Global Hydroxypropyl Distarch Phosphate Market Size, Share Analysis Report By Product Grade (Halal, Vegan), By Function (Thickener, Anticaking Agent, Emulsifier, Stabilizer, Binder, Others), By End-Use (Food and Beverages, Cosmetics, Pharmaceuticals, Personal Care, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152828

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

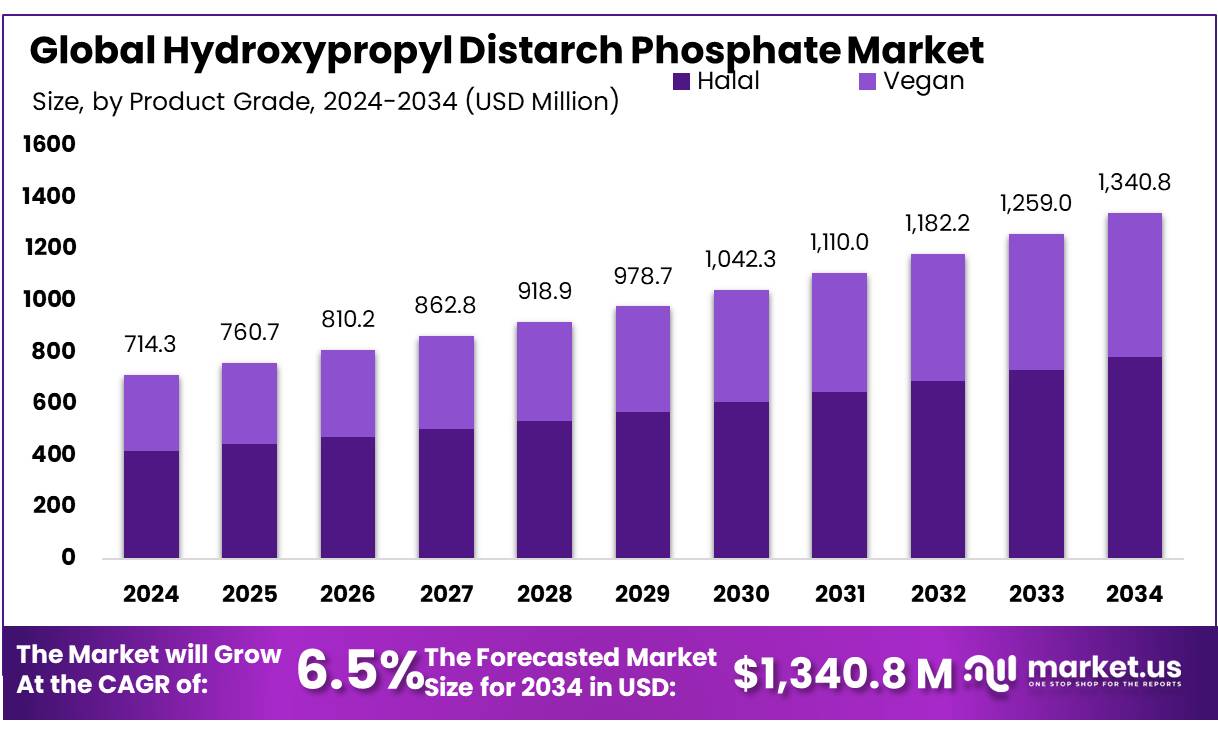

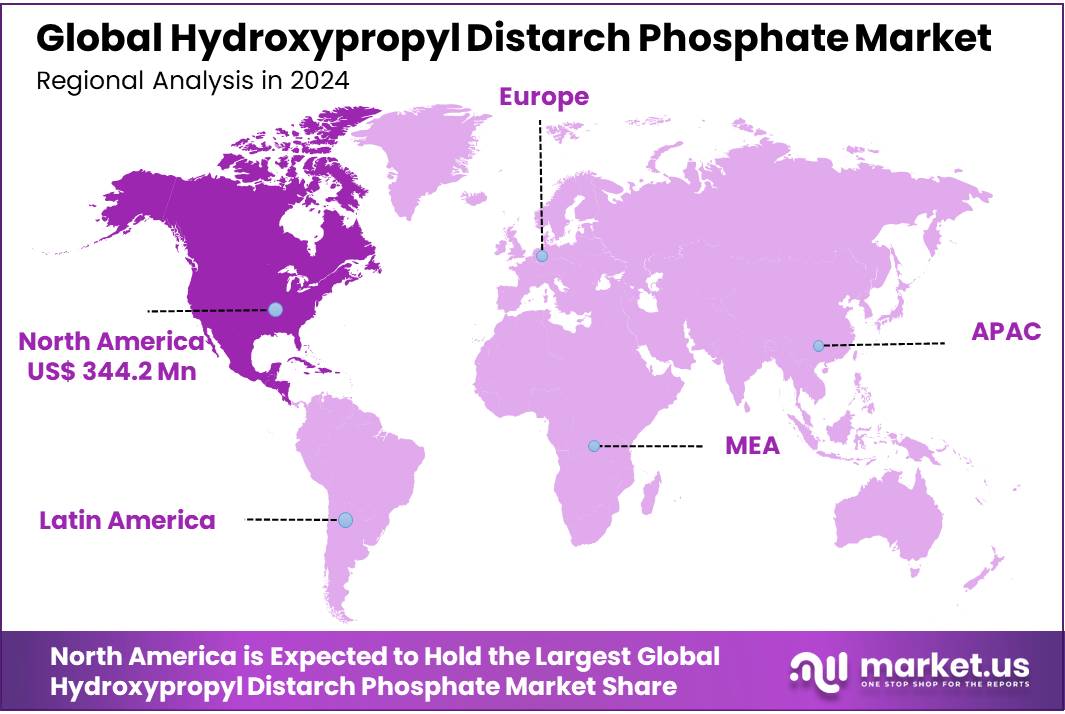

The Global Hydroxypropyl Distarch Phosphate Market size is expected to be worth around USD 1340.8 Million by 2034, from USD 714.3 Million in 2024, growing at a CAGR of 6.5% during the forecast period from 2025 to 2034. In 2024, North American held a dominant market position, capturing more than a 48.2% share, holding USD 344.2 Million revenue.

Hydroxypropyl Distarch Phosphate (INS 1442) is a chemically modified resistant starch, achieved through dual modification by hydroxypropylation and phosphorylation. HDP is approved for use as a thickener, stabilizer, and texturizer across multiple jurisdictions including the EU, U.S., Australia, New-Zealand, Taiwan, and Codex Alimentarius standards.

In the European Union, HPDP is authorized for use in a wide range of food categories, including dairy products, fruit preparations, soups, sauces, and processed meats, under the “quantum satis” principle, meaning it can be used in amounts sufficient to achieve the desired effect without exceeding safety levels. The European Commission Regulation No. 231/2012 specifies that HPDP should not contain more than 0.14% residual phosphorus when derived from potato or wheat starches, and 0.04% when derived from other starches.

In the United States, HPDP is recognized as a safe food additive by the Food and Drug Administration (FDA), listed under 21 CFR 172.892 and 175.105. It is utilized in a variety of food products, including bread, ready-to-eat cereals, and cereal bars, as a thickener or texturizing agent. The FDA’s Generally Recognized as Safe (GRAS) status for HPDP is based on scientific procedures and conforms to the guidance issued under 21 C.F.R. § 170.30(b).

Government regulations and initiatives play a crucial role in the utilization of HPDP. In the European Union, Commission Regulation (EU) No 1130/2011 permits the use of HPDP (E1442) in food products, adhering to the ‘quantum satis’ principle, which allows its use in amounts sufficient to achieve the desired technological effect. Similarly, the United States Food and Drug Administration (FDA) recognizes HPDP as a food ingredient, provided it meets the necessary safety standards.

Key Takeaways

- Hydroxypropyl Distarch Phosphate Market size is expected to be worth around USD 1340.8 Million by 2034, from USD 714.3 Million in 2024, growing at a CAGR of 6.5%.

- Halal held a dominant market position, capturing more than a 58.3% share in the global Hydroxypropyl Distarch Phosphate market.

- Thickener held a dominant market position, capturing more than a 33.6% share in the global Hydroxypropyl Distarch Phosphate market.

- Food & Beverages held a dominant market position, capturing more than a 63.9% share in the global Hydroxypropyl Distarch Phosphate market.

- North America firmly held the lead in the Hydroxypropyl Distarch Phosphate (HDP) market, contributing a dominant 48.2% share—equating to approximately USD 344.2 million.

By Product Grade Analysis

Halal Grade Leads with 58.3% Share Due to Strong Global Compliance Needs

In 2024, Halal held a dominant market position, capturing more than a 58.3% share in the global Hydroxypropyl Distarch Phosphate market by product grade. This leadership is largely attributed to the growing demand for Halal-certified ingredients across the food, pharmaceutical, and cosmetic sectors—particularly in countries with significant Muslim populations such as Indonesia, Malaysia, Saudi Arabia, and parts of Africa. Manufacturers have increasingly aligned their production processes with Halal standards to meet strict religious and ethical guidelines, which has resulted in broader acceptance of Halal-grade HDP in both Islamic and non-Islamic markets.

By Function Analysis

Thickener Leads with 33.6% Share Owing to Its Widespread Use in Food

In 2024, Thickener held a dominant market position, capturing more than a 33.6% share in the global Hydroxypropyl Distarch Phosphate market by function. This strong performance is mainly driven by the growing need for texture-enhancing agents in processed foods, bakery products, sauces, soups, and dairy applications. As consumer preferences shift towards ready-to-eat meals and shelf-stable foods, the demand for reliable thickening agents has surged, positioning Hydroxypropyl Distarch Phosphate as a preferred option due to its stability under heat, acid, and mechanical stress.

By End-Use Analysis

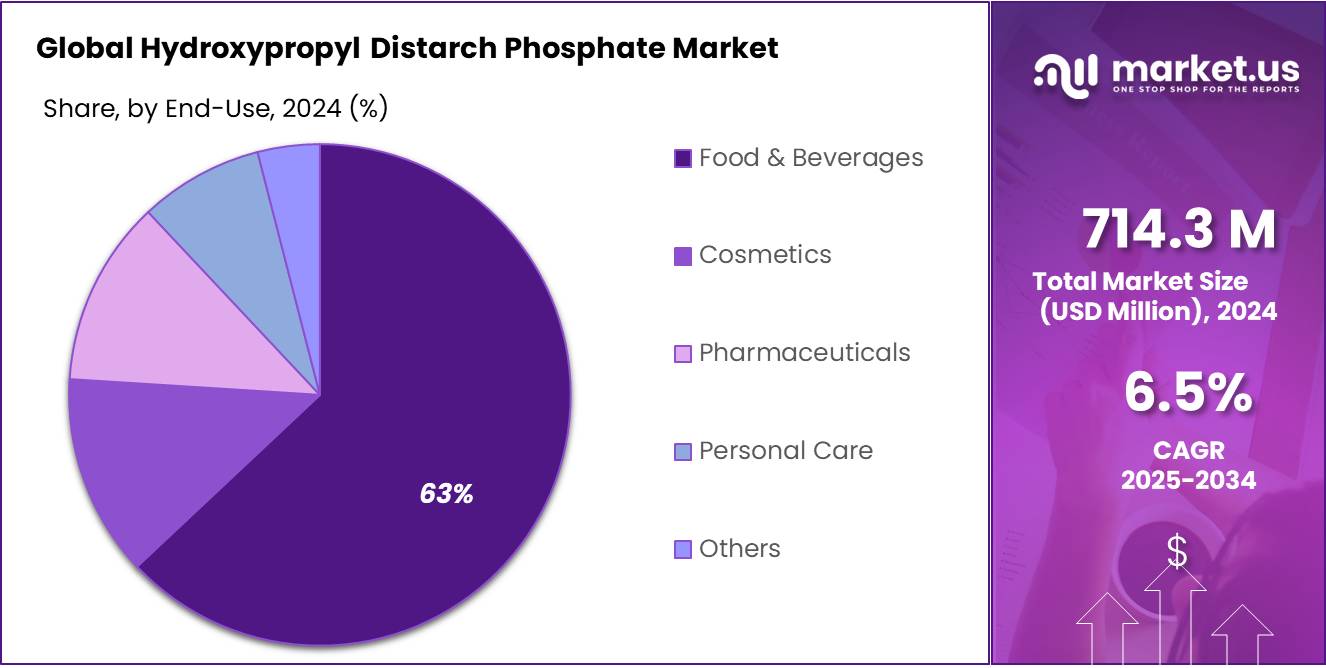

Food & Beverages Dominate with 63.9% Share Due to High Functional Use

In 2024, Food & Beverages held a dominant market position, capturing more than a 63.9% share in the global Hydroxypropyl Distarch Phosphate market by end-use. This substantial share reflects the widespread use of the ingredient as a thickener, stabilizer, and emulsifier in processed foods, bakery items, sauces, dairy products, and ready-to-eat meals. The segment’s leadership is largely driven by the increasing global consumption of convenience foods and the growing demand for ingredients that can improve texture, shelf life, and product stability under harsh processing conditions.

Key Market Segments

By Product Grade

- Halal

- Vegan

By Function

- Thickener

- Anticaking Agent

- Emulsifier

- Stabilizer

- Binder

- Others

By End-Use

- Food & Beverages

- Bakery & Confectionery

- Dairy Products

- Processed Foods

- Nutritional Supplements

- Others

- Cosmetics

- Pharmaceuticals

- Personal Care

- Others

Emerging Trends

Surge in Plant-Based and Clean-Label Applications

A prominent trend in the Hydroxypropyl Distarch Phosphate (HDP) market is its increasing adoption in plant-based and clean-label food products. This shift is driven by consumer demand for natural, non-GMO, and allergen-free ingredients. HDP, a modified starch derived from corn or potatoes, offers functional benefits such as improved texture, stability, and shelf-life, making it ideal for plant-based formulations.

Its versatility allows it to replace synthetic additives, aligning with the clean-label movement that favors transparency and simplicity in ingredient lists. According to industry reports, the global demand for plant-based, modified starches like HDP has seen a significant increase, reflecting the broader consumer trend towards healthier and more natural food options.

In the United States, this trend is particularly evident, with a growing number of food manufacturers incorporating HDP into their products to meet the clean-label and plant-based demands. The U.S. Food and Drug Administration (FDA) has recognized HDP as a safe food additive, further encouraging its use in various food applications. This regulatory support, coupled with consumer preferences, has led to a steady rise in HDP’s application across different food segments, including dairy alternatives, plant-based meats, and gluten-free products.

Globally, the trend towards clean-label and plant-based products is not limited to the United States. In Europe, for instance, the European Food Safety Authority (EFSA) has approved various modified starches, including HDP, for use in food products, provided they meet specific safety standards. This regulatory framework supports the growing adoption of HDP in European markets, where consumers are increasingly seeking products with natural and recognizable ingredients.

Drivers

Consumer Demand for Clean-Label and Functional Ingredients

One of the primary drivers propelling the growth of the Hydroxypropyl Distarch Phosphate (HDP) market is the increasing consumer preference for clean-label and functional ingredients in food products. Consumers are becoming more conscious of the ingredients in their food, seeking products with transparent labeling and natural additives. HDP, as a modified starch, aligns with these preferences by offering functional benefits such as improved texture, stability, and shelf-life without compromising product quality.

The clean-label trend is particularly evident in the North American market, where stringent regulatory standards and growing awareness of dietary and functional ingredients contribute to the market’s expansion. Consumers in this region are increasingly opting for products that are perceived as natural and free from artificial additives. This shift in consumer behavior is driving food manufacturers to seek ingredients like HDP that meet these demands while maintaining product performance.

Moreover, the rise in health-conscious eating habits and the demand for gluten-free and allergen-free products further bolster the adoption of HDP. Modified starches like HDP provide functional benefits without the inclusion of gluten or common allergens, making them suitable for a broader range of consumers. This versatility enhances the appeal of HDP in various food applications, including bakery products, sauces, and dairy items.

Restraints

Regulatory Scrutiny and Compliance Challenges

A significant challenge facing the Hydroxypropyl Distarch Phosphate (HDP) market is the stringent regulatory scrutiny and compliance requirements imposed by food safety authorities worldwide. While HDP is approved for use in various regions, including the European Union (E1442), United States (INS 1442), Australia, Taiwan, and New Zealand , the regulatory landscape is complex and varies across jurisdictions.

In the European Union, for instance, the European Food Safety Authority (EFSA) has initiated a re-evaluation process for food additives permitted before 20 January 2009, including modified starches like HDP. This re-evaluation requires food business operators to submit comprehensive data on use levels, safety assessments, and analytical results to ensure continued authorization . Failure to provide the necessary data within specified timelines could lead to the withdrawal of authorization for certain food categories, impacting market access.

Similarly, in the United States, the Food and Drug Administration (FDA) requires manufacturers to determine that HDP is Generally Recognized As Safe (GRAS) based on scientific procedures. This determination involves submitting detailed information on the ingredient’s identity, manufacturing process, intended uses, and safety data . The process can be time-consuming and resource-intensive, posing barriers for smaller manufacturers or those entering new markets.

Moreover, the evolving nature of food safety regulations necessitates continuous monitoring and adaptation by manufacturers. Regulatory bodies may update guidelines, impose new restrictions, or introduce additional requirements, compelling companies to invest in research, testing, and compliance efforts to maintain market access.

Opportunity

Expansion in Clean-Label and Functional Food Segments

A significant growth opportunity for the Hydroxypropyl Distarch Phosphate (HDP) market lies in the expanding demand for clean-label and functional food ingredients. Consumers are increasingly seeking products with simple, recognizable ingredients that align with their health-conscious lifestyles. HDP, known for its natural origin and functional properties, is well-positioned to meet these consumer preferences.

The global clean-label food market is experiencing substantial growth, driven by consumer demand for transparency and natural ingredients. HDP, as a modified starch, fits into this trend by serving as a functional, clean-label ingredient that enhances the texture, stability, and shelf-life of food products. Its applications in sauces, dressings, dairy products, and convenience foods are expanding as manufacturers seek to meet consumer expectations for clean-label formulations.

In the United States, the clean-label movement is gaining momentum, with a significant portion of consumers actively seeking products with natural ingredients and minimal additives. This shift in consumer behavior is influencing food manufacturers to incorporate ingredients like HDP that align with clean-label principles. The demand for gluten-free and allergen-free products is also contributing to the growth of HDP, as it provides functional benefits without compromising product quality.

Furthermore, the increasing focus on health and wellness is driving the demand for functional foods that offer additional health benefits beyond basic nutrition. HDP’s role as a stabilizer and thickener in functional food products positions it as a valuable ingredient in this growing segment. As consumers continue to prioritize health-conscious eating habits, the demand for functional food ingredients like HDP is expected to rise.

Regional Insights

North America Commands with 48.2% Share, Valued at USD 344.2 Million

In 2024, North America firmly held the lead in the Hydroxypropyl Distarch Phosphate (HDP) market, contributing a dominant 48.2% share—equating to approximately USD 344.2 million in regional sales. This leadership reflects the region’s strong industrial base, high adoption of convenient and clean-label food products, and advanced regulatory frameworks such as those established by the U.S. Food and Drug Administration (FDA) and the Canadian Food Inspection Agency (CFIA). Manufacturers here extensively utilize HDP for its thickening, stabilizing, and freeze-thaw-resistant properties in processed foods, bakery items, and refrigerated meals.

Market growth in North America is underpinned by private-sector innovation and government interest in sustainable food systems. For example, USDA and FDA efforts to promote plant-based ingredients and stringent stability requirements have indirectly supported HDP adoption in consumer products. Additionally, ongoing research collaborations between ingredient producers and universities have focused on optimizing HDP’s functional applications, such as freeze-thaw resistance and viscosity control.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Roquette Frères is a major global producer of plant-based ingredients and a leading supplier of modified starches such as Hydroxypropyl Distarch Phosphate (HDP). The company leverages advanced processing technologies and vertical integration to offer functional starches tailored for food, pharmaceutical, and industrial applications. With production facilities across Europe, Asia, and North America, Roquette emphasizes innovation, sustainability, and regulatory compliance. Its HDP offerings are widely adopted in thickening, stabilizing, and texturizing formulations within clean-label product lines.

AGRANA is a prominent Austria-based agribusiness group involved in starch, fruit, and sugar production. In the Hydroxypropyl Distarch Phosphate market, AGRANA is recognized for its extensive range of modified starches developed from corn, potato, and wheat. Its HDP ingredients are particularly suited for dairy, bakery, and ready-meal sectors, offering consistent texture and thermal stability. AGRANA’s strategic investments in R&D and sustainable raw material sourcing strengthen its role as a reliable HDP supplier across Europe and international markets.

Avebe is a Dutch cooperative specializing in potato-based ingredients, offering unique Hydroxypropyl Distarch Phosphate products with high purity and functionality. Known for its sustainable production methods and clean-label orientation, Avebe’s HDP starches are widely used in food applications such as soups, sauces, and bakery fillings. The company invests heavily in biobased innovation and circular agriculture, aiming to deliver high-performance starch solutions while reducing environmental impact. Avebe holds a strong position in European and Asian specialty starch markets.

Top Key Players Outlook

- Roquette Frères

- AGRANA

- Cargill

- Tate & Lyle

- Avebe

- BENEO

- Grain Processing Corporation

- Chemstar Products Company

- Shandong Fuyang Biotechnology Co. Ltd.

- Sinofi Ingredients

Recent Industry Developments

In 2024, Royal-Avebe—an established Dutch cooperative—consolidated its leadership in the HDP market by leveraging its potato-based expertise and sustainable innovation. The company reported annual revenues of €780 million for 2023–2024 and achieved a performance indicator of €118.62 per tonne of starch potatoes, indicating operational efficiency and strong output quality.

In 2024, Tate &Lyle expanded its footprint in the Hydroxypropyl Distarch Phosphate (HDP) market by leveraging its versatile starch portfolio and a strong sustainability drive. The company, which recorded revenues of £1,647 million with an operating income of £207 million and a net income of £188 million in 2024, invests significantly in specialty starch development.

Report Scope

Report Features Description Market Value (2024) USD 714.3 Mn Forecast Revenue (2034) USD 1340.8 Mn CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Grade (Halal, Vegan), By Function (Thickener, Anticaking Agent, Emulsifier, Stabilizer, Binder, Others), By End-Use (Food and Beverages, Cosmetics, Pharmaceuticals, Personal Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Roquette Frères, AGRANA, Cargill, Tate & Lyle, Avebe, BENEO, Grain Processing Corporation, Chemstar Products Company, Shandong Fuyang Biotechnology Co. Ltd., Sinofi Ingredients Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hydroxypropyl Distarch Phosphate MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Hydroxypropyl Distarch Phosphate MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Roquette Frères

- AGRANA

- Cargill

- Tate & Lyle

- Avebe

- BENEO

- Grain Processing Corporation

- Chemstar Products Company

- Shandong Fuyang Biotechnology Co. Ltd.

- Sinofi Ingredients