Global L-Carnitine Market Size, Share, And Business Benefits By Process (Chemical Synthesis, Bioprocess), By Product (Food and Pharma Grade, Feed Grade), By Application (Animal Feed, Healthcare Products, Functional Animal Feeds, Medicines, Others), By Distribution Channel(Online Retail, Pharmacies, Retail Stores, Direct Sales, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156282

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

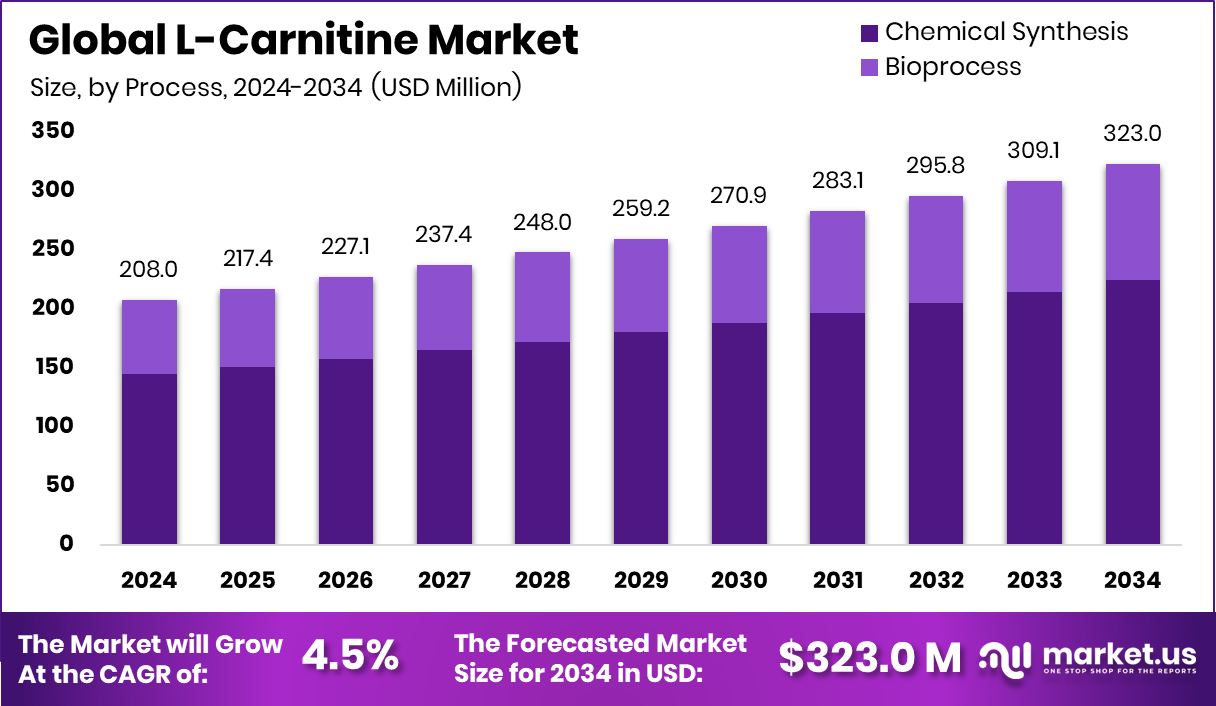

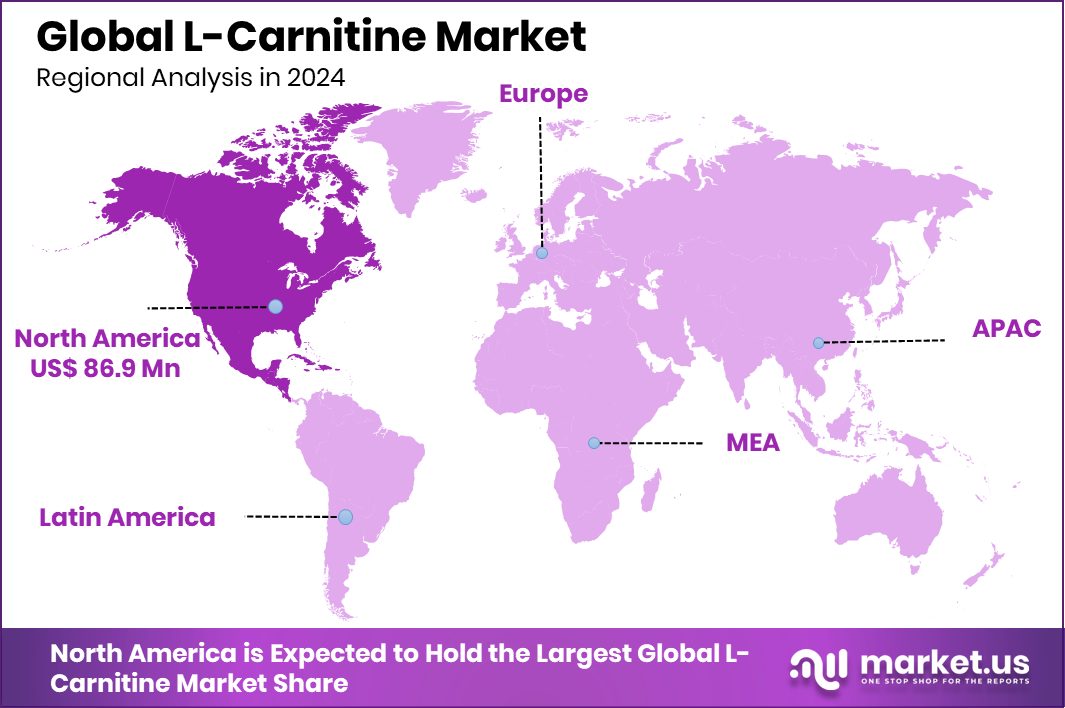

The Global L-Carnitine Market is expected to be worth around USD 323.0 million by 2034, up from USD 208.0 million in 2024, and is projected to grow at a CAGR of 4.5% from 2025 to 2034. Supplement demand supports North America’s 41.8% share, reaching USD 86.9 Mn.

L-Carnitine is a naturally occurring amino acid derivative that plays a key role in energy metabolism. It helps transport long-chain fatty acids into the mitochondria, where they are converted into energy, making it essential for energy production, endurance, and overall metabolic health. It is widely recognized for supporting heart and brain function, muscle activity, and fat metabolism, and is available in dietary sources such as meat, fish, and dairy, as well as in supplemental form.

The L-Carnitine market refers to the global trade, production, and consumption of this compound across dietary supplements, pharmaceuticals, functional foods, and sports nutrition. Rising health consciousness, growing awareness about weight management, and increasing demand for energy-boosting supplements are shaping the demand. Its application is also expanding in clinical nutrition and infant formulas, giving the market a broad base. According to an industry report, The EVERY Co. grabs $175M as it cracks code on animal-free protein products

A major growth factor for the L-Carnitine market is the rising prevalence of lifestyle-related health issues such as obesity, diabetes, and cardiovascular diseases. Consumers are seeking preventive solutions through nutrition, and L-Carnitine is gaining attention for its proven role in supporting fat metabolism and heart health.

On the demand side, the increasing adoption of fitness and wellness routines is driving higher consumption. The growing trend of sports nutrition and energy supplements has pushed L-Carnitine into the mainstream, making it popular among athletes, bodybuilders, and individuals aiming to improve stamina and recovery.

Key Takeaways

- The Global L-Carnitine Market is expected to be worth around USD 323.0 million by 2034, up from USD 208.0 million in 2024, and is projected to grow at a CAGR of 4.5% from 2025 to 2034.

- In the L-Carnitine market, chemical synthesis dominates with 69.5%, reflecting cost-effective large-scale production.

- Food and pharma-grade products hold 79.2%, showing strong demand from health-conscious and clinical nutrition segments.

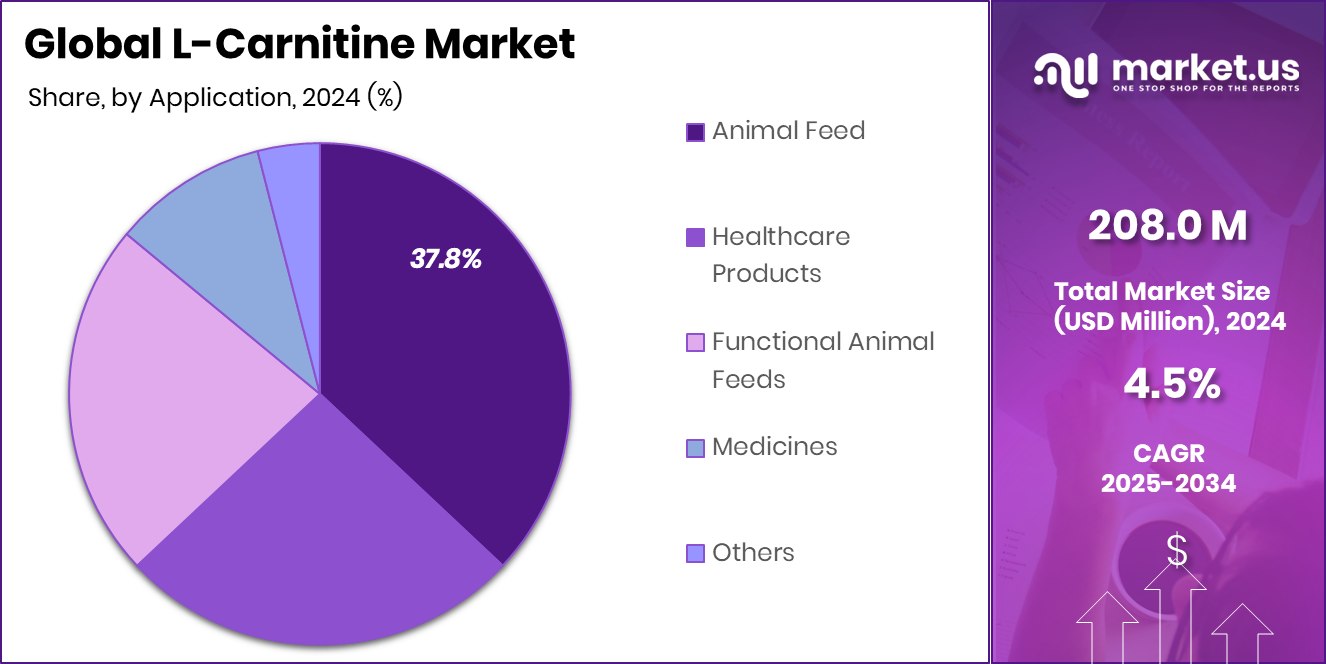

- Animal feed applications capture 37.8%, highlighting L-Carnitine’s importance in improving livestock growth and metabolism.

- Pharmacies lead distribution with 32.3%, as consumers increasingly prefer direct access to trusted supplement sources.

- Rising health awareness drives North America’s 41.8% market, valued at USD 86.9 Mn.

By Process Analysis

The L-Carnitine market is largely driven by chemical synthesis, accounting for 69.5%.

In 2024, Chemical Synthesis held a dominant market position in the By Process segment of the L-Carnitine Market, with a 69.5% share. This leadership reflects the reliability and scalability of chemical synthesis methods, which have become the preferred approach for producing L-Carnitine in bulk.

The process ensures consistent quality, high purity levels, and cost-effectiveness, making it suitable for widespread applications across dietary supplements, pharmaceuticals, and functional foods. Chemical synthesis also offers manufacturers the ability to maintain steady supply chains and meet rising demand from industries focusing on energy metabolism, weight management, and clinical nutrition.

The strong adoption of chemical synthesis is linked to its technological maturity and its ability to deliver commercial-scale production while adhering to stringent regulatory standards. With L-Carnitine being used in diverse sectors such as sports nutrition, medical therapies, and infant formulations, the need for reliable and large-scale production processes is only increasing.

The 69.5% share in 2024 highlights the segment’s importance in sustaining market growth and ensuring affordability for end-users. Moving forward, chemical synthesis is expected to retain its stronghold due to its efficiency and adaptability, making it the backbone of L-Carnitine production worldwide.

By Product Analysis

Food and pharma-grade products dominate the L-Carnitine market, holding a 79.2% share.

In 2024, Food and Pharma Grade held a dominant market position in the By Product segment of the L-Carnitine Market, with a 79.2% share. This strong lead highlights the growing reliance on high-quality, safe, and regulated forms of L-Carnitine, especially in sectors where human health and well-being are the primary focus.

Food and pharma grade L-Carnitine is widely used in dietary supplements, functional foods, sports nutrition products, and medical formulations, where purity and safety standards are critical. Its extensive acceptance in clinical nutrition, particularly for patients with metabolic disorders and cardiovascular conditions, further strengthens its importance.

The 79.2% share underscores how consumers and healthcare providers are prioritizing quality over cost, especially as awareness about preventive health and nutrition continues to rise. With increasing cases of obesity, diabetes, and fatigue-related conditions, the demand for L-Carnitine as a supportive nutrient has expanded significantly.

Moreover, the growing fitness and wellness culture has pushed pharma-grade formulations into mainstream use, not just among athletes but also among general consumers seeking improved energy and recovery. Going forward, the dominance of food and pharma-grade L-Carnitine is expected to persist, supported by strict regulatory frameworks, ongoing clinical research, and the consistent demand for safe and effective health products.

By Application Analysis

Animal feed applications contribute significantly, making up around 37.8% of the market portion.

In 2024, Animal Feed held a dominant market position in the By Application segment of the L-Carnitine Market, with a 37.8% share. This leadership reflects the critical role of L-Carnitine in improving animal health, growth, and overall productivity.

Widely recognized for its ability to enhance fat metabolism and energy utilization, L-Carnitine is increasingly incorporated into feed formulations for poultry, swine, cattle, and aquaculture. Its inclusion supports better feed efficiency, improved weight gain, and healthier livestock, which are essential for meeting the rising global demand for meat, dairy, and related products.

The 37.8% share in 2024 highlights the growing preference of livestock producers for nutrition solutions that improve both animal performance and farm profitability. As the livestock industry faces pressure to optimize resources and ensure sustainability, L-Carnitine is being adopted as a valuable additive that not only boosts productivity but also contributes to healthier herds and flocks.

With increasing focus on sustainable animal farming and higher consumer expectations for quality animal-derived products, demand for L-Carnitine in animal feed is expected to remain strong. Its proven efficiency in improving metabolic health and feed conversion ensures that this segment will continue to be a cornerstone of the L-Carnitine market in the coming years.

By Distribution Channel Analysis

Pharmacies remain a key distribution channel, representing 32.3% of total sales.

In 2024, Pharmacies held a dominant market position in the By Distribution Channel segment of the L-Carnitine Market, with a 32.3% share. This reflects the strong consumer trust in pharmacies as reliable points of purchase for health and wellness products. Pharmacies remain the preferred channel for L-Carnitine, particularly because of their credibility in offering authentic, high-quality, and safe supplements.

Consumers seeking L-Carnitine for weight management, energy support, or clinical purposes often rely on pharmacies due to the availability of professional guidance from pharmacists, which adds an extra layer of assurance in product selection.

The 32.3% share demonstrates how pharmacies have successfully captured demand from both regular supplement users and patients requiring medically recommended dosages. Their wide network and accessibility, from urban centers to smaller towns, further strengthen their role in market distribution. Additionally, pharmacies often cater to consumers with chronic conditions such as obesity, diabetes, and cardiovascular issues, where L-Carnitine supplementation is increasingly recommended as supportive care.

With rising health awareness and growing interest in preventive nutrition, pharmacies are positioned to remain a critical channel. This dominance is expected to continue as consumers increasingly value trust, convenience, and professional advice when purchasing health-related products like L-Carnitine.

Key Market Segments

By Process

- Chemical Synthesis

- Bioprocess

By Product

- Food and Pharma Grade

- Feed Grade

By Application

- Animal Feed

- Healthcare Products

- Functional Animal Feeds

- Medicines

- Others

By Distribution Channel

- Online Retail

- Pharmacies

- Retail Stores

- Direct Sales

- Others

Driving Factors

Rising Health Awareness Boosting Nutritional Supplement Demand

One of the strongest driving factors for the L-Carnitine market is the rising global health awareness, which is pushing consumers toward nutritional supplements for better energy, fitness, and overall wellness. With modern lifestyles often linked to fatigue, obesity, and metabolic issues, more people are looking at preventive solutions rather than curative approaches.

L-Carnitine, known for its role in fat metabolism and energy production, is gaining recognition as a safe and effective option. Growing awareness of lifestyle diseases such as diabetes and cardiovascular conditions further supports this demand, as L-Carnitine is often recommended for improved heart health and weight control. This shift in consumer behavior is creating consistent growth opportunities for the L-Carnitine market worldwide.

Restraining Factors

High Production Costs Limiting Wider Market Adoption

A key restraining factor for the L-Carnitine market is the high production cost associated with ensuring pharmaceutical and food-grade quality. Since L-Carnitine is widely used in health supplements, infant formulas, and clinical nutrition, strict quality control and regulatory compliance are essential. These processes increase manufacturing expenses, making the final product more costly for consumers.

In price-sensitive regions, this often limits accessibility and reduces overall demand. While the benefits of L-Carnitine are well recognized, the affordability challenge can slow its adoption in mass markets. Unless production technologies become more cost-efficient, or governments and industries provide support to lower prices, high costs will continue to restrain the wider penetration of L-Carnitine across global markets.

Growth Opportunity

Expanding Therapeutic Uses Creating New Market Avenues

A major growth opportunity for the L-Carnitine market lies in its expanding therapeutic applications beyond traditional nutrition and fitness. Research is increasingly highlighting L-Carnitine’s potential benefits in areas such as neurological health, fertility improvement, and aging-related conditions. For instance, studies suggest its role in supporting brain function, reducing fatigue in chronic illnesses, and enhancing male reproductive health.

These emerging uses are opening new doors in pharmaceuticals and clinical care, where demand for safe and effective supportive therapies is steadily increasing. As healthcare systems worldwide emphasize preventive and functional treatments, the scope for L-Carnitine is set to grow further. This expansion into specialized therapeutic areas positions the compound as a long-term growth driver for the market.

Latest Trends

Rising Demand for Plant-Based and Vegan Supplements

One of the latest trends in the L-Carnitine market is the growing preference for plant-based and vegan supplements. As more consumers adopt vegetarian and vegan lifestyles, the demand for non-animal-derived L-Carnitine has significantly increased. Traditionally, L-Carnitine is found in meat and dairy products, but companies are now developing vegan-certified supplements produced through fermentation and advanced synthesis methods.

This shift aligns with the global move toward clean-label, sustainable, and ethical nutrition solutions. The trend is especially strong among younger consumers who prioritize health, environmental responsibility, and animal welfare. With plant-based products gaining rapid popularity across the broader supplement industry, vegan L-Carnitine offerings are expected to become a key growth driver in the coming years.

Regional Analysis

In 2024, North America held a 41.8% share, worth USD 86.9 Mn.

In 2024, North America emerged as the dominant region in the L-Carnitine market, securing a substantial 41.8% share valued at USD 86.9 million. This leadership is strongly supported by the region’s advanced healthcare infrastructure, high consumer awareness, and widespread adoption of dietary supplements.

The prevalence of lifestyle-related health issues such as obesity, diabetes, and cardiovascular disorders has further accelerated the use of L-Carnitine in both preventive and therapeutic applications. In addition, the growing fitness culture across the United States and Canada has significantly boosted demand for sports nutrition products, where L-Carnitine is a key ingredient for energy metabolism and endurance.

Consumers in North America are also highly inclined toward clinically validated and pharma-grade supplements, ensuring steady market penetration. Furthermore, government-backed health initiatives promoting balanced nutrition and preventive healthcare add to the region’s strong position in the market.

While other regions such as Europe, Asia Pacific, the Middle East & Africa, and Latin America are contributing to growth, North America continues to lead as the largest revenue generator. The 41.8% dominance not only reflects the maturity of the regional supplement industry but also highlights the strong consumer preference for high-quality, science-backed nutritional solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AllMax Nutrition has positioned itself as a consumer-focused brand, particularly appealing to fitness enthusiasts and athletes. By offering L-Carnitine in accessible supplement formats, the company has strengthened its presence in sports nutrition, where demand for performance and recovery products continues to grow. Its focus on transparency and quality has helped capture trust among a health-conscious consumer base.

BulkSupplements, on the other hand, emphasizes affordability and variety, making it a preferred choice for both individual consumers and small-scale manufacturers. By supplying L-Carnitine in multiple bulk formats, the company serves a broad audience—from everyday supplement users to businesses requiring raw ingredients. This approach not only ensures widespread accessibility but also strengthens the brand’s versatility in the market.

Cayman Chemical contributes to the market from a scientific and research-driven perspective. Its role in supplying L-Carnitine for laboratory and clinical applications supports ongoing studies into new therapeutic uses. This positions Cayman as a key enabler of innovation, ensuring that the compound’s benefits are continually explored and validated.

Top Key Players in the Market

- AllMax Nutrition

- BulkSupplements

- Cayman Chemical

- Ceva

- ChengDa Mediciness Co., Ltd.

- Huanggang Huayang Medicines Co. Ltd.

- Jarrow Formulas

- Kaiyuan Hengtai Nutrition Co., Ltd.

- Lonza

- Northeast Medicines Group Co., Ltd. (NEPG)

Recent Developments

- In August 2025, Huanggang Huayang Pharmaceutical (another name for Huanggang Huayang Medicines Co. Ltd.) applied for a patent concerning a new method to prepare L‑Carnitine Orotate.

- In December 2024, Lonza announced a new organizational structure that will take effect from April 2025. The company will split into three platforms—Integrated Biologics, Advanced Synthesis, and Specialized Modalities. Its Capsules & Health Ingredients (CHI) division, which manages Carnipure® L-carnitine, will continue to operate independently, though Lonza has signaled it may exit this business in the future

Report Scope

Report Features Description Market Value (2024) USD 208.0 Million Forecast Revenue (2034) USD 323.0 Million CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Process (Chemical Synthesis, Bioprocess), By Product (Food and Pharma Grade, Feed Grade), By Application (Animal Feed, Healthcare Products, Functional Animal Feeds, Medicines, Others), By Distribution Channel(Online Retail, Pharmacies, Retail Stores, Direct Sales, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AllMax Nutrition, BulkSupplements, Cayman Chemical, Ceva, ChengDa Mediciness Co., Ltd., Huanggang Huayang Medicines Co. Ltd., Jarrow Formulas, Kaiyuan Hengtai Nutrition Co., Ltd., Lonza, Northeast Medicines Group Co., Ltd. (NEPG) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AllMax Nutrition

- BulkSupplements

- Cayman Chemical

- Ceva

- ChengDa Mediciness Co., Ltd.

- Huanggang Huayang Medicines Co. Ltd.

- Jarrow Formulas

- Kaiyuan Hengtai Nutrition Co., Ltd.

- Lonza

- Northeast Medicines Group Co., Ltd. (NEPG)