Human Chorionic Gonadotropin Market By Product Type (Native and Recombinant), By Therapeutic Area (Female Infertility Treatment, Male Hypogonadism, Chronic Pain, and Others), By Distribution Channel (Hospital Pharmacies, Online Pharmacies, and Retail Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153312

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

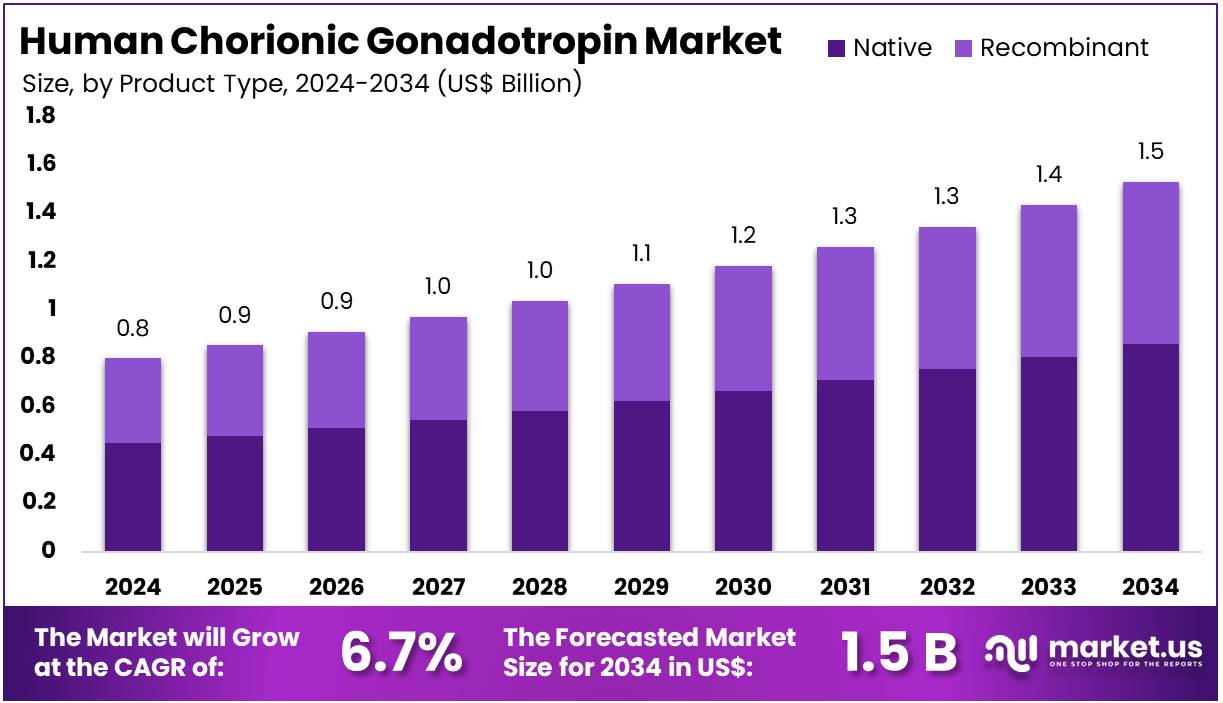

The Human Chorionic Gonadotropin Market Size is expected to be worth around US$ 1.5 billion by 2034 from US$ 0.8 billion in 2024, growing at a CAGR of 6.7% during the forecast period 2025 to 2034.

Increasing demand for fertility treatments and rising awareness about reproductive health are driving the growth of the human chorionic gonadotropin (hCG) market. hCG, a hormone naturally produced during pregnancy, plays a crucial role in various medical applications, including in vitro fertilization (IVF), weight loss treatments, and male fertility management. In IVF, hCG is used to trigger ovulation and support the early stages of pregnancy.

As the global infertility rate rises, particularly among older women, the demand for IVF and fertility treatments continues to grow, directly contributing to the increased use of hCG. Additionally, hCG is being explored for its potential in weight loss programs, where it is used in combination with low-calorie diets to promote fat loss. The growing emphasis on reproductive health and advancements in assisted reproductive technologies create significant opportunities for the market, especially in developing countries.

In May 2024, Turkey made a formal request to India to supply gonadotropin drugs, including hCG, due to the growing demand for in-vitro fertilization in Turkey. This highlights a key trend in the market where countries are actively seeking reliable sources of fertility drugs to meet rising demand.

Recent trends also show increasing research into the safety and efficacy of hCG in different therapeutic areas, fostering innovation in treatment regimens. As healthcare providers continue to expand access to fertility and reproductive health treatments, the hCG market is poised for continued growth, driven by advancements in technology and growing patient needs.

Key Takeaways

- In 2024, the market for human chorionic gonadotropin generated a revenue of US$ 0.8 billion, with a CAGR of 6.7%, and is expected to reach US$ 1.5 billion by the year 2034.

- The product type segment is divided into native and recombinant, with native taking the lead in 2023 with a market share of 56.3%.

- Considering therapeutic area, the market is divided into female infertility treatment, male hypogonadism, chronic pain, and others. Among these, female infertility treatment held a significant share of 54.8%.

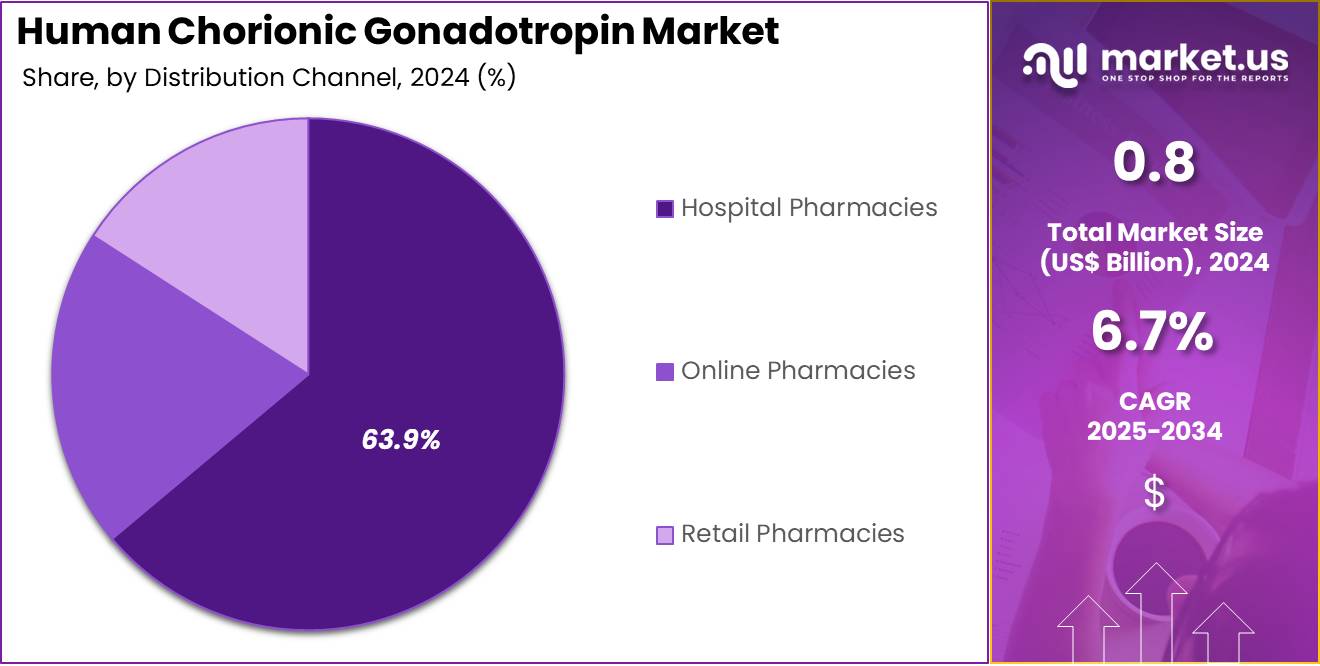

- Furthermore, concerning the distribution channel segment, the market is segregated into hospital pharmacies, online pharmacies, and retail pharmacies. The hospital pharmacies sector stands out as the dominant player, holding the largest revenue share of 63.9% in the human chorionic gonadotropin

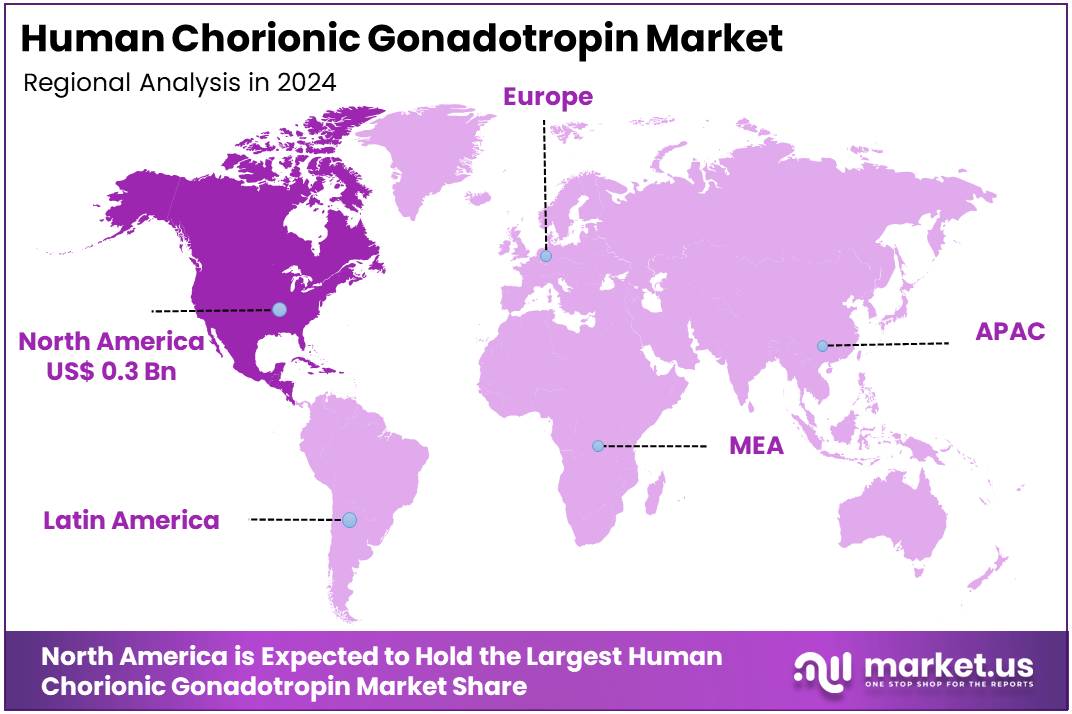

- North America led the market by securing a market share of 43.2% in 2023.

Product Type Analysis

The native form of human chorionic gonadotropin (hCG) dominates the market, holding a share of 56.3%. This growth is expected to continue as native hCG remains the most commonly used form in both therapeutic and diagnostic applications. The natural structure of native hCG allows for its use in fertility treatments and hormone replacement therapies, especially in the treatment of female infertility and male hypogonadism. Native hCG is anticipated to see sustained demand due to its proven efficacy in stimulating ovulation in women undergoing fertility treatments, as well as in stimulating testosterone production in men with low levels of gonadotropins.

Furthermore, native hCG is generally more cost-effective than recombinant forms, making it an attractive option for many healthcare providers and patients. The growing prevalence of infertility worldwide is projected to further drive the demand for native hCG in fertility treatments, ensuring the segment’s continued dominance in the market. Additionally, as healthcare systems and providers focus on affordable treatment options, native hCG will likely maintain its leading position in the market.

Therapeutic Area Analysis

Female infertility treatment holds the largest share of 54.8% in the therapeutic area segment of the human chorionic gonadotropin market. This growth is primarily driven by the increasing rates of infertility globally, particularly among women in developed countries where delayed childbearing and lifestyle factors contribute to the rising incidence of infertility. The demand for hCG-based therapies in assisted reproductive technologies (ART), such as in vitro fertilization (IVF), is projected to increase as more women seek fertility treatments.

hCG plays a crucial role in stimulating ovulation and ensuring the release of mature eggs for fertilization, which is essential in ART procedures. As awareness about infertility treatment options grows, coupled with advancements in fertility treatments, the market for hCG in female infertility treatment is expected to expand further. Additionally, the increasing success rates of ART and the growing number of fertility clinics are anticipated to contribute to the rising demand for hCG treatments in this therapeutic area.

Distribution Channel Analysis

Hospital pharmacies represent the largest distribution channel in the human chorionic gonadotropin market, holding 63.9% of the share. This growth is anticipated to continue as hospitals remain the primary settings for the administration of hCG in fertility treatments, hormone therapies, and certain diagnostic procedures. Hospital pharmacies are expected to continue playing a key role in the distribution of hCG because they offer controlled environments and access to specialized healthcare professionals who can administer treatments, such as those for infertility and hormone-related conditions, safely and effectively.

The increasing number of women undergoing ART procedures, along with the rising demand for hCG injections in male hypogonadism treatments, will likely drive the continued reliance on hospital pharmacies for the supply of these products. Additionally, as hospitals focus on providing comprehensive care for complex conditions, including infertility and chronic pain management, the demand for hCG in hospital pharmacies is projected to grow. The centralization of care and the specialized nature of hospital treatments are key factors in maintaining hospital pharmacies’ dominance in the distribution of hCG products.

Key Market Segments

By Product Type

- Native

- Recombinant

By Therapeutic Area

- Female Infertility Treatment

- Male Hypogonadism

- Chronic Pain

- Others

By Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

Drivers

Rising Global Infertility Rates and Delayed Parenthood are Driving the Market

The increasing global prevalence of infertility and the growing trend of delayed parenthood are significant drivers propelling the human chorionic gonadotropin (hCG) market. More individuals and couples are facing challenges in conceiving naturally, leading to a greater reliance on assisted reproductive technologies (ART) where hCG plays a crucial role in ovulation induction and pregnancy support.

Factors such as lifestyle changes, environmental factors, and increasing maternal age contribute to these rising infertility rates. The World Health Organization (WHO) reported in April 2023 that approximately one in six people globally experience infertility in their lifetime, affecting millions of individuals of reproductive age. In the US, a report from Cofertility in January 2025, citing data from the CDC, revealed that there were 389,993 IVF cycles performed in the US in 2022, marking a 6% increase from 2021, and resulting in 91,771 babies born from IVF in 2022, up from 89,208 in 2021.

This substantial and increasing number of ART cycles directly correlates with a higher demand for hCG, which is essential for stimulating egg maturation and triggering ovulation in women undergoing procedures like in vitro fertilization (IVF) or intrauterine insemination (IUI). The societal shift towards later family planning also increases the need for fertility interventions, further fueling the market.

Restraints

Complex Regulatory Approval Processes and Supply Chain Vulnerabilities are Restraining the Market

The complex and lengthy regulatory approval processes for new hCG products, alongside inherent vulnerabilities within the raw material supply chain, pose significant restraints on the market. HCG, particularly urinary-derived hCG, relies on human urine as its source, which can be inconsistent in supply and quality, posing collection and purification challenges.

Furthermore, ensuring the safety and efficacy of biological products like hCG requires extensive clinical trials and rigorous scrutiny from regulatory bodies such as the US Food and Drug Administration (FDA). Any delays in approval or issues with manufacturing compliance can severely impact product availability and market entry. While specific numbers on hCG-related supply chain disruptions are not publicly aggregated, the broader pharmaceutical industry has faced significant challenges.

A McKinsey Global Supply Chain Leader Survey in October 2024 revealed that nine in ten respondents encountered supply chain challenges in 2024, emphasizing continued instability due to factors like geopolitical conflicts and trade tensions. The FDA’s Adverse Event Reporting System (FAERS) also continuously monitors potential safety signals for all drugs, including hCG, requiring manufacturers to remain vigilant regarding post-market surveillance and potential product modifications. These factors contribute to higher development costs, longer lead times, and potential shortages, thereby restraining the overall growth and stability of the market.

Opportunities

Technological Advancements in Recombinant HCG Production are Creating Growth Opportunities

Significant technological advancements in the production of recombinant human chorionic gonadotropin (rhCG) are creating substantial growth opportunities in the market. Unlike urinary-derived hCG, rhCG is produced using genetically engineered cell lines, offering a more consistent, pure, and potentially safer product profile, free from human-derived contaminants. This method allows for large-scale, controlled production, addressing the supply limitations and variability inherent in urinary sources.

The increased purity and reduced immunogenicity of rhCG make it a preferred option for many fertility clinics and patients. Several pharmaceutical companies are continuously investing in optimizing rhCG production processes, leading to more efficient manufacturing and potentially lower costs over time. This technological evolution enhances product reliability, expands accessibility to high-quality fertility treatments, and opens avenues for novel therapeutic applications, thereby driving significant opportunities within the market.

Impact of Macroeconomic / Geopolitical Factors

Global macroeconomic conditions, including inflation and the overall level of investment in healthcare infrastructure, significantly influence the human chorionic gonadotropin (hCG) market by affecting treatment affordability and research funding. Inflation can increase the operational costs for pharmaceutical companies manufacturing hCG, from raw materials and energy to specialized labor, potentially leading to higher drug prices for patients.

Since fertility treatments, including those involving hCG, are often costly and may not be fully covered by insurance in many regions, economic downturns or rising living costs can reduce patient access and willingness to pursue such treatments. The Centers for Medicare & Medicaid Services (CMS) reported in December 2024 that US national health spending increased by 7.5% in 2023, reaching US$ 4.9 trillion, outpacing GDP growth for the first time since the pandemic, indicating a robust but increasingly expensive healthcare landscape.

Geopolitical stability also plays a role in ensuring smooth global supply chains for the complex components and ingredients required for hCG production. Despite economic challenges, the deeply personal and societal importance of addressing infertility ensures a continued demand for effective fertility treatments, fostering resilience and investment in the hCG market.

Evolving US trade policies, including the potential for tariffs on imported pharmaceutical raw materials, finished drug products, and specialized manufacturing equipment, are shaping the human chorionic gonadotropin (hCG) market by influencing production costs and supply chain stability. The manufacture of hCG, especially recombinant versions, relies on complex global supply chains for cell culture components, purification resins, and specialized equipment.

Tariffs on these imports can increase the manufacturing expenses for pharmaceutical companies operating in or importing into the US, potentially leading to higher drug prices or reduced profitability. The US Bureau of Economic Analysis (BEA) reported in February 2025 that imports of pharmaceutical preparations into the US increased by US$ 43.6 billion in 2024, highlighting the substantial volume of imported medicines.

While specific tariffs directly targeting hCG products or their unique inputs are not always widely publicized, broader trade tensions and tariff threats, such as those discussed in an Al Jazeera report from July 2025 regarding a potential 20% levy on pharmaceutical products, create uncertainty. These policies, while sometimes aimed at encouraging domestic production, can raise immediate costs for manufacturers and ultimately for patients seeking fertility treatments. The critical need for accessible fertility therapies, however, drives efforts by manufacturers to optimize supply chains and advocate for policies that minimize adverse impacts.

Latest Trends

Growing Adoption of Personalized Fertility Treatment Protocols is a Recent Trend

A prominent recent trend shaping the human chorionic gonadotropin market in 2024 and continuing into 2025 is the growing adoption of personalized fertility treatment protocols. This approach leverages individual patient characteristics, such as genetic profiles, ovarian reserve markers, and previous treatment responses, to tailor medication dosages and treatment timelines. The goal is to optimize outcomes while minimizing risks like ovarian hyperstimulation syndrome (OHSS), a serious side effect sometimes associated with hCG administration.

Clinicians are increasingly using predictive analytics and advanced diagnostics to guide decisions on hCG dosage and timing. My OBGyne San Tan Valley, in its January 2025 outlook on emerging trends in fertility treatments, emphasized the integration of personalized medicine, stating that genetic profiling now allows clinicians to customize treatment plans based on an individual’s unique genetic makeup, potentially reducing the number of cycles required to achieve pregnancy.

This shift away from a “one-size-fits-all” approach leads to more effective and safer use of hCG, as dosages are finely tuned to each patient’s physiological response. The emphasis on individualized care, supported by advances in diagnostic tools and a deeper understanding of patient variability, is optimizing the use of hCG and driving innovation in its application within fertility clinics.

Regional Analysis

North America is leading the Human Chorionic Gonadotropin Market

The human chorionic gonadotropin (hCG) market in North America, holding a significant 43.2% share, experienced robust growth in 2024. This expansion was primarily driven by the increasing prevalence of infertility and a growing reliance on assisted reproductive technologies (ART), where hCG plays a crucial role in ovulation induction and pregnancy support.

The Centers for Disease Control and Prevention (CDC) reported that in 2022, the number of babies born from in vitro fertilization (IVF) cycles in the US reached 91,771, an increase from 89,208 in 2021, demonstrating the continued growth in ART procedures that frequently utilize hCG. Furthermore, advancements in diagnostic applications, such as early pregnancy detection and monitoring of certain gynecological conditions, also contributed to the demand.

The general fertility rate in the United States, although declining slightly to 54.5 births per 1,000 females aged 15–44 in 2023 from 56.0 in 2022, as per CDC data, continues to highlight a substantial population seeking fertility interventions. Key pharmaceutical players with strong portfolios in reproductive health have seen consistent performance.

Organon, a company with a significant focus on women’s health, reported that its Women’s Health revenue increased 7% on an as-reported basis and 8% excluding foreign exchange impacts in the fourth quarter of 2023 compared to the fourth quarter of 2022, driven primarily by strong growth in its fertility products.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The human chorionic gonadotropin market in Asia Pacific is expected to grow considerably during the forecast period. This anticipated expansion is primarily fueled by a rising incidence of infertility across the region, increasing awareness about available fertility treatments, and significant improvements in healthcare infrastructure. Countries within Asia Pacific, including China and India, are experiencing demographic shifts and lifestyle changes that contribute to higher rates of infertility, leading more couples to seek medical assistance.

The World Health Organization (WHO) reported in April 2023 that approximately 17.5% of the adult population globally, or 1 in 6 people, experience infertility, indicating a substantial unmet need for fertility care in populous regions like Asia Pacific. Governments and healthcare providers are making concerted efforts to enhance access to assisted reproductive technologies and other fertility interventions. This includes increased investment in specialized clinics and the adoption of advanced treatment protocols.

Merck KGaA, a leading global science and technology company with a strong presence in healthcare, particularly in fertility treatments, continues to expand its operations in the Asia Pacific region, reflecting the growing demand for its reproductive health portfolio. As disposable incomes rise and healthcare infrastructure develops further, more individuals are likely to access sophisticated fertility solutions, which will drive the demand for this hormone across Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the human chorionic gonadotropin (hCG) market employ several strategies to drive growth and enhance patient care. They focus on developing recombinant hCG formulations to improve safety and efficacy, addressing the limitations of native hCG extracted from human urine. Companies are investing in advanced manufacturing technologies to scale production and meet the growing demand for fertility treatments.

Strategic partnerships and acquisitions enable these organizations to expand their product portfolios and geographic reach. Additionally, they are enhancing patient access by increasing the availability of hCG products through various distribution channels, including hospital and retail pharmacies. Emphasis on research and development ensures the continuous innovation of hCG-based therapies to address emerging medical needs.

Merck & Co., Inc., a prominent player in the hCG market, specializes in the development and manufacturing of pharmaceutical products, including hCG-based therapies for fertility treatments. The company offers a range of hCG formulations, such as follitropin alfa and lutropin alfa, which are used to stimulate ovulation in women undergoing assisted reproductive technologies. Merck’s strong product portfolio and global presence have positioned it as a leader in the hCG market. The company’s commitment to innovation and patient-centered care continues to drive its success in the fertility treatment sector.

Top Key Players in the Human Chorionic Gonadotropin Market

- Merck Serono

- Lupin

- Livzon Pharmaceuticals

- Fresenius Kabi

- First Response

- Ferring Pharmaceuticals

- Aspen API

- Abingdon Health

Recent Developments

- In March 2025, Abingdon Health, a medical testing kit manufacturer based in York, expanded its market by introducing its pregnancy testing kits into mainland Europe, including Poland, Germany, and Austria. The company’s Salistick is the first saliva-based pregnancy test, and they received an initial order of 70,000 units.

- In October 2024, First Response launched its Multi Check Pregnancy Test Kit, with EasyCup, which includes two Rapid Result pregnancy tests for added assurance. This kit offers reliable results and is the only one that combines an all-in-one cup test for ultimate convenience and simplicity.

Report Scope

Report Features Description Market Value (2024) US$ 0.8 billion Forecast Revenue (2034) US$ 1.5 billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Native and Recombinant), By Therapeutic Area (Female Infertility Treatment, Male Hypogonadism, Chronic Pain, and Others), By Distribution Channel (Hospital Pharmacies, Online Pharmacies, and Retail Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Merck Serono, Lupin, Livzon Pharmaceuticals, Fresenius Kabi, First Response, Ferring Pharmaceuticals, Aspen API, Abingdon Health. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Human Chorionic Gonadotropin MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Human Chorionic Gonadotropin MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Merck Serono

- Lupin

- Livzon Pharmaceuticals

- Fresenius Kabi

- First Response

- Ferring Pharmaceuticals

- Aspen API

- Abingdon Health