Global Honey Wine Market Size, Share, And Business Benefits By Nature (Organic, Conventional), By Product (Fruits, Spices, Herbs, Others), By Distribution Channel (On-premise (Bars, Restaurants, Tasting Rooms), Off-premise (Retail Stores, Online Platforms)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154559

- Number of Pages: 318

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

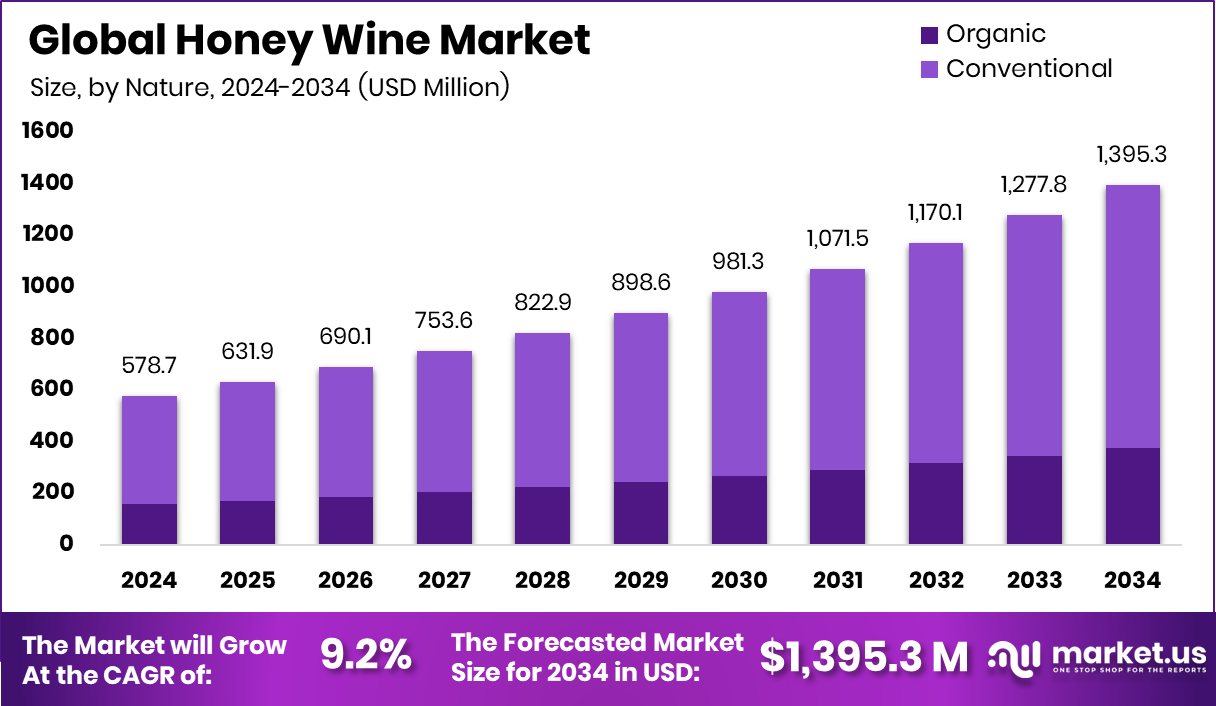

The Global Honey Wine Market is expected to be worth around USD 1,395.3 million by 2034, up from USD 578.7 million in 2024, and is projected to grow at a CAGR of 9.2% from 2025 to 2034. Rapid urbanization boosts demand, making the Asia-Pacific region dominate with 39.8% market share.

Honey Wine, also called mead, is an alcoholic beverage created by fermenting honey with water. Sometimes, fruits, spices, grains, or hops are added to enhance flavor and complexity. Believed to be one of the oldest known alcoholic drinks, honey wine holds deep historical and cultural significance across various ancient civilizations. It has a golden to amber appearance and typically ranges from sweet to dry in taste, depending on fermentation length and added ingredients.

The Honey Wine Market refers to the commercial landscape of production, distribution, and consumption of mead globally. Growing consumer preference for craft beverages and traditional drinks has contributed to a rising interest in honey wine. The market includes different varieties such as traditional mead, fruit-infused mead, and spiced versions, each targeting unique consumer tastes.

One of the key growth factors is the increasing demand for naturally sourced and gluten-free alcoholic beverages. As honey wine is derived from honey rather than grains, it appeals to health-conscious consumers and those with dietary restrictions. The clean label movement, which emphasizes simple and recognizable ingredients, has supported its popularity.

Consumer demand is also being driven by rising interest in ancient and culturally rich products. Honey wine’s historical roots and storytelling potential offer a unique appeal, particularly among millennials and Gen Z consumers seeking authenticity in their food and drink choices. This demand is further reinforced by increased awareness and experimentation through mead festivals, tastings, and local craft alcohol events.

Key Takeaways

- The Global Honey Wine Market is expected to be worth around USD 1,395.3 million by 2034, up from USD 578.7 million in 2024, and is projected to grow at a CAGR of 9.2% from 2025 to 2034.

- In the Honey Wine Market, Conventional products held a dominant 73.4% share due to wider availability.

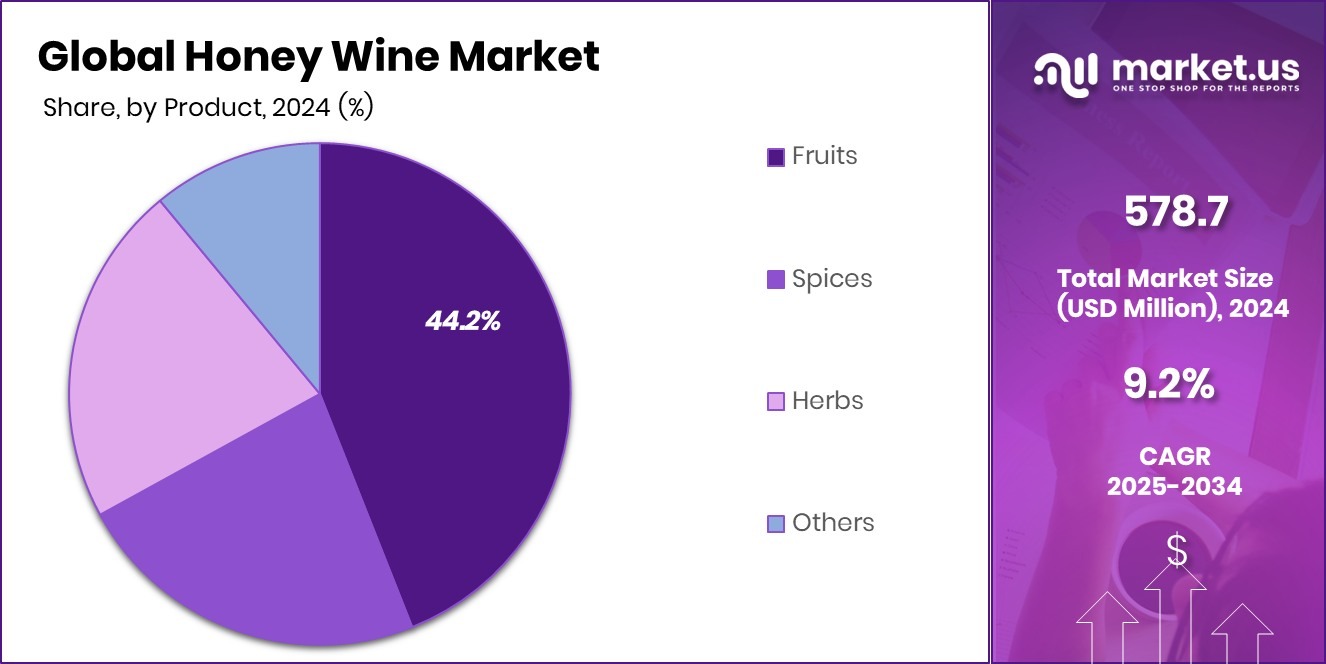

- Fruit-based honey wine captured 44.2% of the market, favored for its rich flavors and variety.

- On-premise consumption led with 63.6%, driven by experiential drinking in restaurants, bars, and meaderies.

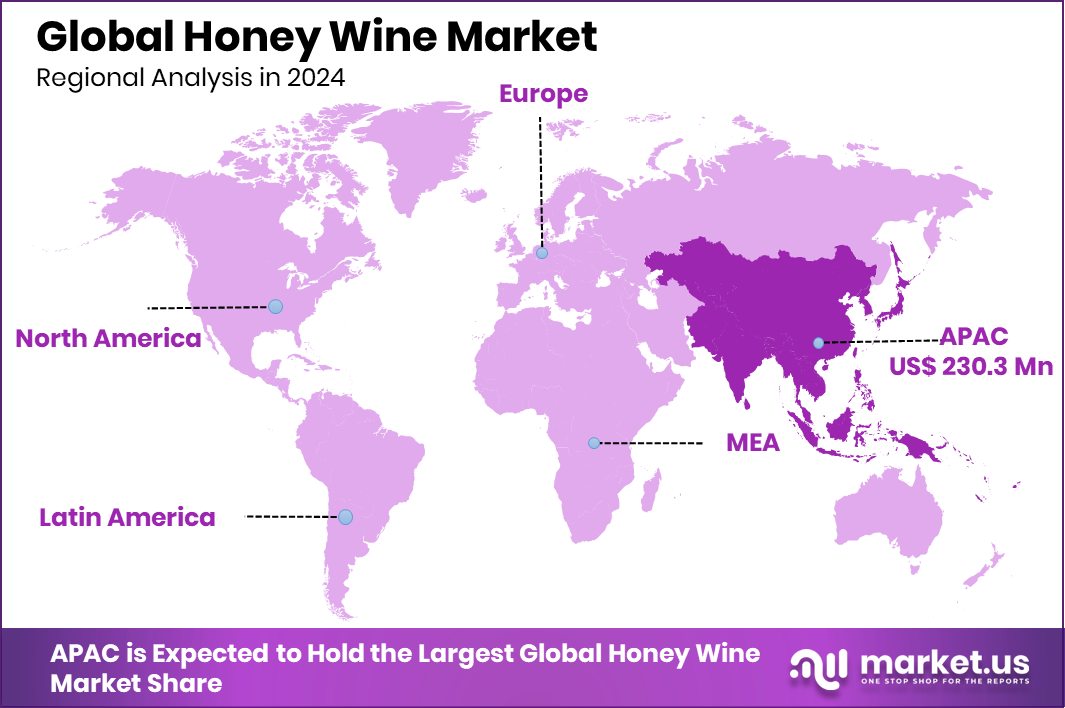

- Strong cultural interest in traditional beverages supports Asia-Pacific’s USD 230.3 Mn market value.

By Nature Analysis

Conventional honey wine holds a 73.4% share in the global market.

In 2024, Conventional held a dominant market position in the By Nature segment of the Honey Wine Market, with a 73.4% share. This dominance can be attributed to the widespread availability of conventionally produced honey, lower production costs, and established fermentation techniques that are well-suited for mass-market honey wine production.

Conventional honey wine continues to appeal to a broader consumer base due to its consistent taste profile, affordability, and wider distribution across both retail and hospitality channels. Many producers prefer conventional methods as they enable higher yields and scalability without compromising the core characteristics of honey wine.

Additionally, conventional honey sources are more readily accessible and typically less expensive than organic alternatives, which helps in keeping the overall pricing of the end product competitive. This pricing advantage plays a crucial role in attracting first-time buyers and sustaining regular consumption in mature markets.

The dominance of conventional honey wine is also supported by strong distribution networks through supermarkets, liquor stores, and online platforms, making it a more visible and convenient option for consumers. As a result, conventional honey wine continues to lead the market, maintaining its strong foothold in the By Nature segment and shaping overall consumption trends within the honey wine category.

By Product Analysis

Fruit-based honey wine dominates with 44.2% market share worldwide.

In 2024, Fruits held a dominant market position in the By Product segment of the Honey Wine Market, with a 44.2% share. This leading position is primarily driven by the growing consumer preference for flavored alcoholic beverages that offer a balance of natural sweetness and fruit-based complexity.

Fruit-infused honey wine enhances the traditional mead profile with added aromas and flavors, making it more appealing to a wider audience, especially younger consumers who seek variety in taste. The infusion of fruits such as berries, apples, and citrus not only improves the sensory experience but also aligns with trends favoring artisanal and naturally flavored beverages.

The dominant share held by fruit-based honey wine is further supported by its strong acceptance in tasting rooms, festivals, and premium alcoholic drink menus where flavor innovation is a key attraction. The visual appeal, seasonal versatility, and perceived health benefits of fruit ingredients contribute to its popularity.

Moreover, the adaptability of fruit variants in both still and sparkling formats provides producers with a competitive edge in catering to diverse consumption occasions. As a result, fruit-based honey wine continues to lead the product segment, reflecting its broad appeal, versatility, and alignment with evolving consumer expectations in the premium and craft beverage space.

By Distribution Channel Analysis

On-premise sales lead with a 63.6% share in the honey wine market.

In 2024, on-premise held a dominant market position in the By Distribution Channel segment of the Honey Wine Market, with a 63.6% share. This dominance reflects the strong presence of honey wine in restaurants, bars, tasting rooms, and event venues, where consumer interest in craft and artisanal alcoholic beverages continues to rise.

On-premise settings offer a curated environment that encourages trial and discovery, allowing consumers to explore honey wine through guided tastings, pairings, and storytelling experiences. These interactive and sensory-driven formats significantly enhance consumer engagement and drive repeat purchases.

The higher share of on-premise distribution is also supported by its role in promoting brand visibility and premium positioning. Producers benefit from showcasing their products directly to target audiences, often leveraging local tourism, events, and food pairings to build brand loyalty.

Additionally, on-premise channels provide valuable consumer feedback and opportunities for seasonal or limited-edition variants, which further strengthen market presence. The strong performance of the on-premise segment in 2024 indicates that honey wine consumption remains closely linked with experiential and social drinking environments, where atmosphere, education, and service quality play a vital role in shaping preferences and purchasing behavior.

Key Market Segments

By Nature

- Organic

- Conventional

By Product

- Fruits

- Spices

- Herbs

- Others

By Distribution Channel

- On-premise

- Bars

- Restaurants

- Tasting Rooms

- Off-premise

- Retail Stores

- Online Platforms

Driving Factors

Rising Demand for Natural and Craft Beverages

One of the top driving factors in the honey wine market is the growing consumer interest in natural and craft alcoholic drinks. People are now more careful about what they consume and often look for beverages made from real, simple ingredients. Honey wine fits this trend perfectly because it is made from honey, water, and sometimes fruits or spices—without artificial flavors or heavy processing.

Consumers are also attracted to the traditional and historical background of honey wine, which adds uniqueness and authenticity to the drinking experience. As more people explore alternatives to beer and grape-based wine, honey wine offers a fresh and flavorful choice, pushing its demand higher in both local and global markets.

Restraining Factors

Low Consumer Awareness Limits Market Growth Potential

A key restraining factor in the Honey Wine Market is the low level of consumer awareness. Many people are still unfamiliar with what honey wine is, how it tastes, or how it is different from other alcoholic drinks like grape wine or beer. This lack of knowledge makes them hesitant to try it, especially when faced with more well-known options in stores or restaurants.

Additionally, honey wine is often mistaken as overly sweet or old-fashioned, which can discourage new customers. Without strong marketing or in-store visibility, it becomes challenging for producers to reach wider audiences.

Growth Opportunity

Expansion Through Tourism and Tasting Room Experiences

A major growth opportunity for the Honey Wine Market lies in tourism and tasting room experiences. Many consumers enjoy visiting local wineries, breweries, or meaderies where they can learn how honey wine is made and try different flavors on-site. These visits often lead to direct purchases and help build brand loyalty. Tasting rooms allow producers to educate people about honey wine’s history, ingredients, and benefits in a relaxed setting.

This face-to-face interaction helps attract new customers who may not have tried honey wine otherwise. Tourism-related activities, especially in wine trails or countryside tours, offer a unique platform to showcase honey wine and expand its reach beyond retail shelves into new and curious consumer segments.

Latest Trends

Sparkling Honey Wine Gains Popularity Worldwide

Sparkling honey wine has emerged as a notable trend in the Honey Wine Market, capturing growing interest among consumers. This fizzy variation offers a refreshing drinking experience, which makes it appealing for celebrations, casual gatherings, and modern cocktail pairings. The bubbles in sparkling honey wine soften the sweetness of honey and enhance aromatic notes, offering a lively and elegant alternative to still versions.

It also aligns with consumer preferences for variety and novelty in alcoholic beverages, especially among younger adults open to exploring new styles. Many producers have begun experimenting with sparkling formats, often combining honey with fruit essences or light spices to elevate flavor. Presented as premium, artisanal products, these sparkling versions are increasingly featured in tasting rooms and fine dining establishments—further helping to promote broader interest in honey wine.

Regional Analysis

Asia-Pacific led the Honey Wine Market with 39.8% share, reaching USD 230.3 Mn.

In 2024, Asia-Pacific held the dominant position in the Honey Wine Market, capturing 39.8% of the total share, which translates to a value of USD 230.3 million. This leadership is supported by a growing consumer base with rising interest in traditional and craft beverages across countries such as Japan, South Korea, and Australia. The market in this region is further driven by cultural affinity towards honey-based drinks, increasing disposable incomes, and expanding premium beverage consumption, especially in urban areas.

In comparison, North America, Europe, the Middle East & Africa, and Latin America represent emerging or secondary markets where honey wine is gradually gaining awareness and shelf presence. While North America and Europe benefit from craft alcohol trends and a strong presence of local meaderies, their market shares remain below that of the Asia-Pacific.

Meanwhile, regions like the Middle East & Africa and Latin America show slower adoption, primarily due to limited product availability and lower consumer familiarity with honey wine. However, these markets may offer potential as awareness grows. Overall, Asia-Pacific’s leading share highlights its central role in driving global honey wine consumption, supported by a combination of tradition, taste innovation, and growing demand for naturally crafted alcoholic products.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Medovina Meadery demonstrated strong positioning in the global honey wine landscape. The company’s focus on traditional mead styles with refined branding facilitated enhanced consumer recognition. Its streamlined production methods enabled consistent quality across batches, supporting steady growth. Medovina’s investment in educational marketing—demonstrations and guided tastings—helped demystify honey wine and attract new customer segments.

Kuhnhenn Brewing Co. LLC continued to leverage its artisanal brewing expertise to differentiate its honey wine portfolio. Emphasizing experimental infusions and small-batch variants, the company introduced innovative flavors that resonated with craft-conscious consumers. Its roots in brewing also lent operational efficiencies and distribution strength, contributing to a robust presence in specialty alcohol retail channels.

At Redstone, product differentiation was driven by a balance of traditional and fruit-forward offerings. The company’s emphasis on brand storytelling—highlighting honey sourcing and fermentation craftsmanship—enhanced its premium positioning. Redstone’s strategic outreach through tasting events and partnerships with on-premise venues cultivated strong engagement and elevated perceived value.

Brothers Drake Meadery remained a key player by combining local sourcing with creative flavor profiles. Its emphasis on authenticity—locally harvested honey, combined with seasonal fruit variants—reinforced its regional identity. The company’s tasting room model expanded direct-to-consumer sales and deepened brand loyalty among enthusiasts and new buyers alike.

Top Key Players in the Market

- Medovina Meadery

- Kuhnhenn Brewing Co. LLC

- Redstone

- Brothers Drake Meadery

- Schramm’s Mead

- The Honey Wine Company

- Moonshine Meadery

- Talon Wines

- Schramm’s Mead

- B. Nektar Meadery

Recent Developments

- In August 2024, Bee d’Vine celebrated its 10th anniversary and expanded its product portfolio to include 11 distinct honey wine varietals, such as new semi-sweet and sparkling expressions, priced across ranges and formats to broaden appeal.

- In March 2024, Brothers Drake Meadery launched a new bar and production facility in Columbus, Ohio. This development boosted their production capabilities, enhanced their ability to host events, and expanded opportunities for customers to enjoy mead directly at the source.

Report Scope

Report Features Description Market Value (2024) USD 578.7 Million Forecast Revenue (2034) USD 1,395.3 Million CAGR (2025-2034) 9.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic, Conventional), By Product (Fruits, Spices, Herbs, Others), By Distribution Channel (On-premise (Bars, Restaurants, Tasting Rooms), Off-premise (Retail Stores, Online Platforms)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Medovina Meadery, Kuhnhenn Brewing Co. LLC, Redstone, Brothers Drake Meadery, Schramm’s Mead, The Honey Wine Company, Moonshine Meadery, Talon Wines, Schramm’s Mead, B. Nektar Meadery Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Medovina Meadery

- Kuhnhenn Brewing Co. LLC

- Redstone

- Brothers Drake Meadery

- Schramm’s Mead

- The Honey Wine Company

- Moonshine Meadery

- Talon Wines

- Schramm's Mead

- B. Nektar Meadery