Global Liquid Metal Market Size, Share Analysis Report By Product Type (Gallium, Mercury, Alloys, Others), By Application (Thermal Management, Flexible Electronics, 3D Printing, Others), By End-User (Electronics, Healthcare, Automotive, Aerospace, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171033

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

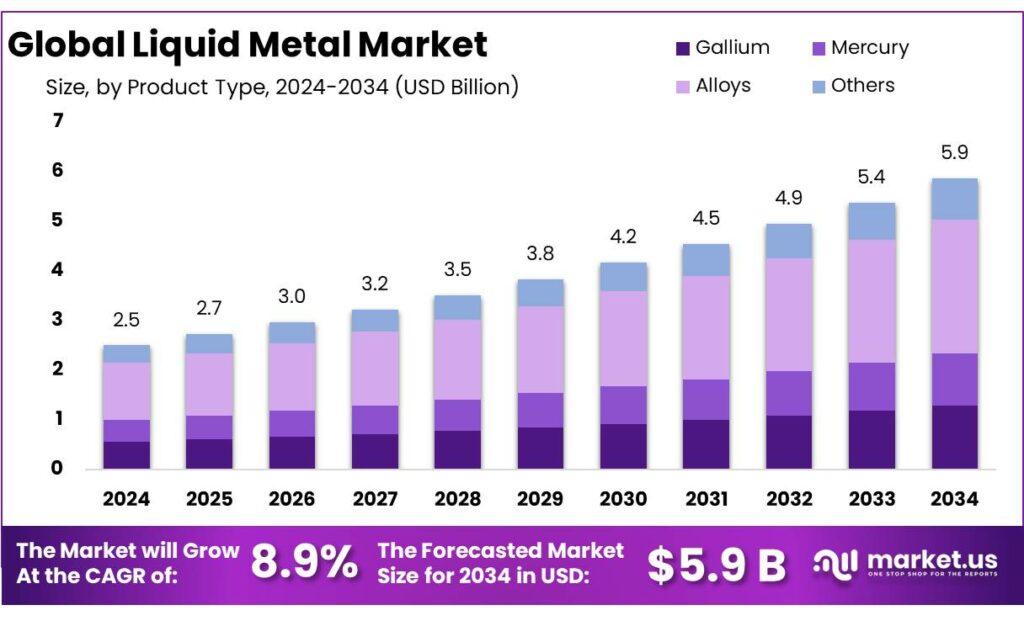

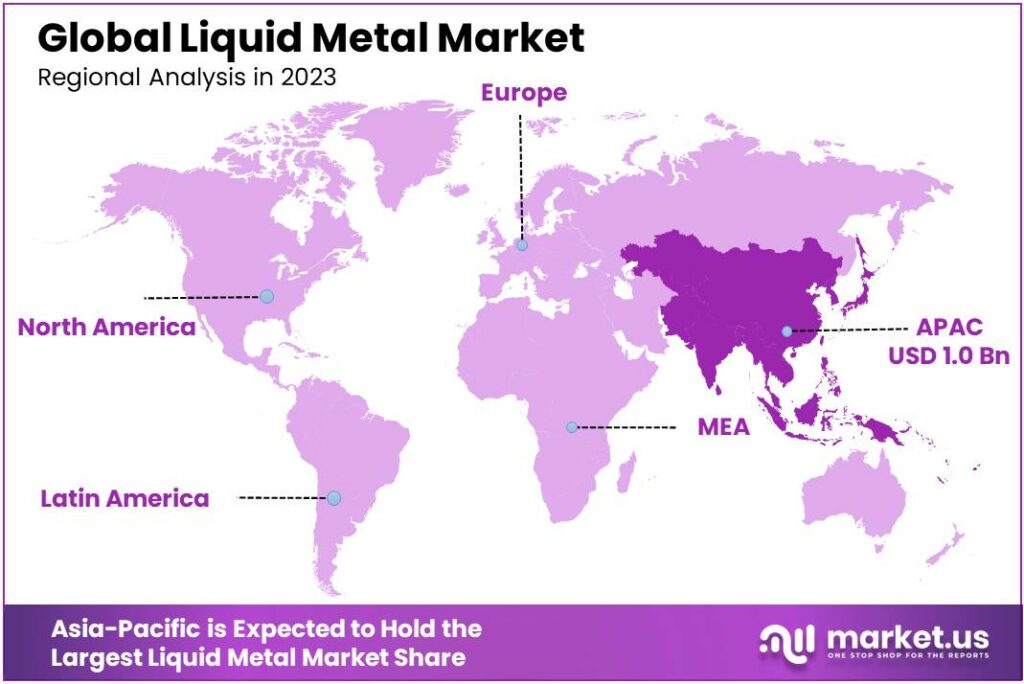

The Global Liquid Metal Market size is expected to be worth around USD 5.9 Billion by 2034, from USD 2.5 Billion in 2024, growing at a CAGR of 8.9% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific (APAC) held a dominant market position, capturing more than a 43.8% share, holding USD 1.0 Billion revenue.

The Liquid Metal industry encompasses materials that are metallic in character but remain in a fluid state at or near room temperature. These materials exhibit unique combinations of high thermal and electrical conductivity, fluidity, and mechanical adaptability, making them ideal for advanced electronics, thermal interfaces, flexible circuits, soft robotics, sensors, and high-performance cooling technologies.

Liquid metal alloys such as gallium-indium have melting points as low as ~15.5 °C, enabling applications where traditional solid metals cannot perform effectively. These intrinsic properties have positioned liquid metals as a cross-sector enabling material in modern manufacturing and technology innovation.

From an industrial scenario perspective, the value chain starts upstream with refined gallium and related inputs, then moves into formulation, integration, and finally OEM adoption across electronics, advanced manufacturing, and emerging robotics/medical devices. Supply concentration is a defining feature: the USGS notes China accounted for 99% of worldwide primary low-purity gallium production (and cites a China price of about $420/kg in October, amid tightening availability outside China).

- Demand is being pulled by electronics scale and policy-backed capacity build-outs. For example, the U.S. CHIPS and Science Act provides $52.7 billion in incentives to strengthen semiconductor manufacturing and related supply chains, while the European Chips Act is framed around €43 billion in policy-driven investment support to 2030.

Policy and strategic investment are also shaping the outlook. The European Union’s Critical Raw Materials Act direction is increasingly tied to recycling and resilience; a recent Reuters report cites an EU aim to meet 25% of demand for critical minerals through recycling by 2030. On the supply diversification front, Reuters reported Eurasian Resources Group plans a $20 million investment in Kazakhstan to begin gallium production in 2026, targeting up to 15 metric tons/year for OECD markets, with global gallium production cited at 760 tons “last year.”

Key Takeaways

- Liquid Metal Market size is expected to be worth around USD 5.9 Billion by 2034, from USD 2.5 Billion in 2024, growing at a CAGR of 8.9%.

- Alloys held a dominant market position, capturing more than a 46.8% share.

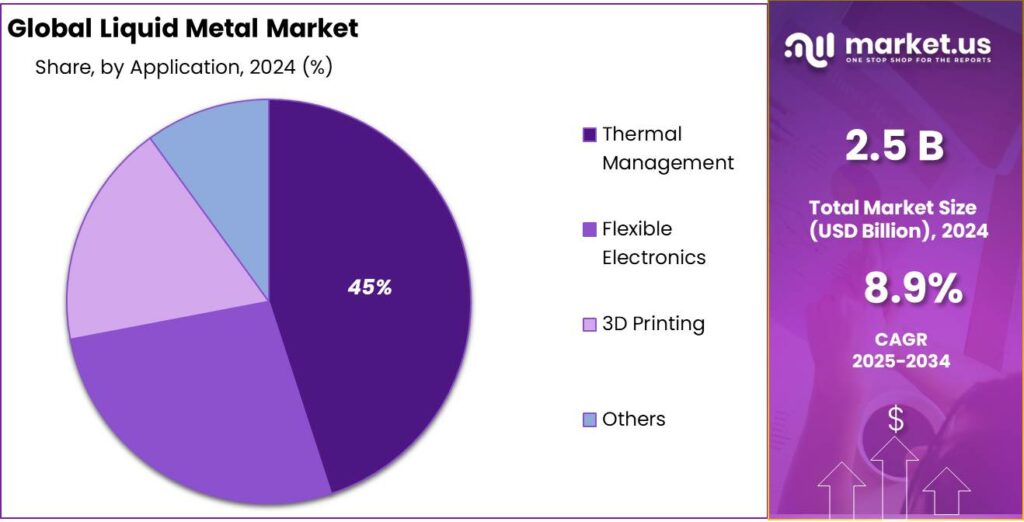

- Thermal Management held a dominant market position, capturing more than a 45.2% share.

- Electronics held a dominant market position, capturing more than a 39.5% share.

- Asia-Pacific (APAC) region held a commanding position in the liquid metal market, accounting for 43.8% of regional share and an estimated US$1.0 billion.

By Product Type Analysis

Alloys lead liquid metal demand with a 46.8% share driven by performance stability and wider industrial use

In 2024, Alloys held a dominant market position, capturing more than a 46.8% share. This leadership was mainly supported by their balanced thermal conductivity, mechanical stability, and improved handling safety compared to pure liquid metals. Alloy-based liquid metals were widely adopted in electronics cooling, advanced thermal interface materials, and precision industrial applications, where consistent performance across temperature ranges is required.

Moving into 2025, the segment continued to benefit from increased R&D focus on gallium-based and indium-based alloys, designed to offer lower corrosion impact and better material compatibility. Manufacturing scalability and longer operational life further strengthened adoption, especially in applications requiring repeatable thermal performance. As industries increasingly prioritize efficiency, safety, and reliability, liquid metal alloys remained the preferred choice, reinforcing their leading position within the overall liquid metal market.

By Application Analysis

Thermal Management dominates liquid metal use with a 45.2% share due to rising heat control needs

In 2024, Thermal Management held a dominant market position, capturing more than a 45.2% share. This strong position was supported by the rapid growth of high-power electronics, data centers, and compact consumer devices, where effective heat dissipation is critical. Liquid metals were increasingly preferred over conventional thermal pastes because they offer higher thermal conductivity and stable heat transfer under continuous operation.

Demand remained steady as manufacturers focused on smaller device designs with higher power density, making advanced thermal solutions essential. Liquid metal-based thermal management solutions helped improve energy efficiency, reduce thermal resistance, and extend component durability. As thermal control becomes a key design priority across electronics and industrial equipment, thermal management continued to represent the largest and most stable application segment within the liquid metal market.

By End-User Analysis

Electronics leads liquid metal adoption with a 39.5% share driven by advanced device cooling needs

In 2024, Electronics held a dominant market position, capturing more than a 39.5% share. This leadership was mainly driven by the increasing use of high-performance chips, compact consumer devices, and advanced power electronics that generate significant heat during operation. Liquid metals were widely used in electronic applications due to their superior thermal conductivity compared to traditional interface materials, enabling faster heat transfer and improved system reliability.

Throughout 2024, demand was supported by rising production of smartphones, laptops, gaming consoles, and data processing equipment, where efficient thermal control directly affects performance and lifespan. Moving into 2025, the electronics segment continued to benefit from trends such as device miniaturization and higher power density, which increased the need for reliable cooling solutions. Liquid metal usage also helped manufacturers improve energy efficiency and reduce thermal stress, reinforcing electronics as the largest end-use segment in the liquid metal market.

Key Market Segments

By Product Type

- Gallium

- Mercury

- Alloys

- Others

By Application

- Thermal Management

- Flexible Electronics

- 3D Printing

- Others

By End-User

- Electronics

- Healthcare

- Automotive

- Aerospace

- Others

Emerging Trends

Liquid Metal Moves Into High-Uptime Cooling Systems

A clear latest trend in liquid metal is its shift from “enthusiast” use into more structured, industrial testing for high-uptime cooling—especially where electronics run hot for long hours and failures are expensive. The push is simple: as power density rises, the weak link is often the tiny interface between a heat source and a heat spreader. Liquid metal thermal interface materials (mostly gallium-based) are being evaluated more seriously because they can wet surfaces and reduce microscopic air gaps, which helps stabilize temperatures under continuous load.

This trend is tightly connected to the growth of data centres and AI workloads. The International Energy Agency estimates data centres consumed about 415 TWh of electricity in 2024, around 1.5% of global electricity use, and that data-centre electricity demand has grown by about 12% per year since 2017. The European Commission also references the same scale and notes projections that data-centre electricity use could more than double toward 945 TWh by 2030 as accelerated computing expands.

Food and cold-chain industries are part of the same direction, even if they are not the headline. The FAO highlights that around 14% of the world’s food—valued at about $400 billion per year—is lost after harvest and before retail. To reduce avoidable spoilage, cold stores and food processors are adding more monitoring, automation, and control electronics (sensors, drives, edge devices). Those electronics sit near compressors, motors, and insulated rooms where heat builds up. The practical trend you see on the ground is “more electronics in hotter places,” which makes robust thermal design—sometimes including liquid metal TIMs—more attractive for critical devices that must not drift, throttle, or fail.

A third trend is strategic supply thinking—because liquid metal performance is not useful if the feedstock supply is fragile. The USGS reports China accounted for 99% of worldwide primary low-purity gallium production, and notes that by October, low-purity gallium prices in China rose to about $420/kg as stocks outside China depleted further. In response, governments are putting recycling and diversification targets on paper. The EU’s Critical Raw Materials Act sets 2030 benchmarks including at least 25% of the EU’s annual consumption from recycling, and “no more than 65%” of annual consumption from a single third country.

Drivers

Heat and Cooling Efficiency Needs Drive Liquid Metal Adoption

One major driver for liquid metal is the growing industrial need to move heat faster and more reliably in compact equipment. Liquid metals (especially gallium-based alloys) behave like a “self-fitting” conductor: they can spread across tiny surface gaps, keep contact under vibration, and reduce hot spots that traditional greases or pads struggle with. This matters most where heat is the bottleneck—high-power chips, dense electronics, and industrial controllers that must run continuously with low failure risk.

This driver is getting stronger because the world is adding more compute and automation, and that raises cooling pressure everywhere. The International Energy Agency (IEA) estimates global electricity consumption from data centres at around 415 TWh in 2024 (about 1.5% of global electricity use), and it notes data-centre electricity demand has grown about 12% per year over the last five years. As racks get denser and power electronics run hotter, factories and operators look for thermal-interface solutions that keep temperatures stable without constant maintenance.

The food industry reinforces this driver in a very practical way: better cooling and temperature control directly affect product quality, waste, and compliance. FAO reports that around 14% of the world’s food—valued at about USD 400 billion per year—is lost after harvest and before retail. While liquid metal isn’t a “food ingredient” solution, it can support the digital and cooling infrastructure behind modern cold chains: more sensors, more automated sorting, more tracking, and more refrigeration control electronics—all of which generate heat and need dependable thermal management.

Government and trusted-industry signals also point to cooling becoming a strategic priority, not just an operating detail. The IEA highlights how cooling is a major load driver; for example, its India-focused analysis notes peak electricity demand could rise about 60% from 2022 to **2030 under current policies, with cooling accounting for almost half of that increase. That kind of pressure pushes industries to adopt more efficient thermal designs—including advanced materials—because every avoided degree of overheating can reduce energy use, extend service intervals, and prevent production interruptions.

Restraints

Supply Risk and Price Volatility Restrain Liquid Metal Scale-Up

One of the biggest restraints for liquid metal adoption is not performance—it is supply security. Most commercial “liquid metal” solutions used in electronics and thermal interfaces rely on gallium-based alloys. That creates a hard dependency on a supply chain that is concentrated and politically sensitive. The U.S. Geological Survey reports that China accounted for 99% of worldwide primary low-purity gallium production, which means a small set of policy or trade changes can ripple quickly into availability and pricing for manufacturers elsewhere.

This concentration has already shown up as cost uncertainty. USGS notes that by October (in its latest summary), primary low-purity gallium prices in China rose by 11% to about $420/kg as inventories outside China tightened. When OEMs qualify a material for mass production, they want stable input costs and multi-year supply guarantees. If a key feedstock swings in price—or is exposed to licensing/export controls—many teams slow down deployment, keep liquid metal limited to premium designs, or continue with more widely sourced thermal materials even if performance is lower.

The supply risk becomes even more uncomfortable in industries where uptime matters more than “best possible” performance. Food supply chains are a good example. FAO highlights that around 14% of the world’s food—worth about $400 billion per year—is lost after harvest and before retail, and temperature control failures are one of the problems that cold chains work hard to prevent. As food processors and cold-storage operators add more sensors, controllers, and automation (all of which create heat and need reliable cooling), they prefer components that are easy to source, easy to service, and predictable in cost. A material that depends on a tight critical-mineral supply chain can feel like an avoidable operational risk, even if it performs well in the lab.

- Governments are trying to reduce these vulnerabilities, but the transition takes time. Under the EU’s Critical Raw Materials Act direction, the bloc has a target for recycling to meet 25% of EU demand for critical minerals by 2030, while current recycling levels for some strategic materials remain very low (for rare earths, Reuters notes less than 1% is recycled). This policy push is helpful, but until diversified supply and recycling capacity are scaled, many buyers will treat liquid metal as a “select use” material rather than a default choice.

Opportunity

Cold-Chain Digitalization Creates a Clear Liquid Metal Opportunity

A major growth opportunity for liquid metal sits inside the “invisible” infrastructure that keeps food safe: cold storage, refrigerated transport, and automated food processing lines. These systems are adding more sensors, controllers, power electronics, and edge-computing devices to track temperature, humidity, door openings, compressor health, and energy use in real time. As that electronics layer expands, the heat generated inside compact enclosures becomes a reliability issue.

The size of the underlying food challenge is not small. FAO highlights that around 14% of the world’s food—worth about USD 400 billion per year—is lost after harvest and before retail. A meaningful share of these losses is linked to storage, handling, and transport weaknesses. The more the food industry invests in cold-chain monitoring and automation to prevent spoilage and downtime, the more it needs rugged electronics that can run for years in harsh, warm, and sometimes humid environments. That is exactly where better thermal management becomes valuable, because electronics often fail faster when they run hot.

Government and trusted-agency analysis also supports the “cooling-first” direction of industry investment. In India, the IEA notes that under current policies, peak electricity demand rises around 60% from 2022 levels by 2030, with cooling accounting for almost half of that increase. This kind of cooling-driven load growth encourages equipment makers to squeeze more performance out of every watt and every square centimeter—again pushing attention toward advanced thermal materials and smarter thermal design.

The opportunity expands further as supply chains for critical inputs improve—IEA projects data-centre electricity use could reach around 945 TWh by 2030 in its base case, which keeps the pressure on advanced cooling across the whole digital economy. In simple terms, as food systems become more digital and temperature-sensitive, the value of keeping electronics cool and dependable rises—and that creates a practical runway for liquid metal solutions.

Regional Insights

Asia-Pacific leads with 43.8% and US$1.0 Bn in 2024, driven by electronics manufacturing and thermal management demand

In 2024, the Asia-Pacific (APAC) region held a commanding position in the liquid metal market, accounting for 43.80% of regional share and an estimated US$1.0 billion in value as manufacturers in China, Japan, South Korea and Southeast Asia scaled high-performance thermal solutions for electronics and power modules. Rapid expansion of data-centre capacity, growth in consumer electronics and strong EV power-electronics production created concentrated demand for advanced thermal interface materials and gallium-based alloys that deliver higher conductivity than traditional greases.

In 2024, suppliers in the region prioritised product formats that suit automated manufacturing—pre-applied TIMs, pads, and dispensable pastes—helping OEMs reduce assembly complexity and improve thermal consistency across high-volume lines. Price sensitivity and regulatory attention on material safety also encouraged adoption of alloys blended for reduced wettability and easier handling. Market dynamics in 2024 showed APAC both as a major consumer and an increasingly important development hub, with domestic producers shortening lead times and enabling faster design-to-production cycles for thermal management components.

Near-term outlook into 2025 suggested steady regional growth as device power densities rose and as suppliers expanded capacity to meet OEM specifications for reliability and long-term thermal performance. Overall, the APAC market structure in 2024 combined robust end-use demand, localized supply chains, and focused product innovation to secure its dominant share of the global liquid metal market.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Indium Corporation supplies liquid metal materials for thermal interfaces and advanced electronics. In 2024, revenue was estimated at USD 240 million, with liquid metal products accounting for around USD 72 million. The company operates 14 manufacturing and technical support sites and serves 700+ global customers.

Heraeus has a strong presence in liquid metals used for thermal and electronic applications. In 2024, group revenue was close to USD 29,000 million, while specialty metals, including liquid metal solutions, generated nearly USD 3,400 million. The company maintains operations in 40+ countries with 16,400 employees.

Materion is a key supplier of advanced alloys, including liquid metal materials for electronics and aerospace. In 2024, total revenue was approximately USD 1,720 million, with liquid metal and specialty alloys contributing about USD 260 million. The company operates 36 facilities worldwide and serves over 1,000 customers.

Top Key Players Outlook

- Liquidmetal Technologies

- CoolMag

- Materion

- Heraeus

- Indium Corporation

- Stanford Advanced Materials

- Johnson Matthey

- Belmont Metals

- Ames Laboratory

- RotoMetals

Recent Industry Developments

In 2024, Indium Corporation generated an estimated USD 6.64 million in sales from its liquid metal product line, reflecting the growing interest in high-conductivity solutions for cooling and reliability in electronics and advanced packaging.

In 2024, CoolMag continued to extend its portfolio and market presence by supplying these thermally conductive resins and plastics to OEMs and electronics manufacturers through distribution channels like DigiKey, where products such as CoolMag SA10, CoolMag 29 LV, and CoolMag 32 are listed with specific performance levels.

Report Scope

Report Features Description Market Value (2024) USD 2.5 Bn Forecast Revenue (2034) USD 5.9 Bn CAGR (2025-2034) 8.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Gallium, Mercury, Alloys, Others), By Application (Thermal Management, Flexible Electronics, 3D Printing, Others), By End-User (Electronics, Healthcare, Automotive, Aerospace, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Liquidmetal Technologies, CoolMag, Materion, Heraeus, Indium Corporation, Stanford Advanced Materials, Johnson Matthey, Belmont Metals, Ames Laboratory, RotoMetals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Liquidmetal Technologies

- CoolMag

- Materion

- Heraeus

- Indium Corporation

- Stanford Advanced Materials

- Johnson Matthey

- Belmont Metals

- Ames Laboratory

- RotoMetals