Global Laser Interferometer Market Size, Share, Growth Analysis, Type (Homodyne, Heterodyne), Application (Surface Topology, Applied Science, Engineering, Biomedical, Semiconductor Detection), Industry Vertical (Electronics & Semiconductor, Automotive, Aerospace & Defense, Industrial, Healthcare, Telecommunications, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 178567

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

Laser Interferometer Market Overview

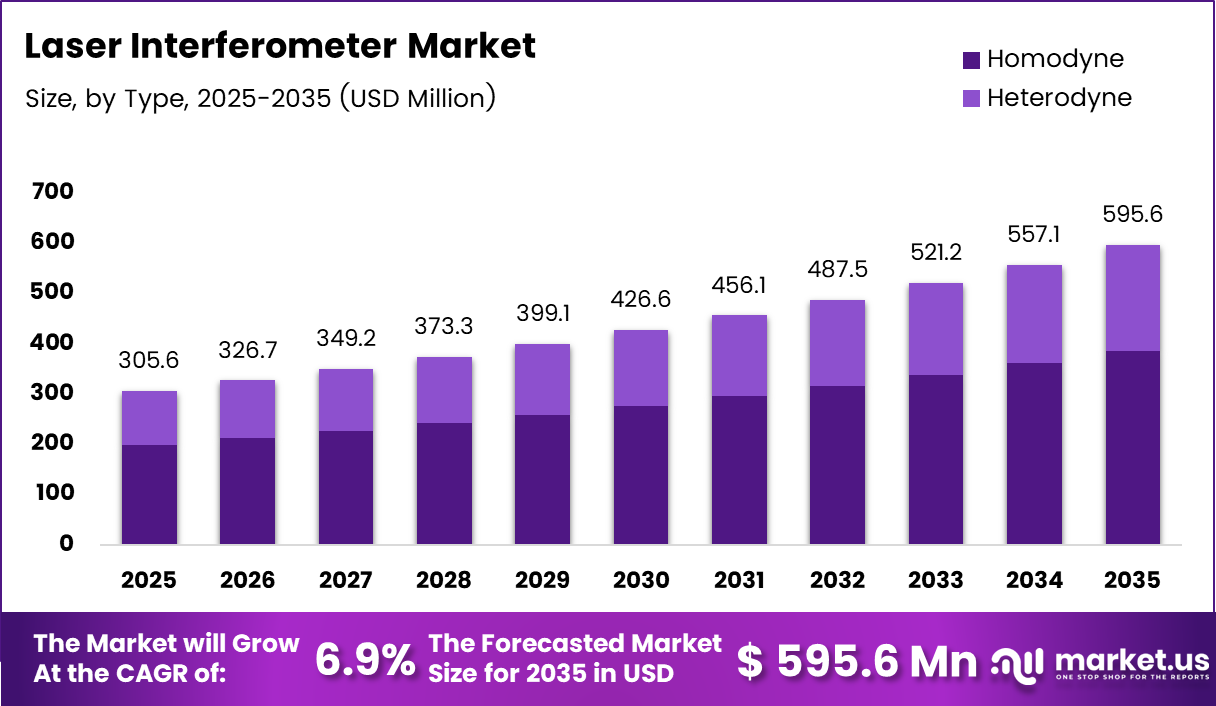

Global Laser Interferometer Market size is expected to be worth around USD 595.6 Million by 2035 from USD 305.6 Million in 2025, growing at a CAGR of 6.90% during the forecast period 2026 to 2035.

A laser interferometer is a precision optical instrument that uses the interference of light waves to measure distances, surface topologies, and motion with extreme accuracy. These systems are widely used across semiconductor, aerospace, industrial, and biomedical sectors where sub-nanometer measurement precision is essential.

The market is driven by rapid advancements in semiconductor manufacturing, where lithography and metrology processes demand increasingly tighter tolerances. Moreover, the expansion of industrial automation and smart manufacturing has created strong demand for high-accuracy positioning and motion control systems based on interferometric technology.

Government investment in scientific research and defense programs continues to support market growth. Aerospace and defense agencies globally are allocating significant budgets toward optical measurement systems for testing and quality assurance. Consequently, laser interferometers are becoming integral components of mission-critical inspection workflows.

Regulatory frameworks around precision manufacturing and medical device quality control further reinforce adoption. Additionally, growing deployment in biomedical imaging and gravitational wave research highlights the expanding application scope of laser interferometry beyond traditional industrial use cases.

According to SIOS Precision, compact reflector designs with tilt capability of up to ±12.5° and inclination of up to ±22.5° are enabling faster and easier calibration of measurement setups, improving field usability significantly.

According to Physical Review Letters, researchers have demonstrated noise suppression levels of 40 dB in a Michelson interferometer with an artificial coherence length below 30 cm, validating the feasibility of next-generation interferometric techniques for high-sensitivity applications.

Key Takeaways

- The global Laser Interferometer Market was valued at USD 305.6 Million in 2025 and is projected to reach USD 595.6 Million by 2035.

- The market is growing at a CAGR of 6.90% during the forecast period 2026 to 2035.

- By Type, Homodyne holds a dominant share of 64.83% in 2025.

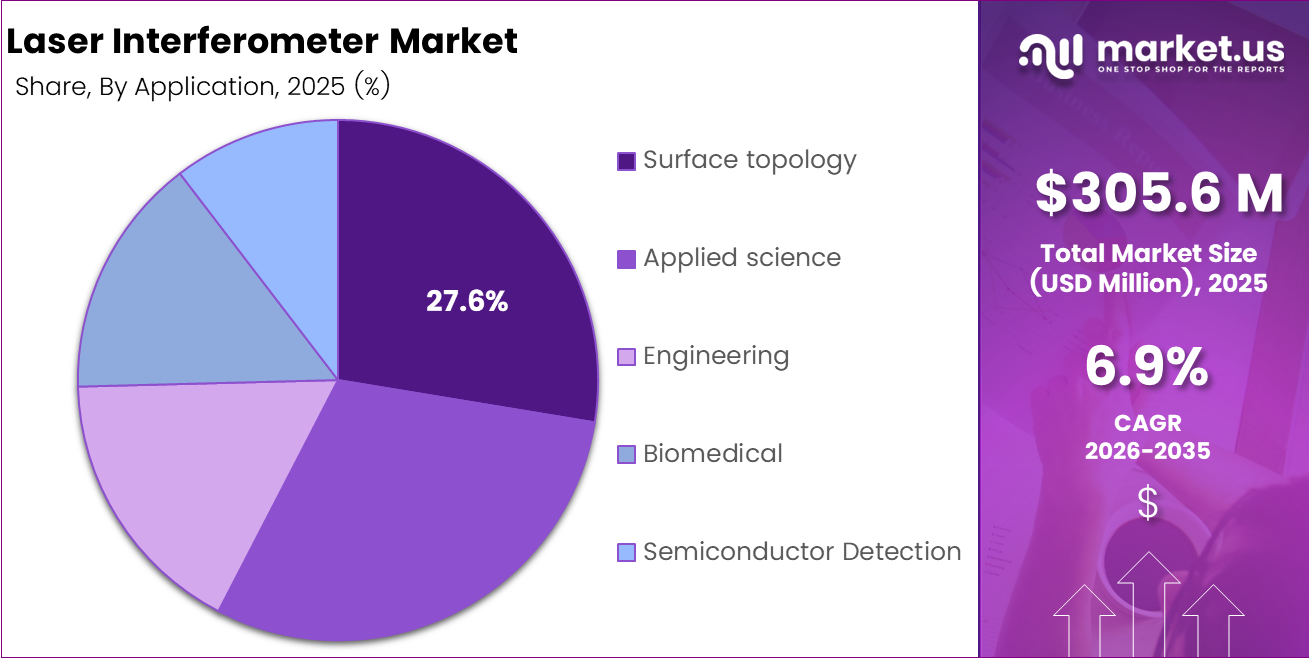

- By Application, Surface Topology leads with a share of 27.61% in 2025.

- By Industry Vertical, Electronics & Semiconductor dominates with a 30.34% share in 2025.

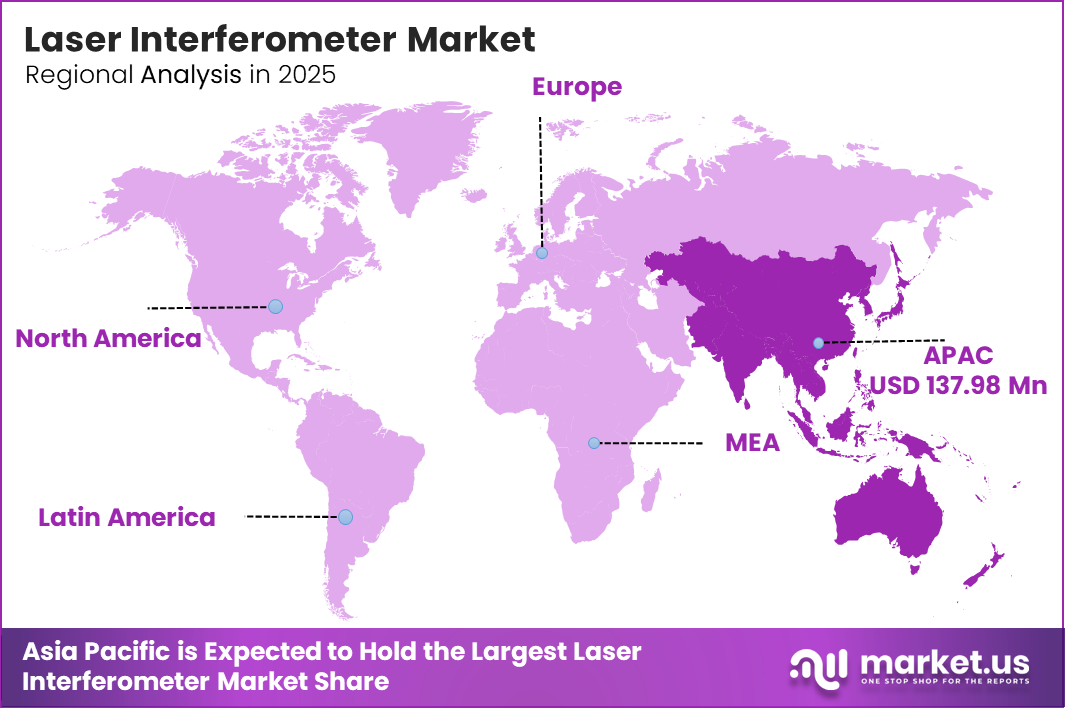

- Asia-Pacific leads regional markets with a 45.15% share, valued at USD 137.98 Million in 2025.

Type Analysis

Homodyne dominates with 64.83% due to its cost-effectiveness and reliability in precision measurement applications.

In 2025, Homodyne held a dominant market position in the Type segment of the Laser Interferometer Market, with a 64.83% share. Homodyne systems use a single-frequency laser and are widely preferred for their simpler optical design, lower cost, and strong performance in displacement and surface measurement tasks across industrial and semiconductor environments.

Heterodyne interferometers use two slightly different laser frequencies to deliver enhanced measurement stability and noise immunity. Therefore, they are increasingly adopted in applications requiring higher dynamic range and accuracy, such as advanced lithography, aerospace component testing, and precision motion systems where environmental vibration presents a significant challenge.

Application Analysis

Surface Topology dominates with 27.61% due to its critical role in quality inspection and precision manufacturing.

In 2025, Surface Topology held a dominant market position in the Application segment of the Laser Interferometer Market, with a 27.61% share. This segment benefits from broad adoption in semiconductor wafer inspection, optical component testing, and manufacturing quality control where precise surface profiling is a fundamental requirement.

Applied Science represents a growing application area where laser interferometers support fundamental physics research, gravitational wave detection, and university-level experimentation. Moreover, increasing funding for scientific infrastructure globally is reinforcing demand for high-sensitivity interferometric instruments in laboratory environments worldwide.

Engineering applications leverage interferometry for dimensional verification, calibration, and machine tool alignment across precision manufacturing facilities. These systems enable engineers to validate component tolerances with high confidence. Consequently, adoption in industrial metrology and production line verification continues to grow as manufacturing standards become increasingly stringent.

Biomedical uses of laser interferometry are expanding steadily in imaging systems, diagnostic equipment, and medical device fabrication. Healthcare manufacturers require sub-micron accuracy during production to meet regulatory compliance. Additionally, optical coherence tomography and other interferometry-based imaging modalities are driving further integration of these systems in clinical and research settings.

Semiconductor Detection supports wafer overlay measurement, stage positioning, and advanced node process control in chip fabrication environments. This segment is among the fastest-growing application areas in the market. Furthermore, as semiconductor manufacturers push toward smaller process nodes, the demand for ultra-precise interferometric detection systems in cleanroom environments continues to accelerate.

Industry Vertical Analysis

Electronics & Semiconductor dominates with 30.34% due to rising demand for sub-nanometer metrology in chip manufacturing.

In 2025, Electronics & Semiconductor held a dominant market position in the ‘Industry Vertical’ segment of the Laser Interferometer Market, with a 30.34% share. The growing complexity of semiconductor nodes and the demand for precise lithography alignment continue to make laser interferometers indispensable in chip fabrication and inspection workflows.

Automotive held a notable position in the Industry Vertical segment of the Laser Interferometer Market. Automotive manufacturers rely on interferometry for component tolerancing, surface finish verification, and dimensional inspection of precision parts. Moreover, as vehicle electrification accelerates, the demand for high-accuracy measurement tools in battery component and powertrain manufacturing is rising steadily across global production facilities.

Aerospace & Defense is a critical vertical for laser interferometer adoption, where structural testing and optical surface verification are standard requirements. Defense procurement programs and aerospace modernization initiatives are driving investment in non-contact precision measurement systems. Consequently, interferometers are being integrated into MRO workflows and component qualification processes for aircraft, satellites, and defense platforms worldwide.

Industrial applications represent a strong and consistent demand driver for laser interferometers across smart manufacturing and Industry 4.0 environments. Machine tool calibration, CNC alignment, and in-line dimensional verification are among the most common use cases. Therefore, as factories automate and adopt real-time quality control practices, the deployment of interferometric measurement systems in industrial settings continues to expand.

Healthcare is an emerging vertical where laser interferometers support the production and inspection of precision medical devices and imaging equipment. Regulatory standards in medical manufacturing demand traceable, high-accuracy measurement at every stage of production. Additionally, interferometric techniques are increasingly used in ophthalmic instruments and diagnostic imaging systems where optical precision is directly tied to patient outcomes.

Telecommunications relies on laser interferometers for fiber optic alignment, connector end-face inspection, and optical component verification in network equipment manufacturing. As demand for high-speed data infrastructure grows globally, the need for precise optical assembly and quality control is intensifying. Consequently, interferometric tools are becoming standard in telecom component production and testing environments.

Others encompasses research institutions, energy sector facilities, and academic laboratories that use laser interferometers for a broad range of scientific and applied measurement tasks. Universities deploy these systems for physics experiments and instrumentation research. Furthermore, energy sector applications include precision alignment in laser systems and measurement support for advanced materials research programs.

Key Market Segments

By Type

- Homodyne

- Heterodyne

By Application

- Surface Topology

- Applied Science

- Engineering

- Biomedical

- Semiconductor Detection

By Industry Vertical

- Electronics & Semiconductor

- Automotive

- Aerospace & Defense

- Industrial

- Healthcare

- Telecommunications

- Others

Drivers

Escalating Demand for Sub-Nanometer Precision Drives Laser Interferometer Market Growth

The semiconductor industry requires measurement accuracy at the sub-nanometer level, particularly in lithography alignment and wafer inspection. Laser interferometers provide the precision needed to meet these demands. Moreover, as chip architectures become more complex, the requirement for highly accurate metrology systems in fabrication environments continues to intensify.

Aerospace and defense agencies are expanding their use of optical measurement systems for component testing and quality assurance. These sectors demand reliable, non-contact measurement tools capable of operating in demanding environments. Consequently, laser interferometers are being integrated into critical inspection and calibration workflows across defense manufacturing programs globally.

Scientific research institutions and industrial automation facilities are also increasing their reliance on interferometry. Advanced laboratories use these systems for fundamental physics experiments, while industrial plants deploy them for high-accuracy motion control. Therefore, the convergence of scientific and industrial demand is creating a broad, sustained growth base for the laser interferometer market.

Restraints

High Capital Costs and Environmental Sensitivity Limit Wider Laser Interferometer Adoption

Laser interferometer systems carry significant upfront capital costs, making them inaccessible for small and mid-sized enterprises. Additionally, complex calibration requirements demand skilled technical personnel, which increases total cost of ownership. These financial and operational barriers slow adoption in cost-sensitive industries and emerging markets where budget constraints are a primary concern.

Environmental disturbances such as vibration, temperature fluctuation, and air turbulence can substantially affect measurement stability and accuracy. Consequently, users must invest in controlled environments or vibration isolation systems to maintain performance. This additional infrastructure requirement raises total deployment costs and complicates integration in field or shop-floor measurement scenarios.

The combination of high initial investment and sensitivity to external conditions creates a meaningful barrier for broader market penetration. However, ongoing efforts to develop more robust and compact interferometer designs are gradually addressing these limitations. Nevertheless, in the near term, these restraints continue to constrain adoption among price-sensitive end users and developing-region manufacturers.

Growth Factors

Semiconductor Innovation and Smart Manufacturing Expansion Accelerate Laser Interferometer Market Growth

The integration of laser interferometers in next-generation semiconductor manufacturing nodes represents a major growth catalyst. As chip makers advance to smaller process nodes, the precision requirements for overlay measurement and stage positioning become more stringent. Moreover, leading fabrication facilities are actively investing in advanced metrology infrastructure to support high-yield production.

Precision medical devices and biomedical imaging applications are creating new deployment opportunities for laser interferometry. Healthcare manufacturers require dimensional accuracy in device fabrication, while imaging systems benefit from interferometric sensing capabilities. Additionally, regulatory requirements for medical device quality are encouraging manufacturers to adopt traceable, high-accuracy measurement solutions throughout their production processes.

The expansion of Industry 4.0 and smart manufacturing is further accelerating market growth. Automated production lines increasingly rely on in-line metrology for real-time quality control. Furthermore, the growing interest in gravitational wave detection and space research programs is creating niche but high-value demand for ultra-sensitive interferometric systems in scientific and government-funded facilities.

Emerging Trends

Compact Designs and AI Integration Are Reshaping the Laser Interferometer Market Landscape

Development of compact and fiber-based laser interferometer designs is a prominent trend reshaping the market. These systems reduce size and weight while maintaining measurement accuracy, enabling deployment in environments where traditional setups are impractical. Consequently, adoption is expanding into portable metrology, on-site calibration, and space-constrained manufacturing environments across multiple industry verticals.

AI-enabled data processing is being integrated into interferometric measurement platforms to enhance accuracy and reduce interpretation time. Machine learning algorithms can identify noise patterns, compensate for environmental disturbances, and automate measurement reporting. Therefore, AI integration is improving both the reliability and operational efficiency of laser interferometer systems in industrial and scientific settings.

Rising demand for multi-axis and 3D interferometric measurement systems reflects the need for comprehensive spatial analysis in advanced manufacturing. Additionally, the shift toward portable and field-deployable interferometers is gaining momentum as industries require on-site verification without moving components to laboratories. These trends collectively signal a broader evolution toward more flexible and intelligent interferometric measurement solutions.

Regional Analysis

Asia-Pacific Dominates the Laser Interferometer Market with a Market Share of 45.15%, Valued at USD 137.98 Million

Asia-Pacific leads the global Laser Interferometer Market, accounting for 45.15% of total revenue, valued at USD 137.98 Million in 2025. The region’s dominance is driven by its massive semiconductor manufacturing base in China, South Korea, Japan, and Taiwan, combined with strong government investment in precision industrial infrastructure and scientific research programs.

North America Laser Interferometer Market Trends

North America holds a significant share of the global market, supported by advanced aerospace and defense manufacturing, cutting-edge semiconductor research, and strong scientific infrastructure. The United States, in particular, drives demand through LIGO-type research programs, defense procurement, and a mature precision manufacturing sector with high metrology standards.

Europe Laser Interferometer Market Trends

Europe maintains a steady market presence, with demand concentrated in Germany, France, and the UK. The region benefits from its strong automotive manufacturing base, aerospace industry, and investment in precision engineering. Moreover, European research institutions actively deploy interferometric systems in physics research and advanced materials testing programs.

Latin America Laser Interferometer Market Trends

Latin America represents an emerging market with growing adoption driven by industrial modernization in Brazil and Mexico. However, limited technical infrastructure and budget constraints slow broader deployment. Additionally, increasing foreign direct investment in manufacturing facilities is gradually building demand for precision measurement tools across the region.

Middle East and Africa Laser Interferometer Market Trends

The Middle East and Africa market is at an early stage of development, with demand primarily concentrated in GCC countries. Investments in oil and gas infrastructure, aerospace MRO, and industrial manufacturing are creating incremental demand. Furthermore, government-led diversification programs in Saudi Arabia and the UAE are expected to support future market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Renishaw plc is a global leader in precision measurement and metrology, with a strong portfolio of laser interferometer systems used in machine tool calibration and dimensional verification. The company’s systems are widely deployed in semiconductor, aerospace, and advanced manufacturing environments. Renishaw’s focus on engineering innovation and application support positions it as a trusted partner for high-accuracy measurement solutions.

AMETEK, Inc. (Zygo Corporation) operates through Zygo as its precision optical metrology division, delivering advanced interferometric systems for surface measurement and wavefront analysis. Zygo’s instruments serve semiconductor, defense, and research markets where ultra-precise surface characterization is critical. In February 2024, Zygo announced the launch of its new Qualifire Laser Interferometer, expanding its product range for optical component testing and quality inspection applications.

Keyence Corporation offers a broad range of measurement systems including laser-based interferometric instruments for industrial and electronics manufacturing. The company’s strength lies in integrating measurement technology with easy-to-use interfaces, making high-precision tools accessible to a wider range of manufacturers. Keyence continues to expand its global footprint through direct sales and strong application engineering support across multiple industry verticals.

Keysight Technologies brings strong expertise in test and measurement instrumentation, including optical and interferometric solutions used in telecommunications, electronics, and scientific research. The company’s capabilities in signal integrity and optical measurement make it a key player in markets that demand both electronic and optical measurement accuracy. Keysight’s investments in R&D and software-driven measurement platforms continue to strengthen its competitive positioning in precision metrology.

Key Players

- Renishaw plc

- AMETEK, Inc. (Zygo Corporation)

- Keyence Corporation

- Keysight Technologies

- OptoMET GmbH

- Bruker

- ACCRETECH Group

- Automated Precision Inc.

- LAMTECH Lasermesstechnik GmbH

- Thorlabs, Inc.

- 4D Technology Corp.

- Chotest Technology Inc.

- Other Key Players

Recent Developments

- February 2024 – Zygo Corporation announced the launch of its new Qualifire Laser Interferometer, expanding its product line for optical surface testing. The system is designed to deliver high-accuracy wavefront measurement for optical component manufacturers and quality inspection laboratories.

- August 2025 – The LIGO-Virgo-KAGRA collaboration announced the detection of 128 black hole collisions, effectively doubling the total number of known gravitational-wave events. This milestone demonstrates the advancing sensitivity and reliability of large-scale laser interferometer systems deployed in global astrophysics research programs.

Report Scope

Report Features Description Market Value (2025) USD 305.6 Million Forecast Revenue (2035) USD 595.6 Million CAGR (2026-2035) 6.90% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Type (Homodyne, Heterodyne), Application (Surface Topology, Applied Science, Engineering, Biomedical, Semiconductor Detection), Industry Vertical (Electronics & Semiconductor, Automotive, Aerospace & Defense, Industrial, Healthcare, Telecommunications, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Renishaw plc, AMETEK, Inc. (Zygo Corporation), Keyence Corporation, Keysight Technologies, OptoMET GmbH, Bruker, ACCRETECH Group, Automated Precision Inc., LAMTECH Lasermesstechnik GmbH, Thorlabs, Inc., 4D Technology Corp., Chotest Technology Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Laser Interferometer MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Laser Interferometer MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Renishaw plc

- AMETEK, Inc. (Zygo Corporation)

- Keyence Corporation

- Keysight Technologies

- OptoMET GmbH

- Bruker

- ACCRETECH Group

- Automated Precision Inc.

- LAMTECH Lasermesstechnik GmbH

- Thorlabs, Inc.

- 4D Technology Corp.

- Chotest Technology Inc.

- Other Key Players