Global Intelligent Flow Meter Market Size, Share, Growth Analysis By Offering (Hardware, Software, Services), By Type (Coriolis, Magnetic, Ultrasonic, Multiphase, Vortex, Variable-Area, Differential Pressure, Thermal, Turbine, Others), By Communication Protocol (HART, Modbus, PROFIBUS, Foundation Fieldbus, Ethernet-IP, Others), By End-User Industry (Oil and Gas, Water and Wastewater, Pharmaceuticals and Life Sciences, Power Generation, Food and Beverages, Chemical and Petrochemical, Paper and Pulp, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 178598

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

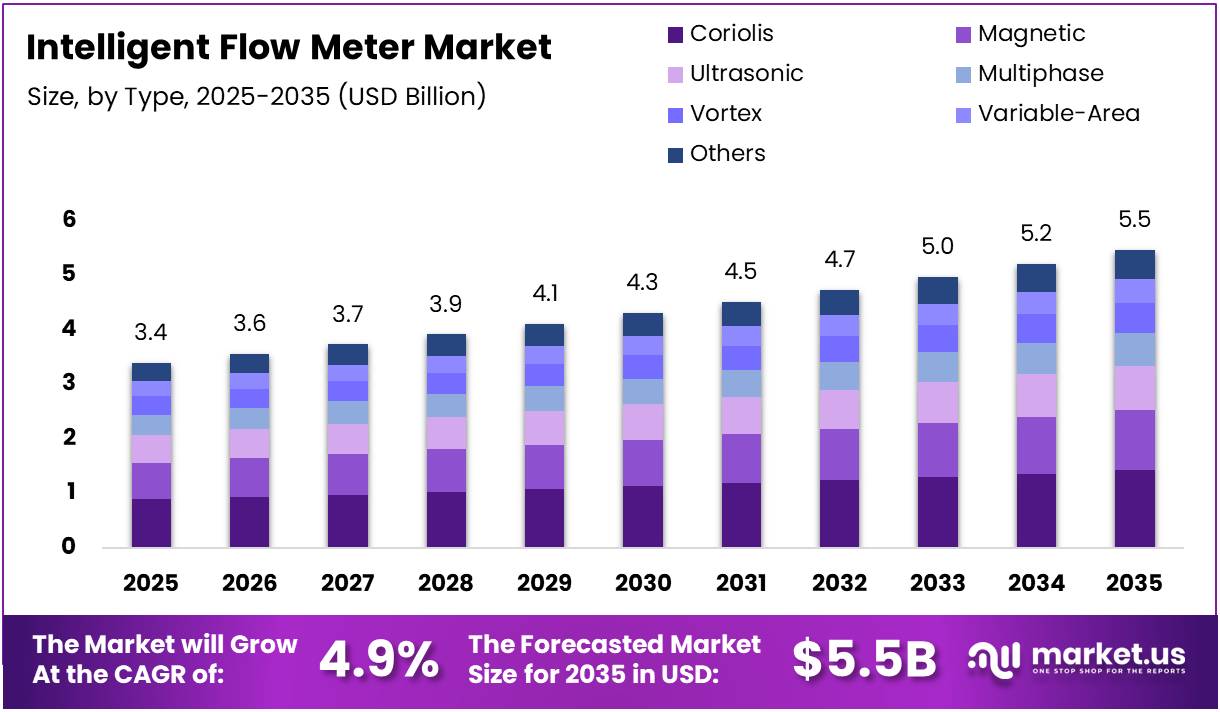

The Global Intelligent Flow Meter Market size is expected to be worth around USD 5.5 Billion by 2035 from USD 3.39 Billion in 2025, growing at a CAGR of 4.9% during the forecast period 2026 to 2035.

The Intelligent flow meter market refers to advanced metering solutions that measure the flow rate of liquids, gases, and steam across industrial pipelines. These devices integrate digital sensors, microprocessors, and communication modules to deliver real-time, accurate flow data. Consequently, they are widely adopted in industries requiring precise process control and regulatory compliance.

Intelligent flow meters differ from conventional meters by offering self-diagnostics, predictive maintenance alerts, and remote monitoring capabilities. Moreover, they support multiple communication protocols such as HART, Modbus, and Ethernet-IP. This enables seamless integration with industrial control systems and cloud-based monitoring platforms, making them essential for modern process automation environments.

The market is driven by rapid industrial automation across manufacturing, oil and gas, water utilities, and power generation sectors. Additionally, increasing pressure on industries to reduce resource waste and improve operational efficiency has accelerated demand for smart flow measurement solutions. Government mandates on environmental monitoring and energy auditing further support adoption.

Regulatory frameworks such as water metering directives in Europe and emission monitoring requirements in North America are pushing industries to upgrade legacy metering infrastructure. Furthermore, growing investments in smart city projects and industrial IoT platforms are creating sustained demand for connected flow measurement devices globally.

According to experimental research published on arXiv, testing of a transit-time ultrasonic flow meter demonstrated that maximum measurement error was reduced from 8.51% to 2.44% after applying a flow profile correction factor. Additionally, the Flow-Weighted Mean Error dropped significantly from 1.78% to 0.08% following calibration improvements, underscoring the precision gains achievable with intelligent metering technologies.

These accuracy improvements highlight the growing technical maturity of intelligent flow meter solutions. Therefore, industries managing custody transfer, pharmaceutical production, and chemical processing are increasingly prioritizing high-precision, digitally enabled meters. This trend continues to strengthen market expansion across both developed and emerging economies through the forecast period.

Key Takeaways

- The Global Intelligent Flow Meter Market was valued at USD 3.39 Billion in 2025 and is projected to reach USD 5.5 Billion by 2035.

- The market is growing at a CAGR of 4.9% during the forecast period 2026 to 2035.

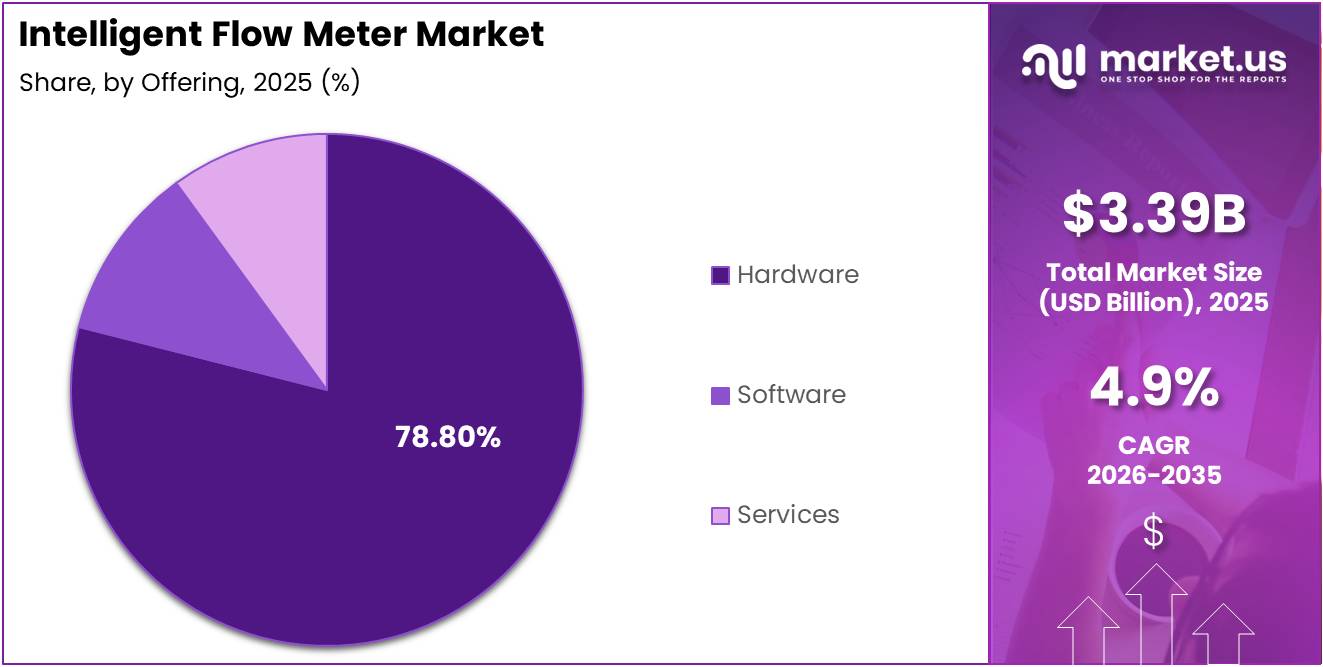

- By Offering, Hardware dominates with a 78.80% share in 2025.

- By Type, Coriolis flow meters lead the market with a 26.10% share.

- By Communication Protocol, HART holds the dominant position with a 45.70% share.

- By End-User Industry, Oil and Gas is the leading segment with a 22% share.

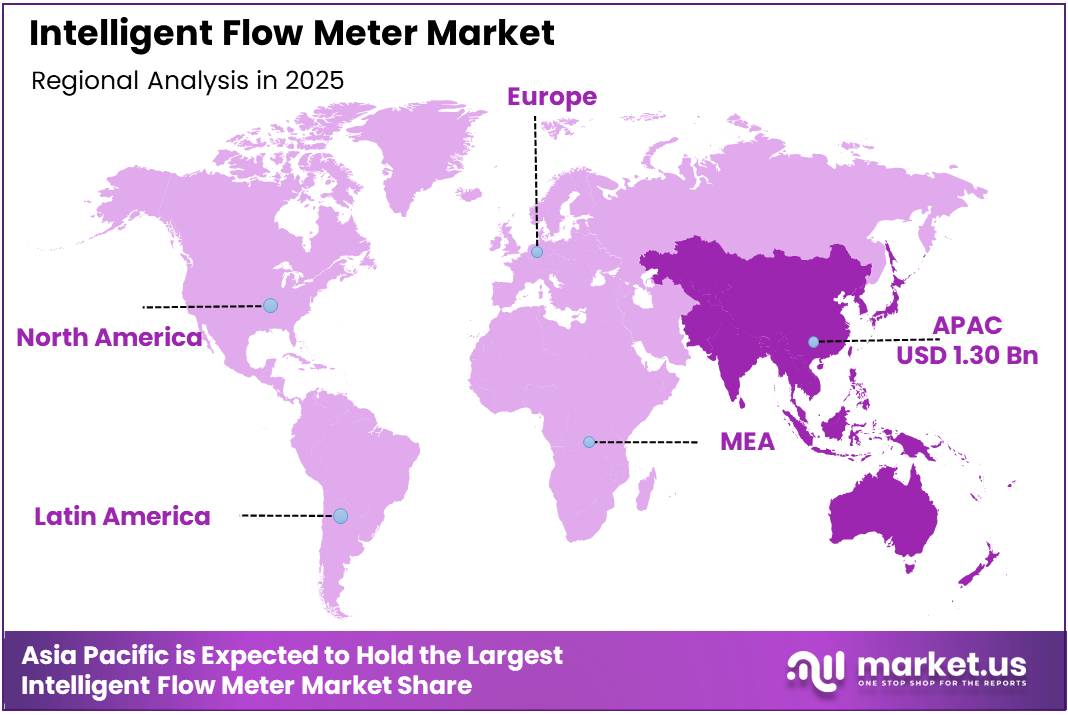

- Asia Pacific dominates the regional landscape with a 38.26% share, valued at USD 1.30 Billion.

Offering Analysis

Hardware dominates with 78.80% due to the fundamental need for physical sensing and measurement components across all industrial applications.

In 2025, Hardware held a dominant market position in the By Offering segment of the Intelligent Flow Meter Market, with a 78.80% share. Hardware components including sensors, transmitters, and housings form the physical backbone of any flow measurement system. Moreover, ongoing upgrades across oil, gas, and water infrastructure continue to drive robust hardware procurement globally.

Software represents a growing segment, encompassing analytics platforms and device management tools. These solutions enable operators to interpret flow data, optimize performance, and manage large meter networks remotely. Additionally, rising adoption of cloud-based industrial platforms is accelerating software integration alongside hardware deployments across process industries.

Services including calibration and remote monitoring are gaining importance as installed meter bases expand. Calibration services ensure measurement accuracy and regulatory compliance, while remote monitoring reduces the need for on-site inspections. Consequently, service contracts are becoming a standard component of intelligent flow meter procurement across utilities and manufacturing sectors.

Type Analysis

Coriolis flow meters dominate with 26.10% due to their high accuracy and suitability for demanding custody transfer and pharmaceutical applications.

In 2025, Coriolis held a dominant market position in the By Type segment of the Intelligent Flow Meter Market, with a 26.10% share. Coriolis meters measure mass flow directly, offering superior accuracy for high-value fluid transfer. Moreover, their compatibility with corrosive and viscous media makes them preferred in chemical, food, and life sciences industries.

Magnetic flow meters are widely used in water, wastewater, and slurry applications due to their non-intrusive design, zero pressure drop, and minimal maintenance requirements. They perform reliably with conductive fluids, making them ideal for municipal water networks and industrial effluent monitoring. Additionally, their long operational lifespan and low total cost of ownership make them a popular choice for utility operators globally.

Ultrasonic flow meters are gaining significant traction due to their clamp-on installation capability and non-contact measurement approach, which eliminates process interruption during installation. They are particularly valued in retrofit projects and applications where pipe penetration is not feasible. Furthermore, advancements in signal processing technology have greatly improved their accuracy across varying flow profiles and fluid types.

Multiphase flow meters are essential in oil and gas upstream operations where simultaneous measurement of oil, water, and gas phases within a single pipeline is required. These meters eliminate the need for test separators, reducing operational complexity and cost. Consequently, their adoption is expanding as operators seek to improve production monitoring efficiency across subsea and surface wellhead installations.

Vortex flow meters are widely used for steam, gas, and liquid flow measurement in power generation and chemical processing applications. They offer reliable performance with minimal moving parts, reducing maintenance frequency significantly. Moreover, their suitability for high-temperature and high-pressure process conditions makes them a preferred choice across industrial utility and energy management systems globally.

Variable-Area meters remain a cost-effective solution for low-flow applications in laboratories and light industrial settings where simple visual flow indication is sufficient. They require no external power source, making them practical for standalone installations. Additionally, their straightforward mechanical design ensures low maintenance requirements and long operational life in applications where digital communication is not a primary requirement.

Differential Pressure flow meters continue to be one of the most extensively deployed meter types globally due to their proven reliability and broad compatibility with diverse process fluids and pipe sizes. They are commonly used in oil and gas, power generation, and HVAC applications. Moreover, their compatibility with smart transmitters enables straightforward integration into digital monitoring systems with minimal additional investment.

Thermal flow meters are specifically designed for gas flow measurement, offering high sensitivity at low flow rates across a wide turndown range. They are widely used in natural gas distribution, compressed air monitoring, and environmental emissions measurement applications. Consequently, their ability to measure mass flow directly without pressure or temperature compensation makes them highly valued in energy management programs.

Turbine flow meters deliver high accuracy for clean liquid and gas flow measurement in fuel management, aerospace, and custody transfer operations. Their fast response time and wide flow range make them suitable for dynamic measurement applications. Additionally, modern turbine meters with digital pulse outputs integrate seamlessly with flow computers and SCADA systems, supporting precise totalization and billing across multiple industries.

Others in this segment include open-channel meters, positive displacement meters, and emerging technology variants that serve niche or specialized measurement requirements. These meter types address specific process conditions not covered by mainstream technologies. Consequently, they continue to find application in research, wastewater management, and specialized industrial processes where standard meter types are not suitable.

Communication Protocol Analysis

HART dominates with 45.70% due to its widespread legacy compatibility and simultaneous analog and digital communication capability.

In 2025, HART held a dominant market position in the By Communication Protocol segment of the Intelligent Flow Meter Market, with a 45.70% share. HART supports two-way digital communication over conventional analog wiring, making it ideal for brownfield upgrades. Moreover, its reliability and backward compatibility keep it the default choice across the majority of installed industrial metering systems worldwide.

Modbus is widely deployed in manufacturing and process automation environments where cost-effective serial field communication is required. It remains a preferred protocol for smaller installations and legacy PLC-based control systems. Additionally, its simplicity and broad device support make it a practical choice for operators managing mixed-vendor instrumentation across diverse industrial environments.

PROFIBUS supports high-speed digital communication across complex process plants and is well established particularly in European industrial facilities. It enables multi-drop device connectivity with deterministic data exchange capabilities. Furthermore, its robust performance in large distributed control environments has maintained its relevance across chemical, pharmaceutical, and power generation applications.

Foundation Fieldbus is used in fully digital, process-critical environments where intrinsically safe and multi-variable field communication is required. It enables advanced process control and device diagnostics directly at the field level. Consequently, it remains a preferred protocol in new greenfield refinery and petrochemical plant designs where full digital integration is a core engineering requirement.

Ethernet-IP is emerging as a preferred protocol for modern smart manufacturing environments requiring high-speed, real-time data exchange with enterprise and cloud systems. Its compatibility with standard IT networking infrastructure simplifies integration with SCADA and analytics platforms. Moreover, growing adoption of Industry 4.0 architectures is steadily accelerating Ethernet-IP deployment in next-generation intelligent flow meter installations.

Others include evolving wireless and IIoT communication standards such as WirelessHART and PROFINET gaining ground in next-generation deployments. These protocols support remote monitoring in hard-to-reach or hazardous locations without requiring wired infrastructure. Consequently, their adoption is expected to grow as industries increasingly prioritize flexible and scalable connectivity for widely distributed metering networks.

End-User Industry Analysis

Oil and Gas dominates with 22% due to critical measurement demands across upstream, midstream, and downstream operations.

In 2025, Oil and Gas held a dominant market position in the By End-User Industry segment of the Intelligent Flow Meter Market, with a 22% share. The sector requires precise custody transfer measurement, leak detection, and emissions monitoring. Moreover, stringent regulatory requirements on flow reporting reinforce consistent demand for high-accuracy intelligent meters across global oil and gas operations.

Water and Wastewater is a major growth segment driven by smart city investments and non-revenue water reduction programs. Municipalities worldwide are deploying intelligent meters to improve billing accuracy and detect pipeline losses early. Additionally, international development funding for water infrastructure in emerging economies is accelerating intelligent meter adoption across this important sector.

Pharmaceuticals and Life Sciences demand high-precision flow meters to maintain product quality and comply with strict GMP and FDA regulatory standards. These industries require meters with hygienic certifications and full traceability of measurement data. Consequently, intelligent flow meters with advanced diagnostics and digital audit trails are increasingly specified in pharmaceutical manufacturing and bioprocessing facilities.

Power Generation relies on intelligent flow meters for steam, cooling water, and fuel gas measurement across conventional and renewable energy plants. Accurate flow data is essential for efficiency optimization and emissions compliance reporting. Furthermore, growing investment in hydrogen and alternative energy infrastructure is creating significant new flow measurement requirements within this expanding segment.

Food and Beverages requires hygienic, CIP-compatible flow meters capable of measuring diverse process fluids including beverages, dairy products, and viscous food preparations. Accuracy and cleanability are the primary meter selection criteria in this sector. Moreover, increasing global food safety regulations are driving upgrades from basic meters to fully intelligent and digitally connected measurement solutions.

Chemical and Petrochemical industries operate demanding environments with corrosive, high-pressure, and high-temperature fluids requiring robust and chemically resistant meter designs. Intelligent meters in this sector must integrate with complex DCS environments and support multiple communication protocols. Additionally, precise flow measurement is critical for yield optimization and raw material cost control throughout chemical production processes.

Paper and Pulp facilities use intelligent flow meters to monitor water, steam, and chemical dosing flows throughout the production process. Accurate measurement supports energy efficiency, chemical usage optimization, and effluent compliance monitoring. Furthermore, aging infrastructure in established paper mills is actively driving meter replacement and upgrade projects across North America and Europe.

Others include sectors such as mining, semiconductor manufacturing, and district energy systems where intelligent flow meters address specialized measurement needs. These applications often require custom configurations and unique material compatibility. Consequently, they represent a diverse and steadily growing portion of total intelligent flow meter market demand across both developed and emerging economies worldwide.

Key Market Segments

By Offering

- Hardware

- Sensors

- Transmitters

- Housings

- Software

- Analytics

- Device Management

- Services

- Calibration

- Remote Monitoring

By Type

- Coriolis

- Magnetic

- Ultrasonic

- Multiphase

- Vortex

- Variable-Area

- Differential Pressure

- Thermal

- Turbine

- Others

By Communication Protocol

- HART

- Modbus

- PROFIBUS

- Foundation Fieldbus

- Ethernet-IP

- Others

By End-User Industry

- Oil and Gas

- Water and Wastewater

- Pharmaceuticals and Life Sciences

- Power Generation

- Food and Beverages

- Chemical and Petrochemical

- Paper and Pulp

- Others

Drivers

Rising Industrial Automation and Real-Time Flow Monitoring Drive Intelligent Flow Meter Market Growth

The rapid adoption of industrial automation across manufacturing, utilities, and process industries is a primary growth driver for intelligent flow meters. Smart process control systems require accurate, real-time flow data to maintain operational efficiency. Moreover, the shift toward Industry 4.0 environments is creating consistent demand for digitally connected metering solutions globally.

Increasing demand for real-time flow monitoring is enabling industries to reduce resource waste and optimize process performance. Operators in oil and gas, water management, and chemical processing rely on intelligent meters to track consumption accurately. Consequently, organizations are replacing conventional meters with smart alternatives that deliver continuous, actionable flow data across complex industrial networks.

Growing emphasis on accurate billing, custody transfer, and regulatory compliance is further strengthening market adoption. Governments and industry regulators are enforcing stricter monitoring requirements for emissions, water usage, and energy consumption. Therefore, end-users across multiple sectors are investing in certified, high-precision intelligent flow measurement systems to meet compliance standards and avoid operational penalties.

Restraints

Integration Complexity and Technical Skill Gaps Restrain Intelligent Flow Meter Market Adoption

One of the key restraints in the intelligent flow meter market is the complexity of integrating new smart devices with legacy industrial control systems. Many facilities operate decades-old infrastructure that lacks compatibility with modern digital communication protocols. Consequently, retrofit projects require significant engineering effort, custom middleware, and extended commissioning timelines that increase overall project cost.

Technical skill gaps among plant operators and maintenance teams present a significant barrier to adopting advanced flow metering solutions. Intelligent meters generate complex datasets that require trained personnel to configure, calibrate, and interpret effectively. Moreover, many organizations in developing markets lack in-house expertise in flow data analytics, limiting their ability to extract full value from smart metering investments.

These challenges are especially pronounced among small and mid-sized enterprises that lack dedicated instrumentation engineering teams. Additionally, budget constraints often prevent organizations from investing in the training and system upgrades necessary to support intelligent meter deployment. Therefore, the gap between technology availability and workforce capability continues to slow adoption in several industries and geographic markets.

Growth Factors

IoT Integration, Renewable Energy Deployment, and Smart Water Infrastructure Drive Intelligent Flow Meter Market Expansion

The integration of intelligent flow meters with IoT platforms and cloud-based industrial monitoring systems is a major growth opportunity. Connected meters can transmit real-time flow data to centralized dashboards, enabling remote diagnostics and predictive maintenance. Moreover, industrial IoT adoption across oil and gas, utilities, and manufacturing is creating large-scale demand for smart, communicable metering solutions.

Rising deployment of intelligent flow meters in renewable energy, hydrogen, and alternative fuel applications is expanding the addressable market significantly. Green energy infrastructure requires precise monitoring of hydrogen flows, cooling fluids, and biofuel streams. Additionally, government-backed clean energy programs in Europe, North America, and Asia Pacific are funding instrumentation upgrades that include intelligent metering for new energy systems.

Increasing penetration in smart water management and urban infrastructure projects represents another strong growth vector. Municipalities are investing in digital water networks to reduce non-revenue water losses and improve billing accuracy. Consequently, intelligent flow meters are becoming a core component of smart city water systems, supported by public infrastructure funding and international development programs worldwide.

Emerging Trends

AI-Enabled Diagnostics, Digital Protocols, and Multi-Parameter Measurement Shape the Future of Intelligent Flow Meters

The growing use of AI-enabled predictive maintenance and self-diagnostics features is reshaping how intelligent flow meters are managed in the field. AI algorithms analyze flow patterns to detect anomalies, predict failures, and schedule maintenance proactively. Moreover, this capability reduces unplanned downtime and lowers total cost of ownership for operators managing large meter deployments across complex facilities.

A clear shift toward digital communication protocols and advanced connectivity standards is transforming the intelligent flow meter landscape. Industrial Ethernet, wireless HART, and IIoT-compatible protocols are replacing older analog-based communication methods. Additionally, this transition enables tighter integration with SCADA, DCS, and cloud-based analytics platforms, improving data accessibility and operational decision-making for process managers.

Rising preference for multi-parameter and hybrid flow measurement technologies is also a defining trend in this market. Modern intelligent meters increasingly measure not just flow rate but also temperature, pressure, density, and viscosity simultaneously. Consequently, these multi-variable devices reduce the need for multiple instruments per measurement point, simplifying system design and lowering installation costs in complex industrial environments.

Regional Analysis

Asia Pacific Dominates the Intelligent Flow Meter Market with a Market Share of 38.26%, Valued at USD 1.30 Billion

Asia Pacific leads the global intelligent flow meter market, holding a dominant share of 38.26% and valued at USD 1.30 Billion in 2025. The region’s growth is driven by rapid industrialization in China, India, and South Korea, alongside large-scale investments in water infrastructure, oil and gas processing, and smart manufacturing. Moreover, government initiatives supporting digital industrial transformation continue to accelerate meter adoption across the region.

North America Intelligent Flow Meter Market Trends

North America represents a mature and high-value market for intelligent flow meters, underpinned by a strong oil and gas sector and advanced industrial automation infrastructure. The United States leads regional demand, with significant investments in pipeline monitoring, custody transfer, and environmental compliance measurement. Additionally, growing hydrogen energy projects and smart water management programs are opening new application areas across the region.

Europe Intelligent Flow Meter Market Trends

Europe holds a significant share of the intelligent flow meter market, supported by stringent environmental regulations and a strong emphasis on energy efficiency and emissions monitoring. Germany, France, and the UK are key contributors, driven by advanced chemical, pharmaceutical, and water utility sectors. Furthermore, the European Union’s industrial digitalization policies are encouraging widespread adoption of smart metering solutions across process industries.

Middle East and Africa Intelligent Flow Meter Market Trends

The Middle East and Africa market is driven primarily by the region’s extensive oil and gas industry, where accurate flow measurement is critical for production and custody transfer operations. GCC countries are investing heavily in upstream and downstream instrumentation upgrades. Moreover, increasing focus on water scarcity management is driving intelligent meter deployments in desalination plants and municipal water networks across the region.

Latin America Intelligent Flow Meter Market Trends

Latin America is an emerging market for intelligent flow meters, with Brazil and Mexico leading adoption across oil and gas, food and beverage, and water management applications. Regional growth is supported by expanding industrial infrastructure and increasing foreign direct investment in process manufacturing. However, economic volatility and limited technical workforce capacity remain challenges that moderate the pace of market expansion in this region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

ABB Ltd. is a global leader in industrial automation and measurement technology, offering a comprehensive portfolio of intelligent flow meters including electromagnetic, Coriolis, and vortex types. The company’s strength lies in deep integration of its flow measurement products with its broader process automation and digital solutions ecosystem, enabling seamless deployment across oil and gas, water, and chemical industries worldwide.

Endress+Hauser AG is recognized for its innovation in process instrumentation, with intelligent flow meters forming a core part of its product offering. The company invests significantly in sensor technology and digital connectivity, supporting protocols such as HART, PROFIBUS, and Industrial Ethernet. Its global service network and strong focus on calibration and lifecycle support make it a trusted partner for industries requiring high measurement reliability.

Siemens AG brings extensive industrial digitalization expertise to the intelligent flow meter segment, combining measurement hardware with advanced software analytics and cloud connectivity. Its flow products are designed to integrate directly with broader plant automation architectures. Moreover, Siemens continues to expand its presence in smart water management and energy sector applications, aligning its meter portfolio with evolving sustainability and decarbonization goals.

Emerson Electric Co. is a prominent player in the intelligent flow meter market, known for its Rosemount and Micro Motion brands covering differential pressure, Coriolis, and magnetic flow technologies. The company leverages its Plantweb digital ecosystem to deliver connected metering solutions that support predictive maintenance and operational analytics. Additionally, Emerson’s strong focus on oil and gas, refining, and life sciences sectors reinforces its global competitive position.

Key Players

- ABB Ltd.

- Endress + Hauser AG

- Siemens AG

- Emerson Electric Co.

- Honeywell International Inc.

- Yokogawa Electric Corporation

- KROHNE Messtechnik GmbH

- Azbil Corporation

- Fuji Electric Co., Ltd.

- Teledyne ISCO Inc.

- Sierra Instruments Inc.

- Brooks Instrument LLC

- Badger Meter Inc.

- Bronkhorst High-Tech B.V.

- Alicat Scientific Inc.

- McCrometer Inc.

- ONICON Incorporated

- AW-Lake Company

- SmartMeasurement

- Flow Technology Inc.

- Others

Recent Developments

- October 2025 – AURELIUS announced its acquisition of Xylem Inc.’s international smart meter division, marking a significant strategic move to expand its presence in the global smart water metering and flow measurement sector. This transaction is expected to strengthen AURELIUS’s industrial instrumentation portfolio across key international markets.

- August 2025 – Sanchuan Wisdom and Honeywell entered into a strategic partnership aimed at expanding their combined footprint in the global smart water market. The collaboration focuses on deploying advanced intelligent metering solutions across municipal water networks, leveraging Honeywell’s digital platform capabilities and Sanchuan’s regional market expertise.

- January 2025 – SICK and Endress+Hauser commenced a strategic partnership focused on process automation, combining complementary sensor and instrumentation technologies to deliver enhanced solutions for industrial customers. The partnership is designed to accelerate innovation in flow measurement and process analytics across manufacturing, chemical, and utility end markets.

Report Scope

Report Features Description Market Value (2025) USD 3.39 Billion Forecast Revenue (2035) USD 5.5 Billion CAGR (2026-2035) 4.9% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Offering (Hardware, Software, Services), By Type (Coriolis, Magnetic, Ultrasonic, Multiphase, Vortex, Variable-Area, Differential Pressure, Thermal, Turbine, Others), By Communication Protocol (HART, Modbus, PROFIBUS, Foundation Fieldbus, Ethernet-IP, Others), By End-User Industry (Oil and Gas, Water and Wastewater, Pharmaceuticals and Life Sciences, Power Generation, Food and Beverages, Chemical and Petrochemical, Paper and Pulp, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ABB Ltd., Endress + Hauser AG, Siemens AG, Emerson Electric Co., Honeywell International Inc., Yokogawa Electric Corporation, KROHNE Messtechnik GmbH, Azbil Corporation, Fuji Electric Co. Ltd., Teledyne ISCO Inc., Sierra Instruments Inc., Brooks Instrument LLC, Badger Meter Inc., Bronkhorst High-Tech B.V., Alicat Scientific Inc., McCrometer Inc., ONICON Incorporated, AW-Lake Company, SmartMeasurement, Flow Technology Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Intelligent Flow Meter MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Intelligent Flow Meter MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd.

- Endress + Hauser AG

- Siemens AG

- Emerson Electric Co.

- Honeywell International Inc.

- Yokogawa Electric Corporation

- KROHNE Messtechnik GmbH

- Azbil Corporation

- Fuji Electric Co., Ltd.

- Teledyne ISCO Inc.

- Sierra Instruments Inc.

- Brooks Instrument LLC

- Badger Meter Inc.

- Bronkhorst High-Tech B.V.

- Alicat Scientific Inc.

- McCrometer Inc.

- ONICON Incorporated

- AW-Lake Company

- SmartMeasurement

- Flow Technology Inc.

- Others