV manufacturing sector and established lithium-ion battery industry.

Drivers

Government Incentives and Policies Fueling Lithium Fluoride Demand

The accelerating global demand for lithium fluoride (LiF) is significantly influenced by governmental initiatives aimed at promoting sustainable energy solutions, particularly in the electric vehicle (EV) sector. LiF, a critical component in lithium-ion batteries, plays a pivotal role in enhancing battery performance and efficiency.

- In the United States, the federal government has implemented substantial incentives to bolster EV adoption. The Inflation Reduction Act offers tax credits of up to $7,500 for new EV purchases and $4,000 for used ones, thereby stimulating consumer interest and accelerating the transition to electric mobility. This surge in EV sales directly correlates with an increased demand for high-purity lithium fluoride, as it is essential for manufacturing advanced battery electrolytes and cathode materials.

Similarly, China’s robust support for the EV industry has positioned it as a global leader in lithium battery production. The Chinese government’s policies, including subsidies and infrastructure development, have facilitated the growth of EV manufacturing, leading to a significant rise in lithium-ion battery production. Consequently, the demand for lithium fluoride in China has surged, as it is integral to the production of high-performance batteries.

- For instance, the U.S. Department of Energy’s $700 million conditional loan to Ioneer Ltd. for its lithium project in Nevada exemplifies efforts to strengthen the domestic supply chain for critical minerals. This initiative aims to support the production of lithium sufficient for approximately 370,000 EVs annually, highlighting the strategic importance of lithium and its compounds in the nation’s energy transition.

Restraints

Supply Chain Challenges Impeding Lithium Fluoride Production

The production of lithium fluoride (LiF), a critical component in lithium-ion batteries, faces significant challenges due to supply chain constraints. These constraints are particularly evident in countries like India, where the demand for lithium-ion batteries is projected to reach 100 GWh per annum by 2030. To meet this demand, approximately 193,000 tons of cathode active material will be required annually, necessitating substantial quantities of lithium carbonate (Li₂CO₃) and lithium hydroxide (LiOH·H₂O).

- According to a report by NITI Aayog, India’s domestic capacity for producing lithium-ion batteries is expected to reach 100 GWh per annum by 2030. To support this, the demand for critical materials such as cathode active material, graphite, aluminum, copper, and electrolyte components is projected to be substantial. Specifically, the demand for lithium carbonate is estimated at 56,000 tons per annum, while lithium hydroxide demand is projected at 64,000 tons per annum.

The limited domestic production of critical minerals in India is a significant concern. For instance, the country does not produce nickel or cobalt from primary resources, relying entirely on imports to meet demand. Similarly, while India produces graphite, the production of spherical graphite, which is essential for lithium-ion battery anodes, is still in the nascent stages. This lack of domestic production capacity for key materials further exacerbates the supply chain challenges.

Opportunity

Expansion of Lithium-Ion Battery Manufacturing in India

India’s burgeoning electric vehicle (EV) market presents a significant growth opportunity for lithium fluoride (LiF), a critical component in lithium-ion batteries. The government’s strategic initiatives, such as the Production-Linked Incentive (PLI) scheme for Advanced Chemistry Cell (ACC) battery storage, aim to bolster domestic manufacturing capabilities and reduce dependency on imports. This policy is expected to enhance the supply chain for critical materials, including lithium fluoride, thereby supporting the growth of the EV industry.

- In FY 2024-25, India witnessed a notable increase in EV sales, with over 2 million units sold, marking a 16.9% growth from the previous fiscal year. The two-wheeler segment dominated, accounting for 59% of total EV sales, followed by three-wheelers at 36%, and four-wheelers at 5%. This surge in EV adoption underscores the escalating demand for lithium-ion batteries and, consequently, for lithium fluoride.

To meet this rising demand, India is aggressively expanding its battery manufacturing capacity. The Ministry of Heavy Industries has allocated 40 GWh of a targeted 50 GWh capacity under the PLI scheme to enhance domestic cell manufacturing. This initiative aims to reduce reliance on imports and strengthen the domestic supply chain for critical materials, including lithium fluoride.

The government’s commitment to the EV sector is further demonstrated by the establishment of the National Mission on Advanced Chemistry Cell (ACC) Battery Storage, which focuses on enhancing domestic manufacturing capabilities and reducing dependency on imports.

Regional Insights

Asia Pacific leads with 37.3% market share in 2024, valued at USD 261.5 million

In 2024, the Asia Pacific region held a dominant position in the global lithium fluoride market, accounting for 37.3% of the total market share, valued at approximately USD 261.5 million. This significant share is attributed to the region’s robust industrial base, substantial investments in electric vehicle (EV) production, and advancements in battery manufacturing technologies.

China, as a major player in the region, has been instrumental in driving the demand for lithium fluoride. The country’s extensive glass production, coupled with its leadership in EV manufacturing, has significantly contributed to the increased consumption of lithium fluoride. In 2024, China was a leading producer of glass in the Asia-Pacific area, positively impacting the regional demand for lithium fluoride. Additionally, China’s dominance in the EV market, with companies like BYD accounting for nearly 50% of the lithium iron phosphate (LFP) battery demand, further underscores the region’s pivotal role in the lithium fluoride market.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Leverton is a prominent supplier of lithium fluoride with applications in energy storage, ceramics, and specialized industrial processes. In 2024, the company emphasized the production of above 98% purity LiF, catering to the growing lithium-ion battery sector and advanced material markets. Leverton’s operations in Europe and Asia facilitate timely distribution to key industrial hubs. Investments in process technology and quality assurance have strengthened its market position. The company continues to innovate in chemical handling and purity enhancement to meet the rigorous standards of modern industries.

Axiom Chemicals provides high-purity lithium fluoride for use in batteries, optics, and industrial applications. In 2024, the company focused on expanding production to meet increasing demand from the EV and electronics sectors. Its commitment to stringent quality standards and customized chemical solutions ensures high reliability and performance. With a presence in North America and partnerships in Asia, Axiom has strengthened its market reach. Continuous investment in process optimization, product development, and customer service reinforces its role as a trusted supplier of lithium fluoride.

Ganfeng Lithium Group, a leading Chinese lithium producer, manufactures lithium fluoride primarily for battery and energy storage applications. In 2024, the company supplied high-purity LiF for lithium-ion batteries, supporting EV growth domestically and globally. Its integrated operations, including mining, processing, and distribution, ensure cost efficiency and reliable supply. Ganfeng’s strategic investments in production capacity and technology enhancements strengthen its competitive advantage. The company’s focus on sustainability, innovation, and market expansion positions it as a key player in the rapidly growing lithium fluoride industry.

Top Key Players Outlook

- Crystran Ltd

- FMC

- American Elements

- Leverton

- Axiom Chemicals

- Ganfeng Lithium Group Co., Ltd

- Harshil Fluoride Brivo Lithium

- Eagle Picher Technologies

- Axiom Chemicals Pvt. Ltd.

- Alpha Chemika

Recent Industry Developments

In 2024 Axiom Chemicals, lithium fluoride with a purity of 99%, available in powder form, suitable for various applications including ceramics, metallurgy, and as a flux in enamels and glasses. Their product is characterized by a high melting point of 848°C and is soluble in water, making it versatile for different industrial processes.

In 2024 Leverton Ltd, lithium fluoride in technical powder form, characterized by its fine white powder appearance and standard packaging in 20 kg sacks. Leverton Ltd’s lithium fluoride products are utilized in various applications such as optical materials, nuclear technology, and specialty ceramics.

Report Scope

Report Features Description Market Value (2024) USD 701.2 Mn Forecast Revenue (2034) USD 2082.5 Mn CAGR (2025-2034) 11.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Upto 98%, Above 98%), By Product Type (Powder, Granule), By Application (Fluorescent Materials, Lithium-ion Batteries, Radiation Measurement, Optical Materials, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Crystran Ltd, FMC, American Elements, Leverton, Axiom Chemicals, Ganfeng Lithium Group Co., Ltd, Harshil Fluoride Brivo Lithium, Eagle Picher Technologies, Axiom Chemicals Pvt. Ltd., Alpha Chemika Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Crystran Ltd

- FMC

- American Elements

- Leverton

- Axiom Chemicals

- Ganfeng Lithium Group Co., Ltd

- Harshil Fluoride Brivo Lithium

- Eagle Picher Technologies

- Axiom Chemicals Pvt. Ltd.

- Alpha Chemika