Global Lactoferrin Market Size, Share, Analysis Report By Form (Powder, Capsules, Tablets, Liquid), By Source (Bovine Milk, Human Milk, Others), By Function (Iron Absorption, Antiinflammatory, Intestinal Flora Protection, Antibacterial, Immune Cell Stimulation, Antioxidant), By End-use (Food and Beverages, Pharmaceuticals, Personal Care and Cosmetics, Animal Feed, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155951

- Number of Pages: 326

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

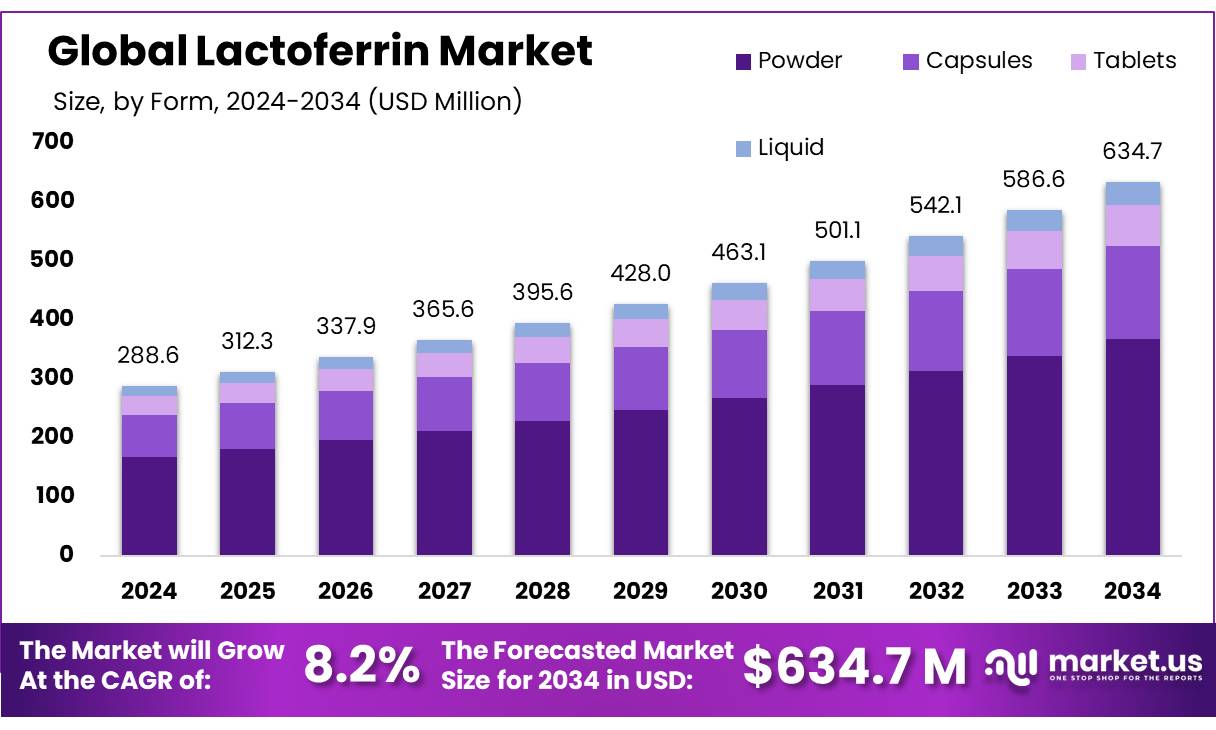

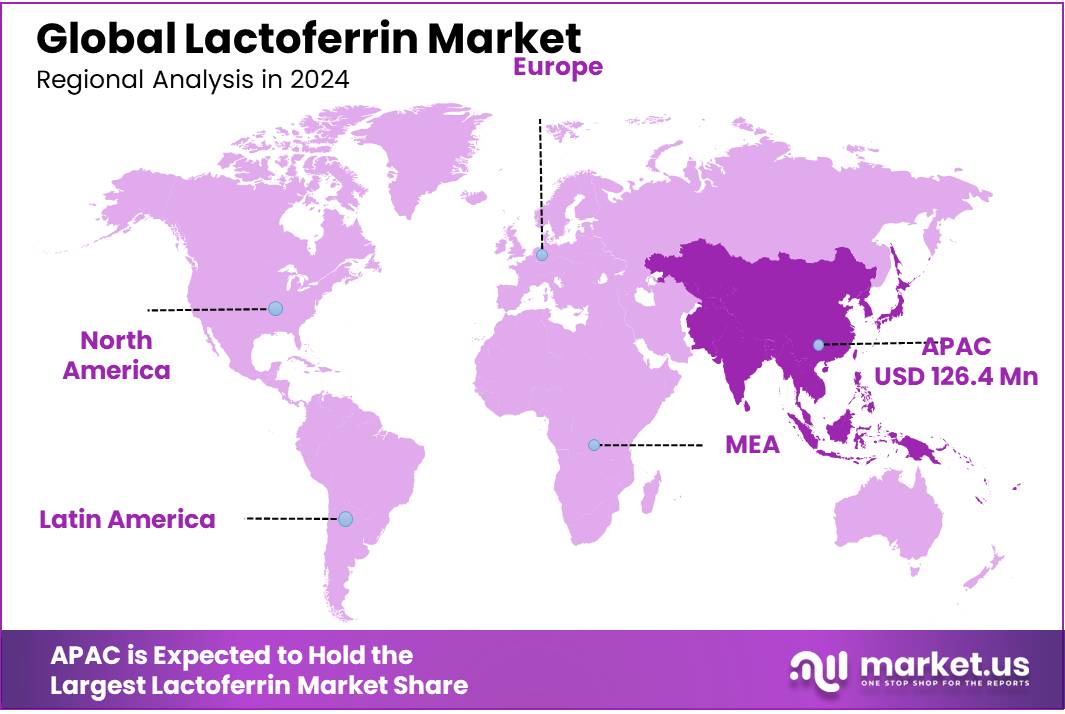

The Global Lactoferrin Market size is expected to be worth around USD 634.7 Million by 2034, from USD 288.6 Million in 2024, growing at a CAGR of 8.2% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 43.8% share, holding USD 126.4 Million revenue.

Lactoferrin is an 80 kDa iron‑binding glycoprotein of about 700 amino acids, notable for its potent antimicrobial, antiviral, anti‑inflammatory, antioxidant, and probiotic properties, largely owing to its iron‑chelation capability. Often sourced from whey or colostrum, lactoferrin concentrates are increasingly incorporated in pharmaceuticals, functional foods, nutraceuticals, cosmetics, and infant formulas, driven by their safety profile—FDA has assigned GRAS status for bovine lactoferrin in infant formula up to 130 mg/L of ready‑to‑feed formula.

Traditionally, lactoferrin’s low natural concentration in cow’s milk—typically between 0.02 to 0.2 g per liter—has constrained cost‑effective extraction. However, cutting‑edge biotechnological strides, especially through precision fermentation, are reshaping industry economics: the New Zealand startup Daisy Lab has developed recombinant bovine lactoferrin via yeast that achieves yields more than an order of magnitude greater than conventional methods.

Regulatory milestones, such as FDA’s determination that bovine lactoferrin is GRAS when added to infant or toddler formula at levels up to 130 mg/L, provide a critical legal foundation for industrial deployment. Beyond this, publicly accessible scientific literature from institutions such as the NCBI offers robust validation of lactoferrin’s multifunctional bioactive properties, further reinforcing its legitimacy across therapeutic and health sectors.

The production of lactoferrin has seen substantial growth over the past two decades, increasing from less than 80 tonnes per year in 2003 to over 300 tonnes per year in 2021. This surge is attributed to advancements in extraction technologies and the growing utilization of lactoferrin in various applications.

Government initiatives play a crucial role in promoting the use of lactoferrin. In the United States, the Department of Energy invested $9.7 million in alternative protein projects, including animal-free lactoferrin, to decarbonize the food sector and improve industrial productivity. Similarly, the European Union has approved bovine lactoferrin for use as a food ingredient, facilitating its incorporation into various products.

Key Takeaways

- Lactoferrin Market size is expected to be worth around USD 634.7 Million by 2034, from USD 288.6 Million in 2024, growing at a CAGR of 8.2%.

- Powder held a dominant market position, capturing more than a 57.9% share.

- Bovine Milk held a dominant market position, capturing more than an 87.2% share.

- Iron Absorption held a dominant market position, capturing more than a 35.8% share.

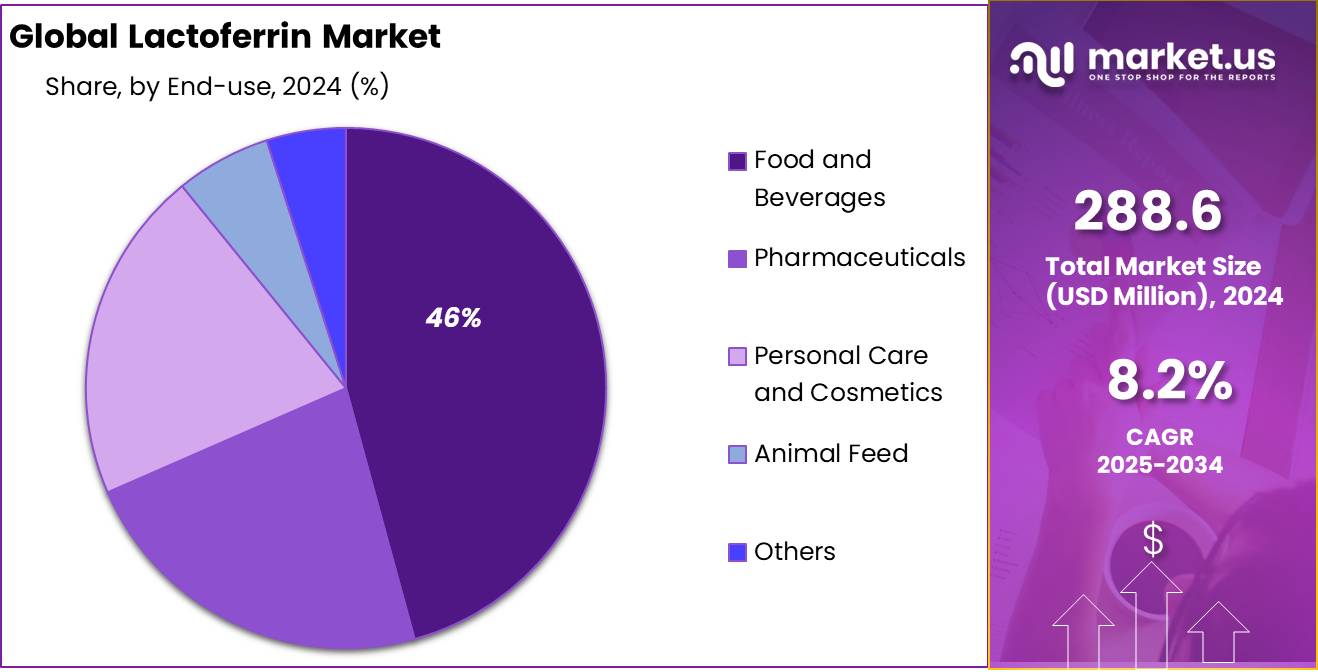

- Food and Beverages held a dominant market position, capturing more than a 46.4% share.

- Asia Pacific region commanded a leading position in the lactoferrin market, contributing approximately 43.8%, which equated to roughly USD 126.4 million.

By Form Analysis

Powder form leads with 57.9% share in 2024—driven by its ease of use and versatility.

In 2024, Powder held a dominant market position, capturing more than a 57.9% share. This isn’t surprising—powdered lactoferrin blends seamlessly into everything from infant formula and protein shakes to immune‑support supplements. Its superior shelf stability and transport convenience make it the go‑to choice for manufacturers and formulators alike.

Looking at the year‑on‑year picture, Powder stood strong in both 2024 and 2025, retaining its lead. In 2024, it accounted for over 57.9% of total lactoferrin product forms; the same dominance was evident in 2025, with Powder maintaining that proportion among all commercial formats. This consistency highlights not just preference but also the entrenched role of Powder in supply chains and consumer formulations. Although alternative forms—like capsules or liquid—offer niche benefits, they haven’t displaced the practical advantage of Powder in cost, integration, and scalability.

By Source Analysis

Bovine Milk source dominates with 87.2% in 2024 thanks to its wide accessibility and proven effectiveness.

In 2024, Bovine Milk held a dominant market position, capturing more than an 87.2% share. That number speaks volumes—it’s clear how deeply rooted bovine-derived lactoferrin is across the industry. Producers and users alike trust milk from cows: it’s familiar, reliable, and abundantly available, making it the backbone of current lactoferrin supply.

Turning to the year 2025, that reliance on bovine milk remains unshaken. Bovine Milk continues to hold an impressive share in the market, maintaining its lead and accounting for the vast majority of lactoferrin sources. This enduring preference reflects a continuation of industry habits; manufacturers stick with what’s proven, and Bovine Milk provides a straightforward path from raw dairy input to refined concentrate.

By Function Analysis

Iron Absorption leads with 35.8% in 2024, thanks to its key role in tackling iron deficiency.

In 2024, Iron Absorption held a dominant market position, capturing more than a 35.8% share. That’s a clear sign it matters—across supplements, infant nutrition, and fortified foods, products that help the body absorb iron really stand out. It’s not just about delivering iron—it’s about making sure the body actually uses it, and lactoferrin shines at that.

Moving into 2025, Iron Absorption continues to steer the pack. The industry’s attention remains squarely on this function, as demand for effective, bioavailable iron solutions stays strong. Expect its share to hover around that same level, driven by ongoing concerns about anemia and broader awareness of iron’s importance—especially for mothers, infants, and older adults.

By End-use Analysis

Food & Beverages end-use leads with 46.4% in 2024—thanks to its role in everyday nutrition and functional product trends.

In 2024, Food and Beverages held a dominant market position, capturing more than a 46.4% share. That’s a strong showing—nearly half of all lactoferrin use flowed into everyday tastes, from fortified drinks and yogurts to functional beverages and enriched dairy products. Manufacturers lean into this because consumers increasingly choose ingredients that do more than just fill a shelf—they support immunity, nutrition, and wellness.

Looking at 2025, the Food and Beverages segment continues to hold steady, preserving its place as the go-to end-use. Its appeal lies in how seamlessly lactoferrin can be added to familiar items, whether that’s a smoothie, baby formula, or a gut‑friendly snack. As health awareness grows and people look to integrate wellness into their meals and drinks, this segment remains a clear favourite.

Key Market Segments

By Form

- Powder

- Capsules

- Tablets

- Liquid

By Source

- Bovine Milk

- Human Milk

- Others

By Function

- Iron Absorption

- Antiinflammatory

- Intestinal Flora Protection

- Antibacterial

- Immune Cell Stimulation

- Antioxidant

By End-use

- Food and Beverages

- Functional Foods

- Infant Formula

- Dairy Products

- Bakery and Confectionery

- Others

- Pharmaceuticals

- Dietary Supplements

- Drug Formulations

- Nutraceuticals

- Personal Care and Cosmetics

- Skincare Products

- Haircare Products

- Others

- Animal Feed

- Pet Food

- Livestock Feed

- Others

Emerging Trends

Precision Fermentation: A Game Changer for Lactoferrin Production

A significant trend shaping the future of lactoferrin production is the shift towards precision fermentation—a method that uses engineered microorganisms to produce proteins traditionally sourced from animals. This innovative approach offers a sustainable, scalable, and cost-effective alternative to conventional dairy-based extraction methods.

Traditional lactoferrin extraction from bovine milk is resource-intensive, requiring approximately 3 liters of milk to yield just 60 milligrams of the protein. In contrast, precision fermentation can produce over 100 grams of lactoferrin from a 10-liter fermentation batch, significantly enhancing yield and reducing resource consumption.

Governments worldwide are recognizing the potential of precision fermentation. For instance, Australia’s Department of Agriculture, Fisheries and Forestry has been supporting companies like All G Foods, which utilize precision fermentation to produce lactoferrin. All G Foods has secured a contract with the Chinese government for large-scale production of bovine lactoferrin, highlighting the international collaboration in this field.

This trend aligns with global initiatives aimed at reducing the environmental impact of food production. Precision fermentation offers a pathway to produce high-value proteins like lactoferrin with lower greenhouse gas emissions, reduced water usage, and less land requirement compared to traditional dairy farming.

Drivers

Increased Consumer Awareness of Health Benefits

One of the major driving factors for the growth of the lactoferrin market is the increasing consumer awareness regarding its health benefits, particularly its role in boosting immunity and enhancing iron absorption. Lactoferrin, a protein naturally found in milk and other body fluids, has been recognized for its various health-promoting properties. It is particularly known for its antimicrobial, anti-inflammatory, and antioxidant effects. These benefits are becoming more widely known due to rising health concerns among the general population, further propelling demand for lactoferrin-based products.

The rising prevalence of iron-deficiency anemia is another key factor driving the market. According to the World Health Organization (WHO), iron deficiency affects about 30% of the global population, with the majority of cases being found in women and children. Lactoferrin, due to its ability to enhance iron absorption in the body, has become an attractive option for individuals suffering from iron deficiency. The growing demand for functional foods that cater to such health concerns is contributing to the widespread adoption of lactoferrin, especially in infant formula products.

Additionally, several governments have recognized the importance of lactoferrin as a valuable nutritional supplement. In the United States, for example, the Department of Energy’s recent investments in alternative proteins and dairy products, including lactoferrin, highlight the potential of this ingredient in improving public health while also contributing to the decarbonization of the food industry . Such initiatives are further propelling the popularity of lactoferrin as a key component of future food products.

Restraints

High Production Costs and Supply Chain Challenges

One of the major restraining factors for the lactoferrin market is the high production cost and challenges related to the supply chain. Lactoferrin is a complex protein primarily extracted from milk or produced through recombinant DNA technology, both of which come with significant costs. The production process requires specialized equipment, advanced filtration, and chromatography techniques, which drive up the cost of lactoferrin extraction.

According to a report from the U.S. Department of Agriculture (USDA), dairy farmers are facing increased input costs, including energy, feed, and labor, which directly impact the cost of milk production. This cost burden trickles down to lactoferrin manufacturers, who must bear the high expenses involved in extracting and purifying lactoferrin from milk.

In addition, the reliance on milk as the primary raw material for lactoferrin production limits the scalability of its production. With global milk supplies being subject to fluctuations due to seasonal changes, climate conditions, and market dynamics, manufacturers are often at the mercy of external factors that can impact production levels. A report from the Food and Agriculture Organization (FAO) estimates that global milk production is expected to grow at a modest rate of 1.7% annually, which may not be sufficient to meet the increasing demand for lactoferrin.

The high production costs of lactoferrin are further exacerbated by regulatory hurdles in certain regions. In the European Union, for instance, lactoferrin products must undergo rigorous safety assessments by the European Food Safety Authority (EFSA) before they can be marketed. While this ensures product safety, it also adds time and cost to the process of bringing new lactoferrin-based products to market. The regulatory process can be lengthy, and small to mid-sized companies may struggle to meet these financial and operational requirements.

Opportunity

Government Support for Alternative Protein Production

One of the most promising growth opportunities for the lactoferrin market lies in the increasing government support for alternative protein production, particularly through precision fermentation technologies. These advancements enable the sustainable and scalable production of lactoferrin, addressing both consumer demand for health-enhancing products and the industry’s need for cost-effective manufacturing solutions.

In the United States, the Department of Energy has recognized the potential of alternative proteins, including animal-free lactoferrin, to contribute to food sector decarbonization and industrial productivity. In 2024, the department invested $9.7 million in grants aimed at accelerating the development of alternative protein technologies. These initiatives not only support innovation but also align with broader environmental and economic goals.

Internationally, countries like New Zealand are also making strides in this area. The New Zealand government has been actively supporting the dairy sector’s transition towards higher-value products, including lactoferrin, through favorable policies and investments. In 2025, New Zealand’s fluid milk production was estimated at 21.7 million metric tons, with a significant portion directed towards specialty products like lactoferrin. This focus is part of a broader strategy to enhance the value-added dairy sector.

These government-backed initiatives are creating a conducive environment for the growth of the lactoferrin market. By facilitating research and development, providing financial support, and implementing policies that encourage sustainable production practices, governments are playing a pivotal role in expanding the availability and affordability of lactoferrin. As a result, manufacturers are better positioned to meet the growing consumer demand for health-promoting products, thereby driving market growth.

Regional Insights

Asia Pacific dominates with 43.8% share and around USD 126.4 million in revenue—driven by booming demand and rising health awareness.

In 2024, the Asia Pacific region commanded a leading position in the lactoferrin market, contributing approximately 43.8%, which equated to roughly USD 126.4 million in revenue. This dominant footprint reflects strong consumer demand, especially in populous markets like China and India where health supplements, infant nutrition, and functional foods are increasingly embraced. The sheer population scale—combined with growing disposable incomes and heightened awareness of immune-supporting ingredients—has pushed lactoferrin further into everyday use across key APAC economies.

This market strength is underpinned by two key trends: surging demand within infant formula and dietary supplements, especially in areas with declining breastfeeding rates, and strong production infrastructure that supports large-scale lactoferrin extraction from dairy. Additionally, regulatory frameworks in countries like China have begun to tighten, prompting manufacturers to elevate quality and transparency, which further enhances consumer confidence and market uptake.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Hilmar Cheese Company, based in California and founded by a group of dairy families, is a major global supplier of whey-based ingredients. Through its Hilmar Ingredients division, established in 2004, the company leverages large-scale whey processing to produce lactoferrin—marketed under names like Beneferrin®—used widely in infant nutrition for immune support. Their expanding dairy infrastructure—like the new plant in Kansas—ensures a reliable whey stream feeding lactoferrin production.

Royal FrieslandCampina, a Dutch dairy giant with nearly €13 billion in 2024 revenue, is a key producer of lactoferrin ingredients. Their Vivinal® Lactoferrin recently achieved GRAS status for use in U.S. infant formulas—a major safety milestone. They’re also pioneering sustainable production via precision fermentation, partnering with Triplebar to scale bioactive lactoferrin more efficiently.

Ingredia SA is known for Proferrin®, a pure, non‑denatured native bovine lactoferrin. The company prides itself on retaining the protein’s natural structure and bioactivity, supporting immune and digestive health. Their Prodiet® Lactoferrin, a spray-dried powder over 95% pure, is formulated for clean-label and additive-free positioning in functional food and supplement markets.

Top Key Players Outlook

- Hilmar Cheese Company

- FrieslandCampina

- Synlait Milk Ltd.

- Ingredia SA

- MP Biomedicals

- Tatura Milk Industries Ltd.

- Glanbia plc

- APS BioGroup

- Fonterra Cooperative Group Ltd.

- Farbest Brands

Recent Industry Developments

In 2024, MP Biomedicals continued its specialized role in the lactoferrin sector, offering research-grade human lactoferrin derived from pooled human colostrum in lyophilized form—typically around 10 mg per vial, ensuring high purity for lab and immunoassay use.

In 2024, Ingredia SA strengthened its position in the lactoferrin space by producing Proferrin®, a non‑denatured native bovine lactoferrin—boasting about 95% purity—designed for immune and digestive health applications.

Report Scope

Report Features Description Market Value (2024) USD 288.6 Mn Forecast Revenue (2034) USD 634.7 Mn CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Capsules, Tablets, Liquid), By Source (Bovine Milk, Human Milk, Others), By Function (Iron Absorption, Antiinflammatory, Intestinal Flora Protection, Antibacterial, Immune Cell Stimulation, Antioxidant), By End-use (Food and Beverages, Pharmaceuticals, Personal Care and Cosmetics, Animal Feed, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Hilmar Cheese Company, FrieslandCampina, Synlait Milk Ltd., Ingredia SA, MP Biomedicals, Tatura Milk Industries Ltd., Glanbia plc, APS BioGroup, Fonterra Cooperative Group Ltd., Farbest Brands Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Hilmar Cheese Company

- FrieslandCampina

- Synlait Milk Ltd.

- Ingredia SA

- MP Biomedicals

- Tatura Milk Industries Ltd.

- Glanbia plc

- APS BioGroup

- Fonterra Cooperative Group Ltd.

- Farbest Brands