Global Life Insurance Policy Administration Systems Market Share Analysis Report By Component (Software, Services (Professional Services, Managed Services)), By Deployment Mode (Cloud-Based (SaaS), On-Premises), By End-User (Insurance Companies, Banks and Financial Institutions, Others), By Policy Type (Term Life Insurance, Whole Life Insurance, Universal Life Insurance, Variable Life Insurance), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153418

- Number of Pages: 336

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

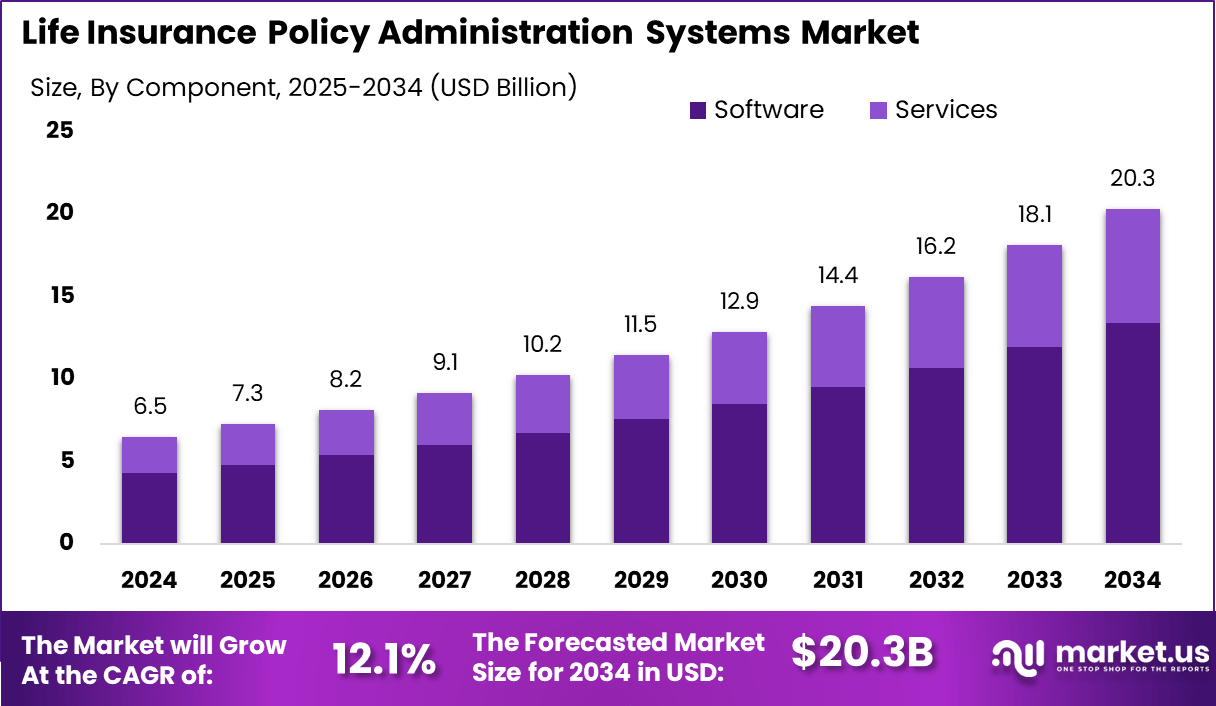

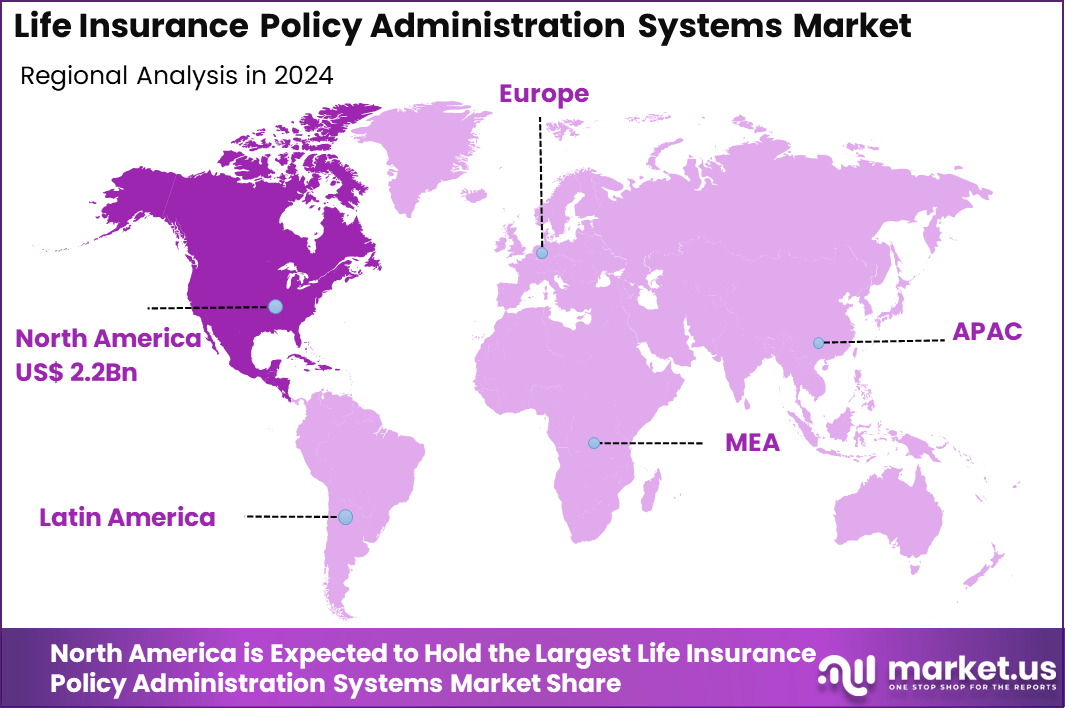

The Global Life Insurance Policy Administration Systems Market size is expected to be worth around USD 20.3 Billion By 2034, from USD 6.5 billion in 2024, growing at a CAGR of 12.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 35% share, holding USD 2.2 Billion revenue.

Life insurance policy administration systems create the digital bridge connecting insurers and policyholders across the entire journey of a policy. These systems handle everything from issuing new policies and collecting premiums to managing claims and customer records. By automating repetitive and critical tasks, such platforms drive both operational efficiency and better customer care.

The push toward automation is the strongest driving force behind the growing interest in life insurance policy administration systems. As insurance products grow complex and customers expect fast digital service, insurers face strong pressure to upgrade policy management. Equally influential is the industry’s commitment to reducing errors, cutting costs, and accelerating everyday operations through the use of smart technology.

Demand for advanced policy administration platforms continues to build as insurance companies strive for more personalized and timely service. Modern life insurance buyers expect round-the-clock access to policy information, fast claim settlements, and self-service tools. The steady shift to remote work has only amplified these needs, encouraging insurers to seek systems that support digital-first engagement and robust data security.

Scope and Forecast

Report Features Description Market Value (2024) USD 6.5 Bn Forecast Revenue (2034) USD 20.3 Bn CAGR (2025-2034) 12.1% Largest Segment Insurance Companies Largest Market North America [35% market share] Largest Country U.S. [USD 6.25 Bn Market Revenue] According to LLCBuddy, around 96% of individuals aged 20–49 in Social Security-eligible jobs in 2020 had access to life insurance through the program. Social Security operates efficiently, with administrative costs at just 0.6% of annual payments – significantly lower than private annuities. Benefits are progressive; high earners receiving 160% of the average wage replace only about 30% of their prior income.

Estimates from the Social Security Administration show that 97% of people aged 60–89 currently receive or are expected to receive benefits. For an average young worker with a spouse and two children, this coverage equaled a life insurance policy worth nearly $800,000 in 2020. Additionally, about 7% of new workers are expected to die before retirement, while many others may face disability

Key Insight Summary

- The Global Life Insurance Policy Administration Systems Market is projected to reach USD 20.3 billion by 2034, rising from USD 6.5 billion in 2024, with a CAGR of 12.1% over 2025–2034.

- In 2024, North America dominated with over 35% share, generating about USD 2.2 billion in revenue.

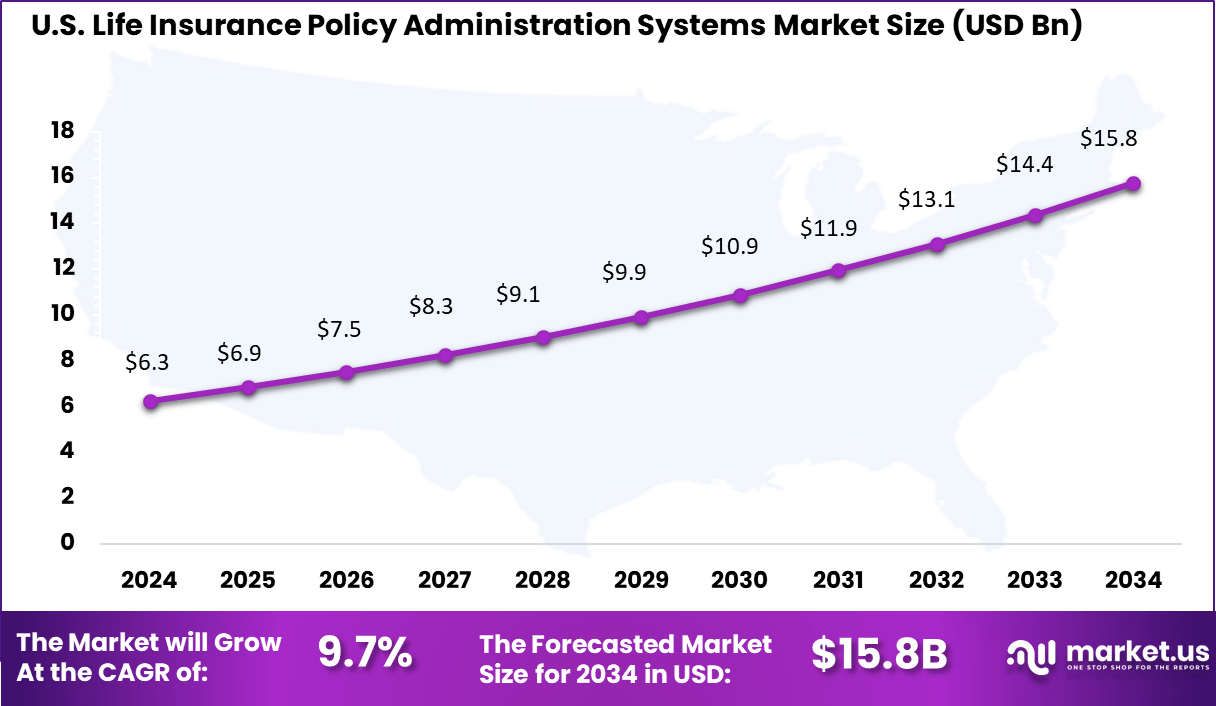

- The United States market was valued at approximately USD 6.25 billion in 2024, growing at a CAGR of 9.7%.

- By component, Software accounted for the largest share of nearly 66%, supported by digitization of insurance processes.

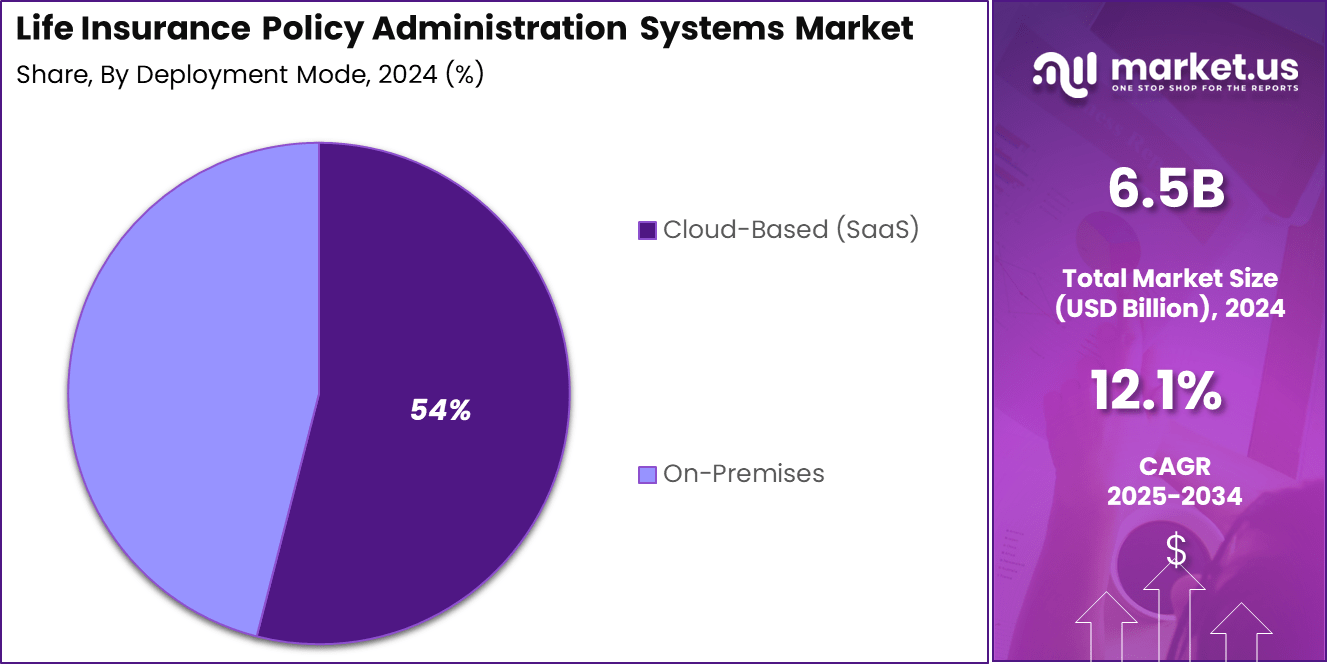

- By deployment mode, Cloud-Based (SaaS) solutions held around 54% share, favored for scalability and lower upfront costs.

- By end-user, Insurance Companies represented the majority with about 71% share, reflecting widespread adoption in core operations.

- By policy type, Term Life Insurance led with approximately 32%, driven by its affordability and growing customer demand.

US Market Size

The U.S. Life Insurance Policy Administration Systems Market was valued at USD 6.3 Billion in 2024 and is anticipated to reach approximately USD 15.8 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 9.7% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 35% share and generating USD 2.2 billion in revenue within the Life Insurance Policy Administration Systems market. This leadership can be attributed to the region’s high rate of digital transformation across the insurance sector, alongside widespread modernization of legacy IT infrastructure.

Major insurance providers in the United States and Canada have made consistent investments in cloud-based platforms, AI-driven policy workflows, and API integrations to improve efficiency and regulatory compliance. Additionally, strong demand for real-time policy servicing and digital self-service portals has accelerated system upgrades across group and individual life insurance lines.

By Component

In 2024, Software segment held a dominant market position, capturing more than a 66% share. Software forms the essential backbone of modern life insurance policy administration, commanding approximately two-thirds of the market share. Its dominance is no surprise – insurers today face constant pressure to improve operational efficiency while ensuring compliance with ever-changing regulations.

Advanced software solutions empower insurers to automate complex administrative processes, from policy issuance and premium calculations to claims management and renewals. By consolidating tasks that once demanded significant manual effort, these platforms significantly minimize errors and accelerate the entire policy lifecycle.

Additionally, the need for flexibility and rapid response drives ongoing investment in policy administration software. Such platforms are no longer just record-keeping tools but have evolved into strategic assets, integrating with external systems and providing insurers with actionable data insights.

The push for customer-centricity means that insurers require software capable of enabling real-time policy updates and personalized communication with policyholders, ultimately leading to improved customer satisfaction and loyalty. As digital transformation continues, insurers are likely to seek out even more sophisticated software solutions to help them stay agile, compliant, and competitive.

By Deployment Mode

In 2024, Cloud-Based (SaaS) segment held a dominant market position, capturing more than a 54% share. Cloud-based (SaaS) solutions are increasingly the go-to deployment mode for insurers, with over half of the market now delivered through the cloud. This shift is driven largely by the flexibility and scalability inherent to SaaS models: insurers can easily adjust capacity as their business grows, paying only for what they use without large, upfront infrastructure investments.

With SaaS, updates and enhancements are delivered seamlessly, ensuring compliance with regulatory changes without disrupting business operations. Moreover, the cloud’s security and disaster recovery capabilities have become a crucial draw for insurers handling sensitive personal and financial data. Advanced encryption and robust access controls ensure compliance with global data privacy laws.

The ability to access policy administration functions securely from any location is particularly valued in an increasingly remote and interconnected work environment. As insurers look to maintain a modern, responsive operational backbone, cloud-based solutions are set to become even more integral to the industry’s digital ecosystem.

By End-User

Insurance companies are by far the largest end-users of policy administration systems, accounting for 71% of market adoption. These organizations are investing in modern administration systems to overhaul legacy processes and centralize data management, allowing for faster underwriting, accurate claims processing, and better regulatory oversight.

Policy administration platforms are helping insurers reimagine their back-office capabilities, supporting everything from policy onboarding to customer engagement, and vastly improving turnaround times. At a strategic level, advanced policy administration systems give insurers the agility they need to respond to changing consumer expectations and regulatory requirements.

For example, with rising demand for digital self-service options, insurance companies are turning to administration systems that provide multi-channel communication and personalized self-service portals. These investments not only reduce administrative burdens but also position insurers to differentiate themselves through superior customer experience and data-driven insights, building stronger and longer-lasting relationships with policyholders.

By Policy Type

Term Life Insurance policies make up a crucial sub-segment within the policy administration market, with a 32% share. These policies, known for their simplicity and fixed-term coverage, align naturally with the strengths of digital administration: automation supports quick policy issuance, real-time premium adjustments, and straightforward claims settlement.

The rising popularity of term policies reflects growing consumer demand for cost-effective, transparent coverage options that provide adequate protection without long-term complexity or high premiums. The strength of the term life segment is further buoyed by digital sales channels, which have made purchasing and managing term policies more accessible than ever before.

Insurers are leveraging policy administration systems to offer instant quotes, paperless applications, and rapid approvals, all of which appeal to digitally savvy consumers. As technology continues to lower barriers for both insurers and policyholders, the trend toward streamlined, accessible term life insurance solutions is likely to accelerate, driving ongoing investment in specialized administration platforms for this policy type.

Key Market Segments

By Component

- Software

- Services

- Professional Services

- Managed Services

By Deployment Mode

- Cloud-Based (SaaS)

- On-Premises

By End-User

- Insurance Companies

- Banks and Financial Institutions

- Others

By Policy Type

- Term Life Insurance

- Whole Life Insurance

- Universal Life Insurance

- Variable Life Insurance

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend

Integration of Artificial Intelligence and Personalization

The world of life insurance policy administration is rapidly evolving, and one of the prominent trends is the growing adoption of artificial intelligence and data-driven personalization. Insurers today are turning to policy administration systems that leverage AI and advanced analytics to tailor products and services around each customer’s unique needs.

This shift is driven by the rising expectations for faster, more relevant customer experiences, with companies striving to offer policy recommendations, claims processing, and communications that are tailored to personal life stages and preferences. This trend is not just about technology; it is about a fundamental change in the way insurers engage with their policyholders.

By implementing systems that can analyze health trends, personal behaviors, and real-time data from various digital sources, insurers can design customized policies and service journeys. The integration of AI-powered chatbots, intelligent customer support, and predictive analytics is significantly enhancing the efficiency of operations while delivering experiences that resonate with individual needs.

Key Driver

Demand for Operational Efficiency and Automation

A major force propelling the adoption of modern policy administration systems in life insurance is the strong need for operational efficiency. Insurance companies face immense pressure to optimize their processes, reduce manual workloads, and respond more quickly to client needs.

Automated policy administration tools are making it possible to accelerate everything from underwriting to claims management, largely by removing repetitive manual tasks that have long slowed down service delivery. As these systems automate core functions such as policy issuance, billing, and claims adjudication, employees are freed from routine paperwork and can focus on higher-value activities.

The result is not only improved efficiency but also a notable enhancement in accuracy, which is vital for customer satisfaction and regulatory compliance. There is greater scope to integrate these systems with other enterprise tools, further streamlining data sharing and process flows. This driver is shaping the way insurers operate, allowing even established firms to remain competitive in a fast-moving sector.

Major Restraint

High Initial Investment and Complexity of Integration

One of the largest obstacles standing in the way of widespread adoption is the substantial upfront cost of implementation. Modern policy administration systems often require not only purchasing advanced software but also investing in new hardware, employee training, and integration with legacy IT environments.

This initial financial burden can be a real setback, especially for smaller firms or those with budget constraints, making it a difficult business case to justify in the short term. Beyond just cost, the technical complexity of integrating new solutions with existing, sometimes outdated, systems is a common sticking point.

The success of a new policy administration system depends strongly on how smoothly it connects with other business applications, databases, and workflows. Insurers are often faced with the task of overcoming data silos and ensuring all systems communicate efficiently while minimizing service interruption during the transition. As a result, this barrier can lead to cautious decision-making, prolonging project timelines and sometimes even preventing full adoption.

Opportunity

Digital Transformation and Customer-Centric Experiences

Digital transformation presents a compelling opportunity for insurers to reshape the experiences they provide. By embracing innovative policy administration systems, organizations can offer digital self-service channels that empower customers to manage their policies, initiate claims, and access support with far more convenience than before.

The move toward digital platforms does not simply streamline internal tasks; it radically changes how customers interact with their insurers, promoting transparency and trust throughout the policy lifecycle. This opportunity also enables insurers to easily adapt their product offerings to changing regulatory conditions and emerging customer expectations.

As these systems become more agile, insurers can quickly launch new types of products or make changes to existing ones, responding with flexibility to both market demands and evolving law. In this way, life insurers are better positioned to attract digital-savvy customers – strengthening relationships and positioning for long-term growth in a digital-first marketplace.

Challenge

Legacy System Limitations and Change Management

Perhaps one of the most persistent challenges in life insurance policy administration is the existence of legacy systems that are resistant to change. Many insurers still rely on old, rigid systems that are expensive to maintain and difficult to integrate with modern digital solutions. This not only slows the pace of innovation but creates barriers to scaling, enhancing products, and staying current with regulatory shifts.

Migrating away from legacy platforms comes with its own unique set of hurdles. Insurers must manage substantial data migration, train personnel on new processes, and ensure continuity of service – all while keeping operational risks at bay. Internal resistance to changing long-standing workflows can also impede progress.

Companies need to foster a culture that is open to digital innovation for new systems to truly deliver their intended benefits. Navigating this challenge requires a strategic approach, balancing technological upgrades with thoughtful change management to secure both operational stability and future readiness.

Key Player Analysis

In the Life Insurance Policy Administration Systems Market, leading players such as Majesco, Accenture Plc, and Oracle Corporation have been driving adoption through modern core system transformation services. These companies offer scalable platforms that support policy issuance, underwriting, and claims. Their solutions often integrate cloud, AI, and digital tools to improve speed and accuracy.

Other major contributors include Insurity, EXL, Infosys, and FAST Technology. These firms focus on delivering modular, API-based systems that support flexibility in life insurance workflows. Their platforms emphasize automation, compliance readiness, and seamless integration with legacy systems. This has gained traction among insurers seeking cost-effective upgrades.

Additional companies such as Edlund, EIS Group Inc., AgencySmart, and Sapiens International Corporation are also expanding their influence in this domain. These vendors offer end-to-end life insurance policy solutions with configurable modules. Furthermore, DXC Technology Company and Concentrix Corporation are leveraging BPO and IT services to strengthen backend administration.

Top Key Players Covered

- Majesco

- Accenture Plc

- Oracle Corporation

- Insurity

- EXL

- Infosys

- FAST Technology

- Edlund

- EIS Group Inc.

- AgencySmart

- DXC Technology Company

- Sapiens International Corporation

- Concentrix Corporation

- Others

Recent Developments

- July 2025: Jio Financial Services Limited (JFSL) and Allianz entered into a binding agreement to form a new 50:50 reinsurance joint venture addressing both general and life insurance in India. This move harnesses JFSL’s robust digital reach with Allianz’s global expertise, specifically to deliver more tailored, digital-first insurance solutions.

- August 2024: Duck Creek Technologies announced the launch of “Policy with Active Delivery,” a next-gen policy administration solution. This product is designed to increase automation and integration, supporting insurance carriers as they transition away from legacy platforms and seek flexible, real-time policy management.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services (Professional Services, Managed Services)), By Deployment Mode (Cloud-Based (SaaS), On-Premises), By End-User (Insurance Companies, Banks and Financial Institutions, Others), By Policy Type (Term Life Insurance, Whole Life Insurance, Universal Life Insurance, Variable Life Insurance) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Majesco, Accenture Plc, Oracle Corporation, Insurity, EXL, Infosys, FAST Technology, Edlund, EIS Group Inc., AgencySmart, DXC Technology Company, Sapiens International Corporation, Concentrix Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Life Insurance Policy Administration Systems MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Life Insurance Policy Administration Systems MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Majesco

- Accenture Plc

- Oracle Corporation

- Insurity

- EXL

- Infosys

- FAST Technology

- Edlund

- EIS Group Inc.

- AgencySmart

- DXC Technology Company

- Sapiens International Corporation

- Concentrix Corporation

- Others