Global Leather Dyes Market Size, Share, And Enhanced Productivity By Type (Acid Dyes, Mordant Dyes, Direct Dyes, Basic Dyes, Pre-Metalled Dyes, Others), By Application (Footwear, Automotive Interiors, Furniture Upholstery, Garments, Bags, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173259

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

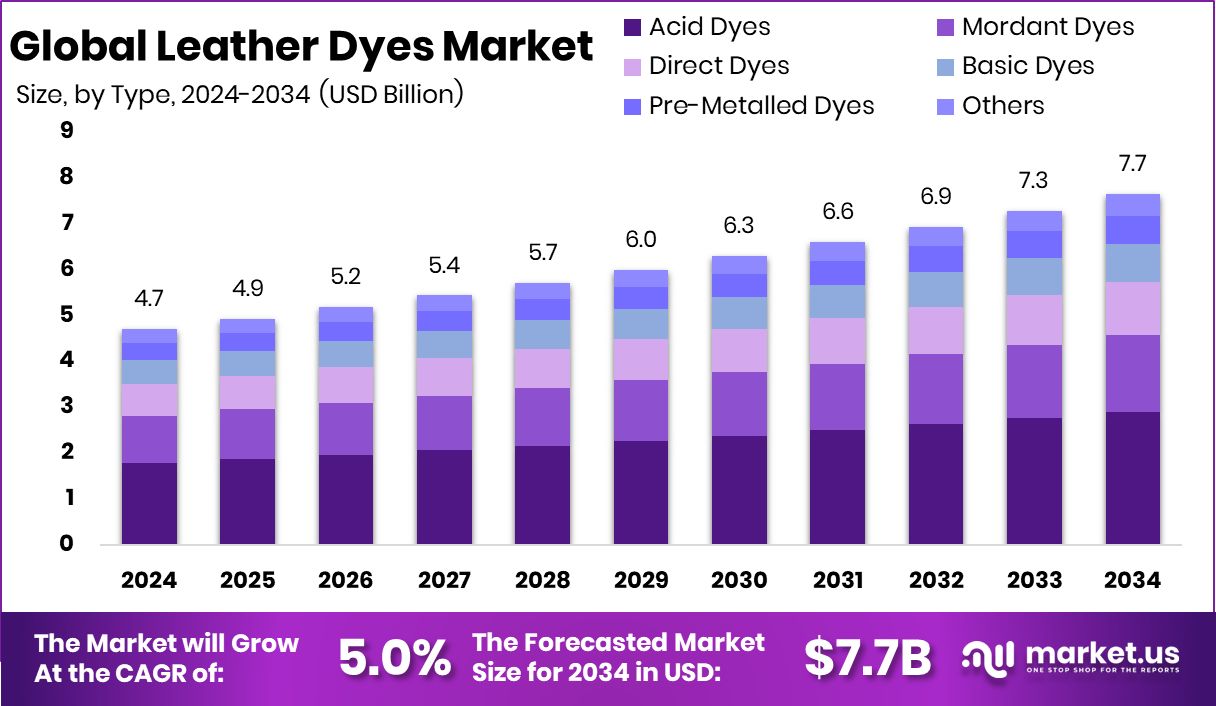

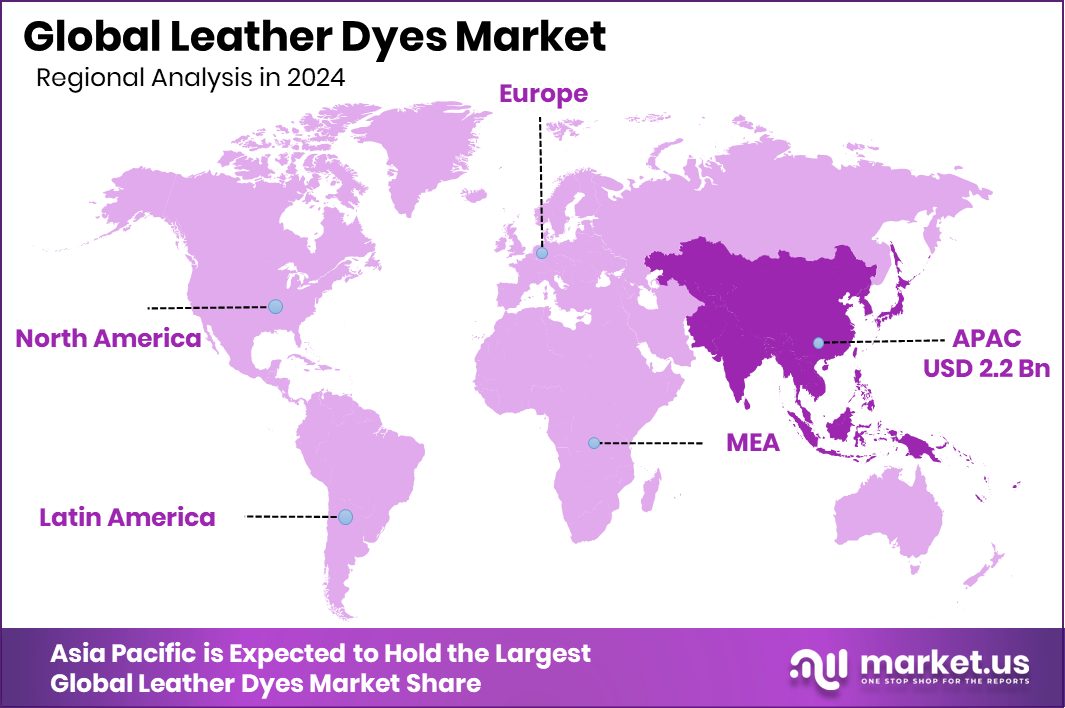

The Global Leather Dyes Market is expected to be worth around USD 7.7 billion by 2034, up from USD 4.7 billion in 2024, and is projected to grow at a CAGR of 5.0% from 2025 to 2034. Asia Pacific USD 2.2 Bn dominance in the leather dyes market reflects scale, exports, and manufacturing strength growth.

Leather dyes are colorants specially made to penetrate and bond with leather fibers, giving leather its final shade, depth, and visual appeal. They are used during different stages of leather processing to achieve uniform coloring, durability, and resistance to fading. Leather dyes are designed to work with natural hides, allowing flexibility, softness, and long-lasting color without damaging the leather’s structure. They play a key role in making leather suitable for footwear, bags, garments, furniture, and automotive interiors.

The Leather Dyes Market refers to the overall system involved in producing, supplying, and using these dyes across the global leather industry. It includes dye manufacturers, tanneries, and downstream users who rely on consistent color quality and performance. The market evolves alongside fashion trends, material innovation, and changing environmental expectations, making leather dyes an essential input for value-added leather products.

One major growth factor is the push toward cleaner and more eco-friendly leather processing. In this context, the European Union backed DITF’s Fabulose project with a $4.05 million grant to support eco-leather development, highlighting strong institutional support for sustainable dye technologies and greener leather value chains.

Demand for leather dyes continues to rise as brands look for safer and more natural coloring options. This shift is reflected in the $2.45 million investment secured by Nature Coatings, a pigment start-up focused on bio-based color solutions, showing how natural pigments are gaining acceptance in leather and fashion applications.

A key opportunity lies in waste-based and fossil-free dye innovation. A startup using dyes made from vegetal waste raised $3.7 million, proving that circular, plant-derived dye solutions can attract funding while opening new paths for sustainable leather coloration.

Key Takeaways

- The Global Leather Dyes Market is expected to be worth around USD 7.7 billion by 2034, up from USD 4.7 billion in 2024, and is projected to grow at a CAGR of 5.0% from 2025 to 2034.

- In the Leather Dyes Market, Acid dyes dominate with a 37.8% share due to strong penetration performance.

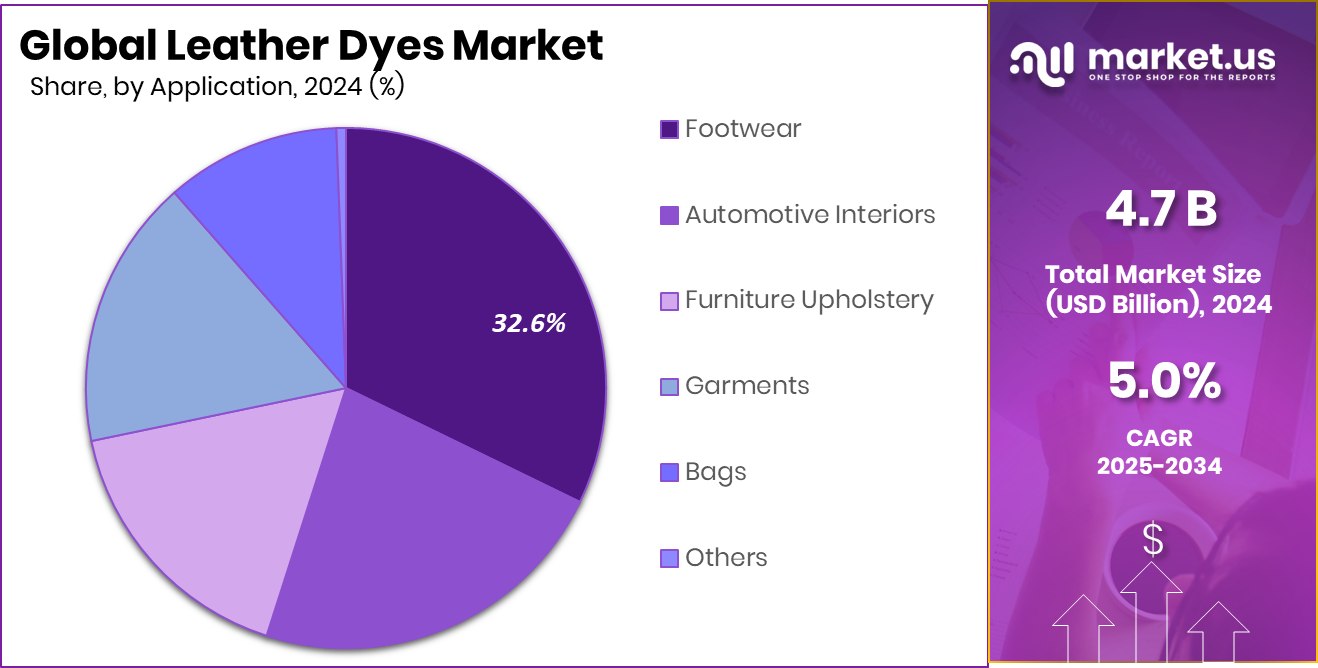

- In the Leather Dyes Market, footwear applications lead with a 32.6% share driven by consistent demand globally.

- The Asia Pacific Leather Dyes Market reached a USD 2.2 Bn value in 2024.

By Type Analysis

In the leather dyes market, acid dyes dominate the type segment, holding 37.8% share.

In 2024, Acid Dyes held a dominant 37.8% share in the Leather Dyes Market by Type, driven by their strong affinity for protein-based leather, reliable color fastness, and ability to deliver deep, uniform shades across footwear, upholstery, and fashion accessories, as tanneries increasingly preferred acid dyes for their consistent performance on chrome-tanned leather, compatibility with modern finishing processes, reduced rework rates, and stable results under varying pH conditions, while ongoing improvements in dye formulation, better bath exhaustion efficiency, and compliance with evolving environmental norms further strengthened adoption among organized leather processors serving export-oriented brands.

By Application Analysis

Footwear leads the leather dyes market applications, accounting for 32.6% overall demand globally.

In 2024, Footwear accounted for a leading 32.6% share in the Leather Dyes Market by Application, supported by steady global demand for leather shoes, safety footwear, and premium lifestyle products, where consistent color matching, abrasion resistance, and visual appeal are critical, as manufacturers focused on fashionable designs, seasonal color launches, and durable finishes to meet consumer expectations, while rising production in Asia, expansion of branded footwear manufacturing, and the need for high-throughput, cost-efficient dyeing solutions continued to position footwear as the largest application segment within the leather dyes industry.

Key Market Segments

By Type

- Acid Dyes

- Mordant Dyes

- Direct Dyes

- Basic Dyes

- Pre-Metalled Dyes

- Others

By Application

- Footwear

- Automotive Interiors

- Furniture Upholstery

- Garments

- Bags

- Others

Driving Factors

Rising Footwear Production Driving Leather Dyes Demand

The leather dyes market is strongly driven by the steady growth of the footwear industry, especially in affordable and mass-market segments where consistent color, durability, and visual appeal are essential. As footwear brands scale production to meet rising consumer demand, the need for reliable leather dyeing solutions increases across shoes, sandals, and safety footwear. This trend is reinforced by fresh capital flowing into footwear manufacturing and brand expansion. Venturi Partners’ $25 million investment in affordable footwear brand JQR highlights growing confidence in large-volume footwear businesses that depend heavily on dyed leather components.

At the same time, innovation-focused players are also expanding, as seen when footwear startup CHK raised $2.5 million from Accel, Bluestone, and others to scale operations. Together, these investments indicate rising footwear output, faster design cycles, and broader market reach, all of which directly push demand for high-performance leather dyes that deliver uniform color, cost efficiency, and production consistency.

Restraining Factors

Cost Pressure and Compliance Slow Leather Dye Adoption

The leather dyes market faces a key restraining factor in the form of rising compliance costs and tight operating margins across the footwear value chain. Smaller and emerging footwear brands often work with limited budgets and prefer low-risk materials, which can slow the adoption of advanced leather dye solutions. This challenge is visible in the funding patterns of young footwear companies. Footwear startup RARA Barefoot raised $500K in a seed round, showing how early-stage brands prioritize product launches and market entry over higher-cost processing inputs.

Similarly, D2C footwear brand CHK secured $2.5 Mn, reflecting a focus on brand building, distribution, and customer acquisition. When budgets are constrained, investments in premium or reformulated leather dyes are often delayed. As a result, dye suppliers face pressure to balance performance, regulatory compliance, and affordability, which can limit faster adoption of upgraded dye technologies across cost-sensitive leather processing segments.

Growth Opportunity

Process Innovation Opens New Paths For Leather Dyes

The leather dyes market has a strong growth opportunity in adopting cleaner and more efficient coating and application technologies. As leather processors look to reduce waste, energy use, and processing steps, there is a rising interest in advanced coating methods that improve dye fixation and surface performance. This direction aligns with broader material innovation efforts, such as Anaphite securing £1.4m funding to advance LFP dry-coating technology, which highlights how dry and low-solvent coating approaches are gaining attention across materials industries.

For leather dyes, similar process innovation can lower water use, cut drying time, and improve color consistency. These improvements create opportunities for dye suppliers to develop next-generation formulations that work well with modern application systems. As tanneries modernize operations, demand may grow for leather dyes designed for efficient, low-impact processing environments.

Latest Trends

Tactile And Functional Finishes Shape Dye Trends

A key latest trend in the leather dyes market is the rising focus on tactile quality and surface feel, alongside color performance. Leather buyers increasingly value how products feel in hand, pushing manufacturers to enhance softness, grip, and texture through dye and finishing systems. This trend is supported by innovation funding beyond traditional dye chemistry. For example, TG0 received €5.4 million in new funding to advance tactile technology, reflecting strong interest in materials that improve touch and sensory experience.

In leather dyes, this translates into color systems that support smooth finishes, controlled friction, and premium touch without compromising durability. As fashion, footwear, and accessories brands compete on user experience, tactile-focused dye solutions are becoming an important differentiator in the evolving leather dyes market.

Regional Analysis

In 2024, the Asia Pacific led the Leather Dyes Market with 48.10% share globally.

The Leather Dyes Market shows clear regional variation across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, shaped by differences in manufacturing scale, export orientation, and end-use demand.

Asia Pacific dominates the global market, holding a leading 48.10% share valued at USD 2.2 Bn, supported by its large leather processing base, strong footwear and accessories production, and well-established export supply chains serving global brands. The region benefits from integrated tanning clusters, skilled labor availability, and consistent demand from domestic and international buyers, reinforcing its leadership position.

Europe remains a mature and quality-driven market, backed by premium leather goods manufacturing and strict processing standards that emphasize color consistency and performance. North America shows steady demand, supported by automotive interiors, furniture, and lifestyle leather products, where durability and shade stability are key purchase factors.

The Middle East & Africa market is gradually expanding, aligned with growing regional tanning activity and rising consumption of finished leather products. Latin America maintains a stable presence, supported by its traditional leather industry and export-oriented production, contributing to balanced global market dynamics.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Archroma continues to be viewed as a highly focused player in the leather dyes market, with strong capabilities in color performance and application-specific solutions. In 2024, the company’s positioning reflects its deep technical understanding of leather processing requirements, especially in achieving consistent shades, high penetration, and reliable fastness properties. Archroma’s close collaboration with tanneries allows it to tailor dye systems to different leather types and finishing needs. Its emphasis on process efficiency and quality consistency supports long-term relationships with footwear, fashion, and upholstery manufacturers operating in competitive global supply chains.

BASF brings scale, chemical expertise, and portfolio depth to the leather dyes market. The company benefits from its integrated chemical knowledge, enabling it to offer dyes that align well with modern tanning and finishing systems. In 2024, BASF’s role is defined by reliability, technical service strength, and its ability to support large-volume leather producers with uniform quality. Its global presence allows it to serve both mature and emerging leather markets efficiently, reinforcing its relevance among multinational footwear and leather goods manufacturers.

Huntsman Corporation remains a technically strong participant, known for performance-oriented dye solutions for leather applications. The company’s expertise in specialty chemicals supports advanced dye formulations that deliver durability, color clarity, and processing flexibility. In 2024, Huntsman’s analyst profile highlights its ability to meet demanding application needs while maintaining stable supply and technical support, making it a trusted partner for professional leather processors worldwide.

Top Key Players in the Market

- Archroma

- BASF

- Huntsman Corporation

- Clariant

- Lanxess

- Stahl Holdings

- Kiri Industries

- Dystar

- TFL Leather

Recent Developments

- In November 2024, Stahl revealed that it planned to sell its wet-end leather chemicals division to Syntagma Capital. This meant shifting focus from some traditional leather chemical operations toward broader specialty coatings, though the final sale was later adjusted.

- In October 2024, Lanxess agreed to sell its Urethane Systems business to UBE Corporation for about €460 million, exiting its last polymer business and focusing more on specialty chemicals instead of traditional chemical lines. This transaction paved the way for completion in the following year.

Report Scope

Report Features Description Market Value (2024) USD 4.7 Billion Forecast Revenue (2034) USD 7.7 Billion CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Acid Dyes, Mordant Dyes, Direct Dyes, Basic Dyes, Pre-Metalled Dyes, Others), By Application (Footwear, Automotive Interiors, Furniture Upholstery, Garments, Bags, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Archroma, BASF, Huntsman Corporation, Clariant, Lanxess, Stahl Holdings, Kiri Industries, Dystar, TFL Leather Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Archroma

- BASF

- Huntsman Corporation

- Clariant

- Lanxess

- Stahl Holdings

- Kiri Industries

- Dystar

- TFL Leather