Global Lithium Carbonate Market Size, Share Analysis Report By Battery (Lithium-ion Batteries, Lithium-metal Batteries, Others), By Source (Brine, Spodumene, Lepidolite/Clay, Recycled Lithium Carbonate), By Grade (Battery Grade, Technical Grade, Industrial Grade), By Application (Electric Vehicles, Pharmaceutical, Cement, Glass And Ceramics, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 163449

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

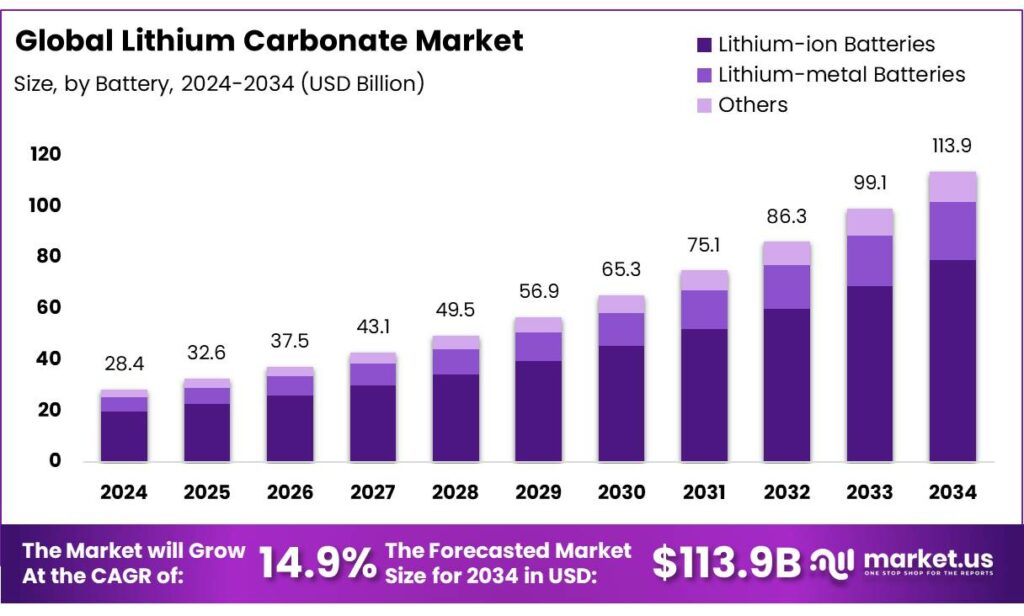

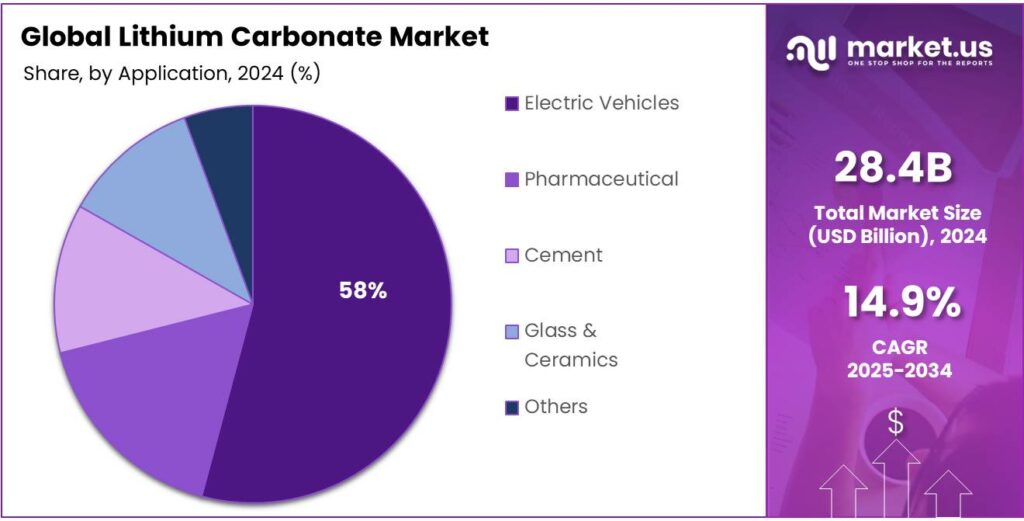

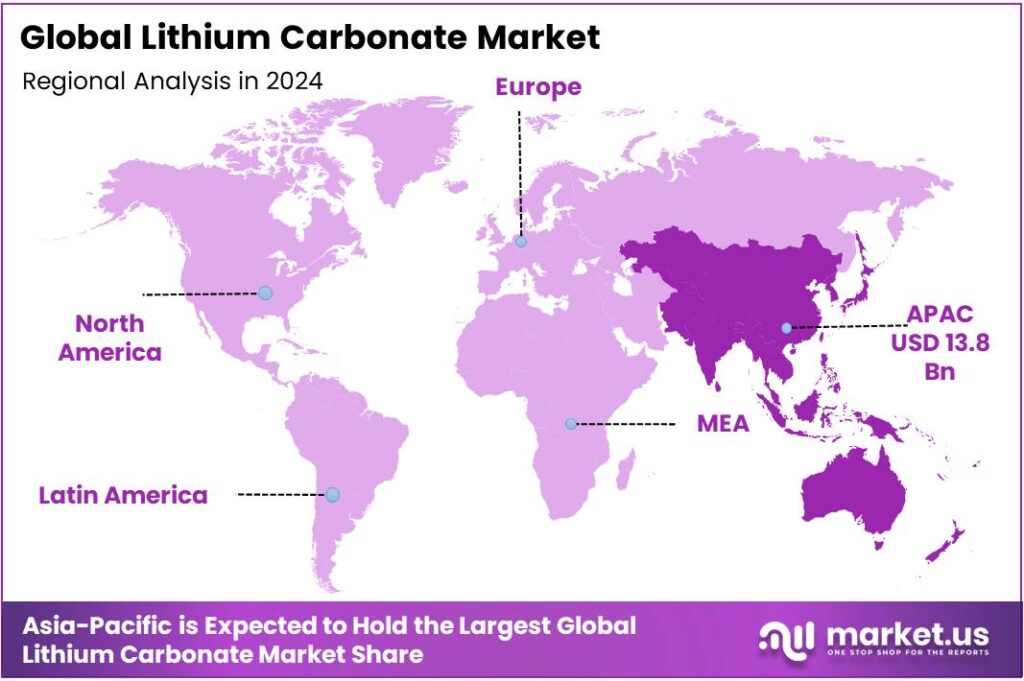

The Global Lithium Carbonate Market size is expected to be worth around USD 113.9 Billion by 2034, from USD 28.4 Billion in 2024, growing at a CAGR of 14.9% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific (APAC) held a dominant market position, capturing more than a 48.9% share, holding USD 13.8 Billion in revenue.

Lithium carbonate sits at the heart of lithium-ion battery chemistries for EVs and stationary storage, with feedstock drawn from both hard-rock spodumene and salar brines; in fact, brines remain the dominant feedstock for lithium carbonate production, especially in Chile and Argentina.

In 2024, global lithium output rose about 18% to ~240,000 t versus 2023 as new mines and expansions responded to earlier price signals—underscoring how quickly supply can surge when capital is available. On the demand side, the IEA estimated lithium demand grew ~30% in 2023, propelled by EV battery installations and grid storage, even as other battery minerals showed slower growth.

- In the U.S., the average fixed-contract price for lithium carbonate was about $46,000/t in 2023, down 32% from 2022, highlighting the differential between spot and term markets that many cathode producers rely on. Cost leadership matters: Western Australia’s average total cash cost was ~US$4,520 per tonne LCE in 2023, compared with a world average ~US$9,714/t LCE—a spread that shapes which assets remain cash-positive during downcycles.

In October 2024, the U.S. DOE Loan Programs Office approved a $2.26 billion loan for Lithium Americas’ Thacker Pass processing facilities, designed to produce ~40,000 t/year of battery-grade lithium carbonate—a clear signal of industrial policy aimed at onshoring midstream conversion. Europe, meanwhile, has set binding Critical Raw Materials Act benchmarks by 2030: at least 10% of annual consumption extracted in the EU, 40% processed, 25% recycled, and no more than 65% from a single third country—targets that directly incentivize lithium carbonate conversion and recycling inside the bloc.

The IEA’s outlook underscores that critical-mineral demand for clean energy continues to rise in all scenarios—with aggregate demand nearly tripling by 2030 in the Net Zero pathway—implying sustained growth in lithium chemical requirements even after price volatility.

Key Takeaways

- Lithium Carbonate Market size is expected to be worth around USD 113.9 Billion by 2034, from USD 28.4 Billion in 2024, growing at a CAGR of 14.9%.

- Lithium-ion Batteries held a dominant market position, capturing more than a 69.6% share in the global lithium carbonate market.

- Brine held a dominant market position, capturing more than a 56.9% share in the global lithium carbonate market.

- Battery Grade held a dominant market position, capturing more than a 65.3% share in the global lithium carbonate market.

- Electric Vehicles held a dominant market position, capturing more than a 58.2% share in the global lithium carbonate market.

- Asia-Pacific (APAC) region, the market for lithium carbonate in 2024 was estimated at approximately USD 13.8 billion, representing a dominant regional share of 48.90%.

By Battery Analysis

Lithium-ion Batteries dominate with 69.6% market share due to rising EV and energy storage demand

In 2024, Lithium-ion Batteries held a dominant market position, capturing more than a 69.6% share in the global lithium carbonate market. The strong dominance of this segment is driven by the surging production of electric vehicles (EVs), portable electronics, and large-scale energy storage systems that rely on lithium-ion technology. The increasing adoption of EVs across regions such as China, the United States, and Europe has led to a significant rise in lithium carbonate consumption, as it serves as a key raw material for cathode production. In 2024, global electric vehicle sales surpassed 14 million units, marking an annual increase of over 35%, which directly elevated the demand for lithium carbonate in battery-grade applications.

Furthermore, government initiatives promoting clean energy and the decarbonization of transportation have accelerated the installation of lithium-ion battery manufacturing facilities. Several nations introduced subsidy programs and tax incentives in 2024–2025 to support domestic battery production, further strengthening the market position of lithium carbonate within this segment. The expansion of gigafactories and technological advancements aimed at enhancing battery capacity and lifecycle efficiency have continued to sustain the demand momentum.

By Source Analysis

Brine dominates with 56.9% share owing to its cost efficiency and abundant natural reserves

In 2024, Brine held a dominant market position, capturing more than a 56.9% share in the global lithium carbonate market. The dominance of brine-based extraction is primarily due to its cost-effectiveness and the large availability of lithium-rich salt flats across South America’s “Lithium Triangle,” which includes Chile, Argentina, and Bolivia. These regions collectively accounted for the majority of global lithium carbonate output in 2024, supported by favorable climatic conditions and vast salar reserves. Brine extraction methods continue to offer lower production costs compared to hard-rock mining, making it the preferred source for lithium carbonate production among major global producers.

Rising lithium demand from electric vehicle batteries and energy storage applications encouraged expansion projects in brine operations, with several capacity additions announced in Chile and Argentina. Brine projects are also benefiting from government initiatives promoting sustainable lithium recovery technologies, particularly those that reduce water usage and improve extraction efficiency. In 2025, technological advancements such as direct lithium extraction (DLE) are expected to further enhance yield rates from brine sources, reducing processing time and environmental impact.

By Grade Analysis

Battery Grade dominates with 65.3% share driven by strong demand from EV and energy storage sectors

In 2024, Battery Grade held a dominant market position, capturing more than a 65.3% share in the global lithium carbonate market. The strong preference for battery-grade lithium carbonate is linked to its high purity level, which is essential for manufacturing lithium-ion batteries used in electric vehicles, portable electronics, and renewable energy storage systems. The growing production of electric vehicles, which exceeded 14 million units in 2024, significantly increased the demand for high-purity lithium carbonate as a key raw material for cathode materials like lithium iron phosphate (LFP) and nickel-manganese-cobalt (NMC).

Several countries accelerated their shift toward clean mobility and renewable energy integration, boosting investment in advanced battery manufacturing facilities. This trend strengthened the position of battery-grade lithium carbonate, as producers prioritized quality and consistency to meet global automotive and energy standards. By 2025, this grade is expected to maintain its leadership due to continuous expansion in gigafactory capacities and ongoing advancements in lithium purification processes.

By Application Analysis

Electric Vehicles dominate with 58.2% share driven by the global shift toward clean mobility

In 2024, Electric Vehicles held a dominant market position, capturing more than a 58.2% share in the global lithium carbonate market. The rising adoption of electric mobility worldwide has made the EV sector the largest consumer of lithium carbonate, as it is a key material used in the production of lithium-ion batteries. Global electric vehicle sales crossed 14 million units in 2024, marking a strong year-on-year growth supported by government incentives, carbon reduction targets, and improved charging infrastructure across major markets such as China, Europe, and North America. This surge directly fueled the demand for battery-grade lithium carbonate, which remains the preferred chemical compound for cathode manufacturing in high-performance batteries.

Governments in the United States, India, and the European Union implemented subsidy programs and policy frameworks encouraging local EV production and battery manufacturing, which further strengthened the demand outlook for lithium carbonate. By 2025, the expansion of gigafactories and growing investment in battery recycling are expected to reinforce this trend, ensuring sustained consumption of lithium carbonate within the EV segment.

Key Market Segments

By Battery

- Lithium-ion Batteries

- Lithium-metal Batteries

- Others

By Source

- Brine

- Spodumene

- Lepidolite/Clay

- Recycled Lithium Carbonate

By Grade

- Battery Grade

- Technical Grade

- Industrial Grade

By Application

- Electric Vehicles

- Pharmaceutical

- Cement

- Glass & Ceramics

- Others

Emerging Trends

LFP’s rise is tilting demand toward lithium-carbonate—and driving cost resets

A major trend shaping lithium carbonate is the rapid global shift toward lithium iron phosphate (LFP) batteries, which use lithium carbonate heavily and are spreading from China to the rest of the world. In 2024, LFP made up nearly half of the global EV battery market, and in China it met about three-quarters of domestic battery demand, with monthly shares touching 80% late in the year—evidence that automakers are prioritizing cost and durability. The International Energy Agency (IEA) adds that by capacity, LFP supplied more than 40% of EV demand in 2023, with two-thirds of China’s EV sales using LFP, while the United States and Europe remained below 10%—a gap that signals further room for LFP growth in Western markets.

This chemistry shift and easing raw-material tightness are flowing through to prices, reinforcing carbonate demand. IEA data show lithium supply exceeded demand by over 10% in 2023, contributing to broad mineral price declines and cheaper batteries. BloombergNEF reports average lithium-ion pack prices fell 20% in 2024 to $115/kWh, the lowest on record; in 2023, LFP cells were 32% cheaper than NMC cells on average—cost signals that favor carbonate-linked LFP cathodes in mass-market EVs and grid storage.

Policy is reinforcing the trend by financing local conversion and pushing supply-chain resilience—both of which create new offtake lanes for battery-grade lithium carbonate. In October 2024, the U.S. Department of Energy’s Loan Programs Office approved a $2.26 billion loan for Thacker Pass processing facilities in Nevada, designed to make ~40,000 t/year of battery-quality lithium carbonate and reduce import dependence in the EV supply chain.

Grid-scale storage is the second engine propelling this trend. The IEA notes over 40 GW of battery storage was added in 2023, roughly doubling year-on-year, taking total power-sector storage past 85 GW—a build-out where LFP is increasingly the default chemistry. The IEA’s Net Zero path calls for batteries to supply 1,200 GW of storage by 2030, about a 14-fold jump from today—evidence that system planners expect a long runway for chemistries like LFP that pair well with lithium carbonate.

Drivers

EV and grid-storage surge, reinforced by public policy

Lithium carbonate demand is being pulled by two powerful forces: faster electric-vehicle (EV) adoption and rapid build-out of grid-scale batteries, both backed by government policy. EV sales neared 14 million in 2023, concentrating in China, Europe, and the U.S.—a scale that directly lifts cathode production and upstream lithium carbonate needs. Entering 2024, the International Energy Agency (IEA) signaled momentum would continue, with >17 million EVs expected to be sold in 2024, keeping battery manufacturing lines busy and sustaining orders for battery-grade lithium carbonate.

Battery demand is now the dominant use for lithium. The IEA estimates battery demand for lithium reached ~140 kt in 2023, about 85% of total lithium demand, and up >30% year-on-year—a clear indicator that the battery supply chain is the prime growth engine for lithium chemicals like lithium carbonate. The story extends beyond cars. Utilities and developers are adding storage to balance renewables: by 2023, the world had >85 GW of battery storage operating in the power sector, creating a second, fast-growing sink for lithium carbonate via LFP and other chemistries.

Public policy is amplifying this demand by de-risking midstream conversion and localization. In the United States, the Department of Energy’s Loan Programs Office issued a $2.26 billion loan (October 2024) to Lithium Americas’ Thacker Pass project to finance processing facilities designed to produce ~40,000 t/year of battery-quality lithium carbonate—a direct, government-led push to expand domestic supply of the exact chemical EV makers require.

The demand outlook further strengthens the case for lithium carbonate. In the IEA’s Stated Policies Scenario, EV battery demand grows ~4.5× by 2030 versus 2023, and ~7× by 2035, implying sustained scaling of cathodes that rely on lithium carbonate either directly or via intermediate streams. Meanwhile, the broader clean-energy transition is putting more electric vehicles on the road, and utilities continue to expand storage to stabilize grids with rising shares of wind and solar.

Restraints

price volatility, long lead-times, and supply-chain concentration

Lithium carbonate faces a tough restraint that sits at the intersection of economics and policy: violent price swings that whipsaw investment, combined with long project lead-times and a concentrated midstream that is hard to diversify quickly. The International Energy Agency (IEA) reported that battery minerals had a turbulent 2023, with lithium spot prices falling about 75%. That collapse forced producers to pause or delay projects and unsettled offtake planning for converters and cathode makers.

These price shocks are amplified by supply timing. The IEA’s analysis of mines commissioned between 2010 and 2019 shows it takes over 16 years on average to move from discovery to first production. When prices are high, many projects are proposed; when prices dive, financing dries up—yet the underlying 16-year clock barely changes. In parallel, oversupply episodes can emerge quickly: the USGS estimates global lithium output rose ~18% in 2024 to ~240,000 t, a surge that contributed to the price reset and squeezed higher-cost assets.

Concentration adds another brake. Refining and conversion capacity is clustered in a handful of countries; the IEA notes the top three refining countries accounted for 96% of global refining in 2023. Such concentration exposes lithium carbonate buyers to logistics bottlenecks, trade frictions, and technology export controls that can disrupt availability even when upstream ore or brine is abundant.

Policy initiatives aim to ease these restraints but cannot eliminate them overnight. The European Union’s Critical Raw Materials framework seeks to raise in-EU processing and recycling shares by 2030, yet building conversion plants, training workforces, and qualifying product with battery customers still takes years. These are helpful hedges against concentration risk, but the near-term supply of battery-grade lithium carbonate will still depend on a few regions and price-sensitive developers.

Opportunity

local conversion And grid storage push unlock new lithium-carbonate demand

The clearest growth lane for lithium carbonate is building midstream conversion capacity close to demand, while riding the surge in EVs and grid batteries. Electric-car sales exceeded 17 million in 2024, taking >20% global share—evidence that battery demand is broad and sticky, not a one-off spike. The IEA’s 2025 outlook shows lithium demand rose nearly 30% in 2024, far above the 2010s trend, and still primarily driven by energy uses such as EVs and storage.

Policy is turning that demand into bankable projects, especially for local conversion. In the United States, the DOE’s Loan Programs Office closed a $2.26 billion loan to Lithium Americas’ Thacker Pass in October 2024, backing a refinery designed to produce ~40,000 t/year of battery-grade lithium carbonate—exactly the material automakers and cell makers need.

Europe is setting structure, not just subsidies: the Critical Raw Materials Act targets by 2030 at least 10% of consumption extracted in the EU, 40% processed, 25% recycled, and no more than 65% from any single third country at each processing stage. These benchmarks directly create commercial space for new carbonate conversion, qualification, and recycling lines inside the bloc.

- A second, distinct opportunity is grid storage. Battery energy storage additions nearly doubled in 2023, with ~42 GW added and total capacity reaching ~85 GW, and the IEA still calls for a much faster build-out to meet clean-power goals. Independent tallies show the same direction: global battery storage capacity hit ~55.7 GW in 2023, with China leaping to 27.1 GW and the U.S. to 16.2 GW—a rapid, geographically diverse sink for lithium-carbonate-based chemistries like LFP.

Regional Insights

Asia-Pacific leads with 48.90% share and a market size of USD 13.8 billion in 2024

In the Asia-Pacific (APAC) region, the market for lithium carbonate in 2024 was estimated at approximately USD 13.8 billion, representing a dominant regional share of 48.90% of the global market. This strong regional performance can be attributed to the substantial lithium-ion battery production ecosystems and electric vehicle (EV) manufacturing hubs established in countries such as China, Japan, South Korea and India. The heavy concentration of battery and cathode manufacturing in APAC has ensured that lithium carbonate consumption remains elevated, supported also by the region’s established supply chains for lithium extraction and chemical conversion.

For example, in Q1 2025 the region already accounted for approximately 59 % of all lithium deployed in EV batteries globally. Meanwhile, other APAC nations such as South Korea and Japan provide advanced battery-technology capabilities and contribute significantly to the downstream value chain. According to data, in 2024 the Asia-Pacific consumption of lithium oxide, hydroxide and carbonate reached around 550 000 tons, with lithium carbonate representing approximately 345 000 tons by volume.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Albemarle Corporation – In 2023 Albemarle recorded net sales of roughly USD 9.62 billion, driven by its lithium-salt business and other specialty chemicals. The company noted that lithium prices dropped by approximately 75-85% from January to end of 2023. As a market-research analyst, Albemarle stands out as the world’s largest lithium producer with a strong cost-advantage position, yet is currently under pressure from falling lithium carbonate prices.

Ganfeng Lithium Co., Ltd. – In 2023 Ganfeng’s operating income was about RMB 32.97 billion and net profit around RMB 4.95 billion, a year-on-year net profit drop of ~75.9%. The company reported lithium carbonate production capacity at 91,000 mt/year at end of 2023. From an analytical standpoint, Ganfeng is aggressively scaling carbonate and hydroxide capacity globally, but is experiencing margin compression due to price declines.

Tianqi Lithium Corporation – At end of 2024 Tianqi reported established lithium chemical production capacity of 91,600 mt/year, with expansion to ~122,600 mt/year planned. The company reported a net loss of RMB 7.905 billion for 2024, its largest since listing. From an investment-analysis viewpoint, Tianqi is building large chemical scale but is under margin and profitability pressure in the current low-price lithium cycle.

Lithium Americas Corp. – In 2023 Lithium Americas spent USD 193.7 million on its Thacker Pass project and held about USD 196 million in cash as of Dec 31, 2023. The project targets nameplate carbonate capacity of 40,000 tpa in Phase 1. As a market research analyst, Lithium Americas is a development-stage U.S. player positioned to supply battery-grade lithium carbonate, but remains exposed to funding, construction risk and price cycles.

Top Key Players Outlook

- Albemarle Corp.

- Ganfeng Lithium Co., Ltd.

- SQM S.A.

- Tianqi Lithium Corporation

- Lithium Americas Corp.

- Mineral Resources Group Co., Ltd.

- Others

Recent Industry Developments

In 2025, Albemarle delivered 44,000 metric tons of lithium-carbonate-equivalent volume, marking a 7.3 % year-on-year increase in its lithium salts business.

In 2024 Lithium Americas Corp, firm capitalised around USD 62.5 million in construction and project-related costs as part of its build-out for the Thacker Pass Project in Nevada.

Report Scope

Report Features Description Market Value (2024) USD 28.4 Bn Forecast Revenue (2034) USD 113.9 Bn CAGR (2025-2034) 14.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Battery (Lithium-ion Batteries, Lithium-metal Batteries, Others), By Source (Brine, Spodumene, Lepidolite/Clay, Recycled Lithium Carbonate), By Grade (Battery Grade, Technical Grade, Industrial Grade), By Application (Electric Vehicles, Pharmaceutical, Cement, Glass And Ceramics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Albemarle Corp., Ganfeng Lithium Co., Ltd., SQM S.A., Tianqi Lithium Corporation, Lithium Americas Corp., Mineral Resources Group Co., Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Albemarle Corp.

- Ganfeng Lithium Co., Ltd.

- SQM S.A.

- Tianqi Lithium Corporation

- Lithium Americas Corp.

- Mineral Resources Group Co., Ltd.

- Others