Global Household Cleaning Agents Market Size, Share, And Business Benefits By Product Type (Laundry Detergents, Surface Cleaners, Dish Cleaners, Toilet Cleaners, Others), By Product Form (Liquids, Wipes, Sprays, Powders), By Category (Bio-Based, Synthetic), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retailers, Specialty Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152554

- Number of Pages: 202

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

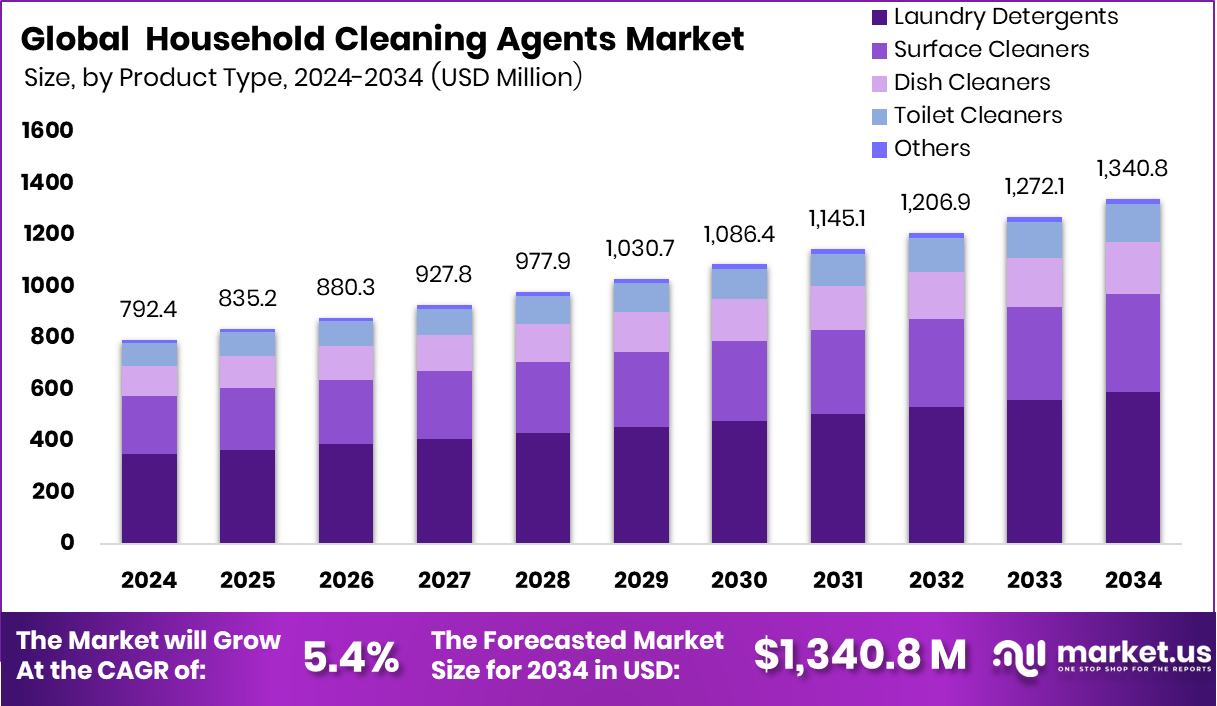

Global Household Cleaning Agents Market is expected to be worth around USD 1,340.8 million by 2034, up from USD 792.4 million in 2024, and grow at a CAGR of 5.4% from 2025 to 2034. Strong hygiene awareness in Europe supported its USD 350.0 million market position.

Household cleaning agents are chemical or natural formulations specifically designed to remove dirt, stains, germs, and bad odors from surfaces within homes. These products are used in kitchens, bathrooms, laundry rooms, and living spaces to maintain hygiene and aesthetic cleanliness. They come in various forms, such as liquids, sprays, powders, and wipes, and typically contain ingredients like surfactants, disinfectants, solvents, and fragrances.

The household cleaning agents market refers to the global or regional trade and consumption of cleaning products designed for residential use. This market includes a wide range of product categories like surface cleaners, dishwashing products, toilet cleaners, and floor cleaners. It is influenced by various factors, including consumer lifestyle, urbanization, health awareness, and product innovation.

The growth of the household cleaning agents market is primarily driven by rising awareness of health and hygiene among consumers. Increasing focus on sanitation, especially after global health concerns, has prompted more frequent use of disinfectants and cleaning products in homes. Urbanization and the rise in nuclear families have further supported market expansion, as smaller households rely more on ready-to-use, efficient cleaning solutions.

Growing demand for convenience-based products is fueling steady consumption of household cleaning agents. Consumers today seek easy-to-use, fast-acting products that offer effective results with minimal effort. The shift toward eco-conscious lifestyles is also influencing demand for non-toxic, biodegradable, and refillable cleaning agents. According to an industry report, Koparo, a direct-to-consumer (D2C) home cleaning brand, has secured ₹14.5 crore in fresh funding.

Key Takeaways

- Global Household Cleaning Agents Market is expected to be worth around USD 1,340.8 million by 2034, up from USD 792.4 million in 2024, and grow at a CAGR of 5.4% from 2025 to 2034.

- Laundry detergents lead the household cleaning agents market, capturing 44.1% of total product type share.

- Liquid products dominate the household cleaning agents market with a 58.3% share, driven by user convenience.

- Bio-based cleaning agents account for 66.4% of the market share, reflecting rising demand for sustainable household solutions.

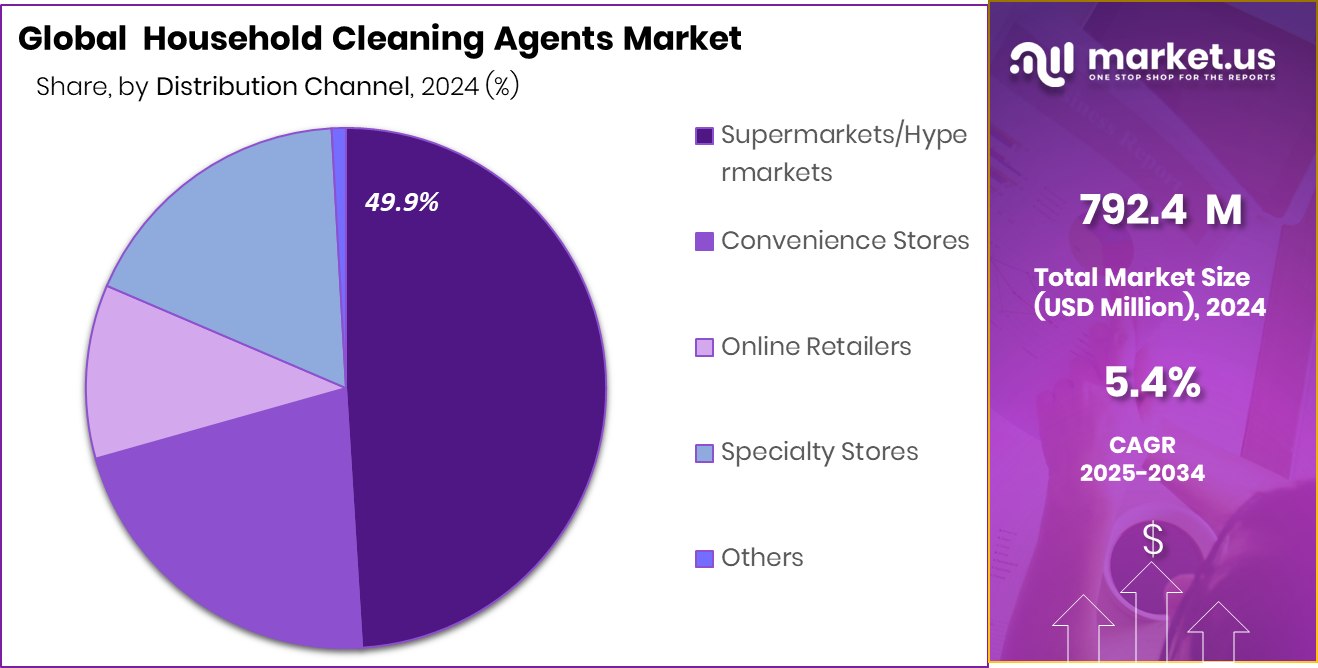

- Supermarkets and hypermarkets remain key distribution channels, holding a 49.9% share in the household cleaning agents market.

- The European market reached a value of USD 350.0 million in 2024.

By Product Type Analysis

Laundry detergents dominate the Household Cleaning Agents Market with a 44.1% share globally.

In 2024, Laundry Detergents held a dominant market position in the By Product Type segment of the Household Cleaning Agents Market, with a 44.1% share. This strong market presence can be attributed to the essential and recurring nature of laundry care in daily household routines.

The widespread use of laundry detergents across both urban and rural households underscores their necessity for maintaining personal hygiene and fabric cleanliness. Consumers continue to prioritize effective stain removal, fabric protection, and fresh fragrance, making laundry detergents a staple in home care regimes.

The segment’s dominance is further supported by the increasing preference for liquid and concentrated formats, which offer better solubility and convenience compared to traditional powders. Moreover, product improvements in formulation to cater to sensitive skin and energy-efficient washing machines have reinforced consumer trust and usage frequency.

Rising awareness regarding hygiene, coupled with consistent demand for clean clothing, has kept laundry detergents at the forefront of household cleaning needs. As households expand and laundry frequency increases with lifestyle changes, the demand for reliable and high-performance laundry care products continues to grow.

By Product Form Analysis

Liquid formats lead the market, holding a strong 58.3% consumption preference.

In 2024, Liquids held a dominant market position in the By Product Form segment of the Household Cleaning Agents Market, with a 58.3% share. This leading position reflects the widespread consumer preference for liquid cleaning solutions due to their ease of application, quick dissolution, and effective coverage on various surfaces. Liquid formats are favored in household routines as they offer better control in usage, compatibility with multiple cleaning tools, and immediate performance on stains and dirt.

The convenience of ready-to-use liquid products, particularly for surface cleaning, dishwashing, and laundry, has significantly contributed to their growing adoption. Liquids are also easier to measure and pour, reducing product wastage and enhancing user experience. The market has seen continued innovation in liquid formulations, with a focus on concentrated solutions and added fragrances that appeal to time-conscious consumers seeking efficient and pleasant cleaning routines.

Moreover, the dominance of liquids is further strengthened by their suitability for both manual and machine-based cleaning methods, making them a versatile choice across households. The 58.3% market share underscores the liquid form’s established role as the preferred format in modern cleaning practices, supported by its adaptability and user-friendly application across a range of cleaning tasks.

By Category Analysis

Bio-based products account for 66.4%, reflecting demand for eco-conscious cleaning solutions.

In 2024, Bio-Based held a dominant market position in the By Category segment of the Household Cleaning Agents Market, with a 66.4% share. This significant lead reflects the growing consumer shift toward environmentally responsible and health-conscious cleaning solutions. The demand for bio-based cleaning agents has been rising steadily, driven by increasing awareness around chemical exposure, indoor air quality, and ecological impact.

The 66.4% market share held by bio-based products highlights their acceptance as mainstream choices in everyday cleaning routines. Consumers are now more inclined to purchase products that align with sustainable living practices, including reducing plastic waste and supporting green formulations. The market has responded to this preference with a broader availability of bio-based solutions across key household applications, further accelerating adoption.

Additionally, the performance of bio-based agents in delivering effective cleaning without harsh chemicals has contributed to their growing credibility. The dominant position of this segment in 2024 signals a strong future outlook for natural and eco-friendly innovations in the household cleaning space, as consumer values continue to evolve toward safety, wellness, and sustainability.

By Distribution Channel Analysis

Supermarkets and hypermarkets contribute 49.9% to household cleaning agents’ total sales.

In 2024, Supermarkets/Hypermarkets held a dominant market position in the By Distribution Channel segment of the Household Cleaning Agents Market, with a 49.9% share. This leading position reflects the continued consumer preference for physical retail outlets that offer convenience, variety, and immediate product availability. Supermarkets and hypermarkets serve as primary purchasing points for household essentials, including cleaning agents, due to their wide reach, regular foot traffic, and attractive promotions.

The 49.9% market share is supported by consumers’ inclination to personally evaluate product quality, packaging, scent, and price before purchase—an experience that supermarkets and hypermarkets facilitate effectively. These stores provide organized shelf displays, allowing customers to compare brands and select according to their cleaning needs and budget. Bulk purchasing options and discount offers also make them a cost-effective choice for regular shoppers.

Moreover, the trusted presence of supermarkets/hypermarkets in both urban and suburban areas ensures consistent access to household cleaning agents. Their strong distribution network and relationships with suppliers further enable regular stock availability. The segment’s dominance in 2024 highlights the critical role of these retail formats in influencing consumer buying behavior and maintaining a steady supply of essential home care products in the market.

Key Market Segments

By Product Type

- Laundry Detergents

- Surface Cleaners

- Dish Cleaners

- Toilet Cleaners

- Others

By Product Form

- Liquids

- Wipes

- Sprays

- Powders

By Category

- Bio-Based

- Synthetic

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retailers

- Specialty Stores

- Others

Driving Factors

Health and Hygiene Awareness Boosts Product Usage

One of the main driving factors for the growth of the household cleaning agents market is the rising awareness about health and hygiene. People are now more careful about keeping their homes clean to protect their families from germs and viruses. Regular cleaning of surfaces, clothes, kitchens, and bathrooms has become a daily habit in many homes.

This behavior change is strongly linked to growing knowledge about how diseases spread and the importance of cleanliness in preventing infections. As a result, the demand for cleaning products such as disinfectants, floor cleaners, and laundry detergents has gone up. This trend is expected to continue as consumers increasingly prioritize hygiene for a safer and healthier living environment.

Restraining Factors

Harmful Chemical Concerns Limit Product Preference

A major restraining factor in the household cleaning agents market is the growing concern about harmful chemicals used in some cleaning products. Many consumers are now more cautious about ingredients that may cause skin irritation, allergies, or long-term health problems. Substances like bleach, ammonia, and synthetic fragrances are often seen as risky, especially in homes with children, elderly people, or pets.

These concerns have led some consumers to reduce their use of chemical-based cleaners or switch to safer, natural alternatives. Additionally, increasing awareness about environmental damage caused by non-biodegradable ingredients and plastic packaging has made people more selective.

Growth Opportunity

Rise of Eco-Friendly Cleaning Products Creates Opportunities

A major growth opportunity in the household cleaning agents market is the increasing demand for eco‑friendly and natural products. More people are choosing cleaning agents made from plant-based, biodegradable ingredients that are safer for families and better for the environment. This shift offers brands a chance to develop new formulas that avoid harsh chemicals, reduce plastic waste, and use recyclable packaging.

As awareness grows about air quality, skin sensitivities, and ecological impact, consumers are willing to pay a bit more for products that align with their values. Introducing refill packs, concentrated liquids, and earth‑friendly packaging can attract these conscious buyers. Manufacturers that invest in truly green products can meet rising demand and win customer loyalty in a market moving toward sustainability.

Latest Trends

Smart Packaging and Convenient Formats Gain Traction

One of the most notable recent trends in the household cleaning agents market is the rise of smart packaging and convenient formats. Consumers appreciate solutions that are easy to use, eco-conscious, and space-saving. Refillable pouches, pre-measured pods, and multi-surface wipes are gaining popularity because they simplify cleaning routines and reduce waste.

Smart packaging—such as QR codes with usage tips or recycling instructions—also adds value by improving user experience and encouraging responsible behavior. These formats help customers avoid overuse and minimize spillage, making homes cleaner and safer. As lifestyle demands shift toward efficiency and sustainability, brands that offer smart, well-designed packaging are likely to stand out and build strong customer loyalty.

Regional Analysis

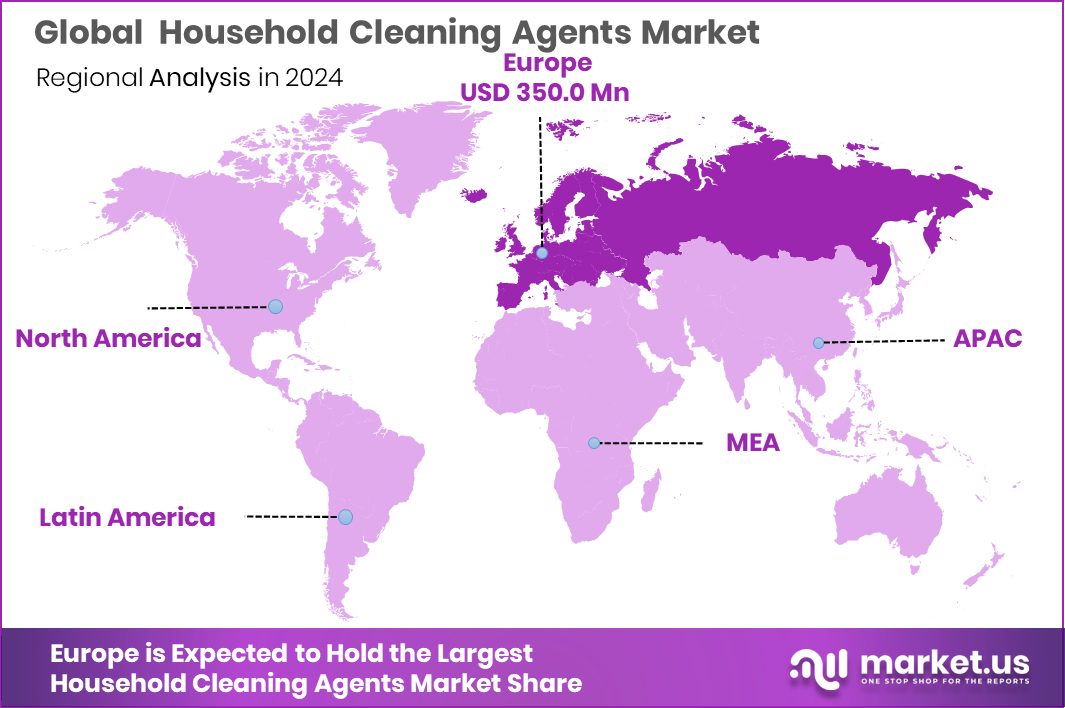

In 2024, Europe led the Household Cleaning Agents Market with a 44.2% share.

In 2024, Europe emerged as the dominant region in the global Household Cleaning Agents Market, accounting for 44.2% of the total market share and reaching a valuation of USD 350.0 million. This leadership position is supported by strong consumer awareness about hygiene, high urbanization rates, and established cleaning routines across households. The demand for household cleaning agents in Europe is also driven by increasing focus on indoor air quality and health, which continues to influence product usage patterns.

North America followed closely, where steady consumer demand for convenience-based cleaning solutions and growing concerns about cleanliness in residential spaces contribute to stable market performance. In the Asia Pacific region, rising disposable incomes, urban expansion, and lifestyle changes have been encouraging the adoption of household cleaning agents across both urban and semi-urban populations.

Meanwhile, Latin America and the Middle East & Africa represent developing markets where growing awareness of hygiene and increased access to consumer goods are gradually supporting market growth. However, Europe remained the most prominent contributor in 2024, reflecting a mature and health-conscious market environment. The region’s high purchasing power and consistent preference for quality cleaning products continue to reinforce its position at the forefront of global market share.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, several multinational firms solidified their positions in the household cleaning agents market through strategic innovation and operational efficiency.

Unilever Plc continued to leverage its broad consumer base and diversified brand portfolio to drive market penetration. Its focus on product variants across cleaning categories — featuring user-friendly packaging and eco‑friendly formulations — contributed to stable volume growth. The company’s global distribution network enabled consistent shelf presence, strengthening its competitive edge in key regions.

Galaxy Surfactants Ltd. made notable progress as a specialty chemicals provider, supplying essential surfactants that underpin the formulation of modern cleaning products. Its technical expertise and high-purity ingredients cater to manufacturers seeking advanced performance and sustainability. Recognition by global brands of the importance of ingredient transparency benefited Galaxy Surfactants, enhancing its role as a key upstream provider.

Reckitt Benckiser Group PLC maintained a strong market stance by integrating hygiene-focused innovation within its cleaning agent range. The company emphasized performance-driven disinfection and multi‑surface solutions, aligning with the rising consumer emphasis on health. Continued global marketing efforts and R&D investments ensured that Reckitt’s cleaning lines remained top of mind in both mature and developing markets.

Henkel AG & Co. KGaA capitalized on its industrial formulation knowledge to introduce concentrated and compact cleaning offerings. The company’s investments in sustainable solutions and refillable packaging attracted consumers seeking both efficiency and ecological advantage. Henkel’s emphasis on operational sustainability practices further reinforced its reputation among environmentally conscious stakeholders.

Top Key Players in the Market

- Unilever Plc

- Galaxy Surfactants Ltd.

- Reckitt Benckiser Group PLC

- Henkel AG & Co. KGaA

- The Procter & Gamble Company

- The Clorox Company

- S. C. Johnson & Son, Inc.

- Diversey Holdings, Ltd.

- Spartan Chemical Company Inc.

- Clean Control Corporation

- Charlotte Products Limited

- CleanWell LLC

- Others

Recent Developments

- In June 2025, Galaxy Surfactants received ISCC PLUS certification for its manufacturing sites in Taloja and Jhagadia, India. This certification confirms that key ingredients—such as SLES and betaines—are produced from renewable, recycled, or circular raw materials. The development reinforces the company’s environmental credentials and enhances its supply chain credibility for sustainable household cleaning agents.

- In April 2024, Unilever introduced Persil Wonder Wash, a revolutionary liquid detergent engineered for 15‑minute short‑cycle washes. Developed using robotics and AI technology, this product was formulated to quickly remove everyday odours and dirt, especially from athleisure and lightly soiled items.

Report Scope

Report Features Description Market Value (2024) USD 792.4 Million Forecast Revenue (2034) USD 1,340.8 Million CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Laundry Detergents, Surface Cleaners, Dish Cleaners, Toilet Cleaners, Others), By Product Form (Liquids, Wipes, Sprays, Powders), By Category (Bio-Based, Synthetic), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retailers, Specialty Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Unilever Plc, Galaxy Surfactants Ltd., Reckitt Benckiser Group PLC, Henkel AG & Co. KGaA, The Procter & Gamble Company, The Clorox Company, S. C. Johnson & Son, Inc., Diversey Holdings, Ltd., Spartan Chemical Company Inc., Clean Control Corporation, Charlotte Products Limited, CleanWell LLC, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Household Cleaning Agents MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Household Cleaning Agents MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Unilever Plc

- Galaxy Surfactants Ltd.

- Reckitt Benckiser Group PLC

- Henkel AG & Co. KGaA

- The Procter & Gamble Company

- The Clorox Company

- S. C. Johnson & Son, Inc.

- Diversey Holdings, Ltd.

- Spartan Chemical Company Inc.

- Clean Control Corporation

- Charlotte Products Limited

- CleanWell LLC

- Others