Global KVM Switch Market Size and Forecast Industry Analysis Report By Component (Standard Desktop, High Performance, In-rack KVM, KVM-over-IP, Others), By Switch Type (Single-User KVM, Multi-User KVM), By Enterprise Size (Small and Medium-sized Enterprises (SMEs), Large Enterprises), By End-Use (Government/Public Sector, Telecom & IT, Healthcare and Pharmaceuticals, Retail, Finance/Insurance, Content Provider/Media, Cloud Service Providers, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Sept. 2025

- Report ID: 158566

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- Investment and Business benefits

- US Market Size

- By Component

- By Switch Type

- By Enterprise Size

- By End-Use

- Key Market Segments

- Emerging Trends

- Growth Factors

- Top 5 Use Cases

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- SWOT Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

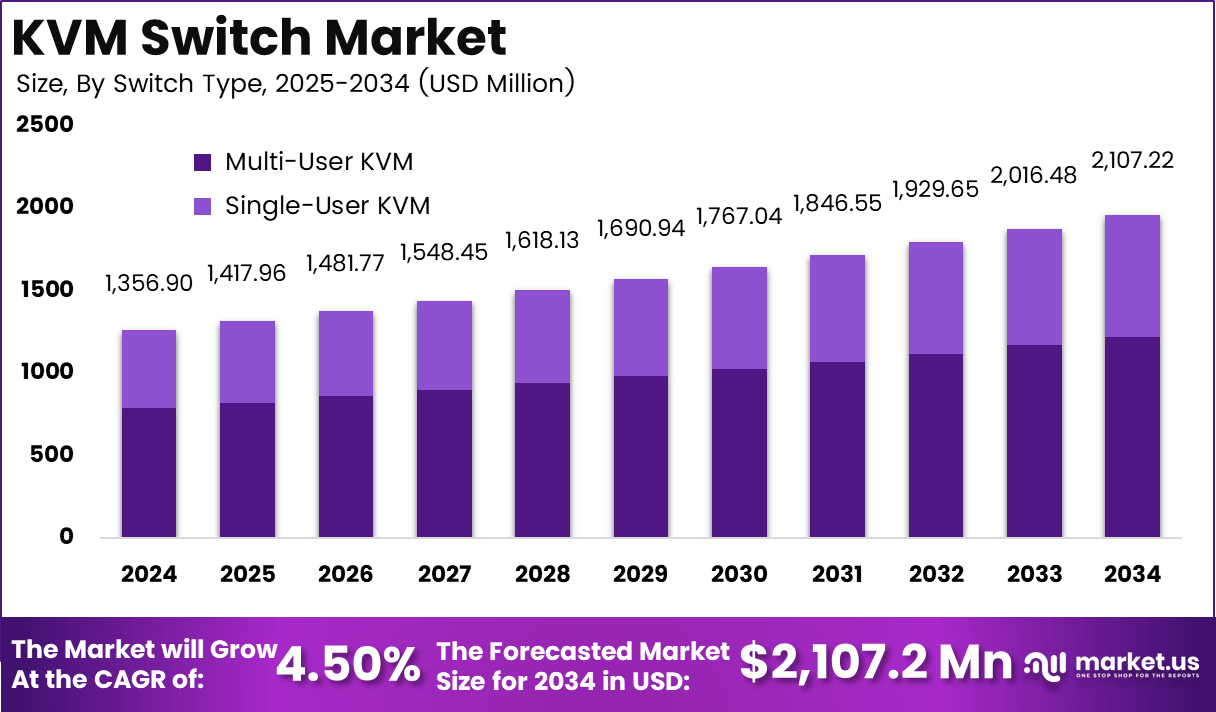

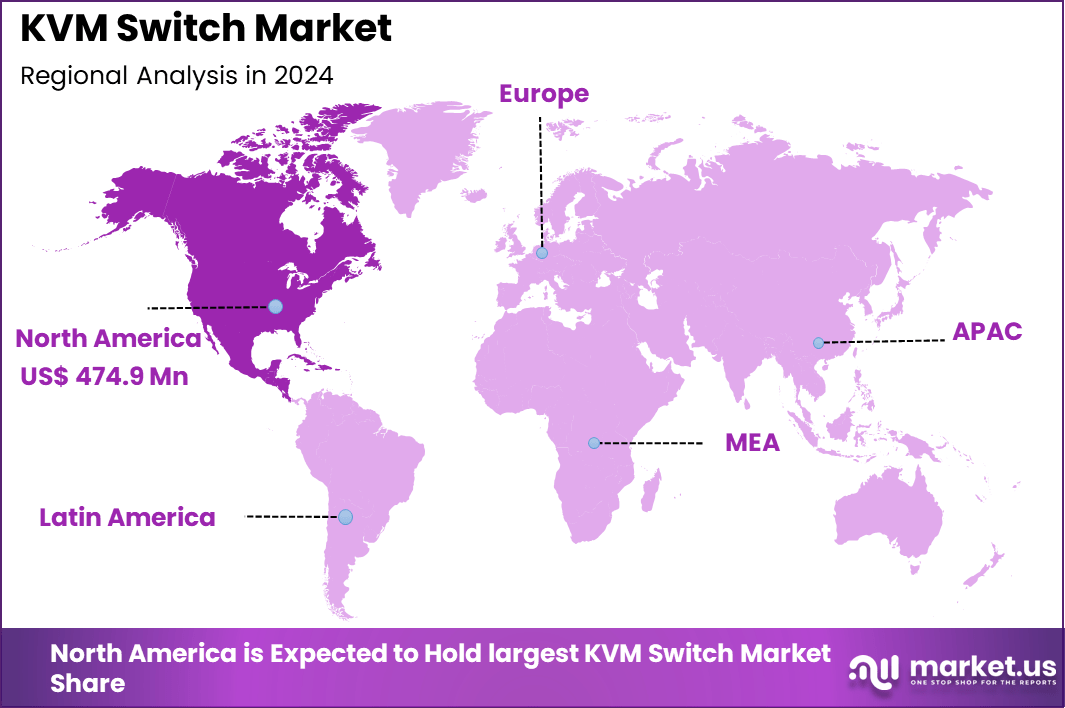

The Global KVM Switch Market size is expected to be worth around USD 2,107.22 Million By 2034, from USD 1,335.9 billion in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 35% share, holding USD 474.9 Million revenue.

The KVM (Keyboard, Video, Mouse) Switch Market comprises hardware systems that allow one human interface (keyboard, monitor, mouse) to control multiple computers or servers. Modern variants include analog, digital, and IP-based KVM switches, sometimes with added capabilities such as secure switching, multi-user operation, USB sharing, and high resolution support. KVM switches are widely deployed in data centers, server rooms, control rooms, broadcasting, and enterprise IT infrastructure.

Top driving factors include the expansion of data centers and server rooms, increased adoption of virtualization and cloud technologies, and stringent cybersecurity requirements across industries. For example, North America leads in market share because of advanced infrastructure and cybersecurity mandates. APAC shows fast growth spurred by SME digitalization and government-backed IT upgrades.

Demand is centered in IT & telecom, public sector, financial services, and large enterprises. In data centers, administrators use KVMs to reduce the need for dedicated keyboards and monitors per server rack. In broadcasting and media, where high-resolution video switching is required, enterprise KVMs are critical. Government and defense sectors demand secure switching and certified KVM hardware.

Key Takeaways

- By component, Standard Desktop KVMs represented 24%, showing steady demand for simple desktop management solutions.

- By switch type, Multi-User KVMs dominated with 58%, reflecting the growing need for shared access in enterprise and data center environments.

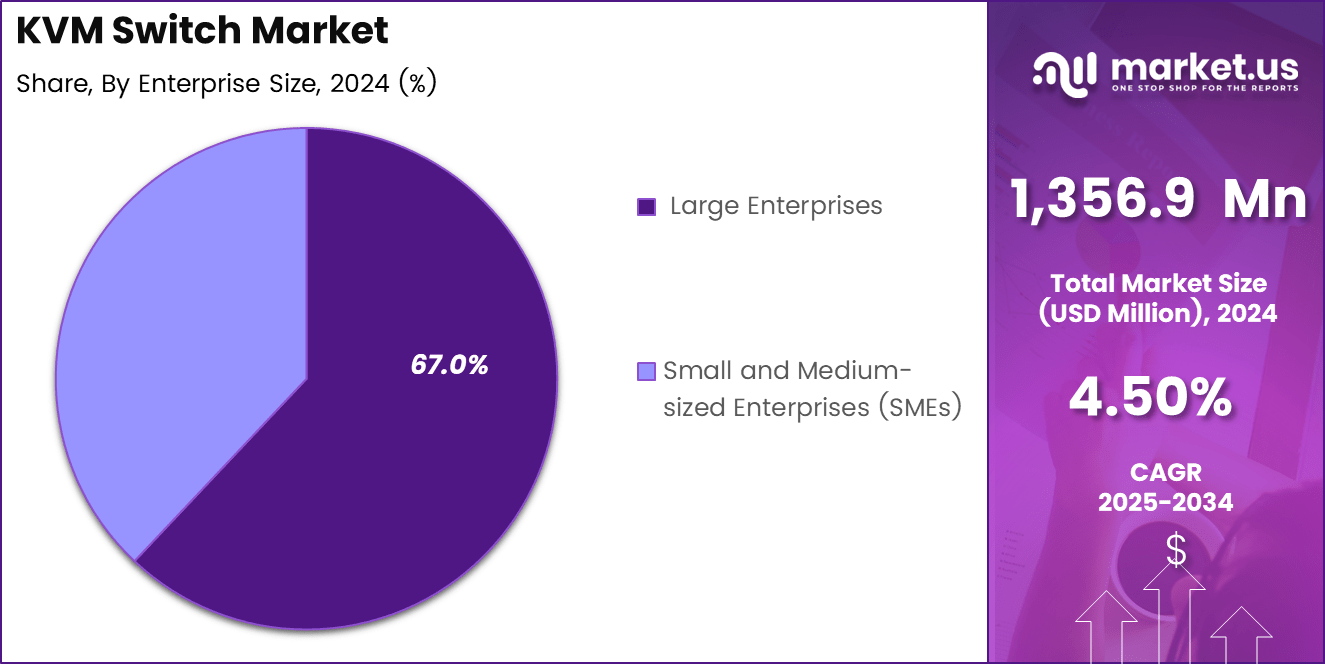

- By enterprise size, Large Enterprises accounted for 67%, underlining their reliance on KVM switches for managing large-scale IT infrastructure.

- By end-use, the Telecom & IT sector led with 30%, demonstrating strong adoption for network control and system monitoring.

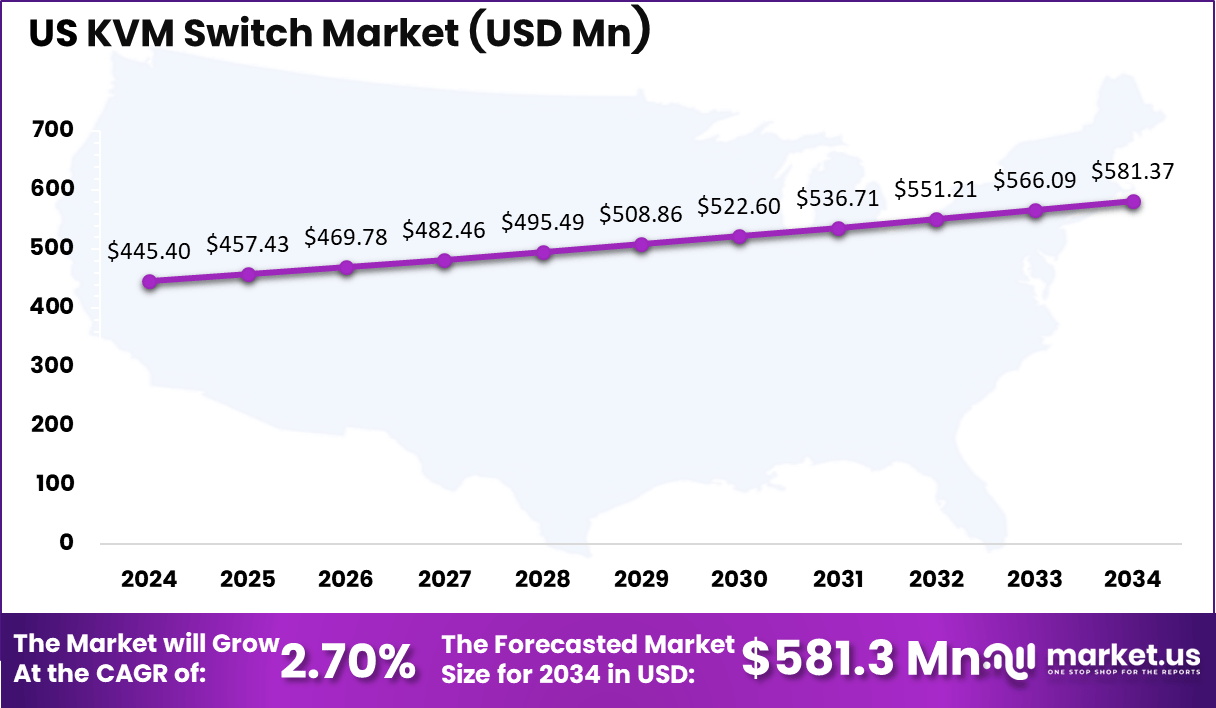

- Regionally, North America held 35% of the market, with the U.S. contributing the most at USD 445.4 million, supported by a moderate CAGR of 2.7%.

Analysts’ Viewpoint

Increasingly, organizations adopt advanced KVM technologies integrating artificial intelligence and machine learning. These features help with predictive maintenance, threat detection, and system optimization. IP KVM switches that enable secure remote access are becoming standard for cloud-native and AI-driven enterprises.

Furthermore, new models emphasize energy efficiency and sustainability, aligning with environmental goals. The combination of high resolution, multi-user capabilities, and encrypted transmission make these switches ideal for mission-critical and regulated environments.

Key reasons for adopting KVM switches include cost and space savings by reducing peripherals, improved productivity by simplifying control across multiple devices, and enhanced security by isolating system access physically. Users gain streamlined IT management and can perform maintenance even during network outages using hardware-level control. In high-stakes environments like healthcare, finance, or government, secure KVM switches prevent unauthorized access while ensuring uninterrupted operations.

Investment and Business benefits

Investment opportunities arise from the growing demand for secure KVM solutions in emerging markets such as Asia-Pacific and Latin America. Technological innovation including AI integration and quantum encryption opens paths for new product development. Mergers and acquisitions are expected as companies consolidate to strengthen cybersecurity portfolios.

Investments supporting hyperscale data centers, 5G expansion, and green data center initiatives also present significant potential. Business benefits associated with KVM switches include operational efficiency, reduced hardware costs, scalable and flexible IT infrastructure management, and reinforced cybersecurity compliance. They help companies maintain system reliability and uptime, lower maintenance efforts, and support digital transformation goals.

The regulatory environment is increasingly shaping KVM switch development with mandates on cybersecurity and zero-trust architecture, especially in vital sectors like energy, transport, and healthcare. Requirements such as multi-factor authentication, encrypted communication, and secure boot processes are becoming standard. Vendors embed security-by-design to meet audit and compliance needs, attracting government and critical infrastructure investments.

US Market Size

The United States remains a key contributor, supported by its large base of IT and telecom operations. The market in the country is expected to see steady progress at a 2.7% CAGR, aided by expanding data management needs and increasing focus on cost-efficient server management solutions.

In 2024, North America represented 35% of the market. The region benefits from its advanced IT infrastructure, high concentration of data centers, and continuous investment in digital technologies. Demand is further driven by the growing need for efficient remote server access in both enterprise and cloud service environments.

By Component

In 2024, Standard desktop KVM switches accounted for 24% of the component share. These switches are widely adopted in small office and home office setups where users need to manage multiple computers from a single workstation. Their cost-effectiveness and ease of setup make them suitable for individual professionals and smaller organizations looking for simple switching solutions.

The growing reliance on remote work environments has also added to their relevance. Many professionals prefer standard desktop switches as they provide convenient access to multiple devices without increasing complexity, which enhances productivity in day-to-day operations.

By Switch Type

In 2024, Multi-user KVM switches dominated the market with 58% share. These switches are vital in enterprise and data center environments where multiple users need to access and control large numbers of servers simultaneously. Their scalability and ability to support complex IT environments make them the most preferred switch type among organizations managing intensive workloads.

The preference for multi-user switches is also supported by security needs. They allow centralized access control while ensuring seamless server management, making them essential for industries where uptime and system reliability are critical.

By Enterprise Size

In 2024, Large enterprises held a majority at 67% of the market. These organizations often operate vast networks and high-density server infrastructures requiring advanced device management. KVM switches help streamline resources, reduce hardware costs, and improve control, which explains their strong position among large-scale businesses.

The need for centralized IT control has further reinforced their role. As enterprises continue to expand geographically, KVM systems provide reliable remote access and management capabilities, making them indispensable for IT teams managing widely distributed operations.

By End-Use

In 2024, Telecom and IT accounted for 30% of the end-use segment. This sector’s reliance on uninterrupted network operations and data center efficiency has increased the importance of KVM switches. They allow telecom operators and IT service providers to monitor and manage servers and storage systems without operational disruptions.

As the demand for data services and cloud infrastructure expands, these switches are becoming increasingly critical. Their role in providing efficient server access ensures consistent service delivery, particularly in high-traffic and large-scale telecom networks.

Key Market Segments

By Component

- Standard Desktop

- High Performance

- In-rack KVM

- KVM-over-IP

- Others

By Switch Type

- Single-User KVM

- Multi-User KVM

By Enterprise Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By End-Use

- Government/Public Sector

- Telecom & IT

- Healthcare and Pharmaceuticals

- Retail

- Finance/Insurance

- Content Provider/Media

- Cloud Service Providers

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

Emerging trends in the KVM switch space include the integration of AI functionalities for predictive diagnostics and real-time optimization. High-performance KVM switches with support for 4K and 8K resolutions, combined with enhanced USB and Ethernet integration, are gaining traction to meet demands in professional and creative fields.

There’s also a growing movement towards cloud and virtualization platform integration, miniaturization, higher port density, and industry-specific customizations, especially for government and financial sectors. For instance, AI-driven remote management capabilities are becoming standard, ensuring secure and seamless access to IT infrastructure across dispersed locations.

Growth Factors

Growth factors for the KVM switch market are driven largely by the rapid expansion of global data centers and the need for efficient server management. Increased remote work models and the demand for secure, remote server control have accelerated adoption, especially for IP-based KVM switches.

Another important driver is the emphasis on energy-efficient and space-saving hardware, which helps reduce power consumption and hardware footprint. More than 70% of key manufacturers are pursuing automation technologies in response to these trends, supporting growth in the industrial and data center markets.

Top 5 Use Cases

- Data Centers: KVM switches manage multiple servers from a single console, driving 40% of market sales with high product value due to scalability and efficiency.

- IT Infrastructure Management: Centralized control in IT infrastructures reduces management costs, representing 30% of KVM switch sales with high product value from remote access features.

- Telecommunications Networks: Telecom companies use KVM switches for efficient network management, accounting for 20% of sales, driven by robust performance and reliability.

- Healthcare Systems: KVM switches manage healthcare equipment and servers, contributing 5% of sales, with increasing adoption due to telemedicine and remote monitoring needs.

- Industrial Applications: KVM switches in industrial environments manage systems across operations, driving 5% of sales with high durability and reliability in harsh conditions.

Driver Analysis

The increasing demand for remote IT management and the rise of data centers are major drivers for the KVM switch market. As businesses and organizations expand their IT infrastructures, the need for efficient, reliable, and secure KVM switches to manage multiple systems is expected to grow significantly.

By 2034, the data center sector is projected to contribute 35% of the total market value, highlighting the importance of KVM switches in modern IT environments. Additionally, the rise of cloud computing and the growth of virtualization technologies are fueling demand for KVM switches in managing virtualized environments.

This segment is expected to account for 25% of total market sales, driven by the increasing adoption of cloud-based services and the need for efficient server management solutions. The integration of smart technologies and IoT into enterprise systems is also driving the need for advanced KVM switches, with this trend projected to grow at a 7% annual rate.

Restraint Analysis

One of the primary restraints in the KVM switch market is the high cost of advanced features and solutions, such as multi-user and 4K resolution support, which may limit adoption in small and medium-sized enterprises (SMEs).

Premium KVM switches that offer high-performance capabilities, such as remote access and multi-platform support, are more expensive, which can hinder growth in price-sensitive markets. This segment is expected to contribute 30% of the total market by 2034, but high initial costs could slow adoption in emerging regions.

Additionally, the complexity of KVM switch integration with existing IT infrastructures, especially in large organizations, may delay implementation and increase operational costs. Furthermore, the need for continuous innovation to keep up with new technologies, such as 5G and edge computing, adds pressure to manufacturers, potentially affecting scalability and increasing R&D investments.

Opportunity Analysis

Emerging markets, especially in regions like Asia-Pacific and Latin America, present significant opportunities for growth in the KVM switch market. As these regions continue to invest in digital infrastructure and cloud-based services, the demand for KVM switches is expected to increase, with the Asia-Pacific region projected to account for 40% of the market by 2034.

The rise of AI, IoT, and 5G technologies offers an opportunity to develop advanced KVM switches that integrate seamlessly with new digital ecosystems. Additionally, the growth in remote working and telecommuting is driving the need for remote management solutions, providing an opportunity for growth in the enterprise and education sectors. These factors are expected to lead to a 6% annual growth in the KVM switch market.

Challenge Analysis

One of the main challenges in the KVM switch market is the increasing complexity of managing IT systems across multiple platforms, devices, and operating systems. As businesses deploy more diverse technology stacks, ensuring compatibility and seamless operation across multiple devices and systems becomes more difficult. This challenge is especially relevant in large enterprises and government sectors, where multiple users and systems need to be managed simultaneously.

Another challenge is the growing demand for customized KVM switch solutions. With different industries requiring specific configurations, manufacturers must continuously innovate and adapt their products, increasing production costs and lead times. The pressure to meet these demands while maintaining competitive pricing could affect long-term profitability and growth.

SWOT Analysis

- Strengths: The KVM switch market is expected to grow significantly, with an estimated market size of USD 4.15 billion by 2034. The increasing demand from data centers and enterprises drives growth, with data centers contributing 35% and enterprise IT systems contributing 30% of the market value.

- Weaknesses: High manufacturing costs for advanced KVM switches, particularly in multi-user and 4K resolution systems, remain a weakness. These systems will make up 30% of total market sales, but their high production costs may limit adoption in price-sensitive markets, especially SMEs.

- Opportunities: Significant opportunities lie in emerging markets, particularly Asia-Pacific, where digital infrastructure investments are expected to drive 40% of market growth by 2034. The rise of remote working, AI, IoT, and 5G technologies also offers opportunities for growth in remote management solutions.

- Threats: The market faces intense competition from low-cost manufacturers and the pressure of rapidly evolving technology. The rise of virtualization, edge computing, and the demand for customized solutions adds complexity to production, potentially increasing costs and reducing profitability.

Key Players Analysis

In the KVM switch market, Aten International, Vertiv Holdings, Dell Technologies, and Belkin International are leading players with strong global presence and diversified product portfolios. Their switches are widely used across data centers, IT infrastructure, and enterprise environments to streamline device management and improve efficiency.

Other key participants such as Tripp Lite, Black Box KVM, Adder Technology, D-Link, Emerson Electric, and Fujitsu strengthen the market with reliable and cost-effective solutions. These firms focus on flexibility, ease of integration, and performance, targeting small and medium-sized enterprises along with industrial users. Their offerings are valued for balancing affordability with robust functionality in multi-device environments.

Additional contributors including Hewlett Packard Enterprise, Schneider Electric, Eaton, Guntermann & Drunck, IHSE, Shenzhen CKL Technology, Legrand, and WEY Group add diversity with specialized and advanced KVM solutions. Their products emphasize high-end performance, security, and scalability, particularly in mission-critical applications.

Top Key Players

- Aten International Co., Ltd.

- Vertiv Holdings Co

- Dell Technologies Inc.

- Belkin International, Inc.

- Tripp Lite

- Black Box KVM Limited

- Adder Technology Limited

- D-Link Corporation

- Emerson Electric Co.

- Fujitsu Limited

- Guntermann & Drunck GmbH

- Hewlett Packard Enterprise Development LP

- IHSE GmbH

- Schneider Electric SE

- Eaton Corporation plc

- Shenzhen CKL Technology Co., Ltd.

- Legrand

- WEY Group

- Other Key Players

Recent Development

- August 2025 – Tripp Lite launched the NetDirector Series with an 8-port 1U rack-mount KVM switch featuring a built-in 19″ LCD and IP remote access. The product supports connection to up to 256 computers via daisy-chaining and provides multi-user security controls, making it suitable for large distributed IT environments.

- April 2025 – Adder Technology showcased advanced IP KVM solutions at NAB 2025, emphasizing their high-performance remote connectivity for media and entertainment workflows. These new IP KVM systems improve workflow efficiency and security in broadcast and virtual production environments.

- January 2024 – Aten International Co., Ltd. reported consolidated sales totaling NT$375 million, reflecting ongoing strong business performance in the enterprise KVM solutions segment. The company continues focusing on secure KVM switch product lines supporting high resolution and robust data security protocols.

Report Scope

Report Features Description Market Value (2024) USD 1,356.9 Mn Forecast Revenue (2034) USD 2,107.2 Mn CAGR(2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Standard Desktop, High Performance, In-rack KVM, KVM-over-IP, Others), By Switch Type (Single-User KVM, Multi-User KVM), By Enterprise Size (Small and Medium-sized Enterprises (SMEs), Large Enterprises), By End-Use (Government/Public Sector, Telecom & IT, Healthcare and Pharmaceuticals, Retail, Finance/Insurance, Content Provider/Media, Cloud Service Providers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Aten International Co., Ltd., Vertiv Holdings Co, Dell Technologies Inc., Belkin International, Inc., Tripp Lite, Black Box KVM Limited, Adder Technology Limited, D-Link Corporation, Emerson Electric Co., Fujitsu Limited, Guntermann & Drunck GmbH, Hewlett Packard Enterprise Development LP, IHSE GmbH, Schneider Electric SE, Eaton Corporation plc, Shenzhen CKL Technology Co., Ltd., Legrand, WEY Group, Other Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Aten International Co., Ltd.

- Vertiv Holdings Co

- Dell Technologies Inc.

- Belkin International, Inc.

- Tripp Lite

- Black Box KVM Limited

- Adder Technology Limited

- D-Link Corporation

- Emerson Electric Co.

- Fujitsu Limited

- Guntermann & Drunck GmbH

- Hewlett Packard Enterprise Development LP

- IHSE GmbH

- Schneider Electric SE

- Eaton Corporation plc

- Shenzhen CKL Technology Co., Ltd.

- Legrand

- WEY Group

- Other