Global Liquid Packaging Cartons Market Size, Share, Growth Analysis By Packaging Type (Aseptic, Gable Top, and Others), By Opening Format (Straw Hole / Punch Hole, Pull Tab, Screw Cap, and Others), By Application (Dairy Beverages, Carbonated Drinks, RTD Tea & Coffee, Functional Beverages, Juices, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171047

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

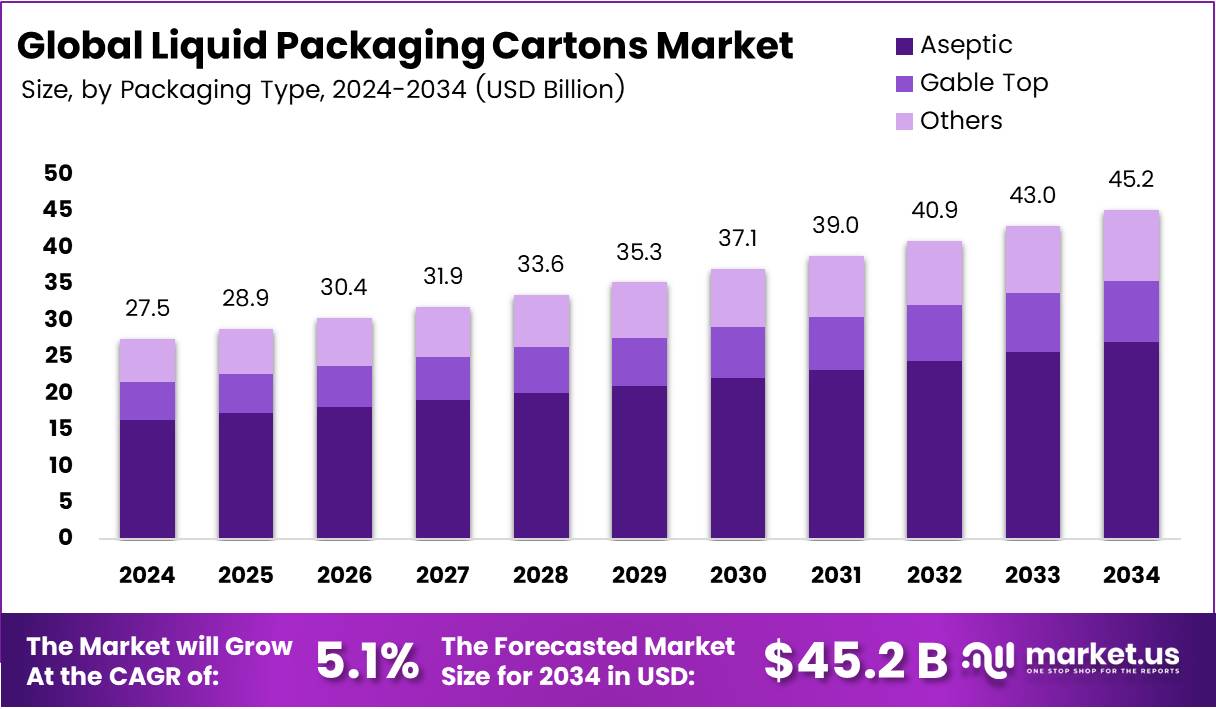

The Global Liquid Packaging Cartons Market size is expected to be worth around USD 45.2 Billion by 2034, from USD 27.5 Billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034.

Liquid packaging cartons are multi-layered, paperboard-based containers designed to keep liquids fresh and safe by combining paperboard with thin plastic and aluminum foil layers, creating a barrier against air, light, and moisture, allowing for long shelf life without refrigeration and offering a lightweight, stackable, and sustainable packaging solution.

The liquid packaging cartons market is shaped by several key trends, including the growing demand for sustainable and eco-friendly packaging solutions. In particular, aseptic cartons dominate the market due to their ability to preserve the quality and freshness of beverages without refrigeration, making them ideal for dairy products such as milk and yogurt. These cartons offer a longer shelf life and are increasingly preferred for their environmental benefits, being made from recyclable materials.

While liquid cartons are widely used for dairy, their application in other beverages such as juices, functional drinks, and RTD teas is expanding, driven by consumer demand for convenience and sustainability. However, challenges such as higher production costs compared to plastic bottles and the complexities in recycling certain composite materials continue to hinder broader adoption.

- On average, around 1 million tons of beverage cartons are put on the market annually in the EU30. Approximately 75% of the milk and 59% of the juice are packed in beverage cartons in the European Union.

Key Takeaways

- The global liquid packaging cartons market was valued at US$27.5 billion in 2024.

- The global liquid packaging cartons market is projected to grow at a CAGR of 5.1% and is estimated to reach US$45.2 billion by 2034.

- On the basis of types of packaging, aseptic packaging dominated the liquid packaging cartons market, constituting 59.8% of the total market share.

- Based on the opening format, the screw cap format dominated the liquid packaging cartons market, with a substantial market share of around 67.4%.

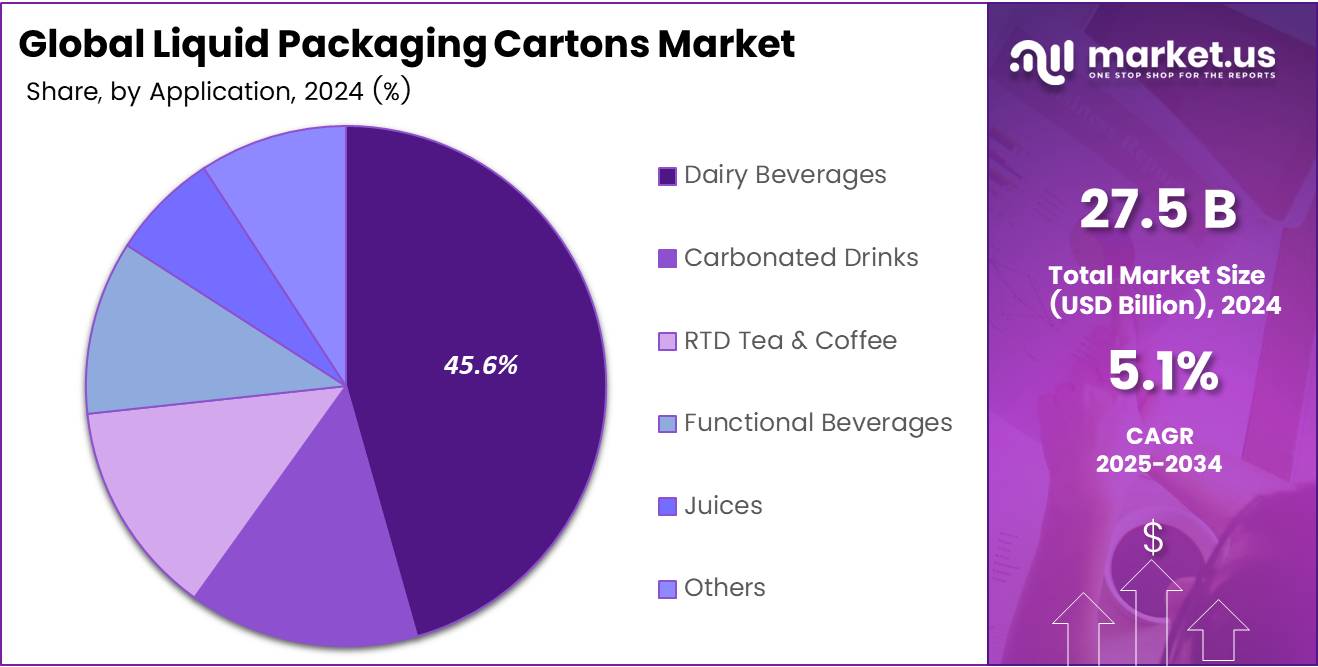

- Among the applications of the liquid packaging cartons, dairy beverages held a major share in the market, 45.6% of the market share.

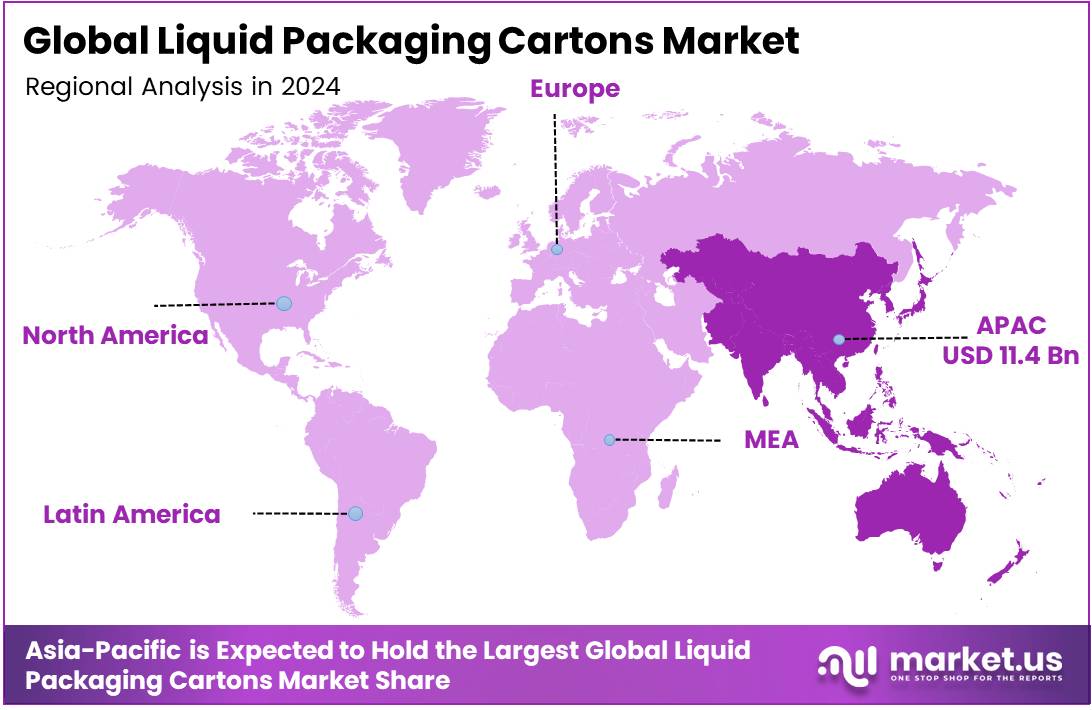

- In 2024, the Asia Pacific was the most dominant region in the liquid packaging cartons market, accounting for 41.5% of the total global consumption.

Packaging Type Analysis

Aseptic Packaging is a Prominent Segment in the Liquid Packaging Cartons Market.

The liquid packaging cartons market is segmented based on types of packaging into aseptic, gable top, and others. The aseptic packaging led the liquid packaging cartons market, comprising 59.8% of the market share, due to their superior ability to preserve product quality without the need for refrigeration.

Aseptic packaging extends shelf life significantly, allowing beverages such as juices, dairy, and ready-to-drink teas to remain fresh for months, even without preservatives. This feature makes aseptic cartons particularly appealing for global distribution, as they reduce logistics costs associated with cold storage and transportation.

Additionally, the growing consumer demand for convenience and longer shelf life in domestic and international markets further boosts the popularity of aseptic cartons. Similarly, their advanced technology, which maintains the nutritional value and taste of the product, is a key differentiator.

Opening Format Analysis

Screw Cap Format Dominated the Liquid Packaging Cartons Market.

On the basis of opening format, the liquid packaging cartons market is segmented into straw hole/punch hole, pull tab, screw cap, and others. Screw cap format dominated the liquid packaging cartons market, comprising 67.4% of the market share. The screw cap opening format is preferred over straw holes, punch holes, or pull tabs for liquid packaging cartons primarily due to its convenience, reusability, and secure seal.

Unlike straw holes or punch holes, which often result in spillage or contamination if not sealed properly, screw caps provide a tight, leak-proof closure that ensures the liquid remains protected until fully consumed. This is particularly important for products such as dairy and juices, where freshness and safety are paramount.

Furthermore, screw caps allow for easy resealing, which appeals to consumers who prefer to store partially consumed beverages without compromising quality. The screw cap’s ease of use, paired with its capacity for preventing accidental leaks, makes it a more practical and reliable option compared to other opening formats.

Application Analysis

Dairy Beverages Held a Major Share of the Liquid Packaging Cartons Market.

Based on the application, the liquid packaging cartons market is segmented into dairy beverages, carbonated drinks, RTD tea & coffee, functional beverages, juices, and others. Among the applications, 45.6% of the revenue in the liquid packaging cartons market is generated from dairy beverages. Liquid packaging cartons are predominantly used for dairy beverages due to their superior ability to preserve the freshness, taste, and nutritional value of dairy products, which are highly sensitive to spoilage.

Dairy beverages, such as milk and flavored milk drinks, require packaging that ensures a long shelf life without refrigeration, which is a key feature of aseptic cartons.The multi-layer structure of these cartons, which includes a barrier against light and oxygen, prevents the degradation of sensitive compounds such as proteins and fats.

This is less critical for carbonated drinks, RTD teas and coffees, functional beverages, or juices, which may have different preservation requirements, such as carbonation or specific flavor profiles that are better maintained in bottles or cans. While cartons are increasingly used for juices, particularly for shelf-stable options, the specific demands of dairy packaging, including the need for extended freshness and minimal handling, make them the primary choice for dairy beverages.

Key Market Segments

By Packaging Type

- Aseptic

- Gable Top

- Others

By Opening Format

- Straw Hole / Punch Hole

- Pull Tab

- Screw Cap

- Others

By Application

- Dairy Beverages

- Carbonated Drinks

- RTD Tea & Coffee

- Functional Beverages

- Juices

- Others

Drivers

Demand for Sustainable Materials Drives the Liquid Packaging Cartons Market

The growing demand for sustainable materials has significantly influenced the liquid packaging cartons market, with key factors driving this shift being increased environmental awareness and consumer preference for eco-friendly products. Recyclable materials such as cardboard and plant-based options are becoming increasingly popular due to their reduced environmental footprint.

For instance, in December 2025, Tetra Pak, in collaboration with Spanish drinks brand García Carrión, unveiled the use of its paper-based barrier technology for juice packaging. The juices are being rolled out in Tetra Brik Aseptic 200 ml Slim Leaf cartons featuring a paper-based barrier for juice.

Additionally, the use of aluminum-free packaging materials has gained traction, as aluminum production is energy-intensive and less sustainable. Major companies in the packaging industry are investing in more easily recyclable materials such as paperboard, driving the adoption of liquid packaging cartons. This shift towards sustainable materials addresses environmental concerns and aligns with consumer demand for products that are eco-conscious and functional.

Restraints

Relatively High Cost Might Hinder the Growth of the Liquid Packaging Cartons Market.

The relatively high cost of liquid packaging cartons compared to alternatives such as plastic bottles may pose a challenge to the growth of the market. While liquid cartons offer superior sustainability and environmental benefits, their production costs are often higher due to the complex multi-layer construction involving paperboard, plastic, and aluminum.

This complexity makes them more expensive to manufacture than single-material alternatives such as plastic bottles, which are produced at lower costs due to simpler processes and economies of scale. For instance, in Western Europe, the total production cost for a unit of PET bottle for 0.33 liters of water is Eur0.135, and the cost of a beverage carton for the same amount of water is Eur0.156.

Additionally, the logistical costs associated with transporting liquid cartons can be higher, as they are more rigid and less flexible than plastic bottles, which can be molded into various shapes for space efficiency. The price-sensitive consumers and manufacturers may opt for less expensive options, particularly in regions where cost competitiveness is a dominant factor. The higher cost of liquid cartons remains a critical obstacle for widespread adoption in some market segments.

Growth Factors

Increased Consumption of Ready-to-Drink Beverages Creates Opportunities in the Liquid Packaging Cartons Market.

The increasing consumption of ready-to-drink (RTD) beverages is creating significant opportunities within the liquid packaging cartons market. According to the Bureau of Labor Statistics, in 2024, 87% of full-time employed individuals worked on an average weekday in the United States.

As the number of working individuals increases, lifestyles become more fast-paced, and consumers are turning to convenient, on-the-go beverage options, including fruit juices, iced teas, dairy products, and health drinks. The manufacturers are increasingly opting for liquid packaging cartons due to their portability, lightweight nature, and ability to preserve beverage quality.

Additionally, the growing focus on sustainability is pushing beverage producers to choose environmentally friendly packaging. Liquid cartons made from renewable resources such as paperboard, combined with recyclable caps, are being used to cater to the eco-conscious consumers, fostering growth in the sector. With a rising trend in health-conscious and eco-friendly consumption, the demand for these sustainable packaging solutions is poised for further expansion.

Emerging Trends

A Shift Towards Circular Economy

The ongoing shift towards a circular economy is driving significant change in the liquid packaging cartons market, with a growing emphasis on recycling and reusing materials. Manufacturers are increasingly focusing on the recyclability of packaging, particularly liquid cartons, which are traditionally more challenging to recycle due to their composite materials.

However, innovations in carton design and recycling processes have made it easier to separate and reuse the components, such as paperboard, plastic, and aluminum layers. Some companies now use a combination of advanced sorting technologies and collection systems to ensure higher recycling rates. For instance, in September 2025, Billerud launched recyclable cartonboards that are designed for strength and moisture resistance.

Additionally, around 490,000 tons of beverage cartons are collected for recycling in the EU30 each year, which is 52% of the total beverage cartons placed in the market in the region annually, contributing to a more sustainable packaging ecosystem. This shift reduces waste and supports the broader goal of minimizing the environmental impact of packaging materials.

Geopolitical Impact Analysis

Geopolitical Tensions Are Reshaping the Dynamics of the Liquid Packaging Cartons Market.

The geopolitical tensions have created a ripple effect on the liquid packaging cartons market, influencing production and distribution channels. Trade disruptions, particularly between major economies, have led to delays in the supply of raw materials such as paperboard, plastics, and aluminum, which are essential components of liquid cartons. These supply chain challenges have caused fluctuations in the availability and prices of these materials, increasing manufacturing costs.

For instance, US tariffs on Russian and Chinese aluminum, and Chinese packaging imports had disrupted normal trade flows and created market uncertainty, raising prices for end-users. Similarly, as the production of these cartons is an energy-intensive process, the tensions such as the Russia-Ukraine conflict and conflicts in the Middle East, which have raised energy prices, have increased the production costs.

Furthermore, conflicts in the Red Sea have created an aluminum deficit in the market, further challenging the liquid packaging carton industry. Moreover, the tensions have led to shifts in consumer behavior, with companies in many regions focusing on local production and sourcing rather than global supply chains. This has prompted manufacturers to explore alternative sourcing strategies, such as nearshoring or diversifying supplier bases to mitigate risk.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Liquid Packaging Cartons Market.

In 2024, the Asia Pacific dominated the global liquid packaging cartons market, holding about 41.5% of the total global consumption. The region holds the largest share of the global liquid packaging cartons market, driven by rapid urbanization, changing consumer preferences, and increasing demand for convenient beverage options. The region’s large working population, particularly in countries such as China, South Korea, and India, contributes significantly to the demand for ready-to-drink beverages, such as fruit juices, milk, and tea, which are commonly packaged in cartons. In addition, governments across the

Asia Pacific are promoting sustainability initiatives, encouraging the adoption of recyclable and eco-friendly packaging solutions, which further boost the adoption of liquid cartons. Moreover, consumer awareness of environmental issues in markets such as Japan and South Korea is increasing, leading to a greater preference for sustainable packaging options like liquid cartons. The combination of consumer demand and regulatory support positions the Asia Pacific as a key driver in the global market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Liquid Packaging Cartons Company Insights

Companies in the liquid packaging cartons market employ several strategies to enhance sales and expand their market reach. The company’s focus on product innovation, such as developing more sustainable packaging options, including cartons made from renewable resources, and improving recyclability. This aligns with the growing consumer demand for eco-friendly solutions.

In addition, the companies emphasize strategic partnerships with beverage manufacturers to offer tailored packaging solutions, ensuring a competitive edge in terms of product differentiation. Similarly, the companies invest in expanding their geographic presence, particularly in emerging markets, by setting up localized production facilities and strengthening supply chains to ensure timely delivery.

Top Key Players in the Market

- Tetra Pak International SA

- SIG Group AG

- Pactiv Evergreen Inc. (Novolex)

- UFlex Limited (ASEPTO)

- IPI Srl (Coesia Group)

- Lami Packaging (Kunshan) Co., Ltd.

- Visy Industries

- Parksons Packaging Ltd.

- Shandong Bihai Packaging Materials Co., Ltd.

- Klabin SA

- Obeikan Industrial Investment Group

- Nampak Ltd.

- Elopak AS

- Greatview Aseptic Packaging Co., Ltd.

- Nippon Paper Industries Co. Ltd.

- Other Key Players

Recent Developments

- In December 2025, SIG and Asahi Group Japan collaborated to introduce LIKE MILK, a yeast-derived beverage with milk-like properties from Asahi Group, using SIG’s aseptic carton and filling technology.

- In October 2025, Elopak announced to invest US$ 30 million in the expansion with its third production line in Arkansas, the US, which is expected to roll out in 2027.

Report Scope

Report Features Description Market Value (2024) USD 27.5 Billion Forecast Revenue (2034) USD 45.2 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Packaging Type (Aseptic, Gable Top, and Others), By Opening Format (Straw Hole / Punch Hole, Pull Tab, Screw Cap, and Others), By Application (Dairy Beverages, Carbonated Drinks, RTD Tea & Coffee, Functional Beverages, Juices, and Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Tetra Pak International SA, SIG Group AG, Pactiv Evergreen Inc. (Novolex), UFlex Limited (ASEPTO), IPI Srl (Coesia Group), Lami Packaging (Kunshan) Co. Ltd., Visy Industries, Parksons Packaging Ltd., Shandong Bihai Packaging Materials Co. Ltd., Klabin SA, Obeikan Industrial Investment Group, Nampak Ltd., Elopak AS, Greatview Aseptic Packaging Co. Ltd., Nippon Paper Industries Co. Ltd, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Liquid Packaging Cartons MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Liquid Packaging Cartons MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Tetra Pak International SA

- SIG Group AG

- Pactiv Evergreen Inc. (Novolex)

- UFlex Limited (ASEPTO)

- IPI Srl (Coesia Group)

- Lami Packaging (Kunshan) Co., Ltd.

- Visy Industries

- Parksons Packaging Ltd.

- Shandong Bihai Packaging Materials Co., Ltd.

- Klabin SA

- Obeikan Industrial Investment Group

- Nampak Ltd.

- Elopak AS

- Greatview Aseptic Packaging Co., Ltd.

- Nippon Paper Industries Co. Ltd.

- Other Key Players