Global Keto Diet Products Market Size, Share, And Enhanced Productivity By Product (Supplements, Beverages, Others), By Form (Powder, Capsules and Tablets, Bars and Snacks, Liquids), By Nature (Conventional, Organic),By Application (Weight Management, Medical, Sports and Performance, General Wellness, Others), By Distribution Channel (Supermarket/Hypermarket, Specialty Retailers, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175808

- Number of Pages: 330

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

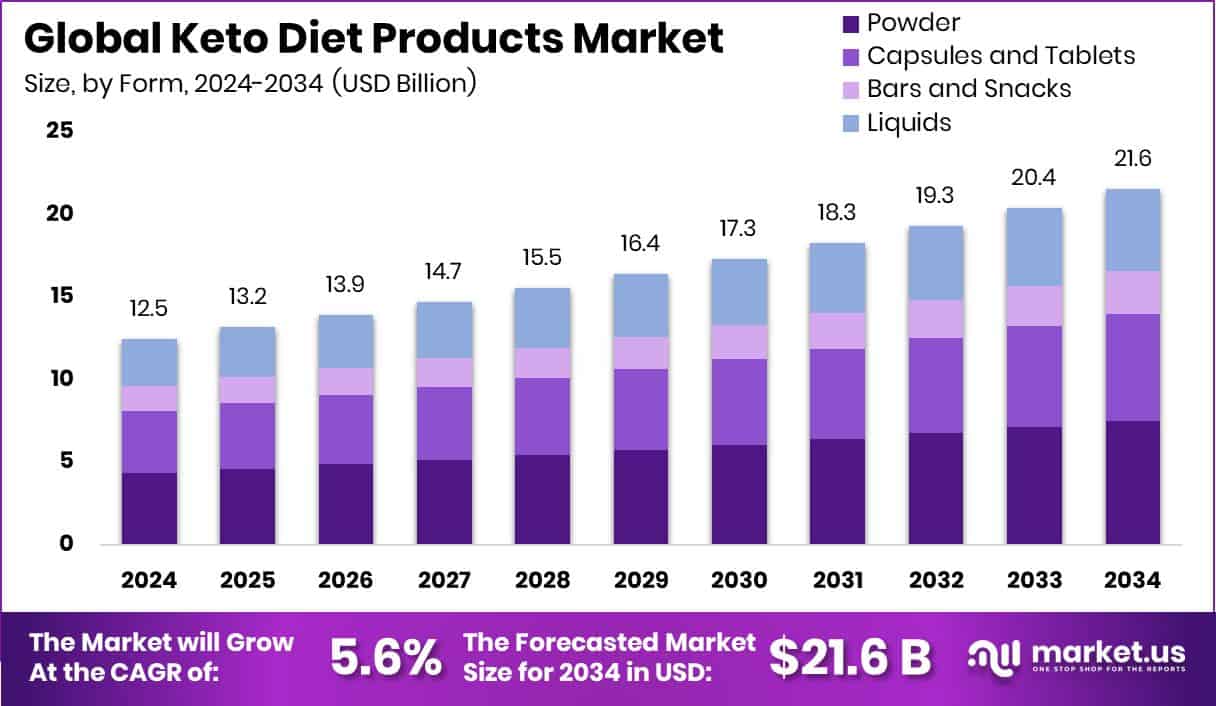

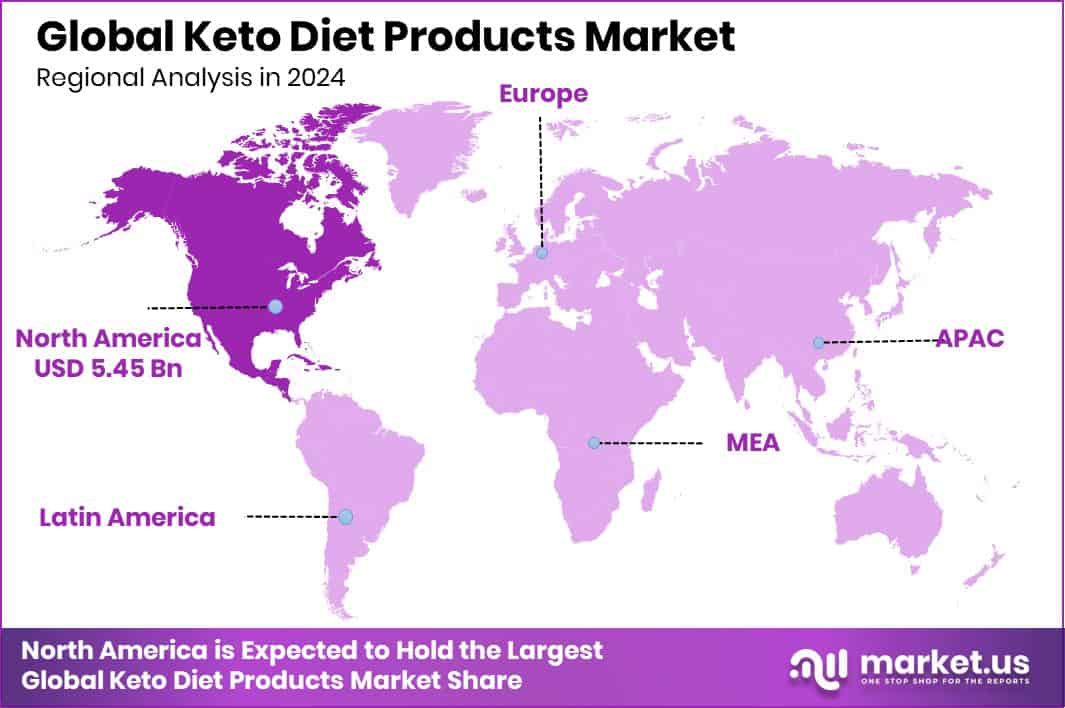

The Global Keto Diet Products Market is expected to be worth around USD 21.6 billion by 2034, up from USD 12.5 billion in 2024, and is projected to grow at a CAGR of 5.6% from 2025 to 2034. Market performance in North America stays dominant at 43.6%, achieving USD 5.45 Bn revenue.

Keto diet products include foods, supplements, and functional items made to support a low-carbohydrate, high-fat dietary pattern that helps the body shift into ketosis for energy. These products range from powders and beverages to snacks, capsules, and other convenient formats that make it easier for individuals to follow a structured ketogenic lifestyle. The Keto Diet Products Market represents the commercial ecosystem built around these offerings, covering manufacturing, distribution, and consumer adoption across categories such as supplements, bars, liquids, conventional and organic varieties, and multiple retail channels.

Growth in this market is influenced by rising interest in structured weight-management plans and clean-label nutrition. Increasing awareness about metabolic health, digestive wellness, and sustained energy fuels a stronger demand for keto-aligned products across everyday consumption. Expanding convenience formats such as powders, snacks, and specialty liquids also improve accessibility for both new and experienced keto followers.

Market opportunity continues to grow as companies invest in low-carb nutrition. Bajo Foods secured $2M, reinforcing the rising investor confidence in low-carb dietary categories. Similarly, ARTAH Nutrition raised £2.85M to expand its supplement portfolio, reflecting stronger demand for nutritionally guided lifestyles. Supportive momentum also comes from related wellness sectors—Kradle’s $4M investment in pet supplements and Evidose’s €455k funding for supplement validation—showing broader confidence in science-backed nutritional solutions.

Key Takeaways

- The Global Keto Diet Products Market is expected to be worth around USD 21.6 billion by 2034, up from USD 12.5 billion in 2024, and is projected to grow at a CAGR of 5.6% from 2025 to 2034.

- The Keto Diet Products Market grows rapidly as supplements reach a 48.8% share among consumers.

- Powder formats dominate the Keto Diet Products Market, holding 34.9% due to easy usability.

- Conventional products lead the keto diet products market with a strong 77.1% consumer preference globally.

- Weight management applications drive the Keto Diet Products Market forward, contributing 41.7% of the overall demand share.

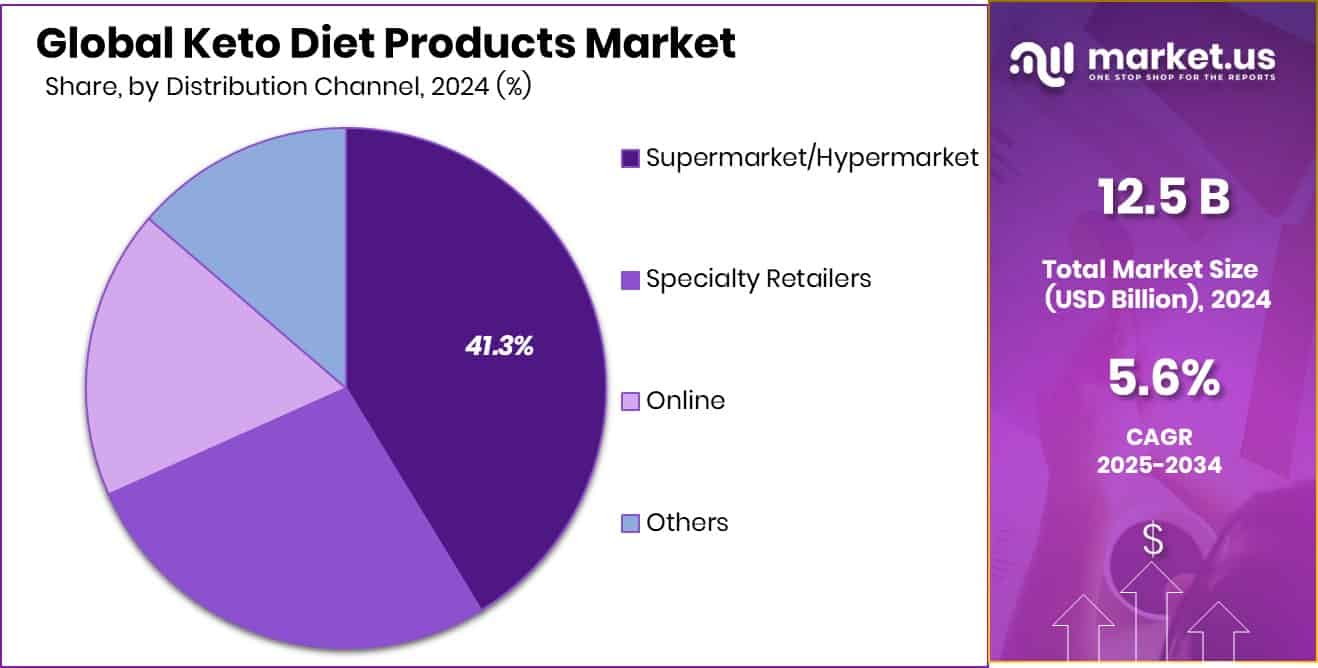

- Supermarket and hypermarket channels strengthen the Keto Diet Products Market with 41.3% distribution dominance.

- The region North America maintains strong growth, holding 43.6% and generating USD 5.45 Bn.

By Product Analysis

The Keto Diet Products Market grows steadily as supplements reach 48.8% dominance.

In 2025, supplements accounted for 48.8% of the global Keto Diet Products Market, emerging as the most influential product category. This dominance reflects the rising consumer shift toward convenient, fast-acting ketogenic solutions that support fat metabolism, appetite control, and sustained energy release. Consumers adopting low-carb lifestyles increasingly prefer capsules, powders, and exogenous ketones to achieve quick ketosis without strict dietary changes.

The availability of diverse supplement formats across retail and online channels further accelerates their usage. Manufacturers are also focusing on clean-label formulations, adding electrolytes, MCT oils, and plant-based components to meet evolving expectations. As awareness of ketogenic nutrition continues to expand, supplement demand is expected to remain steady, driving innovation and reinforcing their market leadership.

By Form Analysis

Powder formats lead the Keto Diet Products Market, capturing a strong 34.9% share.

Powder-based products held a significant 34.9% share of the Keto Diet Products Market, supported by the category’s flexibility and ease of integration into daily routines. Keto powders—including protein mixes, MCT powders, ketone blends, and meal replacements—are widely used by consumers seeking simple, on-the-go nutritional options. Their long shelf life, ability to mix with beverages, and customizable portion control contribute to steady adoption.

Fitness-driven users also favor powder formats because they enable faster absorption and support pre-workout or post-workout energy levels. As brands expand flavor profiles and enhance solubility, powder-based offerings continue to attract both beginners and experienced keto followers. This segment is expected to see consistent growth as consumers seek versatile, performance-oriented ketogenic products.

By Nature Analysis

Conventional offerings dominate the Keto Diet Products Market with an impressive 77.1% presence.

Conventional keto products represented a strong 77.1% share within the overall market, reflecting widespread consumer preference for affordable and readily available options. The conventional category includes mainstream keto snacks, beverages, supplements, and bakery substitutes that meet low-carb nutritional requirements without premium pricing. Retail chains and mass distributors tend to stock larger volumes of conventional products, making them the most accessible option for new and price-sensitive consumers.

Growing awareness of low-carb diets across urban and semi-urban regions also amplifies demand for cost-effective ketogenic alternatives. While organic and clean-label variants continue to rise gradually, conventional keto items remain the backbone of market expansion, supported by scale-driven manufacturing and broad distribution networks.

By Application Analysis

Weight management drives the Keto Diet Products Market, accounting for 41.7% overall demand.

Weight management applications captured 41.7% of the Keto Diet Products Market, highlighting the diet’s strong reputation for promoting fat loss and metabolic efficiency. Consumers increasingly adopt keto products to reduce carbohydrate intake, improve satiety, and accelerate calorie burn, especially during lifestyle transformations. Keto snacks, supplements, and meal replacements are positioned as effective tools for curbing appetite and supporting calorie-controlled routines.

Healthcare professionals and fitness coaches continue recommending ketogenic strategies for individuals aiming to manage body weight while maintaining muscle mass. With obesity rates rising across several regions, the demand for structured weight management solutions remains high. This drives continuous product development focused on nutritional balance, portion control, and ease of adherence for long-term use.

By Distribution Channel Analysis

Supermarket channels strengthen the Keto Diet Products Market expansion with 41.3% distribution share.

Supermarkets and hypermarkets held 41.3% of the market share, underscoring their importance as primary retail spaces for keto-focused shoppers. These outlets offer expanded product visibility, enabling consumers to compare brands, read nutritional labels, and explore new formulations. The rise in keto-specific shelves, promotional displays, and dedicated health-food sections has contributed to greater awareness and impulse purchases.

Large retail chains also negotiate competitive pricing, making keto products more affordable for mainstream buyers. The availability of multiple formats—ranging from snacks to frozen meals and supplements—further strengthens consumer trust and convenience. As retailers continue to broaden their functional food portfolios, supermarkets and hypermarkets remain central to the commercial success of the Keto Diet Products Market.

Key Market Segments

By Product

- Supplements

- Beverages

- Others

By Form

- Powder

- Capsules and Tablets

- Bars and Snacks

- Liquids

By Nature

- Conventional

- Organic

By Application

- Weight Management

- Medical

- Sports and Performance

- General Wellness

- Others

By Distribution Channel

- Supermarket/Hypermarket

- Specialty Retailers

- Online

- Others

Driving Factors

Rising preference for low-carb nutrition

The Keto Diet Products Market continues to expand as consumers show a rising preference for low-carb nutrition, especially among individuals seeking structured dietary solutions for weight management and metabolic balance. This shift is supported by growing interest in clean-label snacks, beverages, and supplements designed to reduce sugar intake while maintaining energy and satiety. The segment receives additional momentum from broader activity in the healthy-snacking ecosystem.

For example, snack brand Phab raised $2 Mn in a seed round led by OTP Ventures, reflecting investor confidence in low-carb and functional food categories. Such developments indirectly strengthen the environment for keto-focused innovation, encouraging brands to introduce new formats that align with changing consumer habits and nutritional expectations.

Restraining Factors

High product pricing limits accessibility

Even with rising interest, the Keto Diet Products Market faces notable restraints, particularly due to high product pricing that limits accessibility for mainstream consumers. Premium formulations, reliance on specific low-carb ingredients, and specialized manufacturing processes often make keto products costlier than conventional options. This pricing gap slows adoption in price-sensitive regions and restricts market expansion within everyday consumption categories.

The funding landscape also highlights competitive pressure in adjacent nutrition sectors. For instance, Protein Brand David closed a $75 Million Series A funding round, demonstrating how large-scale investment in high-protein alternatives can divert attention and purchasing power away from keto-specific formats. These dynamics collectively create challenges for achieving broader market penetration.

Growth Opportunity

Expansion across online retail channels

Significant growth opportunities continue to emerge in the Keto Diet Products Market, especially as consumers increasingly shift toward online purchasing channels. E-commerce platforms allow wider access to powders, snacks, drinks, and supplement formats, enabling smaller brands to serve diverse regions without heavy retail footprints. The expansion of digital marketplaces also supports subscription-based keto products and personalized nutrition kits. Investor activity in the snack and better-for-you segments further supports this momentum.

A notable example is TagZ Foods raising $2 M in a pre-Series A round, signaling strong market appetite for next-generation low-carb and functional snacking solutions. Such investments create a favourable environment for keto-based brands to innovate, differentiate, and scale online.

Latest Trends

Increasing shift toward functional beverages

A major trend shaping the Keto Diet Products Market is the increasing shift toward functional beverages that support energy, hydration, and metabolic balance. Consumers are looking for convenient, ready-to-drink keto options such as MCT beverages, ketone-infused drinks, and electrolyte blends that fit into active and low-carb lifestyles. This demand aligns with broader beverage innovation across the wellness sector.

A relevant development is Beyond Snack securing $8.3 Mn in a Series A funding round, which underscores rising investor interest in modern, better-for-you snacking and beverage categories. Such activity helps accelerate diversification in keto-friendly drink formulations, encouraging companies to introduce more flavour-rich, clean-label, and performance-focused beverage choices for everyday consumption.

Regional Analysis

North America leads the Keto Diet Products Market with 43.6% share worth USD 5.45 Bn.

The Keto Diet Products Market shows strong regional variation, with North America dominating the industry at 43.6% and USD 5.45 Bn, driven by high consumer adoption of low-carb nutritional formats and strong retail penetration. The region benefits from well-established product availability across supermarkets, online channels, and specialty nutrition stores, helping maintain its leadership position.

In Europe, the market grows steadily as consumers embrace weight-management diets and protein-rich alternatives, supported by increasing awareness of low-carb dietary habits. The Asia Pacific region is witnessing rising interest in ketogenic nutrition due to changing lifestyles, expanding urban populations, and higher demand for functional foods among younger consumers.

In the Middle East & Africa, the shift toward healthier eating patterns and premium nutrition offerings is gradually opening opportunities for keto beverages, snacks, and supplements. Latin America continues to adopt the diet at a measured pace, supported by growing interest in weight-management regimes and wider distribution of packaged keto products in key urban markets.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Nestlé S.A. continues to strengthen its presence by leveraging its broad food and beverage portfolio to introduce keto-aligned offerings. The company’s scale, global distribution strength, and ability to reformulate mainstream products help position it as an influential participant in meeting clean-label and reduced-carb expectations. Nestlé’s approach focuses on adapting everyday foods to match ketogenic requirements, improving accessibility for general consumers transitioning to structured diet plans.

Perfect Keto LLC remains a specialized brand that resonates strongly with dedicated keto consumers. Its product strategy emphasizes functional formulations, including ketone supplements, MCT-based items, and convenient snacking options tailored for strict ketogenic adherence. The brand’s targeted positioning enables it to build loyalty among fitness-driven users and individuals seeking performance-enhancing nutritional tools. Perfect Keto’s agility in product innovation supports its competitive edge within the premium keto lifestyle segment.

Bulletproof 360 Inc. continues to influence the market through high-fat, clean-energy nutrition solutions centered on MCT oils, keto snacks, and performance beverages. The company’s focus on mental clarity, sustainable energy, and functional ingredients appeals to consumers pursuing both ketogenic diets and broader wellness goals. This performance-oriented positioning ensures sustained relevance in an evolving, health-conscious market landscape.

Top Key Players in the Market

- Nestlé S.A.

- Perfect Keto LLC

- Bulletproof 360 Inc.

- Zenwise Health

- Ancient Brands, LLC.

- Dang Foods Co.

- Real Ketones

- KetoLogic

- KetoSports

- Atkins Nutritionals, Inc.

Recent Developments

- In 2025, the Real Ketones brand introduced a performance-focused supplement called Elevate Creatine BHB5000, which combines creatine with BHB (exogenous ketones) in one formula. This launch aims to support both physical strength and ketogenic energy, attracting users who want improved performance and enhanced ketosis at the same time.

Report Scope

Report Features Description Market Value (2024) USD 12.5 Billion Forecast Revenue (2034) USD 21.6 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Supplements, Beverages, Others), By Form (Powder, Capsules and Tablets, Bars and Snacks, Liquids), By Nature (Conventional, Organic), By Application (Weight Management, Medical, Sports and Performance, General Wellness, Others), By Distribution Channel (Supermarket/Hypermarket, Specialty Retailers, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Nestle S.A., Perfect Keto LLC, Bulletproof 360 Inc., Zenwise Health, Ancient Brands, LLC., Dang Foods Co., Real Ketones, KetoLogic, KetoSports, Atkins Nutritionals, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Keto Diet Products MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Keto Diet Products MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Nestlé S.A.

- Perfect Keto LLC

- Bulletproof 360 Inc.

- Zenwise Health

- Ancient Brands, LLC.

- Dang Foods Co.

- Real Ketones

- KetoLogic

- KetoSports

- Atkins Nutritionals, Inc.