Global Jellies And Gummies Market Size, Share, And Business Benefits By Type (Functional, Traditional), By Flavor (Grapefruit, Cherry, Peach, Berries, Apple, Others), By Distribution Channel (Store Based, Non-Store Based), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152651

- Number of Pages: 338

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

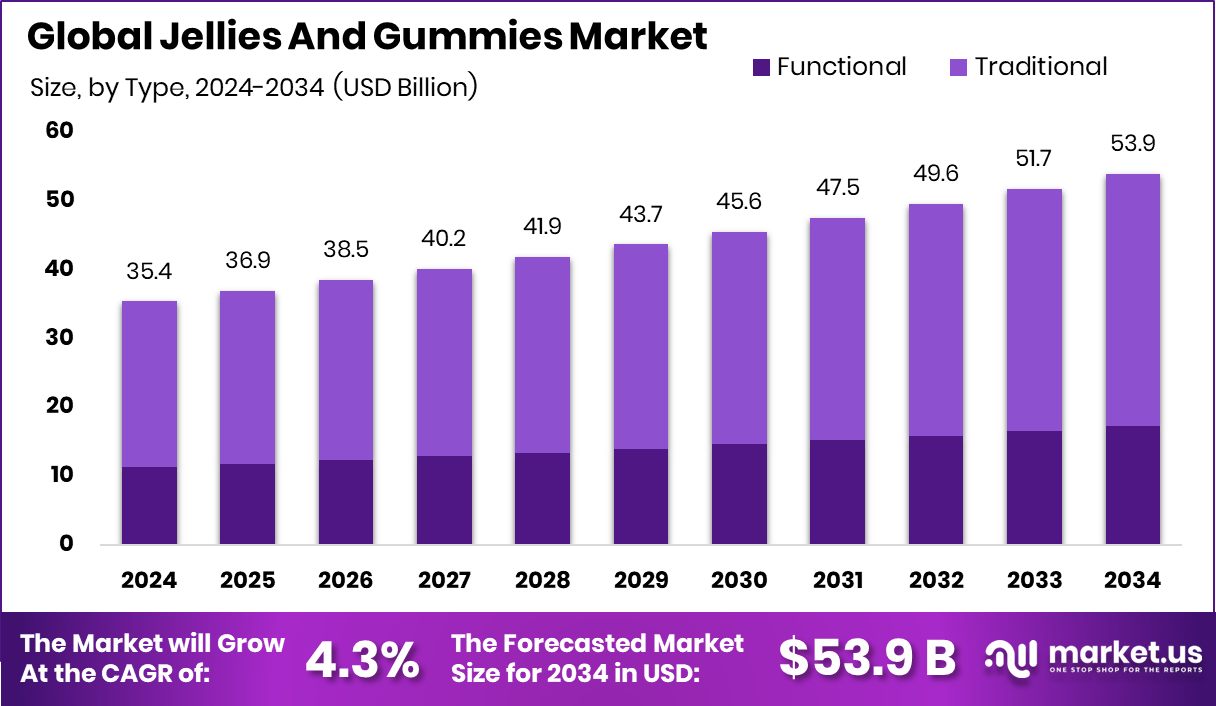

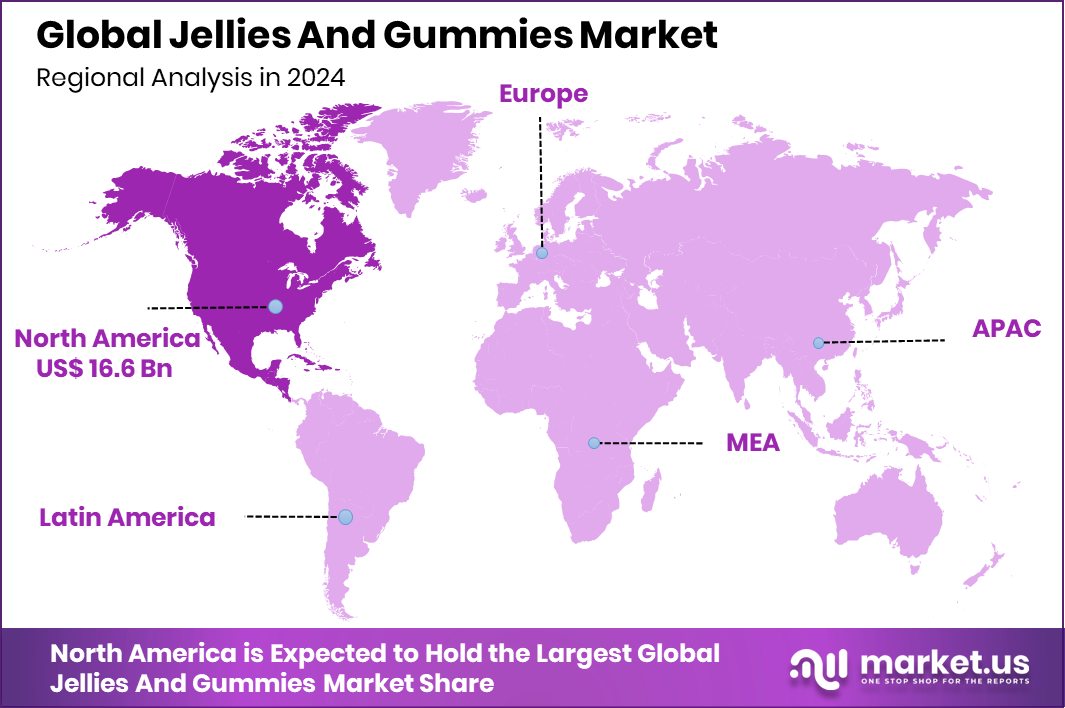

Global Jellies and Gummies Market is expected to be worth around USD 53.9 billion by 2034, up from USD 35.4 billion in 2024, and grow at a CAGR of 4.3% from 2025 to 2034. With 47.10% market share, North America reached USD 16.6 billion in value.

Jellies and gummies are soft, chewy confectionery products made from gelatin or pectin combined with sugar, flavorings, and food colorings. These treats are popular among children and adults alike due to their wide variety of flavors, shapes, and textures. While traditional recipes use animal-based gelatin, modern formulations increasingly rely on plant-based ingredients to cater to vegetarian and vegan consumers. They are often enjoyed as casual snacks and are also used for functional purposes, such as vitamin-enriched or CBD-infused variants.

The jellies and gummies market refers to the global trade and consumption of these products across various segments, including conventional confectionery, functional food, and health supplements. This market is influenced by changing consumer preferences, innovation in product formulation, and regional eating habits. It includes products sold through retail stores, supermarkets, online platforms, and pharmacies. According to an industry report, Farm Automation Today reports that Fieldwork has secured a £1.1 million grant for its BerryBot initiative.

The market’s growth is driven by rising demand for convenient, on-the-go snacks, especially among younger consumers. Increasing urbanization and busy lifestyles have led to a shift toward easily accessible indulgent treats. Furthermore, the expansion of organized retail and e-commerce platforms has improved product reach and visibility across developing markets.

The growing interest in functional confectionery, especially gummies infused with vitamins, minerals, and herbal extracts, is creating strong demand. Consumers are increasingly viewing gummies as an enjoyable alternative to traditional pills and capsules, especially for children and older adults. According to an industry report, Ray Dalio’s family office has invested in a berry-centric startup now valued at $1 billion.

Key Takeaways

- Global Jellies And Gummies Market is expected to be worth around USD 53.9 billion by 2034, up from USD 35.4 billion in 2024, and grow at a CAGR of 4.3% from 2025 to 2034.

- Traditional jellies and gummies dominate the market, accounting for 69.2% due to nostalgic consumer preferences.

- Berries remain the most preferred flavor in the jellies and gummies market, capturing 26.6% share.

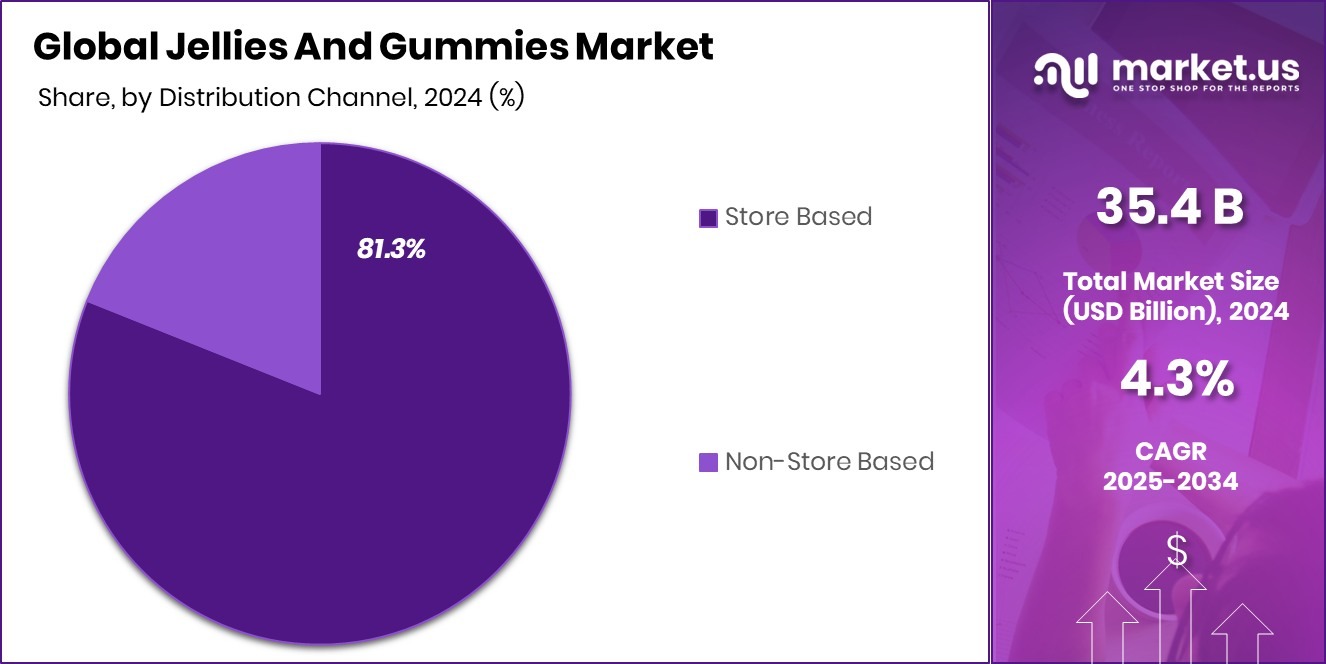

- Store-based channels lead the market, with an 81.3% share driven by impulse buying and visibility.

- North America’s strong consumption trends contributed to USD 16.6 billion and a 47.10% share.

By Type Analysis

Traditional jellies and gummies dominate the market with a 69.2% share.

In 2024, Traditional held a dominant market position in the By Type segment of the Jellies and Gummies Market, with a 69.2% share. This significant share reflects the enduring popularity and widespread consumer preference for classic gelatin-based confections, which continue to be favored across diverse age groups and regions.

Traditional jellies and gummies are often associated with nostalgia, familiar taste profiles, and a wide array of flavors and shapes, making them a staple in both developed and emerging markets. The ease of availability through supermarkets, convenience stores, and local retail outlets has further strengthened their position.

The strong market performance of traditional gummies is also supported by consistent demand for affordable indulgence, particularly in price-sensitive consumer segments. As consumers seek comfort and familiarity in their snacking choices, traditional variants maintain their relevance through appealing textures and trusted recipes.

Furthermore, traditional gummies often serve as a base for seasonal and limited-edition offerings, which help retain consumer interest and stimulate repeat purchases. The dominance of this segment indicates that, despite growing interest in functional or specialty variants, the traditional category remains a cornerstone of the jellies and gummies market, sustained by its deep-rooted consumer loyalty and widespread distribution.

By Flavor Analysis

Berries flavor leads with a 26.6% share in the gummies market.

In 2024, Berries held a dominant market position in the By Flavor segment of the Jellies and Gummies Market, with a 26.6% share. This leadership is largely attributed to the widespread consumer appeal of berry flavors, which are often associated with a balance of sweetness and tanginess that suits a broad range of taste preferences. Flavors such as strawberry, raspberry, blueberry, and mixed berries continue to resonate strongly across all age groups, contributing to their consistent demand in the confectionery sector.

The preference for berry-flavored jellies and gummies is reinforced by their strong presence in both traditional and newer product lines, ensuring familiarity while allowing room for innovation. Additionally, the natural association of berries with antioxidants and health benefits may enhance consumer perception, even in indulgent snack formats. Manufacturers frequently use berry profiles for seasonal promotions and themed packaging, which helps to maintain market visibility and drive impulse purchases.

The dominance of the berry flavor segment highlights its continued relevance and adaptability in a competitive landscape, where flavor remains a key factor influencing consumer choice. The 26.6% market share indicates a well-established preference that supports steady growth and reinforces the segment’s leadership within the overall flavor category.

By Distribution Channel Analysis

Store-based sales account for 81.3% of the jelly and gummies market distribution.

In 2024, Store Based held a dominant market position in the By Distribution Channel segment of the Jellies and Gummies Market, with an 81.3% share. This overwhelming share underscores the continued reliance of consumers on physical retail outlets such as supermarkets, hypermarkets, convenience stores, and specialty candy shops for purchasing confectionery products. The tactile experience of selecting products in-store, along with attractive shelf displays and immediate product availability, plays a crucial role in influencing buying behavior.

Store-based channels also benefit from high foot traffic, especially in urban areas, where impulse buying remains a significant driver of confectionery sales. Promotional strategies such as in-store discounts, product sampling, and seasonal offers further enhance visibility and encourage volume purchases.

Moreover, store-based retail allows consumers to engage with familiar brands and compare offerings directly, reinforcing trust and boosting sales. The strong presence of jellies and gummies across various retail formats reflects their widespread popularity and ease of access, particularly among children and families.

The 81.3% market share held by store-based distribution in 2024 indicates that, despite the rise of digital channels, physical stores remain the primary point of purchase for jellies and gummies, driven by convenience, accessibility, and consumer buying habits.

Key Market Segments

By Type

- Functional

- Traditional

By Flavor

- Grapefruit

- Cherry

- Peach

- Berries

- Apple

- Others

By Distribution Channel

- Store Based

- Non-Store Based

Driving Factors

Rising Demand for Convenient and Tasty Snacks

One of the main driving factors behind the growth of the jellies and gummies market is the increasing consumer demand for easy-to-eat and flavorful snacks. Jellies and gummies are small, portable, and require no preparation, making them ideal for busy lifestyles. Their chewy texture and wide variety of fruity flavors appeal to both children and adults, encouraging frequent consumption.

In many households, they are a go-to option for quick treats, lunchbox additions, or party snacks. As modern consumers look for fun and enjoyable snacking experiences, these products continue to gain popularity. The ease of availability in local stores, supermarkets, and vending machines further supports this trend, making jellies and gummies a preferred choice across different age groups.

Restraining Factors

Health Concerns Due to High Sugar Content

A major factor holding back the growth of the jellies and gummies market is the growing concern about health, especially related to sugar intake. Many of these products contain high amounts of sugar, artificial flavors, and food colors, which can contribute to health issues such as obesity, diabetes, and dental problems. As more people become health-conscious, especially parents looking for better snack options for their children, they may limit or avoid buying such sweets.

Additionally, global campaigns promoting healthy eating habits and warning against added sugars have influenced consumer behavior. This shift in mindset is pushing some consumers to choose healthier snacks over traditional sugary treats, which directly impacts the overall sales growth of jellies and gummies.

Growth Opportunity

Shift Toward Healthier Low‑Sugar and Natural Gummies

A key growth opportunity in the jellies and gummies market lies in developing low‑sugar and naturally flavored options. As consumers become more health-conscious, especially parents and adults seeking better alternatives, there is increasing demand for products made with natural fruit extracts, plant‑based gelling agents, and reduced sugar levels. Such offerings align with broader wellness trends and can attract those who now view traditional sugary gummies as indulgent treats only.

By introducing recipes with minimal added sugars and clean-label ingredients, manufacturers can appeal to a wider, health‑oriented audience. Additionally, promoting transparent nutritional information and positioning these products as better-for-you snacks can generate strong brand trust. This opportunity can support business growth while adapting to evolving consumer preferences in a competitive confectionery market.

Latest Trends

Emergence of Functional Gummies with Added Benefits

Functional gummies enriched with vitamins, minerals, and herbal extracts are becoming increasingly popular in the jelly and gummy market. These products go beyond basic snacking to offer added health benefits, such as improved immunity, better digestion, or enhanced focus. Consumers, especially parents and health-conscious adults, are drawn to these gummies because they offer a convenient, tasty way to supplement their diet.

The fruity and chewy format makes vitamins more enjoyable and easier to take compared to pills or capsules. This trend reflects a broader shift in consumer behavior, where food is expected to be not just filling but also functional. As a result, manufacturers are innovating with new formulations that combine fun flavors and nutritional value, meeting evolving customer demands and driving market growth.

Regional Analysis

In 2024, North America dominated the market with a 47.10% share, worth USD 16.6 billion.

In 2024, North America held the leading position in the global Jellies and Gummies Market, accounting for 47.10% of the total market share, with a valuation of USD 16.6 billion. The region’s dominance is largely supported by strong consumer demand for confectionery products, widespread retail penetration, and high per capita candy consumption across the United States and Canada. Additionally, the popularity of both traditional and functional gummies has contributed to stable year-round sales.

Europe also remains an important regional market, benefiting from established confectionery consumption patterns and the presence of various product innovations tailored to local tastes. Asia Pacific is witnessing increasing demand, driven by rising disposable incomes and changing snacking habits across emerging economies such as China, India, and Southeast Asia. Meanwhile, Latin America is gradually expanding its market share, supported by growing urbanization and exposure to Western-style confectionery products.

The Middle East & Africa region shows steady progress, though its share remains modest, with demand centered around major urban markets. However, all regions are experiencing rising interest in fruit-based and health-oriented gummies. Overall, while global demand is steadily expanding, North America continues to lead the market in both value and volume, firmly establishing its position as the dominant region in 2024.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global jellies and gummies market remained highly competitive, with notable contributions from key players such as HARIBO GmbH & Co. KG, THE HERSHEY COMPANY, Mondelez International, and Nestlé S.A. HARIBO GmbH & Co. KG continued to maintain its iconic status within the gummy candy segment, driven by strong brand recognition, classic product offerings, and expansion into new international markets.

THE HERSHEY COMPANY, traditionally known for its chocolate products, has steadily expanded its presence in the non-chocolate candy space. The company has strengthened its jellies and gummies portfolio to meet rising consumer demand for chewy confectionery and diversified snacking experiences. Strategic distribution, along with innovation in packaging and seasonal assortments, has helped Hershey retain shelf visibility and consumer attention.

Mondelez International leveraged its global network to promote regionally tailored jelly and gummy products. With a strong focus on taste innovation and high-volume retail channels, Mondelez continued to scale operations across emerging markets where modern trade is expanding. Its ability to integrate local flavors has helped the company appeal to diverse consumer bases.

Nestlé S.A. pursued growth through health-focused product lines, introducing gummy formats with added functional benefits, particularly in the wellness and supplement category. The brand’s strength in trusted nutrition has supported its strategy in capturing the growing segment of health-conscious consumers, positioning it as a key player in functional gummy development.

Top Key Players in the Market

- HARIBO GmbH & Co. KG

- THE HERSHEY COMPANY

- Mondelez International

- Nestlé S.A.

- Ferrara Candy Company

- Mars, Incorporated

- Jelly Belly Candy Company

- Perfetti Van Melle

- Meiji Holdings Co., Ltd.

- Cloetta AB

Recent Developments

- In February 2025, Nestlé’s R&D Accelerator launched a Women’s Health Innovation Challenge. The initiative invited start-ups worldwide to develop nutrition-based solutions, including gummy formats, that address women’s specific health needs. The program aimed to fast-track product development in areas like bone, hormonal, and prenatal wellness using innovative gummy supplements.

- In September 2024, Hershey introduced Shaq‑A‑Licious XL Gummies in collaboration with NBA star Shaquille O’Neal. These oversized gummies are available in Original (peach, berry punch, orange) and Sour (pineapple, mixed‑berry, watermelon) varieties, shaped like O’Neal’s face and nicknames. This launch marks Hershey’s entry into premium, celebrity‑branded gelatin treats.

Report Scope

Report Features Description Market Value (2024) USD 35.4 Billion Forecast Revenue (2034) USD 53.9 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Functional, Traditional), By Flavor (Grapefruit, Cherry, Peach, Berries, Apple, Others), By Distribution Channel (Store Based, Non-Store Based) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape HARIBO GmbH & Co. KG, THE HERSHEY COMPANY, Mondelez International, Nestlé S.A., Ferrara Candy Company, Mars, Incorporated, Jelly Belly Candy Company, Perfetti Van Melle, Meiji Holdings Co., Ltd., Cloetta AB Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Jellies And Gummies MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Jellies And Gummies MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- HARIBO GmbH & Co. KG

- THE HERSHEY COMPANY

- Mondelez International

- Nestlé S.A.

- Ferrara Candy Company

- Mars, Incorporated

- Jelly Belly Candy Company

- Perfetti Van Melle

- Meiji Holdings Co., Ltd.

- Cloetta AB