Global Larvicides Market Size, Share, And Business Benefits By Source By Product Type (Synthetic Larvicides, Biological Larvicides), By Formulation (Powders, Liquids, Tablets, Dunks, Others), By Control Method (Chemical Agents, Biocontrol Agents, Insect Growth Regulators (IGR), Others), By Target Insect (Mosquitoes, Flies, Beetles, Others), By Application (Agriculture, Non Agriculture), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157092

- Number of Pages: 241

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Product Type Analysis

- By Formulation Analysis

- By Control Method Analysis

- By Target Insect Analysis

- By Application Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

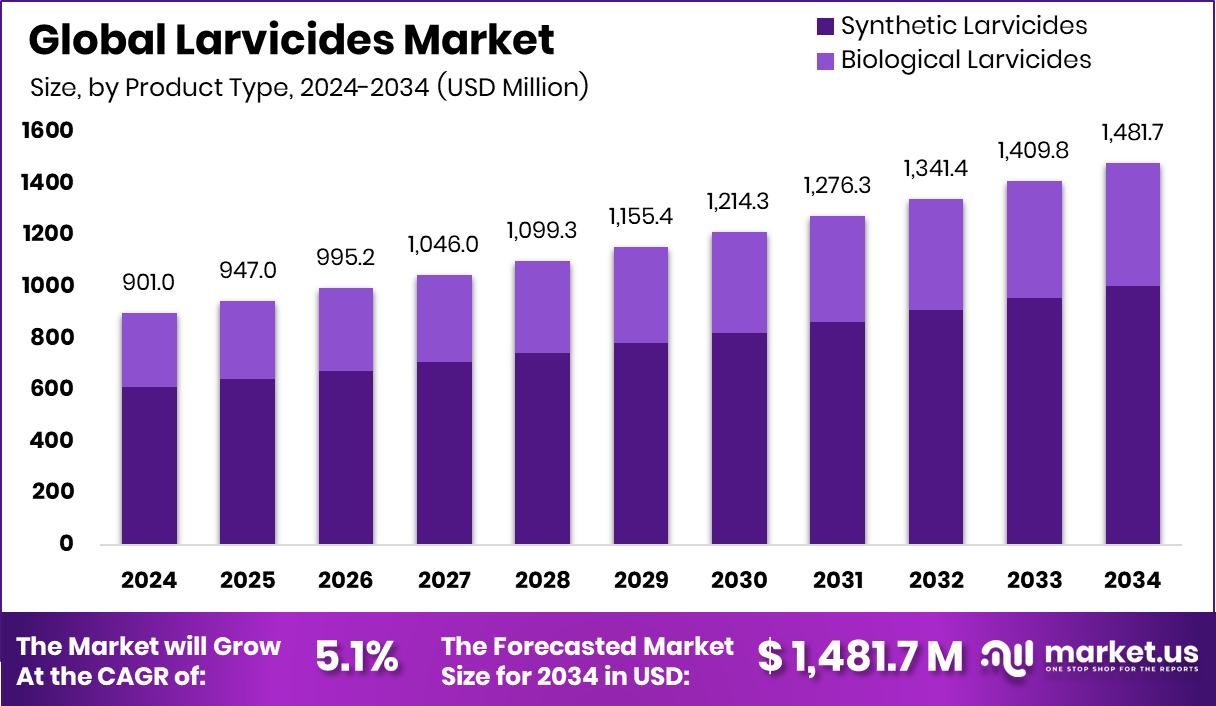

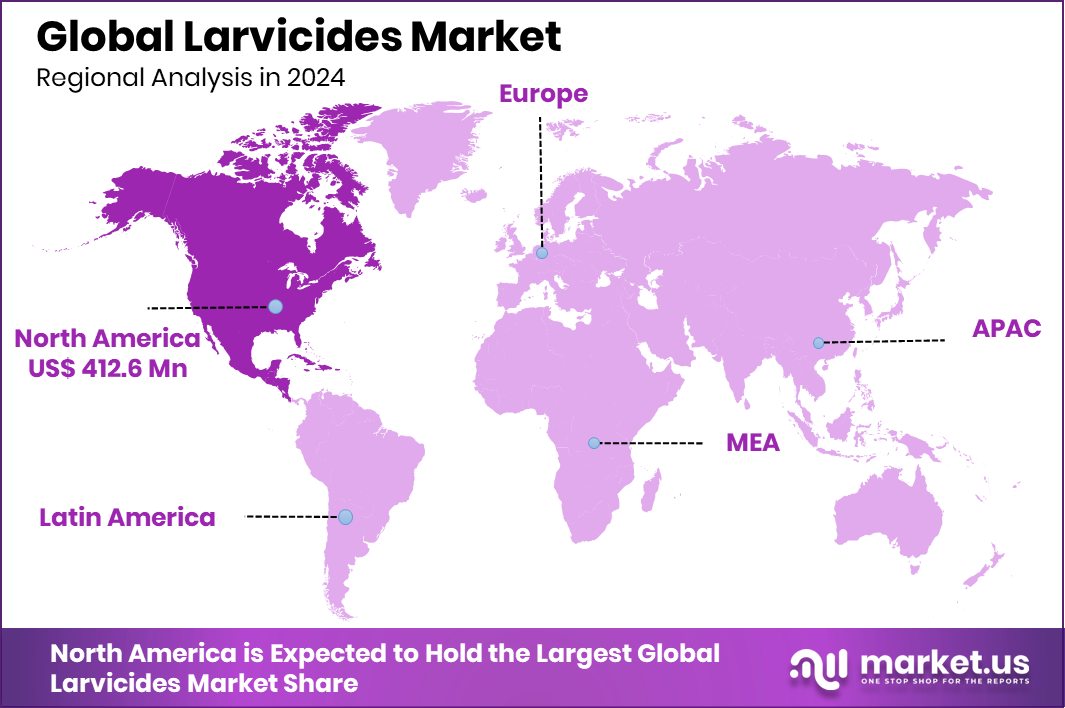

The Global Larvicides Market is expected to be worth around USD 1,481.7 million by 2034, up from USD 901.0 million in 2024, and is projected to grow at a CAGR of 5.1% from 2025 to 2034. With a 45.80% share, the North America Larvicides Market recorded USD 412.6 Mn strong regional performance.

Larvicides are chemical or biological substances used to kill the larval stage of insects, mainly mosquitoes and other disease-spreading pests, before they mature into adults. By targeting larvae in water bodies such as ponds, drains, or containers, larvicides play a vital role in controlling the spread of diseases like malaria, dengue, and Zika virus. They are often applied by public health authorities, farmers, and households to reduce insect populations at the source.

The larvicides market refers to the global industry that produces, distributes, and utilizes these pest-control solutions across agricultural, public health, and household sectors. With rising awareness about vector-borne diseases, governments, and organizations are increasingly investing in preventive solutions, boosting the demand for larvicides in both developing and developed regions. According to an Industry report, EAC Unveils Malaria Program Backed by $29.2M SC Johnson Funding

One major growth factor for the larvicide market is the growing incidence of mosquito-borne diseases. According to the World Health Organization, malaria alone caused over 249 million cases globally in 2022, which continues to drive governments and communities toward effective larval control measures. This alarming health burden directly translates into consistent demand for larvicidal solutions.

The demand for larvicides is further supported by the expansion of urbanization and inadequate waste management in many parts of the world, which create stagnant water environments that are suitable for mosquito breeding. Rising population density and climate change, which extend breeding seasons, are also amplifying the need for larvicidal interventions, keeping their use relevant across regions.

Key Takeaways

- The Global Larvicides Market is expected to be worth around USD 1,481.7 million by 2034, up from USD 901.0 million in 2024, and is projected to grow at a CAGR of 5.1% from 2025 to 2034.

- In 2024, synthetic larvicides dominated the larvicides market, holding a 67.8% share.

- Liquid formulations accounted for 41.2% of the larvicides market, reflecting ease of application.

- Chemical agents led the larvicides market, capturing 58.7% share due to proven effectiveness.

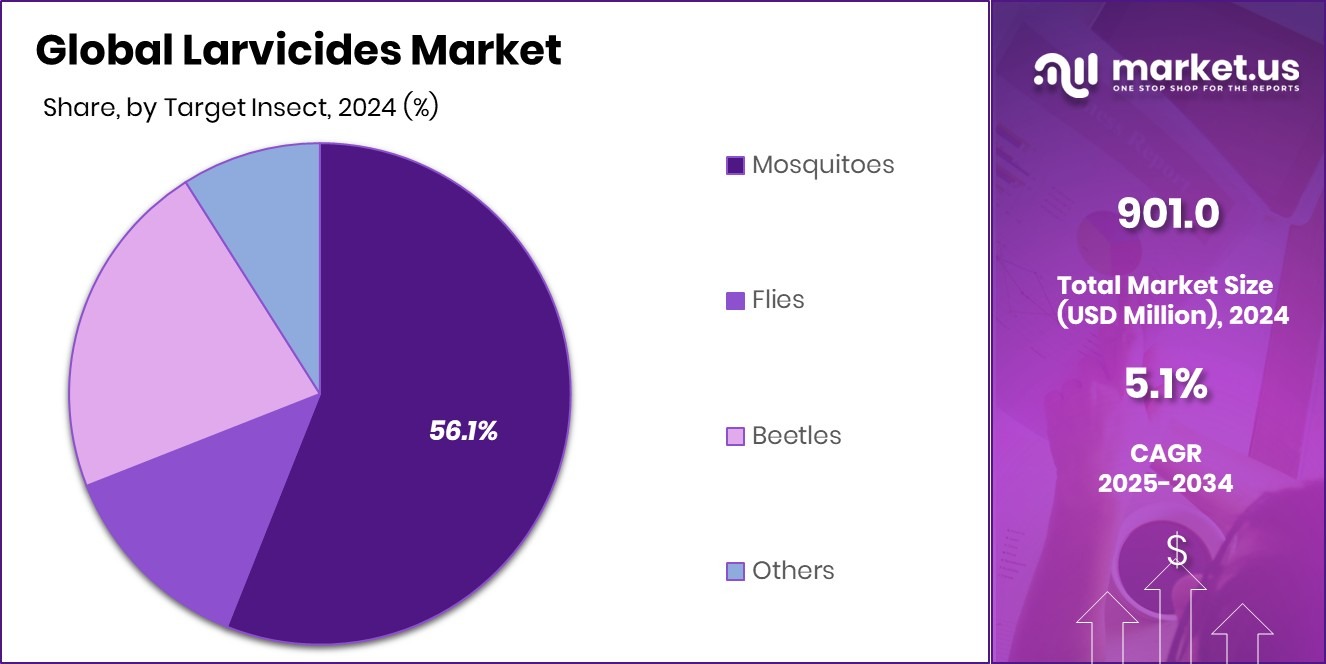

- Mosquitoes remained the prime target, representing 56.1% of the larvicides market globally.

- Non-agriculture applications dominated with a 67.3% share, highlighting public health demand in the larvicides market.

- The North America Larvicides Market, valued at USD 412.6 Mn, captured a 45.80% share.

By Product Type Analysis

In 2024, synthetic larvicides dominated with 67.8% market share.

In 2024, Synthetic Larvicides held a dominant market position in By Product Type segment of the Larvicides Market, with a 67.8% share. This strong presence highlights the continued reliance on chemical-based larvicidal solutions, primarily due to their effectiveness in quickly reducing larval populations in large and challenging breeding grounds.

Synthetic larvicides are widely preferred in public health programs, agricultural applications, and urban pest control as they offer consistent performance, longer residual activity, and ease of large-scale deployment. Their affordability compared to advanced biological alternatives further adds to their dominance in both developed and developing regions.

The widespread use of synthetic larvicides is also driven by the urgent need to control mosquito-borne diseases such as malaria, dengue, and Zika, which continue to pose significant global health challenges. Governments, municipal authorities, and private organizations often adopt synthetic larvicides as the first line of defense due to their proven efficiency and rapid results.

Despite growing environmental concerns, their role remains critical in high-burden regions where disease outbreaks can escalate quickly. As of 2024, the 67.8% share held by synthetic larvicides underlines their importance in the market and signals their continuing role in global pest management strategies in the near term.

By Formulation Analysis

Liquid formulations captured 41.2%, highlighting their wide larvicidal market usage.

In 2024, liquids held a dominant market position in the By Formulation segment of the Larvicides Market, with a 41.2% share. The strong adoption of liquid larvicides is primarily due to their ease of application and ability to spread evenly across diverse breeding environments such as ponds, drains, irrigation canals, and stagnant water bodies.

Liquid formulations allow precise dosing, which ensures effective larval control without the need for extensive manpower or complex equipment. This convenience makes them the preferred choice in both large-scale government vector control programs and smaller community-level interventions.

Another factor behind the dominance of liquid larvicides is their rapid action and effectiveness in treating extensive water surfaces where mosquito larvae typically thrive. Their versatility also contributes to the market share, as they can be applied through spraying, fogging, or direct pouring, offering flexibility for different regions and needs.

Public health authorities often rely on liquid formulations during outbreaks since they deliver quick results and can be scaled up efficiently. The 41.2% share recorded in 2024 reflects the growing trust in this formulation type, indicating that liquid larvicides will continue to play a critical role in safeguarding populations from vector-borne diseases in the years ahead.

By Control Method Analysis

Chemical agents held a 58.7% share in the global larvicides market.

In 2024, Chemical Agents held a dominant market position in By Control Method segment of the Larvicides Market, with a 56.1% share. This dominance reflects the strong reliance on chemical-based approaches to effectively manage larval populations, particularly in regions where vector-borne diseases remain a pressing public health concern.

Chemical agents are widely used due to their proven ability to deliver fast results, broad coverage, and long-lasting residual effects, making them a dependable solution for large-scale mosquito control operations. Their accessibility and cost-effectiveness also make them the preferred choice for many government-driven vector management programs and community health initiatives.

The 56.1% share in 2024 underscores the critical role chemical agents play in curbing outbreaks of diseases such as malaria, dengue, and Zika, especially in high-risk regions. Their ability to disrupt larval growth cycles in diverse breeding habitats, ranging from urban drains to agricultural water bodies, further strengthens their adoption.

While concerns about environmental safety and resistance exist, the continued use of chemical larvicides highlights the balance many stakeholders maintain between immediate disease control needs and long-term sustainability goals. The market share illustrates that chemical agents remain the backbone of larval management strategies, ensuring reliable protection against vector threats.

By Target Insect Analysis

Mosquito control applications represented 56.1% of the larvicides market.

In 2024, Mosquitoes held a dominant market position in By Target Insect segment of Larvicides Market, with a 49.2% share. This leading position highlights the urgent global focus on controlling mosquito populations, which are the primary carriers of several life-threatening diseases such as malaria, dengue, Zika virus, and chikungunya.

The high prevalence of these vector-borne diseases, especially in tropical and subtropical regions, continues to drive the large-scale use of larvicides targeting mosquito larvae. Public health authorities prioritize mosquito control as a cost-effective preventive measure, aiming to stop disease transmission at its source before larvae mature into adult carriers.

The 49.2% share in 2024 demonstrates the concentrated efforts of governments, municipalities, and health organizations in deploying mosquito-focused larvicidal programs. The dominance of mosquitoes as a target insect also reflects growing urbanization and climate change, which create favorable breeding environments through stagnant water accumulation.

Quick and efficient larval control is therefore critical to reducing the public health burden. With their ability to prevent outbreaks and save millions of lives, larvicides directed at mosquitoes will continue to remain the core focus of control measures worldwide, reinforcing their substantial contribution to the overall market.

By Application Analysis

Non-agriculture segment led with 67.3% in the larvicides market.

In 2024, Non Agriculture held a dominant market position in the By Application segment of the Larvicides Market, with a 67.3% share. This dominance is largely attributed to the extensive use of larvicides in public health initiatives, urban sanitation programs, and household-level mosquito control efforts.

Non-agricultural applications play a critical role in safeguarding populations from mosquito-borne diseases such as malaria, dengue, and the Zika virus, which continue to pose serious health risks across many parts of the world. Governments and municipal bodies allocate significant resources toward larvicidal treatments in water storage systems, drainage networks, and stagnant urban water bodies to prevent disease outbreaks at the larval stage.

The 67.3% share in 2024 also highlights the growing role of larvicides in community-level interventions and international health campaigns, particularly in developing regions with high population densities and inadequate sanitation infrastructure. Climate change and rapid urbanization have further intensified mosquito breeding conditions, making larvicides indispensable for protecting public health outside of agricultural settings.

With the majority of vector control programs targeting urban and residential environments, non-agricultural applications are expected to remain the leading driver of larvicide demand. This strong position reflects the continuing reliance on larvicides as a preventive tool for reducing the burden of vector-borne diseases globally.

Key Market Segments

By Product Type

- Synthetic Larvicides

- Biological Larvicides

By Formulation

- Powders

- Liquids

- Tablets

- Dunks

- Others

By Control Method

- Chemical Agents

- Biocontrol Agents

- Insect Growth Regulators (IGR)

- Others

By Target Insect

- Mosquitoes

- Flies

- Beetles

- Others

By Application

- Agriculture

- Non Agriculture

Driving Factors

Rising Mosquito-Borne Diseases Push Larvicides Demand

One of the strongest driving factors for the larvicides market is the rising spread of mosquito-borne diseases around the world. Mosquitoes are responsible for transmitting life-threatening illnesses such as malaria, dengue, chikungunya, and the Zika virus.

According to the World Health Organization, malaria alone accounted for about 249 million cases in 2022, with millions more affected by other mosquito-related diseases. This constant health burden has made it necessary for governments and communities to invest heavily in preventive measures.

Larvicides are considered one of the most effective solutions because they stop mosquitoes at the larval stage, before they grow into adult disease carriers. As outbreaks continue to threaten public health, demand for larvicides is expected to keep growing steadily.

Restraining Factors

Environmental Concerns Limit Widespread Use Of Larvicides

A key restraining factor for the larvicides market is the growing concern over environmental impact and safety. Many chemical-based larvicides, while effective, can harm non-target organisms and contaminate soil or water if not used properly.

Communities and regulators are increasingly cautious about such side effects, which has led to stricter guidelines and reduced approvals for some chemical formulations. This creates barriers for wider adoption, especially in regions that prioritize sustainable practices and ecological balance.

In addition, resistance among mosquito populations to certain chemical agents further limits their long-term effectiveness. As a result, despite their proven benefits in controlling diseases, environmental concerns continue to hold back the full growth potential of the larvicides market.

Growth Opportunity

Eco-Friendly Biological Larvicides Open New Opportunities

A major growth opportunity in the larvicides market lies in the rising demand for eco-friendly biological solutions. Unlike traditional chemical agents, biological larvicides use naturally occurring organisms such as bacteria, fungi, or plant-based extracts to target mosquito larvae without harming other species or the environment.

This approach is gaining popularity as more governments, health agencies, and communities push for sustainable and safe pest control methods. Increasing awareness of environmental protection, coupled with regulatory support for green alternatives, is creating a favorable market space for these products.

As consumers and authorities prefer safer options, investment in research and development of biological larvicides could unlock significant opportunities, shaping the future of mosquito control strategies worldwide.

Latest Trends

Digital Monitoring Boosts Efficiency Of Larvicides Programs

One of the latest trends in the larvicides market is the integration of digital monitoring and smart technologies in vector control programs. Governments and health organizations are adopting tools such as drones, geographic information systems (GIS), and mobile apps to identify mosquito breeding sites with greater accuracy.

These technologies allow precise application of larvicides, reducing wastage and improving effectiveness in high-risk areas. For example, drones can spray liquid larvicides over large water bodies that are difficult to access manually, saving both time and labor.

This combination of traditional larvicides with modern digital tools reflects a shift toward smarter, data-driven approaches. It enhances control efforts, ensures better resource use, and is reshaping how larvicides are applied worldwide.

Regional Analysis

In 2024, North America dominated the Larvicides Market with a 45.80% share, reaching USD 412.6 Mn.

The global larvicides market shows a varied regional landscape, with North America emerging as the leading region in 2024. North America accounted for a dominant 45.80% share, valued at USD 412.6 million, reflecting the region’s strong emphasis on public health programs and advanced vector control strategies.

The high prevalence of mosquito-borne diseases such as West Nile virus and increasing cases of dengue have pushed governments and health agencies to invest heavily in larvicidal interventions. Robust urban infrastructure, combined with widespread awareness campaigns and regulatory support, has further strengthened the adoption of larvicides in the region.

Europe continues to focus on sustainable pest management practices, often driven by stringent environmental policies and growing use of eco-friendly formulations. Asia Pacific, on the other hand, represents a rapidly expanding market due to population growth, urbanization, and the recurring threat of diseases like malaria and chikungunya. Meanwhile, the Middle East & Africa face unique challenges due to climatic conditions favoring mosquito breeding, leading to consistent demand for larvicidal programs.

Latin America also witnesses increasing adoption owing to periodic outbreaks of vector-borne diseases. Together, these regions highlight a global shift toward proactive larval control measures, with North America setting the benchmark in terms of market share and value.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, leading companies such as BASF SE, Bayer AG, and Syngenta AG played a critical role in shaping the global larvicides market through their strong portfolios and continued innovation in pest control solutions. These companies have built trust by delivering effective products that align with public health goals, particularly in combating mosquito-borne diseases.

BASF SE has maintained its position by focusing on advanced chemical formulations and sustainable solutions that address both immediate larval control needs and long-term ecological concerns. Their emphasis on research and adaptability has allowed them to serve diverse markets worldwide.

Bayer AG continues to be recognized for its integrated vector management strategies, which combine chemical efficiency with environmental responsibility. The company’s expertise in crop science and public health strengthens its ability to deliver reliable larvicidal products that meet global safety standards while addressing large-scale disease control challenges.

Syngenta AG has enhanced its presence by leveraging its strong agricultural and pest management expertise. With a focus on innovation, the company supports public health programs by providing products that are both effective and adaptable across different geographies. Its investments in sustainability also position it well for future growth as demand for eco-friendly solutions increases.

Top Key Players in the Market

- BASF SE

- Bayer AG

- Syngenta AG

- Sumitomo Chemical Co.

- Clarke Mosquito Control Products Inc.

- Central Life Sciences

- Gowan

- UPL Ltd.

- FMC Corporation

- Russell IPM

Recent Developments

- In May 2025, BASF signed an agreement to take over the remaining 49% share of its Alsachimie joint venture from DOMO Chemicals, aiming for full ownership. This strategic move strengthens BASF’s control over precursors used in polyamide production—but isn’t directly linked to larvicides.

- In April 2025, Syngenta’s next-generation insecticide Sovrenta® received pre-qualification from the World Health Organization (WHO), paving the way for its use in malaria control programs. Sovrenta® is based on Syngenta’s new PLINAZOLIN® technology, which targets the mosquito’s nervous system to paralyze and kill them. Notably, it offers long-lasting, effective control with a single seasonal application—particularly vital in regions facing insecticide resistance—and supports resistance management when rotated with other products.

Report Scope

Report Features Description Market Value (2024) USD 901.0 Million Forecast Revenue (2034) USD 1,481.7 Million CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Synthetic Larvicides, Biological Larvicides), By Formulation (Powders, Liquids, Tablets, Dunks, Others), By Control Method (Chemical Agents, Biocontrol Agents, Insect Growth Regulators (IGR), Others), By Target Insect (Mosquitoes, Flies, Beetles, Others), By Application (Agriculture, Non-Agriculture) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Bayer AG, Syngenta AG, Sumitomo Chemical Co., Clarke Mosquito Control Products Inc., Central Life Sciences, Gowan, UPL Ltd., FMC Corporation, Russell IPM Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Bayer AG

- Syngenta AG

- Sumitomo Chemical Co.

- Clarke Mosquito Control Products Inc.

- Central Life Sciences

- Gowan

- UPL Ltd.

- FMC Corporation

- Russell IPM