Global Hybrid vehicles Market Size, Share, Growth Analysis By Electric Powertrain Type (Parallel Hybrid, Series Hybrid), By Component Type (Battery, Electric Motor, Transmission), By Propulsion (HEV, PHEV, NGV), By Degree of Hybridization (Full Hybrid, Micro Hybrid, Mild Hybrid), By Vehicle Type (Passenger Car, Commercial Vehicle), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170358

- Number of Pages: 255

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Electric Powertrain Type Analysis

- By Component Type Analysis

- By Propulsion Analysis

- By Degree of Hybridization Analysis

- By Vehicle Type Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Hybrid Vehicles Company Insights

- Recent Developments

- Report Scope

Report Overview

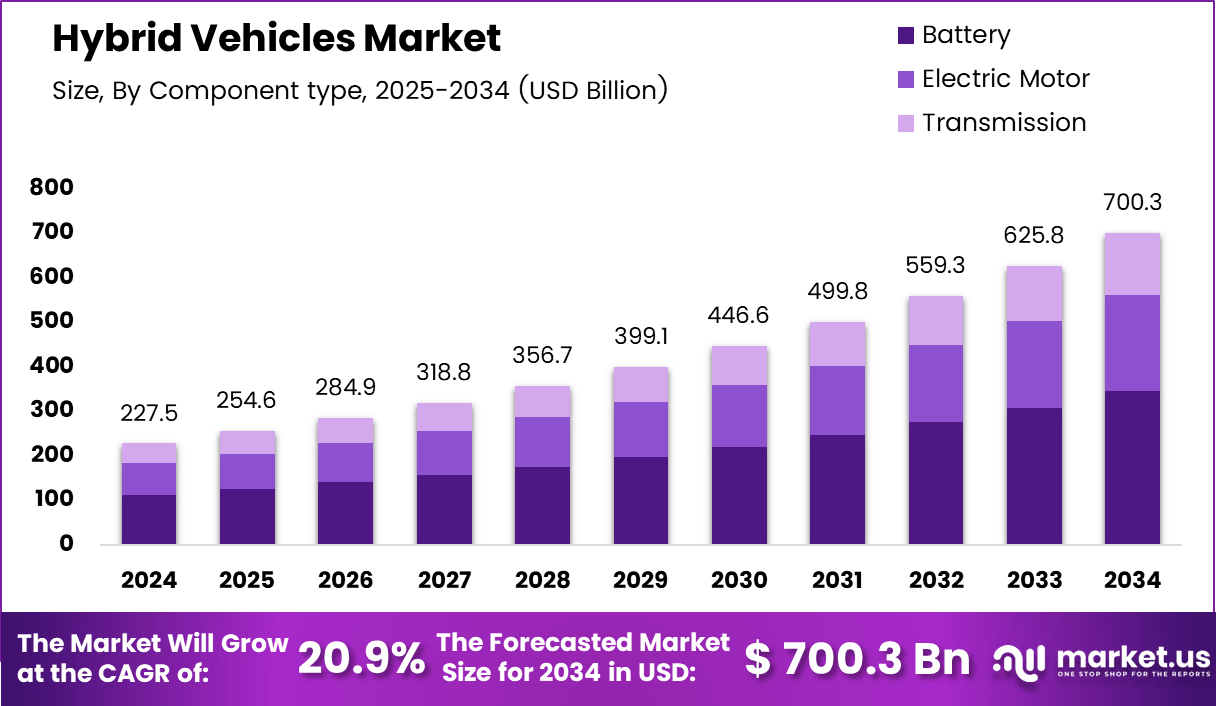

The Global Hybrid vehicles Market size is expected to be worth around USD 700.3 billion by 2034, from USD 227.5 billion in 2024, growing at a CAGR of 20.9% during the forecast period from 2025 to 2034.

The hybrid vehicles market refers to automobiles combining internal combustion engines with electric propulsion systems to improve fuel efficiency and lower emissions. From an analyst perspective, this market represents a transitional mobility solution supporting decarbonization while retaining driving familiarity. Consequently, hybrid vehicles bridge regulatory pressure, consumer practicality, and infrastructure readiness across evolving automotive ecosystems.

From a growth standpoint, the hybrid vehicles market expansion is supported by rising fuel efficiency mandates and gradual electrification strategies. Governments increasingly promote hybrid adoption through tax benefits, emission credits, and localization incentives. As a result, automakers and suppliers align investments toward hybrid powertrains to balance affordability, compliance, and scalability within competitive vehicle portfolios.

Moreover, the hybrid vehicles market offers strong opportunities in urban mobility, fleet operations, and mass-market passenger segments. As charging infrastructure gaps persist, hybrids provide operational reliability without range anxiety. Therefore, demand is expected to remain resilient across emerging economies where fuel costs, congestion, and emission regulations increasingly influence vehicle purchase decisions.

In addition, policy-driven investments in clean mobility are reinforcing market momentum. Regulatory frameworks emphasizing fuel economy standards and carbon reduction targets favor hybrid deployment. Consequently, public-private initiatives supporting localized battery assembly, power electronics, and drivetrain manufacturing strengthen domestic value chains while reducing dependency on fully electric readiness timelines.

Market dynamics are further shaped by changing consumer acceptance and improving hybrid intelligence system efficiency. Automakers increasingly integrate advanced energy management software, lightweight materials, and regenerative braking technologies. As a result, hybrid vehicles are achieving competitive performance metrics, lower lifecycle costs, and broader appeal across private and commercial buyers.

According to the Sale survey, strong hybrid utility vehicle volumes are increasingly influencing the overall market structure. Models such as Grand Vitara recorded 19,179 units, while Invicto accounted for 688 units. Combined strong-hybrid demand supported a retail market share increase to 18% from 17% in FY2025.

Similarly, according to SIAM quarterly disclosures, strong-hybrid sedan sales reached 226 units in Q1 FY2026, representing 283% year-on-year growth from 59 units previously. Despite modest absolute volumes, the segment maintained a stable 1% market share, reinforcing hybrid vehicles’ steady, regulation-driven expansion trajectory.

Overall, the hybrid vehicles market remains strategically positioned between conventional and fully electric mobility. With supportive regulations, incremental technological advances, and measurable sales traction, hybrids are expected to play a sustained role in automotive electrification strategies, offering both transitional stability and near-term commercial viability.

Key Takeaways

- The global hybrid vehicles market is projected to reach USD 700.3 billion by 2034, expanding from USD 227.5 billion in 2024 at a CAGR of 20.9%.

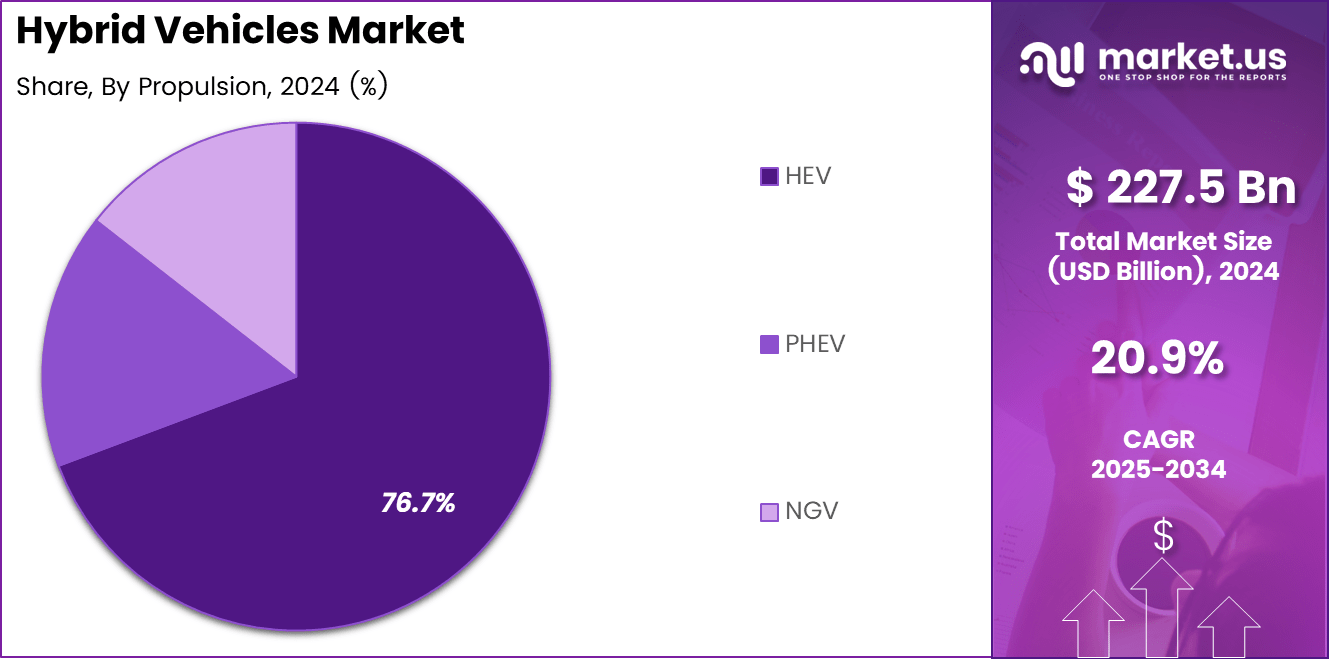

- By propulsion segment, HEV leads the market with a dominant share of 76.7%, reflecting widespread adoption due to infrastructure independence.

- By vehicle type, passenger cars account for the largest share at 88.5%, driven by high consumer demand and urban mobility needs.

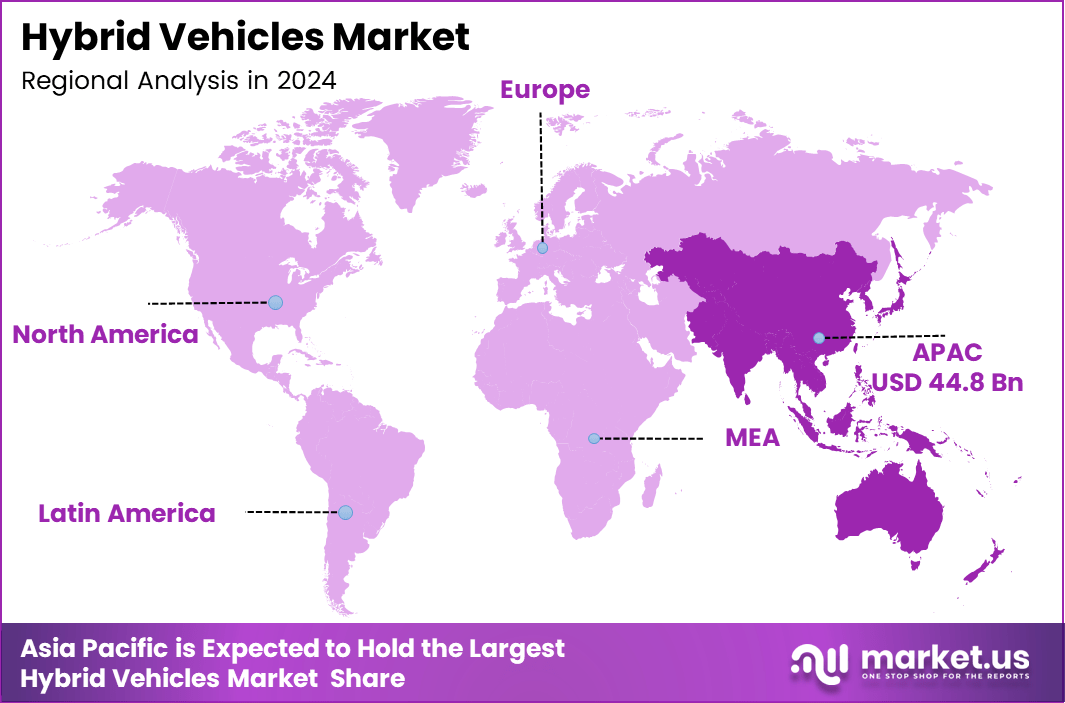

- Asia Pacific dominates the regional landscape with a market share of 44.8%, valued at USD 101.9 billion, supported by strong policy backing and fuel efficiency mandates.

By Electric Powertrain Type Analysis

Parallel Hybrid dominates with a 69.3% share due to balanced efficiency and cost advantages.

In 2024, Parallel Hybrid held a dominant market position in the By Electric Powertrain Type Analysis segment of the Hybrid Vehicles Market, with a 69.3% share. This dominance reflects its ability to combine electric motors and internal combustion engines efficiently, enabling smoother transitions and better fuel economy across varied driving conditions.

Series Hybrid systems operate with the electric motor solely driving the wheels, while the engine functions as a generator. This configuration supports efficient urban driving and reduced mechanical complexity. However, higher energy conversion losses and system costs limit its wider penetration compared to Parallel Hybrid solutions.

By Component Type Analysis

Battery leads with 49.2% share, driven by rising electrification depth.

In 2024, Battery held a dominant market position in the By Component Type Analysis segment of the Hybrid Vehicles Market, with a 49.2% share. Growing reliance on electric propulsion increases demand for advanced batteries that support higher energy density, durability, and improved thermal management.

Electric Motors play a critical role by enabling propulsion assistance, regenerative braking, and energy optimization. Continuous efficiency improvements and compact designs are enhancing system performance, although cost sensitivity remains a challenge across price-competitive vehicle categories.

Transmission systems integrate mechanical and electrical torque delivery. Their role is vital in ensuring seamless power distribution, especially in multi-mode hybrid architectures. Innovation focuses on reducing frictional losses while maintaining reliability under variable hybrid operating cycles.

By Propulsion Analysis

HEV dominates with a 76.7% share as the most adopted hybrid format.

In 2024, HEV held a dominant market position in the By Propulsion Analysis segment of the Hybrid Vehicles Market, with a 76.7% share. Strong consumer acceptance, absence of charging dependency, and regulatory compatibility drive widespread HEV adoption across regions.

PHEV adoption is supported by extended electric-only driving capability and lower tailpipe emissions. However, infrastructure dependence and higher acquisition costs moderate its market expansion compared to HEV platforms.

NGV hybrid configurations remain niche, combining alternative fuels with hybrid systems. Limited fueling infrastructure and higher system complexity constrain broader commercialization despite environmental benefits.

By Degree of Hybridization Analysis

Full Hybrid dominates with a 43.6% share due to optimal fuel savings.

In 2024, Full Hybrid held a dominant market position in the By Degree of Hybridization Analysis segment of the Hybrid Vehicles Market, with a 43.6% share. These systems enable electric-only operation at low speeds, delivering meaningful emission reduction and fuel efficiency improvements.

Micro Hybrid systems primarily support start-stop functionality and limited energy recovery. Their lower cost supports adoption in entry-level vehicles, although efficiency gains remain comparatively modest.

Mild Hybrid solutions provide torque assistance and regenerative braking benefits. They strike a balance between cost and performance, making them attractive for mid-range vehicle segments seeking compliance without full electrification.

By Vehicle Type Analysis

Passenger Car dominates with 88.5% share, reflecting high consumer demand.

In 2024, Passenger Car held a dominant market position in the By Vehicle Type Analysis segment of the Hybrid Vehicles Market, with an 88.5% share. Urbanization, fuel efficiency awareness, and regulatory pressure continue to favor hybrid passenger vehicles globally.

Commercial Vehicles adopt hybrid systems mainly to improve fleet efficiency and reduce operating costs. However, higher payload requirements and cost considerations limit penetration compared to passenger cars, keeping adoption selective across logistics and public transport applications.

Key Market Segments

By Electric Powertrain Type

- Parallel Hybrid

- Series Hybrid

By Component Type

- Battery

- Electric Motor

- Transmission

By Propulsion

- HEV

- PHEV

- NGV

By Degree of Hybridization

- Full Hybrid

- Micro Hybrid

- Mild Hybrid

By Vehicle Type

- Passenger Car

- Commercial Vehicle

Drivers

Stringent Fleet Emission Norms Accelerating OEM Electrification Roadmaps Drive Market Growth

Stringent fleet emission norms are a major driver for the hybrid vehicles market. Governments are tightening average fleet emission limits, pushing manufacturers to adopt cleaner powertrain technologies. As a result, hybrids help OEMs reduce emissions quickly without fully depending on charging infrastructure, making compliance more practical and cost-controlled.

Volatile fuel prices further support hybrid adoption by improving the total cost of ownership. Rising petrol and diesel prices increase consumer focus on fuel efficiency and long-term savings. Consequently, hybrid vehicles become attractive as they lower fuel consumption while maintaining driving range and usability across daily and long-distance travel needs.

Urban air quality mandates also play a critical role in driving the market. Cities are increasingly introducing low-emission zones and pollution control policies. Therefore, hybrids offer a viable solution by reducing tailpipe emissions and supporting cleaner urban mobility without drastic changes in driving behavior.

Government-backed fuel efficiency targets reshape the vehicle powertrain mix. Incentives, tax benefits, and efficiency-based regulations encourage manufacturers to expand hybrid offerings. As a result, hybrids emerge as a strategic bridge between conventional vehicles and full electrification.

Restraints

Higher Upfront Vehicle Pricing Versus Conventional ICE Alternatives Limits Market Expansion

Higher upfront pricing remains a key restraint for the hybrid vehicles market. Hybrid systems involve additional components such as batteries and electric motors, increasing vehicle costs. As a result, price-sensitive buyers often delay adoption despite long-term fuel savings.

Battery degradation concerns also impact long-term ownership confidence. Consumers worry about replacement costs and performance decline over time. Consequently, uncertainty around battery life and resale value slows wider acceptance, especially in emerging markets.

Growth Factors

Expansion of Strong Hybrid Adoption in Mass Market Passenger Vehicles Creates New Opportunities

Strong hybrid adoption in mass market passenger vehicles presents a major growth opportunity. Manufacturers are introducing affordable hybrid models targeting high-volume segments. As a result, hybrids can reach a broader customer base while meeting efficiency and emission requirements.

Integration of hybrid systems in commercial and fleet vehicles also offers growth potential. Fleet operators seek fuel savings and lower emissions. Therefore, hybrids support operational efficiency and regulatory compliance in logistics and urban transport applications.

Emerging Trends

Shift from Mild Hybrids Toward Full and Plug-In Hybrid Architectures Shapes Market Trends

A shift from mild hybrids toward full and plug-in hybrid architectures is a key market trend. Consumers demand higher fuel savings and electric-only driving capability. Consequently, manufacturers invest in advanced hybrid platforms.

AI-enabled energy management systems are increasingly optimizing fuel and battery usage. These systems improve efficiency by adapting power delivery in real time. Additionally, OEMs focus on hybrid SUVs and crossovers, which support volume growth as these segments dominate global vehicle demand.

Regional Analysis

Asia Pacific Dominates the Hybrid Vehicles Market with a Market Share of 44.8%, Valued at USD 101.9 Billion

Asia Pacific accounted for a dominant 44.8% share of the hybrid vehicles market, reaching a valuation of USD 101.9 billion, driven by rapid urbanization, rising fuel efficiency concerns, and strong policy-level electrification support. Large-scale adoption of hybrid powertrains is supported by emissions reduction mandates and consumer preference for cost-effective transition technologies. Expanding charging infrastructure and favorable tax incentives further reinforce regional market leadership.

North America Hybrid Vehicles Market Trends

North America continues to represent a mature and technology-driven hybrid vehicles market, supported by stringent fuel economy standards and growing environmental awareness. Automakers increasingly position hybrids as a bridge solution amid uneven charging infrastructure rollout. Demand remains strong across passenger vehicles, particularly in urban and suburban mobility use cases.

Europe Hybrid Vehicles Market Trends

Aggressive carbon neutrality targets and tightening fleet emission regulations shape Europe’s hybrid vehicles market. Hybrids are widely adopted as compliance-enabling solutions ahead of full electrification timelines. Government-backed incentives, congestion-zone benefits, and high fuel costs sustain consistent demand across both private and fleet segments.

U.S. Hybrid Vehicles Market Trends

The U.S. hybrid vehicles market demonstrates steady growth as consumers balance performance expectations with fuel efficiency benefits. Hybrids remain attractive in regions with long driving distances and limited charging density. Policy emphasis on emission reduction and consumer incentives supports broader penetration across multiple vehicle categories.

Middle East and Africa Hybrid Vehicles Market Trends

The Middle East and Africa region is witnessing gradual hybrid vehicle adoption, driven by fuel diversification strategies and emerging sustainability frameworks. Hybrids are increasingly viewed as practical alternatives amid evolving regulatory environments. Market expansion is supported by urban mobility projects and rising awareness of emission control benefits.

Latin America Hybrid Vehicles Market Trends

Latin America shows developing momentum in hybrid vehicle adoption as governments promote cleaner mobility solutions. Hybrids offer a balanced option where full EV infrastructure remains limited. Rising fuel prices, urban air quality concerns, and policy-led incentives are expected to support continued regional market development.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Hybrid Vehicles Company Insights

Delphi continues to hold a strategically relevant position in the global hybrid vehicles market through its deep expertise in power electronics, advanced propulsion systems, and vehicle electrification architectures. In 2024, the company’s focus on improving inverter efficiency, thermal management, and integrated hybrid modules supports automakers in meeting tightening emission norms while balancing cost and performance. Delphi’s strength lies in its ability to align component innovation with scalable hybrid platforms, making it well positioned for both mild and full hybrid adoption across high-volume vehicle segments.

Continental remains a key enabler of hybrid vehicle growth by leveraging its strong capabilities in electrified powertrain systems, battery management solutions, and intelligent energy control software. In 2024, the company’s hybrid-focused portfolio supports OEMs transitioning from internal combustion engines to electrified drivetrains without disrupting existing manufacturing ecosystems. Analysts observe that Continental’s system-level integration approach enhances fuel efficiency and drivability, positioning it favorably as regulatory pressure and urban emission standards continue to accelerate hybrid vehicle penetration globally.

BorgWarner plays a critical role in advancing hybrid vehicle efficiency through its expanding portfolio of electric motors, power electronics, and transmission technologies optimized for hybrid applications. In 2024, the company’s emphasis on modular electrification solutions allows automakers to adapt hybrid architectures across multiple vehicle classes and regional markets. From an analyst perspective, BorgWarner’s focus on scalable electrification technologies strengthens its competitive position as demand rises for cost-effective hybrid systems that deliver measurable improvements in fuel economy.

ZF maintains strong momentum in the hybrid vehicles market by combining advanced transmission systems with integrated electric drive solutions tailored for hybrid drivetrains. In 2024, ZF’s hybrid-focused innovations will help manufacturers achieve smoother power delivery, reduced emissions, and enhanced driving efficiency across passenger and commercial vehicles. Analysts note that ZF’s ability to embed electrification within conventional drivetrain platforms supports gradual electrification strategies, making it a critical partner for OEMs navigating the transition toward low-emission mobility.

Top Key Players in the Market

- Delphi

- Continental

- BorgWarner

- ZF

- Schaeffler

- Toyota

- Ford

- Volvo

- Honda

Recent Developments

- In Jan 2025, the company announced it had fully acquired Punch Powertrain’s shares in their eDCT hybrid transmission joint venture, gaining complete control over design and production at plants in Metz, France and Turin, Italy. This move accelerates the expansion of MHEV and PHEV programs by strengthening in house hybrid transmission development and manufacturing capabilities.

- In Aug 2025, Hyundai Motor Company and General Motors announced plans for their first five co developed vehicles, marking a major milestone in their strategic collaboration.The program includes four vehicles for Central and South America and an electric commercial van for North America, with platforms supporting internal combustion and hybrid propulsion.

Report Scope

Report Features Description Market Value (2024) USD 227.5 billion Forecast Revenue (2034) USD 700.3 billion CAGR (2025-2034) 20.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Electric Powertrain Type (Parallel Hybrid, Series Hybrid), By Component Type (Battery, Electric Motor, Transmission), By Propulsion (HEV, PHEV, NGV), By Degree of Hybridization (Full Hybrid, Micro Hybrid, Mild Hybrid), By Vehicle Type (Passenger Car, Commercial Vehicle) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Delphi, Continental, BorgWarner, ZF, Schaeffler, Toyota, Ford, Volvo, Honda Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Delphi

- Continental

- BorgWarner

- ZF

- Schaeffler

- Toyota

- Ford

- Volvo

- Honda