Global Integrated Marine Automation System Market Size, Share, Growth Analysis By Product Type (Hardware [Sensors and Field Devices, Control Modules, Navigation and Communication Systems, Others], Software [Integrated Platform-Management SW, Safety and Security SW, Analytics and Predictive-Maintenance SW, Others]), By Solution (Vessel-Management Systems, Power-Management Systems, Safety and Security Systems, Others), By Installation Type (New-build, Retrofit / Upgrade), By End User (Commercial, Defense), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171110

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Solution Analysis

- Installation Type Analysis

- End User Analysis

- Key Market Segments

- Drivers

- Need for Enhanced Navigation and Operational Safety Drives Market Growth

- Restraints

- Complexity of Integrating Legacy Systems Restrains Market Expansion

- Growth Factors

- Adoption of Autonomous Vessels Creates New Growth Opportunities

- Emerging Trends

- Increasing Use of Digital Twin Technology Shapes Market Trends

- Regional Analysis

- Key Integrated Marine Automation System Company Insights

- Recent Developments

- Report Scope

Report Overview

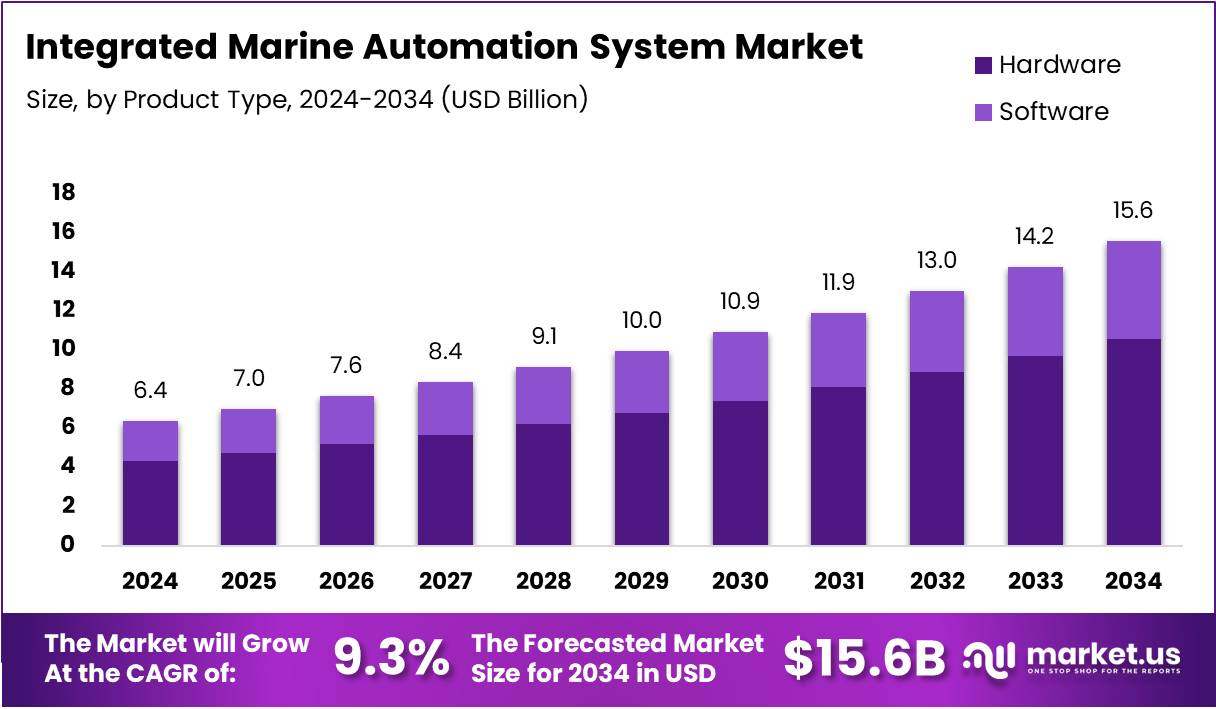

The Global Integrated Marine Automation System Market size is expected to be worth around USD 15.6 Billion by 2034, from USD 6.4 Billion in 2024, growing at a CAGR of 9.3% during the forecast period from 2025 to 2034.

The Integrated Marine Automation System Market encompasses advanced technological solutions designed to automate vessel operations, navigation, and monitoring processes. These systems integrate sensors, control mechanisms, and software platforms to enhance maritime efficiency. Consequently, they enable remote monitoring, predictive maintenance, and autonomous operations. The market serves commercial shipping, naval defense, and offshore industries seeking operational excellence through digital transformation.

Market growth accelerates as shipowners recognize automation’s transformative potential for operational sustainability. Digital integration reduces human error while optimizing resource utilization across maritime operations. Furthermore, aging global fleets require modernization investments to meet contemporary efficiency standards. This convergence of technological advancement and operational necessity drives sustained market expansion. Industry stakeholders increasingly prioritize automation solutions that deliver measurable returns on investment.

Opportunities emerge through regulatory compliance requirements and environmental sustainability mandates globally. International maritime organizations enforce stricter emission standards, compelling vessel operators to adopt fuel-efficient technologies. Additionally, crew shortage challenges across maritime sectors accelerate automation adoption for critical functions. Port infrastructure modernization initiatives further amplify demand for integrated automation systems. These factors collectively create favorable conditions for market participants.

Government investment patterns reflect strategic priorities in maritime security and commercial competitiveness. Naval modernization programs allocate substantial budgets toward autonomous capabilities and digital warfare systems. Similarly, coastal nations invest in smart port infrastructure supporting automated vessel operations. Regulatory frameworks increasingly mandate safety automation systems for new vessel constructions. These policy initiatives fundamentally shape market development trajectories and technology adoption rates.

Commercial adoption priorities demonstrate compelling economic drivers behind automation investments within maritime operations. According to research indicates 29% of commercial respondents identify crew reductions as automation’s primary advantage. Enhanced safety protocols represent 24% of considerations, while fuel efficiency optimization accounts for 22% of key benefits. These priorities reflect operational cost pressures and regulatory compliance demands. Moreover, over 60% of participants anticipate significant operational expenditure reductions from automation-enabled systems, underscoring strong financial justification for technology adoption across vessel types and maritime applications worldwide.

Key Takeaways

- The global Integrated Marine Automation System Market is projected to grow from USD 6.4 Billion (2024) to USD 15.6 Billion (2034) at a CAGR of 9.3%.

- Hardware dominates the product type segment with a market share of 67.4%, driven by sensors, control modules, and navigation systems.

- Vessel-Management Systems lead the solution segment, accounting for 45.2% of total market revenue.

- New-build installations hold the largest share at 59.8%, supported by integrated automation adoption during vessel construction.

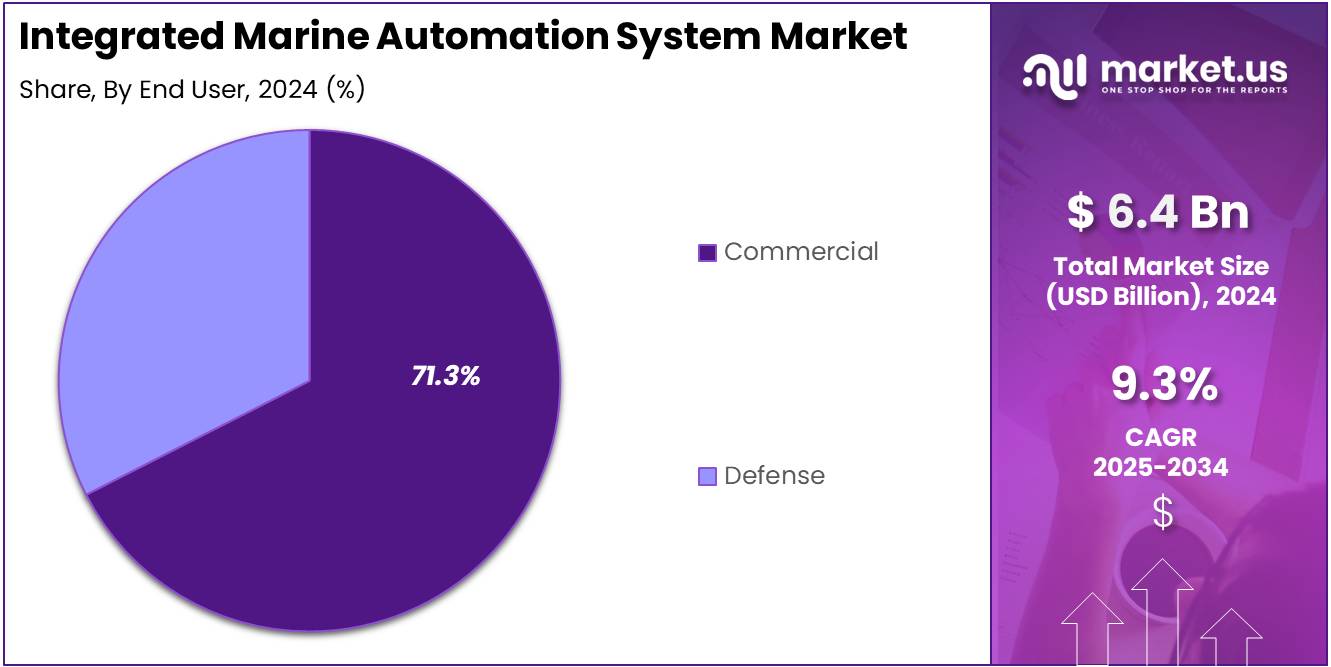

- The Commercial end-user segment commands 71.3% of the market, reflecting strong adoption across cargo and passenger fleets.

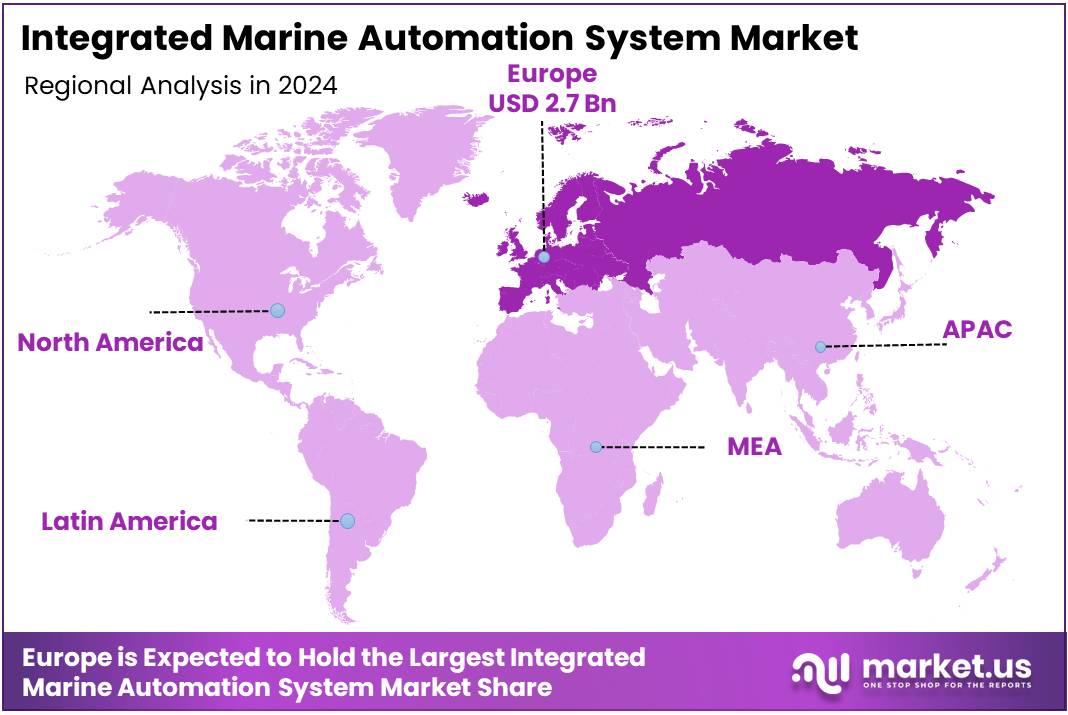

- Europe is the dominating region with a market share of 43.6%, valued at USD 2.7 Billion.

Product Type Analysis

Hardware held a dominant market position in the Product Type segment of the Integrated Marine Automation System Market, with a 67.4% share.

In 2024, Hardware maintains its leading position due to the critical role of physical components in marine automation infrastructure. Sensors and Field Devices form the foundational layer, collecting real-time data from vessel operations and environmental conditions. Control Modules serve as the central nervous system, processing information and executing automated commands across various ship systems. Navigation and Communication Systems ensure safe passage and connectivity, integrating GPS, radar, and satellite technologies. Other hardware components include actuators, controllers, and interface devices that facilitate seamless automation. The substantial investment in hardware reflects the maritime industry’s emphasis on reliability and operational efficiency.

Software represents a rapidly growing segment, driven by digital transformation initiatives across the maritime sector. Integrated Platform-Management Software consolidates multiple operational functions into unified interfaces, enhancing decision-making capabilities. Safety and Security Software addresses growing concerns about cyber threats and regulatory compliance, incorporating advanced threat detection and response mechanisms. Analytics and Predictive-Maintenance Software leverages artificial intelligence and machine learning to optimize vessel performance and reduce downtime. Other software solutions include fleet management tools and environmental monitoring applications that support sustainable operations.

Solution Analysis

Vessel-Management Systems held a dominant market position in the Solution segment of the Integrated Marine Automation System Market, with a 45.2% share.

In 2024, Vessel-Management Systems dominate through comprehensive integration of navigation, propulsion, and operational controls. These systems enable centralized monitoring and management of all vessel functions from a single interface, significantly reducing crew workload and human error. Advanced algorithms optimize fuel consumption and route planning while ensuring compliance with international maritime regulations. The increasing complexity of modern vessels and the push toward autonomous shipping drive continuous investment in sophisticated vessel-management solutions. Integration with shore-based operations further enhances fleet-wide efficiency and coordination.

Power-Management Systems play a crucial role in optimizing energy distribution and consumption across vessel operations. These solutions balance electrical loads, manage generator operations, and integrate renewable energy sources like solar panels and wind turbines. Smart power management reduces fuel costs while extending equipment lifespan through intelligent load balancing and condition monitoring. The growing focus on emission reduction and energy efficiency regulations accelerates adoption of advanced power-management technologies.

Safety and Security Systems address critical concerns regarding crew protection, cargo security, and cybersecurity threats. These solutions incorporate fire detection, access control, surveillance cameras, and intrusion prevention systems. Advanced cybersecurity measures protect against hacking attempts and unauthorized access to critical ship systems, ensuring operational integrity and regulatory compliance.

Others encompass specialized solutions including environmental monitoring systems, cargo management platforms, and entertainment systems that enhance vessel functionality and crew welfare across diverse maritime applications.

Installation Type Analysis

New-build held a dominant market position in the Installation Type segment of the Integrated Marine Automation System Market, with a 59.8% share.

In 2024, New-build installations dominate as shipbuilders integrate advanced automation systems during vessel construction phases. This approach offers optimal system integration, eliminating compatibility issues and ensuring seamless communication between components. Modern shipyards prioritize automation from the design stage, incorporating cutting-edge technologies that meet stringent regulatory requirements. New vessels benefit from complete infrastructure planning, allowing efficient cable routing, sensor placement, and control configurations. The growing global fleet expansion and replacement of aging vessels drive sustained demand for new-build automation installations.

Retrofit/Upgrade installations serve the existing fleet seeking modernization without complete vessel replacement. These projects update legacy systems with contemporary automation technologies, extending operational lifespan and improving efficiency. Retrofit solutions address obsolescence challenges, enhance cybersecurity postures, and enable compliance with evolving environmental regulations. Modular upgrade approaches minimize operational disruption by allowing phased implementation during scheduled maintenance periods. Cost considerations and vessel age significantly influence retrofit decisions.

End User Analysis

Commercial held a dominant market position in the End User segment of the Integrated Marine Automation System Market, with a 71.3% share.

In 2024,Commercial maritime operators lead market adoption driven by economic pressures to maximize operational efficiency and minimize costs. Container ships, tankers, bulk carriers, and cruise vessels increasingly deploy integrated automation systems to reduce crew requirements, optimize fuel consumption, and enhance cargo handling capabilities. The competitive nature of global shipping demands continuous technological advancement to maintain profitability margins. Automation enables commercial operators to comply with stringent environmental regulations including sulfur emission caps and ballast water management requirements. The expansion of international trade and e-commerce logistics fuels sustained investment in commercial fleet automation technologies.

Defense applications prioritize mission-critical reliability, security, and operational readiness in naval operations. Military vessels require specialized automation systems with enhanced cybersecurity features, redundant architectures, and battle-hardened components capable of functioning under extreme conditions. Defense automation emphasizes stealth operations, weapon system integration, and tactical communication networks. Naval modernization programs globally drive steady demand for advanced automation technologies despite smaller overall fleet sizes compared to commercial shipping.

Key Market Segments

By Product Type

- Hardware

- Sensors and Field Devices

- Control Modules

- Navigation and Communication Systems

- Others

- Software

- Integrated Platform-Management SW

- Safety and Security SW

- Analytics and Predictive-Maintenance SW

- Others

By Solution

- Vessel-Management Systems

- Power-Management Systems

- Safety and Security Systems

- Others

By Installation Type

- New-build

- Retrofit / Upgrade

By End User

- Commercial

- Defense

Drivers

The marine industry is experiencing strong demand for integrated automation systems primarily due to safety concerns. Ship operators want better navigation tools that help prevent accidents and reduce human errors. Modern automation systems provide real-time alerts and automated responses that protect vessels, crew, and cargo from potential dangers at sea.

Advanced sensor technologies are transforming how ships operate today. These sensors collect data continuously and feed it into intelligent systems that make ships smarter and more responsive. Real-time data integration allows vessels to adjust their operations instantly based on weather conditions, water depth, and surrounding traffic, creating safer and more efficient voyages.

Artificial intelligence and machine learning are becoming essential tools in marine automation. These technologies analyze patterns in equipment performance and predict when maintenance is needed before breakdowns occur. This predictive approach saves money, prevents unexpected failures, and helps captains make better decisions. AI-powered systems also optimize fuel consumption and route planning, making shipping operations more profitable and environmentally friendly.

Restraints

Complexity of Integrating Legacy Systems Restrains Market Expansion

One major challenge facing the marine automation market is the difficulty of connecting older ship systems with new automation technology. Many vessels still operate with legacy equipment that was not designed to communicate with modern digital platforms. Upgrading these systems requires significant technical expertise, time, and financial investment, which discourages some ship owners from adopting integrated automation solutions.

The marine industry faces a serious shortage of qualified personnel who can operate and maintain advanced automation systems. These sophisticated technologies require specialized training and technical knowledge that many current maritime workers do not possess. Finding technicians who understand both traditional marine operations and cutting-edge automation technology is challenging. This skills gap creates operational risks and increases costs for companies that must invest heavily in training programs or compete for limited talent in the marketplace.

Growth Factors

Adoption of Autonomous Vessels Creates New Growth Opportunities

The development of autonomous and unmanned vessels represents a significant opportunity for the marine automation market. These next-generation ships rely entirely on integrated automation systems to navigate, communicate, and operate without human crews onboard. As shipping companies test and deploy autonomous vessels for cargo transport and specialized missions, demand for sophisticated automation platforms continues to rise substantially.

Environmental regulations are pushing ship owners to install advanced monitoring and compliance systems. Modern automation platforms help vessels track emissions, manage ballast water, and report environmental data to regulatory authorities automatically. These systems ensure ships meet international standards while reducing the administrative burden on crews, making environmental compliance easier and more reliable.

Real-time data analytics are revolutionizing vessel performance management. Integrated automation systems now collect and analyze thousands of data points continuously, identifying opportunities to improve fuel efficiency, reduce wear on equipment, and optimize sailing routes. This analytical capability helps shipping companies lower operating costs while extending the lifespan of their vessels and equipment.

Emerging Trends

Increasing Use of Digital Twin Technology Shapes Market Trends

Digital twin technology is gaining traction in the marine sector as a powerful tool for system simulation and optimization. These virtual replicas of physical ships allow operators to test different scenarios, predict system behavior, and optimize performance without risking actual vessels. Digital twins help engineers identify potential problems early and develop better maintenance strategies, making them increasingly popular in modern fleet management.

Remote monitoring and control systems are becoming standard across maritime operations. Fleet managers can now oversee multiple vessels from shore-based control centers, tracking performance metrics, diagnosing issues, and adjusting operations in real time. This remote capability reduces the need for onboard technical staff while improving response times to operational challenges and emergencies.

Maritime safety regulations are becoming stricter worldwide, driving increased adoption of automation systems. Regulatory bodies require more comprehensive safety monitoring, incident reporting, and compliance documentation than ever before. Integrated automation platforms help shipping companies meet these requirements efficiently by automating data collection, generating compliance reports, and maintaining detailed operational records that satisfy regulatory audits.

Regional Analysis

Europe Dominates the Integrated Marine Automation System Market with a Market Share of 43.6%, Valued at USD 2.7 Billion

Europe leads the integrated marine automation system market, supported by strong adoption across commercial shipping, offshore operations, and naval modernization programs. The region accounts for 43.6% of global demand, representing a market value of USD 2.7 Billion, driven by early technology integration and strict operational efficiency standards. High emphasis on fuel optimization, safety compliance, and digital vessel management continues to reinforce Europe’s dominant position. Ongoing upgrades of existing fleets further sustain regional demand momentum.

North America Integrated Marine Automation System Market Trends

North America represents a mature and technology-driven market, with steady adoption across commercial vessels, offshore energy assets, and defense fleets. The region shows strong demand for advanced navigation, monitoring, and control systems to improve operational reliability and reduce lifecycle costs. Fleet modernization initiatives and the integration of digital and autonomous solutions remain key growth enablers. Focus on cybersecurity and system interoperability also shapes purchasing decisions.

Asia Pacific Integrated Marine Automation System Market Trends

Asia Pacific is witnessing accelerated growth due to expanding shipbuilding activity and increasing investments in port and maritime infrastructure. Rising regional trade volumes and the modernization of commercial fleets are driving the adoption of integrated automation platforms. Demand is particularly strong for systems that enhance fuel efficiency and remote vessel monitoring. The region is gradually transitioning from conventional systems toward more integrated and digitally enabled solutions.

Middle East and Africa Integrated Marine Automation System Market Trends

The Middle East and Africa market is driven by offshore oil and gas operations, naval fleet upgrades, and port development projects. Integrated marine automation systems are increasingly deployed to improve operational endurance and reduce human exposure in high-risk environments. Demand is largely centered on asset monitoring, power management, and safety systems. Gradual digitalization of maritime operations supports long-term market potential.

Latin America Integrated Marine Automation System Market Trends

Latin America shows moderate but stable adoption of integrated marine automation systems, supported by offshore exploration activities and regional trade routes. The market is primarily driven by the need to enhance vessel efficiency and comply with evolving operational standards. Investments are focused on upgrading existing fleets rather than large-scale newbuilds. Growing awareness of automation benefits is expected to support incremental market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Integrated Marine Automation System Company Insights

ABB continues to leverage its established portfolio in electrification and process automation to drive integrated marine solutions. The company’s investments in digitalization and predictive maintenance enhance operational efficiency for vessel operators, positioning ABB as a reliable partner for complex automation needs while reinforcing its global service footprint.

Honeywell International, Inc emphasizes scalable automation frameworks and cybersecurity integration within IMAS offerings. Honeywell’s cross-industry experience enables it to tailor solutions for diverse vessel classes, improving safety and interoperability. The firm’s focus on modular software and analytics tools supports customer demand for reduced lifecycle costs and real-time performance insights.

Rolls-Royce PLC (now part of its marine business restructured units) anchors its strategy in advanced automation tied closely to propulsion and navigation systems. The company’s deep systems engineering expertise drives seamless integration of automation with powertrain components, enhancing fuel efficiency and maneuverability. Its emphasis on holistic vessel performance aligns with owner priorities in sustainability and regulatory compliance.

Wärtsilä builds competitive advantage through platform-based automation solutions designed for full lifecycle value. Wärtsilä’s end-to-end approach—from design and installation to digital services—supports predictable uptime and remote diagnostics. The company’s commitment to open standards and integration with third-party systems further expands its relevance across fleet modernization initiatives.

Top Key Players in the Market

- ABB

- Honeywell International, Inc

- Rolls-Royce PLC

- Wartsila

- Kongsberg

- Seimens

- General Electric

- Tokyo Keiki

- Consilium

Recent Developments

- In March 2025, Nauticus Robotics completed the acquisition of SeaTrepid International to strengthen its subsea robotics and automation capabilities, enhancing integrated underwater operations through combined autonomous and service expertise.

- In November 2025, Syrma SGS agreed to acquire a majority stake in Elcome Integrated Systems, expanding its maritime and defence electronics footprint and strengthening platform automation capabilities.

- In September 2025, Sea Machines launched new marine autonomy APIs for its SM300 system, enabling third-party command and control integration and improving interoperability for vessel automation.

- In November 2025, AST Networks unveiled the MODULA connectivity solution, a modular hybrid system supporting maritime automation platforms with enhanced remote integration and monitoring.

- In April 2024, AST Networks acquired Reygar to strengthen its maritime IoT portfolio, enhancing vessel performance analytics, monitoring, and digital automation solutions.

Report Scope

Report Features Description Market Value (2024) USD 6.4 Billion Forecast Revenue (2034) USD 15.6 Billion CAGR (2025-2034) 9.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Hardware [Sensors and Field Devices, Control Modules, Navigation and Communication Systems, Others], Software [Integrated Platform-Management SW, Safety and Security SW, Analytics and Predictive-Maintenance SW, Others]), By Solution (Vessel-Management Systems, Power-Management Systems, Safety and Security Systems, Others), By Installation Type (New-build, Retrofit / Upgrade), By End User (Commercial, Defense) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ABB, Honeywell International, Inc, Rolls-Royce PLC, Wartsila, Kongsberg, Seimens, General Electric, Tokyo Keiki, Consilium Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Integrated Marine Automation System MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Integrated Marine Automation System MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- Honeywell International, Inc

- Rolls-Royce PLC

- Wartsila

- Kongsberg

- Seimens

- General Electric

- Tokyo Keiki

- Consilium