Life Science and Chemical Instrumentation Market By Technology (Chromatography, Flow Cytometry, Microscopy, NGS, PCR, and Spectroscopy) By End-User (Pharmaceutical & Biotechnology Companies, Hospital & Diagnostic Centers, and Contract Research Organizations & Research Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156407

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

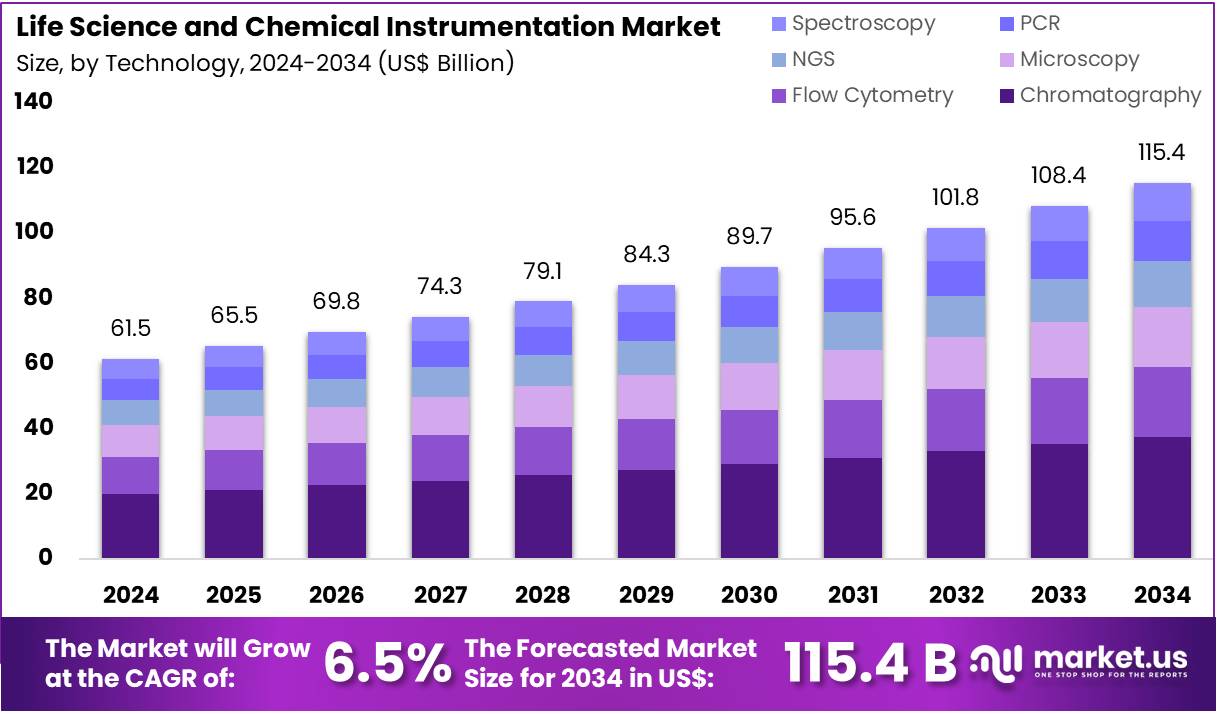

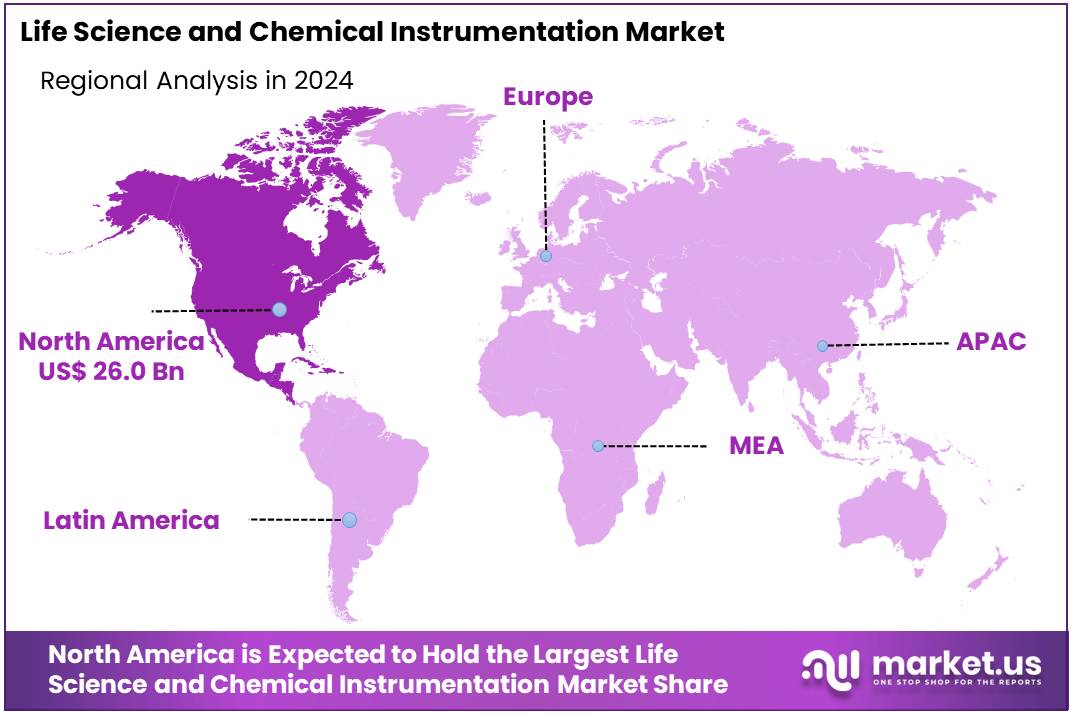

The Life Science and Chemical Instrumentation Market Size is expected to be worth around US$ 115.4 billion by 2034 from US$ 61.5 billion in 2024, growing at a CAGR of 6.5% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 42.2% share and holds US$ 26 Billion market value for the year.

Increased investment in pharmaceutical research and development (R&D) and the rising emphasis on precision medicine are major factors driving growth in the life science and chemical instrumentation market. Pharmaceutical companies globally continue to dedicate significant resources to drug innovation, with industry leaders like Merck and Johnson & Johnson investing billions annually. This consistent funding is driving demand for a wide variety of high-precision instruments used throughout the drug discovery process, including for compound identification, structural analysis, bioprocess monitoring, and quality control. Additionally, the push toward personalized medicine is further fueling market growth, as it relies on instruments capable of detailed genomic, proteomic, and metabolic profiling to customize treatments for individual patients.

Technological advancements are playing a crucial role in shaping the market, as innovations continue to improve efficiency and expand application possibilities. For example, the integration of artificial intelligence (AI) and machine learning is a game-changer, automating repetitive tasks, analyzing complex data, and optimizing instrument performance. Strategic partnerships between industry leaders and academic institutions are also accelerating the pace of translational research. A notable example is Agilent’s 2022 collaboration with the National University of Singapore and the National University Hospital to establish a US$38 million R&D unit dedicated to advancing clinical diagnostics and developing new biochemical methods to improve patient outcomes.

The growing demand for open-source and accessible platforms is democratizing research, creating new opportunities for market growth. TeselaGen Biotechnology’s 2022 launch of the free, cloud-based Community Edition of its DESIGN Module, which enables researchers to design DNA constructs and primers, exemplifies this trend. This move supports the broader adoption of advanced genetic engineering. Combined with the ongoing need for instruments in bioprocessing, environmental monitoring, and food testing, the life science and chemical instrumentation market is well-positioned for continued expansion, serving as a vital catalyst for scientific and technological advancement.

Key Takeaways

- In 2024, the market for life science and chemical instrumentation generated a revenue of US$ 61.5 billion, with a CAGR of 6.5%, and is expected to reach US$ 115.4 billion by the year 2034.

- The technology segment is divided into chromatography, flow cytometry, microscopy, NGS, PCR, and spectroscopy, with chromatography taking the lead in 2024 with a market share of 32.5%.

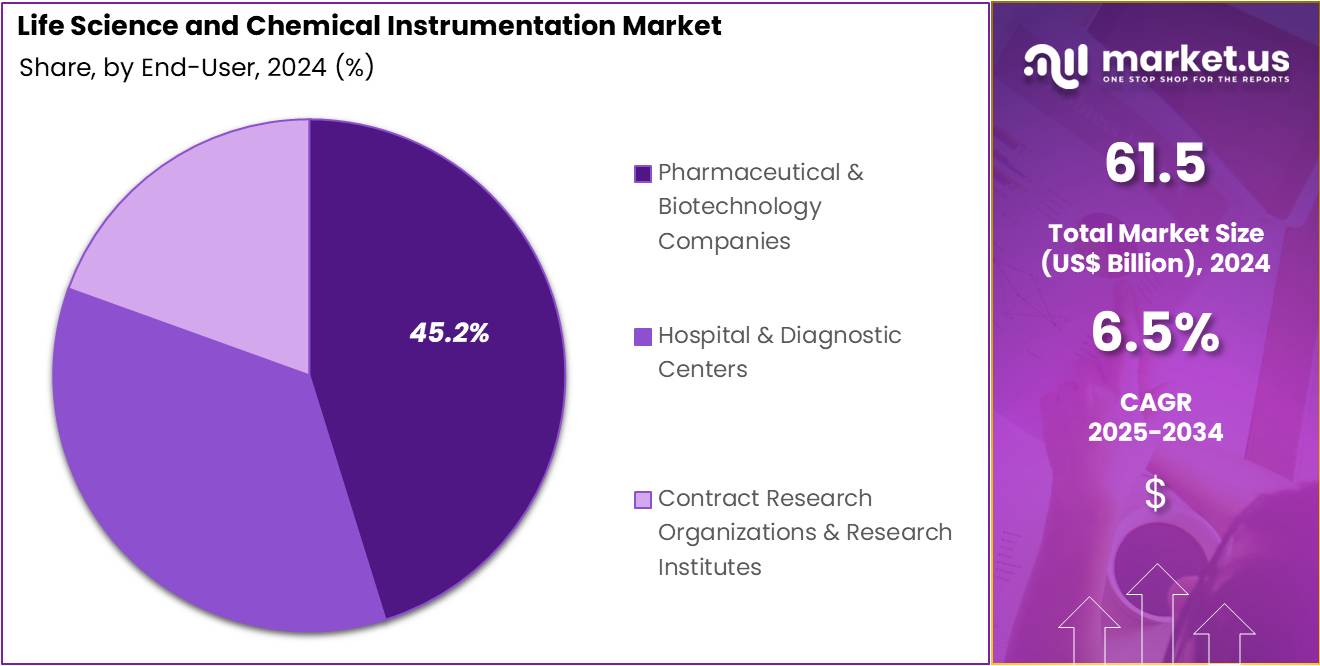

- Considering end-user, the market is divided into pharmaceutical & biotechnology companies, hospital & diagnostic centers, and contract research organizations & research institutes. Among these, pharmaceutical & biotechnology companies held a significant share of 45.2%.

- North America led the market by securing a market share of 42.2% in 2023.

Technology Analysis

Chromatography holds the largest share of 32.5% in the life science and chemical instrumentation market. Its growth is expected to continue due to the increasing demand for efficient separation techniques in research and clinical settings. Chromatography is critical in pharmaceutical and biotechnology industries for purifying compounds, drug development, and quality control. As drug discovery processes become more complex, the need for advanced chromatography techniques is projected to rise.

Regulatory requirements for stringent quality assurance in the pharmaceutical sector are likely to drive further adoption. Chromatography’s ability to provide high-resolution analysis of biological and chemical samples is expected to enhance its demand in academic research. Technological innovations, such as 2D chromatography and miniaturized systems, are likely to improve efficiency, supporting wider adoption in clinical diagnostics. Additionally, the integration of chromatography with other analytical methods like mass spectrometry is anticipated to fuel growth.

The increasing focus on personalized medicine and the growing prevalence of chronic diseases will likely contribute to increased demand. Furthermore, expanding healthcare infrastructure and rising investments in life sciences are expected to drive the segment’s growth, especially in emerging markets. Chromatography’s established role in diagnostic labs will ensure its continued dominance, as new applications in biomarker analysis and food safety testing expand its reach.

End-User Analysis

Pharmaceutical and biotechnology companies represent 45.2% of the end-user segment in the life science and chemical instrumentation market. This segment’s growth is projected to continue as these companies rely heavily on advanced instrumentation for drug discovery, development, and quality control. The increasing demand for biologics and personalized medicine is likely to fuel the need for precise analytical instruments.

Companies are expected to invest heavily in high-throughput screening, bioanalysis, and chemical testing to meet stringent regulatory standards. As the global pharmaceutical industry expands, particularly in emerging markets, the adoption of life science and chemical instruments is anticipated to rise. Technological advancements, such as automated systems for drug formulation and testing, are likely to drive further growth in this segment. The growing emphasis on biologics, gene therapies, and monoclonal antibodies will likely increase demand for chromatography, NGS, and other critical technologies.

Pharmaceutical companies are also focusing on improving drug efficacy and patient safety, which will lead to more frequent and detailed chemical and biological testing. As research and development efforts intensify, particularly for rare diseases and complex disorders, biotechnology companies are expected to increase their reliance on life science instrumentation. Furthermore, partnerships between pharmaceutical companies and research institutions are likely to expand the use of these instruments in clinical trials and preclinical studies, further propelling segment growth.

Key Market Segments

By Technology

- Chromatography

- Flow Cytometry

- Microscopy

- NGS

- PCR

- Spectroscopy

By End-user

- Pharmaceutical & Biotechnology companies

- Hospital & Diagnostic centers

- Contract Research Organizations & Research institutes

Drivers

Increasing R&D expenditure in the pharmaceutical and biotechnology sectors is driving the market

The life science and chemical instrumentation market is driven by the consistent and escalating investment in research and development, particularly within the pharmaceutical and biotechnology sectors. As these industries seek to discover and develop new therapies, drugs, and diagnostics, they rely heavily on cutting-edge analytical and separation instruments to perform complex research.

A 2024 analysis by the National Science Foundation revealed that federal obligations for research and experimental development in the US totaled US$ 186.9 billion in fiscal year 2024, with a significant portion allocated to health and life sciences. This substantial funding fuels the procurement of advanced equipment like mass spectrometers, chromatographs, and spectroscopy systems.

Furthermore, major pharmaceutical companies are consistently increasing their R&D budgets to maintain a competitive pipeline. This continuous influx of capital into research and a commitment to innovation ensure a steady and growing demand for the sophisticated tools that accelerate scientific discovery and drug development.

Restraints

The high initial cost and operational complexity are restraining the market

A significant restraint on the market is the substantial initial capital investment required for high-end life science and chemical instrumentation. Advanced systems like mass spectrometers, high-performance liquid chromatography (HPLC) systems, and nuclear magnetic resonance (NMR) spectrometers can have a price tag that extends into the hundreds of thousands or even millions of dollars. This high cost creates a significant barrier to entry for smaller academic institutions, independent research laboratories, and start-up biotechnology firms with limited budgets.

A 2024 review of the analytical instruments market highlighted that the average cost of a single HPLC system can range from US$10,000 to over US$50,000, depending on its configuration, while a high-end mass spectrometer can exceed US$500,000. Beyond the purchase price, these complex instruments require specialized operational expertise and ongoing maintenance. The need for highly trained personnel to run the equipment and interpret the data adds to the total cost of ownership. This dual challenge of steep financial investment and the requirement for specialized human capital consequently limits the widespread adoption of these instruments.

Opportunities

The growing adoption of laboratory automation is creating growth opportunities

The market is presented with significant opportunities from the increasing adoption of automation and robotics in research and diagnostic laboratories. As labs seek to improve efficiency, increase throughput, and reduce human error, they are integrating automated workstations and liquid handling systems into their workflows. A 2024 analysis of the lab automation sector found that automated workstations registered the largest market share, with key players releasing new platforms to meet this demand.

For example, a major industry leader in 2024 launched a new automated liquid handling system that supports a variety of complex laboratory tasks, from genomics to drug discovery. This shift towards automation is not only improving productivity but also making new, complex experiments feasible on a large scale. By enabling labs to run more samples and generate higher-quality data faster, automation creates a direct need for compatible, high-throughput instrumentation. This synergy between automation and instrumentation drives further innovation and creates a strong demand for integrated, robotic-friendly systems.

Impact of Macroeconomic / Geopolitical Factors

The life science and chemical instrumentation market is currently navigating a challenging macroeconomic and geopolitical landscape that is impacting both capital investment and supply chain reliability. The global increase in interest rates, implemented by central banks to curb inflation, has raised the cost of borrowing for businesses and research institutions alike. This shift is influencing investment strategies, with a mid-2025 report on the US pharmaceutical sector highlighting that rising interest rates are particularly challenging for early-stage companies, making venture capital and financing for high-cost equipment more expensive.

Meanwhile, geopolitical instability has intensified risks to the supply chain, particularly for rare earth metals and semiconductors that are critical for advanced instrumentation. A 2024 analysis by the International Energy Agency (IEA) noted the sector’s heavy dependence on a limited supply of these minerals, warning that trade disruptions could lead to shortages. Despite these challenges, the market is showing resilience. Companies are actively adjusting by diversifying their suppliers and increasing inventories of key components, enhancing operational stability and positioning the market for future growth.

US tariffs are further reshaping the global supply chains for life science and chemical instrumentation, creating both financial obstacles and new opportunities. The imposition of tariffs on imported scientific instruments from key international markets has raised the final cost of these products for US-based academic institutions and biotech companies. A 2024 analysis by the US House of Commons Library revealed that tariffs on scientific instruments from the UK could reach up to 10%, adding significant financial strain on importing organizations. This increase in costs can slow the adoption of new technologies and strain budgets for equipment procurement.

However, these changes are also creating strong incentives for reshoring production. Many companies are accelerating plans to establish or expand production facilities in the US to avoid import duties. For instance, Johnson & Johnson’s 2024 announcement of a multi-billion-dollar investment in a new manufacturing campus in North Carolina illustrates this shift. This significant move is fostering domestic production, reinforcing the US manufacturing sector, and ensuring a more stable and predictable supply chain for essential products.

Latest Trends

Miniaturization and the development of portable instrumentation is a recent trend

A significant trend in 2024 is the move toward miniaturization and the development of portable, user-friendly life science and chemical instrumentation. Traditionally, high-end analytical equipment was large, stationary, and confined to centralized laboratories. However, a growing need for on-site, rapid analysis in fields such as environmental monitoring, food safety, and clinical diagnostics is driving the development of compact, handheld, and field-deployable devices. In 2024, multiple companies introduced new handheld analyzers and portable spectrometers that offer laboratory-grade accuracy in a fraction of the size.

For instance, a major manufacturer released a fourth-generation handheld Raman analyzer designed for instant chemical identification and threat analysis, showcasing a clear shift toward devices for point-of-need use. This trend addresses the need for faster decision-making, especially in emergency response or remote settings. The development of smaller, more robust instruments also makes them more accessible and affordable for a wider range of users, thereby democratizing access to powerful analytical capabilities.

Regional Analysis

North America is leading the Life Science and Chemical Instrumentation Market

The North American market for life science and chemical instrumentation held a commanding 42.2% share of the global market in 2024. This dominant position is driven by several key factors, including substantial and consistent funding for research and development from both government and private sectors, a robust and innovative biopharmaceutical industry, and a high concentration of leading academic institutions.

For instance, the National Institutes of Health (NIH) is a major driver, with a budget of nearly US$48 billion in 2023, funding numerous research projects that rely on advanced life science and chemical instruments. Additionally, the Food and Drug Administration (FDA) plays an active role in facilitating the development of new drugs and medical devices, approving 50 novel drugs in 2024, a figure that aligns with the average of recent years. This high rate of innovation and product development translates into sustained demand for advanced analytical and research tools, further reinforcing market growth in the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific market for life science and chemical instrumentation is expected to experience the fastest growth during the forecast period. This growth is primarily attributed to rapidly increasing government investments in research and development, a flourishing biopharmaceutical sector, and a growing emphasis on technological self-sufficiency.

For example, China’s total expenditure on R&D reached 3.6 trillion yuan (approximately US$496 billion) in 2024, marking a sixteen-fold increase over the past decade. This expansion is driven by government initiatives aimed at fostering a vibrant biotechnology research and manufacturing ecosystem. Furthermore, the region’s aging population and the increasing prevalence of chronic diseases create a significant demand for advanced diagnostic and therapeutic research, further stimulating the need for these instruments.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the sector are driving growth through a strategic focus on technological innovation, acquisitions, and expanding their global presence. Companies are heavily investing in research and development to create next-generation instruments with enhanced automation, artificial intelligence, and data analytics capabilities, which improves precision and productivity in complex research and manufacturing workflows. They are also actively acquiring smaller, innovative firms to expand their product portfolios and enter new application areas like cell and gene therapy. Furthermore, manufacturers are establishing a stronger foothold in emerging markets where increasing R&D activities are fueling demand for advanced scientific tools. This multifaceted approach solidifies their market leadership and competitive advantage.

Agilent Technologies, Inc. is an American company with a global presence, providing instruments, software, services, and consumables for laboratories. Founded in 1999 as a spin-off from Hewlett-Packard, Agilent offers a comprehensive suite of solutions for various markets, including life sciences, diagnostics, and applied chemicals. The company focuses on helping customers address complex laboratory challenges by delivering solutions that span the entire workflow, from sample preparation to data interpretation. Through continuous investment in research and development, Agilent maintains its reputation for creating cutting-edge analytical and diagnostic technologies

Recent Developments

- In June 2025: Dxcover, a UK-based company specializing in AI-driven multiomic technology for early cancer detection, officially opened its US headquarters in Nashville, Tennessee. This strategic expansion aims to bring the company’s PANAROMIC™ cancer test to the US, the largest life sciences market globally. The new facility will function both as a research and development center and as a manufacturing hub for Dxcover’s innovative infrared spectroscopy platform. The company also plans to foster partnerships with local healthcare providers and biotechnology firms to accelerate its cancer diagnostics initiatives and strengthen its leadership in the field.

- In May 2025: DuPont unveiled its AmberChrom™ TQ1 chromatography resin, designed for the purification of peptides and oligonucleotides. This addition broadens DuPont’s bioprocessing portfolio and supports a wide range of biopharmaceutical applications. According to company leadership, the resin is expected to facilitate faster development and commercialization of peptide- and oligonucleotide-based therapeutics, enhancing efficiency in biopharma manufacturing workflows.

- In 2022: MGI introduced HotMPS, a novel sequencing chemistry tailored for its DNBSEQ-G400 sequencer. The chemistry enhances sequencing accuracy and performance and was made commercially available in select international markets starting in April 2022, providing researchers with improved tools for high-throughput genomics studies.

Top Key Players in the Life Science and Chemical Instrumentation Market

-

- Water Corporation

- Thermo Fisher Scientific Inc

- Shimadzu Corporation

- PerkinElmer Inc

- Merck KGaA

- Danaher Corporation

- Bruker Corporation

- Bio-Rad Laboratories, Inc

- Agile Technologies Inc

- Sartorius AG

Report Scope

Report Features Description Market Value (2024) US$ 61.5 billion Forecast Revenue (2034) US$ 115.4 billion CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Chromatography, Flow Cytometry, Microscopy, NGS, PCR, and Spectroscopy) By End-User (Pharmaceutical & Biotechnology Companies, Hospital & Diagnostic Centers, and Contract Research Organizations & Research Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Water Corporation, Thermo Fisher Scientific Inc, Shimadzu Corporation, PerkinElmer Inc, Merck KGaA, Danaher Corporation, Bruker Corporation, Bio-Rad Laboratories, Inc, Agile Technologies Inc, Sartorius AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Life Science and Chemical Instrumentation MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Life Science and Chemical Instrumentation MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Water Corporation

- Thermo Fisher Scientific Inc

- Shimadzu Corporation

- PerkinElmer Inc

- Merck KGaA

- Danaher Corporation

- Bruker Corporation

- Bio-Rad Laboratories, Inc

- Agile Technologies Inc

- Sartorius AG