Global Iron Oxide Market Size, Share, And Business Benefit By Product Type (Red, Yellow, Black, Brown, Orange, Green, Others), By Application (Construction, Paints and Coatings, Plastics, Chemicals, Paper and Pulp Manufacturing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 163241

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

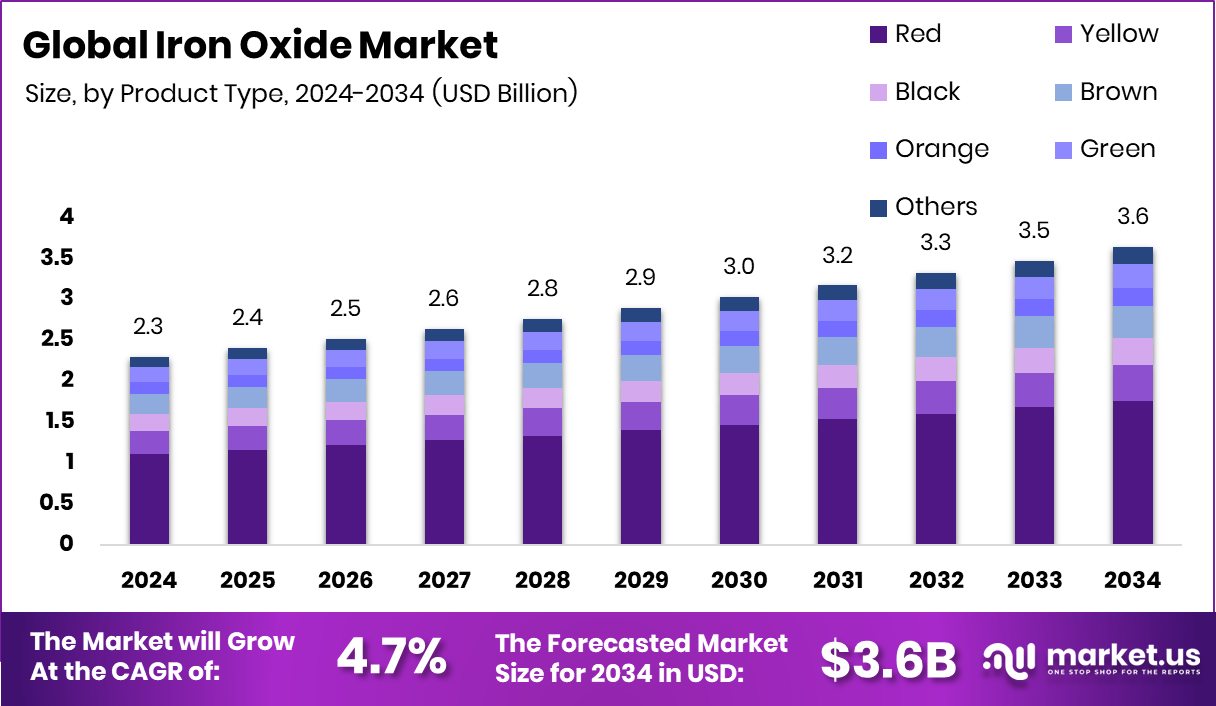

The Global Iron Oxide Market is expected to be worth around USD 3.6 billion by 2034, up from USD 2.3 billion in 2024, and is projected to grow at a CAGR of 4.7% from 2025 to 2034. Ongoing infrastructure upgrades helped North America maintain its 47.90% dominance in market share.

Iron oxide is a chemical compound composed of iron and oxygen, typically occurring in several forms such as FeO, Fe₂O₃, and Fe₃O₄, often with non-stoichiometric compositions. It appears naturally (for example, as the mineral hematite) and is produced synthetically for varied applications. It is valued for its stability, colour variations (yellow/orange/red/brown/black), and affordability in pigment, catalytic, and structural roles.

The iron oxide market refers to the global commercial system oriented around the production, trade, and application of iron oxide compounds across multiple industries—such as pigments for paints and coatings, functional additives in plastics and construction, catalysts, and magnetic materials. It covers raw materials, processing technologies, grade segmentation (e.g., pigment-grade, nano-grade), and end-use sectors, and is influenced by factors such as regulatory frameworks, sustainability drives, and downstream demand shifts.

One major growth factor is the rising demand for high-performance pigments in paints, coatings, and construction materials. As urbanisation and infrastructure development accelerate globally, especially in emerging economies, the need for durable, colour-stable and environmentally acceptable pigments expands.

Moreover, the push for eco-friendly coatings aligns with drives to replace traditional heavy-metal pigments, benefiting iron-oxide-based alternatives. Notably, recent funding headlines such as Ecoat secures €21 million to reinvent the future of paint—sustainably” highlight the broader move towards sustainable coating formulations, which in turn supports the iron oxide pigment segment.

Demand for iron oxide compounds is being bolstered by the increasing use in end-use sectors beyond traditional pigments—for example, in functional applications such as magnetic materials, electronics, and sustainable construction additives. The coatings industry’s renewal is evidenced by large-scale investment news: Battle for Dulux maker: Pidilite, JSW, Indigo Paints in US$2.5 billion race and Nippon Paint Holdings in US$2.3 billion deal for AOC, pointing to rapid expansion in the coatings ecosystem. Such downstream expansion translates upstream into higher consumption of iron-oxide raw materials and enhanced demand for tailored grades and formulations.

Key opportunities lie in innovation around nano- and specialty iron oxides, as well as in geographic expansion into less-served markets. For instance, coatings businesses transforming—BASF is reportedly selling its coatings business at US$6.8 billion valuation—signal industry restructuring that can open new supplier relationships and niche product development. Additionally, small-scale grants, such as Walsall industrial paint specialists, receive a £2,500 grant to drive business growth, showing that even modest funding can underwrite local innovation, creating potential for customized iron oxide solutions.

Key Takeaways

- The Global Iron Oxide Market is expected to be worth around USD 3.6 billion by 2034, up from USD 2.3 billion in 2024, and is projected to grow at a CAGR of 4.7% from 2025 to 2034.

- In 2024, the Iron Oxide Market saw red pigments dominate with a 48.3% strong global share.

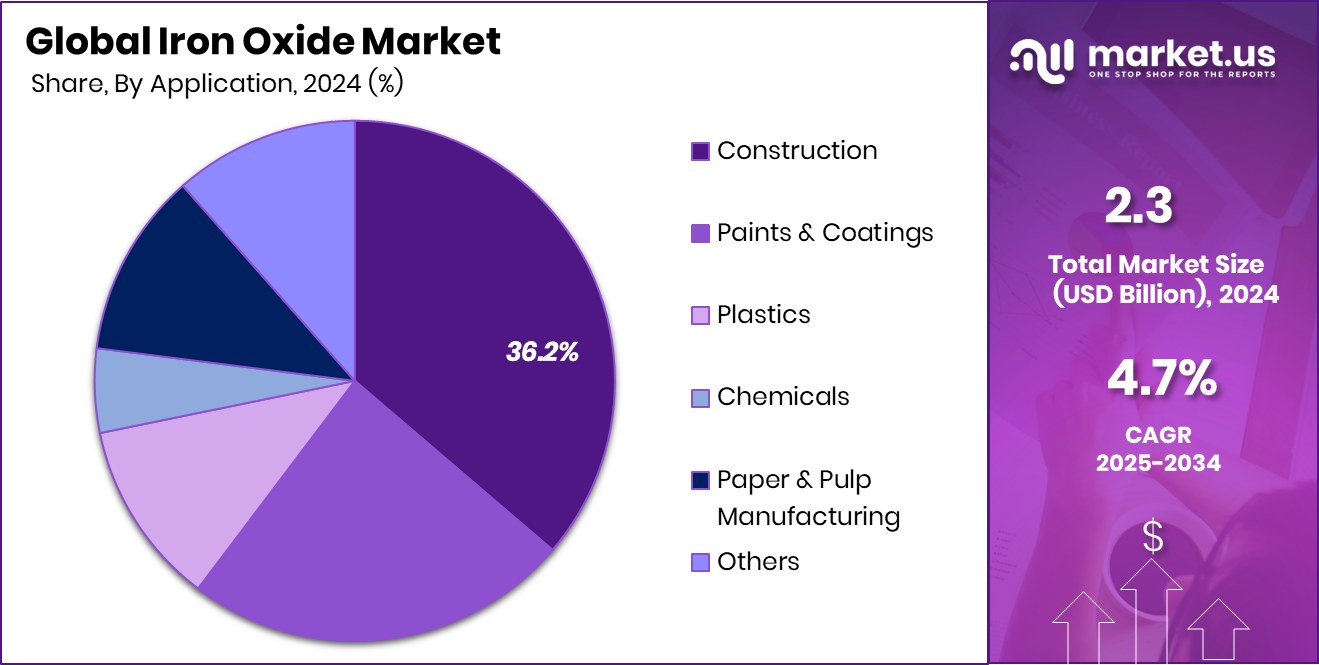

- The Iron Oxide Market recorded a 36.2% share from construction, driven by colored concrete and tiles.

- The North American strong construction and coatings industries significantly supported this USD 1.1 billion valuation.

By Product Type Analysis

In the iron oxide market, red pigments dominate with a strong 48.3% share.

In 2024, Red held a dominant market position in the By Product Type segment of the Iron Oxide Market, with a 48.3% share. This dominance is attributed to its strong usage as a pigment in paints, coatings, and construction materials due to excellent colour stability, UV resistance, and non-toxicity.

Red iron oxide is also preferred for its cost efficiency and versatility across cement, ceramics, and plastics. Its wide availability and ability to produce consistent hues make it the top choice in architectural and decorative coatings.

The construction boom and durable infrastructure projects have further elevated its demand, ensuring that red iron oxide continues to lead the segment through both industrial and decorative applications worldwide.

By Application Analysis

In the Iron Oxide Market, construction holds 36.2%, driven by infrastructure expansion.

In 2024, Construction held a dominant market position in the By Application segment of the Iron Oxide Market, with a 36.2% share. This dominance is mainly due to the extensive use of iron oxide pigments in cement, tiles, pavers, and architectural coatings to achieve long-lasting and aesthetic finishes.

Iron oxide provides superior colouring strength, weather resistance, and UV stability, making it a preferred additive in concrete and building materials. Its ability to withstand harsh environmental conditions and retain colour consistency enhances its suitability for large-scale infrastructure and residential projects.

The growing trend of decorative and sustainable construction materials has further reinforced the strong demand for iron oxide pigments within the construction sector globally.

Key Market Segments

By Product Type

- Red

- Yellow

- Black

- Brown

- Orange

- Green

- Others

By Application

- Construction

- Paints and Coatings

- Plastics

- Chemicals

- Paper and Pulp Manufacturing

- Others

Driving Factors

Rising Demand for Sustainable Pigments in Construction

One major driving factor for the Iron Oxide Market is the growing demand for sustainable pigments in construction materials. As cities expand and eco-friendly infrastructure projects rise, the need for durable and non-toxic colourants has increased sharply. Iron oxide pigments are preferred because they offer long-lasting colour, weather resistance, and environmental safety compared to synthetic alternatives. Governments and industries are encouraging green construction practices, further fueling demand for these pigments.

Recent financial activities, such as ConCntric raising $10 million in Series A funding, underline the ongoing push toward sustainable material innovation and technology development. This investment momentum supports the transition to low-impact pigment production, reinforcing iron oxide’s importance in the future of environmentally responsible construction markets.

Restraining Factors

Fluctuating Raw Material Prices Affect Market Stability

One major restraining factor for the Iron Oxide Market is the fluctuation in raw material prices, which directly impacts production costs and profit margins. The iron oxide manufacturing process depends heavily on iron ore and other mineral inputs whose prices vary with global supply and trade conditions. This instability often affects small and medium producers, reducing their competitiveness in the market.

Additionally, transportation and energy cost surges add further financial pressure on manufacturers. The recent Powerplay valuation halving in fresh funding reflects broader investor caution in industrial and construction-related sectors, highlighting market uncertainty. Such financial fluctuations discourage aggressive expansion and can slow the overall growth of the iron oxide market despite steady end-use demand.

Growth Opportunity

Expanding Use in Smart and Sustainable Infrastructure

A major growth opportunity for the Iron Oxide Market lies in its expanding use in smart and sustainable infrastructure projects. Iron oxide pigments are increasingly applied in eco-friendly concrete, intelligent pavements, and long-lasting construction materials that align with green building goals. These pigments enhance durability, aesthetics, and UV resistance, making them ideal for modern infrastructure designs.

The innovation wave in construction technology supports this momentum—Pavewise closed $2.5 million in seed funding to develop real-time intelligence for road construction, reflecting strong investment in advanced materials and monitoring tools. Additionally, large-scale funding like the $300 million White House ballroom build supported by 37 donors showcases rising infrastructure spending, indirectly boosting demand for performance-based iron oxide materials.

Latest Trends

Rising Integration of Iron Oxide in Mega Projects

One of the latest trends in the Iron Oxide Market is its rising integration into large-scale infrastructure and industrial projects worldwide. Iron oxide pigments are being used in advanced concrete, coatings, and construction materials that require durability, heat resistance, and strong aesthetic value. As global investment in heavy construction continues, the demand for reliable and sustainable materials like iron oxide is strengthening.

A major example of this trend is Afreximbank signing a US$1.35 billion financing deal as the lead arranger in a US$4 billion syndicated facility to refinance the Dangote Refinery construction, one of Africa’s largest industrial projects. Such massive funding initiatives highlight how large infrastructure developments increasingly rely on durable and high-performance iron oxide materials.

Regional Analysis

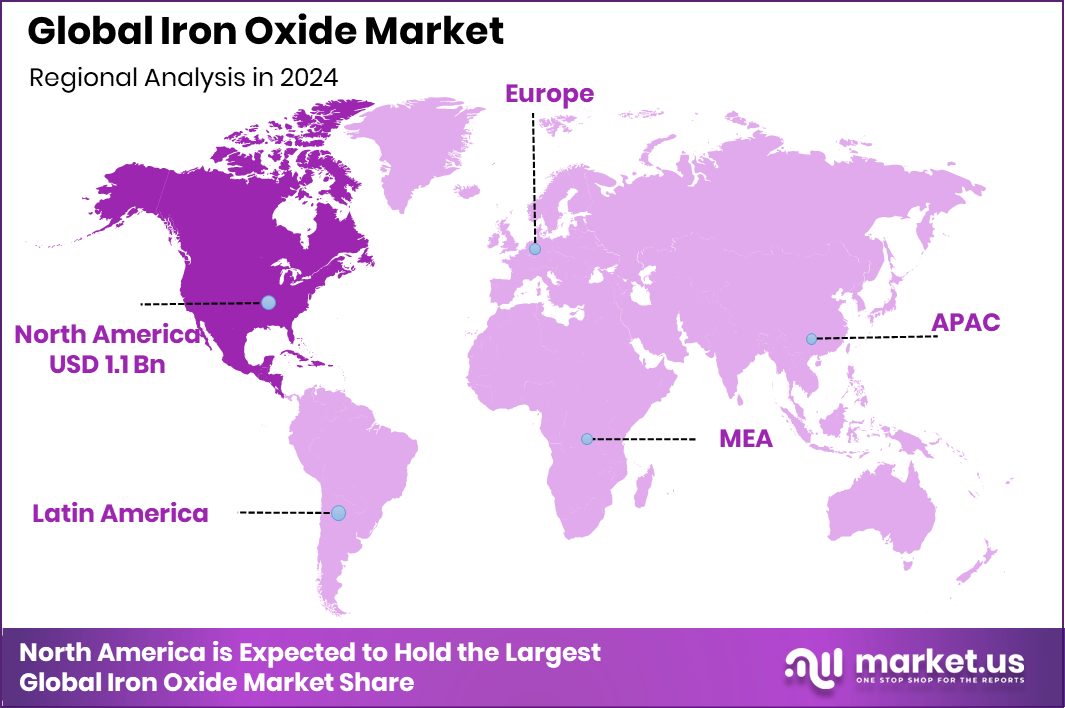

In 2024, North America held a 47.90% share, valued at USD 1.1 billion.

In 2024, North America held a dominant position in the Iron Oxide Market, accounting for 47.90% of the global share, valued at USD 1.1 billion. The region’s leadership is supported by strong demand from the construction, coatings, and infrastructure sectors, which rely on iron oxide pigments for their durability, colour stability, and weather resistance.

In Europe, the market benefits from the growing adoption of eco-friendly pigments in building materials and industrial coatings, aligning with sustainability policies. Asia Pacific continues to experience steady consumption driven by industrial expansion and infrastructure projects.

Meanwhile, Latin America and the Middle East & Africa regions are gradually increasing their usage due to ongoing urban development, contributing to overall market stability and regional diversification.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Lanxess AG maintained a leading role through its advanced pigment technologies and strong global manufacturing presence, focusing on environmentally responsible production processes and high-quality red and yellow iron oxide pigments. The company’s strategic expansion in specialty chemicals also strengthened its pigment portfolio.

Huntsman International LLC continued to emphasize the performance and stability of its iron oxide pigments, catering to construction, coatings, and plastics sectors. Its technological capabilities supported consistent product quality across global markets.

Toda Kogyo Corporation, with its long-standing expertise in inorganic pigments, reinforced its position by focusing on precision manufacturing and high-dispersion pigment applications, particularly for advanced materials. The company’s efforts in efficiency and quality improvement reflected its commitment to industrial innovation.

Collectively, these three companies shaped the global iron oxide industry through sustained investment in product development, supply chain optimization, and eco-conscious production practices. Their combined contributions in 2024 positioned them as pivotal forces driving technological advancement, market stability, and growth within the global iron oxide pigment ecosystem.

Top Key Players in the Market

- Lanxess AG

- Huntsman International LLC

- Toda Kogyo Corporation

- Alabama Pigments Company, LLC

- Golccha Pigments Pvt. Ltd.

- Tata Pigments Company

- Yaroslavsky Pigment Company

- Cathey Industries

- Others

Recent Developments

- In May 2025, Huntsman announced the launch of a new purification and packaging capability at its Conroe, Texas site (in the Performance Products division). This new E-GRADE® unit supports high-purity metal amines and amine oxides for semiconductor and advanced industrial applications.

- In February 2025, Lanxess launched a new sustainable variant of its Bayferrox iron-oxide yellow pigment under the “Scopeblue” brand. This product uses eco-efficient raw materials and offers a product carbon footprint (PCF) around 35% lower than the conventional grade, while keeping the same chemical and colour performance.

Report Scope

Report Features Description Market Value (2024) USD 2.3 Billion Forecast Revenue (2034) USD 3.6 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Red, Yellow, Black, Brown, Orange, Green, Others), By Application (Construction, Paints and Coatings, Plastics, Chemicals, Paper and Pulp Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Lanxess AG, Huntsman International LLC, Toda Kogyo Corporation, Alabama Pigments Company, LLC, Golccha Pigments Pvt. Ltd., Tata Pigments Company, Yaroslavsky Pigment Company, Cathey Industries, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Lanxess AG

- Huntsman International LLC

- Toda Kogyo Corporation

- Alabama Pigments Company, LLC

- Golccha Pigments Pvt. Ltd.

- Tata Pigments Company

- Yaroslavsky Pigment Company

- Cathey Industries

- Others