Global Industrial Lead Acid Battery Market Size, Share Analysis Report By Type (FLA Batteries, VRLA Batteries), By Power Rating (Up to 500 Ah, 500-2000 Ah, 2000-5000 Ah, Above 5000 Ah), By Application (Stationary, Motive Power) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168538

- Number of Pages: 304

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

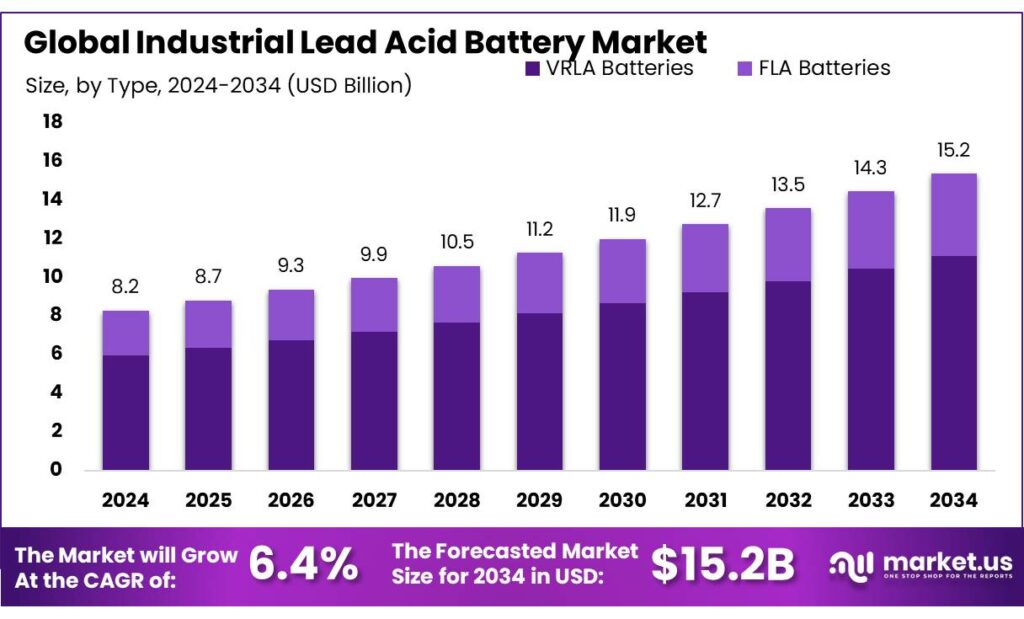

The Global Industrial Lead Acid Battery Market size is expected to be worth around USD 15.2 Billion by 2034, from USD 8.2 Billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 42.6% share, holding USD 2.3 Billion revenue.

Industrial lead-acid batteries form the backbone of many critical power systems, from factory UPS rooms and telecom towers to warehouses full of electric forklifts. They are deep-cycle or high-capacity versions of conventional lead-acid technology, optimized for stationary backup and motive power rather than just starting engines. Their importance is visible in raw-material flows: the U.S. Geological Survey estimates that the lead-acid battery industry accounted for about 86% of reported U.S. lead consumption in 2024.

In terms of industrial energy storage more broadly, the U.S. Department of Energy’s Energy Storage Market Report shows that global industrial storage — including telecom backup, UPS, data centers, fuel-cell refuelling and forklifts — is projected to grow about 2.6×, from just over 60 GWh to 167 GWh by 2030. NREL’s 2024 Industrial Energy Storage Review reiterates this outlook, noting that forklifts are expected to drive much of that growth, with UPS and data-center batteries also expanding steadily.

- Several macro-energy trends are strengthening the industrial case for lead-acid. REN21 reports that global battery storage capacity grew 120% in 2023 to reach 55.7 GW, with China alone rising to 27.1 GW from 7.8 GW in 2022. The IEA’s Batteries and Secure Energy Transitions study projects that total energy-storage capacity must increase roughly sixfold by 2030 in its Net Zero scenario, with batteries leading that expansion.

Cost and circular-economy performance are major driving factors. DOE cost benchmarking, summarized by PV Magazine, places utility-scale lead-acid systems around USD 356/kWh of installed cost, comparable to lithium-ion LFP at the same scale. At the same time, the U.S. Environmental Protection Agency and Battery Council International report that around 99% of lead from lead-acid batteries is recycled in the U.S., making them one of the most recycled consumer products.

Government initiatives are also supportive. The U.S. DOE’s Storage Innovations 2030 – Lead-Acid Batteries technology strategy identifies advanced lead-acid as a candidate for long-duration, low-cost storage in certain use cases and sets R&D priorities to improve lifetime and depth-of-discharge performance. Meanwhile, the IEA’s World Energy Investment 2025 analysis, reported by Reuters, forecasts global energy investment reaching about USD 3.3 trillion in 2025, with clean energy at USD 2.2 trillion and battery storage investment around USD 66 billion.

Key Takeaways

- Industrial Lead Acid Battery Market size is expected to be worth around USD 15.2 Billion by 2034, from USD 8.2 Billion in 2024, growing at a CAGR of 6.4%.

- VRLA (Valve-Regulated Lead-Acid) Batteries held a dominant market position, capturing more than a 72.9% share.

- 500–2000 Ah segment held a dominant market position, capturing more than a 44.1% share of the industrial lead-acid battery market.

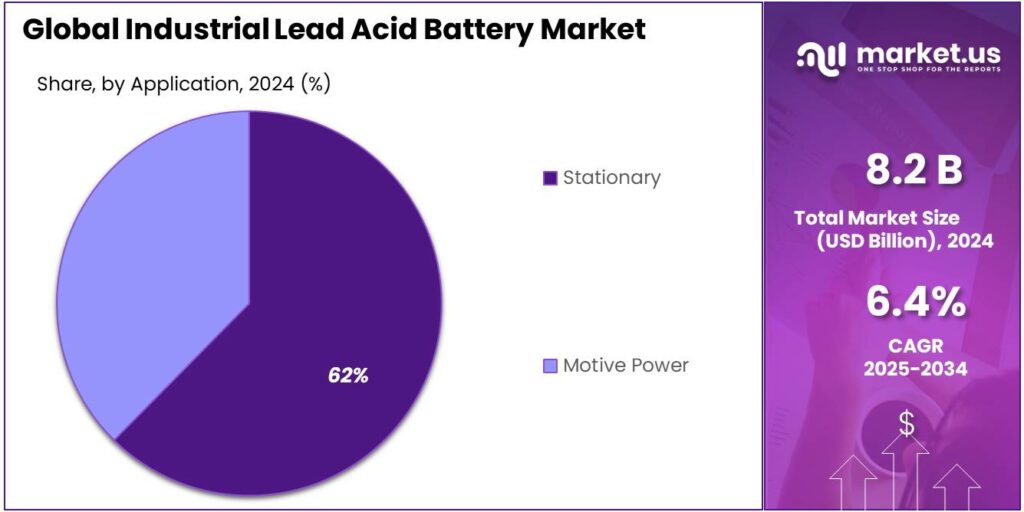

- Stationary applications held a dominant market position, capturing more than a 62.4% share of the industrial lead-acid battery market.

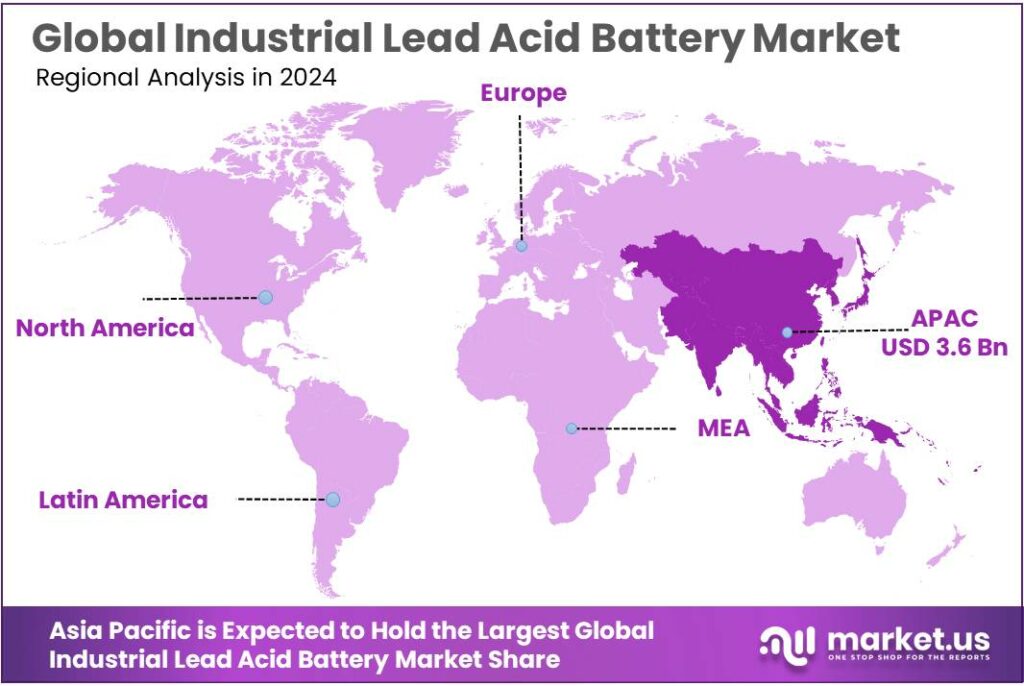

- Asia Pacific region accounted for a dominant 44.30% share of the industrial lead-acid battery market, representing approximately USD 3.6 billion.

By Type Analysis

VRLA Batteries dominate with 72.9% share due to their reliability and maintenance-free operation

In 2024, VRLA (Valve-Regulated Lead-Acid) Batteries held a dominant market position, capturing more than a 72.9% share of the industrial lead-acid battery market. Their popularity stems from being maintenance-free, safe, and reliable for a wide range of industrial applications including UPS systems, telecom, and energy storage. VRLA batteries are preferred for their sealed design, which prevents acid leakage and allows installation in confined spaces. In 2025, demand for VRLA batteries is expected to remain strong, driven by the growing need for uninterrupted power supply, renewable energy integration, and industrial backup solutions. Their consistent performance, long service life, and ease of installation continue to make them the most favored choice in the industrial sector.

By Power Rating Analysis

500–2000 Ah batteries dominate with 44.1% share due to their suitability for industrial backup and heavy-duty applications

In 2024, the 500–2000 Ah segment held a dominant market position, capturing more than a 44.1% share of the industrial lead-acid battery market. Batteries in this range are widely used in industrial facilities, data centers, telecom towers, and large UPS systems because they provide a balance of high capacity, reliable performance, and manageable size. Their ability to deliver long backup times and support critical operations makes them a preferred choice for industries requiring consistent power supply. In 2025, demand for 500–2000 Ah batteries is expected to remain strong, driven by the ongoing need for uninterrupted power in manufacturing, communication, and energy storage sectors. The segment’s reliability, durability, and suitability for medium- to large-scale industrial operations continue to reinforce its dominant market position.

By Application Analysis

Stationary applications dominate with 62.4% share due to their critical role in uninterrupted power supply

In 2024, Stationary applications held a dominant market position, capturing more than a 62.4% share of the industrial lead-acid battery market. These batteries are primarily used for backup power in data centers, telecom networks, and industrial facilities, where consistent electricity supply is crucial. Their reliability, long service life, and ability to operate in standby mode make them ideal for stationary applications. In 2025, demand for stationary lead-acid batteries is expected to remain strong, driven by the growing need for uninterrupted power, industrial expansion, and adoption of energy storage solutions in critical infrastructure, reinforcing the segment’s leading market position.

Key Market Segments

By Type

- FLA Batteries

- VRLA Batteries

By Power Rating

- Up to 500 Ah

- 500-2000 Ah

- 2000-5000 Ah

- Above 5000 Ah

By Application

- Stationary

- Motive Power

Emerging Trends

Industrial lead acid batteries quietly power the new food cold-chain

The food numbers explain why this is happening. FAO now estimates that about 13.2% of food produced is lost between harvest and retail. UNEP’s Food Waste Index 2024 adds that a further 19% of food available to consumers is wasted at retail, in food service and in homes, equal to around 1.05 billion tonnes in 2022. The UN says that, taken together, roughly one-third of all food is lost or wasted, even while 783 million people live with hunger. It is hard for any food company or agriculture ministry to ignore numbers like these.

Cooling access data makes the trend even clearer. Sustainable Energy for All’s latest Chilling Prospects 2025 finds that just over 1 billion people in 77 countries are at high risk because they lack access to sustainable cooling, with 309 million rural poor and 695 million urban poor in that group. For project developers working on small milk collection centres, fish landing sites or vegetable hubs in these regions, the practical design now often includes a modest solar array, a diesel generator, and a bank of rugged industrial lead acid batteries that can hold a few hours of backup and smooth out the different power sources.

National programmes are starting to formalise this pattern. In India, an assessment for the Ministry of Commerce & Industry estimated that about 430,000 tonnes of cold and chilled storage capacity had been deployed by September 2021, growing at roughly 11% per year between 2014 and 2021. The same report links further growth to fisheries schemes such as the Pradhan Mantri Matsya Sampada Yojana, which aims to double fish export value between 2020 and 2025. Behind the scenes, many of these new stores and pre-coolers rely on industrial lead acid UPS systems to ride through brownouts and to start gensets smoothly, because they are well understood by local technicians and banks.

Drivers

Rising demand for reliable backup power in an electrifying industrial world

Across factories, data centres, hospitals, mines and water plants, managers talk about one simple need: “keep the power on.” Global electricity demand grew by about 4.3% in 2024, faster than its long-term average, as more processes, vehicles and buildings switch from fossil fuels to electricity. When more critical loads depend on the grid, industries feel far less tolerant of even short blackouts – and that is exactly where industrial lead acid batteries step in.

At the same time, the power system is under pressure. In 2019, final electricity consumption reached roughly 22,848 TWh worldwide and has kept rising since. The grid must now feed whole clusters of data centres, automated warehouses and electrified manufacturing lines. The International Energy Agency estimates that data centres alone used around 415 TWh of electricity in 2024, equal to about 1.5% of global electricity demand and growing at roughly 12% per year over the last five years.

For many firms, power cuts are still a routine cost of doing business. World Bank enterprise surveys show that in a number of low- and middle-income economies, more than half of firms report experiencing electricity outages in a typical year. For many firms, power cuts are still a routine cost of doing business. World Bank enterprise surveys show that in a number of low- and middle-income economies, more than half of firms report experiencing electricity outages in a typical year. The IEA places the number without access at around 750 million in 2023.

Restraints

Growing health and environmental worries are slowing industrial lead acid batteries

One big brake on industrial lead acid batteries is simple: people are more worried about what lead does to health and the environment. The World Health Organization estimates that lead exposure caused more than 1.5 million deaths in 2021 and over 33 million years of healthy life lost, mainly from heart disease and stroke. When regulators see numbers like this, they naturally tighten the rules around lead-based products, including industrial batteries.

Recent economic analysis goes even further. A World Bank–supported review suggests that lead exposure may be linked to around 5.5 million deaths per year and a loss of 765 million IQ points in children under five, mostly in low- and middle-income countries. These figures turn lead from a narrow occupational risk into a global development issue. For industrial battery producers, that means more public pressure, more scrutiny from investors, and a real risk that customers look for “lead-free” storage technologies.

The weakest link is what happens at the end of a battery’s life. UNEP notes that in Bangladesh about 3.62% of all deaths are tied to lead exposure, and more than 80% of the country’s lead is recycled through informal used-lead-acid battery (ULAB) recyclers with little control of emissions. Similar patterns show up in many developing economies, where backyard smelters burn and break batteries to recover metal. These stories make industrial buyers nervous, especially multinationals with strict ESG commitments.

India illustrates the scale of the challenge. A 2024 study on the country’s ULAB ecosystem estimates that around 1.2 million tonnes of used lead acid batteries are recycled each year, and roughly 90% of this happens in the informal sector, exposing 600,000–700,000 people to high risks. For industrial customers, this raises real questions: if they keep installing large lead battery banks, are they indirectly feeding a hazardous, informal recycling chain.

Opportunity

Expanding cold chains and food security projects need reliable stored power

One of the strongest growth opportunities for industrial lead acid batteries sits quietly in the background of the global food system. Governments and food companies are under pressure to cut food loss and waste, and that means building far more cold rooms, pack houses, dairy chillers and refrigerated warehouses in places where the grid is still weak. The UN’s food agencies estimate that around 14% of the world’s food is lost after harvest before it even reaches retail, while a further 17–19% is wasted at retail and in homes. Together this is close to one-third of all food produced, worth about USD 1 trillion a year.

Access to cooling is now seen as a development issue, not a luxury. Sustainable Energy for All’s Chilling Prospects series finds that in 2023 about 1.12 billion people among the rural and urban poor were at high risk because they lacked adequate access to cooling for food, medicine and basic comfort. Earlier editions put the at-risk number at roughly 1.2 billion people, or one in seven people on the planet. These are exactly the communities where new cold rooms for fruits, vegetables, fish and meat are being planned – often at the edge of fragile grids or in off-grid zones where a simple power cut can spoil a whole day’s harvest.

Global policy is moving in the same direction. Under SDG target 12.3, UN member states have committed to halve per-capita food waste by 2030 and reduce post-harvest losses along supply chains. FAO notes that more than 13% of food is lost between harvest and retail each year, equal to losses of over USD 400 billion. To hit these goals, governments are funding cold-chain infrastructure in horticulture clusters, fisheries harbours and dairy belts. Each new cold store, blast freezer or milk chiller typically includes an industrial battery bank to bridge grid dips, smooth diesel generator starts and protect compressors and control electronics.

Firms themselves face rising costs from unreliable electricity. World Bank Enterprise Surveys show that in some low-income countries, over 70% of firms report regular power outages, and in extreme cases such as Chad the share reaches 96.2% of firms in a typical month. For food processors, cold-storage operators and pack houses, one long outage can mean tonnes of spoiled produce and lost contracts. Industrial lead acid batteries, sized for a few hours of backup, offer an affordable way to keep chillers and control systems running until power returns or a generator takes over.

Regional Insights

Asia Pacific leads with 44.30% share, valued at USD 3.6 billion in 2024 thanks to rapid industrial and infrastructure growth

In 2024, the Asia Pacific region accounted for a dominant 44.30% share of the industrial lead-acid battery market, representing approximately USD 3.6 billion in regional revenue; this leadership is explained by large installed bases in telecom backup, data-center UPS, and industrial power systems across China, India, and Southeast Asia. The region’s strong position is supported by continued expansion of 5G networks and new data-center capacity, which have driven steady demand for reliable stationary backup batteries.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Amara Raja reported strong 2024 performance, with group revenue near USD 2.0 billion and an employee base exceeding 21,800 across its businesses. The company supplies industrial and automotive lead-acid batteries, UPS systems and related power solutions; it has diversified into lithium-ion cell licensing and gigafactory bids to support India’s EV and energy storage goals. Amara Raja’s 2024 results showed double-digit growth in lead-acid product volumes, supported by rising vehicle production and telecom backup demand.

EnerSys reported fiscal 2024 net sales of approximately USD 3.6 billion and a global workforce of about 10,800 employees. The company supplies reserve-power and motive-power batteries, chargers, and DC power systems to telecom, industrial, defense and energy customers. In 2024 EnerSys delivered improved gross margins, completed strategic acquisitions (including Bren-Tronics), and invested in specialty and systems businesses to expand defense and telecom capabilities.

East Penn remained a major lead-acid producer in 2024, with estimated revenues in the USD 1.0–3.2 billion range and employee counts reported between 2,600 and 10,000 depending on sources; the company is noted for large-scale manufacturing, R&D in battery recycling, and broad aftermarket support. East Penn’s 2024 activity emphasised stationary and motive-power battery supply, capacity retention for telecom and UPS markets, and sustainability programs targeting energy and waste reductions.

Top Key Players Outlook

- Amara Raja Batteries Ltd.

- C and D Technologies Inc.

- Crown Battery Manufacturing Co.

- East Penn Manufacturing Co. Inc.

- EnerSys

- EverExceed Corp.

- Exide Industries Ltd.

- Furukawa Electric Co. Ltd.

- GS Yuasa International Ltd.

- Hankook Tire and Technology Co. Ltd.

- HBL Power Systems Ltd.

Recent Industry Developments

In 2025 EnerSys further demonstrated resilience: in Q2 of fiscal 2026, the company posted net sales of US$ 951.3 million, up 7.7% compared to the same quarter a year earlier, driven by continued demand in motive power and energy systems segments.

In July 2024, Crown Battery announced a plan to expand its manufacturing plant by adding an additional 55,870 sq ft, bringing the facility size to about 312,000 sq ft — signalling growing capacity and confidence in demand for industrial storage solutions.

Report Scope

Report Features Description Market Value (2024) USD 8.2 Bn Forecast Revenue (2034) USD 15.2 Bn CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (FLA Batteries, VRLA Batteries), By Power Rating (Up to 500 Ah, 500-2000 Ah, 2000-5000 Ah, Above 5000 Ah), By Application (Stationary, Motive Power) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Amara Raja Batteries Ltd., C and D Technologies Inc., Crown Battery Manufacturing Co., East Penn Manufacturing Co. Inc., EnerSys, EverExceed Corp., Exide Industries Ltd., Furukawa Electric Co. Ltd., GS Yuasa International Ltd., Hankook Tire and Technology Co. Ltd., HBL Power Systems Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Industrial Lead Acid Battery MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Industrial Lead Acid Battery MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amara Raja Batteries Ltd.

- C and D Technologies Inc.

- Crown Battery Manufacturing Co.

- East Penn Manufacturing Co. Inc.

- EnerSys

- EverExceed Corp.

- Exide Industries Ltd.

- Furukawa Electric Co. Ltd.

- GS Yuasa International Ltd.

- Hankook Tire and Technology Co. Ltd.

- HBL Power Systems Ltd.