Global Industrial Coatings Market Size, Share, And Business Benefits By Product (Acrylic, Alkyd, Polyurethane, Epoxy, Polyesters, Others), By Technology (Solvent Borne, Water Borne, Powder Based, Others), By End-use (Automotive, Marine, Electronics, Aerospace, Oil and Gas, Mining, Power Generation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153521

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

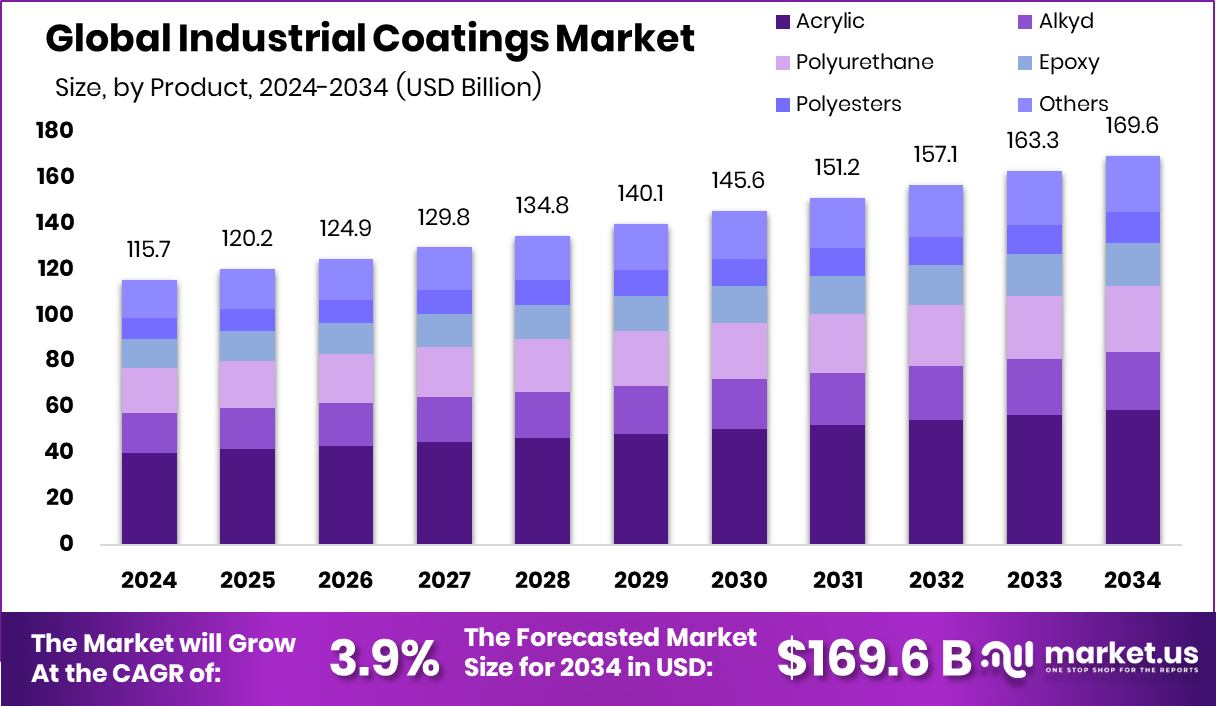

The Industrial Coatings Market is expected to be worth around USD 168.6 billion by 2034, up from USD 115.7 billion in 2024, and is projected to grow at a CAGR of 3.9% from 2025 to 2034. Rapid industrial growth and infrastructure investments drive Asia-Pacific’s 45.7% coatings demand upward.

Industrial coatings are specially engineered paints or chemical solutions applied to various surfaces, primarily for protective rather than decorative purposes. These coatings are used on steel, concrete, and other materials to prevent corrosion, wear, fire, UV damage, and chemical exposure in harsh industrial environments. They are commonly used in sectors such as automotive, construction, oil & gas, marine, and manufacturing.

The industrial coatings market refers to the global trade and production of these specialized protective materials. This market includes a wide range of products such as epoxy, polyurethane, acrylic, and fluoropolymer coatings that serve diverse applications in infrastructure, heavy machinery, and energy systems. The market is influenced by changes in end-user industries, regulatory standards on environmental emissions, and ongoing investments in industrial infrastructure.

The growth of the industrial coatings market is largely driven by increasing infrastructure development and industrialization, especially in developing countries. Rising investments in construction, energy, and transportation projects are generating a strong need for protective coatings to extend asset lifespan. Moreover, industries are shifting toward high-performance, eco-friendly coatings, further accelerating market expansion.

Growing emphasis on equipment maintenance and long-term asset protection is creating sustained demand for industrial coatings. Industries operating in harsh environments—such as marine, chemical processing, and mining—rely heavily on coatings to reduce downtime and repair costs. Furthermore, regulatory pressure to reduce emissions and improve energy efficiency is encouraging adoption of advanced, low-VOC coating technologies.

Key Takeaways

- The Industrial Coatings Market is expected to be worth around USD 168.6 billion by 2034, up from USD 115.7 billion in 2024, and is projected to grow at a CAGR of 3.9% from 2025 to 2034.

- Acrylic coatings hold a 34.6% share in the industrial coatings market due to durability.

- Solvent-borne technology leads the industrial coatings market with a 48.7% share, driven by performance.

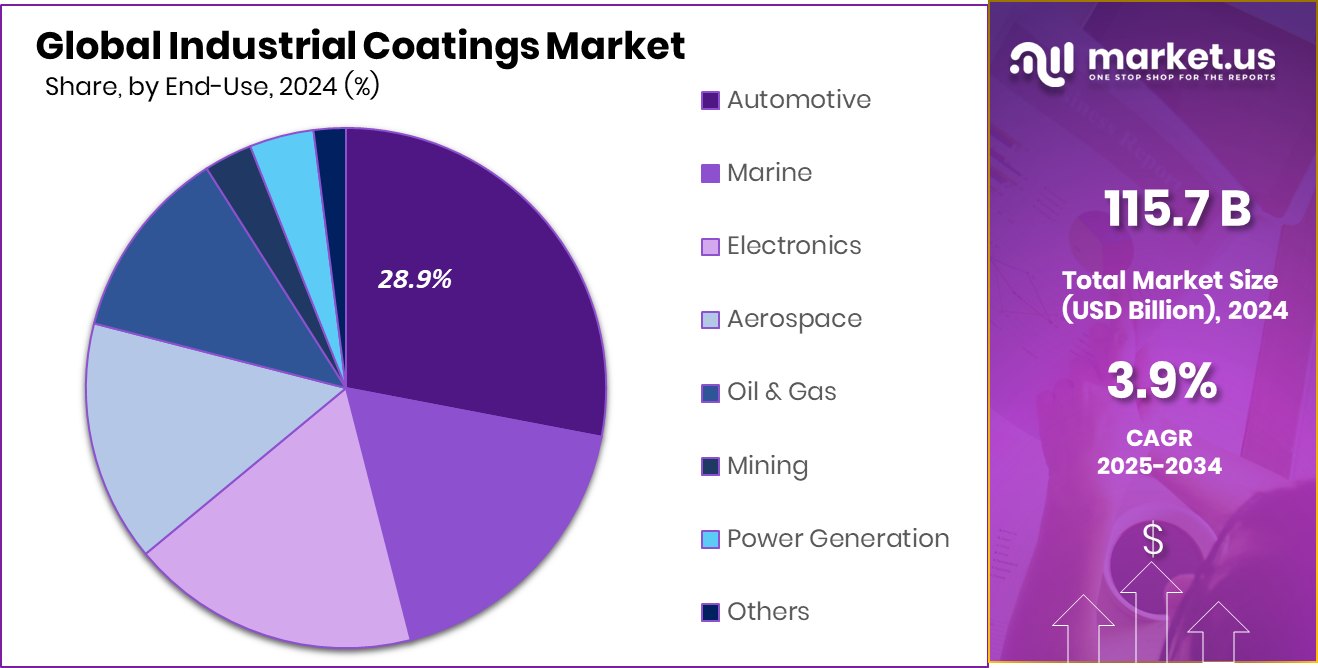

- Automotive sector dominates end-use in the industrial coatings market, accounting for 28.9% market share.

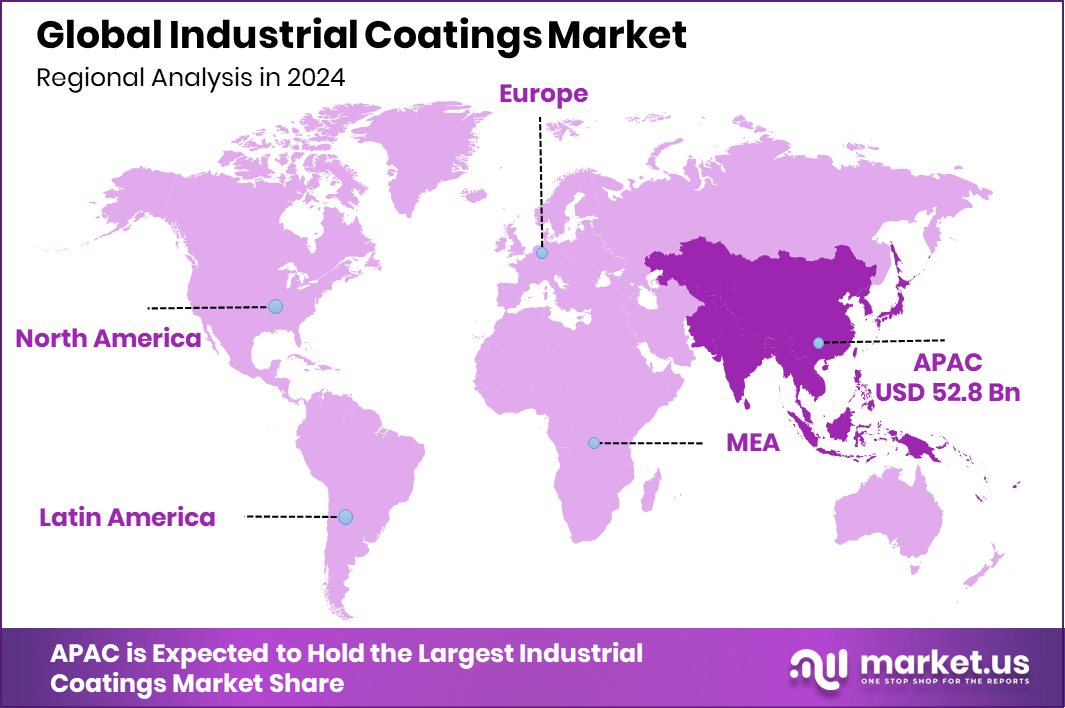

- The Asia-Pacific market value reached a strong total of USD 52.8 billion.

By Product Analysis

Acrylic coatings hold 34.6% share in industrial coatings market.

In 2024, Acrylic held a dominant market position in the By Product segment of the Industrial Coatings Market, with a 34.6% share. This strong positioning can be attributed to acrylic coatings’ versatility, fast-drying nature, and cost-effectiveness across a wide range of industrial applications.

Acrylic-based coatings are especially preferred in environments where weather resistance and color retention are critical, such as exterior metal structures, machinery, and equipment used in fluctuating climates. Their compatibility with both waterborne and solvent-borne systems further enhances their adaptability, aligning well with industries transitioning toward more environmentally conscious solutions.

The growing demand for protective coatings that provide a balance between performance and environmental compliance has reinforced acrylic’s appeal among end-users. Additionally, ease of application and superior adhesion properties make acrylic coatings a favorable choice in maintenance and refurbishment projects, where durability and quick turnaround times are essential. As industrial sectors continue to prioritize surface protection and aesthetic performance without compromising regulatory standards, the market share of acrylic coatings is expected to remain robust.

The 34.6% share recorded in 2024 highlights the material’s ongoing relevance and strong customer preference in the global industrial coatings landscape. This segment’s performance indicates a continuing shift toward dependable and high-performing coating technologies.

By Technology Analysis

Solvent borne technology dominates with 48.7% market share currently.

In 2024, Solvent Borne held a dominant market position in the By Technology segment of the Industrial Coatings Market, with a 48.7% share. This dominance is primarily due to the established reliability and strong performance characteristics of solvent-borne coatings in demanding industrial settings. These coatings are widely valued for their excellent adhesion, smooth finish, and durability on a variety of surfaces, including metal and concrete, even in high-humidity or low-temperature environments.

Their resistance to abrasion, corrosion, and chemical exposure has made them a standard choice across industries that require robust and long-lasting surface protection. Despite increasing environmental regulations, the continued use of solvent-borne systems is supported by their consistent application results and superior protective capabilities. Industries that prioritize performance over environmental considerations, especially in infrastructure maintenance, machinery protection, and transportation assets, continue to rely on this technology.

The 48.7% share achieved by solvent-borne coatings in 2024 reflects a strong market preference driven by functionality and trusted performance outcomes. While technological advancements and sustainability trends are shaping future developments, solvent-borne coatings maintain a solid foothold due to their well-proven benefits in industrial operations where reliability and protective strength remain non-negotiable.

By End-use Analysis

Automotive sector leads end-use segment, contributing 28.9% market share.

In 2024, Automotive held a dominant market position in the By End-use segment of the Industrial Coatings Market, with a 28.9% share. This leadership is largely driven by the critical role coatings play in vehicle durability, aesthetics, and corrosion resistance. Industrial coatings are extensively applied to both OEM and aftermarket automotive components, including chassis, body panels, engine parts, and underbody structures.

The sector’s high production volume and strict performance requirements contribute significantly to the steady demand for specialized coatings that offer enhanced protection against harsh weather, chemicals, and mechanical wear. In particular, the growing focus on vehicle longevity and low maintenance has reinforced the use of high-performance coatings in automotive manufacturing. Additionally, consistent upgrades in coating formulations to meet evolving durability standards have supported the segment’s growth.

The 28.9% share achieved in 2024 indicates the automotive sector’s strong influence within the industrial coatings market, underpinned by continuous production activities and quality expectations. As automotive operations rely heavily on precise and resilient coating applications to maintain product integrity and brand value, this segment is expected to maintain its substantial contribution to overall market demand, reflecting a stable and mature end-use base in the coatings landscape.

Key Market Segments

By Product

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyesters

- Others

By Technology

- Solvent Borne

- Water Borne

- Powder Based

- Others

By End-use

- Automotive

- Marine

- Electronics

- Aerospace

- Oil and Gas

- Mining

- Power Generation

- Others

Driving Factors

Growing Infrastructure Spending Boosts Coatings Demand

One of the key driving factors of the industrial coatings market is the increasing investment in infrastructure development across both developed and developing countries. Roads, bridges, airports, factories, rail networks, and energy facilities all require coatings to protect metal and concrete surfaces from corrosion, moisture, UV rays, and chemical damage. As governments and private sectors focus on improving infrastructure to support economic growth, the demand for industrial coatings continues to rise.

These coatings help increase the lifespan of infrastructure while reducing long-term maintenance costs. In regions with extreme weather or industrial pollution, the use of high-performance coatings is considered essential. This consistent and growing need for infrastructure protection directly contributes to the steady expansion of the industrial coatings market.

Restraining Factors

Strict Environmental Rules Limit Coatings Usage

A major restraining factor for the industrial coatings market is the presence of strict environmental regulations. Many industrial coatings, especially solvent-based ones, contain high levels of volatile organic compounds (VOCs), which contribute to air pollution and health risks. As a result, governments in many countries have introduced strict laws to limit the use of such chemicals. Manufacturers are now required to meet low-VOC or VOC-free standards, which can raise production costs and slow down product approvals.

Small and medium-sized companies often struggle to adapt to these rules, which affects their competitiveness. These environmental restrictions are making it harder for traditional coating products to maintain market share, especially in regions with tough compliance standards and growing sustainability goals.

Growth Opportunity

Rising Demand for Eco-Friendly Coating Solutions

A major growth opportunity in the industrial coatings market lies in the rising demand for eco-friendly and sustainable coating technologies. As environmental awareness increases and regulations become stricter, industries are shifting toward water-based, powder-based, and bio-based coatings that have low or zero volatile organic compounds (VOCs). These coatings reduce harmful emissions and are safer for both workers and the environment.

Companies that invest in developing sustainable formulations and adopt green manufacturing processes are likely to gain a competitive edge. This shift also aligns with global sustainability goals and net-zero emission targets, making eco-friendly coatings a long-term opportunity. The move toward cleaner coatings is not only market-driven but also supported by government incentives and environmental standards.

Latest Trends

Smart Coatings Gaining Attention in Industries

One of the latest trends in the industrial coatings market is the increasing use of smart coatings. These advanced coatings are designed to respond to external conditions such as temperature, pressure, moisture, or mechanical damage. For example, some smart coatings can self-heal small cracks, change color to indicate corrosion, or release protective agents when exposed to moisture.

This intelligent behavior helps reduce maintenance costs and extend the lifespan of industrial equipment and infrastructure. Industries such as automotive, aerospace, and oil & gas are exploring these coatings for critical applications. As technology improves and awareness grows, smart coatings are becoming more practical and attractive for industries looking to improve safety, performance, and cost-efficiency over time.

Regional Analysis

In 2024, Asia-Pacific led the industrial coatings market with 45.7% share.

In 2024, Asia-Pacific emerged as the dominant region in the global industrial coatings market, capturing 45.7% of the total share, which translated to a market value of USD 52.8 billion. This leadership is primarily attributed to the region’s strong manufacturing base, rapid urbanization, and large-scale infrastructure projects across countries such as China, India, and Southeast Asian nations. The expansion of industries like automotive, construction, and heavy machinery has driven consistent demand for durable and protective coatings.

In North America and Europe, the market maintained steady growth due to established industrial sectors and ongoing maintenance needs for aging infrastructure. Meanwhile, the Middle East & Africa and Latin America regions witnessed gradual adoption of industrial coatings, supported by rising construction activities and industrial development. However, these regions still accounted for smaller shares compared to Asia-Pacific.

The overall market landscape in 2024 highlighted Asia-Pacific not only as the largest consumer but also as the fastest-growing region, driven by both domestic consumption and export-oriented manufacturing. The region’s substantial share reflects its strategic importance in the industrial coatings value chain, reinforcing its influence on global supply and demand trends within the sector.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Akzo Nobel N.V. continued to leverage its global manufacturing footprint and well-established R&D capabilities, focusing on the innovation of high-performance and sustainable coating technologies. Its investments in eco-efficient formulations positioned the company favorably, particularly in addressing stricter environmental regulations while maintaining industrial performance standards. Akzo Nobel’s ability to balance innovation with operational efficiency reaffirmed its leadership within the market.

Axalta Coating Systems showcased its expertise in the automotive and industrial segments, emphasizing application-specific coating systems. The company’s strong service network and customized solutions supported its market share in key end-use sectors. Axalta’s focus on improving coating longevity and corrosion resistance addressed critical customer demands, reinforcing its reputation for technical excellence and industry alignment.

BASF SE continued to benefit from its diversified chemical portfolio and global distribution channels. The company’s significant investment in multifunctional coatings enabled it to offer integrated solutions to industrial clients, particularly in manufacturing and infrastructure sectors. BASF’s strong presence in emerging markets and collaboration with industrial clients underlined its strategic agility and proactive market engagement.

Diamond Paints, though smaller in scale, achieved steady growth by focusing on regional excellence and niche industrial segments. Its agility in tailoring products to local standards and customer requirements allowed it to build a strong reputation in specific geographic areas. Diamond Paints’ growth is a testament to the value of regional specialization and customer-centric approaches in a competitive landscape.

Top Key Players in the Market

- Akzo Nobel N.V.

- Axalta Coating Systems

- BASF SE

- Diamond Paints

- Hempel A/S

- Industrial Coatings Ltd.

- Jotun

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc

- RPM International Inc.

- The Chemours Company FC, LLC.

- The Sherwin-Williams Company

Recent Developments

- In February 2025, Akzo Nobel launched RUBBOL WF 3350, a new waterborne wood coating enriched with 20% bio‑based materials. Designed for both interior and exterior use, the product emphasizes renewable content without compromising durability or performance. It reflects the company’s commitment to sustainable innovation and circular economy goals while serving industrial and wood‑finishing applications.

- In July 2024, Axalta launched Cerulean™, a new low‑VOC waterborne coating designed for industrial wood applications like cabinets and millwork. Cerulean™ provides the premium finish of solvent‑based coatings but with VOC levels under 200 g/L, supporting both environmental goals and high aesthetic standards.

Report Scope

Report Features Description Market Value (2024) USD 115.7 Billion Forecast Revenue (2034) USD 168.6 Billion CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Acrylic, Alkyd, Polyurethane, Epoxy, Polyesters, Others), By Technology (Solvent Borne, Water Borne, Powder Based, Others), By End-use (Automotive, Marine, Electronics, Aerospace, Oil and Gas, Mining, Power Generation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Akzo Nobel N.V., Axalta Coating Systems, BASF SE, Diamond Paints, Hempel A/S, Industrial Coatings Ltd., Jotun, Kansai Paint Co., Ltd., Nippon Paint Holdings Co., Ltd., PPG Industries, Inc, RPM International Inc., The Chemours Company FC, LLC., The Sherwin-Williams Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Industrial Coatings MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Industrial Coatings MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Akzo Nobel N.V.

- Axalta Coating Systems

- BASF SE

- Diamond Paints

- Hempel A/S

- Industrial Coatings Ltd.

- Jotun

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc

- RPM International Inc.

- The Chemours Company FC, LLC.

- The Sherwin-Williams Company