Global Industrial Insulation Market Size, Share, And Business Benefits By Material (Mineral Wool, Fiber Glass, Foamed Plastics, Calcium Silicate, Others), By Product (Pipe, Board, Blanket, Others), By End-Use (Chemical and Petrochemical, Automotive, Construction, Electrical and Electronics, Oil and Gas, Power Generation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 160361

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

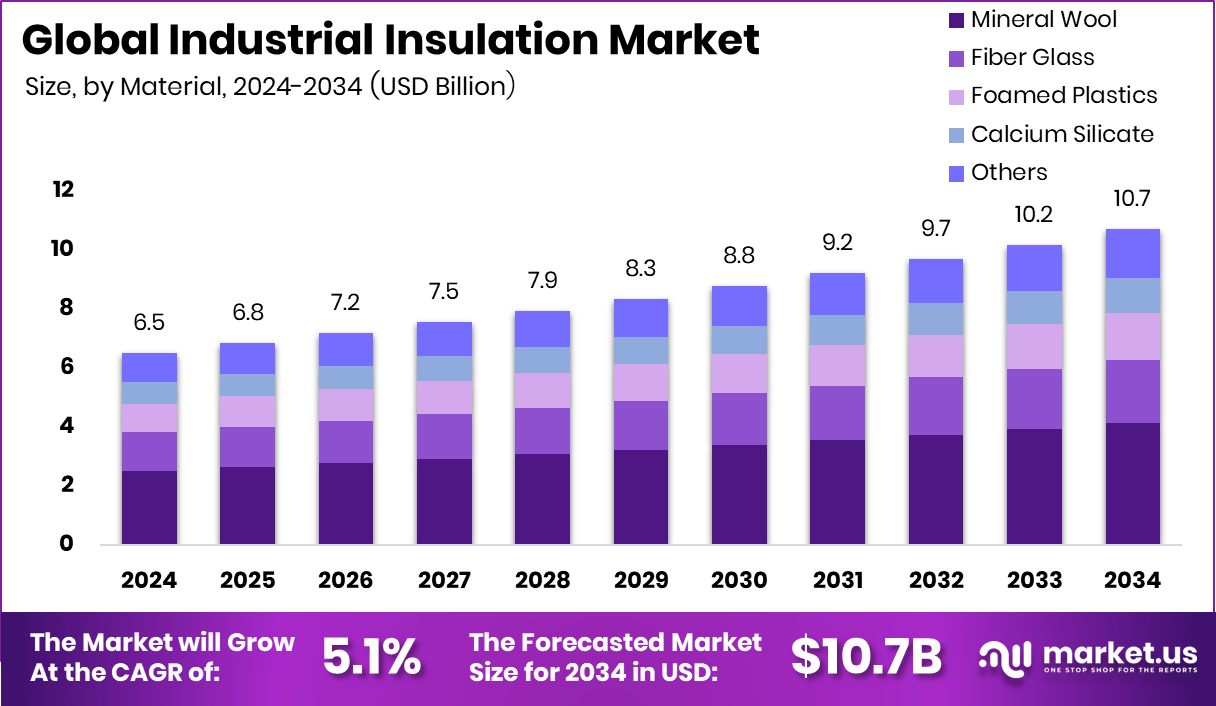

The Global Industrial Insulation Market is expected to be worth around USD 10.7 billion by 2034, up from USD 6.5 billion in 2024, and is projected to grow at a CAGR of 5.1% from 2025 to 2034. Asia-Pacific’s leadership reflects expanding industries and investments, driving the 45.70% market share.

Industrial insulation refers to materials and systems used to control heat, sound, and energy transfer in large-scale industrial facilities. It plays a key role in improving energy efficiency, reducing heat loss, protecting equipment, and ensuring worker safety. Industries such as chemicals, oil & gas, power generation, and manufacturing depend on insulation to maintain stable processes, reduce operating costs, and extend the life of their machinery.

The industrial insulation market covers the demand, production, and installation of these insulation solutions across different sectors. Its growth is strongly tied to rising energy costs, stricter environmental regulations, and the push for sustainable operations. As industries expand and modernize, the demand for effective insulation materials continues to rise globally, driven by energy savings, emission reduction goals, and government-backed infrastructure investments.

Energy efficiency is the biggest growth driver, as industries aim to cut costs and reduce carbon footprints. The rising adoption of advanced petrochemical projects, supported by initiatives like QatarEnergy securing $4.4 billion in financing for the Ras Laffan petrochemicals project, highlights how large-scale investments fuel insulation needs.

Heavy industries such as chemicals and oil & gas are seeing expansions, with projects like Uzbekneftegaz receiving €1.1 billion in funding for the Shurtan gas chemical complex. Such expansions demand advanced insulation to handle high temperatures, protect pipelines, and improve plant safety.

Future opportunities lie in renewable energy, LNG terminals, and green infrastructure. For example, Shinhan and KB Financial Group’s loans to Lotte Chemical surged to 2 trillion won, and LG Chem plans to raise $2.2 billion in Korea’s largest PRS deal, both signaling stronger industrial investments. These projects will create more opportunities for insulation solutions that support sustainable, efficient, and resilient facilities.

Key Takeaways

- The Global Industrial Insulation Market is expected to be worth around USD 10.7 billion by 2034, up from USD 6.5 billion in 2024, and is projected to grow at a CAGR of 5.1% from 2025 to 2034.

- The Industrial Insulation Market is dominated by Mineral Wool, accounting for 38.6% of the material share.

- Pipe insulation leads the Industrial Insulation Market by product type, holding a strong 45.8% share.

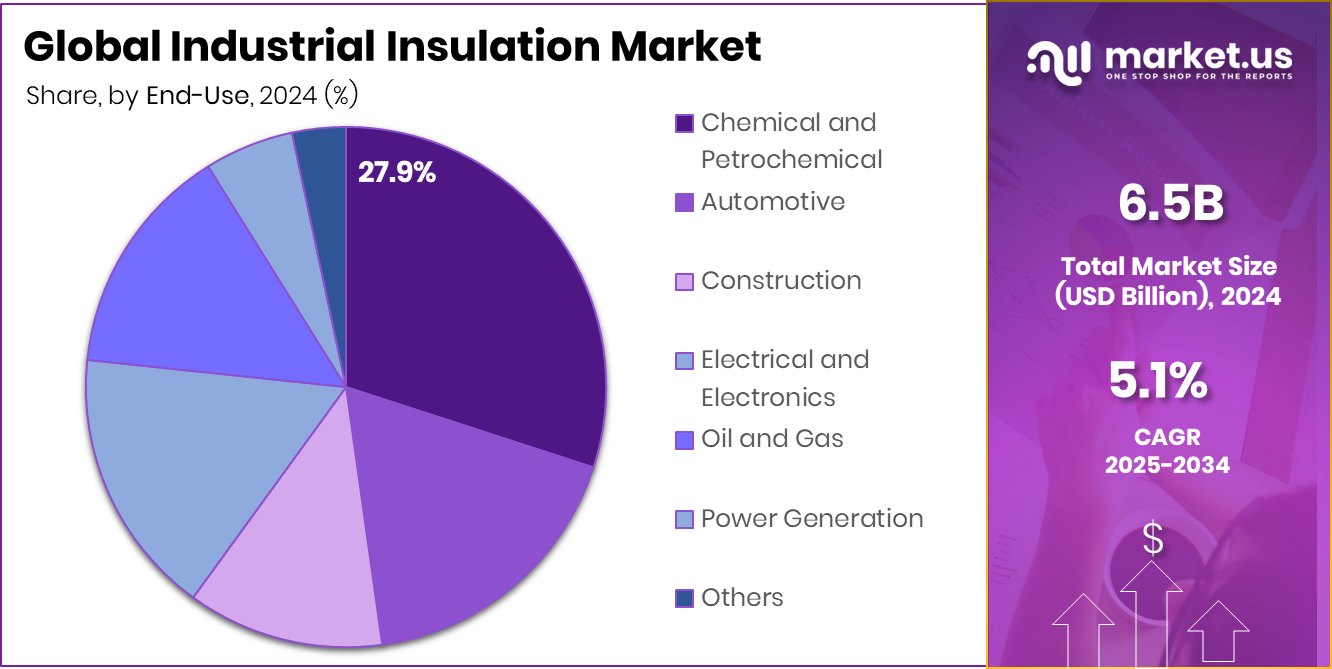

- In the end-use, chemical and petrochemical industries drive the industrial insulation market with a 27.9% contribution.

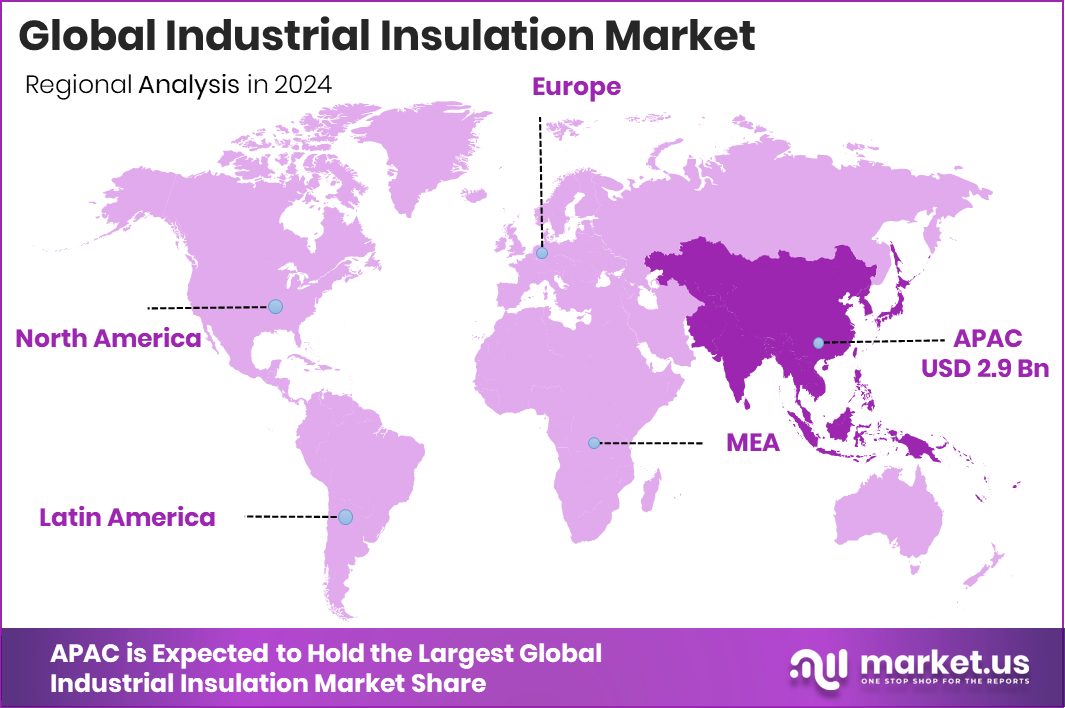

- The Asia-Pacific market size reached USD 2.9 billion, showing strong insulation demand.

By Material Analysis

Industrial Insulation Market by material shows mineral wool leading with 38.6%.

In 2024, Mineral Wool held a dominant market position in the By Material segment of the Industrial Insulation Market, with a 38.6% share. This strong presence reflects its wide use across industrial facilities due to excellent thermal resistance, durability, and fire protection capabilities. Mineral wool is often preferred in high-temperature environments, making it a reliable choice for chemical, oil & gas, and power generation industries.

Its ability to enhance energy efficiency while meeting strict safety and environmental standards further supports its leadership in the market. The material’s cost-effectiveness, coupled with its performance in reducing heat loss and ensuring worker safety, has firmly positioned mineral wool as the top contributor within the industrial insulation sector.

By Product Analysis

Pipe products dominate the Industrial Insulation Market, capturing 45.8% share.

In 2024, Pipe held a dominant market position in the By Product segment of the Industrial Insulation Market, with a 45.8% share. This leadership is driven by the extensive use of pipe insulation across industries to control heat transfer, reduce energy losses, and ensure safe handling of high-temperature fluids.

Insulated pipes are vital in chemical processing, oil & gas operations, and power plants, where efficiency and safety are critical. Their role in minimizing thermal loss not only lowers operational costs but also extends equipment life and enhances overall system reliability. With consistent demand from large-scale industrial facilities, pipe insulation has secured its place as the most significant product category within the industrial insulation sector.

By End-Use Analysis

Chemical and petrochemical end-use drives 27.9% of the Industrial Insulation Market.

In 2024, Chemical and Petrochemical held a dominant market position in the By End-Use segment of the Industrial Insulation Market, with a 27.9% share. This dominance is attributed to the sector’s high demand for thermal management and safety solutions in processing plants. Insulation plays a crucial role in maintaining process stability, preventing energy losses, and protecting pipelines and equipment operating under extreme temperatures.

The chemical and petrochemical industry’s continuous investments in large-scale projects further strengthen the need for effective insulation systems. With efficiency, safety, and compliance with environmental standards being top priorities, the sector’s reliance on advanced insulation materials has positioned it as the leading end-use contributor within the industrial insulation market.

Key Market Segments

By Material

- Mineral Wool

- Fiber Glass

- Foamed Plastics

- Calcium Silicate

- Others

By Product

- Pipe

- Board

- Blanket

- Others

By End-Use

- Chemical and Petrochemical

- Automotive

- Construction

- Electrical and Electronics

- Oil and Gas

- Power Generation

- Others

Driving Factors

Rising Energy Efficiency Needs Drive Market Growth

One of the top driving factors for the industrial insulation market is the growing need for energy efficiency across industries. Companies are under pressure to reduce operational costs and lower carbon emissions, which makes insulation an essential solution. Industrial insulation helps limit heat loss, control temperatures, and improve overall system efficiency, especially in energy-intensive sectors like chemicals, petrochemicals, and manufacturing.

With global focus shifting toward sustainable operations, demand for better insulation continues to rise. Adding to this trend, Solugen raises $357 million to make chemicals from sugar, not petroleum, showing how investments in greener chemical production align with the need for effective insulation. This drive toward energy savings strongly supports the market’s growth outlook.

Restraining Factors

High Installation Costs Limit Wider Market Adoption

A key restraining factor for the industrial insulation market is the high cost of installation and maintenance. While insulation materials provide long-term savings through energy efficiency and safety, the upfront expenses for procurement, skilled labor, and specialized equipment can be significant. Many small and medium-sized industries hesitate to invest due to these high initial costs, which slows down adoption in certain regions.

Additionally, maintenance over time adds further expenses, making it less attractive for companies with tight budgets. On the other hand, innovation is creating new possibilities—Fiber Elements raises €2.6 million seed funding for 3D basalt fiber, a step toward developing advanced, cost-effective solutions. Such advancements could help reduce barriers linked to installation costs.

Growth Opportunity

Sustainable Insulation Solutions Create Major Growth Opportunity

One of the biggest growth opportunities in the Industrial Insulation Market lies in the development and adoption of sustainable insulation technologies. As industries focus on reducing carbon emissions and meeting stricter environmental standards, the demand for eco-friendly materials is rising quickly. Companies are looking for insulation products that not only save energy but are also produced from renewable or recyclable resources. This shift opens new doors for innovative businesses that can deliver greener alternatives without compromising performance.

Supporting this trend, Wull Technologies secures £300,000 to advance sustainable insulation technology, highlighting investor confidence in the future of environmentally responsible solutions. Such advancements position sustainable insulation as a key driver of future market growth.

Latest Trends

Advanced Fiber-Based Materials Shape Emerging Market Trends

A key latest trend in the Industrial Insulation Market is the growing use of advanced fiber-based materials for insulation. Traditional materials remain important, but industries are now moving toward lighter, stronger, and more durable fiber solutions that provide better thermal resistance and longer life. These materials are particularly useful in demanding environments such as petrochemical plants, power generation, and manufacturing facilities, where efficiency and safety are critical.

The trend also reflects the market’s shift toward innovation and sustainability, as fiber-based insulation often reduces waste and offers higher performance. Reinforcing this direction, Fiber Elements raises €2.6M in seed funding to develop 3D basalt fiber, showing how new fiber technologies are gaining attention and shaping market adoption.

Regional Analysis

In 2024, the Asia-Pacific dominated the Industrial Insulation Market with a 45.70% share.

The Industrial Insulation Market is segmented across North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America, with notable differences in market presence and growth. In 2024, Asia-Pacific emerged as the dominating region, holding a substantial 45.70% share, valued at USD 2.9 billion. This leadership reflects the region’s rapid industrialization, expanding petrochemical activities, and large-scale manufacturing, which create significant demand for insulation in energy-intensive operations.

North America maintains a steady market position supported by established oil & gas infrastructure and ongoing investments in energy efficiency. Europe continues to focus on insulation demand driven by strict environmental regulations and the region’s transition toward sustainable industrial practices.

The Middle East & Africa show potential, with increasing construction of petrochemical and power facilities requiring advanced insulation systems. Latin America, though smaller in scale, is gradually expanding with rising industrial output and infrastructure development.

Overall, Asia-Pacific dominates the global market by both share and value, underscoring its importance as the central hub for industrial insulation demand. The strong growth in this region highlights its critical role in shaping the overall direction of the market, while other regions contribute steadily to balanced global expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, leading companies in the global Industrial Insulation Market, such as Rockwool Insulation A/S, Poroc Group Oy, and Knauf Insulation, continue to strengthen their presence with product innovation and targeted solutions. Each of these players focuses on addressing the growing demand for energy-efficient, durable, and environmentally friendly insulation materials across industrial sectors.

Rockwool Insulation A/S is recognized for its strong expertise in mineral wool products, widely used in high-temperature and safety-sensitive applications. The company emphasizes sustainability and performance, making its solutions highly valued in industrial facilities where fire protection and energy conservation are priorities. Its ongoing focus on circular solutions also aligns with global moves toward greener operations.

Poroc Group Oy brings specialized expertise with its tailored insulation solutions, addressing niche needs within industrial environments. The company’s ability to offer lightweight yet effective insulation materials supports industries requiring high efficiency with reduced material use. Its market presence reflects flexibility and commitment to addressing unique customer requirements, particularly in demanding applications.

Knauf Insulation continues to expand its portfolio with a strong emphasis on advanced insulation technologies. Known for its reliability and wide material range, Knauf’s solutions cater to large-scale projects in energy-intensive industries. Its focus on combining performance with environmental responsibility strengthens its position in a market where sustainability is gaining importance.

Top Key Players in the Market

- Rockwool Insulation A/S

- Poroc Group Oy

- Knauf Insulation

- TechnoNICOL Corporation

- Anco Products, Inc.

- Aspen Aerogels, Inc.

- Cabot Corporation

- Morgan Advanced Materials plc

- RATH Group

- IBIDEN Co., Ltd.

- Armacell International

Recent Developments

- In April 2025, ROCKWOOL introduced Smartrock®, a stone wool insulation board with an integrated smart vapor retarder for interior mass walls (concrete/masonry) to improve thermal, vapor, and air control in one product.

- In October 2024, Knauf acquired a low-carbon Rock Mineral Wool insulation business in Uzbekistan. The deal includes a plant in Tashkent using electric melting technology to reduce CO₂ in production.

Report Scope

Report Features Description Market Value (2024) USD 6.5 Billion Forecast Revenue (2034) USD 10.7 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Mineral Wool, Fiber Glass, Foamed Plastics, Calcium Silicate, Others), By Product (Pipe, Board, Blanket, Others), By End-Use (Chemical and Petrochemical, Automotive, Construction, Electrical and Electronics, Oil and Gas, Power Generation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Rockwool Insulation A/S, Poroc Group Oy, Knauf Insulation, TechnoNICOL Corporation, Anco Products, Inc., Aspen Aerogels, Inc., Cabot Corporation, Morgan Advanced Materials plc, RATH Group, IBIDEN Co., Ltd., Armacell International Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Industrial Insulation MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Industrial Insulation MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Rockwool Insulation A/S

- Poroc Group Oy

- Knauf Insulation

- TechnoNICOL Corporation

- Anco Products, Inc.

- Aspen Aerogels, Inc.

- Cabot Corporation

- Morgan Advanced Materials plc

- RATH Group

- IBIDEN Co., Ltd.

- Armacell International