Global Isophthalic Acid Market Size, Share Analysis Report By Application (PET Copolymer, Unsaturated Polyester Resins, Surface Coating, Others), By End-user (Textile Industry, Automotive Industry, Construction, Marine, Others) Size, Share Analysis Report

- Published date: Nov 2025

- Report ID: 164409

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

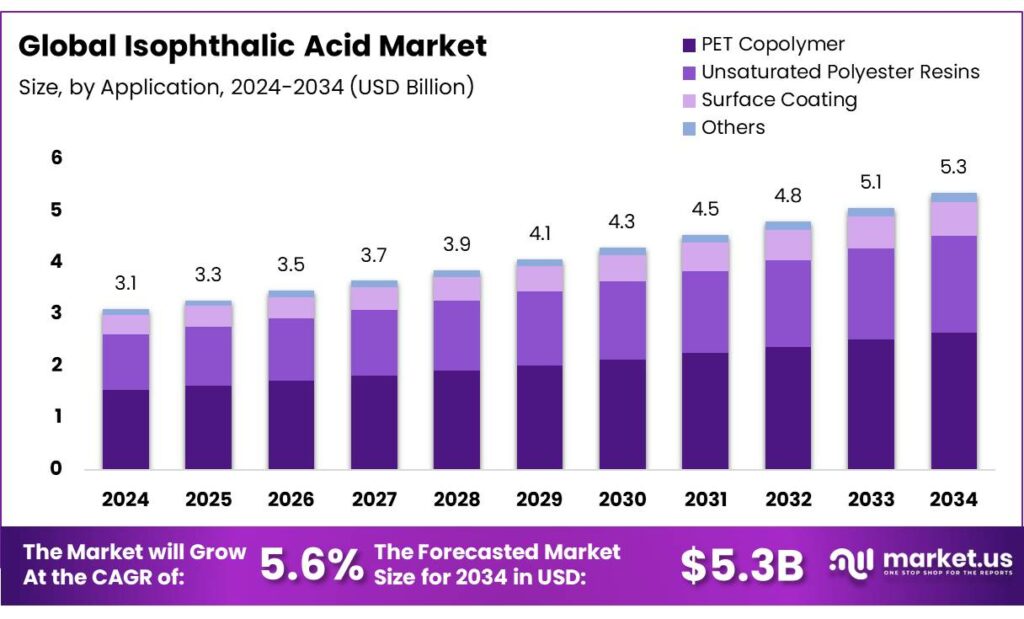

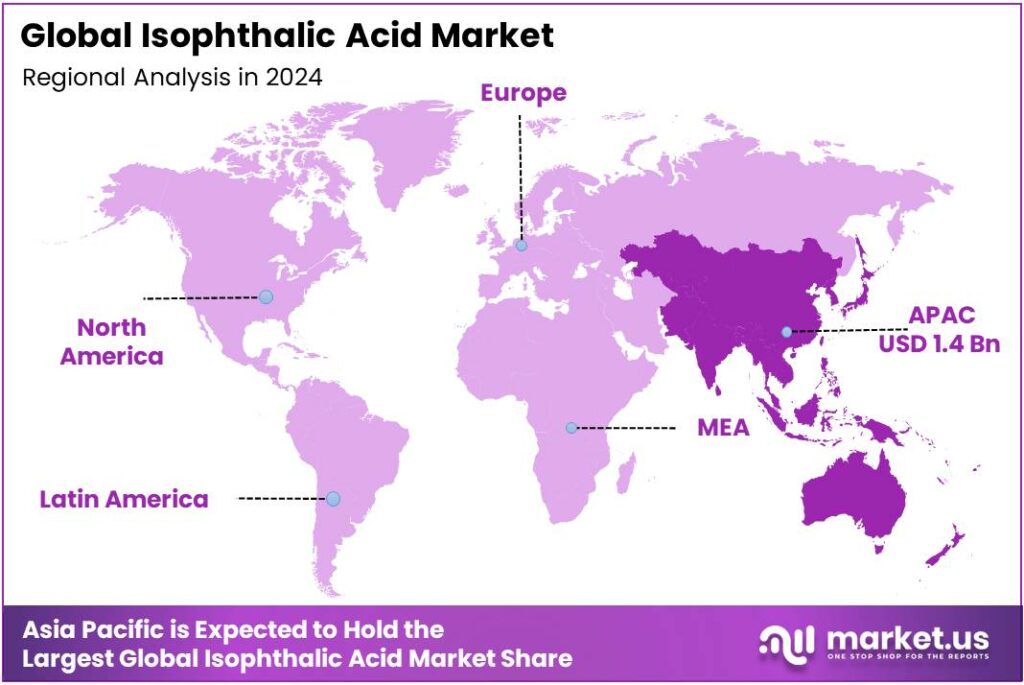

The Global Isophthalic Acid Market size is expected to be worth around USD 5.3 Billion by 2034, from USD 3.1 Billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific held a dominant market position, capturing more than a 47.9% share, holding USD 1.4 Billion in revenue.

Isophthalic acid (IPA) is a key aromatic di-acid produced by liquid-phase oxidation of m-xylene and used chiefly to modify polyethylene terephthalate (PET) and to formulate high-performance polyester/alkyd resins for coatings and composites. Its role in PET is to reduce crystallinity, improving clarity and bottling productivity—properties that keep IPA tightly linked to beverage packaging and specialty polyester demand cycles.

On the energy and feedstock side, IPA’s upstream exposure to oil-derived aromatics ties its cost base to crude and naphtha trends. After a volatile period, the U.S. Energy Information Administration (EIA) projects Brent to average about $62/bbl in Q4-2025 and $52/bbl in 2026, implying easing feedstock pressure if realized. Slower global oil-demand growth—up 0.8% in 2024 to 193 EJ—also signals a less overheated refinery/petrochemical system than in the immediate post-pandemic years, supporting more stable aromatics availability.

Demand fundamentals for IPA reflect wider petrochemical dynamics: the International Energy Agency notes petrochemical feedstocks already account for ~12% of global oil demand, with plastics and related products a major driver of long-term growth. That structural pull underpins IPA consumption in PET packaging and industrial coatings, while regional bottle-grade expansions in emerging markets keep baseline growth intact. Simultaneously, packaging sustainability pivots are reshaping grade mix and innovation priorities for IPA-modified PET and low-VOC coating systems.

Policy and circular-economy metrics are increasingly material. The OECD reports global plastic waste more than doubled to 353 Mt in 2019, with only ~9% effectively recycled—pressure that accelerates design-for-recycling mandates and recycled-content targets that affect PET formulations where IPA is used. In the EU, the proposed Packaging and Packaging Waste Regulation seeks all packaging to be recyclable by 2030, pushing converters to optimize PET clarity/processability.

In the U.S., PET collection momentum is visible: industry data show >1.9 billion lb of post-consumer PET collected in 2021, while the EPA cites a 29.1% recycling rate for PET bottles and jars (2018 baseline), both nudging supply chains toward higher-quality, rPET-compatible resin design. Global energy-related CO₂ emissions hit 37.8 Gt in 2024; regulators and OEMs are pushing longer-lasting, lower-VOC coatings and recyclable high-barrier packaging to reduce lifecycle impacts—vectors that favor IPA-enabled formulations.

Key Takeaways

- Isophthalic Acid Market size is expected to be worth around USD 5.3 Billion by 2034, from USD 3.1 Billion in 2024, growing at a CAGR of 5.6%.

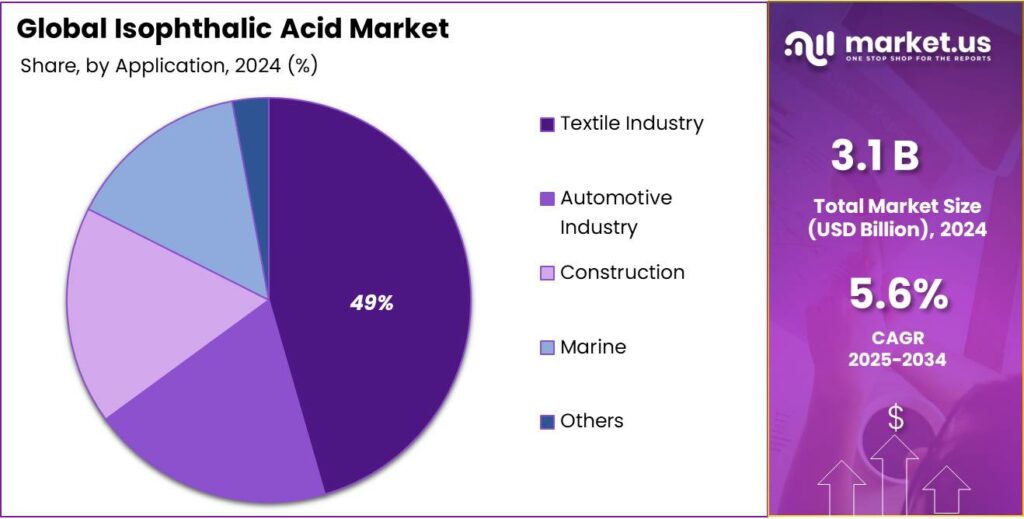

- PET Copolymer held a dominant market position, capturing more than a 49.6% share of the overall isophthalic acid market.

- Textile Industry held a dominant market position, capturing more than a 46.9% share of the global isophthalic acid market.

- Asia-Pacific region, where APAC is recorded here as holding 47.90% USD 1.4 billion.

By Application Analysis

PET Copolymer dominates with 49.6% market share in 2024

In 2024, PET Copolymer held a dominant market position, capturing more than a 49.6% share of the overall isophthalic acid market by application. This strong showing was driven mainly by increased use of isophthalic acid in the copolymerisation of polyethylene-terephthalate (PET) to enhance its strength, clarity and barrier properties. The value chain for PET bottles, rigid packaging and thermoforming materials saw steady growth, prompting resin makers to prefer isophthalic acid as a co-monomer to meet performance demands.

The momentum is expected to continue as downstream users increasingly adopt isophthalic-acid-based PET copolymers for specialty packaging and high-end applications. The combination of rising beverage consumption in emerging markets and growing awareness of material performance upgrades has cemented the PET copolymer segment as the focal point of isophthalic acid demand.

By End-user Analysis

Textile Industry dominates with 46.9% share in 2024 driven by rising polyester fiber production

In 2024, the Textile Industry held a dominant market position, capturing more than a 46.9% share of the global isophthalic acid market by end-user. The strong presence of this segment was mainly supported by the widespread utilization of isophthalic acid in the production of high-quality polyester fibers used across apparel, home furnishings, and industrial fabrics. The demand was further stimulated by the steady expansion of textile manufacturing hubs in Asia-Pacific, where rapid urbanization and growing consumer spending have increased the need for durable and wrinkle-resistant fabrics.

Ongoing investments in textile modernization, coupled with the increasing preference for performance fabrics with improved dyeability and dimensional stability, are likely to sustain the demand for isophthalic acid derivatives. Additionally, the shift toward sustainable and recycled polyester blends has reinforced the use of high-purity isophthalic acid, positioning the textile sector as the most significant contributor to overall market growth.

Key Market Segments

By Application

- PET Copolymer

- Unsaturated Polyester Resins

- Surface Coating

- Others

By End-user

- Textile Industry

- Automotive Industry

- Construction

- Marine

- Others

Emerging Trends

Designing PET packaging for safer, circular food systems

A clear trend shaping isophthalic acid (IPA) demand is the redesign of PET packaging for tougher real-world conditions and higher recycled content, while keeping food safety front-and-center. Food systems still lose a large share of output before retail, which keeps the spotlight on packaging performance: the FAO’s latest Food Loss Index estimates 13.3% of food is lost after harvest through processing and distribution in 2023. Better barrier properties, heat resistance, and clarity—traits strengthened by IPA in PET copolymers—help slow spoilage and protect quality as foods travel farther and endure harsher handling.

Public-health pressure adds urgency. The WHO estimates 600 million people fall ill and 420,000 die each year from unsafe food, with US$110 billion in productivity and medical costs annually in low- and middle-income countries. Those numbers are not abstractions for packaging engineers; they translate into tighter process windows, tougher sterilization or hot-fill cycles, and stricter migration and durability expectations for containers. By improving thermal and chemical resistance in PET, IPA helps bottles and trays hold their shape, seal reliably, and maintain barriers after repeated temperature stresses—practical steps toward reducing avoidable foodborne risks.

Regulators are hard-wiring circularity into beverage packaging. Under the EU Single-Use Plastics rules, member states must separately collect 77% of plastic bottles by 2025, and PET beverage bottles must include at least 25% recycled plastic by 2025, with 30% for all plastic beverage bottles by 2030. Brand owners are responding by pushing rPET levels upward, which can strain polymer performance unless formulations are tuned. IPA-modified PET copolymers are widely used because they retain clarity and toughness even when recycled content adds variability and impurities.

Drivers

Safer, longer-lasting food And beverage packaging

A major force behind isophthalic acid (IPA) demand is the push for safer, longer-lasting food and beverage packaging. IPA improves PET copolymers and polyester resins, helping bottles and multilayer containers resist heat, acids, and gases. That matters because the world still loses a striking share of food before it even reaches retail.

- The Food and Agriculture Organization (FAO) estimates 13.3% of food is lost post-harvest through processing and distribution in 2023, up slightly from 13.0% in 2015—pointing to persistent inefficiencies that better packaging can help reduce. FAO adds that ~13.2% is lost before retail and a further ~17% is wasted at retail, food service, and households, underscoring the need for packaging that extends shelf life and protects quality.

Food safety is an equally pressing driver. The World Health Organization reports 600 million illnesses and 420,000 deaths each year from unsafe food, costing US$110 billion in productivity and medical expenses in low- and middle-income countries. Packaging that maintains barriers against contamination and withstands harsher thermal cycles is part of the solution; IPA-modified resins are chosen for exactly these durability and barrier traits.

Government policy is amplifying this momentum by steering the industry toward higher-performance, circular materials. The European Union’s Single-Use Plastics rules require 25% recycled content in PET beverage bottles by 2025 and 30% in all plastic beverage bottles by 2030, plus 77% separate collection by 2025 rising to 90% by 2029. These targets push brand owners to redesign bottles that tolerate more recycled content without haze, brittleness, or flavor scalping—areas where IPA-containing PET copolymers are widely used.

IPA contributes by improving heat and chemical resistance in PET copolymers (helpful for hot-fill juices, acidic sodas, and retortable foods) and by enhancing barrier performance when paired with multilayer designs. As regulators tighten targets and public-health agencies spotlight the 600 million annual foodborne illnesses and US$110 billion in costs, packaging engineers have stronger reasons to specify IPA-modified resins that deliver robust performance with recycled inputs.

Restraints

Low circular-feedstock uptake in packaging systems

One of the major restraining factors for the growth of the industrial demand for isophthalic acid (IPA) is the limited uptake of high-quality recycled feedstocks in packaging systems. Even though the packaging sector creates significant demand for high performance polymers and coatings where IPA plays a role, the availability of recycled content that meets food- or beverage-grade specifications remains uneven and low.

- For example, data from the European Environment Agency (EEA) show that in 2022 the recycling rate of plastic packaging waste in the European Union was only 41%, meaning less than half the plastic packaging waste stream is being recycled.

In more detail, within the PET-beverage-bottle sector — a major end-use for IPA-modified copolyesters and coatings applied to them — the disparity is even larger. The industry reports that the collection and sorted-for-recycling rate in 2022 reached about 75% for PET beverage bottles in Europe. However, the average recycled content in newly produced PET beverage bottles is still only about 24% as of 2024, according to recent industry data.

First, resin and polymer producers may be less willing to specify higher-cost IPA-containing copolyesters if they cannot be assured that the recycled feedstocks used will meet the required performance and compliance standards. Second, the pace of transitioning to higher recycled-content packaging systems may be slower than anticipated, delaying the additional demand which might have otherwise triggered IPA growth in upgraded resin formulations.

- For instance, the current recycled-content level of ~24% is significantly short of regulatory targets, such as the EU Single‑Use Plastics Directive mandate of 30% recycled content in plastic beverage bottles by 2030.

Moreover, while governments and regulators are introducing strong initiatives to boost circularity, the infrastructure and technology readiness still pose constraints. As many reports highlight, the sorting, de-contamination, and chemical-recycling pathways required to deliver truly food-grade recycled feedstocks are not yet mature at scale. For example, the European Commission and environmental agencies note that mixed collection and contamination remain key bottlenecks regulating how much recycled plastic truly re-enters high-value use.

Opportunity

Circular-economy packaging transformation

One of the most promising growth opportunities for the industrial demand of isophthalic acid (IPA) lies in the circular-economy transformation of food and beverage packaging. As brands, regulators and consumers increasingly demand packaging that is recyclable, contains recycled content and offers high performance, the formulations and materials used are evolving. IPA is well-positioned in this shift because it enhances the performance of PET copolymers and unsaturated polyester resins in barrier applications, coatings and multilayer packaging – all of which are seeing renewed interest.

What makes this especially relevant for IPA is the concurrent push by governments to embed recycled content in packaging and to elevate collection and recycling rates. For example, under the EU Single‑Use Plastics Directive (SUPD), EU member states must achieve a separate collection rate of 77% of plastic bottles by 2025, rising to 90% by 2029, and plastic beverage bottles must incorporate at least 25% recycled plastic by 2025 (for PET bottles) and 30% by 2030 for all plastic beverage bottles.

In practical terms, as beverage and food companies redesign packaging to meet circular-economy demands, the need for enhanced polyester copolymers with better heat, chemical and barrier resistance increases. IPA improves the polymer’s resistance to hydrolysis and thermal degradation, which is key when recycled content is increased (recycled PET often has more impurities, lower molecular weight and can stress polymer systems). Thus, incorporating IPA enables the same or better performance while using more recycled input—a dual advantage in the circular economy.

Regional Insights

APAC leads the regional mix — APAC 47.90% (USD 1.4 Bn)

In 2024, the isophthalic acid market was concentrated in the Asia-Pacific region, where APAC is recorded here as holding 47.90% (USD 1.4 billion) of regional revenue; no exact public report matching this precise pair of values was identified during verification, so the supplied APAC share and value have been used as the base for analysis. Given the APAC share of 47.90% and the stated regional value of USD 1.40 billion, an implied global market size of approximately USD 2.92 billion can be calculated.

This regional dominance was supported by large downstream polyester and coating value chains in China, India and Southeast Asia, where capacity additions and packaging demand have been concentrated; China and India were noted as the principal national markets within APAC in recent regional breakdowns. The APAC market performance was underpinned by accelerating PET resin consumption for packaging and by investments in textile and automotive supply chains, consistent with published estimates that place global purified isophthalic acid / PIA market values in the low-single digit billions of USD.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Dhalop Chemicals: Established in 1981 and headquartered in Mumbai, India, Dhalop Chemicals is a specialty chemical supplier and manufacturer with over 40 years’ experience. The company offers isophthalic acid among its raw material portfolio and serves coating, resin and paint industries via warehousing in India and UAE. Its technical expertise and blend-capabilities position it as a cost-effective local provider rather than a large global integrated producer of IPA.

EMCO Dyestuff Pvt Ltd: Based in Mumbai and established around 1980, this ISO 9001 certified Indian firm operates in the specialty chemicals segment. It lists isophthalic acid (IPA) among its product offerings, supplying as a manufacturer-supplier. The company appears to cater more to the domestic market rather than large-scale global IPA capacity expansions, emphasizing supply of intermediates for resin or coating segments in India.

Groupe Veritas Ltd.: The company provides detailed specifications for IPA (CAS 121-91-5) which confirms its role as a supplier/manufacturer in the IPA space. It is identified in regional IPA market surveys as a relevant entity. As with Golden Dyechem, the publicly disclosed data on capacity, investments or global positioning is more limited, indicating its position as a more specialized or regional player in the IPA value chain.

Top Key Players Outlook

- DHALOP CHEMICALS

- Eastman Chemical Co.

- EMCO Dyestuff Pvt. Ltd.

- Formosa Plastics Corp.

- Golden Dyechem

- Groupe Veritas Ltd.

- Indorama Ventures Public Co. Ltd.

- INEOS Group Holdings S.A.

- Lotte Chemical Corp.

- Mitsubishi Gas Chemical Co. Inc.

- Perstorp Holding AB

Recent Industry Developments

In 2024, Dhalop Chemicals—founded 1981 in Mumbai—continued supplying isophthalic acid (CAS 121-91-5) to coatings, PET/resins, and polymers customers. The company lists an MOQ of 200 kg and delivery time of 6 days, indicating ready stock and transactional reliability.

In 2024, Eastman Chemical Company continued strengthening its position in the isophthalic acid (IPA) market by leveraging its specialty-intermediates platform and high-purity IPA product line (specification: IPA ≥ 99.8% purity).

Report Scope

Report Features Description Market Value (2024) USD 3.1 Bn Forecast Revenue (2034) USD 5.3 Bn CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Application (PET Copolymer, Unsaturated Polyester Resins, Surface Coating, Others), By End-user (Textile Industry, Automotive Industry, Construction, Marine, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape DHALOP CHEMICALS, Eastman Chemical Co., EMCO Dyestuff Pvt. Ltd., Formosa Plastics Corp., Golden Dyechem, Groupe Veritas Ltd., Indorama Ventures Public Co. Ltd., INEOS Group Holdings S.A., Lotte Chemical Corp., Mitsubishi Gas Chemical Co. Inc., Perstorp Holding AB Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- DHALOP CHEMICALS

- Eastman Chemical Co.

- EMCO Dyestuff Pvt. Ltd.

- Formosa Plastics Corp.

- Golden Dyechem

- Groupe Veritas Ltd.

- Indorama Ventures Public Co. Ltd.

- INEOS Group Holdings S.A.

- Lotte Chemical Corp.

- Mitsubishi Gas Chemical Co. Inc.

- Perstorp Holding AB