Global Infrastructure Construction Market Size, Share, And Enhanced Productivity By Infrastructure (Transportation Infrastructure, Utilities Infrastructure, Social Infrastructure, Extraction Infrastructure), By Construction Type (New Construction, Renovation), By Investment Source (Public, Private), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174139

- Number of Pages: 347

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

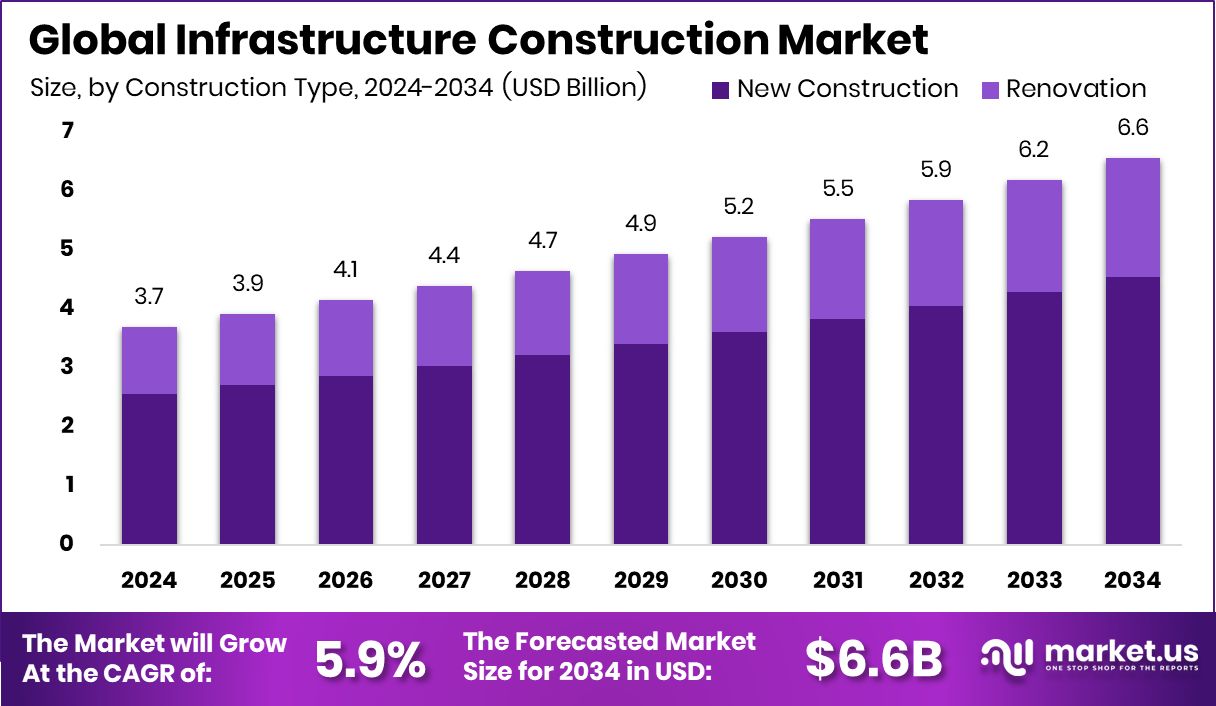

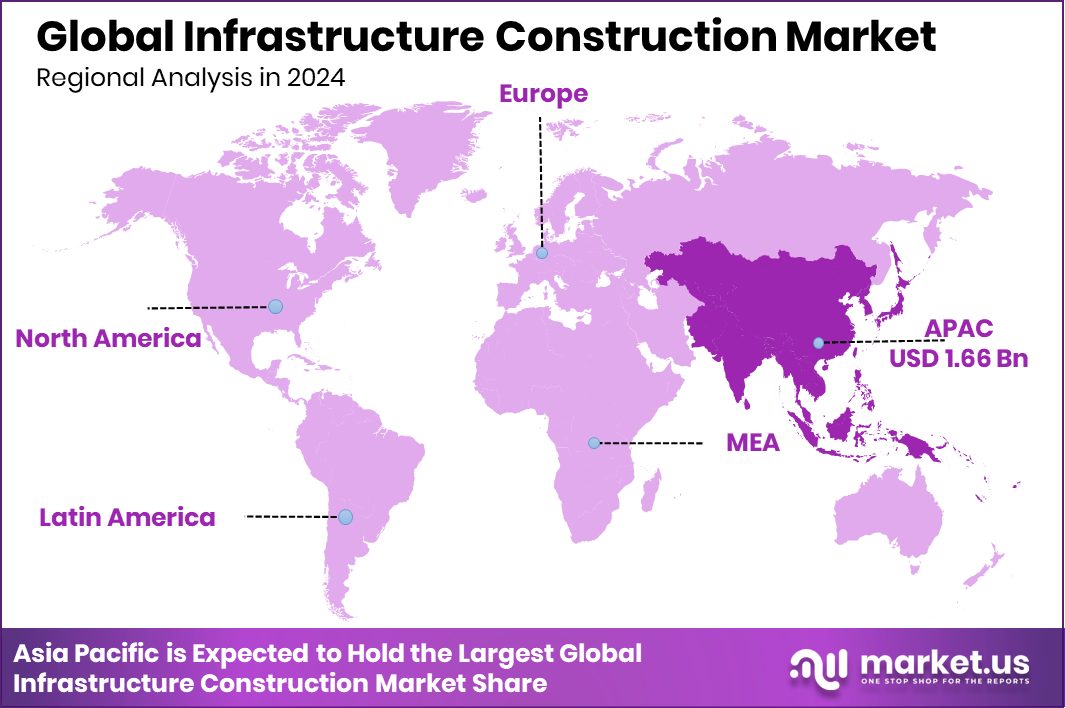

The Global Infrastructure Construction Market is expected to be worth around USD 6.6 billion by 2034, up from USD 3.7 billion in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034. Strong public investment positioned the Asia Pacific Construction Market at 44.9%, USD 1.66 Bn.

Infrastructure construction refers to the planning, building, and expansion of essential physical systems that support daily economic and social activities. These systems include transportation networks, housing developments, utilities, water systems, and public facilities. Infrastructure construction focuses on long-term usability, safety, and connectivity, ensuring communities can grow while maintaining access to basic services and mobility.

The Infrastructure Construction Market represents the organized economic activity around developing and upgrading these foundational assets. It includes public and private projects that improve living standards, enable trade, and strengthen regional resilience. The market responds directly to population growth, urban expansion, and policy priorities aimed at modernizing aging infrastructure and closing development gaps.

Growth in infrastructure construction is strongly supported by targeted funding initiatives. Recent examples include $212 million announced statewide for affordable rental housing, £26m secured to build affordable homes, £20m for new housing developments, and a €400m extension to a housing funding programme. These investments directly accelerate construction activity and improve project viability.

Demand for infrastructure construction continues to rise as governments link housing, transport, and sustainability goals. Funding, such as nearly $1 billion created for housing and transportation initiatives, $23.15 million for a mixed-use housing building, and £33.8m secured for new homes, reflects strong demand for integrated infrastructure solutions.

Opportunities are expanding through innovation-focused and regional funding programs. Initiatives such as €20 million raised for modern construction methods, €45 million allocated for a new expressway, and $725K reserved for housing projects highlight future growth potential. These funds support faster construction, regional development, and more efficient infrastructure delivery.

Key Takeaways

- The Global Infrastructure Construction Market is expected to be worth around USD 6.6 billion by 2034, up from USD 3.7 billion in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034.

- Transportation infrastructure dominates the infrastructure construction market with 39.7% share, driven by urban mobility expansion.

- New construction leads the infrastructure construction market with 69.2%, supported by large-scale development projects globally.

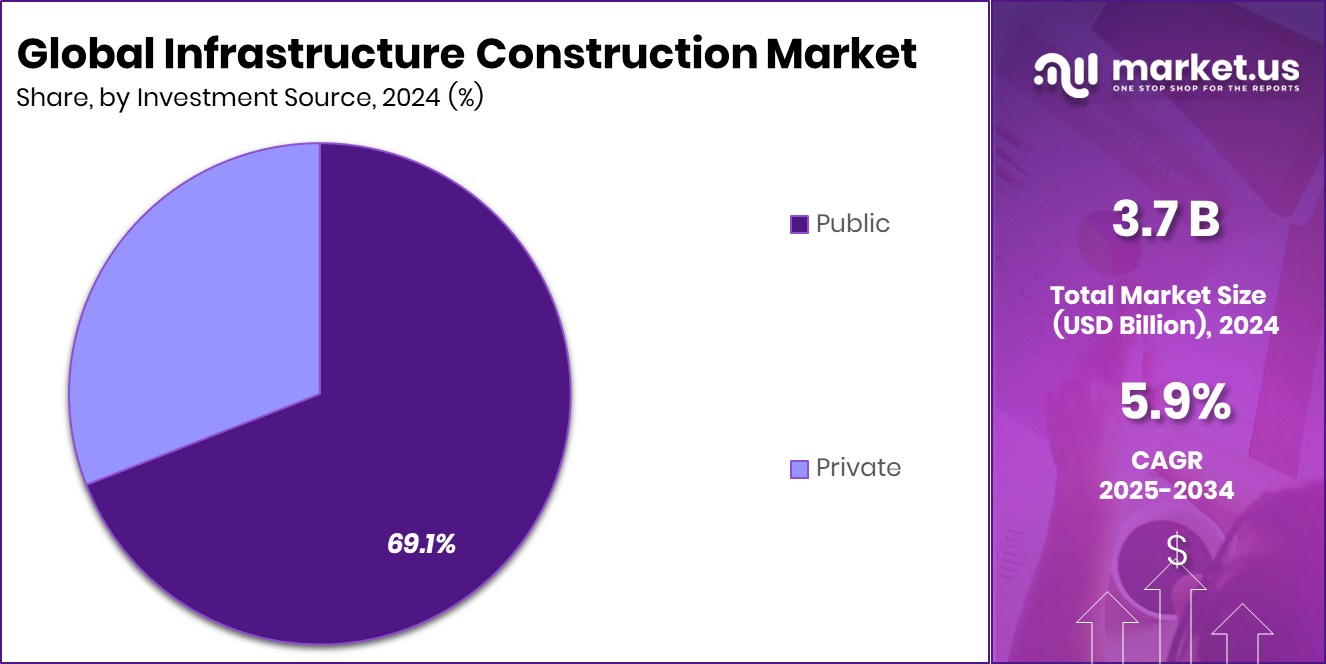

- Public investment accounts for 69.1% of infrastructure construction market funding, reflecting strong government spending priorities.

- Asia Pacific dominated regional infrastructure spending at 44.9%, valued at USD 1.66 Bn.

By Infrastructure Analysis

Transportation infrastructure leads the infrastructure construction market, holding 39.7% share across global investments.

In 2024, the Infrastructure Construction Market saw Transportation Infrastructure emerge as the leading segment, holding a dominant share of 39.7%. This growth was largely supported by rising investments in roads, highways, railways, bridges, and urban transit systems across both developed and emerging economies. Governments prioritized transportation upgrades to reduce congestion, improve logistics efficiency, and support economic growth.

Large-scale highway expansion projects, metro rail developments, and airport modernization programs played a key role in driving demand. Additionally, the rapid growth of e-commerce and cross-border trade increased the need for reliable transport networks. As a result, transportation infrastructure continued to attract consistent funding, long-term planning, and public-private collaboration within the broader infrastructure construction landscape.

By Construction Type Analysis

New construction dominates the infrastructure construction market with 69.2% demand driven by expansion.

In 2024, New Construction dominated the Infrastructure Construction Market by Construction Type, accounting for 69.2% of total activity. This strong share reflects the global push toward building new infrastructure rather than relying solely on repairs or upgrades. Rapid urbanization, population growth, and industrial expansion fueled demand for entirely new roads, ports, power facilities, water systems, and public buildings.

Emerging economies focused on creating foundational infrastructure to support economic development, while developed regions invested in smart cities and modern transport corridors. New construction projects also benefited from improved construction technologies, better project planning, and standardized building practices. These factors helped accelerate project execution timelines, making new construction the preferred approach for large-scale infrastructure development.

By Investment Source Analysis

Public funding anchors the infrastructure construction market, contributing 69.1% of total project investments.

In 2024, Public Investment remained the primary funding source in the Infrastructure Construction Market, contributing 69.1% of total investment. Governments played a central role in financing large infrastructure projects due to their long payback periods and public utility nature. National infrastructure programs, stimulus packages, and long-term development plans supported spending on transportation, energy, water, and social infrastructure.

Public funding was especially critical in regions where private investment appetite remained cautious due to economic or regulatory risks. Additionally, multilateral development banks and government-backed institutions strengthened public investment capacity. This strong public sector involvement ensured project continuity, improved regional connectivity, and supported inclusive economic growth across urban and rural areas.

Key Market Segments

By Infrastructure

- Transportation Infrastructure

- Utilities Infrastructure

- Social Infrastructure

- Extraction Infrastructure

By Construction Type

- New Construction

- Renovation

By Investment Source

- Public

- Private

Driving Factors

Large-Scale Public Infrastructure Funding Drives Growth

Strong government spending is the main driving force of the Infrastructure Construction Market. When public authorities commit large budgets, projects move faster and at larger scale. The USDOT announcement of $1.5 billion in infrastructure funding supports roads, bridges, and transport safety, directly boosting construction demand.

In Europe, the government of the region’s largest economy launched a €500 billion investment fund to modernize major public infrastructure, with a strong focus on transport systems. At the same time, Italy’s investment in high-speed railway projects in the Mezzogiorno shows how national priorities convert funding into real construction activity. These large commitments reduce project uncertainty, encourage long-term planning, and create steady workloads for infrastructure development.

Restraining Factors

Rising Project Complexity Slows Infrastructure Execution

Despite high spending, infrastructure construction faces restraints linked to scale and coordination challenges. Large investments can overwhelm planning systems, approvals, and execution capacity. In Canada, the government announced $6 billion to strengthen trade and transportation infrastructure, but managing timelines, permits, and regional coordination remains demanding.

Similarly, China’s USD 167 billion spending on transport infrastructure within five months highlights how rapid investment can strain labor availability, material supply, and project supervision. These pressures often lead to delays, cost overruns, and slower delivery. As infrastructure projects grow larger and more complex, managing execution efficiently becomes a key restraint, even when strong funding is available.

Growth Opportunity

Sustainable Transport Investment Creates New Construction Opportunities

Green and resilient transport programs are opening strong growth opportunities in infrastructure construction. Governor Newsom’s $1.1 billion allocation for zero-emission transit, safer roadways, and resilient infrastructure supports new construction aligned with environmental goals. This funding encourages development of modern transit corridors, upgraded road systems, and climate-ready infrastructure assets.

At a regional level, CTDOT’s $10 million investment in rural transportation infrastructure creates opportunities in smaller communities that are often underserved. Together, these initiatives expand construction activity beyond traditional urban centers while supporting cleaner mobility and safer transport networks, creating long-term opportunities for infrastructure expansion.

Latest Trends

Private Capital Expands Energy Infrastructure Development Trends

A major trend in the Infrastructure Construction Market is the growing role of private investment in energy and utility assets. Nuveen’s $1.3 billion raised for an energy and power infrastructure fund shows rising investor interest in long-life infrastructure projects.

At the same time, investment firms launching a R150 million smart utilities and infrastructure initiative highlight demand for digitally enabled and efficient infrastructure systems. These funds support the construction of modern power networks, smart utilities, and resilient energy assets. The trend reflects a shift toward infrastructure projects that combine construction with long-term operational value and technology integration.

Regional Analysis

In 2024, the Asia Pacific led the Construction Market with 44.9% share, USD 1.66 Bn.

In 2024, the Asia Pacific region emerged as the dominating region in the Infrastructure Construction Market, accounting for a leading share of 44.9%, valued at USD 1.66 Bn. This dominance reflects strong infrastructure development activity across transportation networks, urban facilities, and core public assets, supported by large-scale construction demand and long-term development priorities. Asia Pacific continues to benefit from rapid urban expansion, rising industrial capacity, and sustained infrastructure buildout across both metropolitan and secondary cities.

In comparison, North America demonstrates stable infrastructure construction activity driven by system upgrades, rehabilitation needs, and steady replacement of aging assets, supporting consistent market participation. Europe reflects a mature infrastructure landscape, where structured planning, regulatory alignment, and steady construction cycles maintain regional demand without aggressive expansion.

The Middle East & Africa region shows selective infrastructure construction growth, focused on connectivity, urban development, and essential public works, contributing steadily to the overall market.

Meanwhile, Latin America maintains moderate infrastructure construction activity, supported by the gradual development of transportation and utility networks. Collectively, these regions shape a balanced global market structure, with the Asia Pacific clearly leading overall performance based on the provided market share and valuation.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

China State Construction Engineering Corp. remained a cornerstone of the global Infrastructure Construction Market in 2024 due to its unmatched execution scale and project diversity. The company demonstrated strong capabilities across transportation corridors, urban infrastructure, and large public facilities. Its vertically integrated operations supported tighter cost control, faster delivery timelines, and consistent quality outcomes. The firm’s ability to manage complex, multi-year infrastructure developments reinforced its position as a preferred contractor for large national and cross-regional projects, strengthening long-term market influence.

VINCI SA maintained a strong global footprint in 2024 by combining construction expertise with operational efficiency. The company’s balanced presence across transport infrastructure, civil engineering, and long-life assets supported steady performance. VINCI’s emphasis on disciplined project management and lifecycle optimization enhanced asset durability and operational value. This integrated approach allowed the company to sustain predictable project execution while reinforcing its reputation for reliability across mature and emerging infrastructure markets.

ACS Group continued to position itself as a technically advanced infrastructure contractor in 2024. The company leveraged engineering depth and international experience to manage complex infrastructure builds efficiently. Its structured approach to risk management and execution discipline supported consistent outcomes across diverse geographies. ACS Group’s focus on operational excellence and scalable project delivery strengthened its competitiveness within the global infrastructure construction landscape.

Top Key Players in the Market

- China State Construction Engineering Corp.

- VINCI SA

- ACS Group

- Bechtel Corp.

- Larsen & Toubro

- Skanska AB

- Hochtief AG

- Bouygues Group

- Balfour Beatty

- Fluor Corp.

- Ferrovial SE

Recent Developments

- In August 2025, Skanska won a USD 249 M contract to work on the Verrazzano-Narrows Bridge. This project includes installing systems to protect cables and new monitoring technology, improving safety and long-term infrastructure performance.

- In February 2025, L&T acquired the remaining 26% stake in its subsidiary L&T Special Steels and Heavy Forgings for ₹170 crore, making it a wholly owned subsidiary. This strengthens L&T’s control over its heavy engineering and materials supply chain, supporting infrastructure and construction capabilities.

- In April 2024, Hochtief’s Australian unit CIMIC bought more shares in mining-services company Thiess, raising its ownership to 60%. This move strengthens Hochtief’s control over mining support services, which tie into broader infrastructure work like road and site development.

Report Scope

Report Features Description Market Value (2024) USD 3.7 Billion Forecast Revenue (2034) USD 6.6 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Infrastructure (Transportation Infrastructure, Utilities Infrastructure, Social Infrastructure, Extraction Infrastructure), By Construction Type (New Construction, Renovation), By Investment Source (Public, Private) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape China State Construction Engineering Corp., VINCI SA, ACS Group, Bechtel Corp., Larsen & Toubro, Skanska AB, Hochtief AG, Bouygues Group, Balfour Beatty, Fluor Corp., Ferrovial SE Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Infrastructure Construction MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Infrastructure Construction MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- China State Construction Engineering Corp.

- VINCI SA

- ACS Group

- Bechtel Corp.

- Larsen & Toubro

- Skanska AB

- Hochtief AG

- Bouygues Group

- Balfour Beatty

- Fluor Corp.

- Ferrovial SE