Global Hydrogenated Castor Oil Market Size, Share Analysis Report By Product Type (Flakes, Powder, Others), By Application (Cosmetics and Personal Care, Pharmaceuticals, Food and Beverage, Industrial Lubricants, Surfactants and Emulsifiers, Others), By Distribution Channel (Online Retail, Offline Retail) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168591

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

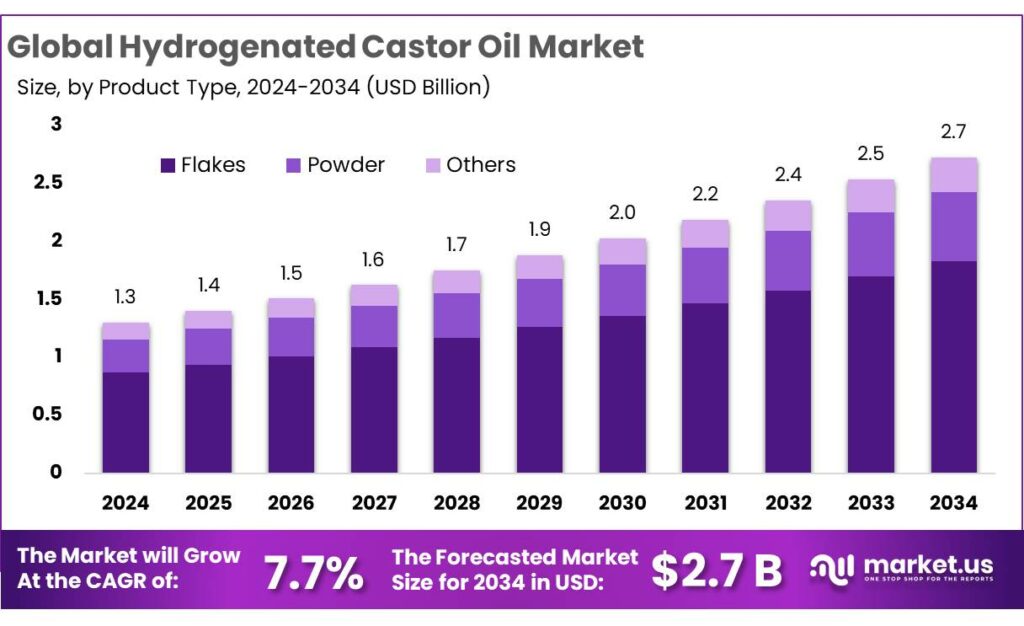

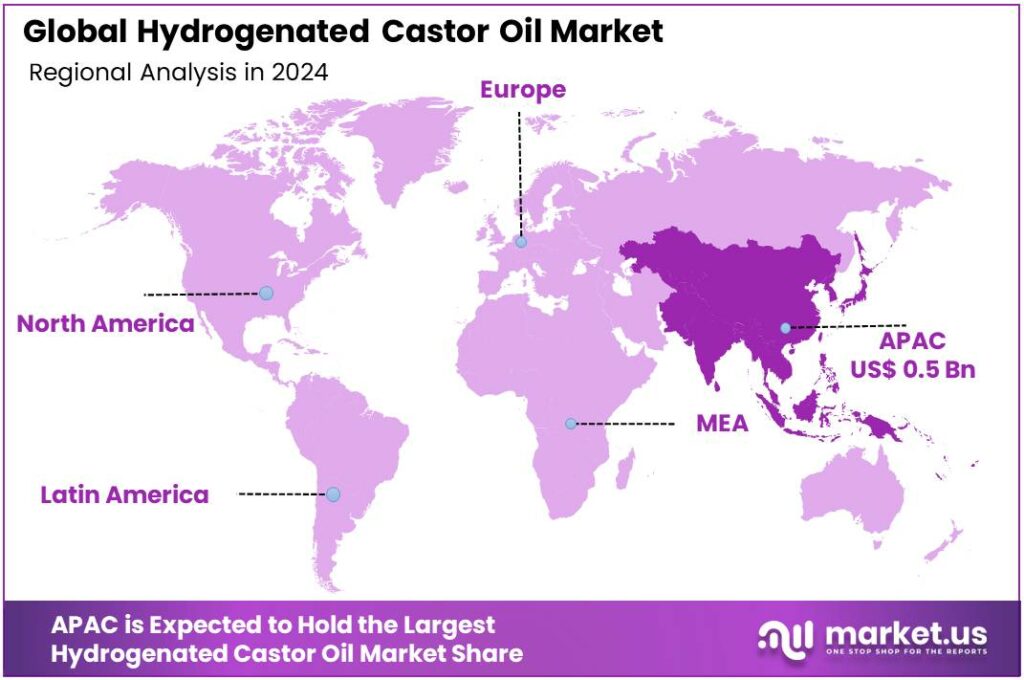

The Global Hydrogenated Castor Oil Market size is expected to be worth around USD 2.7 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 7.7% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 43.10% share, holding USD 0.5 Billion revenue.

Hydrogenated castor oil (HCO) is a fully saturated, wax-like derivative of castor oil produced by catalytic hydrogenation. It appears as white, odourless flakes with a melting point around 86°C, and is valued for its hardness, low iodine value, and oxidative stability. These properties make HCO a versatile bio-based structuring agent for lubricants, greases, coatings, plastic additives, and personal-care formulations, where it often replaces petroleum-derived waxes and synthetic thickeners.

Industrial dynamics for HCO are tightly linked to the upstream castor complex. In 2022, global castor production was estimated at 18.53 million tonnes, with India contributing about 16.18 million tonnes, making it by far the largest producer. Recent trade data show that India accounts for roughly 92% of world castor oil production and dominates export supply, underlining why most HCO capacity and processing know-how is concentrated in Indian clusters serving customers in Europe, North America and East Asia.

Policy-driven decarbonization is an important indirect driver for HCO and other bio-based chemicals. The European Union has made climate neutrality by 2050 a legally binding objective and has committed to cut greenhouse gas emissions by at least 55% by 2030 compared with 1990 levels under the European Green Deal and European Climate Law. Such frameworks push coatings, lubricants, plastics and personal-care manufacturers to lower their fossil-carbon footprint and increase the share of renewable raw materials, supporting gradual substitution of petro-waxes with HCO in premium and regulated applications.

Within the chemical sector, the bioeconomy is still emerging but growing steadily. A European progress assessment notes that bio-based products account for about 3% of the EU’s domestic chemical market, indicating substantial headroom for expansion as technology matures and policies tighten. For more advanced “bio-based platform chemicals,” the share is even smaller at roughly 0.3%, highlighting how early-stage many routes remain but also underscoring long-term opportunity for high-functionality materials such as HCO derivatives in specialty polyamides, polyurethane systems and high-performance lubricants.

Key Takeaways

- Hydrogenated Castor Oil Market size is expected to be worth around USD 2.7 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 7.7%.

- Flakes held a dominant market position, capturing more than a 67.4% share of the hydrogenated castor oil market.

- Cosmetics and Personal Care held a dominant market position, capturing more than a 39.8% share of the hydrogenated castor oil market.

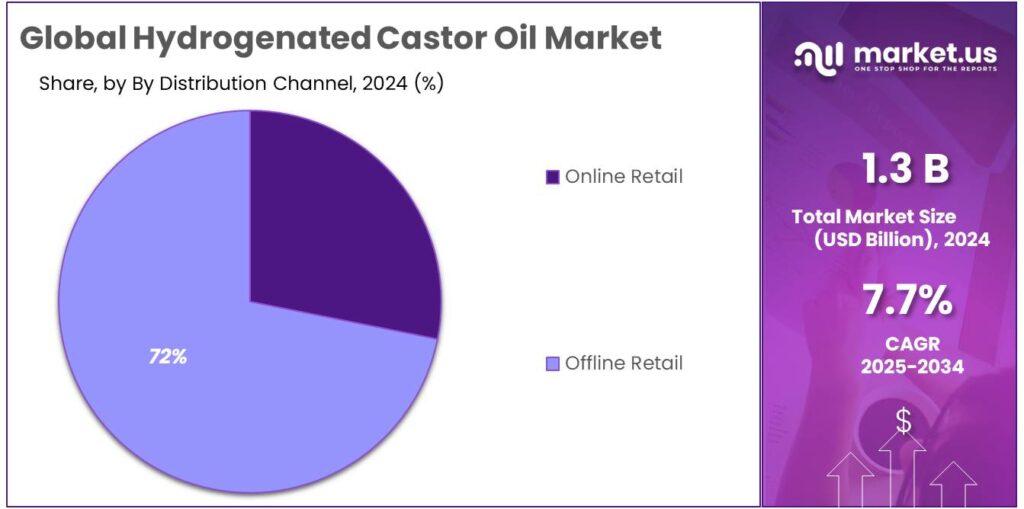

- Offline Retail held a dominant market position, capturing more than a 71.5% share of the hydrogenated castor oil.

- Asia Pacific region accounted for a dominant position in the hydrogenated castor oil market, capturing 43.10% of global demand and representing approximately USD 0.5 billion.

By Product Type Analysis

Flakes dominate with 67.4% share thanks to ease of handling and broad application

In 2024, Flakes held a dominant market position, capturing more than a 67.4% share of the hydrogenated castor oil market. This strong position is explained by flakes’ advantages in storage, dosing and downstream processing, which make them the preferred form for applications in cosmetics, lubricants, plastics and coatings. Manufacturers favor flakes because they simplify melting and blending, reduce waste, and enable consistent product quality across batches.

In 2025, demand for flakes is expected to remain solid as formulators prioritize supply-chain efficiency and product consistency; the format’s operational benefits are likely to sustain its preference over pastilles and liquids where handling and thermal control matter. Overall, the flakes segment’s large share reflects practical manufacturing benefits that translate into lower processing costs and more reliable end-product performance.

By Application Analysis

Cosmetics & personal care lead with 39.8% as formulators prefer HCO for texture and stability

In 2024, Cosmetics and Personal Care held a dominant market position, capturing more than a 39.8% share of the hydrogenated castor oil market. This strength is explained by the ingredient’s role as an emollient, thickener and stabilizer in creams, lipsticks, sunscreens and hair products; formulators value its skin-friendly feel and long shelf life.

Demand is concentrated in regions with rising personal-care spend and premiumisation of beauty routines, which has driven steady uptake in both mass and prestige segments. In 2025 the application is expected to remain the largest end-use, supported by ongoing product launches and replacement of less stable emulsifiers. The cosmetics segment’s blend of functional performance and regulatory acceptability ensures it will continue to anchor hydrogenated castor oil demand.

By Distribution Channel Analysis

Offline retail dominates with 71.5% share due to strong traditional purchase behaviour and wide availability

In 2024, Offline Retail held a dominant market position, capturing more than a 71.5% share of the hydrogenated castor oil distribution channel. This prominence is explained by the entrenched role of distributors, chemical merchants and industrial suppliers that serve formulators and small-to-medium manufacturers needing immediate availability, bulk packaging and local technical support.

Procurement is commonly executed through established dealer networks and regional warehouses, which reduces lead times and simplifies quality inspections for manufacturers of cosmetics, lubricants and plastics. For 2025, the offline channel is expected to remain the primary route to market, supported by continuing preference for face-to-face commercial relationships and bulk purchasing patterns, even as e-commerce gradually increases its footprint in specialty chemical trade.

Key Market Segments

By Product Type

- Flakes

- Powder

- Others

By Application

- Cosmetics and Personal Care

- Pharmaceuticals

- Food and Beverage

- Industrial Lubricants

- Surfactants and Emulsifiers

- Others

By Distribution Channel

- Online Retail

- Offline Retail

Emerging Trends

Shift Toward High-Value, Bio-Based Hydrogenated Castor Oil

One of the clearest recent trends is the move from bulk castor oil to hydrogenated castor oil (HCO) as a high-value, bio-based ingredient in cosmetics, personal care, food-contact coatings and lubricants. Indian export bodies already highlight a “growing market for value-added castor oil products such as hydrogenated castor oil and other derivatives,” signalling that the industry is steadily climbing the value chain rather than relying only on crude oil exports.

Behind this trend sits a tight and volatile vegetable oil market. FAO data show that the Vegetable Oil Price Index reached 169.4 points in October 2025, its highest level since July 2022, while the overall Food Price Index was 126.4 points, still more than 21% below its March 2022 peak but high in historical terms. With brands facing unstable prices for palm, soy and sunflower oil, long-term contracts around niche oils and derivatives such as HCO become more attractive.

Policy signals from major food and agriculture bodies also support this shift. The OECD-FAO Agricultural Outlook 2025-2034 notes that about 52% of global vegetable oil use is for food and food preparation, while 18% is already used as feedstock for biomass-based diesel. As biofuel mandates expand, food and fuel compete more directly for the same oils. This encourages manufacturers to explore non-edible yet plant-based oils like castor, which can be grown on marginal land and converted into hydrogenated grades for high-performance, non-food applications.

Supply is also consolidating around India, which strengthens the case for downstream processing. A recent NITI Aayog report on edible oils estimates that India accounts for an impressive 88.48% of global castor seed production, while still representing a small part of the country’s total oilseed area.

Drivers

Rising Vegetable Oil Demand and Bio-based Shift Drive Hydrogenated Castor Oil

One big force behind hydrogenated castor oil (HCO) demand is the world’s hunger for vegetable oils and bio-based ingredients. Global production of major oilseeds is projected to keep setting records, with FAO estimating main oil crops at about 872 million tonnes in 2023, and forecasting oilseed output around 695.9 million tonnes in 2024/25. This fast-growing vegetable-oil pool feeds not only food uses, but also oleochemicals, lubricants and waxes where HCO fits as a stable, plant-derived structuring agent.

Food demand is a big part of this story. The OECD-FAO Agricultural Outlook projects that by 2032, food use will account for around 57% of total vegetable-oil consumption worldwide, driven by population growth and rising intake in lower- and middle-income countries. At the same time, the same Outlook notes that vegetable oil markets will stay under pressure because they also serve biofuel and industrial uses. This dual pull encourages processors and formulators to look for higher-value, performance oleochemicals such as HCO, which can be used in food-contact packaging, coatings, lubricants and personal-care products derived from a non-edible oil.

Price trends underline how tight and important vegetable oils have become. FAO’s Food Price Index shows that vegetable oil prices rose 7.5% month-on-month in November 2024, and were a key driver of the index reaching a 19-month high. In February 2025, FAO again reported vegetable oil prices up by about 29.1% year-on-year, supported by supply concerns and strong biodiesel demand. For users of hydrogenated castor oil, these signals matter: when mainstream edible oils are tight and volatile, non-edible, specialty oils like castor gain importance as reliable feedstocks for industrial waxes, thickeners and additives that do not compete directly with food.

Policy and trade support add another layer to this driver. India, the dominant castor producer and exporter, treats castor oil as a strategic agri-export. A Government of India paper on agricultural trade shows castor oil export values rising from about USD 884 million to USD 1.27 billion over a recent five-year span, underlining strong global demand for this niche oil. Public agencies such as APEDA promote castor oil and its derivatives in overseas markets, while broader oilseed strategies aim to lift yields and secure raw material supply for processors.

Restraints

Feedstock Price Volatility and Climate Exposure Limit Hydrogenated Castor Oil Growth

One of the strongest restraining factors for hydrogenated castor oil (HCO) is the instability of its raw material supply and pricing. HCO depends almost entirely on castor oil, which in turn relies heavily on agricultural output concentrated in a single geography. According to the Food and Agriculture Organization (FAO), India contributes nearly 85% of global castor seed production, making the worldwide supply chain highly sensitive to weather shocks, crop diseases, and regional policy changes. When a single producing country faces disruptions, downstream industries using hydrogenated castor oil feel the impact almost immediately.

Climate variability is a growing concern. The Government of India’s Ministry of Earth Sciences reports that extreme weather events have increased by over 60% between 2010 and 2022, affecting rainfall-dependent crops such as castor. Castor seeds are largely grown in semi-arid regions of Gujarat, Rajasthan, and Andhra Pradesh, where rainfall irregularity directly influences yield. Lower yields tighten castor oil availability and push prices upward, creating cost uncertainty for hydrogenated castor oil manufacturers that operate on long-term supply contracts.

Price volatility in vegetable oils adds another layer of restraint. FAO’s Vegetable Oil Price Index shows that global vegetable oil prices surged by over 30% on average in 2022, driven by supply shortages, higher input costs, and energy market disruptions. Even though castor oil is non-edible, it is still affected by broader oilseed market dynamics, logistics costs, and competition for land with food crops. For industries using hydrogenated castor oil in lubricants, coatings, or cosmetics, this volatility makes budgeting difficult and discourages substitution away from petrochemical alternatives that often benefit from more stable pricing.

Another limiting aspect is competition from lower-cost synthetic substitutes. Petroleum-based waxes and polymers continue to dominate many industrial applications due to scale advantages. The International Energy Agency (IEA) highlights that fossil-based feedstocks still account for more than 80% of global chemical production, largely because of predictable supply chains and cost efficiency. While hydrogenated castor oil offers sustainability benefits, its price premium can be 15–25% higher than conventional mineral waxes during periods of raw material tightness, reducing its adoption in cost-sensitive industrial uses.

Opportunity

Bio-based and Non-Food Oil Uses Open New Doors for Hydrogenated Castor Oil

One of the biggest growth opportunities for hydrogenated castor oil (HCO) comes from the quiet but steady shift of vegetable oils into non-food, bio-based applications. HCO is made from non-edible castor oil, so it offers a waxy, high-melting, plant-derived alternative in coatings, plastics, lubricants and personal care. As policy makers and brands push for safer, bio-based ingredients, this niche moves from “nice to have” to strategic.

The OECD-FAO Agricultural Outlook 2025-2034 projects total consumption of agricultural and fish commodities to rise by about 13% by 2034, driven mainly by low- and middle-income countries. Within that, vegetable oils are pulled in two directions: food and energy. The Outlook notes that around 52% of vegetable oil use is for food and food preparation, while about 18% is already tied to biomass-based diesel feedstock, leaving roughly 30% for other industrial and technical uses such as cosmetics and coatings.

Energy and climate policy add another layer of opportunity. The International Energy Agency (IEA) estimates that biofuel production needs to grow to over 10 exajoules by 2030 in its Net Zero Emissions scenario, implying average annual growth of about 11% from current levels. It also expects biofuels from waste, residues and non-food crops to exceed 40% of total biofuel demand by 2030, up from roughly 9% in 2021.

In parallel, the EU’s Renewable Energy Directive (RED II) sets a 14% minimum share of renewable energy in road and rail transport by 2030, while newer revisions (RED III and REPowerEU) push the overall renewables share in final energy consumption towards 42.5–45% by 2030. These targets encourage wider use of bio-based feedstocks, not only for fuels but also for lubricants, plasticisers and additives that can help downstream industries cut their carbon footprints. HCO, as a stable, high-melting, non-edible oil derivative, fits neatly into this broader bioeconomy toolkit.

Regional Insights

Asia Pacific leads with 43.10% share, valued at USD 0.5 billion in 2024, driven by large manufacturing and consumer markets

In 2024, the Asia Pacific region accounted for a dominant position in the hydrogenated castor oil market, capturing 43.10% of global demand and representing approximately USD 0.5 billion in regional value. This leadership can be attributed to concentrated downstream activity in cosmetics, personal care, plastics and lubricant manufacturing located in major economies such as China, India and Southeast Asian hubs; production and consumption capacity in these markets has ensured ready uptake of hydrogenated castor oil in both domestic formulations and export-oriented supply chains. The regional supply chain has been supported by local processing units that simplify logistics for flakes and other solid product forms, thereby reducing lead times for formulators and small-to-medium manufacturers.

In 2025, the Asia Pacific market is expected to sustain its primacy as investments in personal-care product lines, polymer additives and specialty lubricants continue, and as regulatory emphasis on product quality and consistency encourages use of hydrogenated castor oil for texture and stability. Key demand drivers include rising per-capita cosmetic spend, expanding industrial production capacity, and the presence of dense distributor networks that support bulk procurement and technical service—factors that favour offline distribution channels and close supplier–buyer relationships.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Vertellus offers specialty derivatives including castor-based and hydrogenated chemistries tailored for cosmetics, lubricants and plastic additives. The company emphasizes flexible batch sizes, custom grades and close technical collaboration with customers. Vertellus’s strengths lie in agile production, customer-focused R&D and niche product optimization that supports small and medium formulators seeking consistent performance and regulatory compliance. Its market positioning is built on responsiveness and specialty-grade customization rather than commodity scale.

BASF supplies hydrogenated castor oil as part of a broad portfolio of specialty chemicals and surfactants. The company leverages large-scale production, global distribution, and formulation expertise to support personal-care and industrial customers. Its strengths include technical service, regulatory support, and integration with downstream raw materials. BASF’s market approach focuses on reliable supply, quality certification, and collaborative product development to help formulators improve texture, stability and shelf life in cosmetics and polymer additives.

Itoh Oil Chemicals supplies castor derivatives, including hydrogenated grades, with a strong presence in Asian markets. The firm emphasizes reliable sourcing, localized technical service and cost-competitive production suited to regional formulators in cosmetics, polymers and lubricants. Itoh’s advantages include regional distribution networks, experience with different castor feedstocks, and the ability to supply both standard and modified hydrogenated products for industrial applications.

Top Key Players Outlook

- BASF

- Vertellus

- ABITEC

- Berg + Schmidt

- Itoh Oil Chemicals

- Gokul Overseas

- ROYAL CASTOR PRODUCTS

- TGV Group

- Alpha Hi-Tech

Recent Industry Developments

In 2024 the BASF Group reported sales: €65.3 billion (preliminary full-year figure) and employed roughly 111,000 people worldwide, reflecting the company’s global reach and manufacturing scale.

In 2024 Gokul Overseas, reported a dedicated hydrogenated castor oil capacity of 31,920 MTPA and castor-derivatives capacity of 27,720 MTPA, enabling steady bulk supply of flakes, powders and specialty grades for cosmetics, polymers and lubricants.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Bn Forecast Revenue (2034) USD 2.7 Bn CAGR (2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Flakes, Powder, Others), By Application (Cosmetics and Personal Care, Pharmaceuticals, Food and Beverage, Industrial Lubricants, Surfactants and Emulsifiers, Others), By Distribution Channel (Online Retail, Offline Retail) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF, Vertellus, ABITEC, Berg + Schmidt, Itoh Oil Chemicals, Gokul Overseas, ROYAL CASTOR PRODUCTS, TGV Group, Alpha Hi-Tech Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hydrogenated Castor Oil MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Hydrogenated Castor Oil MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF

- Vertellus

- ABITEC

- Berg + Schmidt

- Itoh Oil Chemicals

- Gokul Overseas

- ROYAL CASTOR PRODUCTS

- TGV Group

- Alpha Hi-Tech